UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2018

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified

in its charter)

Nuestra Señora de los Ángeles

179

Las Condes, Santiago, Chile

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GEOPARK LIMITED

TABLE

OF CONTENTS

|

ITEM

|

|

|

|

|

|

1.

|

Investor Day Presentation dated November 19, 2018

|

Item 1

GeoPark Investor Day New York, November 19, 2018

2 • The material that follows comprises information about GeoPark Limited (“GeoPark” or the “Company”) and its subsidiaries, as of the date of the presentation . It has been prepared solely for informational purposes and should not be treated as giving legal, tax, investment or other advice to potential investors . The information presented or contained herein is in summary form and does not purport to be complete . • No representations or warranties, express or implied, are made as to, and no reliance should be placed on, the accuracy, fairness, or completeness of this information . Neither GeoPark nor any of its affiliates, advisers or representatives accepts any responsibility whatsoever for any loss or damage arising from any information presented or contained in this presentation . The information presented or contained in this presentation is current as of the date hereof and is subject to change without notice, and its accuracy is not guaranteed . Neither GeoPark nor any of its affiliates, advisers or representatives makes any undertaking to update any such information subsequent to the date hereof . • This presentation contains forward - looking statements, which are based upon GeoPark and/or its management’s current expectations and projections about future events . When used in this presentation, the words “believe,” “anticipate,” “intend,” “estimate,” “expect,” “should,” “may” and similar expressions, or the negative of such words and expressions, are intended to identify forward - looking statements, although not all forward - looking statements contain such words or expressions . Additionally, all information, other than historical facts included in this presentation, regarding strategy, future operations, drilling plans, estimated reserves, estimated resources, future production, estimated capital expenditures, projected costs and costs reductions, cash flows or cash flows growth, GDP growth, the potential of drilling prospects, potential production from existing assets and other plans and objectives of management for 2019 and beyond is forward - looking information . Such statements and information are subject to a number of risks, uncertainties and assumptions . Forward - looking statements are not guarantees of future performance and actual results may differ materially from those anticipated due to many factors, including oil and natural gas prices, industry conditions, drilling results, uncertainties in estimating reserves and resources, availability and cost of drilling rigs, production equipment, supplies, personnel and oil field services, availability of capital resources and other factors . As for forward - looking statements that relate to future financial results and other projections, actual results may be different due to the inherent uncertainty of estimates, forecasts and projections . Because of these uncertainties, potential investors should not rely on these forward - looking statements . Neither GeoPark nor any of its affiliates, directors, officers, agents or employees, nor any of the shareholders or under shall be liable, in any event, before any third party (including investors) for any investment or business decision made or action taken in reliance on the information and statements contained in this presentation or for any consequential, special or similar damages . • Statements related to resources are deemed forward - looking statements as they involve the implied assessment, based on certain estimates and assumptions, that the resources will be discovered and can be profitably produced in the future . Specifically, forward - looking information contained herein regarding "resources" may include : estimated volumes and value of the Company's oil and gas resources and the ability to finance future development ; and, the conversion of a portion of resources into reserves . • The information included in this presentation regarding estimated quantities of proved, probable or possible reserves in Chile, Colombia, Brazil, and Peru as of December 31 , 2017 ; are derived, in part, from the reports prepared by DeGolyer and MacNaughton , or D&M, independent reserves engineers . Certified reserves refers to net reserves independently evaluated by the petroleum consulting firm, D&M . Certain reserves data, such as those based on the D&M report, were prepared under SEC standards, and certain other data were prepared under Petroleum Resources Management System (PRMS) standards . • The information included in this presentation regarding estimated exploration resources in Colombia, Chile, Brazil, and Peru as of December 31 , 2015 , 2016 or 2017 ; are derived, in part, from the reports prepared by Gaffney, Cline & Associates, or GCA . The accuracy of any resource estimate is a function of the quality of the available data and of engineering and geological interpretation . Results of drilling, testing and production that postdate the preparation of the estimates may justify revisions, some or all of which may be material . Accordingly, resource estimates are often different from the quantities of oil and gas that are ultimately recovered, and the timing and cost of those volumes that are recovered may vary from that assumed . • Prospective Resources are those quantities of petroleum that are estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects . Prospective Resources have both an associated “chance of discovery” and a “chance of development” (per PRMS) . Prospective Resources are further subdivided in accordance with the level of certainty associated with recoverable estimates, assuming their discovery and development, and may be sub - classified based on project maturity . There is no certainty that any portion of the Prospective Resources will be discovered . If discovered, there is no certainty that it will be commercially viable to produce any portion of the resources . Prospective Resource volumes are presented as unrisked . The risk or chance of finding a minimum hydrocarbon volume that can flow to surface is presented as Geological Chance of Success ( GCoS ) . • Certain data in this presentation was obtained from various external sources, and neither GeoPark nor its affiliates, advisers or representatives has verified such data with independent sources . Accordingly, neither GeoPark nor any of its affiliates, advisers or representatives makes any representations as to the accuracy or completeness of that data, and such data involves risks and uncertainties and is subject to change based on various factors . • This presentation contains a discussion of Adjusted EBITDA, which is not an IFRS measure . We define Adjusted EBITDA as profit for the period before net finance cost, income tax, depreciation, amortization and certain non - cash items such as impairments and write - offs of unsuccessful exploration and evaluation assets, accrual of stock options and stock awards and bargain purchase gain on acquisition of subsidiaries . Adjusted EBITDA is included in this presentation because it is a measure of our operating performance and our management believes that Adjusted EBITDA is useful to investors because it is frequently used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies in industries similar to ours . Adjusted EBITDA should not be considered a substitute for financial information presented or prepared in accordance with IFRS . Adjusted EBITDA, as determined and measured by us, should also not be compared to similarly titled measures reported by other companies . • Rounding amounts and percentages : Certain amounts and percentages included in this document have been rounded for ease of presentation . Percentage figures included in this document have not in all cases been calculated on the basis of such rounded figures but on the basis of such amounts prior to rounding . For this reason, certain percentage amounts in this document may vary from those obtained by performing the same calculations using the figures in the financial statements . In addition, certain other amounts that appear in this document may not sum due to rounding . Disclaimer

