PROSPECTUS

Filed

pursuant to Rule 424(b)(3)

Registration No.

333-223425

8,993,541 Shares of Class B Common Stock

218,250 Shares of Class B Common Stock underlying

Representatives’ Warrants

The selling stockholders may offer and

sell from time to time up to an aggregate of 8,993,541 shares of

RumbleOn, Inc. (the “Company”) Class B Common Stock

(“Class B Common Stock”). Also, the Company is

registering the issuance of 218,250 shares of Class B Common Stock

underlying outstanding warrants issued to the representatives of

the underwriters (the “Representatives’

Warrants”) in the Company’s October 2017 public

offering (the “2017 Public Offering”).

The

shares of Class B Common Stock that may be offered and sold by the

selling stockholders include 6,268,644 shares of Class B Common

Stock held by executive officers, directors and certain

stockholders of the Company, which shares are subject to a

contractual lock-up that expires on April 21, 2018. Subject to

certain limitations, including sales volume limitations with

respect to shares held by our affiliates, following April 21, 2018,

substantially all of our outstanding shares of common stock will

become eligible for sale.

For information concerning the selling

stockholders and the manner in which they may offer and sell shares

of our Class B Common Stock, see “Selling Stockholders”

and “Plan of Distribution” in this

prospectus.

We are not selling any securities under this prospectus and we will

not receive any proceeds from the sale by the selling stockholders

of their shares of Class B Common Stock.

Our Class B Common Stock trades on the NASDAQ Capital Market

(“NASDAQ”) under the trading symbol "RMBL". On March

13, 2018, the last reported sales price of our Class B Common Stock

on the NASDAQ was $4.62 per share.

-------------------------------------

Investing in the shares involves risks. See “Risk

Factors,” beginning on page 4.

You should rely only on the information contained in this

prospectus. We have not authorized any dealer, salesperson or other

person to provide you with information concerning us, except for

the information contained in this prospectus. The information

contained in this prospectus is complete and accurate only as of

the date on the front cover page of this prospectus, regardless of

the time of delivery of this prospectus or the sale of any common

stock. This prospectus is not an offer to sell these securities and

we are not soliciting an offer to buy these securities in any state

where the offer or sale is not permitted.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or

complete. Any representation to the contrary is a criminal

offense.

The date of this prospectus is March 14, 2018

TABLE OF CONTENTS

Page

|

ABOUT THIS

PROSPECTUS

|

ii

|

|

PROSPECTUS

SUMMARY

|

1

|

|

THE

OFFERING

|

3

|

|

RISK

FACTORS

|

4

|

|

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

|

7

|

|

USE OF

PROCEEDS

|

9

|

|

SELLING

STOCKHOLDERS

|

10

|

|

PLAN OF

DISTRIBUTION

|

12

|

|

INCORPORATION OF

CERTAIN INFORMATION BY REFERENCE

|

14

|

|

WHERE YOU CAN FIND

MORE INFORMATION

|

15

|

|

LEGAL

MATTERS

|

16

|

|

EXPERTS

|

17

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3

that we filed with the Securities and Exchange Commission, or the

SEC, using a “shelf” registration process for the

delayed offering and sale of securities pursuant to Rule 415 under

the Securities Act of 1933, as amended (the “Securities

Act”). Under the shelf process, the selling stockholders may,

from time to time, sell the offered securities described in this

prospectus in one or more offerings. Additionally, under the shelf

process, in certain circumstances, we may provide a prospectus

supplement that will contain specific information about the terms

of a particular offering by one or more of the selling

stockholders. We may also provide a prospectus supplement to add

information to, or update or change information contained in, this

prospectus.

This prospectus does not contain all of the information set forth

in the registration statement, portions of which we have omitted as

permitted by the rules and regulations of the SEC. Statements

contained in this prospectus as to the contents of any contract or

other document are not necessarily complete. You should refer to

the copy of each contract or document filed as an exhibit to the

registration statement for a complete description.

You should rely only on the information contained in or

incorporated by reference into this prospectus and any applicable

prospectus supplements. Such documents contain important

information you should consider when making your investment

decision. We have not authorized anyone to provide you with

different or additional information. The selling stockholders are

offering to sell and seeking offers to buy shares of our Class B

Common Stock only in jurisdictions in which offers and sales are

permitted. The information contained in this prospectus is accurate

only as of the date of this prospectus, regardless of the time of

delivery of this prospectus or any sale of Class B Common

Stock.

