Safe Bulkers, Inc. (the “Company”) (NYSE:SB), an international

provider of marine drybulk transportation services, announced today

its unaudited financial results for the three month period ended

March 31, 2018.

Summary of First Quarter 2018

Results

- Net revenues for the first quarter

of 2018 increased by 31% to $43.5 million from $33.3 million during

the same period in 2017.

- Net income for the first quarter of 2018 was $6.0 million as

compared to a net loss of $3.3 million, during the same period in

2017. Adjusted net income1 for the first quarter of 2018 was $5.7

million as compared to an Adjusted net loss of $3.4 million, during

the same period in 2017.

- EBITDA2 for the first quarter of 2018 increased by 53% to $23.5

million compared to $15.4 million during the same period in 2017.

Adjusted EBITDA3 for the first quarter of 2018 increased by 53% to

$23.2 million from $15.2 million during the same period in

2017.

- Earnings per share4 and Adjusted

earnings per share4 for the first quarter of 2018 were $0.03,

calculated on a weighted average number of 101,540,728 shares,

compared to a Loss per share and Adjusted loss per share of $0.07

during the same period in 2017, calculated on a weighted average

number of 99,284,181 shares.

___________1 Adjusted Net income/(loss) is a

non-GAAP measure. Adjusted Net income/(loss) represents Net

income/(loss), before loss on sale of assets, gain/(loss) on

derivatives and gain/(loss) on foreign currency. See Table 1.2

EBITDA is a non-GAAP measure and represents Net income/(loss) plus

net interest expense, tax, depreciation and amortization. See Table

1.3 Adjusted EBITDA is a non-GAAP measure and represents EBITDA

before loss on sale of assets, gain/(loss) on derivatives and

gain/(loss) on foreign currency. See Table 1.4 Earnings/(loss) per

share and Adjusted Earnings/(loss) per share represent Net

income/(loss) and Adjusted Net income/(loss) less preferred

dividend divided by the weighted average number of shares

respectively. See Table 1.

Redemption of Series B Preferred

Shares

On February 20, 2018, we completed the

previously announced redemption of 379,514 outstanding 8.00% Series

B Cumulative Redeemable Perpetual Preferred Shares (the “Series B

Preferred Shares“) at a redemption price of $25.00 per Series B

Preferred Share plus all accumulated and unpaid dividends. There

are currently no issued and outstanding Series B Preferred

Shares.

Fleet and Employment

Profile

As of May 24, 2018, our operational fleet

comprised of 39 drybulk vessels with an average age of 7.9 years

and an aggregate carrying capacity of 3.5 million dwt. Our fleet

consists of 14 Panamax class vessels, 9 Kamsarmax class vessels, 13

post- Panamax class vessels and 3 Capesize class vessels, all built

2003 onwards. Upon delivery of our last contracted drybulk newbuild

Kamsarmax class vessel, scheduled for delivery in June 2018, and

assuming no additional vessel acquisitions or disposals, our fleet

will comprise of 40 vessels, 11 of which will be eco-design

vessels, with an aggregate carrying capacity of 3.6 million

dwt.

Set out below is a table showing the Company’s

existing and newbuild vessels and their contracted employment as of

May 24, 2018:

