Filed Pursuant to Rule 424(b)(3)

Registration No. 333-221783

Prospectus

APTOSE BIOSCIENCES INC.

6,041,567 Common Shares

This prospectus

relates to the sale, from time to time, of up to 6,041,567 of our common shares by the selling shareholder, Aspire Capital Fund, LLC, an Illinois limited liability company, or “

Aspire Capital

.” Aspire Capital is also referred

to in this prospectus as the selling shareholder. The prices at which the selling shareholder may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. We will not receive proceeds from the

sale of the shares by the selling shareholder. However, we may receive proceeds of up to $15,500,000 from the sale of our common shares to the selling shareholder, pursuant to a common shares purchase agreement entered into with the selling

shareholder on October 27, 2017 (referred to as the “

Purchase Agreement

”) once the registration statement, of which this prospectus is a part, is declared effective. Under the terms of the Purchase Agreement, on

October 31, 2017, Aspire Capital made an initial purchase of 357,143 common shares at a price of $1.40 per share, representing gross proceeds of approximately $500,000. As the date of this prospectus supplement, 2,162,995 common shares remain

available to be issued to Aspire Capital under the terms of the Purchase Agreement.

Aspire Capital is an

“

underwriter

” within the meaning of Section 2(a)(11) of the United States Securities Act of 1933, as amended, or the “

Securities Act

.” Aspire Capital may sell the common shares described in this

prospectus in a number of different ways and at varying prices. See “Plan of Distribution” for more information about how Aspire Capital may sell the common shares being registered pursuant to this prospectus. We will pay the expenses

incurred in registering the common shares to which this prospectus relates, including legal and accounting fees. See “Plan of Distribution.”

Our common shares are listed on Toronto Stock Exchange, which we refer to as the “TSX” under the symbol “APS” and the

Nasdaq Capital Market, which we refer to as “Nasdaq”, under the symbol “APTO.” On April 12, 2018, the last reported sale price per share of our common shares was CDN$4.17 per share on the TSX and $3.34 per share on Nasdaq.

You should read this prospectus and any prospectus supplement, together with additional information described under the headings

“Documents Incorporated by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing in our common shares involves a high degree of risk. See “

Risk Factors

” beginning on page

10.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved

of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this

prospectus is April 13, 2018.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement that we have filed with the SEC. Aspire Capital may sell the securities described in

this prospectus from time to time, in one or more offerings. This prospectus provides you with a general description of the securities that Aspire Capital may offer.

Before investing in our securities, please carefully read both this prospectus together with the documents incorporated by reference into this

prospectus, as listed under “Documents Incorporated by Reference,” and the additional information described below under “Where You Can Find More Information.”

Owning securities may subject you to tax consequences in the United States and in Canada. This prospectus or any applicable prospectus

supplement may not describe these tax consequences fully. You should read the tax discussion in any prospectus supplement with respect to a particular offering and consult your own tax advisor with respect to your own particular circumstances.

You should rely only on the information contained in or incorporated by reference into this prospectus or a prospectus supplement. We

have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The distribution or possession of this prospectus in or from certain jurisdictions

may be restricted by law. This prospectus is not an offer to sell the securities and is not soliciting an offer to buy the securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not

qualified to do so or to any person to whom it is not permitted to make such offer or sale. You should assume that the information contained in this prospectus and in any applicable prospectus supplement is accurate only as of the date on the front

cover of this prospectus or prospectus supplement, as applicable, and the information incorporated by reference into this prospectus or any prospectus supplement is accurate only as of the date of the document incorporated by reference. Our

business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, unless the

context otherwise requires, references to “Aptose,” the “Company,” “we,” “us,” or “our” refer to Aptose Biosciences Inc. and its wholly owned subsidiaries through which it conducts its business.

FINANCIAL STATEMENTS AND EXCHANGE RATE INFORMATION

The consolidated financial statements incorporated by reference into this prospectus and the documents incorporated by reference into this

prospectus, and the financial data derived from those consolidated financial statements included in this prospectus, are presented in U.S. dollars, unless otherwise specified, and have been prepared in accordance with International Financial

Reporting Standards as issued by the International Accounting Standards Board, which we refer to as “

IFRS

”. References in this prospectus to “dollars”, “US$” or “$” are to United States dollars.

Canadian dollars are indicated by the symbol “Cdn$”.

The following table lists, for each period presented, the high and low

exchange rates, the average of the exchange rates during the period indicated, and the exchange rates at the end of the period indicated, for one Canadian dollar, expressed in United States dollars. For the 2014, 2015, and 2016 years, the exchange

rate is based on the noon exchange rate published by the Bank of Canada. For the 2017 year, the exchange rate is based on the daily average exchange rate published by the Bank of Canada.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended December 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

High for the period

|

|

$

|

0.8245

|

|

|

$

|

0.7977

|

|

|

$

|

0.8511

|

|

|

$

|

0.9399

|

|

|

Low for the period

|

|

$

|

0.7276

|

|

|

$

|

0.6869

|

|

|

$

|

0.7161

|

|

|

$

|

0.8579

|

|

|

End of period

|

|

$

|

0.7971

|

|

|

$

|

0.7448

|

|

|

$

|

0.7225

|

|

|

$

|

0.8620

|

|

|

Average for the period

|

|

$

|

0.7708

|

|

|

$

|

0.7550

|

|

|

$

|

0.7821

|

|

|

$

|

0.9053

|

|

On April 12, 2018, the Bank of Canada’s daily average exchange rate was Cdn$1.00 = $0.7939.

1

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement under the Securities Act, with respect to the resale by the selling shareholder of our

common shares pursuant to this prospectus. This prospectus, which is a part of the registration statement, does not contain all of the information contained in the registration statement or the exhibits and schedules to the registration statement,

and you should refer to the complete registration statement. Statements made in this prospectus concerning the contents of any contract, agreement or other document filed as an exhibit to the registration statement are summaries of all of the

material terms of such contracts, agreements or documents, but do not repeat all of their terms. Reference is made to each such exhibit for a more complete description of the matters involved and the summary statements are qualified in their

entirety by reference to the complete document filed as an exhibit. The registration statement and its exhibits, and the reports and other information we have filed with the SEC under the Exchange Act, may be inspected and copied by the public at

the public reference facilities maintained by the SEC Our filings are also available from commercial document retrieval services.

We are

subject to the information reporting requirements of the United States Securities Exchange Act of 1934, which we refer to as the “

Exchange Act

”, and we therefore file reports and other information with the SEC through its

Electronic Document Gathering Retrieval System, which is commonly known by the acronym EDGAR and may be accessed at www.sec.gov. The reports and other information filed by us with the SEC may be read and copied at the SEC’s public reference

room at 100 F Street, N.E., Washington, D.C. 20549. Copies of the same documents can also be obtained from the public reference room of the SEC in Washington by paying a fee. Please call the SEC at

1-800-SEC-0330

for further information on the public reference room. In addition, we are subject to continuous disclosure obligations under Canadian securities laws.

