Kosmos Energy Ltd. (“Kosmos”) (NYSE: KOS) announced today

financial and operating results for the first quarter of 2019.

For the first quarter of 2019, the Company generated a net

loss of $53 million, or $0.13 per diluted share.

When adjusted for certain items that impact the comparability

of results, the Company generated an adjusted net loss(1) of

$23.0 million or $0.06 per diluted share for the first

quarter of 2019.

"Kosmos has made a strong start to 2019 with progress across all

business units and first quarter results in line with guidance,”

said Andrew G. Inglis, chairman and chief executive officer. “We

remain on track to hit our production growth guidance for the year,

while at current prices exceeding the 2019 free cash flow that we

set out at our capital markets day in February. Our intention to

sell down our position in Mauritania and Senegal to around 10% has

generated significant industry interest and we have commenced a

formal process, with bids expected by the end of summer. On the

finance side, we successfully completed a $650 million bond

offering during the quarter meaning Kosmos now has no debt

maturities until 2022. We also paid our inaugural quarterly

dividend in the first quarter.”

It must be noted that the first quarter 2019 results include the

impact of proportionately consolidating the Equatorial Guinea

results. Prior quarters exclude this impact and only include the

minority interest gain or loss in the bottom line. In addition, the

prior year quarter does not include the Gulf of Mexico acquisition

which did not close until the end of the third quarter of 2018.

First quarter 2019 revenues were $297 million on sales of 5.1

million barrels of oil equivalent (boe). Realized oil and gas

revenues, including the impact of the Company’s hedging program,

was $56.73 per barrel in the first quarter of 2019. At quarter end,

the Company was in a net underlift position of approximately

0.8 million barrels of oil. First quarter results included the

following:

- Production expense was $80 million, or

$15.64 per boe

- General and administrative expenses

were $36 million, $28 million in cash expense and $8 million in

non-cash equity based compensation expense

- Depletion and depreciation expense was

$118 million, or $23.14 per boe

- Exploration expenses totaled $30

million

- Capital expenditures in the first

quarter were $110 million

First quarter results included a mark-to-market loss of $77

million related to the Company’s oil derivative contracts. At

March 31, 2019, the Company’s hedging position had a total

commodity net asset value of approximately $39.5 million. As of the

quarter end and including recently executed hedges, Kosmos has

approximately 16 million barrels of oil hedged covering 2019

through 2020 including Brent, WTI, and LLS based hedges.

Kosmos exited the first quarter of 2019 with approximately $0.5

billion of liquidity and $2.1 billion of net debt.

OPERATIONAL UPDATE

Total net production volumes during the first quarter of 2019

averaged approximately 59,500 barrels of oil equivalent (boepd) per

day(2).

Ghana

During the first quarter of 2019, net production volumes from

Ghana averaged approximately 28,620 barrels of oil per day (bopd),

including net volumes from the Jubilee and TEN fields which

averaged approximately 18,315 bopd and 10,305 bopd, respectively.

Kosmos lifted two cargoes, as forecasted, from Ghana during the

first quarter.

At Jubilee, gas handling reliability was enhanced during the

quarter with a spare high-pressure gas compressor now available.

Kosmos continues to work with the operator to increase the gas

handling capacity, which would thereby allow oil production rates

to increase.

At TEN, in March the EN-10 well was completed and brought

online, increasing production from the field. An additional

production well is expected to be brought on stream around the

middle of the year, enabling the field to increase production rates

to the FPSO nameplate oil capacity of 80,000 bopd gross.

Equatorial Guinea

Production in Equatorial Guinea averaged approximately

12,605 bopd net in the first quarter of 2019. Kosmos lifted the

forecasted one and a half cargoes from Equatorial Guinea during the

quarter. The electric submersible pump (ESP) program is on track,

adding around 2,500 bopd gross to offset decline. Kosmos expects to

complete two more ESP conversions around the middle of the

year.

U.S. Gulf of Mexico

U.S. Gulf of Mexico production averaged approximately

18,240 boepd net (81% oil) during the first quarter, exceeding the

high end of the guidance range.

The routine dry-dock work on the Helix Producer-1 was

successfully completed on time, increasing production from the Gulf

of Mexico once the vessel was brought back online. Production

levels were further increased when the Tornado-3 well was brought

online adding around 9,000 boepd gross.