|

|

|

|

|

|

|

|

Vessel Name |

DWT |

Year Built |

Country of construction |

Gross Charter Rate

[USD/day]1 |

Charter Duration2 |

| Panamax |

|

Maria |

76,000 |

2003 |

Japan |

|

|

|

Koulitsa |

76,900 |

2003 |

Japan |

|

|

|

Paraskevi |

74,300 |

2003 |

Japan |

7,400 |

Apr 2017 – Jun 2018 |

|

Vassos |

76,000 |

2004 |

Japan |

13,350 |

Jan 2018 – Sept 2018 |

|

Katerina |

76,000 |

2004 |

Japan |

9,000 |

May 2018 - Apr 2019 |

|

Maritsa |

76,000 |

2005 |

Japan |

10,100 |

Sep 2017 – Dec 2018 |

|

Efrossini |

75,000 |

2012 |

Japan |

12,000 |

May 2018 – Jul 2018 |

|

Zoe |

75,000 |

2013 |

Japan |

8,200 |

Nov 2017 – Mar 2019 |

|

Kypros Land |

77,100 |

2014 |

Japan |

13,000 |

Apr 2018 – Jun 2018 |

|

Kypros Sea |

77,100 |

2014 |

Japan |

11,250 |

Jul 2017 – Aug 2018 |

|

Kypros Bravery |

78,000 |

2015 |

Japan |

14,400 |

Apr 2018 – Aug 2018 |

|

Kypros Sky |

77,100 |

2015 |

Japan |

10,75014,000 |

May 2018 – May 2018Jun 2018 – Oct 2018 |

|

Kypros Loyalty |

78,000 |

2015 |

Japan |

12,850 |

Jan 2018 – Dec 2018 |

|

Kypros Spirit |

78,000 |

2016 |

Japan |

12,75014,000 |

Feb 2018 – May 2018May 2018 – Oct 2018 |

| Kamsarmax |

|

Pedhoulas Merchant |

82,300 |

2006 |

Japan |

14,500 |

Apr 2018 – Mar 2019 |

|

Pedhoulas Trader |

82,300 |

2006 |

Japan |

11,600 |

Sep 2017 – Aug2018 |

|

Pedhoulas Leader |

82,300 |

2007 |

Japan |

13,250 |

Jan 2018 – May 2018 |

|

Pedhoulas Commander |

83,700 |

2008 |

Japan |

|

|

|

Pedhoulas Builder |

81,600 |

2012 |

China |

8,4009,900 |

Apr 2017 – Jun 2018Jun 2018 – Aug 2019 |

|

Pedhoulas Fighter |

81,600 |

2012 |

China |

14,850 |

Mar 2018– Jul 2018 |

|

Pedhoulas Farmer 3 |

81,600 |

2012 |

China |

12,600 |

Jan 2018 – Aug 2018 |

|

Pedhoulas Cherry 3 |

82,000 |

2015 |

China |

6,600 |

Apr 2017 – Oct 2018 |

|

Pedhoulas Rose 3 |

82,000 |

2017 |

China |

10,000 |

Mar 2018 – May 2019 |

| Post-Panamax |

|

Marina |

87,000 |

2006 |

Japan |

12,75013,300 |

Apr 2018 – May 2018May 2018 – Jul 2018 |

|

Xenia |

87,000 |

2006 |

Japan |

10,00012,500 |

Feb 2017 – Jun 2018Jun 2018 – Nov 2019 |

|

Sophia |

87,000 |

2007 |

Japan |

7,250 |

Apr 2016 – Nov 2018 |

|

Eleni |

87,000 |

2008 |

Japan |

12,400 |

Apr 2018 – Jun 2018 |

|

Martine |

87,000 |

2009 |

Japan |

12,700 |

May 2018 – Jun 2018 |

|

Andreas K |

92,000 |

2009 |

South Korea |

14,250 |

Mar 2018 – Jun 2018 |

|

Panayiota K |

92,000 |

2010 |

South Korea |

13,000 |

May 2018 – Jun 2018 |

|

Agios Spyridonas |

92,000 |

2010 |

South Korea |

12,500 |

May 2018 – Jun 2018 |

|

Venus Heritage |

95,800 |

2010 |

Japan |

13,200 |

Nov 2017 – Mar 2019 |

|

Venus History |

95,800 |

2011 |

Japan |

14,750 |

Jan 2018 – Jan 2019 |

|

Venus Horizon |

95,800 |

2012 |

Japan |

13,950 |

Jan 2018 – Dec 2018 |

|

Troodos Sun |

85,000 |

2016 |

Japan |

15,950 |

Mar 2018 – Feb 2019 |

|

Troodos Air |

85,000 |

2016 |

Japan |

12,500 |

May 2018 – Sep 2019 |

| Capesize |

|

Kanaris |

178,100 |

2010 |

China |

25,928 |

Sep 2011 – Jun 2031 |

|

Pelopidas |

176,000 |

2011 |

China |

38,000 |

Feb 2012 – Dec 2021 |

|

Lake Despina |

181,400 |

2014 |

Japan |

24,376 4 |

Jan 2014 – Jan 2024 |

|

Total dwt of existing fleet |

3,513,800 |

|

| |

|

|

| |

|

|

|

|

|

|

Hull Number |

DWT |

Expected delivery |

Country of construction |

Gross Charter Rate [USD/day] |

Charter Duration1 |

| Kamsarmax |

|

Hull 1552 |

81,600 |

H1 2018 |

Japan |

15,500 |

Jun 2018 – May 2019 |

|

Total dwt of orderbook |

81,600 |

|

|

|

|

| |

|

|

|

|

|

- Charter rate is the recognized

gross daily charter rate. For charter parties with variable rates

among periods or consecutive charter parties with the same

charterer, the recognized gross daily charter rate represents the

weighted average gross daily charter rate over the duration of the

applicable charter period or series of charter periods, as