3 Agenda VENUE New York Stock Exchange, Hamilton Room PROGRAM 1 :00 pm Welcome 1:05 pm Value Proposition 1:30 pm Asset Platform 1:40 pm - Colombia 2:30 pm - Peru 3:05 pm - Argentina, Brazil and Chile NEW YORK STOCK EXCHANGE, NOVEMBER 19, 2018 3:10 pm Coffee Break 3:20 pm Growing Assests 3:30 pm Financial Performance 3:40 pm 2019 Work Program 3:50 pm Shareholder Value Creation 4:00 pm End of Investor Day and Cocktail

4 VALUE PROPOSITION

5 VALUE PROPOSITION True Latin American Independent 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Historical Production Production Potential - Existing Assets Production Potential - Future New Acreage ONLY PUBLIC INDEPENDENT POSITIONED ACROSS LATIN AMERICA - THE MOST ATTRACTIVE OIL & GAS INVESTMENT REGION TODAY ARGENTINA BRAZIL PERU COLOMBIA MEXICO ECUADOR Net Average Daily Production ( boepd )

6 COUNTRIES HYDROCARBON BASINS BLOCKS EXPLORATION RESOURCES ACRES VALUE PROPOSITION Proven 16 Year Performance 1 Estimated by dividing total capital expenditures by 2P Reserves added (based on D&M 2017) | 2 Reserve Replacement Index | 3 9M2018 250 wells Llanos 34 70+% 90+% Consolidated Llanos 34 /boe $ 2.8 /boe 2P Gross 2P 2017 RRI 2 261% $4.0 300 + mmboe 9 27 5+ mm Llanos 34 Consolidated Llanos 34 Gross $8 /boe $4 /boe ~ $3.5 mm/well 70,000+ boepd DRILLING SUCCESS RATE 700 - 1,300 mmboe 5 FINDING & DEVELOPMENT COSTS 1 OIL & GAS DISCOVERED OPEX 3 DRILL, COMPLETE & PUT - ON - PRODUCTION WELL COST OPERATED PRODUCTION

7 VALUE PROPOSITION Partner of Choice 1 2015 - 2018 SAFETY ZERO VEHICLE ACCIDENTS IN 6 MM KM 130% STOCK PRICE INCREASE IN 2017 PROSPERITY 100% EMPLOYEES ARE SHAREHOLDERS EMPLOYEES ZERO SANCTIONS ENVIRONMENT ZERO ROAD BLOCKS 1 AND STRIKES 1 COMMUNITY DEVELOPMENT

8 ASSET PLATFORM

9 ASSET PLATFORM Why Latin America? Proven Reserves and Production by Country x UNDEREXPLORED x ONLY A HANDFUL OF INDEPENDENTS x UNDERDEVELOPED x ONLY HALF THE RIGS OF THE PERMIAN BASIN 2017 Reserves (M b bl ) Current Production ( bopd ) 12,800,000 2,600,000 7,200,000 2,220,000 8,300,000 550,000 2,200,000 67 0,000 100,000 25,000 303,000,000 1,230,000 1,700,000 8 70,000 1,200,000 43,000 9