Therefore, we file disclosure documents, reports, statements and other information with the securities commissions or similar regulatory authorities in Canada. We make our filings on the Canadian System for Electronic Document Analysis and

Retrieval, which is commonly known by the acronym SEDAR and which may be accessed at www.sedar.com. SEDAR is the Canadian equivalent of EDGAR. In addition, our documents may be viewed at our head office located at 5955 Airport Road Suite #228,

Mississauga, Ontario, Canada, L4V 1R9.

As a “foreign private issuer” under the Exchange Act, we are exempt from the rules under

the Exchange Act prescribing the furnishing and content of proxy statements, and our officers, directors and principal shareholders are exempt from the reporting and

“short-swing

profit” recovery

provisions contained in Section 16 of the Exchange Act. In addition, we are not required to publish financial statements as promptly as United States companies.

ENFORCEMENT OF CIVIL LIABILITIES

The enforcement by investors of civil liabilities under U.S. federal securities laws may be affected adversely by the fact that we are

incorporated under the laws of Canada, that many of our directors are residents of countries other than the United States, that some of the experts named in this prospectus are residents of countries other than the United States, and that some of

our assets and the assets of said persons are located outside the United States.

In particular, it may be difficult to bring and enforce

suits against us or said persons under U.S. federal securities laws. It may be difficult for U.S. holders of our common shares to effect service of process on us or said persons within the United States or to enforce judgments obtained in the United

States based on the civil liability provisions of the U.S. federal securities laws against us or said persons. In addition, a shareholder should not assume that the courts of Canada (i) would enforce judgments of U.S. courts obtained in actions

against us, our officers or directors, or other said persons, predicated upon the civil liability provisions of the U.S. federal securities laws or other laws of the United States, or (ii) would enforce, in original actions, liabilities against

us, our officers or directors or other said persons predicated upon the U.S. federal securities laws or other laws of the United States.

2

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” the information we have filed with the SEC. This means that we can disclose

important information by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus and information that we file later with the SEC will also be deemed to

be incorporated by reference into this prospectus and be part hereof from the date of filing of such documents and will automatically update and supersede previously filed information, including information contained in this document. The following

documents filed with or furnished to the SEC are specifically incorporated by reference into, and form a part of, this prospectus:

|

|

•

|

|

our Annual Report on Form

40-F

for the fiscal year ended December 31, 2017, filed on March 27, 2018;

|

|

|

•

|

|

the description of our common shares set forth in our registration statement on Form

8-A,

filed on October 21, 2014 (which incorporates by reference the description of our

common shares included in our Annual Report on Form

20-F

for the fiscal year ended May 31, 2014, filed on July 30, 2014); and

|

|

|

•

|

|

all other documents filed by us under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of this prospectus but before the end of the offering of the securities pursuant to this prospectus.

|

In addition, all subsequent Annual Reports on Form

20-F,

Form

40-F,

or Form

10-K,

and all subsequent filings on Form

10-Q

or Form

8-K,

that we file pursuant

to the Exchange Act prior to the termination of this offering, are hereby incorporated by reference into this prospectus. Also, we may incorporate by reference future reports on Form

6-K

that we furnish

subsequent to the date of this prospectus by stating in those Form

6-Ks

that they are being incorporated by reference into this prospectus.

Any statement contained in a document incorporated by reference into this prospectus shall be deemed to be modified or superseded for purposes

of this prospectus to the extent that a statement contained in this prospectus, in one of those other documents or in any other later filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement.

Any such statement so modified shall not be deemed, except as so modified, to constitute a part of this prospectus. Any such statement so superseded shall be deemed not to constitute a part of this prospectus.

Any person receiving a copy of this prospectus, including any beneficial owner, may obtain without charge, upon written or oral request, a

copy of any of the documents incorporated by reference into this prospectus, except for the exhibits to those documents unless the exhibits are specifically incorporated by reference into those documents. Requests should be directed to our principal

executive offices, 5955 Airport Road, Suite #228, Mississauga, Ontario, Canada L4V 1R9, Attention: Chief Financial Officer (telephone: (647)

479-9829).

3

PROSPECTUS SUMMARY

This summary highlights certain information about us, this offering and selected information contained in the prospectus. This summary is

not complete and does not contain all of the information that you should consider before deciding whether to invest in our common shares. For a more complete understanding of our company and this offering, we encourage you to read and consider the

more detailed information in the prospectus and the documents incorporated by reference into this prospectus, including “Risk Factors” and the financial statements and related notes. Unless we specify otherwise, all references in this

prospectus to “Aptose,” “we,” “our,” “us” and “our company” refer to Aptose Biosciences, Inc. and the subsidiaries through which it conducts its business.

Company Overview

Aptose is a

science-driven biotechnology company advancing highly differentiated agents to treat unmet medical needs in life-threatening cancers, such as acute myeloid leukemia, or “AML”, high-risk myelodysplastic syndromes, or “MDS”, and

other hematologic malignancies. Based on insights into the genetic and epigenetic profiles of certain cancers and patient populations, we are building a pipeline of novel and targeted oncology therapies directed at dysregulated processes and

signaling pathways in cancer cells, and this strategy is intended to optimize efficacy and quality of life by minimizing the cytotoxic side effects associated with conventional therapies and minimize the emergence of drug resistance. Our product

pipeline includes cancer drug candidates that exert potent activity as stand-alone agents and that enhance the activities of other anticancer agents without causing overlapping toxicities.

We believe the future of cancer treatment and management lies in the prospective selection and treatment of patients having genotype-specific

malignancies that are genetically or epigenetically predisposed to response based on a drug’s unique mechanism of action. We are of the view that many drugs currently approved for the treatment and management of cancer are not selective for the

specific genetic alterations (targets) that cause the patient’s tumor and hence lead to significant toxicities due to

off-target

effects. Aptose’s strategy is to develop agents that target underlying

disease-promoting mutations or altered pathways within a patient population, and we intend to apply this strategy across several therapeutic indications in oncology, including hematologic malignancies and solid tumor indications, particularly those

cancers that offer orphan drug designation opportunities.

We have a clinical-stage program, a late preclinical stage program, and a third

program that is discovery-stage and positioned for partnering. Aptose’s

pan-FLT3

/ BTK program, CG’806, is currently in preclinical development and moving toward Investigational New Drug, or

“

IND

” submission, with anticipation of commencing a Phase 1 trial during 2018.

APTO-253

is our second program and at the Phase 1b clinical stage for the treatment of patients with

relapsed / refractory blood cancers, including AML and high-risk MDS, under an IND allowed by the United States Food and Drug Administration to evaluate

APTO-253

as a therapeutic agent dosed on a weekly

administration schedule for the treatment of certain hematologic malignancies. The

APTO-253

program has received orphan drug designation from the FDA for the treatment of AML, and is currently on clinical hold

while attempts are made to manufacture a newly formulated and stable clinical supply.

As noted above, we are committed to the development

of anticancer drugs that target aberrant oncologic signaling processes that underlie a particular life-threatening malignancy. This targeted approach is intended to impact the disease-causing events in cancer cells without affecting normal processes

within cells. Such an approach requires that we first identify critical underlying oncogenic mechanisms in cancer cells and then develop a therapeutic that selectively impacts such oncogenic mechanisms. As a multi-kinase

pan-FLT3

/

pan-BTK

inhibitor, CG’806 targets multiple critical pathways that overlap to lead to the proliferation of cancer cells, including the

B-cell

receptor signaling pathways (drive certain B cell malignancies) and FLT3 receptor pathways (drive AML) that converge at various points in the signaling cascade. Further, we created the

4

APTO-253

small molecule targeted drug that inhibits expression of the

c-Myc

oncogene and is under development as a

novel therapy for AML and the related MDS.

