Current Report Filing (8-k)

November 24 2021 - 5:10PM

Edgar (US Regulatory)

0001708176

false

0001708176

2021-11-23

2021-11-23

0001708176

HOFV:CommonStock0.0001ParValuePerShareMember

2021-11-23

2021-11-23

0001708176

HOFV:WarrantsToPurchase1.421333SharesOfCommonStockMember

2021-11-23

2021-11-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November 23, 2021

HALL

OF FAME RESORT & ENTERTAINMENT COMPANY

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-38363

|

|

84-3235695

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

2626

Fulton Drive NW

Canton,

OH 44718

(Address

of principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (330) 458-9176

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

☐

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on

which

registered

|

|

Common Stock, $0.0001 par

value per share

|

|

HOFV

|

|

Nasdaq Capital Market

|

|

Warrants to purchase 1.421333

shares of Common Stock

|

|

HOFVW

|

|

Nasdaq Capital Market

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On

November 23, 2021, Hall of Fame Resort & Entertainment Company (the “Company”), and Industrial Realty Group, LLC, a Nevada

limited liability company that is controlled by the Company’s director Stuart Lichter (“IRG”), entered into a promissory

note (the “Note”) pursuant to which IRG made a loan to the Company in the aggregate amount of $8,500,000 (the “Loan

Amount”). Interest will accrue on the outstanding balance of the Note at a rate of 8% per annum, compounded monthly. The Company

will pay interest to IRG under the Note on the first day of each month, in arrears. The Note has a maturity date of June 30, 2022 (the

“Maturity Date”). The Company may prepay all or any portion of the Note at any time prior to the Maturity Date without penalty

or premium.

The

Note contains customary terms regarding events of default, which include payment defaults and breach of any non-monetary covenant of

the Note. Upon the occurrence of an event of default, IRG may, at its option, declare the Note immediately due and payable. The Company

paid an origination fee of 0.25% of the Loan Amount to IRG under the Note. If the loan evidenced by the Note is not repaid in full by

December 31, 2021, the Company will pay IRG a fee equal to 0.25% of the total then-outstanding amount due under the Note on or before

the earlier to occur of (i) the Maturity Date and (ii) date on which the loan evidenced by the Note is repaid in full. The Note

contains certain customary terms regarding payment of IRG expenses and indemnification of IRG.

The

rights of IRG under the Note are subordinated in right of payment to all obligations owed by the Company under its term loan agreement,

dated as of December 1, 2020, as amended, with Aquarian Credit Funding, LLC (the “Term Loan Agreement”). The loan evidenced

by the Note will remain unsecured until such time as the loan evidenced by the Term Loan Agreement is repaid in full. In connection with

the Company’s repayment of the Term Loan Agreement, each of the Company’s direct and indirect subsidiaries (with certain

exceptions) will execute and deliver to IRG a mortgage as security for the loan evidenced by the Note.

The

foregoing description of the Note is not complete and is qualified in its entirety by reference to the full text of the Note, a copy

of which is filed herewith as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth in Item 10.1 is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

HALL OF FAME RESORT & ENTERTAINMENT

COMPANY

|

|

|

|

|

|

|

By:

|

/s/ Michael

Crawford

|

|

|

|

Name:

|

Michael Crawford

|

|

|

|

Title:

|

President and Chief Executive Officer

|

|

|

|

|

|

Dated: November 24, 2021

|

|

|

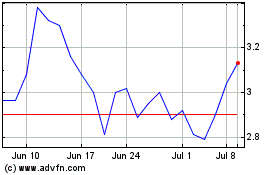

Hall of Fame Resort and ... (NASDAQ:HOFV)

Historical Stock Chart

From Mar 2024 to Apr 2024

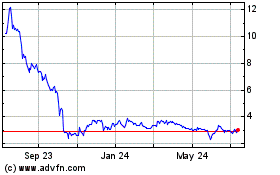

Hall of Fame Resort and ... (NASDAQ:HOFV)

Historical Stock Chart

From Apr 2023 to Apr 2024