UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

|

☐

|

Preliminary Information Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

☒

|

Definitive Information Statement

|

|

COSMOS GROUP HOLDINGS INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

Payment of Filing Fee (Check the appropriate box)

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

5)

|

Total fee paid:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

3)

|

Filing Party:

|

|

|

4)

|

Date Filed:

|

37th Floor, Singapore Land Tower

50 Raffles Place

Singapore 048623

NOTICE OF CORPORATE ACTIONS TAKEN BY WRITTEN CONSENT

OF MAJORITY STOCKHOLDERS WITHOUT SPECIAL MEETING OF THE STOCKHOLDERS

Dear Stockholders:

We are writing to advise you that, on December 29, 2021, the board of directors of Cosmos Group Holdings Inc., a Nevada corporation (“COSG,” “the Company,” “we” or “us”), and certain stockholders holding a majority of the voting rights of our common stock approved by written consent in lieu of a special meeting the taking of all steps necessary to effect the following actions (collectively, the “Corporate Actions”):

|

1.

|

Amend the Company’s Articles of Incorporation filed with the Nevada Secretary of State (the “Articles of Incorporation”) to change the Company’s name to Coinllectibles Inc.;

|

|

2.

|

Amend the Articles of Incorporation to increase the Company’s authorized capital from 530,000,000 to 5,030,000,000 shares, consisting of 5,000,000,000 shares of common stock, par value $0.001, and 30,000,000 shares of preferred stock, par value $0.001; and

|

|

3.

|

Elect NOT to be governed by Sections NRS 78.378 to 78.3792 inclusive of the Nevada Revised Statutes.

|

The accompanying information statement, which describes the Corporate Actions in more detail, is being furnished to our stockholders for informational purposes only, pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder. The consent that we have received constitutes the only stockholder approval required for the Corporate Actions under the Nevada Revised Statutes, our Articles of Incorporation and Bylaws. Accordingly, the Corporate Actions will not be submitted to the other stockholders of the Company for a vote.

The record date for the determination of stockholders entitled to notice of the action by written consent is December 29, 2021. Pursuant to Rule 14c-2 under the Exchange Act, the Corporate Actions will not be implemented until at least twenty (20) calendar days after the mailing of this information statement to our stockholders. This information statement will be mailed on or about January 20, 2022, to stockholders of record on December 29, 2021. As such, we expect that the Corporate Actions will be effective no earlier than February 9, 2022.

No action is required by you to effectuate this action. The accompanying information statement is furnished only to inform our stockholders of the action described above before it takes effect in accordance with Rule 14c-2 promulgated under the Exchange Act.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

PLEASE NOTE THAT THE HOLDERS OF A MAJORITY OF OUR OUTSTANDING SHARES OF COMMON STOCK HAVE VOTED TO AUTHORIZE THE CORPORATE ACTIONS. THE NUMBER OF VOTES RECEIVED IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT AND NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THIS MATTER.

By order of the Board of Directors,

|

|

By:

|

/s/ Man Chung Chan

|

|

|

|

|

Man Chung Chan

|

|

|

|

|

Chief Executive Officer, Chief Financial Officer, Secretary

|

|

|

|

|

January 20, 2022

|

|

COSMOS GROUP HOLDINGS INC.

INFORMATION STATEMENT REGARDING

CORPORATE ACTIONS TAKEN BY WRITTEN CONSENT OF

OUR BOARD OF DIRECTORS AND HOLDERS OF

A MAJORITY OF OUR VOTING CAPITAL STOCK

IN LIEU OF SPECIAL MEETING

Cosmos Group Holdings Inc. (“COSG,” “the Company,” “we” or “us”) is furnishing this information statement to you to provide a description of actions taken by our Board of Directors and the holders of a majority of our outstanding voting capital stock on December 29, 2021, in accordance with the relevant sections of Nevada Revised Statutes of the State of Nevada (the “NRS”).

