SuRo Capital Corp. (“SuRo Capital” or the

“Company”) (Nasdaq:SSSS) today announced its financial

results for the quarter ended June 30, 2020. Net assets

totaled approximately $192.7 million, or $11.84 per share, at June

30, 2020, compared to $10.22 per share at March 31, 2020 and $10.75

per share at June 30, 2019.

“This quarter, SuRo Capital reported the highest

dividend-adjusted net asset value per share in five years. On

July 29, 2020, we were pleased to declare a $0.15 per share

dividend. The quarter was highlighted by several significant

financings for existing portfolio companies and investments in new

opportunities,” said Mark Klein, President and Chief Executive

Officer of SuRo Capital. “The companies in our portfolio

demonstrated strong growth and resilience this quarter despite the

ongoing impact of the COVID-19 outbreak. We believe our

portfolio is well-positioned given the current market

conditions.”

“We are also excited to announce the closing of

two new investments during the second quarter: a $5.0 million

equity investment in Rent the Runway, Inc. and a $6.9 million

collateralized loan to Palantir Lending Trust. SuRo Capital

also made follow-on, pro rata investments in Lime during the second

quarter and Coursera subsequent to quarter-end. We continue to see

more opportunities to deploy capital in credit investments. We have

also been exploring opportunities in pre-business combination

private investments in public equity (“PIPEs”) associated with the

special-purpose acquisition company (“SPAC”) asset class.”

Investment Portfolio as of June 30,

2020

At June 30, 2020, SuRo Capital held positions in

24 portfolio companies with an aggregate fair value of

approximately $199.0 million. As a result of the Company’s

continued strategy to increase the size of its investments in

individual portfolio companies, SuRo Capital has consolidated its

investment portfolio around its top positions. The Company’s

top five portfolio company investments accounted for approximately

68% of the total portfolio at fair value as of June 30, 2020.

Top Five Investments as of June 30,

2020

|

$ in millions |

|

Cost Basis |

|

Fair Value |

|

% of Total Portfolio |

| Coursera,

Inc. |

|

$ |

14.5 |

|

$ |

49.9 |

|

25.1 |

% |

| Course Hero, Inc. |

|

|

5.0 |

|

|

33.2 |

|

16.7 |

|

| Palantir Technologies, Inc. |

|

|

16.2 |

|

|

30.5 |

|

15.3 |

|

| Ozy Media, Inc. |

|

|

10.9 |

|

|

11.3 |

|

5.7 |

|

| Nextdoor.com, Inc. |

|

|

10.0 |

|

|

10.5 |

|

5.3 |

|

|

Total (rounded) |

|

$ |

56.6 |

|

$ |

135.4 |

|

68.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

Second Quarter 2020 Investment Portfolio

Activity

During the three months ended June 30, 2020,

SuRo Capital funded the following new and follow-on investments,

excluding capitalized transaction costs:

|

Portfolio Company |

Investment |

Transaction Date |

Investment |

| Neutron Holdings, Inc. (d/b/a Lime) |

Junior

Preferred Convertible Note |

5/11/2020 |

$0.5

million |

| Rent the Runway, Inc. |

Preferred

Stock |

6/17/2020 |

$5.0

million |

| Palantir Lending Trust |

Collateralized Loan |

6/19/2020 |

$6.9

million |

| |

|

|

|

Subsequent to quarter-end, through August 5,

2020, SuRo Capital funded the following follow-on investment:

