Statement of Changes in Beneficial Ownership (4)

February 22 2021 - 6:52PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

JOHNSON MARIANNE BOYD |

2. Issuer Name and Ticker or Trading Symbol

BOYD GAMING CORP

[

BYD

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Executive Vice President |

|

(Last)

(First)

(Middle)

3883 HOWARD HUGHES PARKWAY, NINTH FLOOR |

3. Date of Earliest Transaction

(MM/DD/YYYY)

2/18/2021 |

|

(Street)

LAS VEGAS, NV 89169

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 2/18/2021 | | A | | 6736 (1) | A | $0 (1) | 89009 | D | |

| Common Stock | 2/18/2021 | | A | | 10000 (2) | A | $0 (2) | 99009 | D | |

| Common Stock | | | | | | | | 40461 | I | By Trust * (3) |

| Common Stock | | | | | | | | 39171 | I | By Trust * (4) |

| Common Stock | | | | | | | | 38971 | I | By Trust * (5) |

| Common Stock | | | | | | | | 25063 | I | By Trust * (6) |

| Common Stock | | | | | | | | 90964 | I | By Trust * (7) |

| Common Stock | | | | | | | | 4047040 | I | By Limited Partnership (8) |

| Common Stock | | | | | | | | 1100000 | I | By Limited Liability Company * (9) |

| Common Stock | | | | | | | | 1735778 | I | By Trust (10) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | The Reporting Person was awarded 6,736 Restricted Stock Units for no consideration pursuant to the Issuer's 2020 Stock Incentive Plan. Each Restricted Stock Unit represents a contingent right to receive one share of Issuer common stock upon vesting. The Restricted Stock Units will vest in full upon the third anniversary of the date of award. The Restricted Stock Units are subject to the forfeiture and other terms and conditions contained in the award agreement and the 2020 Stock Incentive Plan. |

| (2) | The Reporting Person was awarded 10,000 Restricted Stock Units for no consideration pursuant to the Issuer's 2020 Stock Incentive Plan. Each Restricted Stock Unit represents a contingent right to receive one share of Issuer common stock upon vesting. The Restricted Stock Units will vest at the rate of 33.333% per year on the first day of each successive 12 month period commencing one year from grant date. The Restricted Stock Units are subject to the forfeiture and other terms and conditions contained in the award agreement and the 2020 Stock Incentive Plan. |

| (3) | By Marianne Boyd Johnson as Trustee of the Taylor Joseph Boyd Education Trust Dated 7/1/97. |

| (4) | By Marianne Boyd Johnson as Trustee of the William Samuel Boyd Education Trust Dated 7/1/97. |

| (5) | By Marianne Boyd Johnson as Trustee of the Josef William Boyd Education Trust Dated 7/1/97. |

| (6) | By Marianne Boyd Johnson as Trustee of the Justin Boyd Education Trust Dated 11/1/99. |

| (7) | By the Johnson Children's Trust Dated 6/24/96, Bruno Mark, Trustee. |

| (8) | By BG-00 Limited Partnership, of which the Marianne Boyd Gaming Properties Trust, of which the reporting person is the trustee, settlor and beneficiary, is the general partner thereof. |

| (9) | By BG-SUB, LLCof which Marianne Boyd Johnson is the managing member thereof. |

| (10) | By the Marianne E. Boyd Johnson Gaming PropertiesTrust, of which the reporting person is the Trustee, Settlor and Beneficiary, excluding shares held by BG-00 Limited Partnership, which are included in note (8) hereof. |

Remarks:

* The reporting person expressly disclaims beneficial ownership of any securities of the Issuer except for those securities that are owned directly by the Reporting Person or to the extent of the Reporting Person's pecuniary interest in a trust or other entity which owns such securities. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

JOHNSON MARIANNE BOYD

3883 HOWARD HUGHES PARKWAY

NINTH FLOOR

LAS VEGAS, NV 89169 | X |

| Executive Vice President |

|

Signatures

|

| James J. Adams, Attorney-in-Fact for Marianne Boyd Johnson | | 2/22/2021 |

| **Signature of Reporting Person | Date |

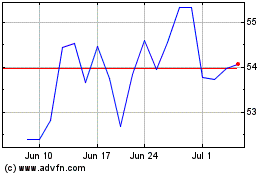

Boyd Gaming (NYSE:BYD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Boyd Gaming (NYSE:BYD)

Historical Stock Chart

From Sep 2023 to Sep 2024