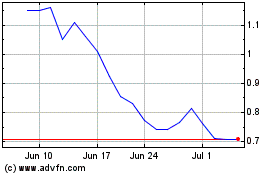

Our common stock and Series Z Warrants are

listed for trading on the NASDAQ Capital Market under the symbols “PAVM” and “PAVMZ,” respectively. On

October 16, 2018, the last reported sale prices of our common stock and Series Z Warrants were $1.14 and $0.39,

respectively.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 (the “Registration Statement”) that we have filed with

the Securities and Exchange Commission (the “SEC”). It is important for you to read and consider all of the information

contained in or incorporated by reference into this prospectus and any applicable prospectus supplement before making any decision

whether to invest in our common stock. This prospectus incorporates by reference important business and financial information

about us that is not included in or delivered with this document, as described in “

Where You Can Find More Information

”

beginning on page 24 in this prospectus. You should also read and consider the additional information contained in the documents

that we have incorporated into this prospectus by reference.

You

should rely only on the information contained in or incorporated by reference into this prospectus or any applicable prospectus

supplement. We have not authorized anyone to give or provide any information different from the information that is contained

in or incorporated by reference into this prospectus or any accompanying prospectus supplement and, if given, such information

must not be relied upon as having been made or authorized by us. The information contained in this prospectus is accurate only

as of the date on the front of this prospectus and information appearing in any applicable prospectus supplement is accurate only

as of the date of the applicable prospectus supplement. Additionally, any information we have incorporated by reference in this

prospectus or any applicable prospectus supplement is accurate only as of the date of the document incorporated by reference,

regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any sale of our common stock. Our

business, financial condition, results of operations and prospects may have changed since that date.

This

prospectus or any accompanying prospectus supplement does not constitute an offer or solicitation by anyone in any state in which

such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so

or to anyone to whom it is unlawful to make such offer or solicitation.

Unless

otherwise indicated or unless the context otherwise requires, all references in this prospectus to the “

Company

”

and to “

we

,” “

us

,” and “

our

” mean PAVmed Inc. and its subsidiaries and

“

Lucid Diagnostics

” means Lucid Diagnostics Inc., a majority-owned subsidiary of ours.

TRADEMARKS

We

have proprietary rights to trademarks used in this prospectus, including PAVmed™, Lucid Diagnostics™, Caldus™,

CarpX™, DisappEAR™, EsoCheck™, NextCath™, NextFlo™, PortIO™ and “Innovating at the Speed

of Life”™. Solely for our convenience, trademarks and trade names referred to in this prospectus may appear without

the “®” or “™” symbols, but such references are not intended to indicate, in any way, that we

will not assert, to the fullest extent possible under applicable law, our rights or the rights to these trademarks and trade names.

We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship

with, or endorsement or sponsorship of us by, any other companies. Each trademark, trade name, or service mark of any other company

appearing in this prospectus is the property of its respective holder.

PROSPECTUS

SUMMARY

Company

Summary

We

are a highly-differentiated multi-product medical device company organized to advance a broad pipeline of innovative medical technologies

we believe address unmet clinical needs and possess attractive market opportunities to commercialization. Our goal is to enhance

and accelerate value creation by employing a business model focused on capital efficiency and speed to market. Since our inception

on June 26, 2014, our activities have focused on advancing the lead products in our pipeline towards regulatory approval and commercialization,

while protecting our intellectual property, and strengthening our corporate infrastructure and management team. As resources permit,

we will continue to explore internal and external innovations that fulfill our project selection criteria without limiting ourselves

to any target specialty or condition.

The

following is a brief overview of the products currently in our pipeline, including our lead products of CarpX™, PortIO™,

and DisappEAR™ together with our recent addition, EsoCheck™. These products are all in various phases of development

and have not yet received regulatory approval. Among other things:

|

●

|

We

have filed final nonprovisional patent applications for PortIO™ and CarpX™ and entered into a licensing agreement

with a group of academic centers securing the worldwide rights in perpetuity to a family of patents and patent applications

underlying our DisappEAR™ product.

|

|

|

|

|

●

|

On

May 12, 2018, Lucid Diagnostics, Inc., a majority-owned subsidiary of the Company, entered into a worldwide license agreement

with Case Western Reserve University for the intellectual property rights to the “EsoCheck™ Technology”,

for the detection of Barrett’s Esophagus, the primary precursor to esophageal cancer, as further discussed herein below.

|

|

|

|

|

●

|

We

have advanced, in partnership with our design and contract manufacturing partners, our CarpX™ product from concept to

working prototypes, completed successful benchtop and cadaver testing confirming the device consistently cuts the transverse

carpal ligament, as well as commercial design and development, and performed pre-submission verification and validation testing.

On November 27, 2017 we filed a 510(k) premarket notification submission with the Federal Food and Drug Administration (“

FDA

”)

for CarpX™ using a commercially available carpel tunnel release device as a predicate. On August 22, 2018, we were notified

by the lead FDA branch reviewing the submission that it had not reached a consensus with the consulting FDA branch within

the review period allotted under the FDA’s rules and regulations. Accordingly, the lead branch recommended to us that

we take the appropriate steps to extend the review process through a resubmission, which we subsequently completed. We have

engaged FDA counsel to assist with the resubmission process and any appeals. In addition, we are preparing to submit for CE

Mark clearance in Europe and have been approved for a first-in-man clinical series outside of the United States. We recently,

hired a Chief Commercial Officer to further develop and implement our commercialization strategy in the United States and

commercialization partnerships worldwide.

|

|

|

|

|

●

|

As

noted above, in May 2018, our majority-owned subsidiary, Lucid Diagnostics Inc. entered into a licensed agreement with Case

Western Reserve University (“

CWRU

”) for the worldwide rights to the EsoCheck™ technology (the “

EsoCheck™

License Agreement

”). The EsoCheck™ technology is comprised of a cell sample collection device (the “

EsoCheck™

Cell Sample Collection Device

”) and highly accurate proprietary DNA biomarkers (the “

EsoCheck™ DNA

Biomarkers

”) that are used to detect “Barrett’s Esophagus,” the primary precursor to esophageal

cancer. The incidence of esophageal adenocarcinoma (“

EAC

”), the most common cancer of the esophagus, the

pipe through which food passes to the stomach, has quadrupled over the past 30 years. Its prognosis, however, remains dismal,

with less than 20% of patients surviving five years.

|

|

|

In

a five-minute office-based test, the patient swallows the EsoCheck™ Cell Sample Collection Device, a vitamin-sized silicone-covered

capsule containing a small inflatable balloon attached to a thin catheter, which swabs the target area for cell collection

as the catheter is withdrawn. The collected cell sample is then tested against a panel of the proprietary EsoCheck™

DNA Biomarkers recently shown to be highly accurate in detecting Barrett’s Esophagus.

|

|

|

|

|

|

The

primary cause of EAC cancer is Gastroesophageal Reflux Disease (“

GERD

”), commonly known as chronic heartburn

or acid reflux. GERD, where stomach acid refluxes into the esophagus, affects 20-40% of Western adult populations, according

to published epidemiological data. The repeated exposure of the esophagus to acid can lead to pre-cancerous changes in its

lining, called Barrett’s Esophagus. Nearly all patients diagnosed with EAC cancer have evidence of previously undetected

