Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-262311

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated February 1, 2022)

$50,000,000

Beyond

Air, Inc.

Common

Stock

We

have entered into a sales agreement with Truist Securities, Inc., or Truist, and Oppenheimer & Co. Inc., or Oppenheimer, each of

whom we refer to as an agent, and together as the agents, relating to shares of our common stock offered by this prospectus supplement.

In accordance with the terms of the sales agreement, we may offer and sell shares of our common stock having an aggregate offering price

of up to $50,000,000 from time to time through the agents.

Our

common stock is listed on the Nasdaq Capital Market under the symbol “XAIR.” On February 2, the last reported sales price

for our common stock was $7.24 per share.

Sales

of our common stock, if any, under this prospectus supplement may be made in sales deemed to be “at the market offerings”

as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, or the Securities Act, including sales made directly

on or through the Nasdaq Capital Market, the existing trading market for our common stock, or any other existing trading market for our

common stock. The agents are not required to sell any specific number or dollar amount of securities, but will act as sales agents, using

commercially reasonable efforts consistent with their normal trading and sales practices, on mutually agreed terms among the agents and

us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The

compensation to the agents for sales of common stock sold pursuant to the sales agreement will be an amount up to 3.0% of the gross proceeds

of any shares of common stock sold under the sales agreement. See “Plan of Distribution” beginning on page S-13 for additional

information regarding the compensation to be paid to the agents. In connection with the sale of the common stock on our behalf, each

of the agents will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of the

agents will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to

the agents with respect to certain liabilities, including liabilities under the Securities Act or the Exchange Act of 1934, as amended,

or the Exchange Act.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading

“Risk Factors” on page S-9 of this prospectus supplement and under similar headings in the other documents that are incorporated

by reference into this prospectus supplement.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED

IF THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS ARE TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

|

Truist

Securities

|

|

Oppenheimer

& Co.

|

February

4, 2022

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is comprised of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering

of our shares of common stock. The second part is the accompanying prospectus, including the documents incorporated by reference into

the accompanying prospectus, which provides more general information, some of which may not apply to this offering. The information included

or incorporated by reference in this prospectus supplement also adds to, updates and changes information contained or incorporated by

reference in the accompanying prospectus. If information included or incorporated by reference in this prospectus supplement is inconsistent

with the accompanying prospectus or the information incorporated by reference therein, then this prospectus supplement or the information

incorporated by reference in this prospectus supplement will apply and will supersede the information in the accompanying prospectus

and the documents incorporated by reference therein.

This

prospectus supplement is part of a registration statement on Form S-3 (File No. 333-262311) that we filed with the Securities and Exchange

Commission, or the SEC, using a “shelf” registration process. Under the shelf registration process, we may from time to time

offer and sell any combination of the securities described in the accompanying prospectus up to a total dollar amount of $200,000,000,

of which this offering is a part. Under this prospectus supplement, we may offer shares of our common stock having a total aggregate

offering price of up to $50,000,000 from time to time at prices and on terms to be determined by market conditions at the time of offering.

We

have not authorized anyone to provide you with information other than that contained or incorporated by reference in this prospectus

supplement, the accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this offering.

We do not take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give

you. Our business, financial condition, results of operations and prospects may have changed since those dates. You should not assume

that the information contained or incorporated in this prospectus supplement and the accompanying prospectus is accurate as of any date

other than their respective dates, regardless of the time of delivery. You should read this prospectus supplement, the accompanying prospectus,

the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus

that we have authorized for use in connection with this offering when making your investment decision. We and the agents are not making

an offer to sell our common stock offered hereto in any jurisdiction where the offer or sale is not permitted.

This

prospectus supplement, the accompanying prospectus and the information incorporated herein and therein by reference includes trademarks,

service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated

by reference into this prospectus supplement or the accompanying prospectus are the property of their respective owners.

Unless

the context indicates otherwise, in this prospectus supplement and the accompanying prospectus the terms, the “Company,”

“we,” “our” or “us” refer to Beyond Air, Inc. and its wholly-owned subsidiaries.

CAUTIONARY

STATEMENTS CONCERNING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein may contain forward looking statements

within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934 (the “Exchange Act”) that involve risks and uncertainties. All statements other than statements of historical

fact contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein, including

statements regarding future events, our future financial performance, business strategy, and plans and objectives of management for future

operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,”

“believes,” “can,” “continue,” “could,” “estimates,” “expects,”

“intends,” “may,” “plans,” “potential,” “predicts,” “should,”

or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements

unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions

and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or

elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein, which may cause

our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking

statements. Moreover, we operate in a highly regulated, very competitive, and rapidly changing environment. New risks emerge from time

to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any

forward-looking statements.

We

have based these forward-looking statements largely on our current expectations and projections about future events and financial trends

that we believe may affect our financial condition, results of operations, business strategy, short term and long-term business operations,

and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results

to differ materially from those reflected in the forward looking statements. Factors that could cause or contribute to such differences

include, but are not limited to, those discussed in this this prospectus supplement, the accompanying prospectus and the documents incorporated

by reference herein, and in particular, the risks discussed below and under the heading “Risk Factors” and those discussed

in other documents we file with the SEC. We undertake no obligation to revise or publicly release the results of any revision to these

forward-looking statements, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events

and circumstances discussed in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein

may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statement.

You

should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this prospectus supplement.

Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date

of this prospectus supplement to conform our statements to actual results or changed expectations.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information about our company, this offering and information appearing elsewhere in this prospectus supplement,

in the accompanying prospectus, and in the documents we incorporate by reference. This summary is not complete and does not contain all

the information that you should consider before investing in our securities. You should carefully read this entire prospectus supplement

and the accompanying prospectus, particularly the information included under the heading “Risk Factors” contained in this

prospectus supplement beginning on page S-9, and the risk factors, financial statements and notes incorporated by reference herein,

before making an investment decision. This prospectus supplement may add to, update or change information in the accompanying prospectus.

Company

Overview

We

are a clinical-stage medical device and biopharmaceutical company developing a nitric oxide (“NO”) generator and delivery

system (the “LungFit® system”) capable of generating NO from ambient air. The LungFit® platform

can generate NO up to 400 parts per million for delivery to a patient’s lungs directly or via a ventilator. LungFit®

can deliver NO either continuously or for a fixed amount of time at various flow rates and has the ability to either titrate dose on

demand or maintain a constant dose. We believe that LungFit® can be used to treat patients on ventilators that require

NO, as well as patients with chronic or acute severe lung infections via delivery through a breathing mask or similar apparatus. Furthermore,

we believe that there is a high unmet medical need for patients suffering from certain severe lung infections that the LungFit®

platform can potentially address. Our current

areas of focus with LungFit® are persistent pulmonary hypertension of the newborn (PPHN), community-acquired viral pneumonia

(CAVP) including COVID-19 (previously termed acute viral pneumonia, or AVP), bronchiolitis (BRO) and nontuberculous mycobacteria (NTM)

lung infection. The Company’s current product candidates will be subject to premarket reviews and approvals by the U.S. Food and

Drug Administration, (the “FDA”), CE marking conformity assessment by a notified body in the European Union (the “E.U.”),

as well as similar regulatory agencies’ reviews or approvals in other countries or regions.