10 ASSET PLATFORM Deep Risk Balanced Portfolio • Leading oil story in Latin America - grew Llanos 34 block from 0 to 65,000+ bopd gross since 2012 • World - class oil fields Tigana / Jacana • Introduced new play concept to Llanos b asin • Third largest oil and gas operator in Colombia COLOMBIA • One of Brazil’s largest non - associated producing gas fields with stable cashflow • Exploration upside in mature proven hydrocarbon basins BRAZIL • Core technical team with strong track - record • L ow - cost acquisition in the Neuquen basin ARGENTINA • Large resource base in Peru • Unique subsurface asset with proven reserves and significant exploration upside PERU • Track - record of exploring and developing mature areas • Potential in proven exploration area + large unconventional resources CHILE

11 COLOMBIA ASSET PLATFORM

12 ASSET PLATFORM – COLOMBIA 100 Years of Oil & Gas Data as of 2017 / Source: IMF, World Bank, DANE, ANALDEX • Population: 49 million • GDP: $309 billion • 2018 projected real GDP growth: 2.8% • Oil & Gas infrastructure in place • Pending reforms: Corporate Tax Barrancabermeja ODL Llanos - 34 Basic Facts $37.8 billion total exports in 2017 $13.2 billion crude oil & derivatives exports in 2017 x Member x 70% Fiscal Revenues generated by oil and gas sector (2016) TOTAL EXPORTS ($) 35% $13.2 Bn

13 ASSET PLATFORM – COLOMBIA Leading Oil Story in Latin America 11.5 16.5 38.6 46.50 67.4 88.2 2012 2013 2014 2015 2016 2017 3,440 6,491 10,807 13,189 15,590 21,788 2012 2013 2014 2015 2016 2017 • Key asset: Llanos 34 • 4 blocks - 2 operated • 0.3 mm acres • D&M 2P and 3P net reserves: 88.2 MM bbl and 101.7 MM bbl respectively • RLI: 1P: 8.3 years; 2P: 11.0 years; 3P: 12.7 years Net Reserves and Production Growth 2P RESERVES (MMBBL) PRODUCTION (BBL/D) CAGR 45% CAGR 50% Pacific Ocean PANAMA VENEZUELA COLOMBIA 200km LLANOS BASIN LLANOS 34 Our Assets Track Record & Value • D&M 2P and 3P NPV: $1,393 million and $1,588 million respectively • Grew from 0 to 65,000+ boepd gross since 2012 • Third largest operator in Colombia • Two new oil fields discovered in 9M2018 and one successful appraisal well drilled beyond D&M 2017 3P outline 13

14 ASSET PLATFORM – COLOMBIA Llanos Orientales Basin: Location and Geology LLANOS ORIENTALES STRATIGRAPHIC COLUMN LLANOS 34 MORONA BLOCK LIGHT OIL w/ CONDENSATE LIGHT TO MEDIUM OIL HEAVY OIL 14

15 ASSET PLATFORM – COLOMBIA Llanos 34: It Just Keeps Growing NORMAL FAULT (Hanging - Wall Block Oil Accumulation) Tua field: first discovery in the HW block of an extensional fault (GPRK Change a Paradigm) Type trap: Combined (Structural + Stratigraphic) 2012: Zero barrels 2018: 800 MMbbl – 1 billion barrels Original Oil in Place Jacana Field Tilo Field Chachalaca Field Chiricoca Field Jacamar Field Curucucú Field Aruco Field Tarotaro Field Tua Field Tigana Field 1 Km Tigui Field Chachalaca Sur Field Max Field

16 ASSET PLATFORM – COLOMBIA 2019 Drilling Campaign * Information included in the map above is subject to change on new information available and wells to be drilled may also be ch anged or subject to partner or regulatory approval LLANOS 34 BLOCK: GEOPARK OPERATED, 45% WI Jacana Field Tilo Field Chachalaca Field Chiricoca Field Jacamar Field Curucucú Field Aruco Field Tarotaro Field Tua Field Chachalaca Sur - 1 Tigui - 1 Tigui Sur - 1 Tigana Field 1 Km Tigui Field 2 - 3 wells 4 - 5 wells 4 - 5 wells 8 - 10 wells 2 - 3 wells 1 well 1 well OPPORTUNITY FOR LOW RISK PRODUCTION GROWTH Development / Appraisal wells Exploration wells 1 well Chachalaca Sur Field Max Field Oil fields (3P D&M 2017) Exploration prospects and resources Wells expected to be drilled or tested in 4Q2018 Oil fields discovered and extensions in 9M2018

