Current Report Filing (8-k)

March 05 2019 - 5:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

pursuant

to Section 13 or 15(d) of The Securities Act of 1934

Date of Report

(Date of earliest event reported): 03/05/19

Turner

Valley Oil & Gas, Inc.

(Exact name

of Registrant as specified in its charter)

Commission

File Number: 0-30891

|

Nevada

|

|

91-1980526

|

|

(Jurisdiction

of Incorporation)

|

|

(I.R.S. Employer

Identification No.)

|

1600

West Loop South, Suite 600, Houston, Texas 77027

(Address

of principal executive offices) (Zip Code)

Registrant's

telephone number, including area code:

1-713-588-9453

INTRODUCTION

This Registrant (Reporting Company)

has elected to refer to itself, whenever possible, by normal English pronouns, such as "We", "Us" and "Our".

This Form 8-K may contain forward-looking statements. Such statements include statements concerning plans, objectives, goals,

strategies, future events, results or performances, and underlying assumptions that are not statements of historical fact. This

document and any other written or oral statements made by us or on our behalf may include forward-looking statements which reflect

our current views, with respect to future events or results and future financial performance. Certain words indicate forward-looking

statements, words like "believe", "expect", "anticipate", "intends", "estimates",

"forecast", "projects", and similar expressions.

Item 1.01. Entry

into a Material Definitive Agreement

Turner entered into an acquisition

agreement with Ark Capital Holdings, LLC (“Ark”) with terms as follows:

TVOG,

is a United States (Nevada) corporation. TVOG is currently pursuing synergistic acquisitions in the Infrastructure Services, Supply

Chain, Technology and Finance segments.

Specifically

within Finance, focused on providing capital to the infrastructure industry including equipment financing, receivable financing,

factoring, equity investment, refinancing, and related financing needs. ACH provides these types of services to corporate clients

now through assets under management and capital relationships.

Per our

recent discussions TVOG and ACH are mutually interested in a partnership with ACH for the acquisition of ACH by TVOG. We are pleased

to present the following proposal to describe the terms and conditions under which this acquisition could occur.

Whereas,

TVOG intends to acquire ACH as a wholly owned subsidiary for the purposes of incubating ACH and pursuing venture capital or a

spin-out of ACH in order to fully capitalize its growth capital needs and unlock valuation.

To that

end, TVOG proposes the following acquisition transaction and financial considerations to ACH:

1.

Acquisition

And Capital Structure:

TVOG

will acquire ACH with the following considerations.

-

All the ownership

of ACH will be acquired by TVOG through a wholly owned subsidiary to be formed called Ark Capital Holdings, Inc. in exchange for

Preferred Stock of TVOG..

-

ACH shall remain

wholly owned by TVOG until such time either a spin-out occurs with the intention of filing an S1 or outside capital is raised

within ACH. Should a spin-out occur or outside capital is raised TVOG and ACH agree to a 25% and 75% respectively, pre-dilution

from acquisitions and capital invested by new investors or capital invested by TVOG more than the costs to file an S1.

-

ACH management will

be appointed to run ACH Subsidiary with Mario Fichera as Chairman and CEO and James Stuart as COO of ACH subsidiary..

-

The board seats will

be mutually agreed to at closing by TVOG, ACH and capital partners including necessary board members that need to be independent,

with ACH appointing 3 board members to a 5 member board of ACH.

-

Bridge capital will

be funded to cover the closing of ACH and operating expenses and initial acquisition(s) for ACH. As ACH confirms or acquires additional

asset books or businesses additional funds will be raised at an improved valuation.

TVOG

will structure underwriting offer with capital markets partner as follows:

-

$10,000,000 equity

raise for common stock equity of ACH.

-

Final pricing and

structure of offering will depend on a number of factors and advisor recommendations.

-

Initial minimum

capital mandate to be available will be $1,000,000.00 over twelve months , and the balance funded with follow-on offering and

remaining balance in follow up offering tiers.

-

Follow on equity

underwritings to be determined. Additional capital available as justified with mergers & acquisitions.

-

Management will

participate in earn-in compensation structure where additional equity will be acquired at key milestones such as revenues and

acquisitions.

Valuation

Metrics:

-

TVOG and ACH agree

to seek best market pricing available in conjunction with capital markets bankers where market comparables and investor proposition

meet.

-

ACH valuation shall

be equal to 4 x Trailing Twelve Months EBITDA,

-

Bolt-on asset books

or businesses will be valued at 4 x Trailing Twelve Months EBITDA net to the Pubco, payable in stock or negotiated cash and stock

split.

-

Adjustments made

for net assets, investment, earn in to be modeled into Purchase And Sale Agreement.

Item

7.01. Regulation FD Disclosure.

The

Company intends to issue a press release on 03/06/19 to provide investors with updates regarding this acquisition. The update

is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

Press release planned to issue

by the Company on 03/06/19

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, this Form 8-K has been signed below by the following person(s) on behalf of the Registrant

and in the capacity and on the date indicated.

Dated: 03/05/19

Turner

Valley Oil and Gas, Inc.

By:

/s/

Steve Helm

Steve Helm,

President/CEO/Director

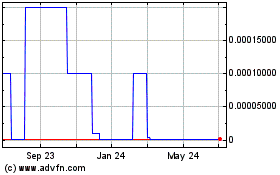

Turner Valley Oil and Gas (CE) (USOTC:TVOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

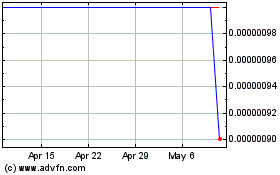

Turner Valley Oil and Gas (CE) (USOTC:TVOG)

Historical Stock Chart

From Apr 2023 to Apr 2024