|

Portfolio Company |

Investment |

Transaction Date |

Investment |

| Coursera, Inc. |

Preferred Shares, Series F |

7/15/2020 |

$2.8 million |

| |

|

|

|

Second Quarter 2020 Financial

Results

|

|

Quarter EndedJune 30, 2020 |

Quarter EndedJune 30, 2019 |

|

|

|

|

|

|

$ in millions |

per share(1) |

$ in millions |

per share(1) |

| |

|

|

|

|

|

Net investment loss (2) |

$ |

(4.7 |

) |

$ |

(0.28 |

) |

$ |

(2.8 |

) |

$ |

(0.14 |

) |

|

|

|

|

|

|

| Net

realized gain/(loss) on investments |

|

(0.0 |

) |

|

- |

|

|

13.6 |

|

|

0.69 |

|

|

|

|

|

|

|

| Net

change in unrealized appreciation/(depreciation) of investments,

net of tax effects |

|

26.5 |

|

|

1.62 |

|

|

(11.4 |

) |

|

(0.58 |

) |

|

|

|

|

|

|

| Net

increase/(decrease) in net assets resulting from operations –

basic(3) |

$ |

21.8 |

|

$ |

1.34 |

|

$ |

(0.7 |

) |

$ |

(0.03 |

) |

|

|

|

|

|

|

|

Repurchase of common stock(4) |

|

(3.6 |

) |

|

0.16 |

|

|

(0.7 |

) |

|

0.03 |

|

|

|

|

|

|

|

|

Stock-based compensation(2) |

|

2.0 |

|

|

0.12 |

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

Increase/(decrease) in net asset value |

$ |

20.2 |

|

$ |

1.62 |

|

$ |

(1.4 |

) |

$ |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________________

- Based on weighted-average number of

shares outstanding for the relevant period

- For the quarter ended June 30,

2020, this balance includes $2.0 million of accelerated recognition

of compensation cost related to the cancellation of all vested and

unvested options on April 28, 2020.

- Total may not sum, due to

rounding.

- During the quarters ended June 30,

2020 and 2019, the Company repurchased 594,637 and 115,801 shares

of SuRo Capital common stock, for approximately $3.6 million and

$0.7 million in cash, respectively, under its Share Repurchase

Program. The use of cash in connection with the repurchases

decreased net asset value as of period end; however, the reduction

in shares outstanding as of period end resulted in an increase in

the net asset value per share.

Weighted-average common basic shares outstanding

were approximately 16.4 million and 19.7 million for the quarters

ended June 30, 2020 and 2019, respectively.

SuRo Capital’s liquid assets were approximately

$23.3 million as of June 30, 2020, consisting of cash and

restricted cash.

Dividend Declaration for Second Quarter

2020

On July 29, 2020, SuRo Capital’s Board of

Directors declared a dividend of $0.15 per share payable on August

25, 2020 to the Company’s common stockholders of record as of the

close of business on August 11, 2020. The dividend will be paid in

cash.

Share Repurchase Program

During the quarter ended June 30, 2020, SuRo

Capital repurchased 594,637 shares under its Share Repurchase

Program for an aggregate purchase price of $3.6 million. The

dollar value of shares that may yet be purchased by the Company

under the Share Repurchase Program is approximately $2.7

million.

Under the publicly announced Share Repurchase

Program and the Modified Dutch Auction Tender Offer, as of August

5, 2020, the Company has repurchased 5,901,324 shares of its common

stock for approximately $37.3 million since the Share Repurchase

Program was announced in August 2017.

Conference Call and Webcast

Management will hold a conference call and

webcast for investors on August 5, 2020 at 2:00 p.m. PT (5:00 p.m.

ET). The conference call access number for U.S. participants is

323-794-2093, and the conference call access number for

participants outside the U.S. is 866-548-4713. The conference ID

number for both access numbers is 3811592. Additionally, interested

parties can listen to a live webcast of the call from the "Investor

Relations" section of SuRo Capital’s website at www.surocap.com. An

archived replay of the webcast will also be available for 12 months

following the live presentation.

A replay of the conference call may be accessed

until 5:00 p.m. PT (8:00 p.m. ET) on August 12, 2020 by dialing

888-203-1112 (U.S.) or +1 719-457-0820 (International) and using

conference ID number 3811592.

