Eagle Point Credit Company Inc. (the “Company”) (NYSE:ECC, ECCA,

ECCB, ECCX, ECCY, ECCZ) today announced financial results for the

quarter ended March 31, 2018, net asset value (“NAV”) as of March

31, 2018 and certain portfolio activity through May 11, 2018.

FIRST QUARTER 2018 HIGHLIGHTS

- Net investment income (“NII”) and

realized capital gains of $0.50 per weighted average common

share1.

- NAV per common share of $16.65 as of

March 31, 2018.

- First quarter 2018 GAAP net income

(inclusive of unrealized mark-to-market losses) of $8.1 million, or

$0.39 per weighted average common share.

- Weighted average effective yield of the

Company’s collateralized loan obligation (“CLO”) equity portfolio

was 14.54% as of March 31, 2018.

- Deployed $41.1 million in net capital

and received $22.7 million in cash distributions from the Company’s

investment portfolio in the first quarter of 2018.

- 4 of the Company’s CLO investments were

reset during the first quarter of 2018.

- Completed an underwritten public

offering of 2,242,500 shares of common stock (including full

exercise of the underwriters’ overallotment option) at a premium to

NAV resulting in net proceeds to the Company of approximately $38.8

million.

SUBSEQUENT EVENTS

- NAV per common share estimated to be

between $16.71 and $16.81 as of April 30, 2018.

- Deployed $15.8 million in net capital

from April 1, 2018 through May 11, 2018; received cash

distributions from the Company’s investment portfolio of $28.8

million over the same period.

- The Company completed an underwritten

public offering of $67.3 million in aggregate principal amount of

6.6875% notes due 2028 (ECCX), including a partial exercise of the

underwriters’ overallotment option, resulting in net proceeds to

the Company of approximately $64.9 million.

- In April 2018, the Company announced it

will redeem 100% of its 7.00% notes due 2020 (ECCZ), or $60.0

million aggregate principal amount, on May 24, 2018.

“We continued to actively manage the Company’s portfolio,

prudently deploying capital while also opportunistically selling

certain investments and realizing gains,” said Thomas Majewski,

Chief Executive Officer. “During the quarter, we deployed $91.6

million into new investments and reset 4 of the Company’s CLO

investments, lengthening the reinvestment periods in each

transaction. Our focus remains on the long term and seeking to lock

in lower cost CLO debt for a longer duration.”

“Our NII and realized capital gains per share increased slightly

from the prior quarter to $0.50 per common share and our CLO equity

portfolio’s weighted average effective yield increased versus the

prior quarter,” noted Mr. Majewski. “We have also been active in

managing the Company’s balance sheet. In January, we completed a

common stock offering with net proceeds of $38.8 million. That

stock was sold at a premium to NAV, which increases NAV for all

shareholders, and much of that capital has already been deployed

into new investments.”

“Subsequent to quarter end, we took advantage of strong market

conditions and looked to effectively refinance our 7% ECCZ

unsecured notes by completing a new notes offering,” added Mr.

Majewski. “The new unsecured notes (ECCX) have a fixed coupon of

6.6875%, 31.25 basis points lower than the ECCZ notes they are

replacing and represent our lowest cost of debt at the Company to

date. Importantly, the ECCX notes have a ten-year maturity compared

to the less than three years remaining on the life of the ECCZ

notes. As a result of the issuance and announced redemption of the

ECCZ notes, the pro-forma weighted average maturity on the

Company’s outstanding notes and preferred stock is now just over

eight years, with the nearest maturity being a little over four

years away. Importantly, all of the Company’s financing is fixed

rate, providing us added certainty in a rising rate

environment.”

FIRST QUARTER 2018 RESULTS

The Company’s NII and realized capital gains for the quarter

ended March 31, 2018 was $0.50 per weighted average common share.

This compared to $0.49 per weighted average common share for the

quarter ended December 31, 2017, and $0.60 per weighted average

common share for the quarter ended March 31, 2017.