Kosmos was one of the most active participants in U.S. Gulf of

Mexico Lease Sale 252 in March and were the apparent high bidder on

nine deepwater blocks.

During the first quarter of 2019, Kosmos farmed in to eighteen

BP-owned blocks in the Garden Banks area of the deepwater U.S. Gulf

of Mexico. In addition, Kosmos can earn an interest in three BP

blocks in other areas of the deepwater Gulf of Mexico. This should

allow Kosmos to execute projects that can be tied back to existing

infrastructure. Kosmos is the designated operator and plans to

commence drilling operations on the first well in Garden Banks

Block 492, the Resolution prospect, in 2019.

Also, during the first quarter of 2019, Kosmos executed a

farm-in agreement with Chevron covering the right to earn an

interest in a strategic block in the deepwater U.S. Gulf of

Mexico. This agreement allows Kosmos further opportunity to

execute its deepwater U.S. Gulf of Mexico strategy of lower risk

prospects with the potential for subsea development near existing

infrastructure. Kosmos will be designated operator and plans to

commence drilling operations on the first well in 2019.

Greater Tortue Ahmeyim Project

As of early May, all major contracts have been awarded for

Tortue Phase 1, and construction activity for the project has

commenced with work on the FPSO.

In April 2019, KBR was awarded the Pre-FEED services contract

for Phases 2 and 3 of the Greater Tortue Ahmeyim project. These

next phases are expected to expand capacity of this hub to almost

10 MMTPA of LNG for export.

In the wider Mauritania/Senegal basin, Kosmos has commenced a

formal process to sell down its interest to around 10% with bids

expected by the end of summer.

Portfolio Additions

Kosmos entered into a petroleum contract in March covering the

Marine XXI block with the Republic of the Congo, subject to

customary governmental approvals. Upon approval, Kosmos will hold

an 85% participating interest and will be the

operator.

In March, Kosmos acquired Ophir's remaining interest in Block

EG-24 offshore Equatorial Guinea, which resulted in Kosmos owning

an 80% participating interest in the block.

(1) A Non-GAAP measure, see attached reconciliation of

adjusted net income. (2) Production means net entitlement volumes.

In Ghana and Equatorial Guinea, this means those volumes net to

Kosmos' working interest or participating interest and net of

royalty or production sharing contract effect. In the Gulf of

Mexico, this means those volumes net to Kosmos's working interest

and net of royalty.

Conference Call and Webcast Information

Kosmos will host a conference call and webcast to discuss first

quarter 2019 financial and operating results today at 10:00 a.m.

Central time (11:00 a.m. Eastern time). A live webcast of the event

and slides can be accessed on the Investors page of Kosmos’ website

at http://investors.kosmosenergy.com/investor-events. The dial-in

telephone number for the call is +1.877.407.3982. Callers outside

the United States should dial +1.201.493.6780. A replay of the

webcast will be available on the Investors page of Kosmos’ website

for approximately 90 days following the event.

About Kosmos Energy

Kosmos is a full-cycle deepwater independent oil and gas

exploration and production company focused along the Atlantic

Margins. Our key assets include production offshore Ghana,

Equatorial Guinea and U.S. Gulf of Mexico, as well as a world-class

gas development offshore Mauritania and Senegal. We also maintain a

sustainable exploration program balanced between proven basin

infrastructure-led exploration (Equatorial Guinea and U.S. Gulf of

Mexico), emerging basins (Mauritania, Senegal and Suriname) and

frontier basins (Cote d'Ivoire, Namibia and Sao Tome and Principe).

Kosmos is listed on the New York Stock Exchange and London Stock

Exchange and is traded under the ticker symbol KOS. As an ethical

and transparent company, Kosmos is committed to doing things the

right way. The Company’s Business Principles articulate our

commitment to transparency, ethics, human rights, safety and the

environment. Read more about this commitment in the

Kosmos 2017 Corporate Responsibility Report. For additional

information, visit www.kosmosenergy.com.

