Dynex Capital, Inc. Declares Fourth Quarter 2018 Dividends

December 11 2018 - 8:00AM

Business Wire

Dynex Capital, Inc. (NYSE: DX) announced today the Company’s

Board of Directors has declared the 44th consecutive quarterly

common stock dividend since launching the new investment strategy

in 2008. The Company will pay a quarterly common dividend of $0.18

per common share for the fourth quarter of 2018 payable on January

31, 2019 to shareholders of record on December 31, 2018.

Preferred Stock Dividends

The Company also announced that it will pay the regular

quarterly dividend of $0.53125 per share on its 8.50% Series A

Cumulative Redeemable Preferred Stock (NYSE: DXPRA) and $0.4765625

per share on its 7.625% Series B Cumulative Redeemable Preferred

Stock (NYSE: DXPRB). Both dividends will be paid on January 15,

2019 to shareholders of record of the Series A and Series B

Preferred Stocks as of January 1, 2019.

Share Repurchase Program

Additionally, the Company announced today that its Board of

Directors has authorized the repurchase of up to $40 million of its

outstanding shares of common stock through December 31,

2020. The Company will only repurchase shares when the

repurchase price per share is less than the Company’s most recent

estimate of the current net book value of a share of common

stock.

As part of the share repurchase program, shares may be purchased

in open market transactions, including through block purchases,

through privately negotiated transactions, or pursuant to any

trading plan that may be adopted in accordance with Rule 10b5-1 of

the Securities Exchange Act of 1934 (the “Exchange Act”). The

timing, manner, price and amount of any repurchases will be

determined in the Company’s discretion and the share repurchase

program may be suspended, terminated or modified at any time for

any reason. The repurchase program does not obligate the

Company to acquire any specific number of shares, and all open

market repurchases will be made in accordance with Exchange Act

Rule 10b-18, which sets certain restrictions on the method, timing,

price and volume of open market stock repurchases.

This new authorization replaces the Company’s prior share

repurchase program, which was to expire on December 31,

2018.

Dynex Capital, Inc. is an internally managed real estate

investment trust, or REIT, which invests in mortgage assets on a

leveraged basis. The Company invests in Agency and non-Agency

RMBS, CMBS, and CMBS IO. Additional information about Dynex

Capital, Inc. is available at www.dynexcapital.com.

“Safe Harbor” Statement under the Private Securities Litigation

Reform Act of 1995: Statements in this press release

regarding the business of Dynex Capital, Inc. that are

not historical facts are “forward-looking statements” that involve

risks and uncertainties. For a discussion of these risks and

uncertainties, which could cause actual results to differ from

those contained in the forward-looking statements, see “Risk

Factors” in the Company’s Annual Report on Form 10-K and other

reports filed with the Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181211005449/en/

Alison Griffin804-217-5897

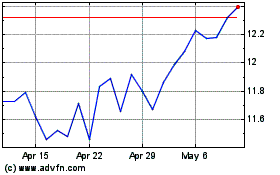

Dynex Capital (NYSE:DX)

Historical Stock Chart

From Mar 2024 to Apr 2024

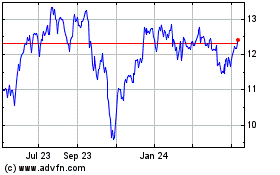

Dynex Capital (NYSE:DX)

Historical Stock Chart

From Apr 2023 to Apr 2024