applicable. In case a charter agreement provides for additional

payments, namely ballast bonus to compensate for vessel

repositioning, the gross daily charter rate presented has been

adjusted to reflect estimated vessel repositioning expenses. In

case of voyage charters the charter rate represents revenue

recognized on a pro-rata basis over the duration of the voyage from

load to discharge port less related voyage expenses.

- The start date represents either

the actual start date or, in the case of a contracted charter that

had not commenced as of May 24, 2018, the scheduled start date. The

actual start date and redelivery date may differ from the

referenced scheduled start and redelivery dates depending on the

terms of the charter and market conditions and does not reflect the

options to extend the period time charter.

- Vessel sold and leased back on a

net daily bareboat charter rate of $6,500 for a period of 10 years,

with a purchase obligation at the end of the 10th year and purchase

options in favor of the Company after the second year of the

bareboat charter, at annual intervals and predetermined purchase

prices.

- A period time charter of ten years

at a gross daily charter rate of $23,100 for the first two and a

half years and of $24,810 for the remaining period. In January

2017, the period time charter was amended to reflect substitution

of the initial charterer with its subsidiary guaranteed by the

initial charterer and changes in payment terms; all other charter

terms remained unchanged. The charter agreement grants the

charterer an option to purchase the vessel at any time beginning at

the end of the seventh year of the charter, at a price of $39

million less a 1.00% commission, decreasing thereafter on a

pro-rated basis by $1.5 million per year. The Company holds a right

of first refusal to buy back the vessel in the event that the

charterer exercises its option to purchase the vessel and

subsequently offers to sell such vessel to a third party. The

charter agreement also grants the charterer the option to extend

the period time charter for an additional twelve months at a time

at a gross daily charter rate of $26,330, less 1.25% total

commissions, which option may be exercised by the charterer a

maximum of two times.

The contracted employment of fleet ownership

days as of May 24, 2018, was:

| |

|

|

| 2018 (remaining) |

58 |

% |

| 2018 (full year) |

74 |

% |

| 2019 |

18 |

% |

| 2020 |

8 |

% |

| |

|

|

Order book, capital expenditure

requirements and liquidity as of May 24, 2018

The remaining order book of the Company

consisted of one newbuild vessel, Hull No. 1552, with scheduled

delivery date in June 2018.

The aggregate remaining capital expenditure,

relating to the purchase consideration of the newbuild, amounted to

$21.6 million payable within 2018.

We have agreed to finance Hull No. 1552 by one

of our wholly-owned subsidiaries issuing $16.9 million of preferred

equity to an unaffiliated investor in 2018.

We had liquidity of $105.0 million consisting of

$69.4 million in cash and bank time deposits, $9.8 million in

restricted cash and $25.8 million net available under committed

loan facilities in addition to $16.9 million of preferred equity

and the capacity to borrow against one unencumbered vessel.

Refinancing of credit

facilities

As of May 24, 2018, the Company has agreed: i)

to finance the recently acquired second hand vessel, which was paid

from cash from operations, by increasing an existing credit

facility of $36.7 million secured by three vessels to $54.0 million

which will be secured by the four vessels after the increase; the

relevant tranche of the loan will have a 6 year term and ii) to

finance an unencumbered vessel and refinance another existing

facility of $23.5 million with a new 5 year term loan of $32.0

million. Both loan facilities contain financial covenants

consistent with the existing loan and credit facilities of the

Company.

