BOQI International Medical Inc. (NASDAQ: BIMI) (“BIMI” or the

“Company”) today announced its financial results for the third

quarter and nine months ended September 30, 2020.

“We have made good progress in line with our new

business, especially the online-to-offline strategy. We opened our

first retail pharmacy store in Chongqing at the end of June 2020,

then gradually opened five more stores in the latter part of the

third quarter,” said Mr. Tiewei Song, Chief Executive Officer and

President of BOQI International Medical Inc. “We are also

developing our online healthcare platform. We plan to connect the

platform with pharmacies, hospitals and other medical institutions

to further strengthen our capabilities in online and offline

healthcare services.”

Revenues

Revenues for the three months ended September

30, 2020 and 2019 were $3,091,071 and $208,402, respectively. The

Company’s revenues for the three months ended September 30, 2020

were principally attributable to wholesale sales of medical devices

and generic drugs by our newly acquired Guanzan Group. The

Company’s revenues for the three months ended September 30, 2019

were attributable to the sales of products manufactured by the NF

Group and from energy saving technical services and product

collaboration processing services performed by the NF Group, which

we sold in June 2020. Revenues from the wholesale medical devices

segment and the wholesale medicine segment for the three months

ended September 30, 2020 were $670,296 and $2,391,674,

respectively. Revenues from the retail pharmacy segment for the

three months ended September 30, 2020 were $29,101.

Revenues for the nine months ended September 30,

2020 and 2019 were $7,317,449 and $1,120,804, respectively. The

553% increase in revenues is attributable to the acquisition of the

Guanzan Group in late March 2020. Revenues from the wholesale

medicine segment for the nine months ended September 30, 2020 were

$4,698,985 and revenues from the wholesale medical device segment

for the nine months ended September 30, 2020 were $2,567,029.

Revenues from the retail pharmacy segment for the nine months ended

September 30, 2020 were $42,898.

Cost of Revenues

Cost of revenues for the three months ended

September 30, 2020 and 2019 were $2,833,793 and $281,014,

respectively, reflecting the impact of the acquisition of the

Guanzan Group. For the three months ended September 30, 2020, the

cost of revenues of the wholesale medical devices segment was

$586,939. For the three months ended September 30, 2020, the cost

of revenues of our wholesale medicine segment was $2,032,947. For

the three months ended September 30, 2020, the cost of revenues for

retail pharmacy segment was $227,883, which included an inventory

impairment charge of $202,981. Cost of revenues for the

nine months ended September 30, 2020 and 2019 were $6,240,962 and

$1,030,862, respectively. For the nine months ended June 30, 2020,

the cost of revenues of our wholesale medical devices segment was

$2,051,563. For the nine months ended September 30, 2020, the cost

of revenues of our wholesale medicine segment was $3,759,707. For

the nine months ended September 30, 2020, cost of revenues of our

retail pharmacy segment was $426,293, which included an inventory

write-off of $390,923.

Gross Profit

For the three months ended September 30, 2020,

the Company had a gross profit margin of 8.32% compared with a

negative gross profit margin of 34.84 % in the quarter ended

September 30, 2019. On a sequential basis, gross profit decreased

by 14.07% from the second quarter of 2020, due to the decrease in

revenues from high gross profit wholesale medical devices segment.

The gross profit margin of the wholesale medical devices and

wholesale medicine segments for three months ended September 30,

2020 were 12.44% and 15%, respectively. The retail pharmacy

segment’s cost of revenues exceeded its revenues by $198,782 in the

quarter.

For the nine months ended September 30, 2020,

the Company had a gross profit margin of 14.71% compared with a

gross profit margin of 8.02% in the first nine months of 2019. The

improvement in the gross profit margin in the first nine months

ended September 30, 2020 is mainly due to the inclusion of the

revenues from the wholesale medical devices and wholesale medicine

segments since the acquisition in March 2020. The gross profit

margin of the wholesale medical devices and wholesale medicine

segments for nine months ended September 30, 2020 were 20.08% and

19.99%, respectively. The retail pharmacy segment’s cost of

revenues exceeded its revenues by $383,395 in the nine-month period

ended September 30, 2020.

Operating Expenses

Operating expenses were $1,689,962 for the three

months ended September 30, 2020 compared to $359,307 for the same

period in 2019, an increase of $1,330,655. The increase is mainly

due to the additional amortization of the discounted convertible

notes and intangible assets and impairment loss of intangible

asset.

