Strong growth in net profit

- Revenues: a further increase to €510

million (+4%)1

- EBITDA increased to €250 million

(+5%)

- Net profit up strongly to €39

million (+15%)

- Revenues increased to €450 million

(+4%)

- Increase in EBITDA of 4% to €247

million

- Revenues increased to €60 million

(+2%)

- Significant increase in EBITDA to €4

million

Regulatory News:

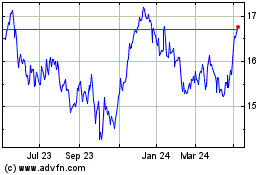

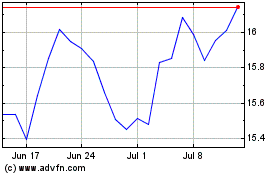

Jacques Gounon, Chairman and Chief Executive Officer of

Getlink (Paris:GET) stated: “For the first six months of 2018,

Getlink has published growth in its revenues and EBITDA for the 9th

consecutive first-half. We confirm our outlook for 2022 and our

shareholder remuneration policy."

Key events in the half

year

- Group

- The arrival of Atlantia as an investor

in the Group

- At its Investor Day on 19 June, the

Group confirmed its financial objectives and dividend policy

- Payment of €160 million in dividends

for the 2017 financial year

- Negative impact of the SNCF strikes on

EBITDA estimated at €4.5 million

- Eurotunnel

- Strength of Le Shuttle and Le Shuttle

Freight

- Opening of the Folkestone Flexiplus

lounge

- Increase in truck market share (+1.7

points) to 40.9% and relative stability in the car market at

57.6%

- Eurostar traffic growth up to 5.2

million passengers (+3%), aided by the opening of the

London-Amsterdam service on 4 April 2018 and a record month in June

with 1.016 million passengers (+6.6%), the second biggest month in

their history, despite the impact of strikes during the second

quarter

- Underlying growth of +20% for

cross-Channel rail freight trains, which were strongly affected by

the SNCF strikes

- Europorte

- Increase in revenues (+2%) due to

winning new contracts

- Negative impact of SNCF strikes on

Europorte EBITDA, estimated at €1.6 million

- Significant increase in EBITDA to €4

million, in line with the strategic plan

- ElecLink

- On-time and on-budget

- €355 million investment to date since

taking control in 2016

____________________

1 All comparisons with the income statement for the first half

of 2017 are made at the average exchange rate for the first half of

2018 of £1=€1.136.

Operating profit continues to

improve

The consolidated revenues for the Group in the first six months

of 2018 reached €510 million, an increase of €18 million, or +4%

compared to the first half of 2017.

The Group’s operating costs have increased by €7 million for the

six months. For the Fixed Link, charges increased by +4% to €203

million.

The consolidated figures for the first six months show an

increase of €11 million in EBITDA to €250 million.

For the Fixed Link, this is the 9th consecutive first-half of

the year when EBITDA has increased, +4% to €247 million.

We should remember that revenues and operating profit remain

characterised by the strong seasonality across the year and that

these first-half results cannot be extrapolated across the full

year.

Net finance costs increased slightly (+€3 million) in the first

six months of 2018, an increase due to the impact of the increase

in British and French inflation on the cost of the indexed tranches

of the debt.

In the first half of 2018, the Group’s net consolidated result

was a profit of €39 million, an increase of +15%.

The Free Cash Flow for the Group’s continuing activities has

increased by +€2 million to €108 million in the first six months of

2018, compared to €106 million in the first half of 2017.

OUTLOOK

Looking towards 2022, the Group remains confident in its

capacity to generate sustainable growth and continues to expect

growth in its EBITDA. The Group reconfirms its outlook for the

medium term:

2018 Objectives:

- EBITDA: €545 million at an exchange

rate of £1=€1.14

- Dividend 2018: €0.35 per share

Outlook for 2022:

- EBITDA: above €735 million (at least

+38%)

- Free Cash Flow: c.€400 million (approx.

+70%)

- Annual increase in dividend: +€0.05 per

share

GROUP REVENUES

First half (January to

June)

€ million 1st half2018*

1st half2017**

Change 1st half2017

Exchange rate €/£ 1.136 1.136

1.161 Shuttle Services 296 282 +5% 285

Railway Network 147 144 +2% 146 Other revenues 7 7

0% 7

Sub-total Fixed Link 450

433 +4% 438 Europorte

60 59 +2% 59

Revenues

510 492 +4% 497

* Average exchange rate for the first half of 2018: 1£ =

€1.136.

** Recalculated at the exchange average rate of the first half

of 2018.

Second quarter (April to

June)

€ million 2nd quarter2018

2nd quarter2017

Change 2nd quarter2017

Shuttle Services 157.5 152.6 +3% 153.9

Railway Network 77.5 76.3 +2% 77.0 Other revenues 3.9

4.1 -5% 4.0

Sub-total Fixed Link

238.9 233.0 +3%

234.9 Europorte 30.1 30.3 -1%

30.3

Revenues 269.0 263.3

+2% 265.2

First quarter (January to

March)

€ million 1st

quarter2018* 1st

quarter2017** Change

1st quarter2017 Exchange rate

€/£ 1.137 1.137

1.168 Shuttle Services 138.3 129.4 +7% 130.8 Railway

Network 70.1 68.1 +3% 68.9 Other revenues 3.3 3.1

+5% 3.2

Sub-total Fixed Link

211.7 200.6 +6%

202.9 Europorte 29.7

28.9

+3% 28.9

Revenues 241.4

229.5 +5% 231.8

* Average exchange rate for the first quarter 2018: 1£ =

€1.137.

** Recalculated at the exchange average rate of the first

quarter of 2018.

FIXED LINK TRAFFIC

First half (January to

June)

1st half-year2018

1st half-year2017 Change

Truck Shuttles 845,132 823,147 +3%

Passenger Shuttles Cars* 1,163,054

1,138,087 +2% Coaches 27,274 27,714

-2%

High-speed passenger

trains (Eurostar)**

Passengers 5,198,821 5,040,425 +3%

Rail Freight*** Tonnes 670,853 601,237

+12% Trains 1,060 1,043 +2%

Second quarter (April to

June)

2nd quarter2018

2nd quarter2017 Change

Truck Shuttles 421,281 413,291 +2%

Passenger Shuttles Cars* 675,851

671,525 +1% Coaches 16,462 16,548

-1%

High-speed passenger

trains (Eurostar)**

Passengers 2,819,078 2,769,754 +2%

Rail Freight*** Tonnes 298,692 292,512

+2% Trains 484 500 -3%

First quarter (January to

March)

1st quarter2018

1st quarter2017 Change

Truck Shuttles 423,851 409,856 +3%

Passenger Shuttles Cars* 487,203

466,562 +4% Coaches 10,812 11,166

-3%

High-speed passenger

trains (Eurostar)**

Passengers 2,379,743 2,270,671 +5%

Rail Freight*** Tonnes 372,161 308,725

+21% Trains 576 543 +6%

* Including motorcycles, vehicles with trailers, caravans and

motor homes.

** Only passengers using Eurostar to cross the Channel are

included in this table, thus excluding those who travel between

Continental stations (such as Brussels-Calais, Brussels-Lille,

Brussels-Amsterdam).

*** Rail freight services by train operators (DB Cargo on behalf

of BRB, SNCF and its subsidiaries, GB Railfreight, Rail Operations

Group, RailAdventure and Europorte) using the Tunnel.

www.getlinkgroup.com

GETLINK SE

HALF-YEAR FINANCIAL REPORT

FOR THE SIX MONTHS

TO 30 JUNE 2018*

CONTENTS

HALF-YEAR ACTIVITY REPORT AT 30 JUNE 2018 1

Analysis of consolidated income statement 1

Analysis of consolidated statement of financial position 6

Analysis of consolidated cash flows 7

Other financial indicators 8

Outlook 9

Risks 9

Related parties 9

SUMMARY HALF-YEAR CONSOLIDATED FINANCIAL STATEMENTS

10

Consolidated income statement 10

Consolidated statement of other comprehensive income 10

Consolidated statement of financial position 11

Consolidated statement of changes in equity 12

Consolidated statement of cash flows 13

Notes to the financial statements 14

A. Important events 14

B. Principles of preparation, main accounting

policies and methods 15

C. Scope of consolidation 16

D. Operating data 17

E. Personnel expenses and benefits 19

F. Intangible and tangible property, plant

and equipment 20

G. Financing and financial instruments 21

H. Share capital and earnings per share

24

I. Income tax expense 26

J. Events after the reporting period 27

STATUTORY AUDITORS’ REVIEW REPORT ON THE 2018 HALF-YEAR

FINANCIAL INFORMATION 28

DECLARATION BY THE PERSON RESPONSIBLE FOR THE HALF-YEAR

FINANCIAL REPORT AT 30 JUNE 2018 29

_________________________

* English translation of Getlink SE’s “rapport financier

semestriel” for information purposes only.