Dividend Policy

The Board of Directors of the Company has not

declared a dividend to its common stock holders for the first

quarter of 2018. The Company had 101,545,460 shares of common stock

issued and outstanding as of May 24, 2018.

The Company declared in April a cash dividend of

$0.50 per share on its 8.00% Series C Cumulative Redeemable

Perpetual Preferred Shares (NYSE:SB.PR.C) and on its 8.00% Series D

Cumulative Redeemable Perpetual Preferred Shares (NYSE:SB.PR.D) for

the period from January 30, 2018 to April 29, 2018, which was paid

on April 30, 2018 to the respective shareholders of record as of

April 23, 2018.

The declaration and payment of dividends, if

any, will always be subject to the discretion of the Board of

Directors of the Company. The timing and amount of any dividends

declared will depend on, among other things: (i) the Company’s

earnings, financial condition and cash requirements and available

sources of liquidity; (ii) decisions in relation to the Company’s

growth and leverage strategies; (iii) provisions of Marshall

Islands and Liberian law governing the payment of dividends; (iv)

restrictive covenants in the Company’s existing and future debt

instruments; and (v) global economic and financial conditions.

Management Commentary

Dr. Loukas Barmparis, President of the Company,

said: “Our revenues continued to improve supporting gradual

increase in our profitability. We intend to continue to use our

cash from operations to further improve our capital structure and

deleverage in forthcoming quarters."

Conference Call

On Wednesday, May 30, 2018 at 8:30 A.M. Eastern

Time, the Company’s management team will host a conference call to

discuss the Company’s financial results.

Participants should dial into the call 10

minutes before the scheduled time using the following numbers: 1

(866) 819-7111 (US Toll Free Dial In), 0(800) 953-0329 (UK Toll

Free Dial In) or +44 (0)1452-542-301 (Standard International Dial

In). Please quote “Safe Bulkers” to the

operator.

A telephonic replay of the conference call will

be available until June 6, 2018 by dialing 1 (866) 247-4222 (US

Toll Free Dial In), 0(800) 953-1533 (UK Toll Free Dial In) or +44

(0)1452 550-000 (Standard International Dial In). Access Code:

1859591#

Slides and Audio Webcast

There will also be a live, and then archived,

webcast of the conference call, available through the Company’s

website (safebulkers.com). Participants in the live webcast should

register on the website approximately 10 minutes prior to the start

of the webcast.

Management Discussion of First Quarter

2018 Results

Net income for the first quarter of 2018 was

$6.0 million compared to a net loss of $3.3 million during the same

period in 2017, mainly due to the following factors:

Net revenues: Net revenues increased by 31% to

$43.5 million for the first quarter of 2018, compared to $33.3

million for the same period in 2017, mainly due to improved charter

rates and to a lesser extent an increase in the average number of

vessels. The Company operated 39.00 vessels on average during the

first quarter of 2018, earning a TCE6 rate of $11,999, compared to

37.82 vessels and a TCE6 rate of $9,417 during the same period in

2017.

Vessel operating expenses: Vessel operating

expenses, which include dry-docking cost and initial supplies

expenses, increased by 19% to $14.5 million for the first quarter

of 2018, compared to $12.2 million for the same period in 2017,

mainly as a result of: i) increased costs of maintenance, general

stores and spares of $3.5 million for the first quarter of 2018,

compared to $2.0 million for the same period in 2017, due to

increased purchase of spares relating to the scheduled drydocking

of three vessels in the second quarter of 2018 and ii) increased

average number of vessels by 3% to 39.00 vessels for the first

quarter of 2018, from 37.82 vessels for the same period in 2017 and

increased maintenance costs due to a second-hand delivery at the

end of 2017.

Depreciation: Depreciation decreased by 8% to

$11.6 million for the first quarter of 2018, compared to $12.6

million for the same period in 2017, as a result of the lower cost

basis of four of our vessels following the impairment recorded

during the fourth quarter of 2017, partly offset by the increase in

the average number of vessels operated by the Company during the

first quarter of 2018.

Interest expenses: Interest expense remained

almost stable to $5.8 million in the first quarter of 2018,

compared to $5.7 million for the same period in 2017.

