Webcast and Conference Call today at 4:30

p.m. ET

- Royalty revenue for the quarter

increased to $67.2 million

- Net income was $27.4 million, or $1.30

per diluted common share

- Cash and marketable securities totaled

$325.1 million

- Phase 2a study initiated with EDP-938

against respiratory syncytial virus (RSV) infection in a human

challenge study

- Hepatitis B virus (HBV) candidate

EDP-514 selected for clinical development in 2019

Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA), a research and

development-focused biotechnology company dedicated to creating

small molecule drugs for viral infections and liver diseases, today

reported financial results for its fiscal fourth quarter and year

ended September 30, 2018.

“Enanta has never been in a stronger position from both a

financial and clinical development perspective,” said Jay R. Luly,

Ph.D. President and CEO, Enanta Pharmaceuticals. “With the recent

start of our Phase 2a study in RSV, we now have three Phase 2

studies ongoing in our wholly-owned development programs. Our

momentum will continue into 2019, when we plan to initiate clinical

testing of EDP-514, our first candidate to treat hepatitis B virus,

and we expect Phase 2 data readouts in our other programs, starting

with NASH and RSV studies.”

Fiscal Fourth Quarter and Year Ended September 30, 2018

Financial Results

Total revenue for the three months ended September 30, 2018

consisted of $67.2 million of royalty revenue, compared to total

revenue of $75.9 million for the three months ended September 30,

2017, which consisted of $10.9 million of royalty revenue and $65.0

million in milestone payment revenue for the approvals of

MAVYRET™/MAVIRET™ (glecaprevir/pibrentasvir) in the U.S. and the

EU. For the twelve months ended September 30, 2018, total revenue

was $206.6 million, compared to $102.8 million for the same period

in 2017.

The increase in royalty revenue for the recent quarter was due

to an increase in royalties earned on AbbVie’s worldwide net sales

of MAVYRET™/MAVIRET™. For the twelve months ended September 30,

2018, revenue consisted of $191.6 million in royalties earned on

AbbVie’s worldwide net sales of HCV regimens containing glecaprevir

or paritaprevir, as well as the final $15.0 million milestone

payment for glecaprevir, which we earned upon the November 2017

reimbursement approval of MAVIRET™ in Japan. For the 2017

twelve-month period, revenue consisted of the $65.0 million in

milestone payments, as well as $37.8 million in royalties earned on

AbbVie’s worldwide net sales of HCV regimens containing

paritaprevir or glecaprevir.

Research and development expenses totaled $26.9 million for the

three months ended September 30, 2018, compared to $16.5 million

for the three months ended September 30, 2017. For the twelve

months ended September 30, 2018, research and development expenses

totaled $94.9 million compared to $57.5 million for the same period

in 2017. The increase in research and development expenses in both

periods was primarily due to increased preclinical and clinical

costs associated with the progression of Enanta’s wholly-owned

R&D programs in non-alcoholic steatohepatitis (NASH), primary

biliary cholangitis (PBC), and respiratory syncytial virus (RSV),

as well as research efforts in hepatitis B virus (HBV).

General and administrative expenses totaled $5.8 million for the

three months ended September 30, 2018, compared to $5.1 million for

the three months ended September 30, 2017. For the twelve months

ended September 30, 2018, general and administrative expenses

totaled $23.4 million, compared to $20.7 million for the same

period in 2017. The increase in general and administrative expenses

in both periods was primarily due to increases in compensation

expense driven by increased headcount to support Enanta’s

wholly-owned R&D programs.

Enanta recorded income tax expense of $8.5 million for the three

months ended September 30, 2018 compared to an income tax expense

of $18.4 million for the same period in 2017. Enanta recorded

income tax expense of $21.2 million for the year ended September

30, 2018 compared to income tax expense of $9.2 million for the

same period in 2017. The Company’s effective tax rate for fiscal

2018 was approximately 23% compared to approximately 34% in fiscal

2017. Enanta’s effective tax rate for fiscal 2018 reflects the

impact of a non-cash revaluation charge against deferred tax assets

due to the reduced federal corporate income tax rate in the U.S.

Tax Cuts and Jobs Act enacted in December 2017.

Net income for the three months ended September 30, 2018 was

$27.4 million, or $1.30 per diluted common share, compared to a net

income of $36.5 million, or $1.86 per diluted common share, for the

corresponding period in 2017. For the twelve months ended September

30, 2018, net income was $72.0 million, or $3.48 per diluted common

share, compared to net income of $17.7 million, or $0.91 per

diluted common share, for the corresponding period in 2017.

Enanta’s cash, cash equivalents and short-term and long-term

marketable securities totaled $325.1 million at September 30, 2018.

This compares to a total of $293.7 million at September 30, 2017.