This information statement is being mailed on or about January 20, 2022 to stockholders of record on December 29, 2021 (the “Record Date”). The information statement is being delivered only to inform you of the corporate actions described herein before such actions take effect in accordance with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). No action is requested or required on your part.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE NOTE THAT THE HOLDERS OF A MAJORITY OF OUR OUTSTANDING SHARES OF COMMON STOCK HAVE VOTED TO AUTHORIZE THE CORPORATE ACTIONS. THE NUMBER OF VOTES RECEIVED IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT AND NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THESE MATTERS.

GENERAL DESCRIPTION OF CORPORATE ACTION

On December 29, 2021, the board of directors of Cosmos Group Holdings Inc., a Nevada corporation, and certain stockholders holding a majority of the voting rights of our common stock approved by written consent in lieu of a special meeting the taking of all steps necessary to effect the following actions (collectively, the “Corporate Actions”):

|

1.

|

Amend the Company’s Articles of Incorporation filed with the Nevada Secretary of State (the “Articles of Incorporation”) to change the Company’s name to Coinllectibles Inc.;

|

|

2.

|

Amend the Articles of Incorporation to increase the Company’s authorized capital from 530,000,000 to 5,030,000,000 shares, consisting of 5,000,000,000 shares of common stock, par value $0.001, and 30,000,000 shares of preferred stock, par value $0.001; and

|

|

3.

|

Elect NOT to be governed by Sections NRS 78.378 to 78.3792 inclusive of the Nevada Revised Statutes.

|

VOTING AND VOTE REQUIRED

Pursuant to COSG’s Bylaws and the NRS, a vote by the holders of at least a majority of COSG’s outstanding capital stock is required to effect the actions described herein. Each common stockholder is entitled to one vote for each share of common stock held by such stockholder. As of the Record Date, COSG had 358,067,481 shares of common stock issued and outstanding. The voting power representing not less than 179,033,741 shares of common stock is required to pass any stockholder resolutions. Pursuant to Section 78.320 of the NRS, the following stockholders holding an aggregate of 239,153,326 shares of common stock, or approximately 66.79% of the issued and outstanding shares of our common stock on the Record Date (the “Majority Stockholders”), delivered an executed written consent dated December 29, 2021, authorizing the Corporate Actions.

|

Name

|

|

Common Shares Beneficially Held

|

|

|

Percentage of Issued and Outstanding

|

|

|

LEE Ying Chiu Herbert

|

|

|

224,500,685

|

|

|

|

62.69

|

%

|

|

CHAN Man Chung

|

|

|

14,380,288

|

|

|

|

4.02

|

%

|

|

TAN Tee Soo

|

|

|

272,353

|

|

|

|

0.08

|

%

|

|

TOTAL

|

|

|

239,153,326

|

|

|

|

66.79

|

%

|

NO APPRAISAL RIGHTS

Under the NRS, stockholders are not entitled to appraisal rights with respect to the Corporate Actions, and we will not provide our stockholders with such rights.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except in their capacity as stockholders, none of our officers, directors or any of their respective affiliates has any interest in the Corporate Actions.

CORPORATE ACTION NO. 1

NAME CHANGE

On December 29, 2021, the Board and the Majority Stockholders approved by written consent in lieu of a special meeting an amendment to the Company’s Articles of Incorporation to change the name of the Company to Coinllectibles Inc. (the “Name Change Amendment”).

Our Board and the Majority Stockholders believe that it is advisable and in the Company’s best interests to authorize and approve the Name Change Amendment in order to more accurately reflect the changes in the Company’s business. After the Effective Date (as hereinafter defined), the Board intends to enter into discussions to acquire one or more additional operating companies. We may also conduct private placements of our securities to secure additional working capital for the Company. Except as set forth above and in our other disclosures filed with the Securities and Exchange Commission, as of the date of this filing we do not have any definitive plans, proposals or arrangements to issue any of the newly available authorized shares of common stock for any purpose or which may result in a change in control of the Company.

Vote Required

Section 78.045 of the NRS provides that proposed amendments to the Articles of Incorporation must first be adopted by the Board and then approved by the Majority Stockholders. On December 29, 2021, our Board and the Majority Stockholders authorized, adopted and approved by written consent in lieu of a special meeting the Name Change Amendment. December 29, 2021, or the Record Date, was the date for determining the stockholders entitled to receive notice of and to vote on the proposed increase to our authorized capital.

