– Enrollment Ongoing for a Phase 2 Clinical

Trial of KVD001 in Diabetic Macular Edema (“DME”) and a Phase 1

Clinical Trial for the Second Candidate in the Oral Hereditary

Angioedema (“HAE”) Portfolio –

KalVista Pharmaceuticals, Inc. (NASDAQ: KALV), a clinical stage

pharmaceutical company focused on the discovery, development, and

commercialization of small molecule protease inhibitors, today

reported operational and financial results for the fiscal third

quarter ended January 31, 2018.

“We are pleased to have the second candidate from our oral

hereditary angioedema portfolio in a Phase 1 trial as we continue

to pursue a best-in-class therapy,” said Andrew Crockett, Chief

Executive Officer of KalVista. “Our diabetic macular edema compound

KVD001 is enrolling in a Phase 2 clinical trial for which we expect

to see data in the second half of 2019. The cash position of

KalVista continues to be sufficient to reach data readouts in both

of these ongoing trials.”

Recent Business Highlights:

- Announced initiation of two clinical

trials: A Phase 2 proof-of-concept clinical trial evaluating the

safety, tolerability, and efficacy of KVD001 as a treatment for

DME, as well as a Phase 1 trial for KVD900, the second clinical

candidate in the HAE portfolio. KalVista also intends to bring at

least one additional HAE drug candidate to the clinic before the

end of 2018.

- KalVista’s Chief Scientific Officer,

Edward Feener, Ph.D., presented at The International Symposium on

Ocular Pharmacology and Therapeutics (ISOPT) on March 2, 2018, in

Tel-Aviv, Israel.

Upcoming Events:

- Presenting “A Novel Oral Plasma

Kallikrein (PKal) Inhibitor KV123833 Blocks VEGF-Mediated Retinal

Vascular Hyperpermeability in a Murine Model of Retinal Edema,” at

The Association for Research in Vision and Ophthalmology (ARVO) on

May 1, 2018, in Honolulu, Hawaii.

Fiscal Third Quarter Financial Results:

- Revenue: Revenue was $2.3 million for

the three months ended January 31, 2018, compared to $0.2 million

for the same period in 2017. The increase in revenue is primarily

due to revenue recognized from the Merck option agreement.

- R&D Expenses: Research and

development expenses were $4.5 million for the three months ended

January 31, 2018, compared to $3.3 million for the same period in

2017. The increase in R&D expense is due to an overall increase

in research activities, primarily driven by the KVD001 Phase 2

trial as well as spending on our other development programs.

- G&A Expenses: General and

administrative expenses were $2.1 million for the three months

ended January 31, 2018, compared to $5.0 million for the same

period in 2017. The decrease was primarily due to a $2.1 million

decrease in professional fees and $0.7 million of severance and

payroll expenses related to the share purchase transaction with

Carbylan Therapeutics, Inc. in the prior year.

- Net Loss: Net loss was $5.2 million, or

$(0.49) per basic and diluted share for the three months ended

January 31, 2018, compared to a net loss of $7.6 million, or

$(1.03) per basic and diluted share, for the same period in

2017.

- Cash: Cash and cash equivalents were

$58.7 million as of January 31, 2018.

About KalVista Pharmaceuticals, Inc.KalVista

Pharmaceuticals, Inc. is a pharmaceutical company focused on the

discovery, development, and commercialization of small molecule

protease inhibitors for diseases with significant unmet need. The

initial focus is on inhibitors of plasma kallikrein, which is an

important component of the body’s inflammatory response and which,

in excess, can lead to increased vascular permeability, edema and

inflammation. KalVista has developed a proprietary portfolio of

novel, small molecule plasma kallikrein inhibitors initially

targeting hereditary angioedema (HAE) and diabetic macular edema

(DME). The Company has created a structurally diverse portfolio of

oral plasma kallikrein inhibitors, and is advancing multiple drug

candidates into Phase 1 clinical trials for HAE. KalVista’s most

advanced program, an intravitreally administered plasma kallikrein

inhibitor known as KVD001, has successfully completed its

first-in-human study in patients with DME and began a Phase 2

clinical trial in 2017.

For more information, please visit www.kalvista.com.

Forward-Looking StatementsThis press release contains

"forward-looking" statements within the meaning of the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Forward-looking statements can be identified by words such

as: "anticipate," "intend," "plan," "goal," "seek," "believe,"

"project," "estimate," "expect," "strategy," "future," "likely,"

"may," "should," "will" and similar references to future periods.