If approved, our system will be marketed as a medical device in the U.S.

An

additional focus of the Company is solid tumors, through our majority-owned affiliate Beyond Cancer, Ltd. For the solid tumor indication

the LungFit® platform is not utilized due to need for ultra-high concentrations of gaseous nitric oxide (“UNO”).

A proprietary delivery system has been developed that can safely deliver UNO in excess of 10,000 ppm directly to a solid tumor. This

program is in preclinical development and will require approval from the FDA or similar regulatory agencies in other countries to enter

human studies. We anticipate beginning the enrollment of patients into the first human trial in the first quarter of calendar year 2022.

We

believe LungFit® will be the first approved system with patented technology that generates NO using room air, enabling

the delivery of unlimited, on-demand NO regardless of dose or flow. To generate the NO, a pump within the LungFit® flows

room air through a small chamber where power, equivalent to a 60-watt lightbulb, ionizes the oxygen and nitrogen molecules. The molecules

recombine as NO. We believe that the on-demand delivery, either to a ventilator circuit or directly to a patient’s lungs, is safe

due to the Company’s system design and the Company’s proprietary nitrogen dioxide (“NO2”) filter.

The NO2 filter removes toxic NO2 for 12 hours when used for PPHN and shorter periods for treating other conditions

that require NO concentrations of 150 ppm or more.

With

respect to PPHN, our novel LungFit® PH is designed to deliver a dosage of NO to the lungs that is consistent with current

guidelines for delivery of 20 ppm NO with a range of 0.5 ppm – 80 ppm (low-concentration NO) for ventilated patients. We believe

the ability of LungFit® PH to generate NO from ambient air provides us with many competitive advantages over the current

standard of NO delivery systems in the U.S., the E.U., Japan and other markets. For example, LungFit® PH does not require

the use of a high-pressure cylinder, does not require cumbersome purging procedures and places less burden on hospital staff in carrying

out safety procedures.

Our

novel LungFit® platform can also deliver a high concentration (>150 ppm) of NO directly to the lungs, which

we believe has the potential to eliminate microbial infections including bacteria, fungi and viruses, among others. We believe that current

FDA-approved NO vasodilation treatments would have limited success in treating microbial infections given the low concentrations of NO

being delivered (<100 ppm). Given that NO is produced naturally by the body as an innate immunity mechanism, at a concentration of

200 ppm, supplemental high dose NO should aid in the body’s fight against infection. Based on our preclinical and clinical studies,

we believe that 150 ppm is the minimum therapeutic dose to achieve the desired pulmonary antimicrobial effect of NO. To date, neither

the FDA nor equivalent regulatory agencies in other countries or regions have approved any NO formulation and/or delivery system for

>80 ppm NO.

LungFit®

PH for the treatment of Persistent Pulmonary Hypertension of the Newborn

In

November 2020 we submitted a PMA application to the FDA for the use of LungFit® PH in PPHN. There is a standard 180-day

review process that starts upon the FDA’s acknowledgement of the submission, though PMA reviews oftentimes take much longer, sometimes

over a year or more. Moreover, the ongoing COVID-19 pandemic and an increased volume of submissions have led to longer review times by

the FDA. We anticipate an FDA decision on the PMA in the first half of the calendar year 2022.

We

also expect to receive the CE Mark under the Medical Device Regulation (“MDR”) in the E.U. in the first half of calendar

year 2022. According to the most recent year-end report from Mallinckrodt Pharmaceuticals, sales of NO were $574.1 million in 2020 (up

from $571.4 million in 2019) for the United States, Canada, Japan, Mexico and Australia, with >90% in the United States. However,

due to increased competition following the launch of competing nitric oxide delivery systems in the United States, Mallinckrodt Pharmaceutical’s

sales of NO faced a downwards trajectory, reporting $134 million in the first quarter of 2021, $106 million in the second quarter of

2021 and $98 million in the third quarter of 2021. Outside of the U.S. there are multiple market participants which translates to considerably

lower sales than in the U.S. We believe the U.S. sales potential of LungFit® PH in PPHN to be greater than $300 million

and worldwide sales potential to be greater than $600 million. If regulatory approval is obtained, we anticipate a product launch in

the U.S. in the first half of calendar year 2022 and will continue to launch in the EU and globally in 2022 and beyond.

LungFit®

PRO for the treatment of viral lung infections in hospitalized patients

Community-Acquired

Viral Pneumonia (including COVID-19)

Viral

pneumonia in adults is most commonly caused by rhinovirus, respiratory syncytial virus (“RSV”) and influenza virus. However,

newly emerging viruses (including SARS-CoV-1, SARS-CoV-2, avian influenza A, and H1N1 viruses) have been identified as pathogens contributing

to the overall burden of adult viral pneumonia. COVID-19 is an infectious disease caused by SARS-CoV-2, that has resulted in a global

pandemic. Excluding the pandemic, there are approximately 350,000 annual viral pneumonia hospitalizations in the US, and 16 million annual

viral pneumonia hospitalizations globally. For the broader annual viral pneumonia, we believe U.S. sales potential to be greater than

$1.5 billion and worldwide market potential to be greater than $3 billion.

We

initiated a pilot study in late 2020 using our novel LungFit® PRO system at 150 ppm to treat patients with CAVP, including

COVID-19. The ongoing trial is a multi-center, open-label, randomized clinical trial in Israel, including patients infected with SARS-CoV-2.

Patients are randomized in a 1:1 ratio to receive either inhalations of 150 ppm NO given intermittently for 40 minutes four times per

day for up to seven days in addition to standard supportive treatment (“NO+SST”) or standard supportive treatment alone (“SST”).

Endpoints related to safety (primary endpoint), oxygen saturation and ICU admission, among others, will be assessed.

