Filed Pursuant to Rule 425

Filing Person: SmartFinancial, Inc.

Subject Company: Foothills Bancorp, Inc.

Commission File No. 001-37661

Welcome to the SmartBank Team!

On June 27th, SmartFinancial, Inc., parent company of SmartBank, and Foothills Bancorp, Inc., parent company of Foothills Bank & Trust, jointly announced the signing of a definitive agreement under which SmartBank will acquire Foothills Bank & Trust.

We are very excited about our expansion and wish you a

warm welcome to the SmartBank team!

SmartBank fosters a work environment that respects individual needs, establishes high expectations and recognizes achievement. Our associates strive to

create “WOW” experiences

and deliver great care for our clients. We are building a team with

high-energy and positive people

that promote SmartBank’s brand and

embrace our culture.

We are excited to get to know you better, and welcome you to the team!

In the coming weeks you will hear more from us on the timeline, specifics of the combination and integration process. As with any business transaction of this nature, SmartBank’s acquisition of Foothills Bank & Trust is subject to regulatory approval and customary closing conditions. At this time we anticipate completion of the acquisition in the fourth quarter of 2018 and a planned bank systems conversion and rebranding in the first quarter of 2019.

It is our goal to make the

integration process seamless

for you and your clients. We want to keep you informed every step of the way, and we will work with you to ease this transition by communicating all transition-related plans often and quickly.

This announcement will likely generate questions. To help answer those, we have included

FAQs

in this packet. Additionally, you will find a

fact sheet

offering a snapshot of our company along with our

Culture and Branding Playbook.

Together we will operate a great bank. We look forward to the weeks and months ahead and could not be more excited about adding Foothills Bank & Trust to our footprint. You are welcome to reach out to Mark Loudermilk or any of us with any questions, and as promised, we will continue to share information about the acquisition as it progresses.

With sincere regards,

FACT SHEET

|

|

-

|

Knoxville-based approximately $2.0 billion Nasdaq traded financial services company

|

|

|

-

|

Billy Carroll, President & CEO | Miller Welborn, Chairman of the Board | Bill Carroll, Vice Chairman of the Board

|

SMARTBANK ORGANIZED IN 2006

|

|

-

|

Recruited Founding Organizers with the original seven member board still serving today

|

|

|

-

|

Now operating with 12 member Board of Directors plus local advisory boards in the Knoxville, Chattanooga, Pensacola and Tuscaloosa markets

|

|

|

-

|

Opened first branch in Pigeon Forge in January 2007

|

GROWTH

–

ORGANIC & M&A

|

|

-

|

By 2011 SmartBank had organically grown to over $325 million in Assets

|

|

|

-

|

2012 – Acquired Destin-based GulfSouth Private Bank adding branches in the Florida Panhandle (October)

|

|

|

-

|

2014 – Announced a definitive agreement to merge with Chattanooga-based Cornerstone Community Bank (December)

|

|

|

-

|

2016 – Successfully completed the merger with Cornerstone Community Bank which added 5 new branches and became a $1 billion combined company (February). Announced definitive agreement to acquire an FSG Bank branch from Atlantic Capital Bank in Cleveland, TN (December)

|

|

|

-

|

2017 – SmartBank successfully completed the acquisition and integration of an FSG Bank branch in Cleveland, TN (May).

|

|

|

-

|

2018 – Successfully completed the acquisition and integration of Tuscaloosa, AL-based Capstone Bank (February) SmartFinancial, Inc. closed the acquisition of Tullahoma, TN-based Southern Community Bank (May).

|

NASDAQ: SMBK

|

|

-

|

SmartFinancial announced trading on the Nasdaq Capital Market in December 2015 trading under the ticker symbol: SMBK

|

BRANCHES

|

|

-

|

26 full-service SmartBank branches spanning Tennessee, Alabama and the Florida Panhandle

|

|

|

-

|

Four Loan Production Offices in Dalton, GA, Daphne, AL, Panama City, FL, and Morristown, TN

|

|

|

-

|

Demonstrate Accountability

|

SMARTFINANCIAL, INC.