Certain Information Regarding the

Dividend

The date of declaration and amount of the

dividend are subject to the sole discretion of SuRo Capital’s Board

of Directors. The aggregate amount of the dividend declared

and paid by SuRo Capital will be fully taxable to

stockholders. The tax character of SuRo Capital’s dividends

cannot be finally determined until the close of SuRo Capital’s

taxable year (December 31). SuRo Capital will report the

actual tax characteristics of each year’s dividends annually to

stockholders and the IRS on Form 1099-DIV subsequent to

year-end.

Registered stockholders with questions regarding

declared dividends may call American Stock Transfer at

800-937-5449.

Forward-Looking Statements

Statements included herein, including statements

regarding SuRo Capital's beliefs, expectations, intentions or

strategies for the future, may constitute "forward-looking

statements". SuRo Capital cautions you that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

or implied in these statements. All forward-looking

statements involve a number of risks and uncertainties, including

the impact of the COVID-19 pandemic and any market volatility that

may be detrimental to our business, our portfolio companies, our

industry, and the global economy, that could cause actual results

to differ materially from the plans, intentions and expectations

reflected in or suggested by the forward-looking statements. Risk

factors, cautionary statements and other conditions which could

cause SuRo Capital's actual results to differ from management's

current expectations are contained in SuRo Capital's filings with

the Securities and Exchange Commission. SuRo Capital undertakes no

obligation to update any forward-looking statement to reflect

events or circumstances that may arise after the date of this press

release.

About SuRo Capital Corp.

SuRo Capital Corp. (Nasdaq:SSSS) is a publicly

traded investment fund that seeks to invest in high-growth,

venture-backed private companies. The fund seeks to create a

portfolio of high-growth emerging private companies via a

repeatable and disciplined investment approach, as well as to

provide investors with access to such companies through its

publicly traded common stock. SuRo Capital is headquartered in San

Francisco, CA. Connect with the company on Twitter, LinkedIn, and

at www.surocap.com ContactSuRo Capital Corp.(650)

235-4769IR@surocap.com

Media ContactBill

DouglassGotham Communications, LLCCommunications@surocap.com

SURO CAPITAL CORP. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

ASSETS AND LIABILITIES (UNAUDITED)