We

reported interim data from this ongoing trial at the American Thoracic Society or ATS International Conference 2021, which was held virtually

from May 14, 2021 through May 19, 2021. At the time of the data cut off, the intent-to-treat (“ITT”) analysis population

included 19 COVID-19 patients (9 NO + SST vs 10 SST). The data readout showed that 150 ppm NO treatment administered via LungFit®

PRO was safe and well tolerated and demonstrated encouraging efficacy signals. From a safety perspective, there were no treatment-related,

or possibly related, adverse events or severe adverse events. NO2 levels were below 4 ppm at all timepoints (trial safety

threshold is 5 ppm) and methemoglobin (“MetHb”) levels were below 4% at all times (trial safety threshold is 10%). With respect

to the requirement of oxygen support beyond hospital stay, 22.2% of subjects in the NO + SST group compared with 40% of control subjects

had this requirement. There was an observable trend of shortening the duration of hospital stay and duration on oxygen support for treated

patients. The pilot study in adult viral pneumonia, including COVID-19, remains active with trial sites open for enrollment. Additional

detailed study results may be submitted for presentation at an upcoming scientific meeting in April 2022.

Bronchiolitis

(BRO)

Bronchiolitis

is the leading cause of hospital admission in children less than 1 year of age. The incidence is estimated to be 150 million new cases

a year worldwide, with 2-3% (over 3 million) of them severe enough to require hospitalization. Worldwide, 95%3 of all cases

occur in developing countries. In the U.S., there are more than 120,000 annual bronchiolitis hospitalizations and approximately 3.2 million

annual child hospitalizations globally. Currently, there is no approved treatment for bronchiolitis. The treatment for acute viral lung

infections that cause bronchiolitis in infants is largely supportive care and is based primarily on prolonged hospitalization during

which the infant receives a constant flow of oxygen to treat hypoxemia, a reduced concentration of oxygen in the blood. In addition,

systemic steroids and inhalation with bronchodilators are sometimes utilized until recovery, but we believe that these treatments do

not successfully reduce hospital length of stay. We believe the U.S. market potential for bronchiolitis to be greater than $500 million

and worldwide market potential to be greater than $1.2 billion.

Our

BRO program is currently on hold due to the COVID-19 pandemic. The pivotal study for bronchiolitis was originally set to be performed

in the winter of 2020/21 but was delayed due to the pandemic. We have completed three successful pilot studies for bronchiolitis. A further

analysis of the three previously reported pilot studies was presented at the ATS International Conference 2021, which was held virtually

from May 14, 2021 through May 19, 2021. Analysis across the studies (n=198 infants, mean age 3.9 months) showed that 150 ppm –

160 ppm NO administered intermittently was generally safe and well tolerated with adverse event rates similar among treatment groups

with no reported treatment-related serious adverse events. The short course of treatments with intermittent high concentration inhaled

NO was effective in shortening hospital length of stay and accelerating time to fit for discharge – a composite endpoint of clinical

signs and symptoms to indicate readiness to be evaluated for hospital discharge. This treatment was also effective in accelerating time

to stable oxygen saturation – measured as SpO2 ≥ 92% in room air. Additionally, NO at a dose of 85 ppm NO showed no difference

compared to control for all efficacy endpoints, while 150 ppm NO showed statistical significance when compared to control.

We

believe that the entirety of data at 150 ppm - 160 ppm NO in both adult and infant patient populations supports further development of

LungFit® PRO in a pivotal study for patients hospitalized with viral pneumonia.

LungFit®

GO for the treatment of Nontuberculous mycobacteria (NTM)

NTM

lung infection is a rare and serious pulmonary disease associated with increased morbidity and mortality. Patients with NTM lung disease

may experience a multitude of symptoms such as fever, weight loss, cough, lack of appetite, night sweats, blood in the sputum and fatigue.

Patients with NTM lung disease, specifically Mycobacterium abscessus (M.abscessus) representing 20% - 25% of all NTM and

other forms of NTM that are refractory to antibiotic therapy, frequently require lengthy and repeated hospital stays to manage

their condition. There are no treatments specifically indicated for the treatment of M. abscessus lung disease in North America,

Europe or Japan.

There

are approximately 50,000 to 90,000 people with NTM infections in the U.S. In Asia, the number of patients suffering from NTM surpasses

what is seen in the U.S. There is one inhaled antibiotic approved for the treatment of refractory Mycobacterium avium complex (“MAC”).

Current guideline-based approaches to treat NTM lung disease involve multi-drug regimens of antibiotics that may cause severe, long lasting

side effects, and treatment can be as long as 18 months or more. Median survival for NTM MAC patients is approximately 13 years while

median survival for patients with other variations of NTM is typically 4.6 years. The prevalence of human disease attributable to NTM

has increased over the past two decades. In a study conducted between 2007 and 2016, researchers found that the prevalence of NTM in

the U.S. is increasing at approximately 7.5% per year. M. abscessus treatment costs are estimated to be more than double that of MAC.

In total, a 2015 publication by co-authors from several U.S. government departments stated that annual cases in 2014 cost the U.S. healthcare

system approximately $1.7 billion. For this indication, we believe U.S. sales potential to be greater than $1 billion and worldwide sales

potential to be greater than $2.5 billion.

In

December 2020 we began a 12-week, multi-center, open-label clinical trial in Australia and we plan to enroll approximately 20 adult patients

with chronic refractory NTM lung disease. We received a grant of up to $2.17 million from the CFF to fund this study and advance the

clinical development of inhaled NO to treat NTM pulmonary disease. The trial is enrolling both cystic fibrosis (“CF”) and

non-CF patients infected with MAC or M. abscessus. The study consists of a run-in period followed by two treatment phases. The

run-in period provides a baseline for the efficacy endpoints. The first treatment phase takes place over a two-week period and begins

in the hospital setting where patients will be titrated from 150 ppm NO up to 250 ppm NO over several days. During this phase patients

receive NO for 40 minutes, four times per day while MetHb levels are monitored. Patients are also trained to use LungFit®

GO and subsequently discharged to complete the remaining portion of the two-week treatment period at their home at the highest tolerated

NO concentration. For the second treatment phase, a 10-week maintenance phase, the administration is twice daily. The study is evaluating

safety, quality of life, physical function, and bacterial load among other parameters.

We

reported positive interim results in October 2021. At the time of data cutoff on September 6, 2021, eight subjects were successfully

titrated up to 250 ppm NO in the hospital setting, and none required dose reductions during the subsequent at-home portion of the study.

The mean age of subjects was 56.6 years (range: 22 – 73 years) with the majority female (87.5%), a distribution consistent with

real-world NTM disease, and occurring at a higher rate in older adult women than men. 250 ppm NO was well-tolerated in all subjects with

no study discontinuations or treatment-related serious adverse events observed. Methemoglobin and NO2 concentrations remained

within acceptable ranges in all subjects during NO treatment, and below the safety thresholds of 10% and 5 ppm, respectively. The study

continues to enroll patients, and we anticipate reporting the complete efficacy and safety results in the first half of calendar year

2022. If the trial is successful, we would anticipate commencing a pivotal study in the first half of calendar year 2024.

