Goldman Sachs to Pay $110 Million to Settle Forex Case

May 01 2018 - 5:15PM

Dow Jones News

By Ira Iosebashvili

Goldman Sachs Group Inc. will pay roughly $110 million to settle

claims that it failed to supervise foreign exchange traders who put

clients at a disadvantage by inappropriately sharing information

about their market positions with rivals.

The firm will make payments of $54.75 million to both the

Federal Reserve Board and the New York Department of Financial

Services, the regulators said Tuesday.

Between 2008 and early 2013, the bank's traders used electronic

chat rooms to share confidential customer information and to

discuss potentially coordinating trading activity, the New York

agency said.

"This improper activity sought to enable banks and the involved

traders to achieve higher profits from execution of foreign

exchange trades, sometimes at customers' expense," it said.

The traders adjusted prices for particular securities and

assisted other banks' traders by providing confidential information

about Goldman Sachs's clients or their orders, sometimes giving

customers code names such as "fiddler" and "dodgy aussie seller,"

the DFS said.

While the bank had policies addressing its foreign exchange

business in place as early as 2001, "escalation of compliance

concerns did not always occur as required, allowing potentially

improper trading activity to continue."

The individuals that had participated in the improper trading

are no longer with the firm, according to a person with knowledge

of the matter.

"We are pleased to have resolved the Federal Reserve Board's and

New York Department of Financial Services' respective reviews and

appreciate their recognition that we have already taken significant

steps to enhance our policies and procedures," Goldman Sachs

said.

The fines come after a string of actions against banks over the

past several years. Five banks -- Barclays PLC, Citigroup Inc.,

JPMorgan Chase & Co., Royal Bank of Scotland Group PLC and UBS

AG -- pleaded guilty in May 2015 and paid $5.6 billion in penalties

to resolve investigations into whether the banks worked together to

manipulate foreign currency prices.

In a separate case that grew out of the investigations,

prosecutors in July charged two HSBC Holdings PLC employees with

fraudulently front-running a $3.5 billion currency trade for a

client. The HSBC traders have pleaded not guilty.

--Telis Demos contributed to this article.

Write to Ira Iosebashvili at ira.iosebashvili@wsj.com

(END) Dow Jones Newswires

May 01, 2018 17:00 ET (21:00 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

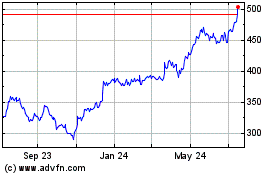

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Mar 2024 to Apr 2024

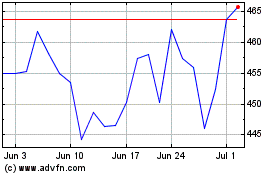

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Apr 2023 to Apr 2024