17 ASSET PLATFORM – COLOMBIA When Everything Works 1 Net of wells drilled during 9M2018 PRODUCTION HISTORY LLANOS 34 BLOCK Multiplying Value 40x in 5 Years 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 55,000 60,000 65,000 0 10,000,000 20,000,000 30,000,000 40,000,000 50,000,000 60,000,000 70,000,000 May-12 Nov-12 May-13 Nov-13 May-14 Nov-14 May-15 Nov-15 May-16 Nov-16 May-17 Nov-17 May-18 Daily Production ( bopd ) Cummulative Production ( bbl ) LLANOS 34 VALUE GROWTH 2012 2017 2P net reserves 0 83 MMbbl Purchase price $30 MM 0 2P NPV 0 $1.3+ Bn Oil Production Cumulative Production WELL ECONOMICS EUR/well 2 - 3 MMbbl IP Rate 1,000 - 2,000 bopd Payback 4 - 6 months IRRs 500%+ Drilling Locations 50 - 60 1 Sep - 18

18 ASSET PLATFORM – COLOMBIA Low Cost Champion $4 /bbl Operating Cost in the Llanos 34 Block Fastest, Safest & Lowest Cost Driller in Colombia: 2012 Avg . Drilling Cost: $6.6 MM 2018 YTD Avg . Drilling Cost: $2.5 MM $ 13.8 $ 8.3 $ 5.8 $ 4.4 $ 4.3 $ 4.3 2013 2014 2015 2016 2017 2018 (YTD) - 70% $5,409 $4,159 $3,929 $2,860 $2,371 $2,527 $2,299 0 500 1000 1500 2012 2013 2014 2015 2016 2017 2018 YTD 43.0 24.2 26.3 20.8 17.4 17.2 17.2 - 10.0 20.0 30.0 40.0 50.0 2012 2013 2014 2015 2016 2017 2018 YTD 63% reduction in average drilling costs per well USD PER FOOT DRILLED AVERAGE DRILLING DAYS PER WELL - 57% - 60% OPERATING COST PER BARREL

19 ASSET PLATFORM – COLOMBIA Transportation Cost Savings Discount Evolution ($/bbl) 20 19 16 15 15 12.5 - 13.5 2014 2015 2016 2017 2018 2019 E E

20 PERU ASSET PLATFORM

21 ASSET PLATFORM – PERU Back to the Oil Business Data for 2017 / Source: IMF, World Bank, DANE, ANALDEX and SNMPE Basic Facts • Population: 32 million • GDP: $211 billion • 2018 projected real GDP growth: 4.1% • Improving Oil & Gas infrastructure • Pending reforms: Hydrocarbons Law PERU LIMA ECUADOR BRAZIL COLOMBIA Terminal Station Bayovar Talara Refinery Iquitos Refinery MARAÑON BASIN Station 1 Andoas Station 3 Norperuano Pipeline Sgto . Puño Base camp Station 5 4 2 Morona Station MORONA BLOCK 1 La Pampilla Refinery Conchan Refinery Northern Branch: 252 km Section I: 306 km Section II: 548 km Pumping Station Collecting Station Norperuano Pipeline Marketing Alternatives 1 2 3 4 Sale to Petroperu with delivery at Morona Station Sale to the domestic market or export with delivery at Bayovar Export to other destinations through the Amazon River Export to Ecuador Situche Central $3.5 Bn 8% TOTAL EXPORTS ($) $44.9 billion total exports in 2017 $3.5 billion crude oil & derivatives exports in 2017 x Investment Grade Economy x Investment grade x $2.5 billion Oil imports in 2017

22 ASSET PLATFORM – PERU Discovered Light Oil Field with 200+ MMbbl Upside • World class asset: Morona block ( Marañon basin) • Partnered with NOC Petroperu for its return to E&P business • 1.9 MM acres • Two wells tested combined production rate of 7,500 bopd of light oil • Exploration resources: 300 - 500 MMbbl Our Assets Track Record & Value • Discovered 80+ MMbbl light oil field ( ƒ 36 API) with upside potential of 211 MMbbl (gross) • 2,700+ km of 2D seismic and 460 km 2 3D seismic • Regional pipeline runs through the block • First oil expected in early 2020 • EIA 1 completed and submitted for approval in July 2018 Pacific Ocean BRAZIL COLOMBIA ECUADOR PERU MARAÑON BASIN MORONA SITUCHE CENTRAL FIELD Discovery Wells: Situche Central 2X and 3X (Short term tests of 2,400 bbl/d and 5,200 bbl/d of 35 - 36 ƒ API oil) 3P Area SC 2 X SC 3 X SITUCHE COMPLEX – 3D SEISMIC AREA Maximum Structural Upside (SITUCHE HORST): 211 MM bbl 1 EIA: Environmental Impact Assessment