Operating expenses were $6,579,201 for the nine

months ended September 30, 2020 compared to $1,607,763 for the same

period in 2019, an increase of $ 4,975,922 or 309%. Operating

expenses for the nine months ended September 30, 2020 consist

mainly of amortization of the discounted convertible notes,

amortization of intangible assets, meeting and promotional

expenses, pharmaceutical and medical device industry compliance

management expenses, legal fees, convertible note issuance-related

costs in the amount of $211,425 and other professional service

fees. The Company also reduced the contingent consideration payable

to the former shareholders of Lasting (the parent of Boqi Zhengji)

by $5,655,709, following a re-evaluation of such commitment.

Operating expenses also included a $903,573

impairment loss with respect to the intangible assets recognized in

the acquisition of Boqi Zhengji.

Other Income

For the three months ended September 30, 2020,

the Company reported other income of $5,247 and other interest

expense of $339,780, as compared to other income of $58,718 and

other interest expense of $ 466,582 for the three months ended

September 30, 2019.

For the nine months ended September 30, 2020,

the Company reported other income of $6,973,409 and other interest

expense of $717,226 compared to other income of $11,021 and other

interest expense of $717,226 in the nine months ended September 30,

2019. Other income in the nine months ended September 30, 2020

includes the gain generated from the disposal of the NF

Group.

Net Profit (Loss)

For the three months ended September 30, 2020,

the Company reported a net loss of $1,860,573 compared to a net

loss of $547,689 for the same period of 2019. For the nine months

ended September 30, 2020, the Company reported a net profit of

$611,090 compared to a net loss of $1,973,382 for the same period

in 2019.

Liquidity and Capital

Resources

On September 30, 2020, the Company had cash and

cash equivalents of $11, 585,325 compared to cash and cash

equivalents of $36,363 on December 31, 2019. As of September 30,

2020, the Company had negative working capital of $5,439,912 as

compared to negative working capital of $500,765 on December 31,

2019.

These conditions raise substantial doubt about

the Company’s ability to continue as a going concern. These

unaudited condensed financial statements do not include any

adjustments to reflect the possible future effect on the

recoverability and classification of assets or the amounts and

classifications of liabilities that may result from the outcome of

these uncertainties. Management believes that the actions presently

being taken to obtain additional funding and implement its

strategic plan provides the opportunity for the Company to continue

as a going concern.

About BOQI International Medical

Inc.

BOQI International Medical Inc. (formerly known

as NF Energy Saving Corporation) (NASDAQ: BIMI) was founded in

2006. In February 2019, the Board of Directors of the company was

reorganized with a focus on the health industry. The Company is now

exclusively a healthcare products provider, offering a broad range

of healthcare products and related services. For more information

about BOQI International Medical, please visit www.usbimi.com.

Safe Harbor Statement

Certain matters discussed in this news release

are forward-looking statements that involve a number of risks and

uncertainties including, but not limited to, the Company’s ability

to achieve profitable operations, its ability to continue to

operate as a going concern, its ability to continue to meet NASDAQ

continued listing requirements, the effects of the spread of the

Coronavirus (COVID-19), the demand for the Company’s products and

the Company’s customers’ economic condition, risk of operations in

the People’s Republic of China, general economic conditions and

other risk factors detailed in the Company’s annual report and

other filings with the United States Securities and Exchange

Commission. Investors are urged to read the Company’s Quarterly

Report on Form 10-Q for the three months ended March 31, 2020 for

further information about the Company’s financial results,

liquidity and capital resources.

IR Contact:

Dragon Gate Investment Partners LLCTel: +1(646)-801-2803Email:

BIMI@dgipl.com

BOQI INTERNATIONAL MEDICAL, INC. AND ITS

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2020 |

|

|

2019 |

|

| |

|

(Unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

Cash |

|

$ |

11,585,321 |

|

|

$ |

36,363 |

|

|

Restricted cash |

|

|

1,365 |

|

|

|

311 |

|

|

Accounts receivable, net |

|

|

3,935,514 |

|

|

|

24,840 |

|

|

Advances to suppliers |

|

|

2,251,811 |

|

|

|

1,252 |

|

|

Amount due from related parties |

|

|

- |

|

|

|

1,350 |

|

|

Inventories, net |

|

|

4,195,247 |

|

|

|

707,526 |

|

|

Prepayments and other receivables |

|

|

3,495,570 |

|

|

|

59,333 |

|

|

Assets from discontinued operations |

|

|

- |

|

|

|

21,218,983 |

|

|

Total current assets |

|

|

25,464,828 |

|

|

|

22,049,958 |

|

| |

|

|

|

|

|

|

|

|

| NON-CURRENT

ASSETS |

|

|

|

|

|

|

|

|

|

Deferred tax assets |

|

|

165,995 |

|

|

|

- |

|

|

Property, plant and equipment, net |

|

|

854,897 |

|

|

|

38,641 |

|

|

Intangible assets, net |

|

|

642,741 |

|

|

|

7,973,179 |

|

|

Goodwill |

|

|

6,443,170 |

|

|

|

- |

|

|

Total non-current assets |

|

|

8,106,803 |

|

|

|

8,011,820 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

$ |

33,571,631 |

|

|

$ |

30,061,778 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

|

|

|

|

|

Short-term loans |

|

$ |

866,297 |

|

|

$ |

- |

|

|

Long-term loans due within one year |

|

|

185,147 |

|

|

|

- |

|

|

Convertible promissory notes, net |

|

|

3,616,330 |

|

|

|

107,383 |

|

|

Derivative liability |

|

|

1,173,505 |

|

|

|

1,272,871 |

|

|

Accounts payable, trade |

|

|

6,790,000 |

|

|

|

641,927 |

|

|

Advances from customers |

|

|

710,515 |

|

|

|

67,975 |

|

|

Amount due to related parties |

|

|

586,027 |

|

|

|

305,760 |

|

|

Taxes payable |

|

|

308,920 |

|

|

|

861 |

|

|

Other payables and accrued liabilities |

|

|

5,788,175 |

|

|

|

6,044,378 |

|

|

Liabilities from discontinued operations |

|

|

- |

|

|

|

13,108,038 |

|

|

Total current liabilities |

|

|

20,024,916 |

|

|

|

21,549,193 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term loans - non-current portion |

|

|

138,632 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| TOTAL

LIABILITIES |

|

|

20,163,548 |

|

|

|

21,549,193 |

|

| |

|

|

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 50,000,000 shares authorized;

10,505,821 and 9,073,289 shares issued and outstanding as of

September 30 2020 and December 31, 2019, respectively |

|

|

10,506 |

|

|

|

9,073 |

|

|

Additional paid-in capital |

|

|

24,081,799 |

|

|

|

15,643,825 |

|

|

Statutory reserves |

|

|

- |

|

|

|

2,227,634 |

|

|

Accumulated deficit |

|

|

(10,834,660 |

) |

|

|

(10,881,667 |

) |

|

Accumulated other comprehensive income |

|

|

26,633 |

|

|

|

1,683,770 |

|

|

Total BOQI International Medical Inc.’s equity |

|

|

13,284,278 |

|

|

|

8,682,635 |

|

| |

|

|

|

|

|

|

|

|

|

NON-CONTROLLING INTERESTS |

|

|

123,805 |

|

|

|

(170,050 |

) |

| |

|

|

|

|

|

|

|

|

|

Total equity |

|

|

13,408,083 |

|

|

|

8,512,585 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

33,571,631 |

|

|

$ |

30,061,778 |

|

BOQI INTERNATIONAL MEDICAL, INC. AND ITS

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE (GAIN)/LOSS(UNAUDITED)

| |

|

For the Three Months Ended September 30 |

|

|

For the Nine Months Ended September 30 |

|

| |

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| REVENUES |

|

|

3,091,071 |

|

|

|

208,402 |

|

|

|

7,317,449 |

|

|

|

1,120,804 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COST OF REVENUES |