The amendment to change our name will not be effective until the date of effectiveness specified in the Amendment to the Articles of Incorporation filed with the Nevada Secretary of State or the date on which our Corporate Actions are approved by the Financial Industry Regulatory Authority (FINRA), whichever is later (the “Effective Date”). No further action on the part of stockholders is required to authorize or effect the amendments to the Articles of Incorporation.

CORPORATE ACTION NO. 2

INCREASE IN AUTHORIZED CAPITAL

On December 29, 2021, the Board and the Majority Stockholders authorized, adopted and approved by written consent in lieu of a special meeting an amendment to the Articles of Incorporation to increase its authorized share capital from 530,000,000 to 5,030,000,000 shares, consisting of 5,000,000,000 shares of common stock, par value $0.001, and 30,000,000 shares of preferred stock, par value $0.001. The proposed amendment to our Articles of Incorporation is included in the Certificate of Amendment, which is attached hereto as Exhibit 1. The general purpose and effect of this amendment to our Articles of Incorporation is to increase our authorized share capital, which we believe will enhance our ability to finance the development and operation of our business.

Reasons For The Increase In Authorized Capital

Our Board authorized and approved the proposed amendment to our Articles of Incorporation to increase our authorized share capital so that such shares will be available for issuance for general corporate purposes, including financing activities, without the requirement of further action by our stockholders. Potential uses of the additional authorized shares may include, but are not limited to, public or private offerings, conversions of convertible securities, issuance of options pursuant to employee stock option plans, acquisition transactions and other general corporate purposes. Increasing the authorized number of shares of our common stock will give us greater flexibility and will allow us to issue such shares, in most cases, without the expense or delay of seeking stockholder approval. We are at all times investigating additional sources of financing, business candidates and other opportunities which our Board believes will be in our best interests and in the best interests of our stockholders. We may also conduct one or more private placements of our securities to secure additional working capital for the Company. Except as set forth above and in our other disclosures filed with the Securities and Exchange Commission, as of the date of this filing we do not have any definitive plans, proposals or arrangements to issue any of the newly available authorized shares of common stock for any purpose or which may result in a change in control of the Company.

Effect of the Increase in Authorized Capital; Anti-Takeover Implications

The amendment to our Articles of Incorporation to increase our authorized share capital will not have any immediate effect on the rights of existing stockholders. However, our Board will have the authority to issue shares of our Common Stock and Preferred Stock without requiring future stockholder approval of such issuances, except as may be required by applicable law or exchange regulations. To the extent that additional shares of Common Stock are issued in the future, such issuance will decrease the existing stockholders’ percentage equity ownership, dilute the earnings per share and book value per share of outstanding shares of Common Stock and, depending upon the price at which they are issued, could be dilutive to the existing stockholders.

Although the increase in authorized capital is prompted by business and financial considerations, stockholders nevertheless should be aware that such increase could facilitate future efforts by our management to deter or prevent a change in control of the Company. By way of example, our management could issue additional shares to dilute the stock ownership and the voting power of persons seeking to obtain control of the Company or shares could be issued to purchasers who would support the Board in opposing a takeover proposal. In addition, the increase in authorized shares may have the effect of delaying or discouraging a challenge for control or make it less likely that such a challenge, if attempted, would be successful, including challenges that are favored by a majority of the stockholders or in which the stockholders might otherwise receive a premium for their shares over then-current market prices or benefit in some other manner. The Board and executive officers of the Company have no knowledge of any current effort to obtain control of the Company or to accumulate large amounts of Common Stock.

We may also conduct one or more private placements of our securities to secure additional working capital for the Company. Except as set forth above and in our other disclosures filed with the Securities and Exchange Commission, the Board has no current plans to use any of the additional shares of Common Stock that will become available when the increase in authorized capital occurs to deter or prevent a change of control of the Company.

The amendment to increase our authorized capital will not be effective until the Effective Date. No further action on the part of stockholders is required to authorize or effect the amendments to the Articles of Incorporation.