Barrett’s Esophagus. If detected before EAC cancer develops, Barrett’s Esophagus can be successfully treated,

usually with non-surgical approaches. Heartburn symptoms, commonly seen in patients with acid reflux with or without Barrett’s,

can easily be treated by over-the counter medications, while endoscopy, the standard diagnostic test, is expensive, invasive

and requires sedation. As a result, wide screening for Barrett’s is not practical or cost-effective. We are pursuing

the development of the EsoCheck™ technology to provide the estimated 50 million at-risk patients a non-invasive, less

costly test to detect Barrett’s to treat it before it turns deadly.

|

|

|

|

|

|

The

proprietary EsoCheck™ DNA Biomarkers was developed by the laboratory of the EsoCheck™ technology co-inventor Sanford

D. Markowitz, MD, PhD, the Ingalls Professor of Cancer Genetics medical oncologist at University Hospitals Seidman Cancer

Center, NCI Outstanding Investigator Awardee, and head of the NIH-Case GI Cancers Program of Research Excellence and GI cancer

genetics program at the Case Comprehensive Cancer Center. In an article published in the periodical Science Translational

Medicine clinical data showed DNA methylation of the VIM and CCNA1 genes is diagnostic of Barrett’s Esophagus and the

EsoCheck™ technology, which combines the proprietary EsoCheck™ Cell Sample Collection Device with these biomarkers,

was over 90% accurate at identifying patients without Barrett’s Esophagus. Another of the EsoCheck™ technology’s

three physician co-inventors, Dr. Joseph E. Willis, MD, professor of pathology and pathology vice-chair for clinical affairs,

at University Hospitals Cleveland Medical Center, is leading an ongoing NIH-supported effort to create a CLIA-certified VIM/CCNA1

DNA methylation test suitable for commercialization.

|

|

|

|

|

|

Our

initial goal is a U.S. launch of the first commercial EsoCheck™ technology-based product early next year. We have begun

building EsoCheck™ Cell Sample Collection Devices for verification and validation testing with FDA 510(k) submission

targeted for the end of this year. We are also working closely with the reference laboratory performing the EsoCheck™

DNA Biomarker test to complete the CLIA certification and clinical validation testing steps required to achieve a designation

of the EsoCheck™ technology as a commercial Laboratory Developed Test, a process which is on target for early next year.

The ongoing multicenter National Institutes of Health-funded clinical study, which seeks to establish the definitive clinical

evidence for widespread EsoCheck™ technology screening of Barrett’s Esophagus, has expanded to eight enrolling

centers. Through our majority-owned subsidiary Lucid Diagnostics, we are working closely with the investigators to provide

all necessary support to accelerate enrollment and ensure the data is of the highest quality for future regulatory submission.

|

|

|

|

|

●

|

We

have advanced, in partnership with our design and contract manufacturing partners, our PortIO™ product from concept

to working prototypes, benchtop, animal, and cadaver testing, commercial design and development, verification and validation

testing, and an initial submission to the FDA for 510(k) market clearance for use in patients requiring 24-hour emergency

type vascular access. After further discussion with the FDA, we have decided to pursue a broader clearance for use in patients

with a need for vascular access up to seven days under section 513(f)2 of the Federal Food, Drug and Cosmetic Act, also referred

to as de novo classification. We have filed a de novo pre-submission package with the FDA, which was followed by an in-person

meeting on January 9, 2018 to discuss the risk assessment and proposed mitigation for the de novo application. Based on FDA

recommendations, we will initiate a seven-day animal study, having successfully completed a pilot animal study which showed

excellent function of the device over the seven-day implant period and on explant. In anticipation of having to follow-up

the animal study with a human clinical safety trial, we have accelerated our strategic partnership efforts to include the

pre-clearance phase.

|

|

●

|

We

have advanced, in partnership with our design and contract manufacturing partners and our academic partners at Tufts University

and Harvard Medical School, our DisappEAR™ product. Our efforts have focused on sourcing commercially ready aqueous

silk and optimizing manufacturing processes consistent with the necessary cost of goods for the commercial product. Preparations

are underway to begin an animal study to assess resorption rates of DisappEAR™, our resorbable, antimicrobial pediatric

ear tube, which we are now able to machine from solid silk rods.

|

|

|

|

|

●

|

We

have advanced the design and development of the NextFlo™ device, including a redesign which dramatically simplifies

the product, lowers the projected cost of goods and expands its application to routine inpatient infusion sets. We have completed

benchtop testing of a working prototype demonstrating constant flows across the range of pressures encountered in clinical

situations. We have recently elevated NextFlo to lead product status having established proof of concept and we are proceeding

with design work to ensure a cost-effective device with the potential to drive down health care costs. We believe this technology

will permit hospitals to return to gravity-driven infusions and eliminate expensive and troublesome electronic pumps for most

of the over 1 million hospital infusions performed in the U.S. each day.

|

|

|

|

|

●

|

Although

we have focused the majority of our resources on our lead products, we have additional products in our pipeline which are

currently in different stages of development. We have completed initial design work on the first product in the NextCath™

product line, completed head-to-head testing of retention forces, comparing our working prototype to several competing products,

which has validated our approach and advanced the commercial design and development process focusing on optimizing the self-anchoring

helical portion as well as cost of materials and manufacturing processes.

|

|

|

|

|

●

|

We

are evaluating which initial applications for our Caldus™ disposable tissue ablation technology to pursue from a clinical

and commercial point-of-view and will reinitiate development activity on this product once resources are available.

|

|

|

|

|

●

|

We

remain actively engaged with our full-service regulatory consulting partner who is working closely with our contract design,

engineering and manufacturing partners as our products advance towards regulatory submission, clearance, and commercialization.

|

|

|

|

|

●

|

We

are evaluating a number of product opportunities and intellectual property covering a spectrum of clinical conditions, which

have been presented to us by clinician innovators and academic medical centers, for consideration of a partnership to develop

and commercialize these products; we are also exploring opportunities to partner with larger medical device companies to commercialize

our lead products as they move towards regulatory clearance and commercialization.

|

|

|

|

|

●

|

We

are exploring other opportunities to grow our business and enhance shareholder value through the acquisition of pre-commercial

or commercial stage products and /or companies with potential strategic corporate and commercial synergies consistent with

our growth strategy.

|

We

were incorporated on June 26, 2014 in the State of Delaware under the name PAXmed Inc. In April 2015, we changed our name to PAVmed

Inc. Our business address is One Grand Central Place, Suite 4600, New York, New York 10165, and our telephone number is (212)

949-4319. Our corporate website is www.pavmed.com. The information contained on, or that can be assessed through, our website

is not incorporated by reference into this prospectus and you should not consider information on our website to be part of this

prospectus or in deciding whether to purchase our securities.

Background

of the Offering

Pre-IPO

and IPO Transactions

Immediately

prior to our initial public offering (“

IPO

”), we had 12,250,000 shares of our common stock and 9,560,296 warrants

to purchase shares of our common stock outstanding, all of which had been issued in private placements. On April 28, 2016, we

consummated our initial public offering of 1,060,000 units, each unit consisting of one share of common stock and one warrant.

The units were sold at an offering price of $5.00 per unit, generating gross proceeds of $5.3 million, and net cash proceeds of

$4.2 million, after deducting cash selling agent discounts and commissions and offering expenses. Upon consummation of our IPO,

the warrants outstanding immediately prior to the IPO automatically converted into warrants identical to those issued in our IPO.