|

|

2,833,793 |

|

|

|

281,014 |

|

|

|

6,240,962 |

|

|

|

1,030,862 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS

PROFIT/(LOSS) |

|

|

257,278 |

|

|

|

(72,612 |

) |

|

|

1,076,487 |

|

|

|

89,942 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

377,977 |

|

|

|

33,096 |

|

|

|

1,028,746 |

|

|

|

119,820 |

|

|

General and administrative |

|

|

1,311,985 |

|

|

|

326,211 |

|

|

|

5,554,939 |

|

|

|

1,487,943 |

|

| Total

operating expenses |

|

|

1,689,962 |

|

|

|

359,307 |

|

|

|

6,583,685 |

|

|

|

1,607,763 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS FROM

OPERATIONS |

|

|

(1,432,684 |

) |

|

|

(431,919 |

) |

|

|

(5,507,198 |

) |

|

|

(1,517,821 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER

INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(339,780 |

) |

|

|

(174,488 |

) |

|

|

(717,226 |

) |

|

|

(466,582 |

) |

|

Other income |

|

|

5,247 |

|

|

|

58,718 |

|

|

|

6,973,409 |

|

|

|

11,021 |

|

| Total other

income (expense), net |

|

|

(334,533 |

) |

|

|

(115,770 |

) |

|

|

6,256,183 |

|

|

|

(455,561 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME

(LOSS) BEFORE INCOME TAXES |

|

|

(1,767,217 |

) |

|

|

(547,689 |

) |

|

|

748,985 |

|

|

|

(1,973,382 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROVISION

FOR INCOME TAXES |

|

|

93,356 |

|

|

|

— |

|

|

|

137,895 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET

INCOME (LOSS) |

|

|

(1,860,573 |

) |

|

|

(547,689 |

) |

|

|

611,090 |

|

|

|

(1,973,382 |

) |

|

Less: net income (loss) attributable to non-controlling

interest |

|

|

49,374 |

|

|

|

(3,220 |

) |

|

|

75,648 |

|

|

|

777 |

|

| NET

INCOME (LOSS) ATTRIBUTE TO BOQI INTERATIONAL MEDICAL INC. |

|

$ |

(1,909,947 |

) |

|

$ |

(544,469 |

) |

|

$ |

535,442 |

|

|

$ |

(1,974,159 |

) |

| OTHER

COMPREHENSIVE INCOME(LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

(108,236 |

) |

|

|

(271,289 |

) |

|

|

34,802 |

|

|

|

(244,964 |

) |

| TOTAL

COMPREHENSIVE INCOME(LOSS) |

|

|

(1,968,809 |

) |

|

|

(818,978 |

) |

|

|

645,892 |

|

|

|

(2,218,346 |

) |

|

Less: comprehensive income (loss) attributable to non-controlling

interests |

|

|

1,193 |

|

|

|

(1,260 |

) |

|

|

(1,408 |

) |

|

|

3,286 |

|

|

COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO BOQI INTERNATIONAL

MEDICAL INC. |

|

$ |

(1,970,002 |

) |

|

$ |

(817,718 |

) |

|

$ |

647,300 |

|

|

$ |

(2,221,632 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

10,505,821 |

|

|

|

8,073,289 |

|

|

|

9,987,848 |

|

|

|

7,871,824 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME (LOSS) PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.19 |

) |

|

$ |

(0.07 |

) |

|

$ |

0.06 |

|

|

$ |

(0.25 |

) |

BOQI INTERNATIONAL MEDICAL, INC. AND ITS

SUBSIDIARIES(CONSOLIDATED STATEMENTS OF CASH FLOWS(UNAUDITED)

| |

|

For the Nine Months Ended September 30, |

|

| |

|

2020 |

|

|

2019 |

|

| CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

Net income (Loss) |

|

$ |

611,090 |

|

|

$ |

(1,973,382 |

) |

|

Adjustments to reconcile net income/(loss) to cash used in

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

810,264 |

|

|

|

716,433 |

|

|

(Profit) on disposal of property |

|

|

(6,944,469 |

) |

|

|

(43,712 |

) |

|

Allowance for doubtful accounts |

|

|

(263,260 |

) |

|

|

(75,203 |

) |

|

Amortization of discount of convertible promissory notes |

|

|

1,950,901 |

|

|

|

1,239 |

|

|

Change in derivative liabilities |

|

|

43,224 |

|

|

|

2,132 |

|

|

Impairment loss from construction in progress |

|

|

- |

|

|

|

24,803 |

|

|

Allowance for inventory provision |

|

|

390,923 |

|

|

|

- |

|

|

Impairment loss of intangible assets |

|

|

903,573 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Change in

operating assets and liabilities |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(1,284,400 |