In June 2016, we announced an exclusive global option and license agreement focused on the

development of CG’806. CG’806 is a highly potent

first-in-class

pan-FLT3 /

pan-BTK

inhibitor. This small molecule therapeutic agent, exhibits a picomolar IC50 toward the

FMS-like

tyrosine kinase 3 with the Internal Tandem Duplication

(FLT3-ITD)

mutation and significant potency against other mutant forms of FLT3 and the wild type form of FLT3.

Because of the potency of CG’806 against the FLT3 enzyme, it may become an effective therapy for AML patients, including the subset of

patients having the

FLT3-ITD,

which occurs in approximately 30% of patients with AML and is associated with poor prognosis. Importantly, CG’806 targets the wild type and all mutant types of FLT3, as well

as other oncogenic kinases which are operative in AML. Consequently, CG’806 has potential to treat a broad range of AML patients, including the

difficult-to-treat

genotype-specific AML patient population having altered FLT3.

In addition to potent inhibition of wild type and mutant forms of the FLT3

enzyme, CG’806 is a highly potent, reversible,

non-covalent

inhibitor of the wild type and mutant forms of the BTK enzymes. Overexpression of BTK drives certain B cell malignancies, including chronic

lymphocytic leukemia, or “CLL”, mantle cell lymphoma, or “MCL”, diffuse large B cell lymphoma, or “DLBCL”, and others. Treatment of such B cell malignancies with covalent BTK inhibitors that target the cysteine residue

in the active site of BTK can lead to drug resistance via mutation of the cysteine amino acid residue to a serine residue

(BTK-C481S

mutant). CG’806 targets the

ATP-binding

pocket of BTK through a reversible,

non-covalent

mechanism, thereby allowing CG’806 to retain low nM potency against the

BTK-C481S

mutant enzyme. In addition, CG’806 inhibits other kinase driven oncogenic pathways (BTK, ERK, AURK, FLT3 and others) on which the malignant B cells depend. Thus, CG’806 may serve as a novel

therapeutic agent to treat B cell malignancy patients that are refractory, resistant or intolerant to covalent BTK inhibitors.

APTO-253,

our second therapeutic program, is a small molecule therapeutic agent that inhibits expression of the

c-Myc

oncogene without causing general myelosuppression of the

healthy bone marrow, and

APTO-253

is currently allowed for development to treat AML in a Phase Ib trial under an IND with the FDA. The

c-Myc

oncogene is overexpressed in

hematologic cancers, including AML.

C-Myc

is a transcription factor that regulates cell growth, proliferation, differentiation and apoptosis, and overexpression amplifies new sets of genes to promote

oncogenesis.

APTO-253

dramatically down-regulates expression of the

c-Myc

oncogene in AML cells and depletes those cells of the

c-Myc

oncoprotein, leading to apoptotic cell death in AML cells. Thus,

APTO-253

may serve as safe and effective

c-Myc

inhibitor

for AML that combines well with other agents and does not impact the normal bone marrow.

Corporate Information

Our principal office is located at 5955 Airport Road, Suite 228, Mississauga, Ontario, Canada, L4V 1R9 and our phone number is (647)

479-9828.

We maintain a website at www.aptose.com where general information about us is available. Investors can obtain copies of our filings with the Securities and Exchange Commission, or SEC, from this site free

of charge, as well as from the SEC website at www.sec.gov. The contents of our website are not incorporated by reference into this prospectus.

Recent

Developments

CG’806

We have

invested significant time, effort and capital to create a scalable synthetic route for the manufacture of CG’806 drug substance, to develop an oral formulation for clinical development, and to study the actions of

5

CG’806 in various preclinical biological pathway studies. We now have solved the synthetic route, have manufactured okg levels of API, and have initiated

in-life

preclinical pharmacokinetic, Dose Range Finding Studies and toxicology studies. Likewise, we also reported that we selected the oral formulation that we intend to take into

first-in-human

clinical trials.

Provided the studies continue on the anticipated timeline, we expect to initiate a

first-in-human

clinical trial during 2018, and greater granularity on the timing of the IND submission and clinical trial will be provided in the coming months. CG’806 is being developed with the intent

to deliver the agent as an oral therapeutic and to develop it in parallel for AML and for appropriate B cell malignancies (likely CLL).

On May 7, 2017, we presented preclinical data for our

pan-FLT3/pan-BTK

inhibitor CG’806 at the 2017 American Association for Cancer Research, or “AACR”, Conference for Hematologic Malignancies: Translating

Discoveries to Novel Therapies in Boston, MA. Two separate presentations highlighting CG’806 were presented. In one presentation, our scientists, with researchers from the Knight Cancer Institute at Oregon Health & Science University,

or “OHSU”, presented data relating to the potency of CG’806 against samples derived from patients with various hematologic malignancies. In a separate presentation, our scientists, with researchers from the MD Anderson Cancer Center,

presented data demonstrating CG’806’s potent activity against AML cells harboring wild type or specific mutant forms of FLT3.

On August 4, 2017 we received a notice from the United States Patent and Trademark Office (the “

USPTO

”) stating

that our U.S. Patent Application is allowed for issuance as a patent. The allowed application claims numerous compounds, including the CG’806 compound, pharmaceutical compositions comprising the CG’806 compound, and methods of

treating various diseases caused by abnormal or uncontrolled activation of protein kinases. The notice of allowance is not a grant of patent rights and although it is uncommon, the USPTO can withdraw the allowed application from issuance.

On December 11, 2017 at the American Society of Hematology Annual Meeting, we presented with the OHSU Knight Cancer Institute preclinical

data demonstrating that CG’806, a

pan-FLT3/pan-BTK

inhibitor, has broad and potent drug activity against AML, CLL and other hematologic disease subtypes. We also

announced the presentation of preclinical data from research led by The University of Texas MD Anderson Cancer Center demonstrating that CG’806 exerts a profound anti-leukemia effect in human and murine leukemia cell lines harboring

FLT-3

ITD mutations, mutations that are usually associated with very poor prognoses in leukemia patients. In addition, CG’806 induces apoptosis, or programmed cell death, in AML patient samples by multiple

mechanisms and is able to overcome resistance that is seen with other FLT3 inhibitors. The data were highlighted in poster presentations on December 10 and 11, 2017 at the American Society of Hematology Annual Meeting.

On December 26, 2017, we announced that the FDA has granted orphan drug designation to CG’806 for the treatment of patients with

AML. Orphan drug designation is granted by the FDA to encourage companies to develop therapies for the treatment of diseases that affect fewer than 200,000 individuals in the United States. Orphan drug status provides research and development tax

credits, an opportunity to obtain grant funding, exemption from FDA application fees and other benefits. If CG’806 is approved to treat AML, the orphan drug designation provides Aptose with seven years of marketing exclusivity.