In this prospectus, we refer to the warrants issued in private placements prior to our IPO and to those issued in our IPO as the

“

IPO Series W Warrants

” and the “

Pre-IPO Series W Warrants

,” respectively, and together

as the “

Series W Warrants

.” The Series W Warrants have an exercise price of $5.00 per share (subject to adjustment

for stock splits, stock dividends and similar events), are currently exercisable and expire on January 29, 2022.

On

April 5, 2018, we completed an exchange offer, pursuant to which we offered to all holders of the Series W Warrants the opportunity

to exchange each Series W Warrant they held for 0.5 Series Z warrants to purchase common stock (the “

Series Z Warrants

”).

Pursuant to the exchange offer, 10,151,682 Series W Warrants, including 849,163 IPO Series W Warrants and 9,302,519 Pre-IPO Series

W Warrants, were validly tendered and not withdrawn. We accepted for exchange all the securities so tendered and issued approximately

5,075,849 Series Z Warrants in exchange for such Series W Warrants, including 424,581 Series Z Warrants (the “

IPO Series

Z Warrants

”) in exchange for the IPO Series W Warrants and 4,651,268 Series Z Warrants (the “

Pre-IPO Series

Z Warrants

”) in exchange for Pre-IPO Series W Warrants. The Series Z Warrants have an exercise price of $1.60 per share

(subject to adjustment for stock splits, stock dividends and similar events), are currently exercisable and expire on April 30,

2024. After the exchange, 124,042 IPO Series W Warrants and 257,776 Pre-IPO Series W Warrants remained outstanding.

In

addition, as of the date of this prospectus, 86,795 IPO Series W Warrants had been exercised and 12,450 Pre-IPO Series Z Warrants

had been publicly transferred in accordance with the exemption from registration provided by Section 4(a)(1) of the Securities

Act of 1933, as amended (the “

Securities Act

”), and Rule 144 thereunder.

As

a result, this prospectus covers the resale of 257,776 shares of common stock underlying Pre-IPO Series W Warrants and 4,638,818

shares of common stock underlying Pre-IPO Series Z Warrants, as well as the initial issuance of such shares to the extent such

warrants are publicly transferred prior to their exercise. This prospectus also covers the initial issuance of 124,042 shares

of common stock underlying the IPO Series W Warrants, 424,581 shares of common stock underlying the IPO Series Z Warrants and

12,450 shares of common stock underlying the Pre-IPO Series Z Warrants that have been publicly transferred.

UPOs

On

April 28, 2016, in connection with the closing of our IPO, we issued 53,000 unit purchase options to the selling agents in our

IPO. The unit purchase options entitled the holders thereof to purchase 53,000 units, each unit consisting of one share of our

common stock and one Series W Warrant, for an exercise price of $5.50 per unit. On August 22, 2018, we entered into an exchange

agreement pursuant to which the outstanding unit purchase options were exchanged for a like number of new unit purchase options

(the “

UPOs

”). The new UPOs entitle the holders thereof to purchase 53,000 units, each unit consisting of one

share of our common stock and one Series Z Warrant (the “

UPO Series Z Warrants

”), for an exercise price of

$5.50 per unit. The UPOs also may be exercised, in whole or in part, on a cashless basis.

This

prospectus covers the resale of 53,000 shares of common stock issuable upon exercise of the UPOs, 53,000 UPO Series Z Warrants

and 53,000 shares of common stock underlying the UPO Series Z Warrants, as well as the initial issuance of the shares underlying

the UPO Series Z Warrants to the extent such warrants are publicly transferred prior to their exercise.

Preferred

Stock Financing

On

January 26, 2017, January 31, 2017 and March 8, 2017, we sold 422,838 shares of Series A Convertible Preferred Stock (the “

Series

A Preferred Stock

”) and 422,838 Series A warrants to purchase common stock (the “

Series A Warrants

”)

in a private placement. The Series A Preferred Stock and Series A Warrants were sold in units consisting of one share and one

warrant, at a purchase price of $6.00 per unit.

On

August 4, 2017, we sold 125,000 shares of Series A-1 Convertible Preferred Stock (the “

Series A-1 Preferred Stock

”)

and 125,000 Series A-1 warrants to purchase common stock (the “

Series A-1 Warrants

”) in a private placement.

The Series A-1 Preferred Stock and Series A-1 Warrants were sold in units consisting of one share and one warrant, at a purchase

price of $4.00 per unit.

On

November 17, 2017, we completed a private exchange offer, pursuant to which we offered to all the holders of our Series A Preferred

Stock and Series A Warrants the opportunity to exchange each share of Series A Preferred Stock for 1.5 shares of Series A-1 Preferred

Stock and each Series A Warrant for one Series A-1 Warrant. 154,837 shares of the Series A Preferred Stock and 154,837 Series

A Warrants were validly tendered and not withdrawn. We accepted for exchange all of the securities so tendered and issued an aggregate

of 232,259 shares of Series A-1 Preferred Stock and 154,837 Series A-1 Warrants. In addition, in November and December of 2017,

18,334 shares of Series A Preferred Stock were converted into 22,093 shares of our commons stock in accordance with their terms.

On

March 15, 2018, we completed another private exchange offer, pursuant to which we offered (i) to all holders of our Series A Preferred

Stock and Series A Warrants, the opportunity to exchange each share of Series A Preferred Stock for two shares of Series B Convertible

Preferred Stock (the “

Series B Preferred Stock

”) and each Series A Warrant for five Series Z Warrants; and

(ii) to all holders of our Series A-1 Preferred Stock and Series A-1 Warrants, the opportunity to exchange each share of Series

A-1 Preferred Stock exchanged for 1.33 shares of Series B Preferred Stock and each Series A-1 Warrant for five Series Z Warrants.

All of the Series A Preferred Stock and Series A Warrants and all of the Series A-1 Preferred Stock and Series A-1 Warrants were

validly tendered and not withdrawn. We accepted for exchange all of the securities so tendered and issued an aggregate of 975,568

shares of Series B Preferred Stock and an aggregate of 2,739,190 Series Z Warrants (the “

Preferred Stock Financing Series

Z Warrants

”). The Series B Preferred Stock has a stated value of $3.00 per share, has a conversion price of $3.00

per share (subject to adjustment for stock splits, stock dividends and similar events) and is currently convertible at the holder’s

election.

As

of the date of this prospectus, 33,325 of shares of Series B Preferred Stock have been converted into 33,325 shares of our common

stock. In addition, 106,045 shares of Series B Preferred Stock have been issued as payment-in-kind dividends. All of the shares

of common stock issued or issuable upon conversion of the outstanding Series B Preferred Stock (including all payment-in-kind

dividends) may be resold without volume or manner of sale restrictions in accordance with the exemption from registration provided

by Section 4(a)(1) of the Securities Act and Rule 144 thereunder.

As

a result, this prospectus covers the resale of 2,739,190 shares underlying Preferred Stock Financing Series Z Warrants, as well

as the initial issuance of such shares to the extent such warrants are publicly transferred prior to their exercise.

Scopia

Debt Financing

On

June 30, 2017, we entered into a Note and Securities Purchase Agreement (the “

NSPA

”) with Scopia Holdings,

LLC (“

Scopia

”). Effective July 3, 2017, we consummated the sale of securities pursuant to the NSPA, upon (i)

the issuance by us of a 15.0% senior secured promissory note with a principal amount of $5,000,000 (the “

Promissory Note

”)

to Scopia; (ii) the issuance by us of Series S warrants to purchase 2,660,000 shares of our common stock (the

“

Series S Warrants

”) to Scopia and its designees; and (iii) the delivery by Scopia to us of $4.8 million in

cash, representing the principal amount of the Promissory Note net of Scopia’s costs.