Non-GAAP Financial Measures

EBITDAX, Adjusted net income (loss) and Adjusted net income

(loss) per share are supplemental non-GAAP financial measures used

by management and external users of the Company's consolidated

financial statements, such as industry analysts, investors, lenders

and rating agencies. The Company defines EBITDAX as Net income

(loss) plus (i) exploration expense, (ii) depletion, depreciation

and amortization expense, (iii) equity based compensation expense,

(iv) unrealized (gain) loss on commodity derivatives (realized

losses are deducted and realized gains are added back), (v) (gain)

loss on sale of oil and gas properties, (vi) interest (income)

expense, (vii) income taxes, (viii) loss on extinguishment of debt,

(ix) doubtful accounts expense and (x) similar other material items

which management believes affect the comparability of operating

results. The Facility EBITDAX definition includes 50% of the

EBITDAX adjustments of Kosmos-Trident International Petroleum Inc

for the period it was an equity method investment and includes Last

Twelve Months ("LTM") EBITDAX for any acquisitions and excludes LTM

EBITDAX for any divestitures.

We believe that EBITDAX, Adjusted net income (loss), and

Adjusted net income (loss) per share and other similar measures are

useful to investors because they are frequently used by securities

analysts, investors and other interested parties in the evaluation

of companies in the oil and gas sector and will provide investors

with a useful tool for assessing the comparability between periods,

among securities analysts, as well as company by company. Because

EBITDAX, Adjusted net income (loss), and Adjusted net income (loss)

per share excludes some, but not all, items that affect net income,

these measures as presented by us may not be comparable to

similarly titled measures of other companies.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All

statements, other than statements of historical facts, included in

this press release that address activities, events or developments

that Kosmos expects, believes or anticipates will or may occur in

the future are forward-looking statements. Kosmos’ estimates

and forward-looking statements are mainly based on its current

expectations and estimates of future events and trends, which

affect or may affect its businesses and operations. Although Kosmos

believes that these estimates and forward-looking statements are

based upon reasonable assumptions, they are subject to several

risks and uncertainties and are made in light of information

currently available to Kosmos. When used in this press release, the

words “anticipate,” “believe,” “intend,” “expect,” “plan,” “will”

or other similar words are intended to identify forward-looking

statements. Such statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond the control of

Kosmos, which may cause actual results to differ materially from

those implied or expressed by the forward-looking statements.

Further information on such assumptions, risks and uncertainties is

available in Kosmos’ Securities and Exchange

Commission (“SEC”) filings. Kosmos undertakes no

obligation and does not intend to update or correct these

forward-looking statements to reflect events or circumstances

occurring after the date of this press release, except as required

by applicable law. You are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

of this press release. All forward-looking statements are qualified

in their entirety by this cautionary statement.

Kosmos Energy Ltd.

Consolidated Statements of

Operations

(In thousands, except per share

amounts, unaudited)

Three Months Ended March 31, 2019

2018 Revenues and other income: Oil and gas

revenue $ 296,790 $ 127,196 Other income, net — (19 ) Total

revenues and other income 296,790 127,177

Costs and

expenses: Oil and gas production 79,799 46,768 Facilities

insurance modifications, net (20,021 ) 8,449 Exploration expenses

30,344 21,193 General and administrative 35,908 21,883 Depletion,

depreciation and amortization 118,095 54,277 Interest and other

financing costs, net 35,041 25,694 Derivatives, net 77,085 38,478

Gain on equity method investments, net — (18,696 ) Other expenses,

net 2,119 3,705 Total costs and expenses 358,370

201,751 Loss before income taxes (61,580 )

(74,574 ) Income tax benefit (8,674 ) (24,348 ) Net loss $ (52,906

) $ (50,226 )

Net loss per share: Basic $ (0.13 ) $

(0.13 ) Diluted $ (0.13 ) $ (0.13 ) Weighted average

number of shares used to compute net loss per share: Basic 401,164

395,600 Diluted 401,164 395,600

Kosmos Energy Ltd.