On March 15, 2018, we announced two abstracts related to the mechanistic properties of CG’806 in AML cells and in B cell malignancy

cells have been accepted for poster presentations at the upcoming 2018 Annual Meeting of the American Association for Cancer Research (AACR).

On March 28, 2018 we announced that we entered into an

“at-the-market”

sales agreement with Cantor Fitzgerald & Co (“

Cantor

”). Under the terms of the sales agreement, we may issue

and sell through Cantor, acting as sole agent, up to thirty million common shares of the company through

at-the-market

distributions.

6

APTO-253

Clinical Hold and Current Status

In 2016, our Phase Ib trial for

APTO-253

was placed on clinical hold in order to solve a

chemistry-based formulation issue, and the chemistry of the API and the formulation had undergone minor modifications to deliver a stable and soluble drug product for return to the clinical setting. In December 2016, we announced that we had

successfully manufactured multiple

non-GMP

batches of a new drug product formulation for

APTO-253,

including a batch that had been stable and soluble for over six

months. However, the 40L batch that was the intended clinical supply encountered an unanticipated mishap during the filling process that compromised the stability of that batch of drug product. On January 23, 2017, we announced that the root

cause and corrective action studies would take longer than originally expected and that we would temporarily delay clinical activities with

APTO-253

in order to elucidate the cause of manufacturing setback,

with the intention of restoring the molecule to a state supporting clinical development and partnering. Formal root cause analyses studies have now been completed and we have identified the mishap that resulted in drug product stability failure, and

we have established a corrective and prevention action plan for the manufacture of future batches of drug product that avoid the earlier mishap. Given these findings, we manufactured a new clinical batch of drug product, and studies required to

demonstrate fitness of the drug product for clinical usage are currently ongoing. We will then present the findings to the FDA with the hope of having the clinical hold removed and returning

APTO-253

to the

clinical trial. Although the Company expects the clinical supply to perform favorably and the clinical hold to be lifted during the first half of 2018, there can be no assurance that the FDA will remove the clinical hold.

Finally, on March 15, 2018, we announced that one abstract related to the mechanistic properties of

APTO-253

was accepted for presentation at the 2018 Annual Meeting of the American Association for Cancer Research.

7

THE OFFERING

This summary highlights information presented in greater detail elsewhere in this prospectus. This summary is not complete and does not

contain all the information you should consider before investing in our common shares. You should carefully read this entire prospectus before investing in our common shares including the section entitled “

Risk

Factors

,” our consolidated financial statements and the documents incorporated herein.

|

Common shares offered by the selling shareholder:

|

Up to 6,041,567 common shares.

|

|

Common shares outstanding:

|

30,702,053 (as of March 27, 2018)

|

|

Use of proceeds:

|

The selling shareholder will receive all of the proceeds from the sale of the shares offered for sale by it under this prospectus. We will not receive proceeds from the sale of the shares by the selling shareholder. However, we may receive up to

$15,500,000 in proceeds from the sale of our common shares to the selling shareholder under the Purchase Agreement. Any proceeds from the selling shareholder that we receive under the Purchase Agreement are expected be used to fund our growth plans,

for working capital, and for other general corporate purposes, including capital expenditures related to our research and development activities.

|

|

Toronto Stock Exchange symbol:

|

“APS”

|

|

Nasdaq Capital Market symbol:

|

“APTO”

|

|

Risk factors:

|

An investment in our securities involves risk. Before you invest in our securities, you should carefully consider the risks involved. Accordingly, you should carefully consider the information contained in or incorporated by reference into this

prospectus, including the risks described below and in our Annual Report on Form

40-F

for the fiscal year ended December 31, 2017, which is incorporated by reference into this prospectus. The discussion

of risks related to our business contained in or incorporated by reference into this prospectus comprises material risks of which we are aware. If any of the events or developments described actually occurs, our business, financial condition or

results of operations would likely be adversely affected.

|

On October 27, 2017, we entered into the Purchase Agreement

with Aspire Capital, which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $15,500,000 of our common shares over the approximately

thirty-month term of the Purchase Agreement. In consideration for entering into the Purchase Agreement, concurrently with the execution of the Purchase Agreement, we issued to Aspire Capital 321,429 common shares as a commitment fee (referred to in

this prospectus as the “

Commitment Shares

”). Upon execution of the Purchase Agreement, the Company agreed to sell to Aspire Capital 357,143 common shares (referred to in this prospectus as the “

Initial Purchase

Shares

”), at $1.40 per share for gross proceeds of $500,000. Concurrently with entering into the Purchase Agreement, we also entered into a registration rights agreement with Aspire Capital (referred to in this prospectus as the

“

Registration Rights Agreement

”), in which we agreed to file one or more registration

8

statements, including the registration statement of which this prospectus is a part, as permissible and necessary to register under the Securities Act, the sale of the common shares that have

been and may be issued to Aspire Capital under the Purchase Agreement. From January 1, 2018 to the date of this registration statement, the Company issued 3,200,000 shares to Aspire Capital at prices from $2.17 to $3.29. As at March 27,

2018, there remain available 2,162,995 common shares to be issued to Aspire under the terms of the Purchase Agreement.

As of

March 27, 2018, there were 30,702,053 common shares outstanding (30,395,271 shares held by

non-affiliates)

which include 3,878,572 shares offered that have been issued to Aspire Capital pursuant to the

Purchase Agreement. If all of the 2,162,995 remaining available common shares offered here were issued and outstanding as of the date hereof, such shares would represent 6.58% of the total common shares outstanding or 6.64% of the

non-affiliate

shares of common shares outstanding as of the date hereof. The number of common shares ultimately offered for sale by Aspire Capital is dependent upon the number of shares purchased by Aspire Capital

under the Purchase Agreement.

Pursuant to the Purchase Agreement and the Registration Rights Agreement, we have registered 6,041,567

common shares under the Securities Act, which includes the Commitment Shares and the Initial Purchase Shares that have already been issued to Aspire Capital, 3,200,000 common shares that have been issued to Aspire Capital between January 1,

2018 and March 27, 2018 and 2,162,995 common shares which we may issue to Aspire Capital. All 6,041,567 common shares are being offered pursuant to this prospectus.

On December 29, 2017, the conditions necessary for purchases under the Purchase Agreement to commence were satisfied. On any trading day

on which the closing sale price of our common shares is not less than $0.25 per share, we have the right, in our sole discretion, to present Aspire Capital with a purchase notice (each, a “

Purchase Notice

”), directing Aspire Capital

(as principal) to purchase up to 200,000 common shares per trading day, up to $15,500,000 of our common shares in the aggregate at a per share price, or the “Purchase Price”, calculated by reference to the prevailing market price of our

common shares (as more specifically described below).

In addition, on any date on which we submit a Purchase Notice for 200,000 shares to

Aspire Capital, we also have the right, in our sole discretion, to present Aspire Capital with a volume-weighted average price purchase notice, or a “

VWAP Purchase Notice

”, directing Aspire Capital to purchase a number of common

shares equal to up to 30% of our aggregate common shares traded on Nasdaq on the next trading day, or the “

VWAP Purchase Date

”, subject to a maximum number of shares we may determine, which we refer to as the “

VWAP Purchase

Share Volume Maximum

”, and a minimum trading price, or the “

VWAP Minimum Price Threshold

” (as more specifically described below). The purchase price per Purchase Share pursuant to such VWAP Purchase Notice, or the

“

VWAP Purchase Price

”, is calculated by reference to the prevailing market price of our common shares (as more specifically described below).