| |

June 30, 2020 |

|

December 31, 2019 |

| ASSETS |

|

|

|

| Investments at fair

value: |

|

|

|

|

Non-controlled/non-affiliate investments (cost of $99,121,577 and

$90,567,041, respectively) |

$ |

168,700,422 |

|

|

$ |

152,866,112 |

|

| Non-controlled/affiliate

investments (cost of $52,857,243 and $52,857,243,

respectively) |

29,438,698 |

|

|

37,944,268 |

|

| Controlled investments (cost

of $7,161,412 and $7,161,412, respectively) |

860,198 |

|

|

775,198 |

|

|

Total Portfolio Investments |

198,999,318 |

|

|

191,585,578 |

|

| Investments in U.S. Treasury

bills (cost of $99,999,611 and $49,996,667, respectively) |

100,000,000 |

|

|

50,000,000 |

|

| Total Investments (cost of

$259,139,843 and $200,582,363, respectively) |

298,999,318 |

|

|

241,585,578 |

|

| Cash |

22,385,073 |

|

|

44,861,263 |

|

| Restricted cash |

900,000 |

|

|

— |

|

| Escrow proceeds

receivable |

67,135 |

|

|

265,303 |

|

| Interest and dividends

receivable |

70,274 |

|

|

84,630 |

|

| Deferred financing costs |

11,382 |

|

|

11,382 |

|

| Prepaid expenses and other

assets(1) |

1,197,711 |

|

|

1,755,933 |

|

|

Total Assets |

323,630,893 |

|

|

288,564,089 |

|

|

LIABILITIES |

|

|

|

| Accounts payable and accrued

expenses(1) |

1,933,219 |

|

|

1,143,923 |

|

| Payable to executive

officers |

— |

|

|

1,369,873 |

|

| Accrued interest payable |

475,000 |

|

|

475,000 |

|

| Dividends payable |

— |

|

|

2,107,709 |

|

| Payable for securities

purchased |

89,499,611 |

|

|

44,746,660 |

|

| Income tax payable |

38,965 |

|

|

— |

|

| 4.75% Convertible Senior Notes

due March 28, 2023(2) |

38,991,657 |

|

|

38,803,635 |

|

|

Total Liabilities |

130,938,452 |

|

|

88,646,800 |

|

| |

|

|

|

| Net

Assets |

$ |

192,692,441 |

|

|

$ |

199,917,289 |

|

| NET

ASSETS |

|

|

|

|

Common stock, par value $0.01 per share (100,000,000 authorized;

16,279,679 and 17,564,244 issued and outstanding,

respectively) |

$ |

162,797 |

|

|

$ |

175,642 |

|

| Paid-in capital in excess of

par |

173,199,798 |

|

|

178,550,374 |

|

| Accumulated net investment

loss |

(33,351,303 |

) |

|

(25,679,362 |

) |

| Accumulated net realized gain

on investments |

12,821,670 |

|

|

5,867,417 |

|

| Accumulated net unrealized

appreciation/(depreciation) of investments |

39,859,479 |

|

|

41,003,218 |

|

|

Net Assets |

$ |

192,692,441 |

|

|

$ |

199,917,289 |

|

|

Net Asset Value Per Share |

$ |

11.84 |

|

|

$ |

11.38 |

|

|

|

|

|

|

|

|

|

|

__________________________________________________

- This balance includes a right of

use asset and corresponding operating lease liability,

respectively.

- As of June 30, 2020 and December

31, 2019, the 4.75% Convertible Senior Notes due March 28, 2023 had

a face value of $40,000,000.

SURO CAPITAL CORP. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED)