Voyage expenses: Voyage expenses remained stable

at $1.5 million for the first quarter of 2018 compared to the same

period in 2017.

Daily vessel operating expenses5: Daily vessel

operating expenses, which are calculated by dividing vessel

operating expenses for the relevant period by ownership days for

such period, increased by 15% to $4,132 for the first quarter of

2018 compared to $3,596 for the same period in 2017 as a result of

the increased purchase of spares relating to the scheduled

drydocking of three vessels in the second quarter of 2018 and

increased maintenance costs due to a second-hand delivery at the

end of 2017.

Daily general and administrative expenses5:

Daily general and administrative expenses, which include management

fees payable to our Managers7 increased by 2.4% to $1,184 for the

first quarter of 2018, compared to $1,156 for the same period in

2017.

___________5 See Table 2.6 Time charter

equivalent rates, or TCE rate, represents the Company’s charter

revenues less commissions and voyage expenses during a period

divided by the number of our available days during such period.7

Safety Management Overseas S.A. and Safe Bulkers Management

Limited, each a related party referred in this press release as

“our Manager” and collectively “our Managers".

| |

| Unaudited Interim Financial Information and

Other Data |

| |

| SAFE BULKERS, INC. |

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED) |

| (In thousands of U.S. Dollars except for share

and per share data) |

| |

|

|

Three-Months Period Ended

March 31, |

| |

2017 |

|

2018 |

|

REVENUES: |

|

|

|

|

|

|

Revenues |

34,663 |

|

|

45,352 |

|

|

Commissions |

(1,336 |

) |

|

(1,851 |

) |

|

Net revenues |

33,327 |

|

|

43,501 |

|

|

EXPENSES: |

|

|

| Voyage

expenses |

(1,452 |

) |

|

(1,506 |

) |

| Vessel

operating expenses |

(12,242 |

) |

|

(14,503 |

) |

|

Depreciation |

(12,640 |

) |

|

(11,601 |

) |

| General

and administrative expenses |

(3,935 |

) |

|

(4,156 |

) |

| Other

operating expense |

(475 |

) |

|

- |

|

| Loss on

sale of assets |

(120 |

) |

|

- |

|

|

Operating income |

2,463 |

|

|

11,735 |

|

| OTHER (EXPENSE)

/ INCOME: |

|

|

| Interest

expense |

(5,701 |

) |

|

(5,786 |

) |

| Other

finance costs |

(49 |

) |

|

(132 |

) |

| Interest

income |

136 |

|

|

214 |

|

| Gain on

derivatives |

101 |

|

|

17 |

|

| Foreign

currency gain |

195 |

|

|

248 |

|

|

Amortization and write-off of deferred finance charges |

(399 |

) |

|

(342 |

) |

|

Net (loss)/ income |

(3,254 |

) |

|

5,954 |

|

| Less

Preferred dividend |

3,493 |

|

|

2,858 |

|

| Net

(loss)/ income available to common shareholders |

(6,747 |

) |

|

3,096 |

|

|

(Loss)/Income per share basic and

diluted |

(0.07 |

) |

|

0.03 |

|

|

Weighted average number of shares |

99,284,181 |

|

|

101,540,728 |

|

|

|

|

|

|

|

|

|

|

| |

|

Three-Months Period Ended

March 31, |

| |

|

2017 |

|

|

2018 |

| (In million of

U.S. Dollars) |

|

|

|

|

|

| CASH FLOW

DATA |

|

|

|

|

|

|

|

| Net cash provided by

operating activities |

|

$ |

10.2 |

|

|

|

$ |

20.1 |

|

| Net cash used in

investing activities |

|

|

(6.4 |

) |

|

|

|

(2.3 |

) |

| Net cash provided

by/(used in) financing activities |

|

|

15.4 |

|

|

|

|

(18.2 |

) |

| Net increase/(decrease)

in cash and cash equivalents |

|

|

19.2 |

|

|

|

|

(0.4 |

) |

|

|

| |

| SAFE BULKERS, INC. |

| CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) |

| (In thousands of U.S.

