Belgravia Provides Corporate Update

November 01 2019 - 8:18AM

BELGRAVIA CAPITAL INTERNATIONAL INC. (CSE:BLGV) (OTCQB:BLGVF)

(“Belgravia” or the “Company”) wishes to provide a corporate

update.

Belgravia Capital has operated as an investment holding company

since November 2017 after the transition from IC Potash Corp. in

which it still owns an outstanding US$12.2M royalty. In the last

two years, Belgravia has dedicated its resources to building a

diversified portfolio of private and public companies, with

attempts at acquiring an operating asset. Through analysis of peer

companies similar to Belgravia, respective market capitalizations

directly correlate to net asset value. This current business model

represents macro and operational risks on the holdings which

prevented shareholder value creation. Upon deeper analysis of the

Canadian micro-caps in a variety of sectors clearly demonstrate an

overarching decline in shareholder value across all spectrums and

depleted treasuries.

Belgravia reported in the Q3 financial statements as of the end

of September 2019, the Company’s net asset value was $9.595,962.

Belgravia is well positioned to adjust to any changes to its

current business model. Two potential new business models that the

Company is investigating are:

- Acquiring a wholly-owned subsidiary and deploying the majority

of its capital to the development and expansion of this business;

and/or

- Structuring a potential reverse take-over (“RTO”) and similarly

deploying capital for growth.

Belgravia is extremely cautious in regard to dilution risks to

its shareholder base, which is the primary reason the previous

targeted acquisitions were unsuccessful. Belgravia will only work

with companies in legal businesses, with compliance to legal

jurisdictions, under rule of law.

The Company is seeking its acquisition and/or RTO candidate with

a market capitalization that will compliment and enhance the

current valuation of Belgravia and potentially create shareholder

value. Belgravia is not seeking a potential partner with a

valuation that is not aligned with the best interests of its

current shareholders. If the acquisition and/or RTO is successful,

the goal is to organically build valuation through corporate

development using current resources. More importantly, maintaining

the three pillars; corporate governance, corporate responsibility

and risk management in our progress towards any strategic

transformation.

President & CEO, Mehdi Azodi, stated, “By having the ability

to liquidate the majority of our investments and transition

Belgravia from an investment holding company to potentially owning

one operating asset or a complete change of business via a

valuation-friendly RTO, we now sit in a position that gives us more

options than before due to the capital crunch in the micro-cap

sector.”

The current model and the transition model are considered high

risk due to the nature of the micro-cap sector, macro markets and

associated executional risks.

Belgravia corporate governance practices are regularly reviewed

to ensure the adequacy of the systems and controls that are in

place. Belgravia maintains the highest standard of corporate

governance policies and procedures. Recently, Belgravia provided

the Ontario Securities Commission (“OSC”) with the Company’s SEDAR

and SEDI policies and procedures which resulted in full

compliance.

About Belgravia

Belgravia Capital International Inc. is a publicly traded

investment holding company which invests in public and private

companies in legal jurisdictions and under the rule of law.

Belgravia and its investments are high risk business ventures and

expose shareholders to financial risks. Belgravia Royalty &

Management Services has a royalty and fee income model. Further,

the cash and investment asset base provide capital to support

expansion on a selective basis.

For more information, please visit

www.belgraviacapital.ca.

Forward-Looking

Statements

Certain information set forth in this news release may contain

forward-looking statements that involve substantial known and

unknown risks and uncertainties and other factors which may cause

the actual results, performance or achievements of the Company to

be materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Forward-looking statements include statements that use

forward-looking terminology such as “may”, “will”, “expect”,

“anticipate”, “believe”, “continue”, “potential” or the negative

thereof or other variations thereof or comparable terminology. Such

forward-looking statements include, without limitation, statements

regarding planned investment activities & related returns, the

timing for completion of research and development activities, the

potential value of royalties, and other statements that are not

historical facts. These forward-looking statements are

subject to numerous risks and uncertainties, certain of which are

beyond the control of the Company, including, but not limited to,

changes in market trends, the completion, results and timing of

research undertaken by the Company, risks associated with resource

assets, the impact of general economic conditions, commodity

prices, industry conditions, dependence upon regulatory,

environmental, and governmental approvals, and the uncertainty of

obtaining additional financing. Readers are cautioned that the

assumptions used in the preparation of such information, although

considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on

forward-looking statements.

For More Information, Please

Contact:

Mehdi Azodi, President & CEOBelgravia

Capital International Inc.(416) 779-3268 mazodi@blgv.ca

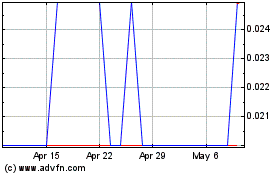

Belgravia Hartford Capital (CSE:BLGV)

Historical Stock Chart

From Mar 2024 to Apr 2024

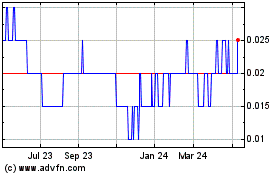

Belgravia Hartford Capital (CSE:BLGV)

Historical Stock Chart

From Apr 2023 to Apr 2024