The

Series S Warrants have an exercise price of $0.01 per share (subject to adjustment for stock splits, stock dividends and similar

events), are currently exercisable and expire on June 30, 2032. The Series S Warrants may also be exercised, in whole or in part,

on a cashless basis. Any outstanding Series S Warrants on the expiration date shall be automatically exercised via cashless exercise.

As

of the date of this prospectus, the Series S Warrants have been exercised for cash as to 1,338,257 shares and on a cashless basis

as to 122,360 shares, resulting in the issuance of 1,460,337 shares of our common stock. Series S Warrants to purchase 1,199,383

shares of our common stock remain outstanding.

As

a result, this prospectus covers the resale of the 1,460,337 shares of common stock issued upon exercise of the Series S Warrants

and 1,199,383 shares underlying the remaining unexercised Series S Warrants.

The

Offering

|

Common

stock to be offered by the selling securityholders

|

10,401,504

shares of common stock

|

|

|

|

|

Series

Z Warrants to be offered by the selling securityholders

|

53,000

Series Z Warrants

|

|

|

|

|

Common

stock to be offered by us

|

8,249,857

shares of common stock

|

|

|

|

|

Common

stock outstanding after the offering

|

36,045,219

shares of common stock(1)

|

|

|

|

|

Series

Z Warrants outstanding after the offering

|

16,868,039

Series Z Warrants(2)

|

|

|

|

|

Use

of proceeds

|

We

will not receive any of the proceeds from the sale or other disposition of the securities by the selling securityholders.

However, we will receive up to approximately $13,481,987 in gross proceeds upon the cash exercise of the UPOs, Series S Warrants,

Series W Warrants and Series Z Warrants covering certain of the securities offered for resale, and we will receive up to approximately

$1,319,460 in gross proceeds upon the cash exercise of the publicly held Series W Warrants and Series Z Warrants. We will

use any such proceeds for working capital. See “

Use of Proceeds

” beginning on page 11 of this prospectus.

|

|

|

|

|

Nasdaq

Capital Market symbols

|

PAVM

(common stock)

PAVMZ (Series Z Warrants)

|

|

|

|

|

Risk

Factors

|

See

“

Risk Factors

” beginning on page 9 of this prospectus and the other information included in or incorporated

by reference into this prospectus for a discussion of the factors you should consider before making an investment decision.

|

|

(1)

|

Based

on 26,542,979 shares of common stock outstanding as of October 16, 2018. Assumes the exercise for cash of all the options

and warrants covering the shares offered for resale or initial issuance hereby. Excludes the following: (1) 1,048,288 shares

of common stock underlying our Series B Convertible Preferred Stock, (2) 9,000,000 shares of common stock underlying our Series

Z Warrants that are not covered by this registration statement, and (3) 3,277,140 shares of common stock underlying our outstanding

stock options.

|

|

(2)

|

Based

on 16,815,039 Series Z Warrants outstanding as of October 16, 2018. Assumes the exercise for cash of all the UPOs,

but no exercise of the Series Z Warrants.

|

NOTE

ON FORWARD-LOOKING STATEMENTS

The

statements contained in this prospectus and in the documents incorporated by reference in this prospectus that are not purely

historical are forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding expectations,

hopes, beliefs, intentions or strategies regarding the future, such as:

|

●

|

our

expectations regarding our existing capital resources will be sufficient to enable us to successfully meet the capital requirements

for all of our current and future products;

|

|

|

|

|

●

|

our

estimates regarding expenses, future revenue, capital requirements and needs for additional financing; and

|

|

|

|

|

●

|

expectations

regarding the time during which we will be an Emerging Growth Company under the JOBS Act.

|

In

addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including

any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continues,”

“could,” “estimates,” “expects,” “intends,” “may,” “might,”

“plans,” “possible,” “potential,” “predicts,” “projects,” “should,”

“would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean

that a statement is not forward-looking.

The

forward-looking statements contained in this prospectus and in the documents incorporated by reference in this prospectus are

based on current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance

that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks,

uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially

different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are

not limited to, those factors incorporated by reference or described in “

Risk Factors

,” as well as the following:

|

●

|

our

limited operating history;

|

|

|

|

|

●

|

our

ability to generate revenue;

|

|

|

|

|

●

|

the

ability of our products to achieve regulatory approval and market acceptance;

|

|

|

|

|

●

|

our

success in retaining or recruiting, or changes required in, our officers, key employees or directors;

|

|

|

|

|

●

|

our

ability to obtain additional financing when and if needed;

|

|

|

|

|

●

|

our

ability to protect our intellectual property rights;

|

|

|

|

|

●

|

our

ability to complete strategic acquisitions;

|

|

|

|

|

●

|

our

ability to manage growth and integrate acquired operations;

|

|

|

|

|

●

|

the

liquidity and trading of our securities; and

|

|

|

|

|

●

|

regulatory

or operational risks.

|

Should

one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may

vary in material respects from those projected in these forward-looking statements. We do not undertake any obligation to update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be

required under applicable securities laws.

RISK

FACTORS

Any

investment in our securities involves a high degree of risk. Potential investors are urged to read and consider the risks and

uncertainties relating to an investment in our company set forth below and those set forth in or incorporated by reference into

this prospectus, including those set forth in our most recent annual report on Form 10-K and those set forth in our quarterly

reports on Form 10-Q for the fiscal quarters commencing after the end of the fiscal year covered by such annual report. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business and results

of operations. If any of these risks actually occur, our business, financial condition or results of operations could be seriously

harmed. In that event, the market price for our common stock could decline and you may lose all or part of your investment.

We

have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

We

will have broad discretion in the application of the balance of the proceeds from this offering and could spend the proceeds in

ways that do not improve our results of operations or enhance the value of our common stock. If we fail to apply these funds effectively

it could result in financial losses that could have a material adverse effect on our business, cause the price of our common stock

to decline and delay the commercialization of any products we may develop. Pending their use, we may invest the net proceeds from

this offering in a manner that does not produce income or that loses value.

Only

a limited market exists for our common stock and Series Z Warrants, which could lead to price volatility.

Our

common stock and Series Z Warrants trade on the Nasdaq Capital Market. However, trading volumes for our common stock and

Series Z Warrants have been low from time to time. The limited trading market for our common stock and Series Z Warrants

may cause fluctuations in the market value of our common stock and Series Z Warrants to be exaggerated, leading to

price volatility in excess of that which would occur in a more active trading market for our common stock and Series Z Warrants.

Sales

of substantial amounts of our common stock by the selling securityholders, or the perception that these sales could occur, could

adversely affect the price of our common stock.

The

sale by the selling securityholders of a significant number of shares of common stock could have a material adverse effect on

the market price of our common stock. In addition, the perception in the public markets that the selling securityholders may sell

all or a portion of their shares as a result of the registration of such shares pursuant to the Registration Statement could also

in and of itself have a material adverse effect on the market price of our common stock.

The

exercise of the UPOs, Series S Warrants, Series W Warrants and Series Z Warrants described herein will dilute our equity, and

there may be future sales or other dilution of our equity, which may adversely affect the market price of our common stock.

