Current Report Filing (8-k)

August 06 2020 - 5:05PM

Edgar (US Regulatory)

CUMULUS MEDIA INC false 0001058623 0001058623 2020-07-31 2020-07-31 0001058623 us-gaap:CommonStockMember 2020-07-31 2020-07-31 0001058623 us-gaap:RightsMember 2020-07-31 2020-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 6, 2020 (July 31, 2020)

CUMULUS MEDIA INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38108

|

|

82-5134717

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

3280 Peachtree Road, NW, Suite 2200, Atlanta GA

|

|

30305

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (404) 949-0700

n/a

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Class A common stock, par value $0.0000001 per share

|

|

CMLS

|

|

Nasdaq Global Market

|

|

Class A Common Stock Purchase Rights

|

|

N/A

|

|

Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On August 1, 2020, the Company entered into a new employment agreement with Suzanne Grimes, the Company’s Executive Vice President of Corporate Marketing and President of Westwood division (as amended, the “Grimes Employment Agreement”). The Grimes Employment Agreement is effective as of August 1, 2020, has an initial term through December 31, 2022 and contains a provision for automatic extensions for one-year periods thereafter, unless terminated in advance by either party in accordance with the terms thereof. The Company previously entered into an employment agreement with Ms. Grimes which expired on July 31, 2020.

The compensation structure outlined in the Grimes Employment Agreement is substantially similar to the compensation structure in her previous employment agreement. The Grimes Employment Agreement provides that Ms. Grimes is entitled to receive an annual base salary of $650,000. The Grimes Employment Agreement also provides that Ms. Grimes will be eligible for an annual cash bonus based upon the achievement of performance criteria or goals set forth in an annual incentive plan (the “EIP”) proposed by the Company’s Chief Executive Officer (the “CEO”) and approved by the Compensation Committee (the “Compensation Committee”) of the Company’s Board of Directors. Ms. Grimes target award opportunity is set at 80% of her base salary, subject to the potential adjustment by the Compensation Committee. If in any given year the Compensation Committee does not approve an EIP proposed by the CEO, or the CEO elects not to propose an EIP, the basis for annual cash bonuses to Ms. Grimes will be governed by the bonus provisions in her employment agreement that was in effect immediately prior to January 1, 2016. In addition, the Grimes Employment Agreement provides that, in the event the Company achieves the performance goals established for the Company as a whole under the EIP and also achieves certain financial and strategic goals as are mutually agreed upon by Ms. Grimes and the CEO, Ms. Grimes will be eligible to receive an additional annual bonus in a target amount of 20% of her base salary. Ms. Grimes is also eligible to receive an annual award of stock options or restricted shares commensurate with her role, subject to the approval and grant by the CEO and Compensation Committee.

In the event the Company terminates Ms. Grimes’s employment without “cause” (including the Company notifying Ms. Grimes of the Company’s intent to not renew the Grimes Employment Agreement) or if Ms. Grimes terminates her employment for “good reason” (as these terms are defined in the Grimes Employment Agreement) during the term of the agreement, subject to Ms. Grimes entering into a separation and release agreement with the Company (which shall include a non-disparagement commitment from Ms. Grimes), Ms. Grimes will be entitled to the following:

|

|

•

|

|

payment of her base salary and target annual bonus through 6 months after the termination of the agreement;

|

|

|

•

|

|

reimbursement for 6 months of COBRA coverage, provided that Ms. Grimes elects such coverage and remains eligible therefor.

|

In the event Ms. Grimes is terminated with cause, then the Company will only be obligated to pay her any unpaid base salary, earned and payable bonus payments and unreimbursed expenses that were accrued, but unpaid. If Ms. Grimes’ employment is terminated due to death or disability, the Company will be obligated to pay only her earned, but unpaid base salary.

During her employment and for 12 months following her termination, Ms. Grimes is subject to compliance with confidentiality and non-solicitation covenants in the Grimes Employment Agreement. In addition, during her employment and for six months following her termination, Ms. Grimes is subject to a non-compete covenant in the Grimes Employment Agreement.

The foregoing description of the Grimes Employment Agreement is qualified in its entirety by reference to the full text thereof, which is attached hereto as Exhibits 10.1 and is incorporated by reference herein.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

CUMULUS MEDIA INC.

|

|

|

|

|

By:

|

|

/s/ Francisco J. Lopez-Balboa

|

|

Name:

|

|

Francisco J. Lopez-Balboa

|

|

Title:

|

|

Executive Vice President, Chief Financial Officer

|

Date: August 6, 2020

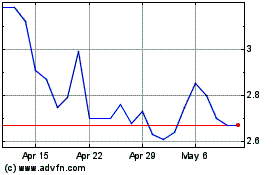

Cumulus Media (NASDAQ:CMLS)

Historical Stock Chart

From Aug 2024 to Sep 2024

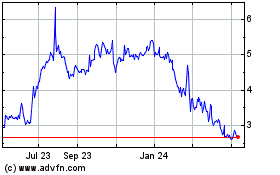

Cumulus Media (NASDAQ:CMLS)

Historical Stock Chart

From Sep 2023 to Sep 2024