23 ASSET PLATFORM – PERU Three Country Petroleum System: Marañon, Oriente & Putumayo Basins x ONE BIG, ATTRACTIVE, UNDERDEVELOPED, UNDEREXPLOITED SYSTEM x 150 FIELDS x THREE BILLION BARRELS OF OIL ALREADY PRODUCED x MAXIMUM ESTIMATED REMAINING RESOURCES / RESERVES: 6 BILLION BARRELS M O P ECUADOR COLOMBIA PERU MORONA BLOCK

24 ASSET PLATFORM – PERU Morona Block: Exploration Potential & Reserves Summary Prospects Leads EXPLORATORY POTENTIAL 300 – 500 MMbbl , Net exploration resources (4 Prospects + 6 Leads) Sit . 2X Sit . 3X 2P 3P Total Horst Area 211 MMbbl P1

25 ASSET PLATFORM – PERU Risk - Balanced Approach NET RESERVES MMBBL NPV10 1P* 18.7 $230 MM 2P* 31.5 $395 MM 3P* 62.2 $773 MM 2020 EIA EXPLORATION BASE CAMP - CRUDE LOADING TEMPORARY ACCESS / FLEXIPIPE INSTALLATION WELL LOCATION & EARLY PRODUCTION FACILITIES INTERVENTION SC - 3X EXTENDED PROGRAM EXPECTED FIRST OIL FLEXIPIPE EXPECTED EIA APPROVAL SOCIAL ENVIRONMENTAL / HS / IT DISPOSAL WELL EPF ENGINEERING WORKOVER SC - 2X SOCIAL ENVIRONMENTAL / HS 2019 BASE CAMP BASE PROGRAM PHASE B PHASE A 1P 2P 3P 3P Fill to Spill Point Exploration Upside EXPECTED FIRST OIL 1Q2020 10,000 bopd 20,000 bopd 45,000 bopd 60,000 bopd Long - Term Potential Production Profile 25 Time *D&M 2017 60,000 0 bopd

26 ASSET PLATFORM – PERU Partnering with Communities Support to Education Health Support Sustainable Development Support Land Titling and Registration Support Local Empowerment Cultural Value Communication and Consultation Local Employment Local Purchases Local Hiring and Contracts Compensation and Indemnification Participative Monitoring and Control SOCIAL MANAGEMENT MITIGATE and MINIMIZE negative social impact SOCIAL INVESTMENT MAXIMIZE p ositive social i mpact DIRECT AREA OF INFLUENCE AFTER DIRECT AREA OF INFLUENCE BEFORE GEOPARK STRATEGY • Lacking basic services • Limited State presence • Local economy depending on resources of the ecosystem (Tropical rain forest) lacking sustainability criteria • Economy dependent on oil activity • Has account basic services (Health and Education) • State presence • Sustainable management of natural resources • Local enterprises not dependent on the oil activity Morona Project

27 ARGENTINA, BRAZIL AND CHILE

28 ARGENTINA, BRAZIL AND CHILE Diversified Existing Opportunities ARGENTINA BRAZIL • L ow - cost acquisition in 1Q2018 • 7 blocks - 3 operated • 2.2 MM acres in Neuquen basin • 2P net reserves (estimated): 12 - 15 MM boe CHILE • Key asset: Fell block • 5 operated blocks • 0.8 MM acres • D&M 2P net reserves: 34.0 MM boe • Key asset: Manati gas field • 10 blocks - 9 operated • 0.3 MM acres • D&M PDP net reserves: 4.3 MM boe • Partners: Pluspetrol , Wintershall , YPF • Development and exploration opportunities • Producing 2,400 - 2,500 boepd of oil and gas • Vaca Muerta and tight gas upside • First private E&P operator, long - term gas contract • Two new gas fields discovered in 2018 • Producing 2,800 - 3,000 boepd of oil and gas • Unconventional upside: shale oil/ tight gas 220 - 600 MM boe • Partner : Petrobras • Low risk, low cost exploration acreage • Producing 2,800 - 3,000 boepd of gas • Generates $15 - 20 MM cash per year • Participating in Petrobras divestitures TRACK RECORD & VALUE

29 GROWING ASSETS Attractive New Opportunities BIG UNDERDEVELOPED HYDROCARBON POTENTIAL PETROBRAS ECOPETROL M&A Bolt - Ons Bolt - Ons Bolt - Ons PEMEX Bolt - Ons PETROPERU P ETROAMAZONAS Bolt - Ons ENAP National Oil Companies NOCs Bolt - Ons Corporate M&A M&A YPF Bolt - Ons $2+ Billion New Project Inventory