Dollars) |

| |

| |

December 31, 2017 |

|

March 31, 2018 |

|

ASSETS |

|

|

|

| Cash,

restricted cash and time deposits |

60,016 |

|

61,265 |

| Other

current assets |

19,070 |

|

17,004 |

| Vessels,

net |

942,876 |

|

931,275 |

| Advances

for vessels |

3,653 |

|

3,976 |

|

Restricted cash non-current |

8,651 |

|

8,651 |

| Other

non-current assets |

831 |

|

826 |

|

Total assets |

1,035,097 |

|

1,022,997 |

| LIABILITIES AND

EQUITY |

|

|

|

| Other

current liabilities |

11,345 |

|

11,076 |

| Current

portion of long-term debt, net |

25,588 |

|

48,046 |

| Long-term

debt, net |

541,816 |

|

514,019 |

|

Shareholders’ equity |

456,348 |

|

449,856 |

|

Total liabilities and equity |

1,035,097 |

|

1,022,997 |

|

|

|

|

|

| |

| TABLE 1 |

| RECONCILIATION OF ADJUSTED NET INCOME/(LOSS),

EBITDA, ADJUSTED EBITDA AND ADJUSTED EARNINGS/(LOSS) PER

SHARE |

| |

|

|

Three-Months Period Ended

March 31, |

| (In thousands of U.S.

Dollars except for share and per share data) |

2017 |

|

2018 |

| Net

(Loss)/Income – Adjusted Net (Loss)/Income |

|

|

| Net (loss)/

income |

(3,254 |

) |

|

5,954 |

|

| Plus Loss on sale of

assets |

120 |

|

|

- |

|

| Less Gain on

derivatives |

(101 |

) |

|

(17 |

) |

| Less Foreign currency

gain |

(195 |

) |

|

(248 |

) |

| Adjusted Net

(loss)/income |

(3,430 |

) |

|

5,689 |

|

|

|

|

|

| EBITDA -

Adjusted EBITDA |

|

|

| Net

(loss)/income |

(3,254 |

) |

|

5,954 |

|

| Plus Net Interest

expense |

5,565 |

|

|

5,572 |

|

| Plus Depreciation |

12,640 |

|

|

11,601 |

|

| Plus Amortization |

399 |

|

|

342 |

|

|

EBITDA |

15,350 |

|

|

23,469 |

|

| Plus Loss on sale of

assets |

120 |

|

|

- |

|

| Less Gain on

derivatives |

(101 |

) |

|

(17 |

) |

| Less Foreign currency

gain |

(195 |

) |

|

(248 |

) |

| ADJUSTED

EBITDA |

15,174 |

|

|

23,204 |

|

|

|

|

|

| (Loss)/

Earnings per share |

|

|

| Net

(loss)/income |

(3,254 |

) |

|

5,954 |

|

| Less Preferred

dividend |

3,493 |

|

|

2,858 |

|

| Net (loss)/income

available to common shareholders |

(6,747 |

) |

|

3,096 |

|

| Weighted average number

of shares |

99,284,181 |

|

|

101,540,728 |

|

|

(Loss)/Earnings

per share |

(0.07 |

) |

|

0.03 |

|

|

|

|

|

| Adjusted

(Loss)/Earnings per share |

|

|

| Adjusted Net

(Loss)/Income |

(3,430 |

) |

|

5,689 |

|

| Less Preferred

dividend |

3,493 |

|

|

2,858 |

|

| Adjusted Net

(loss)/income available to common shareholders |

(6,923 |

) |

|

2,831 |

|

| Weighted average number

of shares |

99,284,181 |

|

|

101,540,728 |

|

| Adjusted

(Loss)/Earnings per share |

(0.07 |

) |

|

0.03 |

|

| |

|

|

|

|

|

EBITDA, Adjusted EBITDA, Adjusted Net

income/(loss) and Adjusted earnings/(loss) per share are not

recognized measurements under US GAAP. - EBITDA represents Net

income/(loss) before interest, income tax expense, depreciation and

amortization. - Adjusted EBITDA represents EBITDA before loss on

sale of assets, gain/(loss) on derivatives, and gain/(loss) on

foreign currency. - Adjusted Net income/(loss) represents Net

income/(loss) before loss on sale of assets, gain/(loss) on

derivatives, and gain/(loss) on foreign currency. - Adjusted

earnings/(loss) per share represents Adjusted Net income/(loss)