HALF-YEAR ACTIVITY REPORT AT 30 JUNE 2018

ANALYSIS OF CONSOLIDATED INCOME STATEMENT

To enable a better comparison between the two periods, the

consolidated income statement for the first half of 2017 presented

in this half-year activity report has been recalculated at the

exchange rate used for the 2018 half-year income statement of

£1=€1.136.

In the first half of 2018, the Group’s consolidated revenues

amounted to €510 million, an increase of €18 million (4%) compared

to 2017. Operating costs totalled €260 million, an increase of €7

million (3%) compared to 2017. EBITDA improved by €11 million (5%)

to €250 million and the trading profit improved by €10 million to

€173 million. At €170 million, the operating profit for the first

six months of 2018 was up by €13 million compared to 2017. Net

finance costs increased by €3 million mainly as a result of the

impact of higher British and French inflation rates on the

index-linked tranches of the debt. The pre-tax result for the

Group’s continuing operations for the first half of 2018 was a

profit of €36 million, an increase of €1 million compared to 2017

restated.

After taking into account a net tax income of €3 million, the

net result for the continuing activities of the Group was a profit

of €39 million compared to a profit of €29 million in 2017. The

Group’s net consolidated result for the first six months of 2018

was a profit of €39 million compared to a profit of €34 million in

2017.

€ million

1st half

2018 1st half 2017 Variance 1st

half 2017 Improvement/(deterioration) of result

* restated €M %

published Exchange rate €/£ 1.136 1.136

1.161 Fixed Link 450 433 17 +4 %

438 Europorte 60 59 1 +2 % 59

Revenue 510 492 18 +4 %

497 Fixed Link (203 ) (196 ) (7 ) -4 % (198 ) Europorte (56

) (56 ) – – (56 ) ElecLink (1 ) (1 ) –

– (1 )

Operating costs (260 )

(253 ) (7 ) -3 % (255

) Operating margin (EBITDA) 250 239

11 +5 % 242 Depreciation (77 )

(76 ) (1 ) -1 % (76 )

Trading profit

173 163 10 +6 % 166 Other net

operating charges (3 ) (6 ) 3

(6 )

Operating profit (EBIT) 170 157

13 +8 % 160 Net finance costs (135 ) (132 ) (3

) -2 % (134 ) Net other financial income 1 10

(9 ) -90 % 10

Pre-tax profit from continuing

operations 36 35 1

+3 % 36 Income tax income/(expense)

3 (6 ) 9 +150 % (6 )

Net

profit from continuing operations 39

29 10 +34 % 30 Net

profit from discontinued operations** – 5 (5 )

5

Net consolidated profit for the

period 39 34 5

+15 % 35

* Restated at the rate of exchange used for the 2018 half-year

income statement (£1=€1.136).

** The Group has applied IFRS 5 “Non-current Assets Held for

Sale and Discontinued Operations” to its maritime segment since the

cessation of MyFerryLink’s operations in the second half of 2015

and to GB Railfreight’s activity since its sale in November 2016.

Accordingly, the net results of these activities for the current

and previous financial periods are presented as a single line in

the income statement called “Net profit from discontinued

operations”.

The evolution of the pre-tax result from continuing operations

by segment compared to 2017 is presented below:

€ million

Fixed Link

Europorte ElecLink Total

continuing activities Pre-tax result from

continuing activities for the 1st half of 2017* 37

- (2 ) 35 Improvement/(deterioration) of

result: Revenue +17 +1 - +18 Operating expenses -7 -

- -7

EBITDA +10 +1 -

+11 Depreciation -1 - - -1

Trading result +9 +1 - +10 Other

net operating income/charges +3 - - +3

Operating result (EBIT) +12 +1 -

+13 Net financial costs and other -12 -

- -12

Total changes - +1

- +1 Pre-tax result from continuing

operations for the 1st half of 2018 37

1 (2 ) 36

* Restated at the rate of exchange used for the 2018 half-year

income statement (£1=€1.136).

1 FIXED LINK SEGMENT

The Group’s core business is the Channel Tunnel Fixed Link

Concession which operates and directly markets its Shuttle Services

and also provides access, on payment of a toll, for the circulation

of High-Speed Passenger Trains (Eurostar) and the Train Operators’

Rail Freight Trains through its Railway Network. As stated in note

D.1 to the half-year consolidated financial statements at 30 June

2018, as the corporate reorganisation as described in note A.1 to

the consolidated half-year financial statements at 30 June 2018 has

only recently been put in place, the separation between the

Eurotunnel and Getlink segments has not been presented in this

half-year financial report. Therefore the Group’s corporate

services are included in the Fixed Link segment as previously.

€ million

1st half 1st

half Variation Improvement/(deterioration) of result

2018 *2017 M€

% Exchange rate €/£ 1.136 1.136

Shuttle Services 296 282 14 +5 % Railway Network 147

144 3 +2 % Other revenue 7 7 – –

Revenue 450 433 17 +4 % External

operating costs (112 ) (107 ) (5 ) -5 % Employee benefits expense

(91 ) (89 ) (2 ) -2 %

Operating

costs (203 ) (196 ) (7

) -4 % Operating margin (EBITDA)

247 237 10 +4 %

EBITDA/revenue 55 % 55 % 0 pts

* Restated at the rate of exchange used for the 2018 half-year

income statement (£1=€1.136).

1.1 FIXED LINK CONCESSION REVENUE

Revenue generated by this segment, which in the first six months

of 2018 represented 88% of the Group’s total revenue, reached €450

million, up 4% compared to 2017.

1.1.1 Shuttle Services

Traffic (number of vehicles)

1st half 2018 1st half 2017

Change Truck Shuttle 845,132 823,147

3 % Passenger Shuttle: Cars * 1,163,054 1,138,087 2 %

Coaches 27,274 27,714 -2 %

* Includes motorcycles, vehicles with trailers, caravans and

motor homes.

Shuttle Services’ revenue for the first half of 2018 amounted to

€296 million, up 5% compared to the previous year due to an

increase in yields which continue to benefit from the Group’s

strategy of optimising the profitability of its Shuttle business

through its dynamic pricing policy for both truck and passenger

traffic.

Truck Shuttle

The Truck Shuttle service increased its share of the Short

Straits cross-Channel truck market from 39.2% for the first half of

2017 to 40.9% for the first half of 2018. The number of vehicles

carried increased by 2.7% to 845,132 trucks which represents a

record for a first half of the year.

Passenger Shuttle

With growth traffic of 2.2% in the first half of 2018, the

market share of the Passenger Shuttle’s car activity remained

relatively stable at 57.6%.

The Passenger Shuttle’s coach market share for the first half of

2018 increased by one point compared to the previous year, to

41.0%.

1.1.2 Railway Network

Traffic 1st half 2018

1st half 2017 Change High-Speed

Passenger Trains (Eurostar) Passengers * 5,198,821

5,040,425 3 % Train Operators' Rail Freight Services **:

Number of tonnes 670,853 601,237 12 % Number of trains 1,060

1,043 2 %

* Only passengers travelling through the Channel Tunnel are

included in this table, excluding those who travel between

continental stations (such as Brussels-Calais, Brussels-Lille,

Brussels-Amsterdam, etc.).

** Rail freight services by train operators (DB Cargo for BRB,

SNCF and its subsidiaries, GB Railfreight, Rail Operations Group,

RailAdventure and Europorte) using the Tunnel.

The Group earned revenues of €147 million in the first half of

2018 from the use of its Railway Network by Eurostar’s High-Speed

Passenger Trains and by the Train Operators’ Rail Freight Services,

up 2% compared to 2017. Revenues generated by both Eurostar and

rail freight trains were impacted by the series of SNCF strikes in

France during April, May and June 2018.

Despite being impacted by the SNCF strikes, the 5,198,821

Eurostar passengers that used the Tunnel in the first half of 2018

represented a record first-half, with June being the second best

month ever. This growth of 3% compared to the previous year was

across all destinations and was boosted by the start of direct

services from London to Amsterdam on 4 April 2018.