CORPORATE ACTION NO. 3

OPT-OUT OF SECTIONS NRS 78.378 TO 78.3792 INCLUSIVE OF NRS

On December 29, 2021, the Board and the Majority Stockholders authorized, adopted and approved by written consent in lieu of a special meeting to elect not to be governed by Sections NRS 78.378 to 78.3792, inclusive, of the Nevada Revised Statutes (the “Opt Out”).

Anti-Takeover Provisions of Nevada State Law

Certain anti-takeover provisions of Nevada law could have the effect of delaying or preventing a third-party from acquiring us, even if the acquisition arguably could benefit our stockholders.

Nevada’s “combinations with interested stockholders” statutes, NRS 78.411 through 78.444, inclusive, prohibit specified types of business “combinations” between certain Nevada corporations and any person deemed to be an “interested stockholder” for two years after such person first becomes an “interested stockholder” unless the corporation’s board of directors approves the combination, or the transaction by which such person becomes an “interested stockholder”, in advance, or unless the combination is approved by the board of directors and sixty percent of the corporation’s voting power not beneficially owned by the interested stockholder, its affiliates and associates. Further, in the absence of prior approval certain restrictions may apply even after such two-year period. However, these statutes do not apply to any combination of a corporation and an interested stockholder after the expiration of four years after the person first became an interested stockholder. For purposes of these statutes, an “interested stockholder” is any person who is (1) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the corporation, or (2) an affiliate or associate of the corporation and at any time within the two previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the corporation. The definition of the term “combination” is sufficiently broad to cover most significant transactions between a corporation and an “interested stockholder.” These statutes generally apply to Nevada corporations with 200 or more stockholders of record. However, a Nevada corporation may elect in its articles of incorporation not to be governed by these particular laws, but if such election is not made in the corporation’s original articles of incorporation, the amendment (1) must be approved by the affirmative vote of the holders of stock representing a majority of the outstanding voting power of the corporation not beneficially owned by interested stockholders or their affiliates and associates, and (2) is not effective until 18 months after the vote approving the amendment and does not apply to any combination with a person who first became an interested stockholder on or before the effective date of the amendment. Our Articles of Incorporation already provide that we will not be governed by NRS 78.411 through 78.444, inclusive.

Nevada’s “acquisition of controlling interest” statutes, NRS 78.378 through 78.379, inclusive, contain provisions governing the acquisition of a controlling interest in certain Nevada corporations. These “control share” laws provide generally that any person that acquires a “controlling interest” in certain Nevada corporations may be denied voting rights, unless a majority of the disinterested stockholders of the corporation elects to restore such voting rights. Absent such provision in our bylaws, these laws would apply to us as of a particular date if we were to have 200 or more stockholders of record (at least 100 of whom have addresses in Nevada appearing on our stock ledger at all times during the 90 days immediately preceding that date) and do business in the State of Nevada directly or through an affiliated corporation, unless our articles of incorporation or bylaws in effect on the tenth day after the acquisition of a controlling interest provide otherwise. These laws provide that a person acquires a “controlling interest” whenever a person acquires shares of a subject corporation that, but for the application of these provisions of the NRS, would enable that person to exercise (1) one fifth or more, but less than one third, (2) one third or more, but less than a majority or (3) a majority or more, of all of the voting power of the corporation in the election of directors. Once an acquirer crosses one of these thresholds, shares which it acquired in the transaction taking it over the threshold and within the 90 days immediately preceding the date when the acquiring person acquired or offered to acquire a controlling interest become “control shares” to which the voting restrictions described above apply. We currently are subject to the provisions of NRS 78.378 through 78.379, inclusive.

Nevada law also provides that directors may resist a change or potential change in control if the directors determine that the change is opposed to, or not in the best interests of, the corporation. The existence of the foregoing provisions and other potential anti-takeover measures could limit the price that investors might be willing to pay in the future for shares of our common stock. They could also deter potential acquirers of our Company, thereby reducing the likelihood that you could receive a premium for your common stock in an acquisition.