Condensed Consolidated Balance

Sheets

(In thousands, unaudited)

March 31, December 31, 2019 2018

Assets Current assets: Cash and cash equivalents $ 134,423 $

173,515 Receivables, net 186,179 140,006 Other current assets

163,525 196,179 Total current assets 484,127 509,700

Property and equipment, net 3,914,803 3,459,701 Other non-current

assets 102,926 118,788

Total assets $ 4,501,856

$ 4,088,189

Liabilities and stockholders’

equity Current liabilities: Accounts payable $ 174,073 $

176,540 Accrued liabilities 187,941 195,596 Other current

liabilities 51,713 12,172 Total current liabilities 413,727

384,308 Long-term liabilities: Long-term debt, net 2,195,826

2,120,547 Deferred tax liabilities 704,122 477,179 Other

non-current liabilities 311,588 164,677 Total long-term

liabilities 3,211,536 2,762,403 Total stockholders’ equity

876,593 941,478

Total liabilities and stockholders’

equity $ 4,501,856 $ 4,088,189

Kosmos Energy Ltd.

Condensed Consolidated Statements of

Cash Flow

(In thousands, unaudited)

Three Months Ended March 31, 2019

2018 Operating activities: Net loss $

(52,906 ) $ (50,226 ) Adjustments to reconcile net loss to net cash

used in operating activities: Depletion, depreciation and

amortization 120,482 56,717 Deferred income taxes (39,833 ) (24,697

) Unsuccessful well costs (160 ) 43 Change in fair value of

derivatives 73,807 38,966 Cash settlements on derivatives, net(1)

(3,576 ) (20,397 ) Equity-based compensation 8,441 8,017 Loss on

extinguishment of debt — 4,056 Distributions in excess of equity in

earnings — 5,234 Other 10,647 (478 ) Changes in assets and

liabilities: Net changes in working capital (134,249 ) (34,251 )

Net cash used in operating activities (17,347 ) (17,016 )

Investing activities Oil and gas assets (78,377 ) (34,712 )

Other property (1,071 ) (1,757 ) Return of investment from KTIPI —

41,070 Net cash provided by (used in) investing

activities (79,448 ) 4,601

Financing activities:

Borrowings on long-term debt 175,000 — Payments on long-term debt

(100,000 ) — Purchase of treasury stock (1,980 ) (11,874 )

Dividends (18,147 ) — Deferred financing costs (1,160 ) (24,969 )

Net cash provided by (used in) financing activities 53,713

(36,843 ) Net decrease in cash, cash equivalents and

restricted cash (43,082 ) (49,258 ) Cash, cash equivalents and

restricted cash at beginning of period 185,616 304,986

Cash, cash equivalents and restricted cash at end of period

$ 142,534 $ 255,728

_______________

(1)

Cash settlements on commodity hedges were

$7.3 million and $19.7 million for the three months ended March 31,

2019 and 2018, respectively.

Kosmos Energy Ltd.

Equity Method Investment

(In thousands, unaudited)

Three months ended March 31, 2018 Revenues and

other income: Oil and gas revenue $ 246,354 Other income 287

Total revenues and other income 246,641 Costs and expenses:

Oil and gas production 51,700 Depletion and depreciation 54,070

Other expenses, net (79 ) Total costs and expenses 105,691

Income before income taxes 140,950 Income tax expense 49,632

Net income $ 91,318 Kosmos' share of net

income $ 45,659 Basis difference amortization(1) 26,963

Equity in earnings - KTIPI $ 18,696

_______________

(1)

The basis difference, which is associated

with oil and gas properties and subject to amortization, has been

allocated to the Ceiba Field and Okume Complex. We amortize the

basis difference using the unit-of-production method.

Kosmos Energy Ltd.

EBITDAX

(In thousands, unaudited)

Three Months Ended Three Months Ended March

31, 2019 March 31, 2018 Kosmos Kosmos

EquatorialGuinea (EquityMethod)(1)

Total Net income (loss) $ (52,906 ) $ (50,226 ) $ 18,696 $

(31,530 ) Exploration expenses 30,344 21,193 — 21,193 Facilities

insurance modifications, net (20,021 ) 8,449 — 8,449 Depletion,

depreciation and amortization 118,095 54,277 53,997 108,274

Equity-based compensation 8,441 8,017 — 8,017 Derivatives, net

77,085 38,478 — 38,478 Cash settlements on commodity derivatives

(7,289 ) (19,744 ) — (19,744 ) Inventory impairment and other 187

19 — 19 Disputed charges and related costs (14 ) 2,335 — 2,335 Gain

on equity method investment - KTIPI — (18,696 ) — (18,696 )