At SmartBank, delivering unparalleled value to our Shareholders, Associates, Clients and the Communities we serve drives every decision and action we take. Exceptional Value means being there with smart solutions, fast responses and deep commitment every single time. By doing this, we will create the Southeast’s next, great community banking franchise.

Q: Who are SmartFinancial and SmartBank?

A: SmartFinancial, Inc. is a single-bank holding company based in Knoxville, Tennessee that operates SmartBank, a full-service commercial bank founded in 2007, with approximately $2 billion in assets, 26 branches and four loan production offices throughout throughout Tennessee, Alabama and the Florida Panhandle.

Q: Will we be part of a publicly traded company?

A: Yes. SmartFinancial stock is traded on Nasdaq under the ticker symbol SMBK.

Q: What do I say to clients who call with concerns as a result of the acquisition?

A: Refer them to the appropriate relationship managers, and if they have further questions, direct them to the appropriate management team member. A letter will be mailed within the next 2 weeks to all clients and shareholders with a copy of the press release.

Q: Who will lead the combined company? The banks?

A: At both the company (SmartFinancial) and the bank (SmartBank),

Billy Carroll

is the President & Chief Executive Officer.

Miller Welborn

is the Chairman of both SmartFinancial and SmartBank.

Bill Carroll

is the Vice Chairman of both SmartFinancial and SmartBank.

Q: Where will the company’s headquarters be? The bank’s?

A: SmartFinancial’s headquarters are in Knoxville, and the bank will remain headquartered in Pigeon Forge.

Q: Who serves on the board?

A: The SmartFinancial & SmartBank boards consist of Miller Welborn, Chair; Bill Carroll, Vice Chair; Monique Berke; Vic Barrett; Billy Carroll; Clifton Miller; Ted Miller; David Ogle; Keith Whaley; Geoff Wolpert; Steve Tucker; and Beau Wicks.

Q: When will the acquisition occur?

A: We currently anticipate the transaction taking place in the fourth quarter 2018 with a planned systems conversion and rebranding in the first quarter of 2019. We will begin integration planning immediately.

Q: What does this decision mean for me? Do I still have a job?

A: There will be no immediate changes. Unfortunately, in transactions such as these there is always some impact as a result of the overlap that exists between the two companies and some Associates will be impacted. We will begin Associate meetings in the coming weeks. With corporate offices being so close in location, there may be a number of potential opportunities for ongoing roles for impacted Associates.

Q: Will any locations close because of the acquisition?

A: We currently plan no changes to Foothills locations.

Q: How are clients being notified about the transaction?

A: A press release has been distributed nationally. Clients will be notified through our website, regular mail and email where applicable. Shareholders will be notified through email and regular mail.

Q: How will the acquisition impact clients? What differences will they see?

A: None immediately. As we convert systems in first quarter 2019, we will be communicating with clients to make the conversion process as smooth as possible. We will continue to deliver the outstanding client service that both banks are known for, and that’s the real key.

Q: How should we answer the phone? Starting when?

A: No changes on phone answering at this time.

Q: Will we have career opportunities at other SmartBank offices?

A: Yes, we will look to post job opportunities in all of our markets.

Q: Who should I contact if I have questions about the acquisition?

A: Any member of the executive management team should be able to answer questions; however, please do not hesitate to contact either Mark Loudermilk (mloudermilk@fhbank.com) or Billy Carroll (billy.carroll@smartbank.com).

(continued on back)

Q: What if I have HR-related questions about the acquisition process?

A: You may contact your manager or Diane Short (diane.short@smartbank.com) or Becca Boyd (becca.boyd@smartbank.com), Corporate Human Resources, with any questions that need immediate attention. If we don’t have specific answers yet due to timing or other considerations, we will share additional information with you as soon as we are able.

Q: How often will we receive updates regarding the acquisition?