The

exercise prices of the UPOs, Series S Warrants, Series W Warrants and Series Z Warrants are $5.50 per unit, $0.01 per share,

$5.00 per share and $1.60 per share, respectively. Such warrants likely will be exercised only at a time when it is economically

beneficially for the holder to do so. Accordingly, the exercise of these options and warrants by the selling securityholders likely

will dilute our other equity holders. In addition, we may issue additional shares of common stock and/or other securities that

are convertible into or exchangeable for, or that represent the right to receive, shares of common stock. The market price of

our shares could decline as a result of sales of our common stock or such other securities, or the perception that such sales

could occur.

Holders

of our Series Z Warrants will have no rights as a common stockholder until such holders exercise their Series Z Warrants and acquire

our common stock.

Until

holders of Series Z Warrants acquire shares of our common stock upon exercise of the Series Z Warrants, holders of Series Z Warrants

will have no rights with respect to the shares of our common stock underlying such Series Z Warrants. Upon exercise of the Series

Z Warrants, the holders thereof will be entitled to exercise the rights of a common stockholder only as to matters for which the

record date occurs after the exercise date.

The

market price of our common stock may never exceed the exercise price of the Series Z Warrants offered hereby.

The

Series Z Warrants offered hereby are currently exercisable and will expire on April 30, 2024, or earlier upon

certain redemption provisions. The market price of our common stock may never exceed the exercise price of the Series Z Warrants

prior to their date of expiration. Any Series Z Warrants not exercised by their date of expiration will expire worthless and we

will be under no further obligation to the warrant holder.

An

investor will only be able to exercise a Series Z Warrant if the issuance of shares of common stock upon such exercise has been

registered or qualified or is deemed exempt under the securities laws of the state of residence of the holder of the warrants.

No

Series Z Warrants will be exercisable for cash and we will not be obligated to issue shares of common stock unless the shares

of common stock issuable upon such exercise has been registered or qualified or deemed to be exempt under the securities laws

of the state of residence of the holder of the warrants. Our common stock is currently listed on Nasdaq, which provides an exemption

from registration in every state. However, we cannot assure you that our common stock will remain so listed. If the shares of

common stock issuable upon exercise of the Series Z Warrants are not qualified or exempt from qualification in the jurisdictions

in which the holders of the warrants reside, the Series Z Warrans may be deprived of any value, the market for the warrants may

be limited and they may expire worthless if they cannot be sold.

We

may amend the terms of the Series Z Warrants in a way that may be adverse to holders with the approval by the holders of a majority

of the then outstanding Series Z Warrants.

Our

Series Z Warrants are issued in registered form under a warrant agreement between Continental Stock Transfer & Trust Company,

as warrant agent, and us. The warrant agreement provides that the terms of the Series Z Warrants may be amended without the consent

of any holder to cure any ambiguity or correct any defective provision. The warrant agreement requires the approval by the holders

of a majority of the then outstanding Series Z Warrants (including those held by our affiliates, which presently account for 18%

of the outstanding Series Z Warrants) in order to make any change that adversely affects the interests of the registered holders.

We

may redeem the Series Z Warrants at a time that is not beneficial to investors.

We

may call our Series Z Warrants, other than those held by our founders, certain members of management and their respective affiliates,

for redemption at any time after the redemption criteria described elsewhere in this prospectus have been satisfied. If we call

such warrants for redemption, holders may be forced to accept a nominal redemption price or sell or exercise the Series Z Warrants

when they may not wish to do so.

Our

ability to require holders of our Series Z Warrants to exercise such warrants on a cashless basis will cause holders to receive

fewer shares of common stock upon their exercise of the Series Z Warrants than they would have received had they been able to

exercise their warrants for cash.

If

we call our Series Z Warrants for redemption after the redemption criteria described elsewhere in this prospectus have been satisfied,

we will have the option to require any holder that wishes to exercise its warrant (including any warrants held by our initial

stockholders or their permitted transferees) to do so on a “cashless basis.” If we choose to require holders to exercise

their Series Z Warrants on a cashless basis, the number of shares of common stock received by a holder upon exercise will be fewer

than it would have been had such holder exercised his warrant for cash. This will have the effect of reducing the potential “upside”

of the holder’s investment in our company.

Since

the Series Z Warrants are executory contracts, they may have no value in a bankruptcy or reorganization proceeding.

In

the event a bankruptcy or reorganization proceeding is commenced by or against us, a bankruptcy court may hold that any unexercised

Series Z Warrants are executory contracts that are subject to rejection by us with the approval of the bankruptcy court. As a

result, holders of the Series Z Warrants may, even if we have sufficient funds, not be entitled to receive any consideration for

their Series Z Warrants or may receive an amount less than they would be entitled to if they had exercised their Series Z Warrants

prior to the commencement of any such bankruptcy or reorganization proceeding.

USE

OF PROCEEDS

Certain

of the shares sold under this prospectus will be sold or otherwise disposed of for the account of the selling securityholders,

or their pledgees, assignees or successors-in-interest. We will not receive any of the proceeds from the sale or other disposition

of the shares by the selling securityholders. However, we will receive up to approximately $13,481,987 in gross proceeds upon

the cash exercise of the UPOs, Series S Warrants, Series W Warrants and Series Z Warrants covering certain of the shares offered

for resale, and we will receive up to approximately $1,319,460 in gross proceeds upon the cash exercise of the publicly held Series

W Warrants and Series Z Warrants. We will use any such proceeds for working capital.

DESCRIPTION

OF SECURITIES

Capital

Stock

We

are authorized to issue 75,000,000 shares of common stock, par value $0.001, and 20,000,000 shares of preferred stock, par value

$0.001. As of October 16, 2018, we had outstanding:

|

●

|

26,542,979

shares of our common stock.

|

|

|

|

|

●

|

1,048,288

shares of Series B Convertible Preferred Stock, each with a stated value of $3.00 and convertible at the holder’s option

into shares of common stock at a price of $3.00 per share, subject to adjustment.

|

|

|

|

|

●

|

381,818

Series W Warrants, each entitling the holder to purchase one share of common stock at $5.00 per share, subject to adjustment,

and expiring on January 29, 2022.

|

|

|

|

|

●

|

16,815,039

Series Z Warrants, each entitling the holder to purchase one share of common stock at $1.60 per share, subject to adjustment,

and expiring on April 30, 2024.

|

|

|

|

|

●

|

1,199,383

Series S Warrants, each entitling the holder to purchase one share of common stock at an exercise price of $0.01 per share,

subject to adjustment, and expiring on June 30, 2032.

|

|

|

|

|

●

|

53,000

UPOs, each entitling the holder to purchase one unit, comprised of one share of common stock and one Series Z Warrant, at

an exercise price of $5.00 per unit, subject to adjustment, and expiring on January 29, 2021.

|

|

|

|

|

●

|

S

tock

options entitling the holders thereof to purchase 3,277,140 shares of common stock at a weighted average exercise price

of $3.72 per share.

|

Holders

of common stock are entitled to one vote per share on matters on which our stockholders vote. There are no cumulative voting rights.

Subject to any preferential dividend rights of any outstanding shares of preferred stock, holders of common stock are entitled

to receive dividends, if declared by our board of directors, out of funds that we may legally use to pay dividends. If we liquidate

or dissolve, holders of common stock are entitled to share ratably in our assets once our debts and any liquidation preference

owed to any then-outstanding preferred stockholders are paid. Our certificate of incorporation does not provide the common stock

with any redemption, conversion or preemptive rights. All shares of common stock that are outstanding as of the date of this Prospectus

will be fully-paid and non-assessable.

