Current Report Filing (8-k)

May 22 2019 - 6:49AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 21, 2019

CrossAmerica Partners LP

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-35711

|

|

45-4165414

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

600 Hamilton Street, Suite 500

Allentown, PA

|

|

18101

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(610) 625-8000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Units

|

CAPL

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item

1.01

As previously disclosed in a Current Report on Form 8-K filed by CrossAmerica Partners LP (“CrossAmerica” or “the Partnership”) on December 17, 2018, the Partnership entered into an Asset Exchange Agreement (the “Asset Exchange Agreement”) with Circle K Stores Inc., a Texas corporation (“Circle K”), on December 17, 2018, pursuant to which the Partnership and Circle K agreed to exchange (i) certain assets of the Partnership related to 56 convenience and fuel retail stores currently leased and operated by Circle K pursuant to a master lease that the Partnership previously purchased jointly with or from CST Brands Inc. (the “master lease properties”) and 17 convenience and fuel retail stores currently owned and operated by the Partnership located in the U.S. Upper Midwest (the “Upper Midwest properties”), for (ii) certain assets of Circle K related to 192 (162 fee and 30 leased) company-operated convenience and fuel retail stores. The transactions contemplated by the Asset Exchange Agreement are to be closed in a series of “tranche” closings, which the Partnership now expects will be completed by no later than the end of the first quarter of 2020.

On May 21, 2019, the closing of the first tranche of asset exchanges under the Asset Exchange Agreement occurred (the “First Asset Exchange”). In this First Asset Exchange, Circle K transferred to the Partnership 60 (52 fee and 8 leased) U.S. company-operated convenience and fuel retail stores having an aggregate value of approximately $58.1 million, and the Partnership transferred to Circle K all 17 of the Upper Midwest properties and the real property for eight of the master lease properties having an aggregate value of approximately $58.3 million.

In connection with the closing of the First Asset Exchange, the stores transferred by Circle K were dealerized as contemplated by the Asset Exchange Agreement and Circle K’s rights under the dealer agreements and agent agreements that were entered into in connection therewith were assigned to the Partnership. Additionally, at the closing of the First Asset Exchange, Lehigh Gas Wholesale LLC (“LGW”), a wholly-owned subsidiary of the Partnership, and Circle K entered into a Sub-Jobber Agreement, dated as of May 21, 2019 (the “Sub-Jobber Agreement”), pursuant to which Circle K will supply fuel to LGW for resale to the dealers at the 60 stores that Circle K transferred to the Partnership in the First Asset Exchange. While there is no minimum or maximum quantity of products that LGW is required to purchase from Circle K, for each store location covered by the Sub-Jobber Agreement, LGW must purchase from Circle K all of the requirements for motor fuel at the stores covered by the Sub-Jobber Agreement, except in certain limited circumstances described in the Sub-Jobber Agreement. The term of the Sub-Jobber Agreement will expire on May 21, 2024, unless earlier terminated by either party in accordance with the terms of the Sub-Jobber Agreement. Circle K also has the right to grant temporary extensions of the Sub-Jobber Agreement of up to 180 days per extension.

After each subsequent “tranche” closing under the Asset Exchange Agreement, the Sub-Jobber Agreement will be amended by agreement of LGW and Circle K to add the store locations acquired by the Partnership at such closing to the Sub-Jobber Agreement.

The foregoing description of the Sub-Jobber Agreement does not purport to be complete and is qualified in its entirety by reference to the Sub-Jobber Agreement, which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Relationship between the Parties.

Circle K indirectly owns 100% of the membership interests in CrossAmerica GP LLC, a Delaware limited liability company and the general partner of the Partnership (the “General Partner”). Circle K provides the Partnership and the General Partner with management, administrative and operating services. Circle K and the Partnership have also entered into real property leases and fuel supply agreements, among others. For more information about the relationship between the Partnership and Circle K, see the description thereof included in Part III, Item 13, “Certain Relationships and Related Party Transactions, and Director Independence” in the Partnership’s Annual Report on Form 10-K for the year ended December 31, 2018.