The Purchase Agreement provides that we and Aspire Capital shall not effect any sales under the Purchase Agreement on any purchase date where

the closing sale price of our common shares is less than $0.25 per share, which we refer to as the “

Floor Price

”. This Floor Price and the respective prices and share numbers in the preceding paragraphs shall be appropriately

adjusted for any reorganization, recapitalization,

non-cash

dividend, stock split, reverse stock split or other similar transaction. There are no trading volume requirements or restrictions under the Purchase

Agreement, and we will control the timing and amount of any sales of our common shares to Aspire Capital. Aspire Capital has no right to require any sales by us, but is obligated to make purchases from us as we direct in accordance with the Purchase

Agreement. There are no limitations on use of proceeds, financial or business covenants, restrictions on future fundings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement. Aspire Capital may

not assign its rights or obligations under the Purchase Agreement. The Purchase Agreement may be terminated by us at any time, at our discretion, without any penalty or cost to us. The Purchase Agreement may be terminated by Aspire Capital in case

of default by us. The TSX has approved the transaction, but under no circumstance shall we issue, or make issuable, more than 6,041,567 common shares in aggregate, without shareholder approval.

9

RISK FACTORS

An investment in our securities involves risk. Before you invest in our securities, you should carefully consider the risks involved.

Accordingly, you should carefully consider the information contained in or incorporated by reference into this prospectus, including the risks described below and in our Annual Report on Form

40-F

for the

fiscal year ended December 31, 2017, which is incorporated by reference into this prospectus. The discussion of risks related to our business contained in or incorporated by reference into this prospectus comprises material risks of which we

are aware. If any of the events or developments described actually occurs, our business, financial condition or results of operations would likely be adversely affected.

Risks Related to this Offering

We

will need to raise substantial additional capital in the future to fund our operations and we may be unable to raise such funds when needed and on acceptable terms

Our ability to utilize the Purchase Agreement with Aspire Capital as a source of funding will depend on a number of factors, including the

prevailing market price of our common shares, the volume of trading in our common shares and continuing the listing of our common stock on the Nasdaq Capital Market or an equivalent stock exchange. The number of shares that we may sell to Aspire

Capital under the Purchase Agreement on any given day and during the term of the agreement is limited. See “The Aspire Capital Transaction” section of this prospectus for additional information. Additionally, we and Aspire Capital may not

effect any sales of our common shares under the Purchase Agreement during the continuance of an event of default or on any trading day that the closing sale price of our common shares is less than $0.25 per share, but under no circumstances shall we

issue, or make issuable, more than 6,041,567 common shares in aggregate without shareholder approval. Even if we are able to access the full committed amount of $15,500,000 under the Purchase Agreement, we will still need additional capital to fully

implement our business, operating and development plans.

We will have broad discretion in how we use the proceeds, and we may use

the proceeds in ways in which you and other shareholders may disagree.

We intend to use the net proceeds we receive from the

issuance of common shares to Aspire Capital pursuant to the Purchase Agreement for working capital and general corporate purposes. Our management will have broad discretion in the application of the proceeds from this offering and could spend the

proceeds in ways that do not necessarily improve our operating results or enhance the value of our common shares.

The sale of our

common shares to Aspire Capital may cause substantial dilution to our existing shareholders and the sale of common shares acquired by Aspire Capital could cause the price of our common shares to decline.

We have registered for sale the Commitment Shares and Initial Purchase Shares that we have issued and 5,362,995 shares that we may sell to

Aspire Capital (of which 2,162,995 are available to be sold to Aspire Capital) under the Purchase Agreement. It is anticipated that shares registered in this offering will be sold over a period of up to approximately thirty months from the date of

this prospectus. The number of shares ultimately offered for sale by Aspire Capital under this prospectus is dependent upon the number of shares we elect to sell to Aspire Capital under the Purchase Agreement. Depending on a variety of factors,

including market liquidity of our common shares, the sale of shares under the Purchase Agreement may cause the trading price of our common shares to decline.

Aspire Capital may ultimately purchase all, some or none of the common shares that, together with the Commitment Shares and Initial Purchase

Shares (for aggregate value, including the Commitment Shares and Initial Purchase Shares, of up to $15,500,000), is the subject of this prospectus. Aspire Capital may sell all, some or none of our shares that it holds or comes to hold under the

Purchase Agreement. Sales by Aspire Capital of shares acquired pursuant to the Purchase Agreement under the registration statement, of which this prospectus is a part, may result in dilution to the interests of other holders of our common shares.

The sale of a substantial

10

number of common shares by Aspire Capital in this offering, or anticipation of such sales, could cause the trading price of our common shares to decline or make it more difficult for us to sell

equity or equity-related securities in the future at a time and at a price that we might otherwise desire. However, we have the right under the Purchase Agreement to control the timing and amount of sales of our shares to Aspire Capital, and the

Purchase Agreement may be terminated by us at any time at our discretion without any penalty or cost to us.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the information that we incorporate by reference, contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995 that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this prospectus, including statements regarding our future operating results and

financial position, business strategy, and plans and objectives of management for future operations, are forward-looking statements. In many cases, you can identify forward-looking statements by terms such as “may,” “should,”

“expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,”

“potential,” or “continue” or the negative of these terms or other similar expressions.

The forward-looking

statements contained in this prospectus reflect our views as of the date of this prospectus about future events and are subject to risks, uncertainties, assumptions, and changes in circumstances that may cause our actual results, performance, or

achievements to differ significantly from those expressed or implied in any forward-looking statement. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results,

performance, or achievements. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements, including, without limitation, those factors described in “Risk Factors.”

In addition, those “Risk Factors” may be updated from time to time by our filings under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Except as required by law, after the date of this prospectus, we are under no

duty to update or revise any of the forward-looking statements contained or incorporated by reference herein, whether as a result of new information, future events or otherwise.

You should read this prospectus, including the information that we incorporate by reference, completely and with the understanding that our

actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

CAPITALIZATION AND INDEBTEDNESS

The following provides our capitalization and indebtedness as at December 31, 2017, in accordance with IFRS as issued by the

International Accounting Standards Board.

|

|

|

|

|

|

|

|

|

|

|

(in thousands other than securities numbers)

(1)

|

|

Actual

|

|

|

Proforma

As Adjusted

(2)

|

|

|

Common shares (unlimited authorized, 27,502,053 issued and outstanding, without par

value)

|

|

$

|

231,923

|

|

|

$

|

240,784

|

|

|

Stock options (exchangeable into 2,342,840 common shares)

|

|

$

|

6,456

|

|

|

$

|

6,456

|

|

|

Contributed surplus

|

|

$

|

22,909

|

|

|

$

|

22,909

|

|

|

Accumulated other comprehensive income

|

|

$

|

(4,298

|

)

|

|

$

|

(4,298

|

)

|

|

Deficit

|

|

$

|

(246,788

|

)

|

|

$

|

(246,788

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

10,202

|

|

|

$

|

19,063

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

The table above is based on 27,502,053 common shares outstanding on December 31, 2017.

|

|

(2)

|

The Proforma As Adjusted column reflects 3,200,000 common shares that have been issued by us for the period from January 1, 2018 to March 28, 2018 at an average price of $2.77.

|

11

You should read this table in conjunction with our audited consolidated financial statements as

at and for the year ended December 31, 2017, which are incorporated by reference in this prospectus.