Our

certificate of incorporation authorizes the issuance of blank check preferred stock. Accordingly, our board of directors is empowered,

without stockholder approval, to issue shares of preferred stock with dividend, liquidation, redemption, voting or other rights

which could adversely affect the voting power or other rights of the holders of shares of our common stock. In addition, shares

of preferred stock could be utilized as a method of discouraging, delaying or preventing a change in control of us.

As

of the date of this prospectus, we have authorized one series of preferred stock, the Series B Convertible Preferred Stock. The

Series B Preferred Stock has no voting rights. It provides for dividends at a rate of 8% per annum on the stated value of the

Series B Preferred Stock, with such dividends compounded quarterly, accumulate, and are payable in arrears upon being declared

by our Board of Directors. The Series B Preferred Stock dividends from April 1, 2018 through October 1, 2021 are payable-in-kind

in additional shares of Series B Preferred Stock. The dividends may be settled after October 1, 2021, at the option of the Company,

through any combination of the issuance of additional Series B Preferred Stock, shares of common stock, and /or cash payment.

Series

Z Warrants

We

have 16,815,039 Series Z Warrants outstanding. A Series Z Warrant may be exercised for one share of common stock at an exercise

price of $1.60 per share, with such exercise price not subject to further adjustment, except for the effect of stock dividends,

stock splits or similar events affecting the common stock, and will expire after the close of business on April 30, 2024. The

Series Z Warrants are immediately exercisable.

Commencing

on May 1, 2019, we may redeem the outstanding Series Z Warrants, at our option, in whole or in part, at a price of $0.01 per Series

Z Warrant at any time while the Series Z Warrants are exercisable, upon a minimum of 30 days’ prior written notice of redemption,

if, and only if, the volume weighted average closing price of the common stock equals or exceeds $9.00 (subject to adjustment)

for any 20 out of 30 consecutive trading days ending three business days before we issue our notice of redemption, and provided

the average daily trading volume in the common stock during such 30-day period is at least 20,000 shares per day; and if, and

only if, there is a current registration statement in effect with respect to the shares of common stock underlying such Series

Z Warrants. Under the terms of the warrant agreement governing the Series Z Warrants, all modifications or amendments to the Series

Z Warrants (other than amendments for the purpose of curing or correcting ambiguities and/or defective provisions), including

any amendment to increase the warrant price or shorten the exercise period of the Series Z Warrants, shall require the written

consent or vote of the registered holders of at least two-thirds of the then outstanding Series Z Warrants (including any Series

Z Warrants held by our officers and directors or their respective affiliates). Notwithstanding the foregoing, pursuant to the

terms of the warrant agreement governing the Series Z Warrants, we may lower the warrant price or extend the duration of the exercise

period without the consent of the registered holders.

Under

the terms of the warrant agreement governing the Series Z Warrants, we have agreed to use our best efforts to cause a registration

statement covering the shares of common stock underlying the Series Z Warrants to continue to be effective until the expiration

of the Series Z Warrants in accordance with the terms of the warrant agreement.

Anti-Takeover

Provisions

Provisions

of the Delaware General Corporation Law (the “

DGCL

”) and our certificate of incorporation and bylaws could

make it more difficult to acquire us by means of a tender offer, a proxy contest or otherwise, or to remove incumbent officers

and directors. These provisions, summarized below, are expected to discourage certain types of coercive takeover practices and

takeover bids that our board of directors may consider inadequate and to encourage persons seeking to acquire control of us to

first negotiate with our board of directors. We believe that the benefits of increased protection of our ability to negotiate

with the proponent of an unfriendly or unsolicited proposal to acquire or restructure us outweigh the disadvantages of discouraging

takeover or acquisition proposals because, among other things, negotiation of these proposals could result in improved terms for

our stockholders.

Delaware

Anti-Takeover Statute

. We are subject to Section 203 of the DGCL, an anti-takeover statute. In general, Section 203 of the

DGCL prohibits a publicly-held Delaware corporation from engaging in a “business combination” with an “interested

stockholder” for a period of three years following the time the person became an interested stockholder, unless the business

combination or the acquisition of shares that resulted in a stockholder becoming an interested stockholder is approved in a prescribed

manner. Generally, a “business combination” includes a merger, asset or stock sale, or other transaction resulting

in a financial benefit to the interested stockholder. Generally, an “interested stockholder” is a person who, together

with affiliates and associates, owns (or within three years prior to the determination of interested stockholder status did own)

15% or more of a corporation’s voting stock. The existence of this provision would be expected to have an anti-takeover

effect with respect to transactions not approved in advance by the board of directors, including discouraging attempts that might

result in a premium over the market price for the shares of common stock held by stockholders.

Amendments

to Our Certificate of Incorporation

. Under the DGCL, the affirmative vote of a majority of the outstanding shares entitled

to vote thereon and a majority of the outstanding stock of each class entitled to vote thereon is required to amend a corporation’s

certificate of incorporation. Under the DGCL, the holders of the outstanding shares of a class of our capital stock shall be entitled

to vote as a class upon a proposed amendment, whether or not entitled to vote thereon by the certificate of incorporation, if

the amendment would:

|

|

●

|

increase

or decrease the aggregate number of authorized shares of such class;

|

|

|

|

|

|

|

●

|

increase

or decrease the par value of the shares of such class; or

|

|

|

|

|

|

|

●

|

alter

or change the powers, preferences or special rights of the shares of such class so as to affect them adversely.

|

If

any proposed amendment would alter or change the powers, preferences or special rights of one or more series of any class of our

capital stock so as to affect them adversely, but shall not so affect the entire class, then only the shares of the series so

affected by the amendment shall be considered a separate class for the purposes of this provision.

Classified

Board

. Our board of directors is divided into three classes. The number of directors in each class is as nearly equal as possible.

Directors elected to succeed those directors whose terms expire shall be elected for a term of office to expire at the third succeeding

annual meeting of stockholders after their election. The existence of a classified board may extend the time required to make

any change in control of the board when compared to a corporation with an unclassified board. It may take two annual meetings

for our stockholders to effect a change in control of the board, because in general less than a majority of the members of the

board will be elected at a given annual meeting. Because our board is classified and our certificate of incorporation does not

otherwise provide, under Delaware law, our directors may only be removed for cause.

Vacancies

in the Board of Directors

. Our certificate of incorporation and bylaws provide that, subject to limitations, any vacancy occurring

in our board of directors for any reason may be filled by a majority of the remaining members of our board of directors then in

office, even if such majority is less than a quorum. Each director elected to fill a vacancy resulting from the death, resignation

or removal of a director shall hold office until the expiration of the term of the director whose death, resignation or removal

created the vacancy.

Special

Meetings of Stockholders

. Under our bylaws, special meetings of stockholders may be called by the directors, or the president

or the chairman, and shall be called by the secretary at the request in writing of stockholders owning a majority in amount of

the entire capital stock of the corporation issued and outstanding and entitled to vote.

No

Cumulative Voting

. The DGCL provides that stockholders are denied the right to cumulate votes in the election of directors

unless our certificate of incorporation provides otherwise. Our certificate of incorporation does not provide for cumulative voting.

Dividends

We

have not paid any cash dividends on our shares of common stock to date. The payment of cash dividends in the future will be dependent

upon our revenues and earnings, if any, capital requirements and general financial condition and will be within the discretion

of our board of directors. It is the present intention of our board of directors to retain all earnings, if any, for use in our

business operations and, accordingly, our board of directors does not anticipate declaring any dividends in the foreseeable future.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock and Series Z Warrants is Continental Stock Transfer & Trust Company.