In the first half of 2018, cross-Channel rail freight recorded a

growth of 2% in the number of trains compared to the same period in

2017. After a first quarter with 6% growth and well set to continue

like this with the launch of two new cross-Channel rail freight

services to Italy and Germany and the new Silk Road service, the

second quarter was affected by the SNCF strikes and fell by 3%.

The impact on Railway Network revenue of the SNCF strikes in the

first half of 2018 is estimated at €2.9 million.

1.2 FIXED LINK OPERATING COSTS

Fixed Link’s operating costs amounted to €203 millions for the

first half of 2018, up 4% compared to 2017. This increase of €7

million was due mainly to increased activity and maintenance costs

as well as to increased electricity costs and UK business rates,

partially offset by the impact on the period of credits from EDF

energy savings certificates in relation to operation of the new

Truck Shuttles amounting to €4 million.

2 EUROPORTE SEGMENT

The Europorte segment covers the entire rail freight transport

logistics chain in France and includes Europorte France and

Socorail.

€ million

1st half 1st half

Change Improvement/(deterioration) of result

2018 2017 €M Revenue 60 59 1

External operating costs (33 ) (33 ) – Employee benefits expense

(23 ) (23 ) –

Operating costs

(56 ) (56 ) – Operating

margin (EBITDA) 4 3 1

Despite the SNCF strikes that had a significant impact on

Europorte’s activities during the second quarter of 2018,

Europorte’s revenues and EBITDA for the first half of 2018

increased by €1 million compared to 2017. The results for the

period were driven by the contribution of new business and

increased activity, particularly in the petrochemical sector and by

the continued strategy to sustainably reinforce Europorte’s

profitability. The impact of the SNCF strikes on revenue and EBITDA

is estimated at €1.6 million for the first half of 2018.

3 ELECLINK SEGMENT

ElecLink’s activity is the construction and operation of a 1,000

MW electricity interconnector between the UK and France.

Construction works began in 2016 and the interconnector is expected

to be in commercial operation at the beginning of 2020.

Costs directly attributable to the project are capitalised.

During the first half of 2018, works continued to advance in

accordance with the schedule and investment in the project amounted

to €116 million.

Operating costs for the first half of 2018 amounted to €1

million, at a similar level as in the first half of 2017.

4 OPERATING MARGIN (EBITDA)

EBITDA by business segment evolved as follows:

€ million

Fixed Link

Europorte ElecLink Total

Group EBITDA 1st half 2017 * 237 3 (1 )

239

Improvement/(deterioration): Revenue 17 1 –

18 Operating

costs (7 ) – –

(7 ) Total

changes 10 1 –

11 EBITDA 1st half 2018 247

4 (1 ) 250

* Restated at the rate of exchange used for the 2018 income

statement (£1=€1.136).

At €250 million in 2018, the Group’s operating margin improved

by €11 million compared to 2017 (+5%) as a result of an increase in

revenue and control of costs. The series of SNCF strikes during the

second quarter of 2018 impacted the EBITDA of both the Fixed Link

and Europorte segments by an estimated €4.5 million.

5 OPERATING PROFIT (EBIT)

Depreciation charges increased by €1 million compared to the

first half of 2017 to €77 million.

At €173 million in the first half of 2018, the trading profit

improved by €10 million (+6%) compared to 2017.

After taking into account net other operating charges of €3

million (€6 million in 2017), the operating profit for the first

six months of 2018 was up by €13 million (+8%) compared to 2017, to

€170 million.

6 NET FINANCIAL CHARGES

At €135 million for the first half of 2018, net finance costs

increased by €3 million compared to 2017 at a constant exchange

rate. This increase was mainly as a result of the impact of the

increase in inflation rates in the UK and France on the

index-linked tranches of the debt and of the loan for the

acquisition of the inflation-linked bonds partially offset by the

capitalisation of interest on the financing of the ElecLink

project.

Other net financial income of €1 million in the first half of

2018 include net exchange losses of €0.1 million (2017: net

exchange gains of €8 million) and a net income of €1 million on the

bonds held by the Group (2017: €3 million).

7 NET RESULT FROM CONTINUING OPERATIONS

The Group’s pre-tax result for continuing operations for the

first six months of 2018 was a profit of €36 million, up €1 million

compared to 2017 at a constant exchange rate.

After taking into account a net tax income of €3 million, the

Group’s post-tax result for continuing operations for the first

half of 2018 was a profit of €39 million compared to a profit of

€29 million in 2017.

8 NET RESULT FROM DISCONTINUED ACTIVITIES

Information on discontinued activities is set out in note C.2 to

the Group’s half-year consolidated financial statements as at 30

June 2018.

9 NET CONSOLIDATED RESULT

The net consolidated result for the Group for the first half of

the 2018 financial year was a profit of €39 million compared to a

profit of €34 million (restated at an equivalent exchange rate) for

the same period in 2017.

ANALYSIS OF CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

€ million

30 June 2018

31 December 2017 Exchange rate €/£ 1.129

1.127 Fixed assets 6,554 6,493 Other non-current assets

559 229

Total non-current assets 7,113

6,722 Trade and other receivables 111 96 Other current

assets 65 61 Cash and cash equivalents 274 613

Total current assets 450 770

Total assets 7,563 7,492 Total

equity 1,914 2,051 Financial liabilities 4,568 4,346 Interest rate

derivatives 719 716 Other liabilities 362 379

Total equity and liabilities 7,563

7,492

The table above summarises the Group’s consolidated statement of

financial position as at 30 June 2018 and 31 December 2017. The

main elements and changes between the two dates, presented at the

exchange rate for each period, are as follows:

- At 30 June 2018, “Fixed assets” include

property, plant and equipment and intangible assets amounting to

€5,964 million for the Fixed Link segment, €512 million for the

ElecLink segment and €79 million for the Europorte segment. The

increase between 31 December 2017 and 30 June 2018 results mainly

from investments of €116 million in the ElecLink project.

- Other non-current assets at 30 June

2018 include the inflation-linked bonds acquired by the Group in

February 2018 amounting to €336 million (see note A.2 to the

half-year consolidated financial statements at 30 June 2018) and a

deferred tax asset of €218 million.

- At 30 June 2018, “Cash and cash

equivalents” amounted to €274 million after payment of the €160

million dividend, net capital expenditure of €111 million, €126

million in debt service costs (interest, repayments and fees) and

net payments of €192 million in respect of the acquisition of the

inflation-linked bonds (a total payment of €407 million for the

purchase of the bonds financed in part by a loan of €214

million).

- Equity decreased by €137 million as a

result of the €160 million dividend payment, the impact of the

first-time application of IFRS 9 on the opening balance sheet

at 1 January 2018 (€22 million) and the purchase of treasury shares

(€13 million) partly offset by the recycling of the fair value of

value on the hedging contracts (€18 million) and the net profit for

the period (€39 million).

- Financial liabilities have increased by

€222 million compared to 31 December 2017 as a result of the €214

million loan to finance the acquisition of the inflation-linked

bonds in February 2018, an increase of €30 million arising from

fees and the effect of inflation on the index-linked debt tranches

of the Term Loan and €26 million for the impact of the first-time

application of IFRS 9 on the accounting value of the debt at 1

January 2018. These increases have been partially offset by the

contractual debt repayments of €39 million.

- The valuation of the fair value of the

interest rate derivatives liability increased by €3 million.

- Other liabilities include €287 million

of trade and other payables and provisions, as well as retirement

liabilities of €75 million.

ANALYSIS OF CONSOLIDATED CASH FLOWS

Consolidated cash flows

€ million

1st half 2018

1st half 2017 Exchange rate €/£ 1.129

1.137

Continuing activities: Net cash inflow from trading

271 261 Other operating cash flows and taxation (9 )

1

Net cash inflow from operating activities 262

262 Net cash outflow from investing activities (111 ) (168 )

Net cash outflow from financing activities (298 ) (269 ) Net cash

(outflow)/inflow from financing operation (192 ) 265

(Decrease)/increase in cash in the period from continuing

activities (339 ) 90

Discontinued activities *: Net cash outflow from sale of

subsidiary – (2 ) Net cash inflow from financing activities

– 120

Increase in cash in the period from discontinued

activities – 118 Total

(decrease)/increase in cash in the period (339 )

208

* Maritime segment and GB Railfreight Limited, see note C.2 to

the consolidated accounts at 30 June 2018.