Enanta expects that its current cash, cash equivalents and

marketable securities, as well as its continuing royalty revenue,

will be sufficient to meet the anticipated cash requirements of its

existing business and development programs for the foreseeable

future.

Financial Guidance for Fiscal 2019

- Research and Development Expense: $135

to $155 million

- General and Administrative Expense: $27

to $33 million

Development Programs and Business Review

Respiratory Syncytial Virus (RSV)

- Phase 1 results for EDP-938, Enanta’s

non-fusion N-inhibitor candidate, were presented at the 11th

International Respiratory Syncytial Virus Symposium in Asheville,

North Carolina on November 1. Additional preclinical results of

EDP-938 were also presented in an oral presentation demonstrating

that EDP-938 has a high barrier to resistance in vitro.

- Dosing began in October in a Phase 2a

study to evaluate the safety, pharmacokinetics and antiviral

activity of multiple doses of orally administered EDP-938 against

respiratory syncytial virus infection in a human challenge study.

Initial data is expected in the third quarter of calendar

2019.

Hepatitis B Virus (HBV)

- Enanta’s HBV program continues to move

ahead as Enanta announces that it has selected EDP-514, a promising

inhibitor of the HBV core protein, as its first development

candidate in this program. A Phase 1 study of EDP-514, consisting

of evaluation of single and multiple doses of drug in healthy

volunteers and incorporating a Phase 1b arm in chronic HBV

patients, is planned to begin in 2019.

Non-Alcoholic Steatohepatitis (NASH) and Primary Biliary

Cholangitis (PBC)

- Two preclinical posters titled “The

Farnesoid X Receptor (FXR) Agonist EDP-305 Reduces Ascites and

Hepatocellular Carcinoma Development in a Rat Model of Cirrhosis”

and “The Farnesoid X Receptor (FXR) Agonist EDP-305 Inhibits

Fibrosis Progression in a Rat Model of Non-alcoholic

Steatohepatitis Cirrhosis” were presented at The Liver Meeting®

2018 in November.

- Enrollment continues in the ARGON-1

study for non-alcoholic steatohepatitis (NASH), and in the INTREPID

study for primary biliary cholangitis (PBC) patients. Enrollment

will continue through the remainder of 2018 and into 2019. Initial

data is expected starting in mid-2019.

Hepatitis C Virus (HCV)

- Enanta’s HCV collaboration partner,

AbbVie, presented data for its pan-genotypic chronic HCV treatment,

MAVYRET™(glecaprevir/pibrentasvir), in treatment-naïve patients

with compensated cirrhosis, as a late-breaking oral presentation at

The Liver Meeting® 2018 on November 13, 2018. Results from the

Phase 3 EXPEDITION-8 study showed that with 8 weeks of MAVYRET, 100

percent (n=273/273) of genotypes 1, 2, 4, 5 and 6 patients achieved

a sustained virologic response 12 weeks after treatment

(SVR12).

Upcoming Events and Presentations

- 37th Annual J.P. Morgan Healthcare

Conference, January 7-10, 2019

- Enanta plans to issue its fiscal first

quarter financial results press release, and hold a conference call

regarding those results, on February 6, 2019.

Conference Call and Webcast InformationEnanta will host a

conference call and webcast today at 4:30 p.m. ET. To participate

in the live conference call, please dial (855) 840-0595 in the U.S.

or (518) 444-4814 for international callers. A replay of the

conference call will be available starting at approximately 7:30

p.m. ET on November 26, 2018, through 11:59 p.m. ET on November 28,

2018 by dialing (855) 859-2056 from the U.S. or (404) 537-3406 for

international callers. The passcode for both the live call and the

replay is 9952167. A live audio webcast of the call and replay can

be accessed by visiting the “Events and Presentation” section on

the “Investors” page of Enanta’s website at www.enanta.com.

About Enanta Pharmaceuticals, Inc.Enanta Pharmaceuticals

is using its robust, chemistry-driven approach and drug discovery

capabilities to become a leader in the discovery and development of

small molecule drugs for the treatment of viral infections and

liver diseases. Glecaprevir, a protease inhibitor discovered by

Enanta, has been developed by AbbVie, and is now approved and sold

in numerous countries as part of AbbVie’s newest treatment for

chronic hepatitis C virus (HCV) infection. This leading HCV regimen

is sold under the tradenames MAVYRET™ (U.S.) and MAVIRET™ (ex-U.S.)

(glecaprevir/pibrentasvir).

Royalties from the AbbVie collaboration are helping to fund

Enanta’s research and development efforts, which are currently

focused on the following disease targets: respiratory syncytial

virus (RSV), non-alcoholic steatohepatitis (NASH), primary biliary

cholangitis (PBC), and hepatitis B virus (HBV). Please visit

www.enanta.com for more information.