Listing

of our Securities

Our

common stock, Series W Warrants, and Series Z Warrants are traded on the Nasdaq Capital Market under the symbols “PAVM”,

“PAVMW” and “PAVMZ,” respectively.

SELLING

SECURITYHOLDERS

The

selling securityholders, or their pledgees, assignees or successors-in-interest, are offering for resale, from time to time, up

to an aggregate of 10,401,504 shares of our common stock and 53,000 Series Z Warrants. As more fully described in “

Prospectus

Summary – Background of the Offering

,” such shares consist of:

|

|

●

|

257,776

shares of common stock underlying Pre-IPO Series W Warrants and 4,638,818 shares of common stock underlying the Pre-IPO Series

Z Warrants.

|

|

|

|

|

|

|

●

|

53,000

shares of common stock and 53,000 UPO Series Z Warrants issuable upon exercise of the UPOs and 53,000 shares of common stock

underlying the UPO Series Z Warrants;

|

|

|

|

|

|

|

●

|

2,739,190

shares of common stock underlying the Preferred Stock Financing Series Z Warrants; and

|

|

|

|

|

|

|

●

|

1,460,337

shares of common stock issued and 1,199,383 shares of common stock issuable upon exercise of the Series S Warrants.

|

Because

the Series S Warrants, the UPOs and, in certain circumstances, the Series W Warrants and Series Z Warrants permit cashless

exercise, the number of shares that ultimately will be issuable upon any exercise thereof (and, in the case of the UPO, of the

underlying UPO Series Z Warrants) may be less than the number of shares being offered by this prospectus. The selling securityholders

may sell all, some or none of their shares in this offering. The selling securityholders also may sell, transfer or otherwise

dispose of some or all their shares in transactions exempt from, or not subject to the registration requirements of, the Securities

Act. See “

Plan of Distribution

.”

The

tables below have been prepared based solely on information supplied to us by the selling securityholders, or included in statements

on Schedule 13D or 13G or other public documents filed by the selling securityholders with the SEC, and assumes the sale of all

the shares offered hereby. Other than as described in the footnotes below, none of the selling securityholders have, within the

past three years, had any position, office or other material relationship with us or any of our predecessors or affiliates other

than as a holder of our securities, or are broker-dealers or affiliates of a broker-dealer. Information concerning the selling

securityholders may change from time to time and, if necessary and required, we will amend or supplement this prospectus accordingly.

Beneficial

ownership is determined in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended, or the “Exchange

Act,” and generally includes shares over which the selling securityholder has voting or dispositive power, including any

shares that the selling securityholder has the right to acquire within 60 days of October 16, 2018. The percentages of

ownership before the offering are calculated based on 26,542,979 shares outstanding as of October 16, 2018. The percentages

of ownership after the offering assume the exercise of all the UPOs, Series S Warrants, Series W Warrants and Series Z Warrants

the underlying shares of which are offered for resale hereby, and the sale by each selling securityholder of all of the shares

offered for resale hereby.

Pre-IPO

Selling Securityholders

|

|

|

Beneficial

Ownership

Before

|

|

|

Shares

|

|

|

Beneficial

Ownership

|

|

|

|

|

Offering

|

|

|

Offered

|

|

|

After

Offering

|

|

|

Selling

Securityholder

|

|

Shares

|

|

|

Hereby

|

|

|

Shares

|

|

|

Percent

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lishan Aklog, M.D.(1)

|

|

|

1,307,098

|

|

|

|

350,588

|

|

|

|

956,510

|

|

|

|

2.7

|

%

|

|

Jeffrey P. Bergholtz(2)

|

|

|

418,089

|

|

|

|

139,363

|

|

|

|

278,726

|

|

|

|

*

|

|

|

Paul Christie IRA(3)

|

|

|

175,597

|

|

|

|

41,809

|

|

|

|

133,788

|

|

|

|

*

|

|

|

Graubard Miller(4)

|

|

|

48,777

|

|

|

|

48,777

|

|

|

|

0

|

|

|

|

*

|

|

|

Matthew J. Glennon(5)

|

|

|

209,045

|

|

|

|

69,682

|

|

|

|

139,363

|

|

|

|

*

|

|

|

Ira S. Greenspan(6)

|

|

|

1,227,729

|

|

|

|

775,828

|

|

|

|

451,901

|

|

|

|

1.3

|

%

|

|

Robert M. Greenspan(7)

|

|

|

24,388

|

|

|

|

3,484

|

|

|

|

20,904

|

|

|

|

*

|

|

|

HCFP Inc.(8)

|

|

|

508,492

|

|

|

|

448,492

|

|

|

|

60,000

|

|

|

|

*

|

|

|

HCFP LLC(9)

|

|

|

250,000

|

|

|

|

250,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Neil Kaufman(10)

|

|

|

22,872

|

|

|

|

6,968

|

|

|

|

15,904

|

|

|

|

*

|

|

|

Peter M. Kendall(11)

|

|

|

196,545

|

|

|

|

57,182

|

|

|

|

139,363

|

|

|

|

*

|

|

|

Josh Lamstein(12)

|

|

|

131,589

|

|

|

|

81,589

|

|

|

|

50,000

|

|

|

|

*

|

|

|

Lawrence M. Levinson(13)

|

|

|

290,760

|

|

|

|

87,629

|

|

|

|

203,131

|

|

|

|

*

|

|

|

Pavilion Venture Partners, LLC(1)

|

|

|

6,528,855

|

|

|

|

2,072,285

|

|

|

|

4,456,570

|

|

|

|

12.6

|

%

|

|

Richard J. Salute(14)

|

|

|

680,318

|

|

|

|

226,773

|

|

|

|

453,545

|

|

|

|

1.3

|

%

|

|

Richard X. Seet(15)

|

|

|

83,618

|

|

|

|

27,873

|

|

|

|

55,745

|

|

|

|

*

|

|

|

Chris P. Vieira(16)

|

|

|

452,930

|

|

|

|

34,841

|

|

|

|

418,089

|

|

|

|

1.2

|

%

|

|

James P. Ward(17)

|

|

|

418,089

|

|

|

|

139,363

|

|

|

|

278,726

|

|

|

|

*

|

|

|

Ella Damiano(18)

|

|

|

19,902

|

|

|

|

3,501

|

|

|

|

16,401

|

|

|

|

*

|

|

|

Michael Damiano(18)

|

|

|

19,902

|

|

|

|

3,501

|

|

|

|

16,401

|

|

|

|

*

|

|

|

Lawrence Howard(19)

|

|

|

11,540

|

|

|

|

1,347

|

|

|

|

10,193

|

|

|

|

*

|

|

|

Londonderry Capital LLC(20)

|

|

|

13,847

|

|

|

|

1,616

|

|

|

|

12,231

|

|

|

|

*

|

|

|

Sheryl Masella(21)

|

|

|

4,616

|

|

|

|

808

|

|

|

|

3,808

|

|

|

|

*

|

|

|

Amy Newmark(18)

|

|

|

19,902

|

|

|

|

3,501

|

|

|

|

16,401

|

|

|

|

*

|

|

|

Rosemary Rouhana(18)

|

|

|

19,902

|

|

|

|

3,501

|

|

|

|

16,401

|

|

|

|

*

|

|

|

Timothy Rouhana(18)

|

|

|

19,902

|

|

|

|

3,501

|

|

|

|

16,401

|

|

|

|

*

|

|

|

William J. Rouhana, Jr. (18)

|

|

|

19,902

|

|

|

|

3,501

|

|

|

|

16,401

|

|

|

|

*

|

|

|

Alan Salzbank(22)

|

|

|

4,616

|

|

|

|

539

|

|

|

|

4,077

|

|

|

|

*

|

|

|

Lauren Smith(23)

|

|

|

47,410

|

|

|

|

22,154

|

|

|

|

25,256

|

|

|

|

*

|

|

|

Stewart and Sons LLC(24)

|

|

|

45,002

|

|

|

|

5,251

|

|

|

|

39,751

|

|

|

|

*

|

|

|

Mark J. Wishner(19)

|

|

|

11,540

|

|

|

|

1,347

|

|

|

|

10,193

|

|

|

|

*

|

|

|

*

|

Less

than 1%.

|

|

|

|

|

(1)

|

Dr.