Continuing activities

At €271 million, net cash generated from trading by

continuing operations in the first half of 2018 improved by

€10 million compared to the first half of 2017. This change is

explained mainly by:

- an increase of €9 million to

€271 million for the Fixed Link’s activities (first half of

2017: €262 million),

- Europorte’s trading cash flow remained

stable at €1 million, and

- ElecLink’s expenditure remained

relatively stable at €1 million (first half of 2017:

€2 million).

The €10 million reduction in “Other operating cash flows

and taxation” is mainly due to a net increase in tax payments: net

payments of €6 million in the first half of 2018 compared to net

receipts of €3 million in the first half of 2017.

At €111 million in the first half of 2018 (down by

€57 million compared to the first half of 2017), net cash

payments from investing activities comprised mainly:

- a net amount of €31 million

relating to the Fixed Link (first half of 2017: €27 million).

The main expenditure was €11 million on infrastructure,

€8 million on rolling stock, €4 million for new Flexiplus

lounges (the Folkestone lounge opened 18 May 2018), €3 million to

improve service to customers on the terminals and €2 million

on computing and digital projects, and

- payments of €79 million for the

construction works on the ElecLink project (€140 million in

the first half of 2017).

On 9 February 2018, the Group completed the acquisition of

inflation-linked bonds (see notes A.2 and G.1 to the notes to the

half-year consolidated financial statements at 30 June 2018), which

was financed in part by an external loan. This transaction

generated a net cash outflow of €192 million.

Other net financing payments in the first half of 2018 amounted

to €298 million compared to €269 million in the first

half of 2017. During 2018, cash flow from financing comprised:

- debt service costs of

€126 million:

- €84 million of interest paid on the

Term Loan and on other borrowings (€111 million in the first half

of 2017, including the associated hedging transactions before their

partial termination in June 2017); the decrease in interest paid

results from the new financing conditions obtained from the debt

restructuring in June 2017;

- €39 million paid in respect of the

scheduled repayments on the Term Loan and other borrowings

(€17 million in the first half of 2017), including €31 million

in respect of the first repayments of tranche A of the debt,

and

- €4 million in relation to fees on

the operation to simplify the debt completed at the end of 2015

(€3 million in the first half of 2017).

- €15 million paid in respect of the

share buyback programme (€4 million in the first half of

2017),

- €160 million paid in dividends (€139

million in the first half of 2017), and

- net receipts of €3 million from

the liquidity contract and interest received (€7 million in the

first half of 2017, including €3 million on the floating rate notes

held by the Group until June 2017).

Free Cash Flow

The Group defines its Free Cash Flow as net cash flow from

operating activities less net cash flow from investing activities

(excluding the initial investment in new activities and the

acquisition of shareholdings in subsidiary undertakings) and net

cash flow from financing activities relating to debt service plus

interest received (on cash and cash equivalents and other

financial assets).

€ million

1st half 2018

1st half 2017 Exchange rate €/£ 1.129

1.137 Net cash inflow from operating activities 262 262 Net cash

outflow from investing activities (31 ) (28 ) Debt service costs

(interest paid, fees and repayments) (126 ) (134 ) Interest

received and other receipts 3 6

Free Cash Flow

from continuing operations 108 106

Free Cash Flow from discontinuing operations – 5 Free

Cash Flow 108 111 Dividend paid (160 ) (139 )

Purchase of treasury shares and net movement on liquidity contract

(16 ) (2 ) ElecLink: project expenditure (79 ) (140 ) Refinancing

operations (192 ) 266 Sale of GB Railfreight Limited – (2 ) Sale of

ferries – 114

Use of Free Cash Flow

(447 ) 97 (Decrease)/increase in cash in

the period (339 ) 208

At €108 million in the first half of 2018, Free Cash Flow

for continuing activities has increased by €2 million compared

to the same period in 2017 for the reasons set out above.

OTHER FINANCIAL INDICATORS

Financial covenants

Following the completion of the Group’s corporate reorganisation

during the first half of 2018 (see note A.1 to the consolidated

financial statements at 30 June 2018), the debt service cover ratio

is now based on the cash flows of the Eurotunnel Holding SAS

sub-group of companies only, being defined as their net operating

cash flow less capital expenditure and taxes compared to their debt

service costs, calculated on a rolling 12 month basis. The

synthetic debt service cover ratio is calculated on the same basis

but using a hypothetical amortisation on the Term Loan.

The ratios for the 12 months ending 30 June 2018 were 2.53 and

2.53 respectively and hence the financial covenants for the period

were respected.

Net debt to EBITDA ratio

The net debt to EBITDA ratio as defined by the Group in

paragraph 2.1.4 of the 2017 Registration Document, is the ratio

between consolidated EBITDA and financial liabilities less the

value of the inflation-linked notes and cash and cash equivalents

held by the Group. The Group does not consider it appropriate to

publish this ratio when calculated on the basis of the activity of

a six month period. At 31 December 2017, the ratio was 7.1.

EBITDA to finance cost ratio

The ratio of the Group’s consolidated EBITDA to its finance

costs (excluding interest received and indexation) as defined in

paragraph 2.1.4 of the 2017 Registration Document is 2.2 at 30 June

2018 (30 June 2017 restated: 2.2).

OUTLOOK

The Group's results for the first half of 2018 reflect the

orientations adopted within the framework of the strategic plan.

They confirm the robustness of its business model focused on

sustainable growth in its various business segments and on creating

value for its shareholders.

The results of the Shuttle business, with traffic growth of

between 2 and 3% and revenue increasing by 5%, reflect the strategy

of optimising profitability through active management of prices,

for both the truck and car activities.

This strategy, driven by an attractive commercial proposition

based on quality of service and the digitalisation of processes, is

intended to generate continuous growth in Tunnel traffic whilst

optimising margins. The Group’s investment policy serves this

strategy and, such as with the opening of the new Flexiplus lounge

on the Folkestone terminal during the first half of the year, the

Group is continuing its targeted investments aimed at reinforcing

service quality and modernising its infrastructure and

equipment.

Despite the SNCF strike during the period, passenger high-speed

train traffic travelling through the Tunnel continued the growth

seen in 2017, and the launch in April 2018 of the new service

between London and Amsterdam confirms the potential for growth of

the rail transport market between the UK and the Continent over and

above existing services and destinations.

The Group remains very confident in the solidity of its Fixed

Link business and in its potential for growth. The Fixed Link

continues to be, and will increasingly assert itself as, the

principle choice for trade and movement of people between the UK

and continental Europe.

The Group is closely following the negotiations on the exit of

the United Kingdom from the European Union, which, with the recent

publication of a white paper by the British Government, has entered

an intense phase in the run-up to the effective date of 29 March

2019. Since 2016, the Group has been in constant contact with the

French and British authorities and other stakeholders so as to be

informed of potential changes to the framework for future

cross-border controls and the definition of technological options

to facilitate them. As a private company, manager of its own

infrastructure and with 25 years of experience in the management of

change, the Group remains confident in its ability – once the

arrangements have been agreed between the parties – to deliver

the solutions required to enable it to guarantee the fluidity of

traffic through the Tunnel and to reinforce its position as a vital

link in the European economic landscape. It is to be remembered

that under the Treaty of Canterbury, the management of frontiers is

the joint responsibility of the two States.

Europorte continues its strategy of prioritising the

profitability of its operations and the quality of its services.

Its performance in the first half of the year, achieved despite the

SNCF strikes, reinforces the Group’s objective of creating value in

rail freight in France through managed growth and a high quality of

service.

The ElecLink project is progressing normally and is in line with

both budget and timetable except for a small shift in the

deployment in the rail tunnel. The various studies and independent

expert opinions requested by the IGC in order to give authorisation

for the installation of the cable will be completed and delivered

in the next few weeks. The objective of a start of operations at

the beginning of 2020 remains valid.

Following the completion of its corporate reorganisation in

April 2018, the Group continues to work on the optimisation of its

financing structure in order to minimise, as market conditions

allow, the cost of its debt and to support its strategy to develop

its core businesses of infrastructure and transport activities.

During the second half of 2018, the Group intends to refinance the

EASL external bank loan of £190 million.

With confidence in its future and in light of its first half

results, the Group confirms its financial objective as published in

its 2017 Registration Document of a consolidated EBITDA of €545

million in 2018 (on the basis of an exchange rate of £1=€1.14 and

the current scope of consolidation)*.

