Current Report Filing (8-k)

June 28 2018 - 4:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

June 22, 2018

NELNET, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Nebraska

|

|

001-31924

|

|

84-0748903

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

121 South 13th Street, Suite 100

Lincoln, Nebraska

|

|

68508

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code

(402) 458-2370

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

[ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

[ ]

Item 1.01 Entry into a Material Definitive Agreement.

On June 22, 2018, Nelnet, Inc. (the “Company”) entered into Amendment No. 2 (the “Amendment”) to the Amended and Restated Credit Agreement dated as of October 30, 2015 and previously amended as of December 12, 2016 (the “Amended and Restated Credit Agreement”) for the Company’s $350 million unsecured line of credit with U.S. Bank National Association, as agent for the lenders, and the lender parties thereto. The original Credit Agreement was previously reported under Part II, Item 5 of the Company’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2015 filed by the Company on November 5, 2015, and the prior amendment was previously reported in the Company’s Current Report on Form 8-K filed on December 14, 2016.

The following provisions of the Amended and Restated Credit Agreement were modified under the terms of the Amendment:

|

|

|

|

•

|

The maturity date was extended from December 12, 2021 to June 22, 2023.

|

|

|

|

|

•

|

The definition of the Company’s line of business was expanded and other terms were modified to allow the formation or acquisition of a chartered bank subsidiary.

|

|

|

|

|

•

|

The definition for permitted acquisitions was revised to increase the aggregate amount of consideration that may be paid for the acquisition in any fiscal year of a business or businesses not in the Company’s defined line of business from 7.5 percent of the Company’s consolidated net worth to 12.5 percent.

|

|

|

|

|

•

|

The provisions for permitted investments were expanded to allow (i) a one-time, initial capital contribution of up to $150 million by the Company in connection with the formation or acquisition of a chartered bank subsidiary, and (ii) investments in pools of consumer loans.

|

|

|

|

|

•

|

The amount of loans not originated under the Federal Family Education Loan Program that the Company is permitted to own was increased from $500 million to $850 million.

|

The facility size of $350 million and the cost of funds did not change as part of the Amendment. As of March 31, 2018 and May 8, 2018, there was $150 million and $190 million outstanding, respectively, under the unsecured line of credit and $200 million and $160 million, respectively, was available for future use.

The foregoing summary of the Amendment does not purport to be a complete description of all of the provisions of the Amendment, and is qualified in its entirety by the complete text of the Amendment, a copy of which is filed with this report as Exhibit 10.1 and is incorporated by reference herein.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information related to the $350 million unsecured line of credit discussed under Item 1.01 above is hereby incorporated by reference into this Item 2.03.

Item 7.01 Regulation FD Disclosure.

On June 28, 2018, the Company issued a press release announcing it had filed an application with the Federal Deposit Insurance Corporation (“FDIC”) and the Utah Department of Financial Institutions to establish Nelnet Bank, a Utah-chartered industrial bank. A copy of the press release is furnished as Exhibit 99.1 to this report.

The above information and Exhibit 99.1 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), nor shall such information and Exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

On June 28, 2018, the Company announced it had filed an application with the FDIC and the Utah Department of Financial Institutions to establish Nelnet Bank, a Utah-chartered industrial bank. If the charter is granted, Nelnet Bank would operate as an internet bank franchise focused on the private education loan marketplace, with a home office in Salt Lake City. Nelnet Bank would be a separate subsidiary of the Company, and the industrial bank charter would allow the Company to maintain its other diversified business offerings. The Company expects the charter application process to take an extended period of time.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

The following exhibits are filed or furnished as part of this report:

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1*

|

|

|

|

10.2*

|

|

|

|

99.1**

|

|

|

*

Filed herewith.

** Furnished herewith.

Forward-looking and cautionary statements

This report contains forward-looking statements that involve risks and uncertainties. The words “expect,” “will,” “would,” and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements. No assurance can be given that the results expressed or implied in any forward-looking statements will be achieved, and actual results could be affected by one or more risks and uncertainties, which could cause them to differ materially. Among the key risks and uncertainties that may have a direct bearing on the Company’s future operating results, performance, or financial condition expressed or implied by the forward-looking statements are the risk that the announced industrial bank charter application may not result in the grant of a charter within the expected timeframe or at all; the uncertain nature of the expected benefits from obtaining an industrial bank charter; and other risks and uncertainties set forth in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 and subsequent quarterly reports on Form 10-Q. All forward-looking statements contained in this report are qualified by these cautionary statements and are made only as of the date of this report. Although the Company may from time to time voluntarily update or revise its prior forward-looking statements to reflect actual results or changes in the Company’s expectations, the Company disclaims any commitment to do so except as required by securities laws.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: June 28, 2018

NELNET, INC.

By:

/s/ JAMES D. KRUGER

|

|

|

|

Title:

|

Chief Financial Officer

|

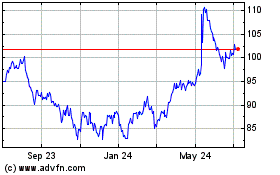

Nelnet (NYSE:NNI)

Historical Stock Chart

From Mar 2024 to Apr 2024

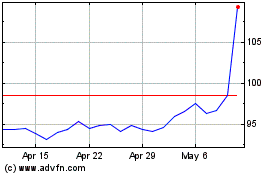

Nelnet (NYSE:NNI)

Historical Stock Chart

From Apr 2023 to Apr 2024