Zions Bancorporation Delivers Paycheck Protection Program Loan Approvals for More Than 40,000 Small Businesses

May 11 2020 - 4:05PM

Business Wire

More than Half a Million Workers’ Paychecks May

Be Protected Through the Loans

Zions Bancorporation, N.A. (NASDAQ: ZION) announced today that

it has processed and obtained approval for 40,483 U.S. Small

Business Administration (SBA) Paycheck Protection Program (PPP)

loans totaling $7.05 billion, as of May 10, 2020.

Originated and processed by Zions Bancorporation’s affiliate

banks operating across 11 western states, the loans will help

preserve payrolls for more than 600,000 workers, based on applicant

data.

More than 66% of the loans were made to businesses with fewer

than 10 employees. Nearly 80% of the loans approved were for

amounts less than $150,000 (55% for amounts less than $50,000) and

the median loan amount approved was $41,600. Additionally,

approximately 21% of the loans approved have been for businesses

that were not previously Zions Bancorporation customers.

“As one of the nation’s leading small business banks, we care

deeply about the health and vitality of America’s entrepreneurs,

their employees and businesses,” said Zions Bancorporation Chairman

and CEO Harris H. Simmons. “We are very proud of the work we have

done to provide loans to small businesses and qualifying non-profit

organizations under the CARES Act. Our work isn’t done; we will

continue to accept and submit applications in all of our markets

until the PPP funds are exhausted.”

The company engaged approximately 2,000 employees — roughly 20%

of its workforce — in various aspects of the project. At its peak,

the company’s central loan center processed approximately 140 times

its normal daily volumes.

Demonstrating the company’s ability to quickly harness financial

technology tools to solve client needs, Zions Bancorporation’s

Enterprise Technology and Operations division developed an

end-to-end PPP technology solution in less than a week leveraging

its investments in automated robotic processing and API

capabilities.

Breakdown of SBA Paycheck Protection Program funding approved by

market:

Data by Zions Bancorporation

Markets as of May 10, 2020

State

% of State’s Total PPP

Approvals ($)

# of Loans

$ Amount of Loans

Median $ Per Loan

Arizona

8.3%

4,831

$736,970,285

$42,850

California

2.5%

8,359

$1,698,523,442

$57,500

Colorado

4.4%

3,179

$463,968,876

$30,300

Idaho

9.8%

2,054

$256,675,146

$32,400

Nevada

14.3%

4,160

$587,198,500

$37,100

New Mexico

0.8%

103

$18,716,700

$40,700

Oregon

1.5%

224

$105,101,200

$115,300

Texas

3.2%

6,969

$1,373,988,810

$39,600

Utah

24.8%

9,554

$1,355,352,929

$34,900

Washington

2.5%

601

$309,530,359

$140,000

Wyoming

1.1%

57

$11,081,200

$62,300

Other

n/a

392

$131,399,200

$68,300

TOTAL

n/a

40,483

$7,048,506,647

$41,600

Zions Bancorporation, N.A. is one of the nation's premier

financial services companies with annual net revenue of $2.8

billion in 2019 and more than $70 billion of total assets. Zions

operates under local management teams and distinct brands in 11

western states: Arizona, California, Colorado, Idaho, Nevada, New

Mexico, Oregon, Texas, Utah, Washington and Wyoming. The Bank is a

consistent national and statewide leader of customer survey awards

in small and middle-market banking, as well as a national leader in

Small Business Administration lending and public finance advisory

services. In addition, Zions is included in the S&P 500 and

NASDAQ Financial 100 indices. Investor information and links to

local banking brands can be accessed at

zionsbancorporation.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200511005882/en/

James Abbott Director of Investor Relations Tel: (801)

844-7637

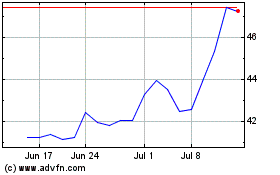

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Mar 2024 to Apr 2024

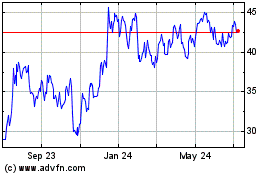

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Apr 2023 to Apr 2024