Certain Article and Bylaws Provisions

Our Amended Articles of Incorporation and Amended and Restated Bylaws provide that:

|

|

☐

|

A majority of the outstanding shares of the Corporation entitled to vote, represented in person or any proxy, shall constitute a quorum at a meeting of stockholders;

|

|

|

|

|

|

|

☐

|

Our stockholders may not call special meetings of our stockholders unless they not less than one fourth of the outstanding shares entitled to vote at a meeting of stockholders.

|

|

|

☐

|

Subject to certain limitations, our directors have the power to adopt, amend or repeal our bylaws without stockholders approval;

|

|

|

☐

|

Our stockholders may not cumulate votes in the election of directors; and

|

|

|

☐

|

We will indemnify directors and officers against losses that they may incur in investigations and legal proceedings resulting from their services to us, which may include services in connection with takeover defense measures and advance such expenses on their behalf prior to final adjudication of whether such directors and officers were entitled to indemnification.

|

These provisions of our Amended Articles of Incorporation or Amended and Restated Bylaws may have the effect of delaying, deferring or discouraging another person or entity from acquiring control of us.

The amendment to opt out of NRS 78.411 to 78.444, inclusive, will not be effective until the Effective Date. No further action on the part of stockholders is required to authorize or effect the amendments to the Articles of Incorporation.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock, as of December 29, 2021, for: (i) each of our named executive officers; (ii) each of our directors; (iii) all of our current executive officers and directors as a group; and (iv) each person, or group of affiliated persons, known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock.

Except as indicated in footnotes to this table, we believe that the stockholders named in this table will have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them, based on information provided to us by such stockholders. Unless otherwise indicated, the address for each director and executive officer listed is: c/o Cosmos Group Holdings Inc., 37th Floor, Singapore Land Tower, 50 Raffles Place, Singapore 048623.

|

|

|

Common Stock Beneficially Owned

|

|

|

Name and Address of Beneficial Owner

|

|

Number of Shares

and Nature of

Beneficial

Ownership

|

|

|

Percentage of

Total Common

Equity (1)

|

|

|

CHAN Man Chung (2)

|

|

|

14,380,288

|

|

|

|

4.02

|

%

|

|

LEE Ying Chiu Herbert (2)

|

|

|

224,500,685

|

|

|

|

62.69

|

%

|

|

TAN Tee Soo (2)

|

|

|

272,353

|

|

|

|

0.08

|

%

|

|

All executive officers and directors as a Group (3 persons)

|

|

|

239,153,326

|

|

|

|

66.79

|

%

|

____________________

|

(1)

|

Applicable percentage ownership is based on 358,067,481 shares of common stock outstanding as of December 29, 2021, together with securities exercisable or convertible into shares of common stock within 60 days of December 29, 2021. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock that a person has the right to acquire beneficial ownership of upon the exercise or conversion of options, convertible stock, warrants or other securities that are currently exercisable or convertible or that will become exercisable or convertible within 60 days of December 29, 2021, are deemed to be beneficially owned by the person holding such securities for the purpose of computing the number of shares beneficially owned and percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

|

|

(2)

|

On June 28, 2021, Messrs. Chan Man Chung, Lee Ying Chiu Herbert and Tan Tee Soo were appointed to the Company’s Board of Directors and Chan Man Chung was appointed to serve as the CEO, CFO and Secretary of the Company.

|

CHANGE IN CONTROL

Change in Control

On June 14, 2021, Asia Cosmos Group Limited, an entity controlled by our former Chief Executive Officer, and Koon Wing Cheung agreed to sell 6,230,618 and 8,149,670 shares, respectively, of our common stock to Chan Man Chung for a total purchase price of four hundred twenty thousand dollars (US$420,000). The common stock being sold constitutes sixty-six and seventy-seven hundredth percent (66.77%) of the issued and outstanding shares of our common stock. The sellers relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to Mr. Chan. The funds came from the personal funds of Mr. Chan, and was not the result of a loan. The closing occurred June 28, 2021.

In connection with such sale, Miky Wan, our former CEO, President and CFO resigned from her positions as a director and sole executive officer of the Company. Concurrently therewith, Messrs. Chan Man Chung, Lee Ying Chiu Herbert and Tan Tee Soo were appointed to the Company’s Board of Directors and Chan Man Chung was appointed to serve as the CEO, CFO and Secretary of the Company.