The start of ElecLink operations in 2020 will enable a

significant step change in the Group’s profitability. In total, in

the current context, the Group believes it should exceed an EBITDA

of €735 million (at £1=€1.14) in 2022.*

The Group confirms its intention to continue with its policy of

a regular growth in dividend payments to shareholders with a target

increase per share of €0.05 per year.

RISKS

The main risks and uncertainties that the Group may face in the

remaining six months of the financial year are identified in the

“Risks and Controls” chapter (chapter 3) of the 2017 Registration

Document, which contains a detailed description of the risk factors

to which the Group is exposed. However, other risks, not identified

at the date of publication of this half-year report, may exist.

RELATED PARTIES

In the first half of 2018, the Group did not have any related

parties transactions as defined by IAS 24.

_____________________________

* These objectives are based on data, assumptions and estimates

that are considered to be reasonable. They take particular account

of the consequences of the geopolitical context but are however

liable to change or to be modified due to uncertainties related in

particular to the economic, financial, competitive and regulatory

environment. Furthermore, the materialisation of certain risks as

described in chapter 3 “Risks and Controls” of the 2017

Registration Document could have an impact on the Group’s

activities and its capacity to achieve its objectives. The Group

does not therefore make any commitments nor does it give any

guarantee that the objectives will be met, and the forward looking

information contained in this chapter cannot be used to make a

forecast of results.

SUMMARY HALF-YEAR CONSOLIDATED FINANCIAL STATEMENTS

CONSOLIDATED INCOME STATEMENT

€'000

Note 1st

half 2018 1st half 2017

Full year 2017 Revenue D.1 510,373 496,993 1,032,978

Operating expenses D.2 (145,128 ) (141,119 ) (278,184 ) Employee

benefits expense E (115,169 ) (113,682 )

(228,550 )

Operating margin (EBITDA) D.1

250,076 242,192 526,244 Depreciation F

(77,353 ) (76,448 ) (152,590 )

Trading

profit 172,723 165,744 373,654 Other

operating income D.3 663 696 1,289 Other operating expenses

D.3 (2,966 ) (6,205 ) (10,241 )

Operating

profit 170,420 160,235 364,702 Finance

income G.2 859 565 1,808 Finance costs G.2 (136,421 )

(134,438 ) (272,031 ) Net finance costs (135,562 )

(133,873 ) (270,223 ) Other financial income G.3 9,317 57,064

69,245 Other financial charges G.3 (7,937 )

(47,291 ) (112,092 )

Pre-tax profit from continuing

operations 36,238 36,135 51,632 Income tax

expense of continuing operations I.1 2,961

(5,939 ) 56,534

Net profit from continuing operations

39,199 30,196

108,166 Net profit from discontinued operations C.2

4 5,205 5,116

Net profit for the year

39,203 35,401

113,282 Net profit attributable to: Group share

39,203 35,460 112,932 Minority interest share

– (59 ) 350

Earnings per share (€): H.3 Basic

earnings per share: Group share 0.07 0.07 0.21 Diluted earnings per

share: Group share 0.07 0.07 0.21 Basic earnings per share from

continuing operations 0.07 0.06 0.20 Diluted earnings per share

from continuing operations 0.07 0.06

0.20

CONSOLIDATED STATEMENT OF OTHER COMPREHENSIVE INCOME

€'000

Note 1st

half 2018 1st half 2017

Full year 2017 Items that will never be

reclassified to the income statement: Actuarial gains and

losses on employee benefits (21 ) (363 ) 26,560 Related tax ,, I 6

93 (300 )

Items that are or may be reclassified to the income

statement: Foreign exchange translation differences (2,133 )

41,960 56,608 Hedging contracts: movement in market value and

recycling of the fair value on the partially terminated contracts

G.1 25,780 126,913 126,337 Related tax I (7,376 )

65,601 50,434

Net income recognised directly in

equity 16,256 234,204 259,639 Profit for

the period – Group share 39,203 35,460

112,932

Total comprehensive income – Group share

55,459 269,664 372,571 Total comprehensive

(expense)/income – minority interest share –

(59 ) 650

Total comprehensive income for the

period 55,459 269,605

373,221

The accompanying notes form an integral part of these

consolidated financial statements. The exchange rates used for the

preparation of these financial statements are set out in note B.2

below.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

€'000

Note 30 June 2018

31 December 2017 ASSETS

Goodwill F 20,392 20,392 Intangible assets F 119,955

119,955

Total intangible assets 140,347

140,347 Concession property, plant and equipment F 5,960,681

6,013,175 Other property, plant and equipment F

452,877 339,529

Total property, plant and equipment

6,413,558 6,352,704 Deferred tax asset I.2 218,371

217,420 Other financial assets G.4 341,246

11,697

Total non-current assets 7,113,522

6,722,168 Inventories 2,123 1,843 Trade receivables 110,669

96,422 Other receivables 62,383 58,781 Other financial assets G.4

199 – Cash and cash equivalents 274,297

612,533

Total current assets

449,671 769,579 Total assets

7,563,193 7,491,747 EQUITY

AND LIABILITIES Issued share capital H.1 220,000 220,000 Share

premium account 1,711,796 1,711,796 Other reserves H.4 (347,687 )

(286,106 ) Profit for the period 39,203 112,932 Cumulative

translation reserve 290,257 292,390

Equity – Group share 1,913,569 2,051,012

Minority interest share – –

Total

equity 1,913,569 2,051,012 Retirement benefit

obligations 74,934 73,970 Financial liabilities G 4,251,674

4,219,528 Other financial liabilities 41,646 52,078 Interest rate

derivatives G.1 718,726 716,371

Total

non-current liabilities 5,086,980 5,061,947

Provisions D.4 15,805 73,059 Financial liabilities G 270,038 67,872

Other financial liabilities 4,820 6,885 Trade payables 206,730

197,925 Other payables 65,251 33,047

Total current liabilities

562,644 378,788 Total equity and

liabilities 7,563,193

7,491,747

The accompanying notes form an integral part of these

consolidated financial statements. The exchange rates used for the

preparation of these financial statements are set out in note B.2

below.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

€'000

Issued share capital

Share premium account *

Consolid- ated reserves Result

Cumulative translation reserve

Group share Minority interests

Total 1 January 2017 220,000 1,711,796 (555,788 )

200,585 235,782

1,812,375 (650 )

1,811,725 Transfer

to consolidated reserves – – 200,585 (200,585 ) –

– –

– Payment of dividend – – (139,005 ) – –

(139,005 ) –

(139,005 ) Share based payments – – 5,972 – –

5,972 –

5,972 Acquisition/sale of treasury shares – – (901 ) – –

(901 ) –

(901 ) Result for the year – – – 112,932 –

112,932 350

113,282 Minority interests – – – – –

– 300

300 Profit/(loss) recorded directly in other

comprehensive income: ▪ Actuarial gains and losses on employee

benefits – – 26,560 – –

26,560 –

26,560 ▪ Related tax

– – (300 ) – –

(300 ) –

(300 ) ▪ Movement in fair

value of hedging contracts – – 96,104 – –

96,104 –

96,104 ▪ Recycling of the fair value on the partially

terminated hedging contracts – – 30,233 – –

30,233 –

30,233 ▪ Related tax – – 50,434 – –

50,434 –

50,434 ▪ Foreign exchange translation differences –

– – – 56,608

56,608

–

56,608 31 December 2017

220,000 1,711,796 (286,106 ) 112,932

292,390 2,051,012 – 2,051,012 Transfer

to consolidated reserves – – 112,932 (112,932 ) –

– –

– Impact of the first application of IFRS 9 (G.1) – –

(25,901 ) – –

(25,901 ) –

(25,901 ) Related tax – –

3,448 – –

3,448 –

3,448 Payment of dividend (H.4) – –

(160,385 ) – –

(160,385 ) –

(160,385 ) Share based

payments ** – – 3,094 – –

3,094 –

3,094

Acquisition/sale of treasury shares – – (13,158 ) – –

(13,158

) –

(13,158 ) Result for the period – – – 39,203 –

39,203 –

39,203 Profit/(loss) recorded directly in

other comprehensive income: ▪ Actuarial gains and losses on

employee benefits – – (21 ) – –

(21 ) –

(21 ) ▪

Related tax – – 6 – –

6 –

6 ▪ Movement in fair value

of hedging contracts (G.1) – – (2,635 ) – –

(2,635 ) –

(2,635 ) ▪ Recycling of the fair value on the partially

terminated hedging contracts (G.1) – – 28,415 – –

28,415 –

28,415 ▪ Related tax – – (7,376 ) – –

(7,376 ) –

(7,376 ) ▪ Foreign exchange translation differences –

– – – (2,133 )

(2,133 )

–

(2,133 ) 30 June 2018

220,000 1,711,796 (347,687 )

39,203 290,257 1,913,569

– 1,913,569

* See note H.4 below.