These statements are subject to numerous risks and uncertainties

that could cause actual results to differ materially from what we

expect. Examples of forward-looking statements include, among

others, available funding, our cash runway and future clinical

trial timing and results. Further information on potential risk

factors that could affect our business and its financial results

are detailed in the annual report on Form 10-K filed on July 27,

2017, our most recent Quarterly Report on Form 10-Q, and other

reports as filed from time to time with the Securities and

Exchange Commission. We undertake no obligation to publicly update

any forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

KalVista Pharmaceuticals Inc. Condensed Consolidated

Balance Sheets (in thousands, except share and per share

amounts) (Unaudited)

January 31, April 30, 2018 2017

Assets Current assets: Cash and cash equivalents $ 58,678 $

30,950 Research and development tax credit receivable 4,989 2,250

Grants and other receivables 40 297 Prepaid expenses and other

current assets 2,003 701

Total

current assets 65,710 34,198 Other assets 173 50

Property and equipment, net 774 97

Total assets $ 66,657 $

34,345 Liabilities and Stockholders'

Equity Accounts payable $ 1,575 $ 1,153 Accrued expenses

2,290 1,865 Deferred revenue - current portion 19,996 - Capital

lease liability - current portion 222 -

Total current liabilities 24,083 3,018

Long-term liabilities: Deferred revenue - net of current

portion 13,889 - Capital lease liability, net of current portion

117 -

Total long-term liabilities

14,006 - Stockholders’ equity Common

stock, $0.001 par value 11 10 Additional paid-in capital 99,696

89,815 Accumulated deficit (71,003 ) (55,855 ) Accumulated other

comprehensive loss (136 ) (2,643 )

Total

stockholders’ equity 28,568 31,327

Total liabilities and stockholders' equity $

66,657 $ 34,345

KalVista Pharmaceuticals Inc. Condensed Consolidated

Statements of Operations (in thousands, except share and per

share amounts) (Unaudited)

Three Months Ended

Nine Months Ended January 31, January 31,

2018 2017 2018 2017

Revenue $ 2,331 $ 248 $

3,554 $ 1,390 Operating expenses:

Research and development 4,548 3,339 12,385 9,670 General and

administrative 2,129 5,026 6,905

8,973

Total operating expenses

6,677 8,365 19,290 18,643

Operating loss (4,346 )

(8,117 ) (15,736 )

(17,253 ) Other income (expense): Interest

income 14 7 17 31 Foreign currency exchange gain (loss) (1,887 )

(195 ) (1,836 ) 1,511 Other income 985 661

2,407 1,310

Total other

income (888 ) 473 588

2,852

Net loss $ (5,234 )

$ (7,644 ) $ (15,148 )

$ (14,401 ) Net loss per share to

common stockholders, basic and diluted

$ (0.49

) $ (1.03 ) $ (1.49

) $ (5.50 ) Weighted average

common shares outstanding, basic and diluted 10,788,556 7,657,874

10,168,520 3,013,073

KalVista Pharmaceuticals Inc.

Condensed Consolidated Statements of Cash Flows (in

thousands, unaudited)

Nine Months Ended January 31 2018 2017

Cash Flows from Operating Activities Net loss $

(15,148 ) $ (14,401 ) Adjustments to reconcile net loss to net cash

provided by (used in) operating activities: Depreciation and

amortization 129 29 Stock-based compensation 779 228 Foreign

currency remeasurement (gain) loss (500 ) (1,464 ) Changes in

operating assets and liabilities: Research and development tax

credit receivable (2,383 ) (1,303 ) Prepaid expenses and other

current assets (1,206 ) (689 ) Grants and other receivables 281 36

Other assets (123 ) - Accounts payable 548 (1,957 ) Accrued

expenses 332 (1,560 ) Deferred revenue 33,804

- Net cash provided by (used in) operating activities

16,513 (21,081 )

Cash Flows from Investing

Activities Cash acquired in transaction - 34,139 Acquisition of

property and equipment (343 ) (67 ) Net cash provided

by (used in) investing activities (343 ) 34,072

Cash Flows from Financing Activities Capital

lease principal payments (101 ) - Issuance of common stock

9,100 2 Net cash from financing activities

8,999 2 Effect of exchange rate changes

on cash 2,559 (1,259 ) Net increase in cash

and cash equivalents 27,728 11,734 Cash and cash equivalents,

beginning of period 30,950 21,764 Cash

and cash equivalents, end of period $ 58,678 $ 33,498

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180316005172/en/

KalVista Pharmaceuticals, Inc.Leah Monteiro,

857-999-0808Director, Corporate Communications & Investor

Relationsleah.monteiro@kalvista.com

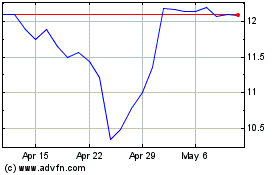

KalVista Pharmaceuticals (NASDAQ:KALV)

Historical Stock Chart

From Mar 2024 to Apr 2024

KalVista Pharmaceuticals (NASDAQ:KALV)

Historical Stock Chart

From Apr 2023 to Apr 2024