The

Company’s program in chronic obstructive pulmonary disease (“COPD”) is in the preclinical stage and we anticipate beginning

a pilot study in calendar year 2022 or 2023.

Ultra-High

Concentration NO in solid tumors through majority-owned affiliate Beyond Cancer, Ltd.

In

November 2021, we secured commitments of $23.9 million in a concurrent private placement of common shares, not to exceed $30 million,

providing the investors with up to 20% equity ownership in Beyond Cancer, a new and independently managed, private company. The funding

is expected to be used to accelerate ongoing preclinical work including the completion of IND-enabling studies, completion of a Phase

1 study, expansion of preclinical programs for combination studies, hiring of additional Beyond Cancer team members, and optimization

of the delivery system, as well as for general corporate purposes. The concurrent private placement is expected to close in the fourth

fiscal quarter.

Beyond

Cancer will benefit from Beyond Air’s NO expertise, IP portfolio, preclinical oncology team, and regulatory progress, and will

pay Beyond Air a single digit royalty on all future revenues. Beyond Cancer will be led by a seasoned leadership team with experience

in emerging healthcare companies and clinical oncology.

Ultra-high

concentration NO has shown anticancer properties in preclinical trials by eliciting an immune response from the host. We have released

this preclinical data at several medical/scientific conferences showing the promise of delivering NO at concentrations of 20,000 ppm

– 200,000 ppm directly to tumors. Results showed that local tumor ablation with NO conveyed anti-tumor immunity to the host. In

our most recent release of data, 8 of 11 mice treated with a single administration of 25,000 ppm NO over five minutes were resistant

to a subsequent tumor challenge and 11 of 11 mice treated with 50,000 ppm NO were resistant to a subsequent tumor challenge. Preclinical

work will continue with a goal of beginning the enrollment of patients in a first-in-human study in the first half of calendar year 2022.

For

more information about us, please refer to other documents that we have filed with the SEC and that are incorporated by reference into

this prospectus supplement, as listed under the heading “Incorporation of Documents by Reference.”

Litigation

Update

On

March 16, 2018, Empery Asset Master, Ltd. (“Empery Master”), Empery Tax Efficient, LP (“Empery I) and Empery Tax Efficient

II, LP (“Empery II), (collectively, “Empery”) filed a complaint in the Supreme Court of the State of New York (the

“Trial Court”), relating to the notice of adjustment of both the exercise price of and the number of warrant shares issuable

under warrants issued to Empery in January 2017. Empery alleges that, as a result of certain circumstances in connection with the February

2018 financing transaction, the 166,672 warrants issued to Empery in January 2017 provide for adjustments to both the exercise price

of the warrants and the number of warrant shares issuable upon such exercise. On August 20, 2020, the Trial Court denied the Company’s

summary judgment motion as to the first and third claim for relief, but dismissed the second claim for declaratory judgment as moot (the

“August 20 Decision”). The Appellate Division First Department denied the Company’s appeal of the August 20 Decision

on September 30, 2021. Following a three day bench trial, the Trial Court issued a decision on October 14, 2021, finding in favor of

Empery on the two remaining claims, granting reformation of the Warrant Agreement, and awarding Empery damages in the aggregate amount

of approximately $5.8 million (the “October 14 Decision”). On November 12, 2021, we filed a notice of appeal. Pending appeal,

we are required to use approximately $7.4 million of cash as collateral to secure a supersedeas bond for the full amount of damages and

interest in the case that we are unsuccessful in our appeal. On September 30, 2021, we recorded an estimate for a contingent loss of

$2.4 million related to the Empery litigation. We, in consultation with outside legal counsel, believe that we have several meritorious

defenses against the claims, and the decision of the Trial Court.

On

December 28, 2021, Hudson Bay Master Fund (“Hudson”) filed a complaint in the Trial Court relating to the notice of adjustment

of both the exercise price of and the number of warrant shares issuable under warrants issued to Hudson in January 2017. Hudson’s

complaint alleges breach of contract and that it is entitled to damages estimated at approximately $2.6 million. We, in consultation

with outside legal counsel, believe that we have several meritorious defenses against Hudson’s claims. We believe that Hudson’s

claims have no merit and we shall vigorously defend such lawsuit.

Corporate

Information

We

were incorporated on April 28, 2015 under Delaware law. On June 25, 2019, our name was changed to Beyond Air, Inc. from AIT Therapeutics,

Inc.

Our

principal executive offices are located at 900 Stewart Avenue, Suite 301, Garden City, New York 11530, and our telephone number is (516)

665-8200. Our website address is www.beyondair.net. The information contained on, or that can be accessed through, our website is not

part of this prospectus. We have included our website address in this prospectus supplement solely as an inactive textual reference.

THE

OFFERING

|

Common

Stock Offered By Us

|

|

Shares

of our common stock having an aggregate offering price of up to $50,000,000.

|

|

Manner

of Offering

|

|

“At

the market offering” that may be made from time to time through our agents, Truist and Oppenheimer. See “Plan of Distribution”

on page S-13 of this prospectus supplement.

|

|

Use

of Proceeds

|

|

We

currently intend to use the net proceeds from this offering primarily to further advance our pipeline of product candidates and for

working capital and general corporate purposes. See “Use of Proceeds” on page S-11 of this prospectus supplement.

|

|

Risk

Factors

|

|

Investing

in our common stock involves significant risks. See “Risk Factors” on page S-9 of this prospectus supplement, and under

similar headings in other documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

|

|

Nasdaq

Capital Market Symbol

|

|

“XAIR”.

|

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider

the risk factors we describe in this prospectus supplement, any related free writing prospectus for a specific offering of securities,

as well as those incorporated by reference into this prospectus supplement or accompanying prospectus (including, without limitation,

in our Annual Report on Form 10-K for the year ended March 31, 2021). You should also carefully consider other information contained

and incorporated by reference in this prospectus supplement and the accompanying prospectus, including our financial statements and the

related notes thereto incorporated by reference herein. The risks and uncertainties described in this prospectus supplement and our other

filings with the SEC incorporated by reference herein are not the only ones we face. Additional risks and uncertainties not presently

known to us or that we currently consider immaterial may also adversely affect us. Our business, financial condition or results of operations

could be materially harmed by these risks. In such case, the value of our securities could decline and you may lose all or part of your

investment.