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| INVESTMENT

INCOME |

|

|

|

|

|

|

|

| Non-controlled/non-affiliate

investments: |

|

|

|

|

|

|

|

|

Interest income |

$ |

61,126 |

|

|

$ |

198,175 |

|

|

$ |

216,211 |

|

|

$ |

336,672 |

|

|

Dividend income |

— |

|

|

— |

|

|

50,000 |

|

|

— |

|

| Non-controlled/affiliate

investments: |

|

|

|

|

|

|

|

|

Interest income/(reversal of interest income accrual) |

(49,612 |

) |

|

60,127 |

|

|

(29,184 |

) |

|

119,593 |

|

|

Dividend income |

30,000 |

|

|

— |

|

|

56,250 |

|

|

— |

|

| Controlled investments: |

|

|

|

|

|

|

|

|

Interest income |

— |

|

|

29,650 |

|

|

— |

|

|

58,937 |

|

|

Dividend income |

200,000 |

|

|

200,000 |

|

|

200,000 |

|

|

200,000 |

|

|

Total Investment Income |

241,514 |

|

|

487,952 |

|

|

493,277 |

|

|

715,202 |

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

| Management fees(1) |

— |

|

|

— |

|

|

— |

|

|

848,723 |

|

| Reversal of incentive fee

accrual(1) |

— |

|

|

— |

|

|

— |

|

|

(4,660,472 |

) |

| Costs incurred under

Administration Agreement(1) |

— |

|

|

— |

|

|

— |

|

|

306,084 |

|

| Compensation expense(2) |

3,005,524 |

|

|

469,944 |

|

|

3,930,440 |

|

|

632,108 |

|

| Directors’ fees |

111,250 |

|

|

86,250 |

|

|

222,500 |

|

|

172,500 |

|

| Professional fees |

678,472 |

|

|

1,310,028 |

|

|

1,817,838 |

|

|

3,371,950 |

|

| Interest expense |

568,627 |

|

|

600,205 |

|

|

1,142,027 |

|

|

1,204,373 |

|

| Income tax expense |

39,590 |

|

|

29,949 |

|

|

48,255 |

|

|

33,712 |

|

| Other expenses |

505,439 |

|

|

796,807 |

|

|

1,004,158 |

|

|

991,753 |

|

|

Total Operating Expenses |

4,908,902 |

|

|

3,293,183 |

|

|

8,165,218 |

|

|

2,900,731 |

|

|

Net Investment Loss |

(4,667,388 |

) |

|

(2,805,231 |

) |

|

(7,671,941 |

) |

|

(2,185,529 |

) |

| Realized

Gains/(Losses) on Investments: |

|

|

|

|

|

|

|

| Non-controlled/non-affiliated

investments |

(23,987 |

) |

|

13,590,233 |

|

|

6,954,253 |

|

|

21,859,371 |

|

| Non-controlled/affiliate

investments |

— |

|

|

— |

|

|

— |

|

|

(12,334,831 |

) |

|

Net Realized Gain/(Loss) on Investments |

(23,987 |

) |

|

13,590,233 |

|

|

6,954,253 |

|

|

9,524,540 |

|

| Change in Unrealized

Appreciation/(Depreciation) of Investments: |

|

|

|

|

|

|

|

| Non-controlled/non-affiliated

investments |

24,821,654 |

|

|

(6,751,196 |

) |

|

7,276,832 |

|

|

10,277,147 |

|

| Non-controlled/affiliate

investments |

1,569,843 |

|

|

(1,220,012 |

) |

|

(8,505,571 |

) |

|

7,802,636 |

|

| Controlled investments |

130,698 |

|

|

(4,469,112 |

) |

|

85,000 |

|

|

(9,820,352 |

) |

|

Net Change in Unrealized Appreciation/(Depreciation) of

Investments |

26,522,195 |

|

|

(12,440,320 |

) |

|

(1,143,739 |

) |

|

8,259,431 |

|

|

Provision for taxes on unrealized appreciation of investments |

— |

|

|

979,713 |

|

|

— |

|

|

885,566 |

|

|

Net Change in Net Assets Resulting from

Operations |

$ |

21,830,820 |

|

|

$ |

(675,605 |

) |

|

$ |

(1,861,427 |

) |

|

$ |

16,484,008 |

|

| Net Change in Net

Assets Resulting from Operations per Common Share: |

|

|

|

|

|

|

|

|

Basic |

$ |

1.33 |

|

|

$ |

(0.03 |

) |

|

$ |

(0.11 |

) |

|

$ |

0.84 |

|

|

Diluted(3) |

$ |

1.10 |

|

|

$ |

(0.03 |

) |

|

$ |

(0.11 |

) |

|

$ |

0.70 |

|

| Weighted-Average

Common Shares Outstanding |

|

|

|

|

|

|

|

|

Basic |

16,383,188 |

|

|

19,719,706 |

|

|

16,912,091 |

|

|

19,741,058 |

|

|

Diluted(3) |

20,300,980 |

|

|

19,719,706 |

|

|

16,912,091 |

|

|

23,472,402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________________________________________________________________________________________________________________________

- This balance references a

related-party transaction.

- For the three and six months ended

June 30, 2020, this balance includes $1,962,431 of accelerated

recognition of compensation cost related to the cancellation of

unvested options on April 28, 2020.

- For the six months ended June 30,

2020 and the three months ended June 30, 2019, 3,917,792 and

3,731,344 potentially dilutive common shares, respectively, were

excluded from the weighted-average common shares outstanding for

diluted net increase in net assets resulting from operations per

common share because the effect of these shares would have been

anti-dilutive.

