Nortech Systems Inc. (NASDAQ: NSYS) today reported net sales of

$29.6 million for the third quarter ended September 30, which

includes $1.9 million of revenue recognized under new FASB

accounting guidelines adopted this fiscal year. This compares with

$28.3 million reported for the third quarter of 2017. On a pro

forma basis to adjust for this change in accounting guidance, sales

were $27.7 million for the third quarter of 2018.

For the nine months ended September 30, Nortech’s net sales were

$84.5 million, which includes $4.2 million of revenue recognized

under the new FASB guidelines. For the comparable period in 2017,

net sales were $86.8 million.

Operating income for the third quarter was $649,000, compared

with $284,000 for the third quarter of 2017. For the nine-month

period, Nortech reported operating income of $1.3 million, compared

with $500,000 for the same period in 2017.

Nortech Systems reported net income in the third quarter of

$364,000, or $0.14 per diluted common share, compared with $43,000,

or $0.02 per diluted common share, for the same period last year.

For the nine months ended September 30, 2018, Nortech reported net

income of $362,000, or $0.13 per diluted common share. This

compares with net income of $13,000, or $0.00 per diluted common

share, for the same period in 2017.

“We’re encouraged by our quarterly performance and continued

profit improvement,” said Rich Wasielewski, Nortech Systems’

president and CEO. “Our customers remain optimistic and confident,

influenced by a strong economy, an increase in defense spending and

higher medtech investing.”

Nortech continues to face challenges related to electronic

component shortages, which are expected to continue into next year.

The company estimates these shortages had a negative revenue impact

of approximately five percent in the third quarter, with

profitability also affected by related inefficiencies in production

and increased inventory levels. Nortech is working with its

customers and supply chain partners to reduce this impact.

Two facility-related developments expected to provide long-term

benefits are scheduled to conclude by year-end: the move of

Nortech’s Monterrey, Mexico, operations into a new larger and more

efficient facility and the relocation of the Devicix by Nortech

medical device product development group to an expanded corporate

headquarters building in Maple Grove, Minn.

“These improvements to our infrastructure and operations support

our ongoing strategy of equipping the company for future growth and

profitability,” concluded Wasielewski. He added that the company’s

backlog position of $27.7 million – up double digits both

sequentially and year-over-year – should help absorb

investment-related costs and provide momentum to finish out the

year.

Conference CallNortech

Systems will hold a conference call at 10:00 a.m. (CST) on

Thursday, November 15, 2018, to discuss the company’s third quarter

results. Anyone interested in participating in the conference can

access the call by dialing 877-407-0782 from within the United

States, or 201-689-8567 if calling internationally.

An audio webcast and replay of this conference call can be

accessed at the investor relations portion of Nortech Systems’

website at www.nortechsys.com or at www.investorcalendar.com. The

telephone replay will be available through November 29, 2018, by

dialing 877-481-4010 (from U.S.) or 919-882-2331 (International).

To access the replay, the conference PIN #40286 is required.

About Nortech Systems

IncorporatedNortech Systems Incorporated

(www.nortechsys.com), based in Maple Grove, Minn., is a

full-service electronics manufacturing services (EMS) provider of

wire and cable assemblies, printed circuit board assemblies and

higher-level complete box build assemblies for a wide range of

industries. Markets served include industrial, medical and

aerospace/defense. The company has operations in the U.S., Mexico

and China. Nortech Systems Incorporated is traded on the NASDAQ

Stock Market under the symbol NSYS.

Forward-Looking

StatementsThis press release contains forward-looking

statements made pursuant to the safe harbor provision of the

Private Securities Litigation Reform Act of 1995. While this

release is based on management’s best judgment and current

expectations, actual results may differ and involve a number of

risks and uncertainties. Important factors that could cause actual

results to differ materially from the forward-looking statements

include, without limitation: volatility in market conditions which

may affect market supply of and demand for the company’s products;

increased competition; changes in the reliability and efficiency of

operating facilities or those of third parties; risks related to

availability of labor; commodity and energy cost instability;

general economic, financial and business conditions that could

affect the company’s financial condition and results of operations;

as well as risk factors listed from time to time in the company’s

filings with the SEC.

Condensed Consolidated Statements of

Operations(in thousands, except for share data)

As Reported As Reported Pro Forma as if the

previous accounting guidance was in effect THREE MONTHS

ENDED NINE MONTHS ENDED

THREEMONTHSENDED

NINEMONTHSENDED

SEPTEMBER 30, SEPTEMBER 30, SEPTEMBER 30,

Unaudited Unaudited Unaudited

Unaudited Unaudited Unaudited

2018 2017 2018 2017 2018

2018 Net Sales $ 29,558 $ 28,310 84,543 $ 86,762

27,665 $ 80,323 Cost of Goods Sold 26,171 24,794

74,311 76,789 24,454 70,291

Gross Profit 3,387 3,516 10,232 9,973

3,211 10,032 11.5 % 12.4 % 12.1 % 11.5 % 11.6

% 12.5 % Operating Expenses Selling Expenses 717 1,144 2,792

3,676 717 2,792 General and Administrative Expenses 2,021 2,088

6,177 6,152 2,021 6,177 Gain on Sale of Property and Equipment -

- - (355 ) - - Total Operating

Expenses 2,738 3,232 8,969 9,473 2,738

8,969 Income From Operations 649 284

1,263 500 472 1,063 Other

Expense Loss on Extinguishment of Debt - - - (175 ) - - Interest

Expense (170 ) (172 ) (551 ) (453 ) (170 ) (551 ) Income

(Loss) Before Income Taxes 479 112 712 (128 ) 303 512 Income

Tax Expense (Benefit) 115 69 350 (141 ) 115

350 Net Income $ 364 $ 43 362

$ 13 188 $ 162 Income Per Common

Share - Diluted $ 0.14 $ 0.02 0.13 $ 0.00

0.07 $ 0.06 Weighted Average Number of

Common Shares Outstanding - Diluted 2,682,901 2,748,533

2,702,503 2,748,973 2,682,901 2,702,503

Condensed Consolidated Balance

Sheets(in thousands)

SEPTEMBER 30, 2018 DECEMBER 31, 2017 Unaudited

Audited Cash $ 397 $ 473 Restricted Cash 236 306 Accounts

Receivable 18,979 17,417 Inventories 15,236 18,527 Contract Assets

7,076 - Prepaid Expenses and Other Current Assets 1,380 1,044

Property and Other Long-term Assets 10,124 10,204 Goodwill and

Other Intangible Assets, Net 3,953 4,114 Total Assets $ 57,381 $

52,085 Accounts Payable $ 16,887 $ 11,699 Other Current

Liabilities 6,222 6,346 Long Term Line of Credit 8,058 8,503

Long-term Debt and Other Long-term Liabilities 4,931 5,712

Shareholders’ Equity 21,283 19,825 Total Liabilities and

Shareholders’ Equity $ 57,381 $ 52,085

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181114005878/en/

Connie BeckNortech Systems Incorporated(952) 345-2244orWarren

DjerfBrookside Communications Group952-920-3908 /

warren@brookcomm.net

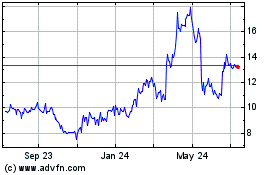

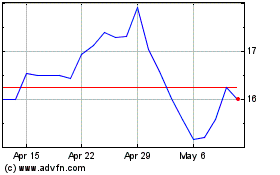

Nortech Systems (NASDAQ:NSYS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Nortech Systems (NASDAQ:NSYS)

Historical Stock Chart

From Sep 2023 to Sep 2024