** Of which €1,516,000 is in respect of free shares and

€1,578,000 is in respect of preference shares.

The accompanying notes form an integral part of these

consolidated financial statements. The exchange rates used for the

preparation of these financial statements are set out in note B.2

below.

CONSOLIDATED STATEMENT OF CASH FLOWS

€'000

Note 1st

half 2018 1st half 2017

Full year 2017 Operating margin (EBITDA) from

continuing operations D.1 250,076 242,192 526,244 Operating margin

(EBITDA) from discontinued operations C.2 (48 ) (531 ) (681 )

Exchange adjustment * (904 ) (2,216 ) (3,397 ) Decrease/(increase)

in inventories (279 ) 124 153 (Increase)/decrease in trade and

other receivables (11,023 ) (11,653 ) (3,106 ) Increase in trade

and other payables 33,012 32,996

19,713

Net cash inflow from trading 270,834

260,912 538,926 Other operating cash flows (3,297 )

(3,010 ) (5,302 ) Taxation paid (5,373 )

4,136 (1,406 )

Net cash inflow from operating

activities 262,164

262,038 532,218 Payments to acquire property,

plant and equipment (110,604 ) (167,691 ) (275,240 ) Sale of

property, plant and equipment 17 6 169 Purchase of shares – – 300

Sale of subsidiary – (2,338 )

(2,338 )

Net cash outflow from investing activities

(110,587 ) (170,023 )

(277,109 ) Dividend paid (160,385 ) (139,005 ) (139,005 )

Exercise of stock options 2,922 1,735 2,365 Purchase of treasury

shares (14,923 ) (3,698 ) (8,695 ) Liquidity contract (net) (460 )

1,725 4,816 Cash received from loans 214,435 1,956,708 1,949,757

Fees paid on new loans (1,622 ) (19,879 ) (25,177 ) Purchase of

inflation-linked bonds (405,028 ) – – Fees paid for partial

termination of hedging contracts – (484,297 ) (481,982 ) Early

repayment of loans – (1,351,030 ) (1,347,486 ) Cash received from

redemption of floating rate notes – 163,995 163,995 Fees paid on

loans (3,546 ) (3,435 ) (7,151 ) Interest paid on loans (83,656 )

(77,639 ) (162,954 ) Interest paid on hedging instruments – (33,786

) (33,703 ) Scheduled repayment of loans (38,998 ) (18,681 )

(25,968 ) Cash received under finance leases – 119,552 121,807

Interest received on cash and cash equivalents 938 563 2,641

Interest received on other financial assets –

2,742 2,742

Net cash (outflow)/inflow from

financing activities **

(490,323 )

115,570 16,002 (Decrease)/increase in cash

in the period (338,746 )

207,585 271,111

* The adjustment relates to the restatement of elements of the

income statement at the exchange rate ruling at the

period end.

** In 2017, the fees paid during the renegotiation of tranche C

totalling €25 million were recognised for €18 million as an

adjustment to the amount of the debt. The fees paid on the

termination of the swaps correspond to the fair value of the

instruments (€502 million on the transaction date) after taking

into account the discount obtained from the counterparties and the

negotiation costs.

Movement during the period

€'000

1st half 2018 1st half 2017

Full year 2017 Cash and cash equivalents at 1

January 612,533 346,637 346,637 Effect of movement in exchange rate

471 (4,061 ) (5,395 ) (Decrease)/increase in cash in the period

(338,746 ) 207,585 271,111 Increase/(decrease) in interest

receivable in the period 39 (9 )

180

Cash and cash equivalents at the period end

274,297 550,152

612,533

The accompanying notes form an integral part of these

consolidated financial statements. The exchange rates used for the

preparation of these financial statements are set out in note B.2

below.

NOTES TO THE FINANCIAL STATEMENTS

Getlink SE, formerly Groupe Eurotunnel SE, is the Group’s

consolidating entity. Its registered office is at 3 rue La

Boétie, 75008 Paris, France and its shares are listed on Euronext

Paris and on NYSE Euronext London, The term “Getlink SE” refers to

the holding company which is governed by French law. The term

“Group” refers to Getlink SE and all its subsidiaries.

The main activities of the Group are the design, financing,

construction and operation of the Fixed Link’s infrastructure and

transport system in accordance with the terms of the Concession

(which will expire in 2086), the rail freight activity of the

Europorte segment as well as the construction and operation

(expected for the beginning of 2020) of the 1,000 MW electricity

interconnector in the Tunnel by ElecLink. The maritime activity was

discontinued in 2015 (see note C.2 below).

The summary half-year consolidated financial statements for 2018

were prepared under the responsibility of the Board of Directors at

its meeting held on 24 July 2018.

A. Important events

A.1 Internal legal reorganisation of the Group

On 23 April 2018, the Group finalised the implementation of its

corporate reorganisation. This internal reorganisation concerned

its main activity, that of the operation of the Fixed Link which is

now in a distinct sub-group, separate from other of the Group’s

activities which are managed and financed independently from the

Fixed Link activity. This releases Getlink SE from its

commitments as a guarantor under the Term Loan as described in

section 8.1.4 of the 2017 Registration Document and should also

enable a more flexible funding structure to be put in place in

future that is more suitable for the Group’s development needs.

The reorganisation involved the transfer of the companies in

Getlink SE’s Fixed Link sub-group (including the Concessionaires,

France Manche SA and Channel Tunnel Group Ltd) to Eurotunnel

Holding SAS which is now the new holding company for the Eurotunnel

sub-group and the bearer of the obligations under the Term Loan

which previously resided with Getlink SE.

This reorganisation forms part of the Group’s long-term strategy

to develop its core infrastructure and transport activities.

As this corporate reorganisation has only recently been put in

place, it is not reflected in the segment information in note D.1

of the consolidated financial statements at 30 June 2018, but it

will be included in the annual consolidated financial statements to

31 December 2018.

A.2 Acquisition of inflation-indexed bonds

On 9 February 2018, Eurotunnel Agent Services Limited (an

English subsidiary of Getlink SE), completed the acquisition of the

Channel Link Enterprises Finance Plc (CLEF) G2 bonds held by

FMS.

The G2 bonds, which have a nominal value of £150 million and are

indexed on UK inflation, were acquired for £359 million which was

financed in part by an external loan of £190 million and in part by

the Group’s own funds.

The G2 bonds have been recognised as “Other financial assets” at

their fair value at the date of acquisition of £302 million.

Information on the accounting treatment of the transaction is

given in note D.4 and G.4 to the notes to the consolidated

financial statements at 30 June 2018.

A.3 ElecLink

ElecLink’s construction works continued to progress as planned

during the period in terms of both cost and timetable. Investment

in the project during the first half of 2018 amounted to €116

million, bringing the total investment since the Group took full

control of ElecLink in 2016 to €355 million.

B. Principles of preparation, main accounting policies

and methods

B.1 Statement of compliance

The summary half-year consolidated financial statements have

been prepared in accordance with IFRS as adopted by the European

Union and applicable on that date. They have been prepared in

accordance with IAS 34. Thus, they do not contain all the

information required for complete annual financial statements and

must be read in conjunction with Getlink SE’s consolidated

financial statements for the year ended 31 December 2017.

B.2 Basis of preparation and presentation of the

consolidated financial statements

The summary half-year consolidated financial statements for

Getlink SE and its subsidiaries are prepared as at 30

June.

The summary half-year consolidated financial statements have

been prepared using the principles of currency conversion as

defined in the 2017 annual financial statements as at 31 December

2017.

The average and closing exchange rates used in the preparation

of the 2018 and 2017 half-year accounts and the 2017 annual

accounts are as follows:

€/£

30 June 2018 30

June 2017 31 December 2017 Closing rate 1.129

1.137 1.127 Average rate 1.136 1.161 1.140

B.3 Changes in accounting standards as at 30 June

2018

The standards and interpretations used and described in the

annual financial statements as at 31 December 2017 have been

supplemented by the standards, amendments and interpretations whose

application is mandatory for financial years beginning on or after

1 January 2018.

B.3.1 Texts adopted by the European Union whose

application is compulsory

The texts adopted by the European Union, the application of

which is compulsory for financial years beginning on or after

1 January 2018, are as follows:

- IFRS 15 “Revenue from Contracts with

Customers” and its amendments;

- IFRS 9 “Financial Instruments”;

- amendments to IFRS 4 “Application of

IFRS 9 and IFRS 4”;

- amendments to IFRS 2 “Classification

and measurement of share-based payment transactions”;

- IAS 40 “Transfers of investment

property”; and

- interpretation IFRIC 22 “Foreign

Currency Transactions and Advance Consideration”.