Risks

Relating to Our Business Operations

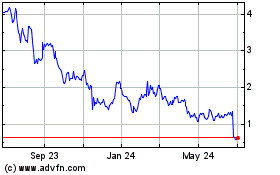

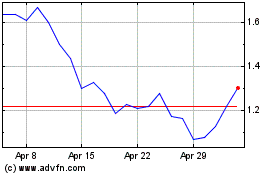

Recent

trading in our common stock has been volatile and may continue to be volatile in the future.

Our

common stock has recently experienced extreme volatility. In November 2021, our common stock closed as high as $15.61 per share and in

January 2022 as low as $6.06 per share. Our common stock may continue to be volatile and could materially fall for a number of reasons

including:

|

|

●

|

Announcements

by competitors that they have successfully produced an effective vaccine or other treatment option for COVID-19;

|

|

|

●

|

Public

announcement that the rapid spread of COVID-19 has receded;

|

|

|

●

|

Our

ability to obtain FDA approval of the PMA for our LungFit® system;

|

|

|

●

|

The

continued large declines in major stock market indexes which causes investors to sell our common stock;

|

|

|

●

|

The

termination of any other factors which may have created volatility and spike in volume; or

|

|

|

●

|

Other

possible reasons for volatility which we have disclosed in our reports filed with the SEC and incorporated by reference into this

prospectus supplement.

|

We

cannot assure you that our stock price and volume will remain at current levels in which case investors may sustain large losses.

We

face business disruption and related risks resulting from the COVID-19 pandemic, which could have a material adverse effect on our business

plan.

The

development of our product candidates could be further disrupted and materially adversely affected by a resurgence of the COVID-19 pandemic.

We experienced significant delays in the supply chain for LungFit® due to the redundancy in parts and suppliers with ventilator

manufacturing which has since been remedied. We continuously assess the impact that COVID-19 may have on our business plans and our ability

to conduct the preclinical studies and clinical trials as well as on our reliance on third-party manufacturing and our supply chain.

However, there can be no assurance that we will be able to avoid part or all of any impact from COVID-19 or its consequences if a resurgence

occurs.

The

ultimate resolution of two lawsuits against us, while not material to our operations, may be material to our financial statements.

On

September 30, 2021, we recorded an estimate for a contingent loss of $2.4 million related to the lawsuit filed against us in 2018 by

Empery relating to the notice of adjustment of the exercise price of and the number of warrant shares issuable under warrants issued

to Empery in January 2017. In December 2021 Hudson filed a lawsuit against us related to the notice of adjustment of the exercise price

of and the number of warrant shares issuable under warrants issued to Hudson in January 2017. The ultimate resolution of these two lawsuits

against us, and potential lawsuits that may be filed by other holders of warrants issued in January 2017 relating to the adjustment of

such warrants’ exercise price and number of underlying shares, if unfavorable, could result in losses in excess of our current

estimates which may be material to our financial statements.

Risks

Related to This Offering

Our

management will have broad discretion over the use of any net proceeds from this offering, you may not agree with how we use the proceeds,

and the proceeds may not be invested successfully.

Our

management will have broad discretion as to the use of any net proceeds from this offering and could use them for purposes other than

those contemplated at the time of this offering. Accordingly, you will be relying on the judgment of our management with regard to the

use of any proceeds from the sale of shares of common stock in this offering, and you will not have the opportunity, as part of your

investment decision, to assess whether the proceeds are being used appropriately. It is possible that the proceeds will be invested in

a way that does not yield a favorable, or any, return for you.

You

may experience dilution.

The

offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this

offering. Assuming that an aggregate of 6,906,077 shares of our common stock are sold at a price of $7.24 per share, the last reported

sale price of our common stock on the Nasdaq Capital Market on February 2, 2022, for aggregate gross proceeds of $50,000,000, and after

deducting commissions and estimated offering expenses payable by us, you would experience immediate dilution of $4.47 per share, representing

the difference between our as adjusted net tangible book value per share as of September 30, 2021, after giving effect to this offering,

and the assumed offering price. The exercise of outstanding stock options and warrants would result in further dilution of your investment.

See the section entitled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate

in this offering. Because the sales of the shares offered hereby will be made directly into the market, the prices at which we sell these

shares will vary and these variations may be significant. Purchasers of the shares we sell, as well as our existing stockholders, will

experience significant dilution if we sell shares at prices significantly below the price at which they invested.

Investors

in this offering may experience future dilution as a result of future equity offerings.

In

order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into

or exchangeable for our common stock. Investors purchasing our shares or other securities in the future could have rights superior to

existing common stockholders, and the price per share at which we sell additional shares of our common stock or other securities convertible

into or exchangeable for our common stock in future transactions may be higher or lower than the price per share in this offering.

Sales

of a significant number of shares of our common stock in the public markets, or the perception that such sales could occur, could depress

the market price of our common stock.

Sales

of a substantial number of shares of our common stock in the public markets could depress the market price of our common stock and impair

our ability to raise capital through the sale of additional equity securities. We cannot predict the effect that future sales of our

common stock would have on the market price of our common stock.

We

do not intend to pay any cash dividends on our common stock in the foreseeable future and, therefore, any return on your investment in

our common stock must come from increases in the fair market value and trading price of our common stock.

We

do not intend to pay any cash dividends on our common stock in the foreseeable future and, therefore, any return on your investment in

our common stock must come from increases in the fair market value and trading price of our common stock.

USE

OF PROCEEDS

We

may issue and sell shares of our common stock having aggregate sales proceeds of up to $50,000,000 from time to time in this offering.

Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount,

commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will sell any shares under

or fully utilize the sales agreement with the agents as a source of financing.

We

intend to use net proceeds from this offering for general corporate purposes, which may include working capital, capital expenditures,

research and development expenditures, clinical trial expenditures, commercial expenditures, acquisitions of new technologies, products

or businesses, and investments. The amounts and timing of these expenditures will depend on numerous factors, including the development

of our current business initiatives. Pending use of the net proceeds from this offering as described above, we may invest the net proceeds

in short-term interest-bearing investment grade instruments.

DILUTION

If

you purchase shares in this offering, you will experience dilution to the extent of the difference between the public offering price

of the shares and the net tangible book value per share of our common stock immediately after this offering.

Our

net tangible book value as of September 30, 2021 was approximately $40,565,000 or $1.61 per share of common stock. Net tangible book

value per share is determined by dividing our total tangible assets, less total liabilities, by the number of our shares of common stock

outstanding as of September 30, 2021. Dilution in net tangible book value per share represents the difference between the amount per

share paid by purchasers of shares in this offering and the net tangible book value per share of our common stock immediately after this

offering.