A: Leaders of our companies have discussed our common commitment to thorough and ongoing communication. We are committed to provide updates and answer your questions as often and candidly as possible. You can always reach out to your manager or any member of the senior management team.

Q: What should I do if someone from the media calls to ask about the acquisition?

A: Send all media related inquires to Kelley Fowler at kelley.fowler@smartbank.com or 865.868.0611. Kelley will field the media inquiries and forward to the most appropriate executive management team member.

Q: How and when will I get trained on SmartBank systems and processes?

A: Training on operations, policies and procedures may take place at your branch/office prior to the transition date, provided it is not disruptive to the current operations of the branches/offices. You will receive future communication regarding training.

Q: Will my benefits change?

A: As part of our integration planning over the coming months, we will be reviewing benefits at both banks and making a determination on the appropriate benefits for our combined company. There will be changes, but we assure you that we will provide a very sound benefits package. Our goal is to provide the best benefits package possible to our team members in order to recruit and retain the best talent.

Q: Will our culture change?

A: Culture is one of the most critical pieces of this transaction, and any changes will be for the betterment and unity of the new combined teams and our bank’s brand identity.

Important Information for Shareholders

This communication shall not constitute an offer to sell, the solicitation of an offer to sell, or the solicitation of an offer to buy any securities or the solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed merger, SmartFinancial, Inc. (

“SmartFinancial”

) will file a registration statement on Form S-4 with the Securities and Exchange Commission (the

“SEC”

), which will contain the proxy statement of Foothills Bancorp, Inc. (

“Foothills Bancorp”

) and a prospectus of SmartFinancial. Shareholders of Foothills Bancorp are encouraged to read the registration statement, including the proxy statement/ prospectus that will be part of the registration statement, because it will contain important information about the merger, Foothills Bancorp, and SmartFinancial. After the registration statement is filed with the SEC, the proxy statement/prospectus and other relevant documents will be mailed to all Foothills Bancorp shareholders and will be available for free on the SEC’s website (www.sec.gov). The proxy statement/prospectus will also be made available for free by contacting Ron Gorczynski, Chief Administrative Officer at (865) 437-5724. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Forward-Looking Statements

Certain of the statements made in this communication may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements, including statements regarding the intent, belief, or current expectations of SmartFinancial’s management regarding the company’s strategic direction, prospects, future results, and benefits of the merger, are subject to numerous risks and uncertainties. Such factors include, among others, (1) the risk that the cost savings and any revenue synergies from the merger may not be realized or take longer than anticipated to be realized, (2) disruption from the merger with customers, suppliers or employee relationships, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (4) the risk of successful integration of the two companies’ businesses, (5) the failure of Foothills Bancorp’s shareholders to approve the merger, (6) the amount of the costs, fees, expenses and charges related to the merger, (7) the ability to obtain required governmental approvals of the proposed terms of the merger, (8) reputational risk and the reaction of the parties’ customers to the merger, (9) the failure of the closing conditions to be satisfied, (10) the risk that the integration of Foothills Bancorp’s operations with SmartFinancial will be materially delayed or will be more costly or difficult than expected, (11) the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by SmartFinancial’s issuance of additional shares of its common stock in the merger, and (13) general competitive, economic, politics of and market conditions. Additional factors which could affect the forward looking statements can be found in SmartFinancial’s annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K filed with or furnished to the SEC and available on the SEC’s website at http://www.sec.gov. SmartFinancial disclaims any obligation to update or revise any forward-looking statements contained in this release which speak only as of the date hereof, whether as a result of new information, future events or otherwise.

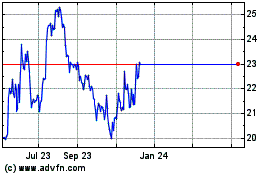

SmartFinancial (NASDAQ:SMBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

SmartFinancial (NASDAQ:SMBK)

Historical Stock Chart

From Apr 2023 to Apr 2024