For the quarter ended March 31, 2018, the Company recorded GAAP

net income of $8.1 million, or $0.39 per weighted average common

share. Net income was comprised of total investment income of $17.0

million and net realized capital gains on investments of $1.8

million, offset by total expenses of $8.5 million and net

unrealized depreciation (or unrealized mark-to-market loss on

investments) of $2.2 million.

NAV as of March 31, 2018 was $355.2 million, or $16.65 per

common share, which is $0.12 per common share lower than the

Company’s NAV as of December 31, 2017, and $0.48 per common share

lower than the Company’s NAV as of March 31, 2017.

During the quarter ended March 31, 2018, the Company deployed

$91.6 million in gross capital and $41.1 million in net capital.

The weighted average effective yield of new CLO equity investments

made by the Company during the quarter, which includes a provision

for credit losses, was 17.37% as measured at the time of

investment. Additionally, during the quarter, the Company received

$50.5 million of proceeds from the sale of investments and

converted 1 of its existing loan accumulation facilities into a new

CLO.

During the quarter ended March 31, 2018, the Company received

$22.7 million of cash distributions from its investment portfolio,

or $1.10 per weighted average common share, including amounts

received from called investments. Excluding proceeds from called

investments, the Company received cash distributions of $1.04 per

weighted average common share during the quarter.

During the quarter ended March 31, 2018, 4 of the Company’s CLO

investments were reset, bringing the total number of such CLO

equity positions that were refinanced or reset since January 1,

2017 to 26 and 10, respectively.

As of March 31, 2018, the weighted average effective yield on

the Company’s CLO equity portfolio was 14.54%, an increase from

14.42% as of December 31, 2017. As of March 31, 2017, that measure

stood at 16.21%.

Pursuant to the Company’s “at-the-market” offering program under

which the Company may issue shares of common stock and 7.75% Series

B Term Preferred Stock due 2026 (“Series B Term Preferred Stock”),

the Company sold 295,969 shares of common stock at a premium to NAV

during the first quarter for total net proceeds to the Company of

approximately $5.2 million.

PORTFOLIO STATUS

As of March 31, 2018 on a look-through basis, and based on the

most recent CLO trustee reports received by such date, the Company

had indirect exposure to approximately 1,295 unique corporate

obligors. The largest look-through obligor represented 0.98% of the

Company’s CLO equity and loan accumulation facility portfolio. The

top-ten largest look-through obligors together represented 6.28% of

the Company’s CLO equity and loan accumulation facility portfolio.

The look-through weighted average spread of the loans underlying

the Company’s CLO equity and related investments was 3.59% as of

March 2018.

As of March 31, 2018, the Company had debt and preferred

securities outstanding which totaled approximately 35% of its total

assets (less current liabilities). Over the long term, management

expects the Company to operate under current market conditions

generally with leverage within a range of 25% to 35% of total

assets. Based on applicable market conditions at any given time, or

should significant opportunities present themselves, the Company

may incur leverage outside of this range, subject to applicable

regulatory limits.

SECOND QUARTER 2018 PORTFOLIO ACTIVITY THROUGH MAY 11, 2018

AND OTHER UPDATES

From April 1, 2018 through May 11, 2018, the Company received

$28.8 million of cash distributions from its investment portfolio,

or $1.35 per weighted average common share, including amounts

received from called investments. Excluding proceeds from called

investments, the Company received cash distributions of $0.99 per

weighted average common share for the same period. As of May 11,

2018, some of the Company’s investments had not yet reached their

payment date for the quarter. Also from April 1, 2018 through May

11, 2018, the Company deployed $15.8 million in net capital. From

April 1, 2018 through May 11, 2018, 1 of the Company’s CLO

investments was reset.

As of May 11, 2018, the Company has approximately $16.7 million

of cash available for investment.

As previously published on the Company’s website, management’s

estimate of the Company’s range of NAV per common share as of April

30, 2018 was $16.71 to $16.81.