Acquisition of Art Collectibles

On July 23, 2021, the Company and Lee Ying Chiu Herbert, our director, (the “Seller”) entered into a Sale and Purchase Agreement pursuant to which the Company agreed to purchase Fifty-Five (55) sets of art collectibles (the “Collectibles”) for HK$10,344,000, payable through the issuance of 180,855 shares of common stock of the Company (the “Shares”). The sale consummated on August 13, 2021.

The Collectibles were appraised by Hong Kong International Auction House Limited, an independent third-party appraisal firm who reported that the Collectibles would have a valuation equal to or exceeding HK$12,930,000.

Agreement with Massive Treasure

On June 17, 2021, the Company entered into a Share Exchange Agreement with the shareholders of Massive Treasure Limited (“Massive Treasure”). Pursuant to the Share Exchange Agreement, the Company agreed to issue 1,078,269,470 in exchange for 100% of Massive Treasure. Massive Treasure is a party to numerous agreements to acquire 12 additional business entities. As such, the Company further agreed to issue an additional 55,641,014 shares of common stock to complete the acquisition of such 12 business entities in the near future. In May 2021, Massive Treasure consummated the acquisition of 9 entities as more fully described below. Herbert Lee, the Company’s director, beneficially owns 95% of Massive Treasure. This acquisition consummated on September 17, 2021. Due to the insufficiency of the Company’s authorized capital, shares of common stock due to be issued in connection with this acquisition were delayed until the Effective Date, at which time all such unissued shares will be issued.

The foregoing description of the Share Exchange Agreement is qualified in its entirety by reference to the Share Exchange Agreement which is filed as Exhibit 10.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on September 17, 2021.

Description of Agreements of Massive Treasure with 9 Entities

E-on Finance and 8M Ltd.

In May 2021, Massive Treasure entered into a Share Swap Letter Agreement (the “100% Share Swap Letter”) with the shareholders of each of E-on Finance Limited, a Hong Kong corporation (“E-on”) and 8M Limited, a Hong Kong corporation (“8M”) to acquire 100% of each of E-on and 8M for approximately 20,110,604 and 10,055,302 shares of common stock, respectively, of the Company based upon the closing price of the common stock of the Company as of the date of signing of the 100% Share Swap Letter and determined in accordance with the terms of the 100% Share Swap Letter on the date. The acquisition of E-on and 8M consummated in May 2021. The Company intends to issue 10,256,409 shares and 5,128,204 shares to the shareholders of E-on and 8M, respectively, in the immediate future. The Company will become obligated to issue the remaining balance of the shares on the first anniversary of the Closing of the acquisition of each of E-on and 8M, subject to certain claw back provisions.

E-on and 8M are obligated to meet certain financial milestones in each of the two year anniversaries following the Closing. Failure to meet such milestones will result in a claw back of the shares issued to the shareholders. On the second anniversary of the Closing, if E-on or 8M exceeds the aggregate financial milestone set for the two years, the shareholders thereof shall be entitled to additional shares of the Company as determined in accordance with the 100% Share Swap Letter.

The foregoing description of the 100% Share Swap Letter is qualified in its entirety by reference to a form of the 100% Share Swap Letter which is filed as Exhibit 10.2 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on September 17, 2021.

Other Seven Entities

In May and June 2021, Massive Treasure entered into a Share Swap Letter Agreement (the “51% Share Swap Letter”) with the shareholders of each of the following Hong Kong corporations (collectively, the “51% Entities”) to acquire 51% of the issued and outstanding securities of the 51% Entities for an aggregate amount of 23,589,736 shares of the Company’s common stock as set forth below (the “First Tranche Shares”), based upon the closing price of the common stock of the Company as of the date of signing the 51% Share Swap Letter and determined in accordance with the terms of the 51% Share Swap Letter:

|

Name of Company

|

|

No. of Shares of

COSG Common Stock

|

|

|

Star Credit Limited

|

|

|

3,076,921

|

|

|

VAAV Limited

|

|

|

3,076,922

|

|

|

Long Journey Finance Limited

|

|

|

5,128,205

|

|

|

Rich Finance (Hong Kong) Limited

|

|

|

3,076,922

|

|

|

Lee Kee Finance Limited

|

|

|

3,076,922

|

|

|

Dragon Group Mortgage Limited

|

|

|

3,076,922

|

|

|

Healthy Finance Limited

|

|

|

3,076,922

|

|

On the first anniversary of the Closing, the Company is obligated to issue a second tranche of shares of its common stock, based upon the closing price of its shares as of the fifth business day prior to such first anniversary as determined in accordance with the terms of the 51% Share Swap Letter (the “Second Tranche Shares”). Upon the issuance of the Second Tranche Shares, each of the 51% Entities will deliver the remaining 49% of the issued and outstanding securities to the Company to become wholly owned subsidiaries of the Company. The acquisition of the 51% Entities consummated in May, 2021. The Company intends to issue the First Tranche Shares in the immediate future.

Each of the 51% Entities are obligated to meet certain financial milestones in each of the two year anniversaries following the Closing. Failure to meet such milestones will result in a claw back of the shares issued to the shareholders. On the second anniversary of the Closing, if any 51% Entity exceeds the aggregate financial milestone set for the two years, the shareholders thereof shall be entitled to additional shares of the Company as determined in accordance with the 51% Share Swap Letter.

The foregoing description of the 100% Share Swap Letter is qualified in its entirety by reference to a form of the 51% Share Swap Letter which is filed as Exhibit 10.3 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on September 17, 2021.

FORWARD-LOOKING STATEMENTS

This Information Statement may contain certain “forward-looking” statements (as that term is defined in the Private Securities Litigation Reform Act of 1995 or by the U.S. Securities and Exchange Commission in its rules, regulations and releases) representing our expectations or beliefs regarding our company. These forward- looking statements include, but are not limited to, statements regarding our business, anticipated financial or operational results and objectives. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” “might,” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. These statements, by their nature, involve substantial risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors, including factors discussed in this and other filings of ours with the Securities and Exchange Commission.

GENERAL INFORMATION

COSG will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. COSG will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending this Information Statement to the beneficial owners of COSG’s common stock.

COSG will deliver only one Information Statement to multiple security holders sharing an address unless COSG has received contrary instructions from one or more of the security holders. Upon written or oral request, COSG will promptly deliver a separate copy of this Information Statement and any future annual reports and information statements to any security holder at a shared address to which a single copy of this Information Statement was delivered, or deliver a single copy of this Information Statement and any future annual reports and information statements to any security holder or holders sharing an address to which multiple copies are now delivered. You should direct any such requests to the following address: Cosmos Group Holdings Inc., 37th Floor, Singapore Land Tower, 50 Raffles Place, Singapore 048623. The Secretary may also be reached by telephone at +86 137 168 55155.

ADDITIONAL AND AVAILABLE INFORMATION

COSG is subject to the informational filing requirements of the Exchange Act and, in accordance therewith, is required to file periodic reports, proxy statements and other information with the SEC relating to its business, financial condition and other matters. Such reports, proxy statements and other information can be inspected and copied at the public reference facility maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. Information regarding the public reference facilities may be obtained from the SEC by telephoning 1-800-SEC-0330. Our filings are also available to the public on the SEC’s website (www.sec.gov).

|

Dated: January 20, 2022

|

By order of the Board of Directors

|

|

|

|

|

|

|

|

|

/s/ Man Chung CHAN

|

|

|

|

By:

|

Man Chung CHAN

|

|

|

|

|

Chief Executive Officer, Chief Financial Officer and Secretary

|

|

|

Exhibit 1.

|

|

Certificate of Amendment filed with the Nevada Secretary of State on January 14, 2022.

|

EXHIBIT 1

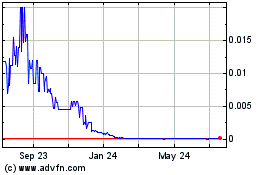

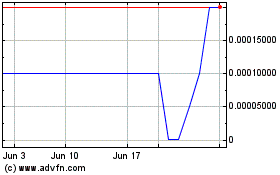

Cosmos (PK) (USOTC:COSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cosmos (PK) (USOTC:COSG)

Historical Stock Chart

From Apr 2023 to Apr 2024