) |

|

|

970,444 |

|

|

Advances to suppliers |

|

|

418,847 |

|

|

|

- |

|

|

Inventories |

|

|

(2,928,419 |

) |

|

|

(634,860 |

) |

|

Prepayments and other receivables |

|

|

(1,245,981 |

) |

|

|

(67,709 |

) |

|

Accounts payable, trade |

|

|

4,844,674 |

|

|

|

(284,077 |

) |

|

Advances from customers |

|

|

(707,586 |

) |

|

|

|

|

|

Taxes payable |

|

|

(9,368 |

) |

|

|

55,943 |

|

|

Other payables and accrued liabilities |

|

|

594,793 |

|

|

|

371,982 |

|

|

Net cash used in operating activities |

|

|

(2,815,194 |

) |

|

|

(935,967 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS

FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Cash received from acquisition of Guanzan Group |

|

|

95,220 |

|

|

|

- |

|

|

Proceeds from disposal of property, planet, and equipment |

|

|

- |

|

|

|

50,063 |

|

|

Purchase of property, planet, and equipment |

|

|

(121,176 |

) |

|

|

- |

|

|

Cash received from sale of NF Group |

|

|

10,375,444 |

|

|

|

- |

|

|

Repayment from related party loan |

|

|

- |

|

|

|

540,294 |

|

|

Loan to related party |

|

|

- |

|

|

|

(1,161,458 |

) |

|

Net cash provided by (used in) investing activities |

|

|

10,349,488 |

|

|

|

(571,101 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS

FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net proceeds from issuance of convertible promissory notes |

|

|

3,457,325 |

|

|

|

- |

|

|

Proceeds from short-term loans |

|

|

27,371 |

|

|

|

5,835,897 |

|

|

Repayment of short-term loans |

|

|

(65,516 |

) |

|

|

(5,838,815 |

) |

|

Repayment of long-term loans |

|

|

(48,164 |

) |

|

|

- |

|

|

Amount financed by related parties |

|

|

173,547 |

|

|

|

1,591,910 |

|

|

Net cash provided by financing activities |

|

|

3,544,563 |

|

|

|

1,588,992 |

|

| |

|

|

|

|

|

|

|

|

| EFFECT OF

EXCHANGE RATE ON CASH |

|

|

471,155 |

|

|

|

(33,401 |

) |

| |

|

|

|

|

|

|

|

|

| INCREASE IN

CASH |

|

|

11,550,012 |

|

|

|

48,523 |

|

| |

|

|

|

|

|

|

|

|

| CASH AND

CASH EQUIVALENTS, beginning of period |

|

|

36,674 |

|

|

|

197,356 |

|

| |

|

|

|

|

|

|

|

|

| CASH AND

CASH EQUIVALENTS, end of period |

|

$ |

11,586,686 |

|

|

$ |

245,879 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTAL

CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

|

Cash paid for income tax |

|

$ |

42,130 |

|

|

$ |

- |

|

|

Cash paid for interest expense, net of capitalized interest |

|

$ |

62,636 |

|

|

$ |

434,198 |

|

| |

|

|

|

|

|

|

|

|

| NON-CASH

TRANSACTIONS OF INVESTING AND FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Issuance of common shares for the equity acquisition of Chongqing

Guanzan Technology Co., Ltd. |

|

$ |

2,717,000 |

|

|

$ |

- |

|

|

Goodwill recognized from the equity acquisition of the Boqi

Group |

|

$ |

6,443,170 |

|

|

$ |

2,040,000 |

|

|

Outstanding payment for the equity acquisition of Chongqing Guanzan

Technology Co., Ltd. |

|

$ |

4,414,119 |

|

|

$ |

- |

|

|

Common shares to be issued upon conversion of convertible

promissory notes |

|

$ |

5,160,473 |

|

|

$ |

- |

|

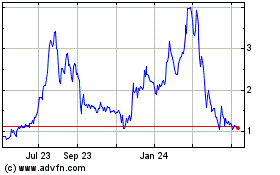

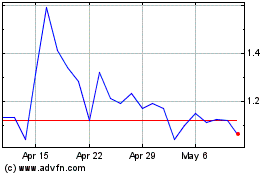

BIMI International Medical (NASDAQ:BIMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

BIMI International Medical (NASDAQ:BIMI)

Historical Stock Chart

From Apr 2023 to Apr 2024