30 FINANCIAL PERFORMANCE

31 17 16 24 32 4 2 4 3 2015 2016 2017 2018E Operating Netback ($/boe) F&D ($/boe) GROWING ASSETS Growing Within Cashflow 2018E considering Brent at $70/bbl. 9M2018 recycle ratio calculated assuming last 3 - year average F&D. Recycle Ratio = Operating Netback / F&D 118 122 228 380 - 400 49 39 106 140 - 150 2015 2016 2017E 2018E Cost and Capital Efficiency Leading to Superior Returns Powerful Cash Generation 240+ 100+ 80+ 65+ CAPEX ($ MM ) Operating Netback ($ MM ) Cash Surplus ($ MM ) (Operating Netback minus CAPEX) 60+ MMboe of 2P net reserves added with total CAPEX (2015 - 2017) < $200 mm 3 - Year a verage F&D $3/ boe 39 24 21 16 35 6 17 5 30 8 7 2 3 12 7 1 1 14 3 7 11 8 7 46 29 65 69 Colombia Chile Brazil Argentina Consolidated HIGH NETBACKS ($/ boe ) 3Q2018 Vasconia Differential & Other Discounts Hedge OPEX Transportation OIL: $76 /BBL, GAS: $5 /MCF 76 4X Recycle Ratio 8X Recycle Ratio 6X Recycle Ratio 10X+ Recycle Ratio 9M2018 CASHFLOW 2 - 3X CAPEX

32 FINANCIAL PERFORMANCE Proven Balance Sheet Management • Cash of $153 million • 1P NPV of $1.5 billion • 2P NPV of $2.3 billion ASSETS LIABILITIES • Recent $425 million 144 - A/ Reg - S bond • 2024 bullet maturity • 6.5% coupon • $1.8 billion oversubscribed Strong Balance Sheet Net Leverage Below 1X Lowest Yield Among Latam Peer Group 1.2 X 1.1 X 4.0 X 3.7 X 1.7 X 0.9 X 2013 2014 2015 2016 2017 9M2018E Net Leverage Ratio *As of November 14, 2018 3.5x Net Debt / Adj EBITDA Ratio Incurrence Covenant GeoPark 2024 Bond 6.58 % 7.13 % 7.98 % 8.06 % GeoPark 6.5 09/21/2024 Peer 1 Peer 2 Peer 3 B+ B+ B B+ BB - B1 BB - B+ GeoPark 2024 Bond Peer group includes: Gran Tierra, Frontera Energy and Canacol Credit rating Yield*

33 2019 WORK PROGRAM

34 2019 WORK PROGRAM Principles TECHNICAL • Maximum efficient development of Llanos 34 • Initiate Morona block p roject , with production in 1Q2020 • Increase production by 15% • Delineate new plays, leads and prospects ECONOMIC • Operate and grow within cashflow • Grow operating netback, EBITDA and operating cashflow • Reduce costs • Achieve maximum net present value for the assets STRATEGIC • Achieve scale • Improve and add to core capabilities • Strengthen SPEED and compliance culture • Promote Innovation METHODOLOGY APPROACH 215 238 49 39 105 140 - 150 220 - 240 109 100 53 45 55 72 1 65 - 75 2 -80 -30 20 70 120 0 50 100 150 200 250 300 350 2013 2014 2015 2016 2017 2018 2019 Brent ($/bbl) CAPEX ($MM) • Flexible p rograms to success oil volatility Production (boepd) Op. Netback ($MM) CAPEX ($MM) 2019 IN NUMBERS - BRENT $65 - 75 /BBL 40,500 - 41,500 220 - 240 • Capital allocated to highest value - adding projects • 25+ wells in Llanos 34 • Unlocking Morona project • Active program in Argentina and Chile • 8 - 10 gross exploration wells CAPEX $3 - 4 MM CAPEX $20 - 25 MM CAPEX $85 - 95 MM CAPEX $17 - 20 MM CAPEX $95 - 105 MM 2019 420 - 500 2 Assuming base case 2 1 9M2018

35 2019 WORK PROGRAM Building Production 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 2018 2019 Production (Boepd) 2019 Estimated Average Production ( Boepd ) Production Metrics 2018 Average: 35,500 - 36,500 boepd 2019 Average: 40,500 - 41,500 boepd 2,542 Colombia Chile Brazil Argentina 85% Oil 15% Gas 32,500 - 33,500 2,400 - 2,600 2,000 - 2,300 3,200 - 3,400 E E 75,000+ Gross Operated Production (boepd) 40,500 – 41,500 +15% (vs. 2018) Net Production ( boepd ) 85% Oil Production Mix

