Canadian National Makes $30 Billion Topping Bid for Kansas City Southern -- 4th Update

April 20 2021 - 12:42PM

Dow Jones News

By Cara Lombardo

Canadian National Railway Co. made a roughly $30 billion bid for

Kansas City Southern, kicking off a bidding war for a railroad

operator that has already agreed to a sale to another Canadian

rival.

Canadian National offered $325 for each Kansas City Southern

share, including $200 in cash and 1.059 Canadian National shares.

The company said the offer represents a 21% premium to Canadian

Pacific Railway Ltd.'s agreement to pay $275 a share, including $90

in cash, a roughly $25 billion deal reached last month.

The move sets up a tussle for a key strategic asset poised to

benefit from an expected surge in economic activity as the world

emerges from the coronavirus pandemic. Either combination would

create the first freight-rail network linking the U.S., Mexico and

Canada by connecting ports in the three countries.

Kansas City Southern, the smallest of the five major freight

railroads in the U.S., plays a big role in U.S.-Mexico trade, with

a network stretching across both countries. Its trains bring autos

and other industrial products up from factories south of the border

into Texas and the Midwest and haul U.S. farm goods back to Mexico.

It also runs a rail link along the Panama Canal.

Canadian National anticipates the combination it is proposing

would generate incremental cash flow -- in the form of earnings

before interest, taxes, depreciation and amortization -- of about

$1 billion, mainly from increased revenue from offering lower-cost

alternatives to trucking routes. The company says it is better

positioned than Canadian Pacific given a larger footprint and

limited route overlap with Kansas City Southern. It also owns a

route that bypasses Chicago congestion, which can save days of

travel time.

Canadian Pacific had said it expects its combination would

meaningfully reduce truck traffic on U.S. highways and produce

annual synergies of roughly $780 million over three years.

Canadian National has a network spanning Canada that stretches

down past Chicago to New Orleans after the acquisition of other,

smaller U.S. operators including Elgin Joliet and Eastern Railway

Co., Wisconsin Central Ltd. and Illinois Central Corp. As a result,

it could have a tougher time winning regulatory approval than

Canadian Pacific, which has major rail lines running across Canada,

some northern U.S. states and south to Chicago. That might help

explain why Canadian National felt compelled to offer so much

more.

There is no guarantee either deal would pass regulatory muster.

A transaction would need approval from the U.S. Surface

Transportation Board, which requires major railroad combinations to

be in the public interest and enhance competition.

Should Kansas City Southern deem Canadian National's bid

superior, Canadian Pacific would have a chance to match it or walk

away with a $700 million breakup fee, as stipulated by the current

merger agreement.

Kansas City Southern investors cheered the news, first reported

Tuesday morning by The Wall Street Journal, sending the shares up

more than 15%. Canadian National stock was off 6% at midday, while

Canadian Pacific was down 1.7%.

Kansas City Southern had a market value of roughly $24 billion

as of Monday's close. Canadian National's was about $84 billion and

Canadian Pacific's, $50 billion. Canadian National is roughly

14%-owned by Cascade Investment LLC, Bill Gates's investment firm,

according to FactSet.

If successful, Canadian National plans to use the same two-step

process for the deal that Canadian Pacific previously outlined.

Under the arrangement, the buyer would create a trust to acquire

Kansas City Southern shares, with the company continuing to be run

by its board and management until the STB review is completed. If

the regulator rejects the merger, the trust would divest itself of

the shares under a plan to be approved by the regulator. Both

companies would have U.S. headquarters for a combined company in

Kansas City, Mo.

Kansas City Southern has been seen as one of the last big

acquisition targets in the railroad sector after Brookfield

Infrastructure Partners LP and Singapore sovereign-wealth fund GIC

agreed to take Genesee & Wyoming Inc. private for $8.4 billion

including debt in 2019.

Before striking the deal with Canadian Pacific on March 21,

Kansas City Southern had rejected takeover interest from buyout

firms Blackstone Group Inc. and Global Infrastructure Partners, the

Journal reported last year.

Merger-and-acquisition activity is up significantly in 2021

compared with last year's slow start and has featured a healthy

helping of bidding wars, not to mention

special-purpose-acquisition-company deals.

Typically a rare phenomenon, bidding wars are popping up more

frequently, partly because of sky-high valuations that leave a

limited number of attractive acquisition targets, and low interest

rates that make financing cheap and abundant. Laser maker Coherent

Inc. was the subject of a frenzied three-way bidding contest that

ended in a nearly $7 billion deal last month.

More recently, a deal by hedge fund Alden Global Capital LLC to

buy Tribune Publishing Co. was later topped by a proposed bid from

a hotel magnate and a billionaire partner aiming to prevent deep

cuts at the Chicago Tribune publisher. The effort has since been

thrown into question after the partner providing the bulk of the

funding backed out.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

April 20, 2021 12:27 ET (16:27 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

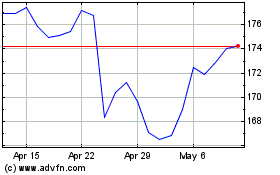

Canadian National Railway (TSX:CNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

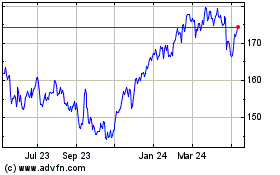

Canadian National Railway (TSX:CNR)

Historical Stock Chart

From Apr 2023 to Apr 2024