OFFER AND LISTING

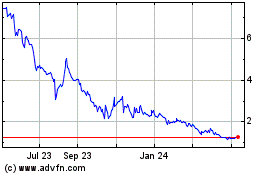

Our common shares have been listed on Nasdaq since October 23, 2014 under the symbol “APTO.” Our common shares are also listed

on the TSX, under the symbol “APS.”

The following table sets out the price ranges of our common shares on the TSX for the

periods indicated below, as adjusted to reflect the 1 for 12 share consolidation of our common shares that occurred on October 1, 2014.

TSX

(CDN$)

|

|

|

|

|

|

|

|

|

|

|

Five most recent full fiscal years:

|

|

High

|

|

|

Low

|

|

|

Year ended December 31, 2017

|

|

$

|

3.00

|

|

|

$

|

1.05

|

|

|

Year ended December 31, 2016

|

|

$

|

5.13

|

|

|

$

|

1.12

|

|

|

Year ended December 31, 2015

|

|

$

|

8.73

|

|

|

$

|

3.06

|

|

|

7 month period ended December 31, 2014

|

|

$

|

9.14

|

|

|

$

|

4.80

|

|

|

|

|

|

|

Year ended December 31, 2017

|

|

$

|

3.00

|

|

|

$

|

1.05

|

|

|

Quarter ended December 31, 2017

|

|

$

|

3.00

|

|

|

$

|

1.64

|

|

|

Quarter ended September 30, 2017

|

|

$

|

2.20

|

|

|

$

|

1.63

|

|

|

Quarter ended June 30, 2017

|

|

$

|

2.20

|

|

|

$

|

1.05

|

|

|

Quarter ended March 31, 2017

|

|

$

|

1.93

|

|

|

$

|

1.23

|

|

|

|

|

|

|

Year ended December 31, 2016

|

|

$

|

5.13

|

|

|

$

|

1.12

|

|

|

Quarter ended December 31, 2016

|

|

$

|

4.02

|

|

|

$

|

1.12

|

|

|

Quarter ended September 30, 2016

|

|

$

|

3.65

|

|

|

$

|

2.51

|

|

|

Quarter ended June 30, 2016

|

|

$

|

5.13

|

|

|

$

|

2.80

|

|

|

Quarter ended March 31, 2016

|

|

$

|

4.21

|

|

|

$

|

2.74

|

|

|

|

|

|

|

Most recent six months:

|

|

|

|

|

|

|

|

|

|

March 31, 2018

|

|

$

|

5.18

|

|

|

$

|

3.37

|

|

|

February 28, 2018

|

|

$

|

3.71

|

|

|

$

|

3.16

|

|

|

January 31, 2018

|

|

$

|

4.80

|

|

|

$

|

2.69

|

|

|

December 31, 2017

|

|

$

|

3.00

|

|

|

$

|

2.17

|

|

|

November 30, 2017

|

|

$

|

2.92

|

|

|

$

|

1.95

|

|

|

October 31, 2017

|

|

$

|

2.07

|

|

|

$

|

1.64

|

|

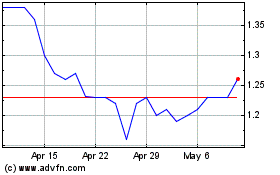

The following table sets out the price ranges and trading volumes of our common shares on Nasdaq for the

periods indicated below.

Nasdaq

(US$)

|

|

|

|

|

|

|

|

|

|

|

Five most recent full fiscal years:

|

|

High

|

|

|

Low

|

|

|

Year ended December 31, 2017

|

|

$

|

2.58

|

|

|

$

|

0.78

|

|

|

Year ended December 31, 2016

|

|

$

|

4.30

|

|

|

$

|

0.83

|

|

|

Year ended December 31, 2015

|

|

$

|

6.81

|

|

|

$

|

2.17

|

|

|

7 month period ended December 31, 2014

|

|

$

|

7.78

|

|

|

$

|

5.60

|

|

12

|

|

|

|

|

|

|

|

|

|

|

Five most recent full fiscal years:

|

|

High

|

|

|

Low

|

|

|

|

|

|

|

Year ended December 31, 2017

|

|

$

|

2.58

|

|

|

$

|

0.78

|

|

|

Quarter ended December 31, 2017

|

|

$

|

2.58

|

|

|

$

|

1.30

|

|

|

Quarter ended September 30, 2017

|

|

$

|

1.75

|

|

|

$

|

1.25

|

|

|

Quarter ended June 30, 2017

|

|

$

|

1.70

|

|

|

$

|

0.78

|

|

|

Quarter ended March 31, 2017

|

|

$

|

1.43

|

|

|

$

|

0.91

|

|

|

|

|

|

|

Year ended December 31, 2016

|

|

$

|

4.30

|

|

|

$

|

0.83

|

|

|

Quarter ended December 31, 2016

|

|

$

|

3.20

|

|

|

$

|

0.83

|

|

|

Quarter ended September 30, 2016

|

|

$

|

2.82

|

|

|

$

|

1.92

|

|

|

Quarter ended June 30, 2016

|

|

$

|

4.30

|

|

|

$

|

2.12

|

|

|

Quarter ended March 31, 2016

|

|

$

|

3.41

|

|

|

$

|

1.93

|

|

|

|

|

|

|

Most recent six months:

|

|

|

|

|

|

|

|

|

|

March 31, 2018

|

|

$

|

3.97

|

|

|

$

|

2.62

|

|

|

February 28, 2018

|

|

$

|

3.03

|

|

|

$

|

2.51

|

|

|

January 31, 2018

|

|

$

|

3.90

|

|

|

$

|

2.10

|

|

|

December 31, 2017

|

|

$

|

2.58

|

|

|

$

|

1.68

|

|

|

November 30, 2017

|

|

$

|

2.30

|

|

|

$

|

1.50

|

|

|

October 31, 2017

|

|

$

|

1.61

|

|

|

$

|

1.30

|

|

USE OF PROCEEDS

This prospectus relates to our common shares that may be offered and sold from time to time by Aspire Capital. We will receive no proceeds

from the sale of our common shares by Aspire Capital in this offering. However, we may receive gross proceeds of up to $15,500,000 from Aspire Capital under the Purchase Agreement. We estimate that the net proceeds to us from the sale of our common

shares to Aspire Capital pursuant to the Purchase Agreement will be up to $15,353,458 over an approximately

30-month

period, assuming that we sell the full amount of our common shares that we have the right,

but not the obligation, to sell to Aspire Capital under the Purchase Agreement and other estimated fees and expenses. See “

Plan of Distribution

” elsewhere in this prospectus for more information.

