Current Report Filing (8-k)

November 20 2018 - 4:33PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 14, 2018

C-Bond

Systems, Inc.

(Exact

name of registrant as specified in its charter)

|

Colorado

|

|

0-53029

|

|

26-1315585

|

|

(State

or Other Jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

Incorporation)

|

|

File

Number)

|

|

Identification

Number)

|

6035

South Loop East, Houston, TX 77033

(Address

of principal executive offices) (zip code)

(832)

649-5658

(Registrant’s

telephone number, including area code)

(Former

Name or Former Address if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Cautionary

Note on Forward-Looking Statements

This

Current Report on Form 8-K (this “Report”) and any related statements of representatives and partners of the Company

contain, or may contain, among other things, certain “forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of

1934, as amended (the “Exchange Act”). Such forward-looking statements involve significant risks and uncertainties.

Such statements may include, without limitation, statements with respect to the Company’s plans, objectives, projections,

expectations and intentions and other statements identified by words such as “projects,” “may,” “will,”

“could,” “would,” “should,” “believes,” “expects,” “anticipates,”

“estimates,” “intends,” “plans,” or similar expressions. These statements are based upon the

current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties, including

those detailed in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in

the Risk Factors of its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and any Current Reports on Form 8-K. Actual

results may differ significantly from those set forth in the forward-looking statements. These forward-looking statements involve

certain risks and uncertainties that are subject to change based on various factors (many of which are beyond the Company’s

control). The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable law.

Item

1.01 Entry into a Material Definitive Agreement.

On

November 14, 2018, C-Bond Systems, Inc. (the “Company”) entered into a Revolving Credit Facility Loan and Security

Agreement (“Loan Agreement”) and a Secured Promissory Note (the “Note”) with BOCO Investments, LLC (the

“Lender”). Subject to and in accordance with the terms and conditions of the Loan Agreement and the Note, the Lender

agrees to lend to the Company up to $400,000 (the “Maximum Loan Amount”) against the issuance and delivery by the

Company of the Note for use as working capital and to assist in inventory acquisition. The Lender loaned an initial amount of

$200,000 at closing and may loan additional amounts to the Company at any time and from time to time through November 14, 2020,

up to an aggregate amount not to exceed the Maximum Loan Amount. The Company must repay all principle, interest and other amounts

outstanding on or before November 14, 2020. The Company’s obligations under the Loan Agreement and the Note are secured

by a first-priority security interest in substantially all of the Company’s assets (the “Collateral”). The outstanding

principal advanced to Company pursuant to the Loan Agreement bears interest at the rate of 12% per annum, compounded annually.

The Lender is currently a shareholder of the Company that has previously filed a Schedule 13D/A with the SEC on May 10, 2018 and

was previously a related party of the Company prior to the merger on April 25, 2018, as previously disclosed in our Current Report

on Form 8-K filed with the SEC on May 1, 2018.

The

Loan Agreement and Note contain customary representations, warranties and covenants, including covenants requiring the Company

to maintain certain inventory and accounts receivable amounts, certain restrictions on the Company’s ability to incur additional

debt or create liens on its property. The Loan Agreement and the Note also provide for certain events of default, including, among

other things, payment defaults, breaches of representations and warranties and bankruptcy or insolvency proceedings, the occurrence

of which, after any applicable cure period, would permit Lender, among other things, to accelerate payment of all amounts outstanding

under the Loan Agreement and the Note, as applicable, and to exercise its remedies with respect to the Collateral, including the

sale of the Collateral.

The

discussion herein regarding the Loan Agreement and Note is qualified in its entirety by reference to the Loan Agreement and the

Note attached hereto as Exhibits 10.1, and 4.1, respectively.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information provided in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

C-Bond

Systems, Inc.

|

|

|

|

|

|

Date:

November 20, 2018

|

By:

|

/s/

Scott R. Silverman

|

|

|

Name:

|

Scott

R. Silverman

|

|

|

Title:

|

Chief

Executive Officer

|

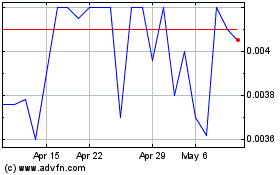

C Bond Systems (PK) (USOTC:CBNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

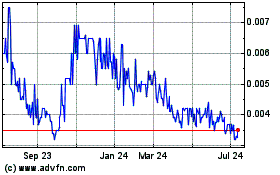

C Bond Systems (PK) (USOTC:CBNT)

Historical Stock Chart

From Apr 2023 to Apr 2024