Interest and other financing costs, net 35,041 25,694 — 25,694

Income tax expense (benefit) (8,674 ) (24,348 ) 24,816 468

EBITDAX $ 180,289 $ 45,448 $ 97,509 $

142,957

Twelve Months Ended March 31,

2019 Kosmos

EquatorialGuinea (EquityMethod)(2)

Total Net income (loss) $ (96,671 ) $ 54,185 $ (42,486 )

Exploration expenses 310,643 352 310,995 Facilities insurance

modifications, net (21,515 ) — (21,515 ) Depletion and depreciation

393,653 80,985 474,638 Equity-based compensation 35,654 — 35,654

Derivatives, net 7,177 — 7,177 Cash settlements on commodity

derivatives (124,598 ) — (124,598 ) Inventory impairment and other

456 — 456 Disputed charges and related costs (12,102 ) — (12,102 )

Gain on sale of assets (7,666 ) — (7,666 ) Gain on equity method

investment - KTIPI (54,185 ) — (54,185 ) Interest and other

financing costs, net 110,523 — 110,523 Income tax expense 58,805

53,675 112,480 EBITDAX $ 600,174 $

189,197 $ 789,371

_______________

(1)

For the three months ended March 31, 2018

we have presented separately our 50% share of the results from

operations and amortization of our basis difference for the

Equatorial Guinea investment as we accounted for such investment

under the equity method during this period.

(2)

For the twelve months ended March 31,

2019, we have presented separately our 50% share of the results

from operations and amortization of our basis difference for the

Equatorial Guinea investment through December 31, 2018, as we

accounted for such investment under the equity method through this

date.

Adjusted Net Income

(In thousands, except per share

amounts, unaudited)

Three Months Ended March 31, 2019

2018 Net loss $ (52,906 ) $ (50,226 )

Derivatives, net 77,085 38,478 Cash settlements on commodity

derivatives (7,289 ) (19,744 ) Facilities insurance modifications,

net (20,021 ) 8,449 Inventory impairment and other 187 19 Disputed

charges and related costs (14 ) 2,335 Loss on extinguishment of

debt — 4,056 Total selected items before tax 49,948

33,593 Income tax expense on adjustments(1)

(20,041 ) (6,564 ) Impact of U.S. tax law change — —

Adjusted net loss $ (22,999 ) $ (23,197 ) Net loss per

diluted share $ (0.13 ) $ (0.13 ) Derivatives, net 0.19 0.10

Cash settlements on commodity derivatives (0.02 ) (0.05 )

Facilities insurance modifications, net (0.05 ) 0.02 Inventory

impairment and other — — Disputed charges and related costs — —

Loss on extinguishment of debt — 0.01 Total selected

items before tax 0.12 0.08 Income tax expense

on adjustments(1) (0.05 ) (0.01 ) Adjusted net loss per diluted

share $ (0.06 ) $ (0.06 ) Weighted average number of diluted

shares 401,164 395,600

_______________

(1)

Income tax expense is calculated at the

statutory rate in which such item(s) reside. Statutory rates for

the U.S. and Ghana are 21% and 35%, respectively.

Operational Summary(1)

(In thousands, except barrel and per

barrel data, unaudited)

Three Months Ended March 31, 2019

2018 Net Volume Sold Oil (MMBbl) Kosmos 4.690

1.934 Equity method investment - Equatorial Guinea — 1.880

Total Oil (MMBbl) 4.690 3.814 Gas (MMcf) 1.801 — NGL (MMBbl)