36 2019 WORK PROGRAM Growing Cashflow and Creating Efficiencies 10 7 7 8 7 - 8 7 6 6 5 5 - 6 2015 2016 2017 2018 2019 OPEX per boe ($/boe) Cashflow Reducing Costs $17/boe $13/boe $13/boe $14/boe $13 - 14/boe Added Neuquen Assets $ 28 - 34 per boe 2019E OP. NETBACK ($65 - 75/Brent) G&G, G&A ($/ boe ) E E 118 122 228 380 - 400 420 - 500 2015 2016 2017 2018 2019 E 2 E 1 Operating Netback ($MM) 36 Oil Price Sensitivity 1 Base case $65 - 75/Brent 2 Estimates with $70/Brent

37 2019 WORK PROGRAM Flexible Growth in Any Oil Price Scenario OIL PRICE VOLATILITY ($/bbl) + - FLEXIBLE WORK PROGRAM + - GROWTH PROGRAM • 23 - 27 wells in Colombia (2 rigs ½ operating full year) • Early production facilities in Situche Central light oil field in Peru • Exploration and development activities in Argentina and Chile ACCELERATED PROGRAM • Third rig in Colombia operating full year • Accelerated activities in Argentina and Chile REDUCED PROGRAM • Flexibility to develop activities in Peru • Reduced activity in Argentina and Chile $80+/bbl PRODUCTION GROWTH $65 - 75/bbl $60 - /bbl $540 - 580 MM 15% - 20% OPERATING NETBACK CAPEX $240 - 270 MM 15% $420 - 500 MM $220 - 240 MM $340 - 390 MM 15% $120 - 140 MM

38 SHAREHOLDER VALUE CREATION

39 SHAREHOLDER VALUE CREATION Building Partnerships LTM Nov 2018 Conferences 24 Non - deal Roadshows 12 Management Presentations /Field Trip/Other 5 Investor Meetings 450+ Cities 34 Increased Marketing Efforts 0.0 0.0 0.0 0.0 1.1 0.4 0.1 0.1 0.1 0.4 1.1 0.5 0.9 0.4 1.1 0.9 2.4 1.3 1.3 0.9 0.8 0.8 1.3 0.7 1.3 1.1 2.4 5.5 5.5 8.7 5.9 5.1 5.2 4.4 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sept-18 Oct-18 $5.3K $4.5MM 1Q2016 YTD Dramatic Increase in Liquidity 39

40 SHAREHOLDER VALUE CREATION Firing On All Cylinders * As of November 16, 2018 Colombia Chile, Brazil, Peru & Argentina 2P NPV Non - Controlling Interest (LGI) Net Debt Adjusted 2P NPV GPRK Market Cap * Net Debt SUM OF THE PARTS VALUATION EXERCISE $MM ( Based on D&M 2017) 1,393 897 2,290 (228) (291) 1,771 1,097 2P NPV (D&M) 2P RESERVES 2017 2012 1,005 2 ,290 2017 2012 MMBOE (D&M) 56.9 159.3 $ MM CAGR 18% CAGR 23% 2P RLI 15.5 YEARS

42 GEOPARK SPEAKERS Biographies JAMES F. PARK AUGUSTO ZUBILLAGA Chief Executive Officer Chief Operating Officer Mr . Park has served as our Chief Executive Officer and as a member of our Board of Directors since co - founding the Company in 2002 . Jim has over 40 years of experience in all phases of the upstream oil and gas business, with a strong background in the acquisition, implementation and management of international projects and teams in North America, South America, Asia, Africa, Europe and the Middle East . Jim received a Bachelor of Science degree in Geophysics from the University of California at Berkeley and previously worked as a research scientist in earthquake and tectonic studies at the University of Texas . In 1978 , Jim helped pioneer the development of commercial oil and gas production in Central America with Basic Resources, an oil and gas exploration company in Guatemala . He remained a member of the Board of Directors until the company was successfully sold in 1997 . Mr . Park is also a member of the Board of Directors of Energy Holdings and is a member of the AAPG and SPE . Jim has lived in Latin America since 2002 . Augusto has served as our Chief Operating Officer since May 2015 . He previously served in other management positions throughout the Company including as Operations Director, Argentina Director and Production Director . He previously served as our Production Director . He is a petroleum engineer with more than 23 years of experience in production, engineering, well completions, corrosion control, reservoir management and field development . He has a degree in petroleum engineering from the Instituto Tecnológico de Buenos Aires . Prior to joining our company, Mr . Zubillaga worked for Petrolera Argentina San Jorge S . A . and Chevron San Jorge S . A . At Chevron San Jorge S . A . , he led multi - disciplinary teams focused on improving production, costs and safety, and was the leader of the Asset Development Team, which was responsible for creating the field development plan and estimating and auditing the oil and gas reserves of the Trapial field in Argentina . Mr . Zubillaga was also part of a Chevron San Jorge S . A . team that was responsible for identifying business opportunities and working with the head office on the establishment of best business practices . He has authored several industry papers, including papers on electrical submersible pump optimization, corrosion control, water handling and intelligent production systems . ANDRÉS OCAMPO Chief Financial Officer Andrés has served as our Chief Financial Officer since November 2013 . He previously served as our Director of Growth and Capital (from January 2011 through October 2013 ), and has been with our company since July 2010 . Mr . Ocampo graduated with a degree in Economics from the Universidad Católica Argentina . He has more than 16 years of experience in business and finance . Before joining our company, Mr . Ocampo worked at Citigroup and served as Vice President Oil & Gas and Soft Commodities at Crédit Agricole Corporate & Investment Bank . SALVADOR MINNITI Director of Exploration Salvador has been our Director of Exploration since January 2012 . He previously served as our Exploration Manager . He holds a bachelor degree in geology from National University of La Plata and has a graduate degree from the Argentine Oil and Gas Institute in oil geology . Mr . Minniti has over 35 years of experience in oil exploration and has worked with YPF S . A . , Petrolera Argentina San Jorge S . A . and Chevron Argentina .