The impact of the first-time application of IFRS 9 is set out in

note G.1 below. The application of other texts has not had a

significant impact on the Group's consolidated financial

statements.

B.3.2 Texts adopted by the European Union but not yet

mandatory

IFRS 16 “Leases” will be mandatory for financial years beginning

on or after 1 January 2019. Under this standard, all leases other

than short-term leases and those for low-value assets must be

recognised in the lessee’s statement of financial position, in the

form of a right-of-use asset and in consideration of a financial

debt. The Group currently presents operating leases off-balance

sheet. The analysis of the potential impact of this standard, which

mainly concerns the Europorte segment, is currently being

finalised.

The Group does not intend to apply this standard in advance.

B.3.3 Other texts and amendments published by the IASB

but not approved by the European Union

The following texts concerning accounting rules and methods

specifically applied by the Group have not yet been approved by the

European Union:

- interpretation IFRIC 23 “Uncertainty

over Income Tax Treatments”;

- amendments to IAS 28 “Long-term

Interests in Associates and Joint Ventures”;

- amendments to IAS 19 “Defined Benefit

Plans: Plan Amendment, Curtailment or Settlement”; and

- amendments to IFRS 10 and IAS 28 “Sales

or contributions of assets between an investor and its associate/

joint venture”.

The potential impact of these other texts will be assessed by

the Group in subsequent years.

B.4 Use of estimates and judgements

The preparation of the consolidated financial statements

requires estimates and assumptions to be made that affect the

reported amounts of assets and liabilities and the reported amounts

of revenues and expenses for the period. The Group’s management and

Board of Directors periodically review its valuations and estimates

based on their experience and various other factors considered

relevant for the determination of reasonable and appropriate

estimates of the assets’ and liabilities’ carrying value.

Accordingly, the estimates underlying the preparation of half-year

consolidated financial statements to 30 June 2018 have been

established in the context of the decision by the UK to leave the

European Union as described below. Depending on the evolution of

these assumptions, actual results may differ from current

estimates.

The use of estimations concerns mainly the valuation of

intangible and tangible property, plant and equipment (see note F),

the evaluation of the Group’s deferred tax situation (note I), the

valuation of the Group’s retirement liabilities and certain

elements of the valuation of financial assets and liabilities (note

G.5).

Brexit: the United Kingdom’s exit from the European

Union

Following the UK's decision to leave the European Union on 23

June 2016, formal negotiations between the UK government and the

European Commission on the terms and mechanisms of the exit which

started on 19 June 2017, entered the second phase in December 2017

and are continuing as of the closing date of these accounts.

During the first half of 2018, the Group has not noted any

significant impact of this decision on its business but continues

its process of active monitoring and detailed follow-up of

potential risks that may arise.

The Group has taken account of this situation in the

determination of the principal estimates and assumptions used in

the preparation of its consolidated financial statements at 30 June

2018 as set out above.

B.5 Seasonal variations

The revenue and the trading result generated in each reporting

period are subject to seasonal variations over the year, in

particular for the Passenger Shuttle’s car activity during the peak

summer season. Therefore the results for the first half of the year

cannot be extrapolated to the full year.

C. Scope of consolidation

C.1 Changes in the scope of consolidation

The scope of consolidation at 30 June 2018 is the same as that

at 31 December 2017.

C.2 Assets held for sale and discontinued

operations

The net result per discontinued activity is as below:

€'000

1st half 2018

1st half 2017 Full year

2017 Maritime segment 4 2,316 2,230 GB Railfreight Limited

– 2,889 2,886

Net result from discontinued

activities 4 5,205

5,116 Earnings per share from discontinued activities

(€): Basic – 0.01 0.01 Diluted – 0.01 0.01

Maritime segment MyFerryLink

The Group has applied IFRS 5 “Non-Current Assets Held for Sale

and Discontinued Operations” to its maritime segment since the

ending of its maritime activity in the second half of 2015. In

2017, the Group sold its three ferries.

The Group is the subject of a number of legal claims following

the cessation of its maritime activity for which provision has been

made amounting to €11 million as at 30 June 2018.

Maritime segment’s income statement

€'000

1st half 2018

1st half 2017 Full year

2017 Operating costs (48 ) (531 ) (681

)

Operating margin (EBITDA) (48 ) (531 )

(681 ) Other operating income/(charges) 48

2,847 2,911

Operating profit/(loss) –

2,316 2,230 Net financial income/(charges) 4

– –

Pre-tax profit/(loss) 4

2,316 2,230 Deferred tax – 15,790

15,790 Income tax expense – (15,790 ) (15,790

)

Net profit/(loss) 4 2,316

2,230

Maritime segment’s cash flow statement

€'000

1st half 2018

1st half 2017 Full year

2017 Net cash flow from operating activities (17 ) (331 )

(13,371 ) Net cash flow from investing activities 12 – 75 Net cash

flow from financing activities – 119,552

121,807

Increase/(decrease) in cash in year (5

) 119,221 108,511

GB Railfreight Limited

In the first half of 2017, the Group recorded an income of €2.9

million in relation to the final price adjustment following the

sale of its subsidiary GB Railfreight Limited on 15 November

2016.

D. Operating data

D.1 Segment information

As explained in note A.1 above, the Group put in place a new

corporate structure during the first half of 2018, which splits the

old “Fixed Link” segment into two new segments: “Eurotunnel” and

“Getlink”. The Group is therefore now organised around the

following four sectors, which correspond to the internal

information reviewed and used by the main operational decision

makers (the Executive Committee):

- the “Eurotunnel” segment, which

includes the Concessionaires’ of the cross-Channel Fixed Link and

their subsidiaries,

- the “Europorte” segment, the main

activity of which is that of rail freight operator,

- the “ElecLink” segment, whose activity

is the construction and operation of a 1,000 MW electricity

interconnector running through the Channel Tunnel, and

- the “Getlink” segment which includes

the Group’s corporate services and which, since the Group’s

corporate reorganisation, is reported separately from the

Eurotunnel segment.

As the new organisation has only recently been put in place, the

separation between the Eurotunnel and Getlink segments is not

presented in this note which uses the old segmentation that

regroups Eurotunnel and Getlink in the Fixed Link segment. The new

organisation will be reflected in the annual consolidated financial

statements to 31 December 2018.

Information by segment

€'000

Fixed Link Europorte

ElecLink

Consolidation

adjustments

Total of

continuing

operations

Discontinued

operations*

Total At 30 June 2018 Revenue 450,604 59,769 –

–

510,373 –

510,373 EBITDA 248,465 3,813 (926)

(1,276)

250,076 –

250,076 Trading profit/(loss)

173,997 948 (946) (1,276)

172,723 –

172,723 Pre-tax

result of continuing operations 38,951 993 (2,430) (1,276)

36,238 –

36,238 Net consolidated result

39,199

4

39,203 Investment in property, plant and equipment 24,238

943 115,816 (1,272)

139,725 –

139,725 Property, plant

and equipment (intangible and tangible) 5,964,018 78,907 511,614

(634)

6,553,905 –

6,553,905 External financial

liabilities 4,508,641 13,071 – –

4,521,712 –

4,521,712 At 30 June

2017 Revenue 437,773 59,220 – –

496,993 –

496,993

EBITDA 241,388 2,634 (1,397) (433)

242,192 –

242,192

Trading profit/(loss) 167,902 (317) (1,408) (433)

165,744 –

165,744 Pre-tax result of continuing operations 35,741 18

(2,088) 2,464

36,135 –

36,135 Net consolidated result

30,196 5,205

35,401 Investment in property, plant and

equipment 24,716 1,281 136,572 2,464

165,033 –

165,033 Property, plant and equipment (intangible and

tangible) 6,039,721 81,480 330,977 2,397

6,454,575 –

6,454,575 External financial liabilities 4,272,350

14,072 – –

4,286,422 –

4,286,422 At 31 December 2017 Revenue 914,531

118,447 – –

1,032,978 –

1,032,978 EBITDA 522,058

5,939 (800) (953)

526,244 –

526,244 Trading

profit/(loss) 375,423 12 (828) (953)

373,654 –

373,654 Pre-tax result of continuing operations 53,936 325

(3,329) 700

51,632 –

51,632 Net consolidated result

108,166 5,116

113,282 Investment in property, plant

and equipment 76,913 3,648 180,964 705

262,230 –

262,230 Property, plant and equipment (intangible and

tangible) 6,015,767 80,829 395,817 638

6,493,051 –

6,493,051 External financial liabilities 4,273,823

13,577 – –

4,287,400 –

4,287,400

* See note C.2 above.