FORWARD LOOKING STATEMENTS

This press release contains forward-looking statements,

including statements with respect to the prospects for advancement

of Enanta’s clinical programs in NASH/PBC and RSV and its

preclinical program in HBV, as well as Enanta’s projections of its

expenses in fiscal 2019 and the prospects for AbbVie’s

MAVYRET™/MAVIRET™ regimen for HCV and future royalty revenue to

Enanta from sales of that regimen. Statements that are not

historical facts are based on management’s current expectations,

estimates, forecasts and projections about Enanta’s business and

the industry in which it operates and management’s beliefs and

assumptions. The statements contained in this release are not

guarantees of future performance and involve certain risks,

uncertainties and assumptions, which are difficult to predict.

Therefore, actual outcomes and results may differ materially from

what is expressed in such forward-looking statements. Important

factors and risks that may affect actual results include: Enanta’s

revenues in the short-term are dependent upon the success of

AbbVie’s continuing commercialization efforts for its HCV treatment

regimen MAVYRET™/MAVIRET™; competitive pricing, market acceptance

and reimbursement rates for MAVYRET™/MAVIRET™ compared to

competitive HCV products on the market; the discovery and

development risks of early stage discovery and clinical efforts in

other disease areas such as NASH, PBC, RSV and HBV; potential

competition from the development efforts of others in those other

disease areas; Enanta’s lack of clinical development experience;

Enanta’s need to attract and retain senior management and key

research and development personnel; Enanta’s need to obtain and

maintain patent protection for its product candidates and avoid

potential infringement of the intellectual property rights of

others; and other risk factors described or referred to in “Risk

Factors” in Enanta’s most recent Form 10-Q for the quarter ended

June 30, 2018 and other periodic reports filed more recently with

the Securities and Exchange Commission. Enanta cautions investors

not to place undue reliance on the forward-looking statements

contained in this release. These statements speak only as of the

date of this release, and Enanta undertakes no obligation to update

or revise these statements, except as may be required by law.

ENANTA PHARMACEUTICALS,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONSUNAUDITED(in thousands, except per share

amounts)

Three Months EndedSeptember

30,

Year EndedSeptember 30, 2018 2017

2018 2017 Revenue $ 67,205 $ 75,927 $ 206,625

$ 102,814 Operating expenses Research and development 26,923 16,514

94,856 57,451

General and administrative

5,830 5,118 23,441

20,749 Total operating expenses 32,753

21,632 118,297 78,200 Income

from operations 34,452 54,295 88,328 24,614 Other income, net

1,429 660 4,793

2,333 Income before income taxes 35,881 54,955 93,121 26,947

Income tax expense (8,461 ) (18,447 ) (21,165

) (9,237 ) Net income $ 27,420 $ 36,508 $

71,956 $ 17,710 Net income per share Basic $ 1.41 $

1.91 $ 3.74 $ 0.93 Diluted $ 1.30 $ 1.86 $ 3.48 $ 0.91 Weighted

average common shares outstanding Basic 19,380 19,097 19,255 19,066

Diluted 21,066 19,611 20,650 19,407

ENANTA

PHARMACEUTICALS, INC.CONDENSED CONSOLIDATED BALANCE

SHEETSUNAUDITED(in thousands)

September

30,2018 September 30,2017 Assets Current

assets Cash and cash equivalents $ 63,902 $ 65,675 Short-term

marketable securities 244,828 157,994 Accounts receivable 67,205

10,614 Prepaid expenses and other current assets 4,454

3,536 Total current assets 380,389 237,819 Long-term

marketable securities 16,389 70,038 Property and equipment, net

8,374 8,049 Deferred tax assets 8,375 10,123 Restricted cash 608

608 Other long-term assets 92 - Total assets $

414,227 $ 326,637 Liabilities and Stockholders' Equity Current

liabilities Accounts payable $ 4,745 $ 3,714 Accrued expenses and

other current liabilities 9,892 7,970 Income taxes payable

1,388 9,298 Total current liabilities 16,025 20,982 Warrant

liability - 807 Series 1 nonconvertible preferred stock 1,628 762

Other long-term liabilities 2,895 2,410 Total

liabilities 20,548 24,961 Total stockholders' equity

393,679 301,676 Total liabilities and stockholders'

equity $ 414,227 $ 326,637

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181126005548/en/

Investor Contact:Carol

Miceli617-607-0710cmiceli@enanta.comMedia Contact:Kari

WatsonMacDougall Biomedical

Communications781-235-3060kwatson@macbiocom.com

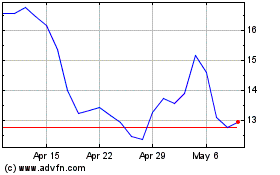

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Aug 2024 to Sep 2024

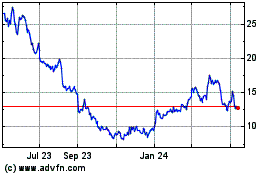

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Sep 2023 to Sep 2024