After

giving effect to the assumed sale of 7,429,421 shares of our common stock in this offering at an assumed offering price of $7.24 per

share, the last reported sale price of our common stock on the Nasdaq Capital Market on February 2, 2022 and after deducting commissions

and estimated offering expenses payable by us, our as adjusted net tangible book value as of September 30, 2021 would have been approximately

$89,065,000, or $2.77 per share. This represents an immediate increase in net tangible book value of $1.16 per share to existing stockholders

and immediate dilution of $4.47 per share to investors purchasing our common stock in this offering at the assumed offering price. The

following table illustrates this dilution on a per share basis:

|

Assumed

public offering price per share

|

|

$

|

7.24

|

|

|

Net

tangible book value per share as of September 30, 2021

|

|

$

|

1.61

|

|

|

Increase

per share attributable to this offering

|

|

$

|

1.16

|

|

|

As

adjusted net tangible book value per share as of September 30, 2021 after this offering

|

|

$

|

2.77

|

|

|

Dilution

per share to new investors participating in this offering

|

|

$

|

4.47

|

|

The

number of shares of our common stock that will be issued and outstanding immediately after this offering as shown above is based on 25,209,749

shares of common stock issued and outstanding as of September 30, 2021 and excludes, as of that date:

|

|

●

|

4,271,160

shares of our common stock issuable upon exercise of outstanding stock options;

|

|

|

●

|

3,109,627

shares of our common stock issuable upon exercise of outstanding warrants;

|

|

|

●

|

787,200

shares of our common stock underlying restricted stock units pursuant to our amended and restated 2013 Equity Incentive Plan (“2013

Plan”); and

|

|

|

●

|

520,511

shares of our common stock reserved for future issuance under our 2013 Plan and 2021 Employee Stock Purchase Plan (“2021 Plan”).

|

The

table above assumes for illustrative purposes that an aggregate of 7,429,421 shares of our common stock are sold during the term of the

sales agreement with the agents at a price of $7.24 per share, the last reported sale price of our common stock on the Nasdaq Capital

Market on February 2, 2022 for aggregate gross proceeds of $50,000,000. The shares sold in this offering, if any, will be sold from time

to time at various prices. An increase of $1.00 per share in the price at which the shares are sold from the assumed offering price of

$7.24 per share, assuming all of our common stock in the aggregate amount of $50,000,000 during the term of the sales agreement with

the agents is sold at that price, would decrease our adjusted net tangible book value per share after the offering to $1.24 share and

would increase the dilution in net tangible book value per share to new investors in this offering to $5.39 per share, after deducting

commissions and estimated offering expenses payable by us. A decrease of $1.00 per share in the price at which the shares are sold from

the assumed offering price of $7.24 per share, assuming all of our common stock in the aggregate amount of $50,000,000 is sold at that

price, would decrease our adjusted net tangible book value per share after the offering to $1.07per share and would decrease the dilution

in net tangible book value per share to new investors in this offering to $3.56 per share, after deducting commissions and estimated

offering expenses payable by us. This information is supplied for illustrative purposes only.

We

may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds

for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible

debt securities, the issuance of these securities may result in further dilution to our shareholders. To the extent that outstanding

options or warrants outstanding as of September 30, 2021 have been or may be exercised or other shares issued, investors purchasing our

common stock in this offering may experience further dilution.

PLAN

OF DISTRIBUTION

We

have entered into a sales agreement with Truist and Oppenheimer, under which we may issue and sell from time to time up to $50,000,000

of our common stock through Truist and Oppenheimer as our sales agents. Sales of our common stock, if any, will be made at market prices

by any method that is deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act, including

sales made directly on the Nasdaq Capital Market or any other trading market for our common stock. If authorized by us in writing, the

agents may purchase shares of our common stock as principal.

The

agents will offer our common stock subject to the terms and conditions of the sales agreement on a daily basis or as otherwise agreed

upon by us and the agents. We will designate the maximum amount of common stock to be sold through the agents on a daily basis or otherwise

determine such maximum amount together with the agents. Subject to the terms and conditions of the sales agreement, the agents will use

their commercially reasonable efforts to sell on our behalf all of the shares of common stock requested to be sold by us. We may instruct

the agents not to sell common stock if the sales cannot be effected at or above the price designated by us in any such instruction. The

agents or we may suspend the offering of our common stock being made through the agents under the sales agreement upon proper notice

to the other parties. The agents and we each have the right, by giving written notice as specified in the sales agreement, to terminate

the sales agreement in each party’s sole discretion at any time.

The

aggregate compensation payable to Truist and Oppenheimer as sales agents equals up to 3.0% of the gross sales price of the shares sold

through them pursuant to the sales agreement. We have also agreed to reimburse the agents for up to $50,000 of the actual outside legal

expenses incurred by the agents. We estimate that the total expenses in connection with the transactions contemplated by the sales agreement

payable by us, excluding commissions payable to the agents under the sales agreement, will be approximately $125,000.

The

remaining sales proceeds, after deducting any expenses payable by us and any transaction fees imposed by any governmental, regulatory,

or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of such common stock.

The

agents will provide written confirmation to us following the close of trading on the Nasdaq Capital Market on each day in which common

stock is sold through them as sales agents under the sales agreement. Each confirmation will include the number of shares of common stock

sold through the agents as sales agent on that day, the volume weighted average price of the shares sold, the percentage of the daily

trading volume and the net proceeds to us.

Settlement

for sales of common stock will occur, unless the parties agree otherwise, on the second business day that is also a trading day following

the date on which any sales were made in return for payment of the net proceeds to us. There is no arrangement for funds to be received

in an escrow, trust or similar arrangement.

In

connection with the sales of our common stock on our behalf, each of the agents may be deemed to be an “underwriter” within

the meaning of the Securities Act, and the compensation paid to the agents may be deemed to be underwriting commissions or discounts.

We have agreed in the sales agreement to provide indemnification and contribution to the agents against certain liabilities, including

liabilities under the Securities Act. As sales agents, the agents will not engage in any transactions that stabilizes our common stock.

Our

common stock is listed on the Nasdaq Capital Market and trades under the symbol “XAIR”. The transfer agent of our common

stock is Action Stock Transfer Corporation.

The

agents and/or their affiliates have provided, and may in the future provide, various investment banking and other financial services

for us for which services they have received and, may in the future receive, customary fees.

LEGAL

MATTERS

Certain

legal matters with respect to the legality of the issuance of the securities offered by this prospectus supplement will be passed upon

for us by Sichenzia Ross Ference LLP, New York, New York. Goodwin Procter LLP, New York, New York will pass upon certain legal matters

in connection with the offering for Truist and Oppenheimer.