0.113 — Total (MMBoe) 5.103 3.814

Revenue Oil sales: Kosmos $ 290,864 $ 127,196 Equity

method investment - Equatorial Guinea — 123,177 Total

Oil sales 290,864 250,373 Gas sales 3,662 — NGL sales 2,264

— Total sales 296,790 250,373 Cash settlements on commodity

derivatives (7,289 ) (19,744 ) Realized revenue $ 289,501 $

230,629

Oil and Gas Production Costs Kosmos $

79,799 $ 46,768 Equity method investment - Equatorial Guinea —

25,850 Total oil and gas production costs $ 79,799

$ 72,618 Oil sales per Bbl: Kosmos $ 62.02 $

65.77 Equity method investment - Equatorial Guinea — 65.52 Total

Oil sales per Bbl 62.02 65.65 Gas sales per Mcf 2.03 — NGL sales

per Bbl 20.13 — Total sales per Boe 58.16 65.65 Cash settlements on

commodity derivatives per oil Bbl(2) (1.55 ) (10.21 ) Realized

revenue per Boe(3) 56.73 60.47 Oil and gas production costs

per Boe: Kosmos $ 15.64 $ 24.18 Equity method investment -

Equatorial Guinea — $ 13.75 Total oil and gas production costs

15.64 19.04

_______________

(1)

For the three months March 31, 2018, we

have presented separately our 50% share of the results from

operations for the Equatorial Guinea investment, as we accounted

for such investment under the equity method during this period.

(2)

Cash settlements on commodity derivatives

are only related to Kosmos and are calculated on a per barrel basis

using Kosmos' Net Oil Volumes Sold.

(3)

Realized revenue includes revenue from

Kosmos, Equatorial Guinea (equity method investment), and Cash

settlements on commodity derivatives; on a per Boe basis realized

revenue is calculated using the total Net Volume Sold from both

Kosmos and Equatorial Guinea (equity method investment).

Kosmos was underlifted by approximately 795 thousand barrels as

of March 31, 2019.

Hedging Summary

As of March 31,

2019(1)

(Unaudited)

Weighted Average Price per Bbl Index

MBbl Floor(2) Sold Put

Ceiling 2019: Three-way collars Dated Brent 7,880 $

53.33 $ 43.81 $ 73.57 Swaps NYMEX WTI 1,224 52.22 — — Collars NYMEX

WTI 169 57.77 — 63.70 Collars Argus LLS 750 60.00 — 88.75

2020: Three-way collars Dated Brent 6,000 $ 57.50 $ 45.00 $

80.18

_______________

(1)

Please see the Company’s filed 10-Q for

full disclosure on hedging material. Includes hedging position as

of March 31, 2019 and hedges added since quarter-end.

(2)

“Floor” represents floor price for collars

or swaps and strike price for purchased puts.

Note: Excludes 0.7 MMBbls of sold (short) calls with a

strike price of $80.00 per Bbl in 2019 and 8.0 MMBbls of sold

(short) calls with a strike price of $85.00 per Bbl in 2020.

2019 Guidance

FY 2019 Production(1,2) 69,000 - 73,000 boe

per day Opex $12.00 - $15.00 per boe DD&A $22.00

- $25.00 per boe G&A(3) $115 - $125 million

Exploration Expense ~$30 million average per quarter Net

Interest $35 - $37 million per quarter Tax $3.00 - $5.00 per

boe Capex $425 - $475 million in FY 2019

_______________

Note: Ghana/EG revenue calculated by

number of cargos.

(1)

2Q 2019 - Ghana: 3 cargos / Equatorial

Guinea 1 cargo. FY 2019 Ghana: 13 cargos / Equatorial Guinea 5.5

cargos. Average cargo sizes 950,000 barrels of oil.

(2)

GoM Production - 2Q 2019: 23,000-25,000

boe per day. FY 2019 22,000-24,000 boe per day. Oil/Gas/NGL split

for 2019: U.S. Gulf of Mexico: 80%/12%/8%.

(3)

G&A - Approximately 70% cash.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190505005054/en/

Investor RelationsJamie Buckland+44 (0) 203 954

2831jbuckland@kosmosenergy.com

Rhys Williams+1-214-445-9693rwilliams@kosmosenergy.com

Media RelationsThomas

Golembeski+1-214-445-9674tgolembeski@kosmosenergy.com

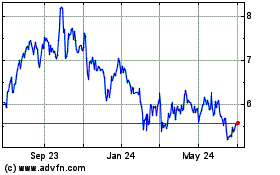

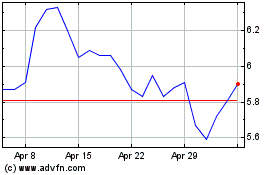

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Apr 2023 to Apr 2024