PREVIOUSLY DECLARED DISTRIBUTIONS AND ADDITIONAL

UPDATES

The Company paid a monthly distribution of $0.20 per common

share on April 30, 2018 to stockholders of record as of April 12,

2018. Additionally, and as previously announced, the Company

declared distributions of $0.20 per share of common stock payable

on May 31, 2018 and June 29, 2018, to stockholders of record as of

May 11, 2018 and June 12, 2018, respectively.

The Company paid distributions of $0.161459 per share of the

Company’s 7.75% Series A Term Preferred Stock (NYSE: ECCA) and

Series B Term Preferred Stock (NYSE: ECCB) on April 30, 2018, to

stockholders of record as of April 12, 2018. The distributions

represented a 7.75% annualized rate, based on the $25 liquidation

preference per share for each series of preferred stock.

Additionally, and as previously announced, the Company declared

distributions of $0.161459 per share on each series of preferred

stock, payable on each of May 31, 2018 and June 29, 2018, to

stockholders of record as of May 11, 2018 and June 12, 2018,

respectively.

As one of the requirements for the Company to maintain its

ability to be taxed as a “regulated investment company” (which it

has elected to be), the Company is generally required to pay

distributions to holders of its common stock in an amount equal to

substantially all of the Company’s taxable income within one year

of the end of its tax year, which is November 30. The Company

currently estimates its taxable income for the tax year ended

November 30, 2017 to be slightly below the Company’s overall

distributions on its shares of common stock for the applicable

year, in large part due to the impact of accelerating certain tax

deductions within the Company’s CLOs in conjunction with

refinancing and resetting certain CLOs in the Company’s investment

portfolio during such period. As such, the Company does not

currently expect to pay a special distribution for the tax year

ended November 30, 2017.

For periods subsequent to the quarter ended March 31, 2018, the

Company is changing its accounting policy related to newly issued

debt securities and preferred stock by electing to recognize debt

issuance costs in the period in which such costs are incurred. For

prior periods, when issuing debt securities or preferred stock, the

Company amortized such expenses over the stated maturity of the

security. For securities issued beginning in the quarter ending

June 30, 2018, the Company will now take a one-time upfront charge

of such expenses. For the quarter ending June 30, 2018, management

estimates the non-recurring cost relating to the issuance of the

ECCX notes and the acceleration of unamortized issuance costs

associated with the redemption of the ECCZ notes during the quarter

will impact NII and realized gains/losses for the quarter by

approximately $0.20 per common share.

CONFERENCE CALL

The Company will host a conference call at 10:00 a.m. (Eastern

Time) today to discuss the Company’s financial results for the

quarter ended March 31, 2018, as well as a portfolio update.

All interested parties may participate in the conference call by

dialing (833) 231-8253 (domestic) or (647) 689-4099

(international), and entering Conference ID 2160819 approximately

10 to 15 minutes prior to the call. A live webcast will also be

available on the Company’s website

(www.eaglepointcreditcompany.com) – please go to the Investor

Relations section at least 15 minutes prior to the call to

register, download and install any necessary audio software.

An archived replay of the call will be available shortly

afterwards until June 18, 2018. To hear the replay, please dial

(800) 585-8367 (domestic) or (416) 621-4642 (international). For

the replay, enter conference ID 2160819.

ADDITIONAL INFORMATION

The Company has made available on its website,

www.eaglepointcreditcompany.com (in the financial statements and

reports section) its unaudited consolidated financial statements as

of and for the period ended March 31, 2018. The Company has also

filed this report with the Securities and Exchange Commission. The

Company also published on its website (in the investor

presentations and portfolio information section) an investor

presentation which contains additional information about the

Company and its portfolio as of and for the quarter ended March 31,

2018.

ABOUT EAGLE POINT CREDIT COMPANY

The Company is a non-diversified, closed-end management

investment company. The Company’s investment objectives are to

generate high current income and capital appreciation primarily

through investment in equity and junior debt tranches of

collateralized loan obligations. The Company is externally managed

and advised by Eagle Point Credit Management LLC.