Aklog is our Chairman of the Board and Chief Executive Officer. Dr. Aklog’s beneficial ownership includes (i) 618,413

shares held by Dr. Akog, 2,303 shares held by his daughter, 2,280 shares held by his son and 20,000 shares held by HCFP/AG

LLC, an entity co-controlled by Dr. Aklog, (ii) 363,313 shares underlying Series Z Warrants (including 350,888 offered hereby)

held by Dr. Aklog, 1,018 shares underlying Series Z Warrants held by his daughter, 980 shares underlying Series Z Warrants

held by his son, and 10,000 shares underlying Series Z Warrants held by HCFP/AG LLC, and (iii) 288,791 shares underlying employee

stock options held by Dr. Aklog, which excludes 185,043 shares underlying employee stock options that are not exercisable

and will not become exercisable within 60 days. Pavilion Venture Partners LLC is controlled by Lishan Aklog, M.D., our Chairman

of the Board and Chief Executive Officer, as manager. Accordingly, Dr. Aklog may be deemed to beneficially own the shares

of common stock and warrants held by such entity. Pavilion Venture Partners, LLC’s beneficial ownership includes 4,456,570

shares and 2,078,285 shares underlying Series Z Warrants held by it.

|

|

|

|

|

(2)

|

Mr.

Bergholtz’s beneficial ownership includes 278,726 shares and 139,363 shares underlying Series Z Warrants (all of which

are offered hereby).

|

|

|

|

|

(3)

|

Paul

Christie may be deemed to have beneficial ownership of the shares of common stock held by the Paul Christie IRA. The Paul

Christie IRA’s beneficial ownership includes 133,788 shares and 41,809 shares underlying Series Z Warrants (all of which

are offered hereby).

|

|

|

|

|

(4)

|

Graubard

Miller is our outside general counsel. David Alan Miller, Managing Partner of Graubard Miller, exercises voting and dispositive

power over securities held by such entity. Graubard Miller’s beneficial ownership includes 48,777 shares underlying

Series Z Warrants (all of which are offered hereby).

|

|

(5)

|

Mr.

Glennon’s beneficial ownership includes 139,363 shares and 69,682 shares underlying Series Z Warrants (all of which

are offered hereby).

|

|

|

|

|

(6)

|

Mr.

Ira Greenspan is a former member of our board of directors. Mr. Ira Greenspan’s beneficial ownership includes (i) 421,691

shares and 776,038 shares underlying Series Z Warrants (including 775,828 of which are offered hereby) held by Mr. Ira Greenspan

and (ii) 20,000 shares and 10,000 shares underlying Series Z Warrants held by HCFP/AG LLC, an entity co-controlled by Mr.

Ira Greenspan.

|

|

|

|

|

(7)

|

Mr.

Robert Greenspan is Mr. Ira Greenspan’s son. Mr. Robert Greenspan’s beneficial ownership includes 20,904 shares

and 3,484 shares underlying Series Z Warrants (all of which are offered hereby).

|

|

|

|

|

(8)

|

HCFP

Inc.’s beneficial ownership includes 60,000 shares and 448,492 shares underlying Series Z Warrants (all of which are

offered hereby).

|

|

|

|

|

(9)

|

HCFP

LLC’s beneficial ownership includes 250,000 shares underlying Series W Warrants (all of which are offered hereby).

|

|

|

|

|

(10)

|

Mr.

Kaufman’s beneficial ownership includes 15,904 shares and 6,968 shares underlying Series W Warrants (all of which are

offered hereby).

|

|

|

|

|

(11)

|

Mr.

Kendall is affiliated with MKM Partners, a broker-dealer. Mr. Kendall’s beneficial ownership includes 139,363 shares

and 57,182 shares underlying Series Z Warrants (all of which are offered hereby).

|

|

|

|

|

(12)

|

Mr.

Lamstein is a former member of our board of directors. Mr. Lamstein’s beneficial ownership includes 50,000 shares and

81,589 shares underlying Series Z Warrants (all of which are offered hereby).

|

|

|

|

|

(13)

|

Mr.

Levinson’s beneficial ownership includes 203,131 shares and 87,629 shares underlying Series Z Warrants (all of which

are offered hereby).

|

|

|

|

|

(14)

|

Mr.

Salute’s beneficial ownership includes 453,545 shares and 226,773 shares underlying Series Z Warrants (all of which

are offered hereby).

|

|

|

|

|

(15)

|

Mr.

Seet’s beneficial ownership includes 55,745 shares and 27,873 shares underlying Series Z Warrants (all of which are

offered hereby).

|

|

|

|

|

(16)

|

Mr.

Vieira’s beneficial ownership includes 418,089 shares and 34,841 shares underlying Series Z Warrants (all of which are

offered hereby).

|

|

|

|

|

(17)

|

Mr.

Ward’s beneficial ownership includes 278,726 shares and 139,363 shares underlying Series Z Warrants (all of which are

offered hereby).

|

|

|

|

|

(18)

|

Each

of Ms. Damino, Mr. Damiano, Ms. Newmark, Ms. Rouhana, Mr. Timothy Rouhana and Mr. William Rouhana’s beneficial ownership

includes 10,051 shares and 9,851 shares underlying Series Z Warrants (3,501 of which are offered hereby).

|

|

|

|

|

(19)

|

Mr.

Wishner is a partner of Greenberg Traurig LLP, counsel to the company. Each of Ms. Howard and Mr. Wishner’s beneficial

ownership includes 7,693 shares and 3,847 shares underlying Series Z Warrants (1,347 of which are offered hereby).

|

|

|

|

|

(20)

|

Londonderry

Capital LLC’s beneficial ownership includes 9,231 shares and 4,616 shares underlying Series Z Warrants (1,616 of which

are offered hereby).

|

|

|

|

|

(21)

|

Ms.

Masella’s beneficial ownership includes 2,308 shares and 2,308 shares underlying Series W Warrants (808 of which are

offered hereby).

|

|

|

|

|

(22)

|

Mr.

Salzbank’s beneficial ownership includes 3,077 shares and 1,539 shares underlying Series Z Warrants (539 of which are

offered hereby).

|

|

|

|

|

(23)

|

Ms.

Smith’s beneficial ownership includes 12,308 shares, 26,154 shares underlying Series Z Warrants (22,154 of which are

offered hereby) and 8,948 shares underlying Series B Preferred Stock.

|

|

|

|

|

(24)

|

Stewart