Unless otherwise indicated in the applicable prospectus supplement, information incorporated by reference or free writing prospectus, we

expect to use any proceeds that we receive under the Purchase Agreement to fund our growth plans, for working capital, and for other general corporate purposes, including capital expenditures related to our research and development activities.

THE ASPIRE CAPITAL TRANSACTION

General

On October 27, 2017,

we entered into the Purchase Agreement which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $15,500,000 of our common shares over the term

of the Purchase Agreement. In consideration for entering into the Purchase Agreement, concurrently with the execution of the Purchase Agreement, we issued to Aspire Capital the Commitment Shares. Upon execution of the Purchase Agreement, we agreed

to sell to Aspire Capital 357,143 initial Purchase Shares at a price of $1.40 per share, for gross proceeds of $500,000. Concurrently with entering into the Purchase Agreement, we also entered into the Registration Rights Agreement, in which we

agreed to file one or more registration statements as permissible and necessary to register under the Securities Act, the sale of the shares of our common shares that have been and may be issued to Aspire Capital under the Purchase Agreement. From

January 1, 2018 to the date of this registration statement,

13

the Company issued 3,200,000 shares to Aspire Capital at prices from $2.17 to $3.29. As at March 27, 2018, there remain available 2,162,995 common shares to be issued to Aspire under the

terms of the Purchase Agreement.

As of March 27, 2018, there were 30,702,053 common shares outstanding (30,395,271 shares held by

non-affiliates)

which include 3,878,572 shares offered that have been issued to Aspire Capital pursuant to the Purchase Agreement. If all of the 2,162,995 remaining available common shares offered here were issued

and outstanding as of the date hereof, such shares would represent 6.58% of the total common shares outstanding or 6.64% of the

non-affiliate

shares of common shares outstanding as of the date hereof. The

number of common shares ultimately offered for sale by Aspire Capital is dependent upon the number of shares purchased by Aspire Capital under the Purchase Agreement.

Pursuant to the Purchase Agreement and the Registration Rights Agreement, we have registered 6,041,567 common shares under the Securities Act,

which includes the Commitment Shares and the Initial Purchase Shares that have already been issued to Aspire Capital, 3,200,000 common shares that have been issued to Aspire between January 1 2018 and March 27, 2018 and 2,162,995 common

shares which we may issue to Aspire Capital. All 6,041,567 common shares are being offered pursuant to this prospectus.

On

December 29, 2017, the conditions necessary for purchases under the Purchase Agreement to commence were satisfied. On any trading day on which the closing sale price of our common shares is not less than $0.25 per share, we have the right,

in our sole discretion, to present Aspire Capital with a Purchase Notice, directing Aspire Capital (as principal) to purchase up to 200,000 common shares per business day, up to $15,500,000 of our common shares in the aggregate over the term of

the Purchase Agreement, at a Purchase Price calculated by reference to the prevailing market price of our common shares over the preceding

10-business

day period (as more specifically described below);

however, no sale pursuant to a Purchase Notice may exceed $500,000 per trading day.

In addition, on any date on which we submit a

Purchase Notice to Aspire Capital for 200,000 Purchase Shares, we also have the right, in our sole discretion, to present Aspire Capital with a VWAP Purchase Notice directing Aspire Capital to purchase a number of common shares equal to up to 30% of

the aggregate common shares of the Company traded on the Nasdaq Capital Market on the next trading day, subject to the VWAP Purchase Share Volume Maximum and the VWAP Minimum Price Threshold. The VWAP Purchase Price is calculated by reference to the

prevailing market price of our common shares (as more specifically described below).

The Purchase Agreement provides that we and Aspire

Capital shall not effect any sales under the Purchase Agreement on any purchase date where the closing sale price of our common shares is less than the Floor Price. There are no trading volume requirements or restrictions under the Purchase

Agreement, and we will control the timing and amount of any sales of our common shares to Aspire Capital. Aspire Capital has no right to require any sales by us, but is obligated to make purchases from us as we direct in accordance with the Purchase

Agreement. There are no limitations on use of proceeds, financial or business covenants, restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement. Aspire Capital may

not assign its rights or obligations under the Purchase Agreement. The Purchase Agreement may be terminated by us at any time, at our discretion, without any penalty or cost to us.

Purchase of Common Shares Under the Common Shares Purchase Agreement

Under the Purchase Agreement, on any trading day selected by us on which the closing sale price of our common shares is not less than $0.25 per

share, we may direct Aspire Capital to purchase up to 200,000 common shares per trading day. The Purchase Price of such shares is equal to the lesser of:

|

|

•

|

|

the lowest sale price of our common shares on the purchase date; or

|

14

|

|

•

|

|

the arithmetic average of the three lowest closing sale prices for our common shares on the Nasdaq Capital Market (or successor principal market) during the ten consecutive trading days ending on the trading day

immediately preceding the purchase date.

|

In addition, on any date on which we submit a Purchase Notice to Aspire Capital

for purchase of 200,000 shares, we also have the right to direct Aspire Capital to purchase a number of common shares equal to up to 30% of the aggregate common shares of the Company traded on the Nasdaq Capital Market on the next trading day,

subject to the VWAP Purchase Share Volume Maximum and the VWAP Minimum Price Threshold, which is equal to the greater of (a) 80% of the closing price of our common shares on the business day immediately preceding the VWAP Purchase Date or

(b) such higher price as set forth by us in the VWAP Purchase Notice. The VWAP Purchase Price of such shares is the lower of:

|

|

•

|

|

the Closing Sale Price on the VWAP Purchase Date; or

|

|

|

•

|

|

97% of the volume-weighted average price for our common shares traded on the Nasdaq Capital Market:

|

|

|

•

|

|

on the VWAP Purchase Date, if the aggregate shares to be purchased on that date have not exceeded the VWAP Purchase Share Volume Maximum or

|

|

|

•

|

|

during that portion of the VWAP Purchase Date until such time as the sooner to occur of (i) the time at which the aggregate shares traded on the Nasdaq Capital Market exceed the VWAP Purchase Share Volume Maximum

or (ii) the time at which the sale price of our common shares falls below the VWAP Minimum Price Threshold.

|

The TSX

has approved the transaction and the Nasdaq Capital Market has completed its review of the listing of the common shares issuable in connection with the transaction, but under no circumstance shall we issue, or make issuable, more than 6,041,567

common shares in aggregate, without shareholder approval.

Maximum Number of Shares

The TSX has approved the transaction, but under no circumstance shall we issue, or make issuable, more than 6,041,567 common shares in

aggregate, without shareholder approval.

Minimum Share Price

Under the Purchase Agreement, we and Aspire Capital may not effect any sales of common shares under the Purchase Agreement on any trading day

that the closing sale price of our common shares is less than $0.25 per share.