The Company makes certain unaudited portfolio information

available each month on its website in addition to making certain

other unaudited financial information available on its website

(www.eaglepointcreditcompany.com). This information includes (1) an

estimated range of the Company’s net investment income (“NII”) and

realized capital gains or losses per weighted average share of

common stock for each calendar quarter end, generally made

available within the first fifteen days after the applicable

calendar month end, (2) an estimated range of the Company’s NAV per

share of common stock for the prior month end and certain

additional portfolio-level information, generally made available

within the first fifteen days after the applicable calendar month

end, and (3) during the latter part of each month, an updated

estimate of NAV, if applicable, and, with respect to each calendar

quarter end, an updated estimate of the Company’s NII and realized

capital gains or losses for the applicable quarter, if

available.

FORWARD-LOOKING STATEMENTS

This press release may contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Statements other than statements of historical facts

included in this press release may constitute forward-looking

statements and are not guarantees of future performance or results

and involve a number of risks and uncertainties. Actual results may

differ materially from those in the forward-looking statements as a

result of a number of factors, including those described in the

Company’s filings with the U.S. Securities and Exchange Commission

(“SEC”). The Company undertakes no duty to update any

forward-looking statement made herein. All forward-looking

statements speak only as of the date of this press release.

FURTHER INFORMATION REGARDING ESTIMATED TAX AND PROSPECTIVE

FINANCIAL INFORMATION

The (1) estimates of the Company’s taxable income and

distributions for the tax year ended November 30,

2017 and (2) projection of the estimated impact of the

Company’s recognition of debt securities and preferred stock

issuance costs reflects management’s judgment as of the date of

this press release of conditions currently existing and that it

expects to exist with respect to the tax year ended November

30, 2017 and the redemption of the ECCZ notes, as applicable. The

estimates regarding taxable income are based on taxable income

reported to date and assumptions relating to the underlying tax

characteristics of income and other items as reported to the

Company. Although the Company considers its assumptions to be

reasonable as of the date of this press release, such assumptions

are subject to a wide variety of significant uncertainties that

could cause actual results to differ materially from those

contained in the estimates, including risks and uncertainties

relating to the completeness and accuracy of information reported

or received by the Company from underlying investments, and those

described in the notes to the Company’s audited consolidated

financial statements for the fiscal year ended December 31,

2017 and the Company’s unaudited consolidated financial

statements for the fiscal quarter ended March 31, 2018.

Accordingly, there can be no assurance that actual results will not

differ materially from those presented in the estimates.

The projection of the estimated impact of the Company’s

recognition of debt securities and preferred stock issuance costs

was not prepared with a view toward complying with the guidelines

established by the American Institute of Certified Public

Accountants and Financial Accounting Standards Board, as modified

by Regulation S-X under the Securities Act of 1933, as amended,

with respect to prospective financial information. Rather such

estimate, and the estimate of the Company’s taxable income for the

tax year ended November 30, 2017, was prepared on a reasonable

basis and reflects the best currently available estimates and

judgment of Company management. However, this estimate is not fact

and readers of this press release should not rely upon this

information or place undue reliance on such estimate.

Neither the Company’s independent registered public accounting

firm nor any other independent accountants has compiled, examined

or performed any procedures with respect to estimated information

contained herein, or expressed any opinion or assurance with

respect to the estimated information or its achievability, and

accordingly each assumes no responsibility for, and disclaims any

association with, the estimates.

1 “Per weighted average common share” data are on a weighted

average basis based on the average daily number of shares of common

stock outstanding for the period and “per common share” refers to

per share of the Company’s common stock.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180517005386/en/

Investor and Media

Relations:ICR203-340-8510IR@EaglePointCredit.comwww.eaglepointcreditcompany.com

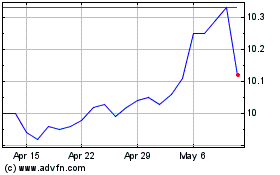

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

From Mar 2024 to Apr 2024

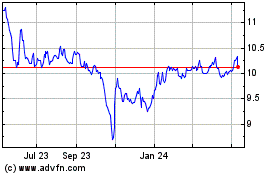

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

From Apr 2023 to Apr 2024