UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2018

Commission File Number: 001-34476

BANCO SANTANDER (BRASIL) S.A.

(Exact name of registrant as specified in its charter)

Avenida Presidente Juscelino Kubitschek, 2041 and 2235

Bloco A – Vila Olimpia

São Paulo, SP 04543-011

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

N/A

BANCO SANTANDER (BRASIL) S.A.

Publicly-Held Company with Authorized Capital

CNPJ/MF No. 90.400.888/0001-42

NIRE 35.300.332.067

Minutes of the Board of Directors’ Meeting

held on November 5

, 2018

On November 5, 2018, at 2:30 p.m., all members of the Board of Directors of Banco Santander (Brasil) S.A. (“

Company

” or “

Santander Brazil

”) attended a teleconferencing meeting in order to resolve on the following Agenda:

To examine, discuss and resolve on

(i)

the issuance, abroad, through Santander Brazil’s Grand Cayman Branch, of instruments that make up the Tier 1 and Tier 2 of Santander Brazil’s regulatory capital (

patrimônio de referência)

(the “

Notes

”), pursuant to National Monetary Council (CMN) Resolution No. 4,192 of March 1, 2013 (“

CMN Resolution 4,192/13

”), in the aggregate amount of two billion, five hundred million American dollars US$ (2,500,000,000.00), pursuant to an offering to be made to non-US Persons outside Brazil and of the United States, under Regulation S of the US Securities Act de 1933 (the “Securities Act”), with the purpose of, combined with the resolution (ii) of the agenda, reducing financial costs of the current indebtedness and, consequently, optimizing the capital structure of Santander Brazil (the “

Offering of Notes

”);

(ii)

the redemption of instruments that currently make up the Tier 1 and Tier 2 of Santander Brazil’s regulatory capital, pursuant to CMN Resolution 4,192/13, which were issued under the resolution approved at Santander Brazil’s Board of Directors meeting held on January 14, 2014, whose eligibility for the regulatory capital was approved by the Central Bank of Brazil (“

BACEN”

) through Official Letter 5389/2014-BCB/DEORF/DIFIN (the “

Redemption

”); and

(iii)

the execution, delivery and performance of all documents to which Santander Brazil is a party and/or that are signed by, or on behalf of, Santander Brazil in relation to the issue of the Notes and to the Redemption.

Subsequently, after examining and discussing the aforementioned matter in the Agenda, which is being held in the context of the proposal for reduction of financial costs of the current indebtedness and consequent optimization of the capital structure of Santander Brazil, and in line with Santander Brazil’s business plan, and based on the documents presented to the Directors, which were duly identified as documents supporting the transaction (“

Supporting Documents

”) and will be filed at the Company’s headquarters, the Company’s Board of Directors approved without restrictions, with the abstention of Messrs.

José Antonio Álvarez Álvarez

and

José Maria Nus Badía

, who declared to be impaired for performing or having recently performed executive duties at Banco Santander, S.A. (“

Santander Spain

”):

(i)

the issuance of Notes abroad, in the amount of two billion and five hundred million American dollars (US$(2,500,000,000.00), with the following common characteristics: (a)

Unit value

: the unit face value of the Notes will be one hundred and fifty thousand United States dollars (US$ 150,000.00) and in integral multiples of one thousand American dollars (US$ 1,000.00) where it exceeds such minimum amount; (b)

Repurchase and redemption

: subject to the occurrence of certain events and conditions defined in the Supporting Documents, the Notes may be repurchased or redeemed by Santander Brazil (1)

after the fifth (5

th

) anniversary of the issue date of the Notes, in the sole discretion of the Company or as a result of changes in tax laws applicable to the Notes

; or (2) at any time, as a result of the occurrence of certain regulatory events; (c)

Write-off of the Notes

: the Notes may be permanently written-off upon the occurrence of certain regulatory events defined in CMN Resolution No. 4,192/13; (d)

Offering and trading

: The Notes will not be offered to the public in the United States, Brazil or elsewhere. Accordingly, they will not be registered with

the U.S. Securities and Exchange Commission, the Brazilian Securities Commission – CVM or any other authority, nor will they be traded on securities markets in the U.S. or Brazil. The Notes will be offered outside the United States and outside Brazil to non-US Persons, pursuant to Regulation S of the US Securities Act. The Notes will be listed on the Luxembourg Stock Exchange and admitted to trading on the Euro MTF Market of the Luxembourg Stock Exchange; (e)