Events of Default

Generally, Aspire Capital may terminate the Purchase Agreement upon the occurrence of any of the following, among other, events of default:

|

|

•

|

|

the effectiveness of any registration statement that is required to be maintained effective pursuant to the terms of the Registration Rights Agreement between us and Aspire Capital lapses for any reason (including,

without limitation, the issuance of a stop order) or is unavailable to Aspire Capital for sale of common shares, and such lapse or unavailability continues for a period of ten consecutive business days or for more than an aggregate of thirty

business days in any

365-day

period, which is not in connection with a post-effective amendment to any such registration statement; in connection with any post-effective amendment to such registration

statement that is required to be declared effective by the SEC such lapse or unavailability may continue for a period of no more than 40 consecutive business days;

|

15

|

|

•

|

|

the suspension from trading or failure of our common shares to be listed on our principal market for a period of three consecutive business days;

|

|

|

•

|

|

the delisting of our common shares from our principal market (currently the Nasdaq Capital Market), provided our common shares are not immediately thereafter trading on the New York Stock Exchange, the NYSE MKT, the

Nasdaq Capital Market, the Nasdaq Global Select Market, the Nasdaq Global Market, the OTB Bulletin Board or the OTCQB marketplace or OTCQX marketplace of the OTC Markets Group;

|

|

|

•

|

|

our transfer agent’s failure to issue to Aspire Capital common shares which Aspire Capital is entitled to receive under the Purchase Agreement within five business days after an applicable purchase date;

|

|

|

•

|

|

any breach by us of the representations or warranties or covenants contained in the Purchase Agreement or any related agreements which could have a material adverse effect on us, subject to a cure period of five

business days;

|

|

|

•

|

|

if we become insolvent or are generally unable to pay our debts as they become due; or

|

|

|

•

|

|

any participation or threatened participation in insolvency or bankruptcy proceedings by or against us.

|

Our Termination Rights

The

Purchase Agreement may be terminated by us at any time, at our discretion, without any penalty or cost to us.

No Short-Selling or Hedging by Aspire

Capital

Aspire Capital has agreed that neither it nor any of its agents, representatives and affiliates shall engage in any direct

or indirect short-selling or hedging of our common shares during any time prior to the termination of the Purchase Agreement.

Effect of Performance

of the Purchase Agreement on Our Shareholders

The Purchase Agreement does not limit the ability of Aspire Capital to sell any or

all of the 6,041,567 common shares registered in this offering. It is anticipated that common shares registered in this offering will be sold over a period of up to approximately thirty months from the date of this prospectus. The sale by Aspire

Capital of a significant amount of shares registered in this offering at any given time could cause the market price of our common shares to decline and/or to be highly volatile. Aspire Capital may ultimately purchase all, some or none of the

5,362,995 common shares not yet issued but registered in this offering. After it has acquired such common shares, it may sell all, some or none of such shares. Therefore, sales to Aspire Capital by us pursuant to the Purchase Agreement also may

result in substantial dilution to the interests of other holders of our common shares. However, we have the right to control the timing and amount of any sales of our shares to Aspire Capital and the Purchase Agreement may be terminated by us at any

time at our discretion without any penalty or cost to us.

Percentage of Outstanding Shares After Giving Effect to the Purchased Shares Issued to

Aspire Capital

In connection with entering into the Purchase Agreement, we authorized the sale to Aspire Capital of up to

$15,500,000 of our common shares. However, we estimate that we will sell no more than 5,362,995 shares to Aspire Capital under the Purchase Agreement (exclusive of the Commitment Shares and Initial Purchase Shares), all of which are included in this

offering. Subject to any required approval by our board of directors, we have the right but not the obligation to issue more than the 6,041,567 shares included in this prospectus to Aspire Capital under the Purchase Agreement. In the event we elect

to issue more than 6,041,567 shares under the Purchase Agreement, we will be required to file a new registration statement and have it declared effective by the SEC. The number of shares ultimately offered for sale by Aspire Capital in this offering

is dependent upon the number

16

of shares purchased by Aspire Capital under the Purchase Agreement. The following table sets forth the number and percentage of outstanding shares to be held by Aspire Capital after giving effect

to the sale of common shares issued to Aspire Capital at varying purchase prices:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assumed Average

Purchase Price

|

|

|

Proceeds from the Sale

of Shares to Aspire Capital

Under the Purchase

Agreement Registered

in

this Offering

|

|

|

Number of Shares to be Issued

in this Offering at the Assumed

Average Purchase Price

(1)

|

|

|

Percentage of Outstanding

Shares After Giving Effect to

the Purchased Shares Issued

to

Aspire Capital

(2)

|

|

|

$

|

0.25

|

|

|

$

|

1,340,749.00

|

|

|

|

5,362,995

|

|

|

|

*

|

|

|

$

|

0.50

|

|

|

$

|

2,681,498.00

|

|

|

|

5,362,995

|

|

|

|

16.5

|

%

|

|

$

|

1.00

|

|

|

$

|

5,362,995.00

|

|

|

|

5,362,995

|

|

|

|

16.5

|

%

|

|

$

|

1.50

|

|

|

$

|

8,044,493.00

|

|

|

|

5,362,995

|

|

|

|

16.5

|

%

|

|

$

|

2.50

|

|

|

$

|

13,407,488.00

|

|

|

|

5,362,995

|

|

|

|

16.5

|

%

|

|

$

|

5.00

|

|

|

$

|

15,000,000.00

|

|

|

|

3,000,000

|

|

|

|

10.0

|

%

|

|

$

|

10.00

|

|

|

$

|

15,000,000.00

|

|

|

|

1,500,000

|

|

|

|

5.3

|

%

|

|

(1)

|

Excludes 321,429 Commitment Shares and 357,143 Initial Purchase Shares issued under the Purchase Agreement between us and Aspire Capital.

|

|

(2)

|

The denominator is based on 27,049,724 shares outstanding as of November 22, 2017, which includes the 678,572 shares previously issued to Aspire Capital and the number of shares set forth in the adjacent column

which we would have sold to Aspire Capital. The numerator is based on the number of shares which we may issue to Aspire Capital under the Purchase Agreement (that are the subject of this offering) at the corresponding assumed purchase price set

forth in the adjacent column.

|

SELLING SHAREHOLDER

The selling shareholder may from time to time offer and sell any or all of the common shares set forth below pursuant to this prospectus. When

we refer to the “selling shareholder” in this prospectus, we mean the entity listed in the table below, and its respective pledgees, donees, permitted transferees, assignees, successors and others who later come to hold any of the selling

shareholder’s interests in common shares other than through a public sale.

The following table sets forth, as of the date of this

prospectus, the name of the selling shareholder for whom we have registered shares for sale to the public, the number of common shares beneficially owned by the selling shareholder prior to this offering, the total number of common shares that the

selling shareholder may offer pursuant to this prospectus and the number of common shares that the selling shareholder will beneficially own after this offering. Except as noted below, the selling shareholder does not have, or within the past three

years has not had, any material relationship with us or any of our predecessors or affiliates and the selling shareholder is not or was not affiliated with registered broker-dealers.

Based on the information provided to us by the selling shareholder, assuming that the selling shareholder sells all of the common shares

beneficially owned by it that have been registered by us and does not acquire any additional shares during the offering, the selling shareholder will not own any shares other than those appearing in the column entitled “Beneficial Ownership

After This Offering.” We cannot advise you as to whether the selling shareholder will in fact sell any or all of such common shares. In addition, the selling shareholder may have sold, transferred or otherwise disposed of, or may sell, transfer

or otherwise dispose of, at any time and

17

from time to time, the common shares in transactions exempt from the registration requirements of the Securities Act after the date on which it provided the information set forth in the table

below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of

Common

Stock

Owned