SURO CAPITAL CORP. AND

SUBSIDIARIESFINANCIAL HIGHLIGHTS

(UNAUDITED)

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| Per Basic Share

Data |

|

|

|

|

|

|

|

|

Net asset value at beginning of the period |

$ |

10.22 |

|

|

$ |

10.75 |

|

|

$ |

11.38 |

|

|

$ |

9.89 |

|

|

Net investment income/(loss)(1) |

(0.28 |

) |

|

(0.14 |

) |

|

(0.45 |

) |

|

(0.11 |

) |

|

Net realized gain/(loss) on investments(1) |

— |

|

|

0.69 |

|

|

0.41 |

|

|

0.48 |

|

|

Net change in unrealized appreciation/(depreciation) of

investments(1) |

1.62 |

|

|

(0.63 |

) |

|

(0.07 |

) |

|

0.42 |

|

|

Provision for taxes on unrealized appreciation of

investments(1) |

— |

|

|

0.05 |

|

|

— |

|

|

0.05 |

|

|

Repurchases of common stock(1) |

0.16 |

|

|

0.03 |

|

|

0.45 |

|

|

0.02 |

|

|

Stock-based compensation(1) |

0.12 |

|

|

— |

|

|

0.12 |

|

|

— |

|

| Net asset value at end of

period |

$ |

11.84 |

|

|

$ |

10.75 |

|

|

$ |

11.84 |

|

|

$ |

10.75 |

|

| Per share market value at end

of period |

$ |

8.47 |

|

|

$ |

6.40 |

|

|

$ |

8.47 |

|

|

$ |

6.40 |

|

| Total return based on market

value(2) |

44.54 |

% |

|

(15.57 |

)% |

|

29.31 |

% |

|

22.61 |

% |

| Total return based on net

asset value(2) |

15.85 |

% |

|

— |

% |

|

4.04 |

% |

|

8.70 |

% |

| Shares outstanding at end of

period |

16,279,679 |

|

|

19,646,846 |

|

|

16,279,679 |

|

|

19,646,846 |

|

| Ratios/Supplemental

Data: |

|

|

|

|

|

|

|

| Net assets at end of

period |

$ |

192,692,441 |

|

|

$ |

211,125,048 |

|

|

$ |

192,692,441 |

|

|

$ |

211,125,048 |

|

| Average net assets |

$ |

169,877,812 |

|

|

$ |

211,244,233 |

|

|

$ |

184,435,968 |

|

|

$ |

203,070,126 |

|

| Ratio of gross operating

expenses to average net assets(3) |

8.19 |

% |

|

5.14 |

% |

|

7.83 |

% |

|

4.66 |

% |

| Ratio of income tax provision

to average net assets |

— |

% |

|

(0.46 |

)% |

|

— |

% |

|

(0.44 |

)% |

| Ratio of net operating

expenses to average net assets(3) |

8.19 |

% |

|

4.68 |

% |

|

7.83 |

% |

|

4.22 |

% |

| Ratio of net investment

income/(loss) to average net assets(3) |

(7.61 |

)% |

|

(5.39 |

)% |

|

(7.29 |

)% |

|

(2.18 |

)% |

| Portfolio Turnover Ratio |

— |

% |

|

— |

% |

|

5.88 |

% |

|

5.04 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

___________________________________________________

- Based on weighted-average number of

shares outstanding for the relevant period.

- Total return based on market value

is based on the change in market price per share between the

opening and ending market values per share in the year. Total

return based on net asset value is based upon the change in net

asset value per share between the opening and ending net asset

values per share.

- Financial Highlights for periods of

less than one year are annualized and the ratios of operating

expenses to average net assets and net investment loss to average

net assets are adjusted accordingly. Significant and material

non-recurring expenses are not annualized. For the three and six

months ended June 30, 2020, the Company excluded $1,962,431 and

$1,962,431, respectively of non-recurring expenses. For the three

and six months ended June 30, 2019, the Company excluded $617,536

and $(1,769,820), respectively, of non-recurring expenses and did

not annualize the income tax provision. Because the ratios are

calculated for the Company’s common stock taken as a whole, an

individual investor’s ratios may vary from these ratios.

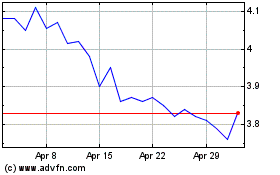

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Aug 2024 to Sep 2024

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Sep 2023 to Sep 2024