EXPERTS

The

consolidated financial statements as of March 31, 2021 and 2020 and for each of the years in the two year period ended March 31, 2021

incorporated by reference in this prospectus supplement from our Annual Report on Form 10-K for the year ended March 31, 2021 have been

so included in reliance on the report of Friedman LLP, an independent registered public accounting firm, given on the authority of said

firm as experts in accounting and auditing.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We

file annual, quarter and periodic reports, proxy statements and other information with the SEC. You may access such reports and information

at the SEC’s website at www.sec.gov.

This

prospectus supplement and the accompanying prospectus are part of the registration statement on Form S-3 filed with the SEC under the

Securities Act for the common stock offered by this prospectus supplement. This prospectus supplement does not contain all of the information

set forth in the registration statement, certain parts of which have been omitted in accordance with the rules and regulations of the

SEC. For further information, reference is made to the registration statement and its exhibits. Whenever we make references in this prospectus

supplement or the accompanying prospectus to any of our contracts, agreements or other documents, the references are not necessarily

complete and you should refer to the exhibits attached to the registration statement for the copies of the actual contract, agreement

or other document.

INCORPORATION

OF DOCUMENTS BY REFERENCE

We

are “incorporating by reference” in this prospectus certain documents we file with the SEC, which means that we can disclose

important information to you by referring you to those documents. The information in the documents incorporated by reference is considered

to be part of this prospectus. Statements contained in documents that we file with the SEC and that are incorporated by reference in

this prospectus will automatically update and supersede information contained in this prospectus, including information in previously

filed documents or reports that have been incorporated by reference in this prospectus, to the extent the new information differs from

or is inconsistent with the old information. We incorporate by reference the following information or documents that we have filed with

the SEC (excluding those portions of any Form 8-K that are not deemed “filed” pursuant to the General Instructions of Form

8-K):

|

|

●

|

our

Annual Report on Form 10-K for the fiscal year ended March 31, 2021, filed with the SEC on June 10, 2021, as amended by our Annual

Report on Form 10-K/A filed with the SEC on July 23, 2021;

|

|

|

●

|

our

Proxy Statement filed with the SEC on January 21, 2022;

|

|

|

●

|

our

Quarterly Reports on Form 10-Q for the quarterly period ended June 30, 2021, filed with the SEC on August 10, 2021, and September

30, 2021, filed with the SEC on November 12, 2021;

|

|

|

●

|

our

Current Reports on Form 8-K, filed with the SEC on May 13, 2021, May 26, 2021, August 25, 2021, September 27, 2021, October 20, 2021,

November 5, 2021, November 15, 2021 (except Item 2.02 and the portions of Item 99.1 covered by Item 2.02) and December 10, 2021;

and

|

|

|

●

|

the

description of our common stock contained in our Registration Statement on Form 8-A, filed with the SEC on May 3, 2019, including

any amendments or reports filed for the purpose of updating such description.

|

Any

information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information

in this prospectus supplement or the accompanying prospectus or in a later filed document that is incorporated or deemed to be incorporated

herein by reference modifies or replaces such information.

We

also incorporate by reference any future filings (excluding information furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits

filed on such form that are related to such items) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act,

until we sell all of the securities offered by this prospectus supplement. Information in such future filings updates and supplements

the information provided in this prospectus supplement. Any statements in any such future filings will automatically be deemed to modify

and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein

by reference to the extent that statements in the later filed document modify or replace such earlier statements.

You

may request, orally or in writing, a copy of these documents, which will be provided to you at no cost (other than exhibits, unless such

exhibits are specifically incorporated by reference), by contacting Adam T. Newman, c/o Beyond Air, Inc., at 900 Stewart Avenue, Suite

301, Garden City, New York 11530. Our telephone number is (516) 665-8200. Information about us is also available at our website at http://www.beyondair.net.

The information in our website is not a part of this prospectus and is not incorporated by reference.

PROSPECTUS

$200,000,000

Common

Stock

Preferred

Stock

Warrants

Debt

Securities

Units

We

may offer to the public from time to time in one or more series or issuances:

|

|

●

|

shares

of our common stock;

|

|

|

|

|

|

|

●

|

shares

of our preferred stock;

|

|

|

|

|

|

|

●

|

warrants

to purchase shares of our common stock, preferred stock and/or debt securities;

|

|

|

|

|

|

|

●

|

debt

securities consisting of debentures, notes or other evidences of indebtedness;

|

|

|

|

|

|

|

●

|

units

consisting of a combination of the foregoing securities; or

|

|

|

|

|

|

|

●

|

any

combination of these securities.

|

The

aggregate initial offering price of all securities sold by us pursuant to this prospectus will not exceed $200,000,000.

This

prospectus provides a general description of the securities that we may offer. Each time that we offer securities under this prospectus,

we will provide the specific terms of the securities offered, including the public offering price, in a supplement to this prospectus.

Any prospectus supplement may add to, update or change information contained in this prospectus.

The

securities may be sold by us to or through underwriters or dealers, directly to purchasers or through agents designated from time to

time. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution”

in this prospectus and the comparable section of any applicable prospectus supplement. If any underwriters are involved in the sale of

the securities with respect to which this prospectus is being delivered, the names of such underwriters and any applicable discounts

or commissions and over-allotment options will be set forth in the applicable prospectus supplement.

Our

common stock trades on the Nasdaq Capital Market under the ticker symbol “XAIR.” On January 21, 2022, the last reported

sale price per share of our common stock was $6.77. We have not yet determined whether the other securities that may be offered

by this prospectus will be listed on any exchange, interdealer quotation system or over-the-counter market. If we decide to seek the

listing of any such securities upon issuance, the prospectus supplement relating to those securities will disclose the exchange, quotation

system or market on which those securities will be listed.

INVESTING

IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. RISKS ASSOCIATED WITH AN INVESTMENT IN OUR SECURITIES WILL BE DESCRIBED IN THE APPLICABLE

PROSPECTUS SUPPLEMENT AND CERTAIN OF OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION INCORPORATED BY REFERENCE INTO THIS PROSPECTUS,

AS DESCRIBED UNDER “RISK FACTORS” ON PAGE 4.

You

should read this prospectus and any applicable prospectus supplement together with additional information described under the heading

“Where You Can Find More Information” before you make your investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is February 1, 2022.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is a part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using

a “shelf” registration process. Under this shelf registration process, we may offer to sell any of the securities, or any

combination of the securities, described in this prospectus, in each case in one or more offerings, up to a total dollar amount of $200,000,000.

This

prospectus provides you only with a general description of the securities that we may offer. Each time securities are sold under the

shelf registration statement, we will provide a prospectus supplement that will contain specific information about the terms of those

securities and the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus.

If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information

in the prospectus supplement. You should read both this prospectus and any prospectus supplement, including all documents incorporated

by reference herein and therein, together with the additional information described under “Where You Can Find More Information”

below.