43 GEOPARK SPEAKERS Biographies BARBARA BRUCE Director for Peru Barbara has been our Director for Peru since June 2017 . Ms . Bruce holds a degree in Geology from the Universidad Nacional de Ingeniería , Lima, Peru, a Master’s degree in Reservoirs from Colorado School of Mines, USA and an MBA from Universidad Adolfo Ibañez , USA/Chile . Before joining GeoPark , she previously worked with Occidental Petroleum in different international operations, including in the Caño Limon field in Colombia and the Dhurnal and Bhangali gas fields in Pakistan . Barbara Bruce later worked as deputy President of an offshore operation by Petrotech Peruana, joined Hunt Oil and as General Manager of Peru LNG, leading the construction and startup of operation of Peru’s first LNG plant and managed the exploration venture of Hunt Oil in Madre de Dios, Peru . VERÓNICA DÁVILA Director of Commercial Verónica joined GeoPark in December 2016 as our Commercial Director . Mrs . Dávila has 14 years of experience in the commodities and financial sectors . Prior to joining GeoPark , she worked at Goldman Sachs as Vice President for Commodities in Latin America and served within Goldman Sachs mergers and acquisitions coverage team for Latin America . Mrs . Dávila holds a BA in economics from Pontificia Universidad Católica Argentina . MARCELA VACA Director for Colombia Marcela has been our Director for Colombia since August 2012 . Mrs . Vaca holds a degree in law from Pontificia Universidad Javeriana in Bogotá, Colombia, a Master’s Degree in commercial law from the same university and an LLM from Georgetown University . She served in the legal department of a number of companies in the mining and energy sector in Colombia . In 2000 Mrs Vaca joined GHK Company Colombia leading the legal, social and environmental strategy for the development of the Guaduas field and the construction of its pipeline . Prior to joining our company in 2012 , Mrs . Vaca served for nine years as the General Manager of the Hupecol Group, led the development of the Caracara field, the construction of the Jaguar – Santiago Pipeline, and was also involved in the structuring of the company’s asset development, its financing and sales strategy . STACY STEIMEL Director of Shareholder Value Stacy joined GeoPark in February 2017 as our Shareholder Value Director . Mrs . Steimel has more than 20 years of experience in the financial sector as Fund Manager and subsequently as regional CEO for PineBridge Investments, ex - AIG Investments in Latin America . Before AIG, Mrs . Steimel held positions in the US Treasury Department and at the InterAmerican Development Bank . She holds an MBA from the Pontificia Universidad Católica de Chile, an MA in Latin American Studies from the University of Texas at Austin and a BA from the College of William and Mary .

CONTACTS Santiago, Chile Nuestra Señora de los Ángeles 179 Las Condes, Santiago, Chile Phone: +(56 2) 2242 9600 Email: ir@geo - park.com JAMES F. PARK Chief Executive Officer ANDRÉS OCAMPO Chief Financial Officer STACY STEIMEL Shareholder Value Director

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

|

GeoPark Limited

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Andrés

Ocampo

|

|

|

|

|

|

Name:

|

Andrés Ocampo

|

|

|

|

|

|

Title:

|

Chief Financial Officer

|

Date:

November 19, 2018

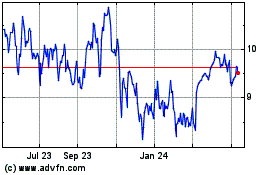

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Apr 2023 to Apr 2024