D.2 Operating costs

Operating costs are analysed as follows:

€'000

1st half 2018

1st half 2017 Full year

2017 Operations and maintenance: subcontracting and spares

54,470 51,060 104,782 Electricity 14,037 14,349 30,086 Cost of

sales and commercial costs 9,637 9,940 16,349 Regulatory costs,

insurance and local taxes 25,040 22,960 40,040 General overheads

and centralised costs 8,747 8,872 20,166

Sub-total Fixed Link 111,931 107,181

211,423 Europorte 32,619 33,029 66,252 ElecLink 578

909 509

Total 145,128

141,119 278,184

D.3 Other operating income and (expenses)

€'000

1st half 2018

1st half 2017 Full year

2017 Other operating income 663 696

1,289

Sub-total other operating income 663 696

1,289 Net loss on disposal or write-off of assets (2,196 )

(1,419 ) (4,733 ) Other (770 ) (4,786 ) (5,508

)

Sub-total other operating expenses (2,966 )

(6,205 ) (10,241 ) Total

(2,303 ) (5,509 ) (8,952 )

D.4 Provisions

€'000

1 January

2018 Charge to income statement

Release of unspent provisions

Provisions utilised 30 June 2018

Continuing activities 61,059 165 (2,174 ) (54,443 )

4,607

Discontinued maritime activity(see note C.2) 12,000 –

– (802 )

11,198 Total

73,059 165 (2,174 )

(55,245 ) 15,805

The provision of £48 million, which was recorded in 2017 in

respect of the indemnity to be paid as part of the acquisition of

the inflation-linked bonds, was released in the first half of 2018

following its payment in February 2018 (see note A.2 above).

E. Personnel expenses and benefits

Share-based payments

E.1 Free share plans with no performance

conditions

Following the approval by the general meeting of shareholders on

18 April 2018 of the plan to issue existing free shares, Getlink

SE’s Board of Directors decided on 18 April 2018 to grant a total

of 348,700 Getlink SE ordinary shares (100 shares per employee) to

all employees of Getlink SE and its related companies with the

exception of executive and corporate officers of Getlink SE. The

vesting period for these shares is one year and is followed by a

three-year lock-up period.

During the first half of 2018, 122,600 free shares issued in

2014 and 237,975 free shares issued in 2017 were acquired by

employees.

Movements on the free share plans

Number of shares

2018

2017 In issue at 1 January 573,075 954,550 Granted during

the period 348,700 253,800 Renounced during the period (9,100 )

(54,175 ) Acquired during the period (360,575 )

(581,100 )

In issue at the end of the period

552,100 573,075

Assumptions used for the fair value measurement on the grant

date

Year of grant

2018 Fair value of free shares

on grant date (€) 10.82 Share price on grant date (€) 11.55 Number

of beneficiaries 3,487 Risk-free interest rate (based on government

bonds): 1 year -0.46 % 4 years -0.04 %

E.2 Preference shares convertible into ordinary shares

subject to performance conditions

On 18 April 2018, the general meeting of shareholders authorised

the Board of Directors to grant to executives and senior staff of

Getlink SE and its subsidiaries preference shares (class D shares)

with a nominal value of €0.01 each with no voting rights which are

convertible into Getlink SE ordinary shares subject to performance

conditions at the end of a three-year period. The total number of

preference shares may not give the right to more than 1,500,000

ordinary shares of a nominal value of €0.40 each. Under this

scheme, the Board approved on 18 April 2018 the grant of 1,500

preference shares, each convertible at the end of the period into a

maximum of 1,000 ordinary shares.

Information on the preference share plans

Date of grant / main staff

concerned Number of shares

Conditions for acquiring rights

Vestingperiod Preference shares granted tokey

executives and senior staff on 18 April 2018 (D shares)

1,500 Staff must remain as employees of the Group.Internal

performance condition for 50% of the attributable volume: based on

the Group's long-term economic performance measured by reference to

the average rate of achievement of the EBITDA targets announced to

the market for the years 2018, 2019 and 2020.External performance

condition (TSR) for 40% of the attributable volume: based on the

stock market performance of the Getlink SE share compared to the

performance of the GPR Getlink SE index (dividends included) over a

3-year period.CSR internal performance condition for 10% of

attributable volume: based on the performance of the 2020 Composite

CSR index. 3 years

Assumptions used for the fair value measurement of

preference shares on the grant date

The fair value on grant date of the rights granted to staff as

part of the plan was calculated by using the Monte Carlo valuation

model. The assumptions used to measure the fair value of the plan

on grant date were as follows:

D shares Fair value on grant date (€)

7.69 Share price on grant date (€) 11.55 Number of beneficiaries 53

Risk-free interest rate (based on government bonds): 1 year -0.32 %

2 years -0.20 % 3 years 0.08 %

E.3 Charges to income statement

€'000

1st half 2018

1st half 2017 Full year

2017 Free shares with no performance conditions 1,551 2,250

3,731 Preference shares and free shareswith performance conditions

1,492 894 2,028

Total

3,043 3,144 5,759

F. Intangible and tangible property, plant and

equipment

The goodwill of €20,392,000 was recorded as part of the

acquisition of ElecLink in 2016.

Other property, plant and equipment consists mainly of the

Europorte subsidiaries’ rolling stock fleet and ElecLink’s

construction works.

Fixed asset additions during the first half of 2018 relate

mainly to construction works on the ElecLink project.

The Group has not identified any indication of impairment in

either the tangible or intangible assets of its Eurotunnel or

Europorte activities or of the ElecLink project.

G. Financing and financial instruments

G.1 Financial liabilities

The movements in financial liabilities during the period were as

follows:

€'000

31 December 2017 published

31 December 2017 restated*

Adjustment IFRS 9** Reclass-

ification Drawdown Repayment

Interest, indexation and fees

30 June 2018 Term Loan 4,206,973 4,209,860 25,929

(23,738 ) – – 27,598 4,239,649 Europorte loans 12,555

12,555 – (530 ) – – –

12,025

Total non-currentfinancial liabilities

4,219,528 4,222,415 25,929

(24,268 ) – –

27,598 4,251,674 Term Loan 61,766 61,814 –

23,738 – (38,492 ) 944 48,004 EASL loan – – – – 214,435 – – 214,435

Europorte loans 1,022 1,022 – 530 – (506 ) – 1,046 Accrued interest

on loans 5,084 5,088 – – –

– 1,465 6,553

Total current

financial liabilities 67,872

67,924 – 24,268

214,435 (38,998 ) 2,409

270,038 Total 4,287,400

4,290,339 25,929 –

214,435 (38,998 ) 30,007

4,521,712

* The financial liabilities at 31 December 2017 (calculated at

the year-end exchange rate of £1=€1.127) have been recalculated at

the exchange rate at 30 June 2018 (£1=€1.129) in order to

facilitate comparison.

** Amount at the exchange rate on 30 June 2018.

Adjustment relating to IFRS 9 : Financial

Instruments

IFRS 9, which is applicable from 1 January 2018, establishes new

principles for the classification and measurement of financial

assets and liabilities and notably modifies the treatment of debt

restructurings which renegotiate debt.

The renegotiation of the A tranches of the Term Loan in December

2015 is the only one of the Group’s transactions which requires

retreatment in accordance with IFRS 9. In accordance with IAS 39,

the debt was maintained in the balance sheet with an adjustment of

the effective interest rate and the spreading of the cash flow

differential over the residual maturity of the debt. In accordance

with IFRS 9, this difference is now recognised in the income

statement as at the renegotiation date.

Application of IFRS 9 is retrospective, by recognising the

cumulative transition effect as an adjustment to opening debt and

equity at 1 January 2018. As a consequence, the restatement has the

effect of increasing the carrying value of the Group’s financial

liabilities by approximately €26 million at 1 January 2018 through