The

information contained in this prospectus is not complete and may be changed. You should rely only on the information provided in or incorporated

by reference in this prospectus or in any prospectus supplement, or documents to which we otherwise refer you. We have not authorized

anyone else to provide you with different information.

We

have not authorized any dealer, agent or other person to give any information or to make any representation other than those contained

or incorporated by reference in this prospectus and any accompanying prospectus supplement. You must not rely upon any information or

representation not contained or incorporated by reference in this prospectus or an accompanying prospectus supplement. This prospectus

and the accompanying prospectus supplement, if any, do not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the registered securities to which they relate, nor do this prospectus and the accompanying prospectus supplement, if any,

constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful

to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus and

the accompanying prospectus supplement, if any, is accurate on any date subsequent to the date set forth on the front of such document

or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated

by reference, even though this prospectus and any accompanying prospectus supplement is delivered or securities are sold on a later date.

References

in this prospectus to the terms “the Company,” “Beyond Air,” “we,” “our” and “us”

or other similar terms mean Beyond Air, Inc. and our wholly owned subsidiaries, unless we state otherwise or the context indicates otherwise.

FORWARD-LOOKING

STATEMENTS

This

prospectus and the documents incorporated by reference herein contain, and any prospectus supplement and the documents incorporated therein,

contain forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements

other than statements of historical facts contained in this prospectus, any prospectus supplement or the documents incorporated herein

and therein by reference, including statements regarding our future results of operations and financial position, business strategy,

prospective product candidates and products, product approvals, timing of our clinical development activities, research and development

costs, timing and likelihood of success and the plans and objectives of management for future operations and future results of anticipated

products are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors

that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

express or implied by the forward-looking statements.

In

some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,”

“expect,” “plan,” “anticipate,” “expect,” “could,” “intend,”

“target,” “project,” “contemplate,” “believe,” “estimate,” “predict,”

“potential” or “continue” or the negative of these terms or other similar conditional expressions. The forward-looking

statements in this prospectus, any prospectus supplement or the documents incorporated herein and therein by reference, are only predictions.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak

only as of the date of this prospectus and are subject to a number of important factors that could cause actual results to differ materially

from those in the forward-looking statements, including the factors described under Item 1A “Risk Factors” contained in our

most recently filed Annual Report on Form 10-K, as well as the following:

|

|

●

|

our

status as a development-stage company and our expectation to incur losses in the future;

|

|

|

|

|

|

|

●

|

our

future capital needs and our need to raise additional funds;

|

|

|

|

|

|

|

●

|

our

ability to obtain U.S. Food and Drug Administration (“FDA”) approval of the Premarket

Approval Application for the LungFit® system;

|

|

|

|

|

|

|

●

|

our

ability to build a pipeline of product candidates and develop and commercialize products;

|

|

|

|

|

|

|

●

|

our

ability to enroll patients in clinical trials, timely and successfully complete those trials

and receive necessary regulatory approvals;

|

|

|

|

|

|

|

●

|

our

ability to maintain our existing or future collaborations or licenses;

|

|

|

|

|

|

|

●

|

our

ability to protect and enforce our intellectual property rights;

|

|

|

|

|

|

|

●

|

federal,

state and foreign regulatory requirements, including the FDA regulation of our product candidates;

|

|

|

|

|

|

|

●

|

our

ability to obtain and retain key executives and attract and retain qualified personnel;

|

|

|

|

|

|

|

●

|

our

ability to successfully manage our growth; and

|

|

|

|

|

|

|

●

|

our

ability to address business disruption and related risks resulting from the COVID-19 pandemic,

which could have a material adverse effect on our business plan.

|

Moreover,

we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management

to predict all risk factors and uncertainties.

We

cannot guarantee that the results and other expectations expressed, anticipated or implied in any forward-looking statement will be realized.

The risks set forth under Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2021, as revised or supplemented

by our Quarterly Reports on Form 10-Q and other documents we file with the SEC, describe major risks to our business, and you should

read and interpret any forward-looking statements together with these risks. A variety of factors, including these risks, could cause

our actual results and other expectations to differ materially from the anticipated results or other expectations expressed, anticipated

or implied in our forward-looking statements. Should known or unknown risks materialize, or should underlying assumptions prove inaccurate,

actual results could differ materially from past results and those anticipated, estimated or projected in the forward-looking statements.

You should bear this in mind as you consider any forward-looking statements.

You

should read this prospectus, any prospectus supplement and the documents that we incorporate by reference herein and therein completely

and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking

statements by these cautionary statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking

statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

MARKET,

INDUSTRY AND OTHER DATA

This

prospectus and any applicable prospectus supplement and the documents incorporated by reference herein and therein contain estimates,

projections, market research and other information concerning our industry, our business, markets for LungFit® PH and

our other product candidates and the size of those markets, the prevalence of certain medical conditions, LungFit® PH

market access, prescription data and other physician, patient and payor data. Unless otherwise expressly stated, we obtain this information

from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical

and general publications, government data and similar sources as well as from our own internal estimates and research and from publications,

research, surveys and studies conducted by third parties on our behalf. Information that is based on estimates, projections, market research

or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events

and circumstances that are reflected in this information. As a result, you are cautioned not to give undue weight to such information.

SUMMARY

This

summary highlights selected information from this prospectus and does not contain all of the information that you need to consider in

making your investment decision. You should carefully read the entire prospectus, the applicable prospectus supplement and any related

free writing prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors” contained

in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that

are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this

prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Company

Overview

We

are a clinical-stage medical device and biopharmaceutical company developing a nitric oxide (“NO”) generator and delivery

system (the “LungFit® system”) capable of generating NO from ambient air. The LungFit® platform

can generate NO up to 400 parts per million for delivery to a patient’s lungs directly or via a ventilator. LungFit® can

deliver NO either continuously or for a fixed amount of time at various flow rates and has the ability to either titrate dose on demand

or maintain a constant dose. We believe that LungFit® can be used to treat patients on ventilators that require NO, as

well as patients with chronic or acute severe lung infections via delivery through a breathing mask or similar apparatus. Furthermore,

we believe that there is a high unmet medical need for patients suffering from certain severe lung infections that the LungFit®

platform can potentially address. The Company’s current areas of focus with LungFit® are persistent pulmonary

hypertension of the newborn (PPHN), acute viral pneumonia (AVP) including COVID-19, bronchiolitis (BRO) and nontuberculous mycobacteria

(NTM) lung infection. The Company’s current product candidates will be subject to premarket reviews and approvals by the FDA, CE

marking conformity assessment by a notified body in the European Union, as well as similar regulatory agencies’ reviews or approvals