Sole investor

: Santander Spain, controlling shareholder of Santander Brazil, will underwrite and pay up the Notes to be issued in the Offering of Notes; (f)

Other conditions

: the Notes shall comply with all other conditions required under CMN Resolution No. 4,192/13. The specific characteristics of the Notes issued to make up Tier 1 capital are as follows: (g)

Principal Amount

: one billion and two hundred and fifty million American dollars (US$ (1,250,000,000.00); (h)

Interest Rate

: 7.250% per year; (i)

Maturity Date

: the Tier 1 Notes will be perpetual notes; (j)

Interest Payment Frequency

: interest will be paid

semi-annually each May 8 and November 8, commencing on May 8, 2019

. The specific characteristics of the Notes issued to make up Tier 2 capital are as follows: (k)

Principal Amount

: one billion and two hundred and fifty million American dollars (US$ (1,250,000,000.00); (l)

Interest Rate

: 6.125% per year; (m)

Maturity Date

: the Tier 2 Notes will

mature on November 8, 2028

; and (n)

Interest Payment Frequency

: interest will be paid

semi-annually each May 8 and November 8, commencing on May 8, 2019

;

(ii)

the Redemption according to terms and conditions defined in the documents that formalized the issue of the instruments that currently make up Santander Brazil’s regulatory capital Tier 1 and Tier 2.

The Redemption will be carried out with funds raised through the Offering of Notes, in accordance with the terms and conditions of the documents that formalized the issuance of these instruments.

The Company will apply for simultaneous approvals to BACEN for the Notes which make up the regulatory capital Tier 1 and Tier 2, as well as to make the Redemption, in accordance with CMN Resolution 4,192/13; and

(iii)

the execution, delivery and performance of all documents to which Santander Brazil is a party and/or that are signed by, or on behalf of, Santander Brazil in relation to the possible issue of Notes, including, but not limited to (i) the Agency Agreement, (ii) the Trust Deed, (iii) the Listing Prospectus; the Subordination Nucleus of Tier 1 Subordinated Notes; (iv) the Subordination Nucleus of Tier 2 Subordinated Notes; (v) the Subscription Agreement

;

and

(vi)

other documents to formalize the Redemption.

The transaction was submitted for review and received a favorable opinion from the Audit Committee. The Executive Office is hereby authorized to take such actions as necessary for issue of the Notes, and also to sign the documents necessary to this end.

There being no further business, the meeting was closed and these Minutes were drawn up, which, after being read and approved, were signed by all.

São Paulo, November 5, 2018.

Signatures: Mr.

Álvaro Antonio Cardoso de Souza – Chairman; Sergio Agapito Lires Rial – Vice-president; Messrs. Celso Clemente Giacometti, Conrado Engel

, Deborah Patricia Wright, Deborah Stern Vieitas,

José Antonio Álvarez Álvarez

,

José de Paiva Ferreira, José Luciano Duarte Penido and José Maria Nus Badía – Directors.

These minutes are a true copy of the minutes drawn up in the Company’s own books.

_______________________________________

Daniel Pareto

Secretary

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: November 5, 2018

|

Banco Santander (Brasil) S.A.

|

|

|

|

|

|

By:

|

/

S

/

Amancio Acurcio Gouveia

|

|

|

|

Amancio Acurcio Gouveia

Officer Without Specific Designation

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/

S

/

Angel Santodomingo Martell

|

|

|

|

Angel Santodomingo Martell

Vice - President Executive Officer

|

|

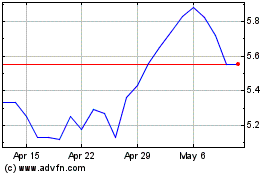

Banco Santander Brasil (NYSE:BSBR)

Historical Stock Chart

From Apr 2024 to May 2024

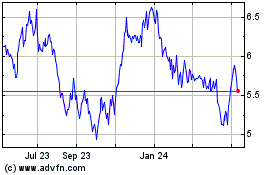

Banco Santander Brasil (NYSE:BSBR)

Historical Stock Chart

From May 2023 to May 2024