less preferred dividend divided by the weighted average number of

shares.EBITDA, Adjusted EBITDA, Adjusted Net income/(loss) and

Adjusted earnings/(loss) per share are used as supplemental

financial measures by management and external users of financial

statements, such as investors, to assess our financial and

operating performance. The Company believes that these non-GAAP

financial measures assist our management and investors by

increasing the comparability of our performance from period to

period. The Company believes that including these supplemental

financial measures assists our management and investors in (i)

understanding and analyzing the results of our operating and

business performance, (ii) selecting between investing in us and

other investment alternatives and (iii) monitoring our financial

and operational performance in assessing whether to continue

investing in us. The Company believes that EBITDA, Adjusted EBITDA,

Adjusted Net income/(loss) and Adjusted earnings/(loss) per share

are useful in evaluating the Company’s operating performance from

period to period because the calculation of EBITDA generally

eliminates the effects of financings, income taxes and the

accounting effects of capital expenditures and acquisitions, the

calculation of Adjusted EBITDA generally further eliminates the

effects from loss on sale of assets, gain/(loss) on derivatives and

gain/(loss) on foreign currency, items which may vary from year to

year and for different companies for reasons unrelated to overall

operating performance. Furthermore, the calculation of Adjusted Net

income/(loss) generally eliminates the effects of loss on sale of

assets, gain/(loss) on derivatives and gain/(loss) on foreign

currency, items which may vary from year to year and for different

companies for reasons unrelated to overall operating performance.

EBITDA, Adjusted EBITDA, Adjusted Net income/(loss) and Adjusted

earnings/(loss) per share have limitations as analytical tools, and

should not be considered in isolation, or as a substitute for

analysis of the Company’s results as reported under US GAAP.

EBITDA, Adjusted EBITDA, Adjusted Net income/(loss) should not be

considered as substitutes for net income and other operations data

prepared in accordance with US GAAP or as a measure of

profitability. While EBITDA and Adjusted EBITDA, Adjusted Net

income/(loss) and Adjusted earnings/(loss) per share, are

frequently used as measures of operating results and performance,

they are not necessarily comparable to other similarly titled

captions of other companies due to differences in methods of

calculation. In evaluating Adjusted EBITDA, Adjusted Net

income/(loss) and Adjusted earnings/(loss) per share, you should be

aware that in the future we may incur expenses that are the same as

or similar to some of the adjustments in this presentation. Our

presentation of Adjusted EBITDA, Adjusted Net income/(loss) and

Adjusted earnings/(loss) per share should not be construed as an

inference that our future results will be unaffected by the

excluded items.