The terms of the Sub-Jobber Agreement were unanimously approved by the conflicts committee (the “Conflicts Committee”) of the board of directors of the General Partner in December 2018 at the time when the terms of the Asset Exchange Agreement were approved. The Conflicts Committee, which is composed of the independent members of the board of directors of the General Partner, retained independent legal and financial advisors to assist in evaluating and negotiating the terms of the Sub-Jobber Agreement. Upon the recommendation of the Conflicts Committee, the board of directors of the General Partner subsequently approved the terms of the Sub-Jobber Agreement.

Item 2.01 Completion of Acquisition or Disposition of Assets

The information included in Item 1.01 is incorporated by reference into this Item 2.01.

Item 7.01 Regulation FD Disclosure

A copy of the press release issued by the Partnership on May 22, 2019 announcing the closing of the First Asset Exchange is furnished herewith as Exhibit 99.1, and the information set forth therein is incorporated herein by reference and constitutes a part of this report.

Furnished herewith as Exhibit 99.2 are slides regarding the closing of the First Asset Exchange, which provide additional information.

The information in this Item 7.01 and in Exhibit 99.1 and Exhibit 99.2 of Item 9.01 of this Current Report on Form 8-K, according to genera

l instruction B.2., shall not be deemed “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any registration

statement pursuant to the Securities Act of 1933, as amended. By furnishing this information, the Partnership makes no admission as to the materiality of such information that the Partnership chooses to disclose solely because of Regulation FD.

Item 9.01 Financial Statements and Exhibits

* Certain identified information has been omitted pursuant to Item 601(b)(10) of Regulation S-K because such information is both (i) not material and (ii) would likely cause competitive harm to the Partnership if publicly disclosed. The Partnership hereby undertakes to furnish supplemental copies of the unredacted exhibit upon request by the Securities and Exchange Commission (the “SEC”).

+ Non-material schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Partnership hereby undertakes to furnish supplemental copies of any of the omitted schedules upon request by the SEC.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K and the exhibits to this report contain forward-looking statements regarding the Partnership’s or its management’s expectations or predictions of the benefits of the Asset Exchange Agreement between the Partnership and Circle K, including the Partnership’s plans, objectives and intentions, the expected timing of completion of the transactions contemplated by the Asset Exchange Agreement and other statements that are not historical facts. It is important to note that the Partnership’s actual results could differ materially from those projected in such forward-looking statements. Factors that could affect those results include those mentioned in the documents that the Partnership has filed with the SEC. Forward-looking statements speak only as of the date they are made, and the Partnership undertakes no duty or obligation to publicly update or revise the information contained in this report, whether as a result of new information, future events or otherwise, although the Partnership may do so from time to time as management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure. Readers of this Current Report on Form 8-K are cautioned not to rely on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary statement is applicable to all forward-looking statements contained in this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CrossAmerica Partners LP

|

|

|

By:

|

CrossAmerica GP LLC

|

|

|

|

its general partner

|

|

|

|

|

|

|

|

By:

|

/s/ Michael W. Federer

|

|

|

|

Name:

|

Michael W. Federer

|

|

|

|

Title:

|

Senior Director - Legal, and Corporate Secretary

|

Dated: May 22, 2019

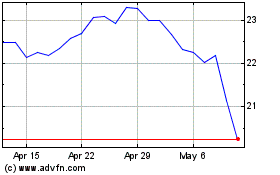

CrossAmerica Partners (NYSE:CAPL)

Historical Stock Chart

From Aug 2024 to Sep 2024

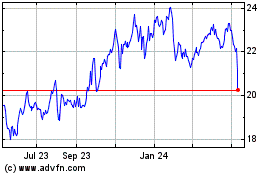

CrossAmerica Partners (NYSE:CAPL)

Historical Stock Chart

From Sep 2023 to Sep 2024