| |

|

|

| TABLE 2: FLEET DATA AND AVERAGE DAILY

INDICATORS |

| |

|

|

| |

|

Three-Month Period Ended March 31, |

| |

|

|

2017 |

|

|

|

2018 |

|

| |

|

|

|

|

| FLEET DATA |

|

|

|

|

| Number of vessels at

period end |

|

|

38 |

|

|

|

39 |

|

| Average age of fleet

(in years) |

|

|

6.75 |

|

|

|

7.76 |

|

| Ownership days (1) |

|

|

3,404 |

|

|

|

3,510 |

|

| Available days (2) |

|

|

3,385 |

|

|

|

3,500 |

|

| Operating days (3) |

|

|

3,333 |

|

|

|

3,424 |

|

| Fleet utilization

(4) |

|

|

97.9 |

% |

|

|

97.5 |

% |

| Average number of

vessels in the period (5) |

|

|

37.82 |

|

|

|

39.00 |

|

| |

|

|

|

|

| AVERAGE DAILY

RESULTS |

|

|

|

|

| Time charter equivalent

rate (6) |

|

$ |

9,417 |

|

|

$ |

11,999 |

|

| Daily vessel operating

expenses (7) |

|

$ |

3,596 |

|

|

$ |

4,132 |

|

| Daily general and

administrative expenses (8) |

|

$ |

1,156 |

|

|

$ |

1,184 |

|

| |

|

|

|

|

|

|

|

|

___________

| (1) |

|

Ownership days

represents the aggregate number of days in a period during which

each vessel in our fleet has been owned by us. |

| (2) |

|

Available days

represents the total number of days in a period during which each

vessel in our fleet was in our possession, net of off-hire days

associated with scheduled maintenance, which includes major

repairs, drydockings, vessel upgrades or special or intermediate

surveys. |

| (3) |

|

Operating days

represents the number of our available days in a period less the

aggregate number of days that our vessels are off-hire due to any

reason, excluding scheduled maintenance. |

| (4) |

|

Fleet utilization is

calculated by dividing the number of our operating days during a

period by the number of our ownership days during that period. |

| (5) |

|

Average number of

vessels in the period is calculated by dividing ownership days in

the period by the number of days in that period. |

| (6) |

|

Time charter equivalent

rate, or TCE rate, represents our charter revenues less commissions

and voyage expenses during a period divided by the number of

available days during such period. |

| (7) |

|

Daily vessel operating

expenses include the costs for crewing, insurance, lubricants,

spare parts, provisions, stores, repairs, maintenance, statutory

and classification expense, drydocking, intermediate and special

surveys and other miscellaneous items. Daily vessel operating

expenses are calculated by dividing vessel operating expenses for

the relevant period by ownership days for such period. |

| (8) |

|

Daily general and

administrative expenses include daily management fees payable to

our Managers and daily company administration expenses. Daily

general and administrative expenses are calculated by dividing

general and administrative expenses for the relevant period by

ownership days for such period. |

About Safe Bulkers, Inc.The

Company is an international provider of marine drybulk

transportation services, transporting bulk cargoes, particularly

coal, grain and iron ore, along worldwide shipping routes for some

of the world’s largest users of marine drybulk transportation

services. The Company’s common stock, series C preferred stock and

series D preferred stock are listed on the NYSE, and trade under

the symbols “SB”, “SB.PR.C”, and “SB.PR.D”, respectively.

Forward-Looking Statements This

press release contains forward-looking statements (as defined in

Section 27A of the Securities Exchange Act of 1933, as amended, and

in Section 21E of the Securities Act of 1934, as amended)

concerning future events, the Company’s growth strategy and

measures to implement such strategy, including expected vessel

acquisitions and entering into further time charters. Words such as

“expects,” “intends,” “plans,” “believes,” “anticipates,” “hopes,”

“estimates” and variations of such words and similar expressions

are intended to identify forward-looking statements. Although the

Company believes that the expectations reflected in such

forward-looking statements are reasonable, no assurance can be

given that such expectations will prove to have been correct. These

statements involve known and unknown risks and are based upon a

number of assumptions and estimates that are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of the Company. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, changes in the demand

for drybulk vessels, competitive factors in the market in which the

Company operates, risks associated with operations outside the

United States and other factors listed from time to time in the

Company’s filings with the Securities and Exchange Commission. The

Company expressly disclaims any obligations or undertaking to

release any updates or revisions to any forward-looking statements

contained herein to reflect any change in the Company’s

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based.

For further information please

contact:

Company Contact:Dr. Loukas

BarmparisPresident Safe Bulkers, Inc.Tel.: +30 211

1888400 +357 25 887

200E-Mail:directors@safebulkers.com

Investor Relations / Media

Contact:Nicolas Bornozis, PresidentCapital Link, Inc.230

Park Avenue, Suite 1536New York, N.Y. 10169Tel.: (212) 661-7566Fax:

(212) 661-7526E-Mail: safebulkers@capitallink.com

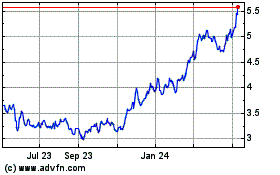

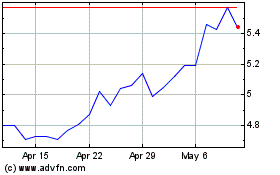

Safe Bulkers (NYSE:SB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Safe Bulkers (NYSE:SB)

Historical Stock Chart

From Apr 2023 to Apr 2024