Unless the context otherwise requires,

all references to “RumbleOn,” “RMBL,” the

“Company,” “registrant,” “we,”

“us,” “our” and similar names refer to

RumbleOn, Inc.

, formerly Smart Server, Inc.,

and its consolidated

subsidiaries.

|

PROSPECTUS SUMMARY

This summary does not contain all of the information that is

important to you. You should read the entire prospectus carefully,

including the “Risk Factors” section and the

consolidated financial statements and related notes included in

this prospectus or incorporated by reference into this prospectus,

before making an investment decision.

Overview

RumbleOn, Inc.,

operates a

capital light disruptive e-commerce platform facilitating the

ability of both consumers and dealers to Buy-Sell-Trade-Finance

pre-owned vehicles in one online location. Our goal is to transform

the way pre-owned vehicles are bought and sold by providing users

with the most efficient, timely and transparent transaction

experience. Our initial focus is the market for vin specific

pre-owned vehicles with an initial emphasis on motorcycles and

other powersports.

Serving both

consumers and dealers, through our online marketplace platform, we

make cash offers for the purchase of pre-owned vehicles. In

addition, we offer a large inventory of pre-owned vehicles for sale

along with third-party financing and associated products. Our

operations are designed to be scalable by working through an

infrastructure and capital light model that is achievable by virtue

of a synergistic relationship with our regional partners,

consisting of dealers and auctions. We utilize regional partners in

the acquisition of pre-owned vehicles as well as to provide

inspection, reconditioning and distribution services.

Correspondingly, we earn fees and transaction income, while our

regional partners earn incremental revenue and enhance

profitability through increased sales and fees from inspection,

reconditioning and distribution programs.

Our

business model is driven by a technology platform we acquired in

February 2017, through our acquisition of substantially all of the

assets of NextGen Dealer Solutions, LLC (“NextGen”).

The acquired system provides integrated vehicle appraisal,

inventory management, customer relationship and lead management,

equity mining, and other key services necessary to drive the online

marketplace. Over the past 16 years, the developers of the software

have designed and built, for large multi-national clients, a number

of dealer and, what we believe to be, high quality applications

solutions.

Our

business combines a comprehensive online buying and selling

experience with a vertically-integrated supply chain solution that

allows us to buy and sell high quality vehicles to and from

consumers and dealers transparently and efficiently at a

value-oriented price. Using our website or mobile application,

consumers and dealers can complete all phases of a pre-owned

vehicle transaction. Our online buying and selling experience

allows consumers to:

●

Sell us a

vehicle.

We address the lack of liquidity available in

the market for a cash sale of a vehicle by consumers and dealers

through our cash offer to buy program. Dealers and consumers can

sell us a vehicle independent of a purchase. Using our free and

simple appraisal tool, consumers and dealers can receive a

haggle-free, guaranteed 3-day firm cash offer for their pre-owned

vehicle within minutes and, if accepted, receive prompt payment.

Our cash offer to buy is based on the use of extensive pre-owned

retail and wholesale vehicle market data. When a consumer accepts

our offer, we ship their vehicles to our closest regional partner

where the vehicle is inspected, reconditioned and prepared for

pending sale. We believe buying pre-owned vehicles directly

from consumers is the primary driver of our source of supply for

sale and a key to our ability to offer competitive pricing to

buyers. By being one of the few online sources for consumers to

receive cash for their vehicle, we have a significant opportunity

to buy product at a lower cost since dealer and auction markup is

eliminated from these consumer purchases. In addition, we believe

our willingness to provide cash offers and purchase a

customer’s vehicle sight unseen, whether or not the customer

is buying a vehicle from us, provides a competitive sourcing

advantage for vehicles.

●

Purchase a pre-owned

vehicle.

Our 100% online marketplace approach to retail

consumer and dealer distribution addresses the many issues

currently facing the consumer and dealer distribution marketplace

for pre-owned vehicles, a marketplace we believe is primed for a

disruptive change. We believe the issues facing the marketplace

include: (i) heavy use of inefficient listing sites,

(ii) a highly fragmented dealer network; (iii) a limited

selection of high quality pre-owned vehicles for sale;

(iv) negative consumer perception of the current buying

experience; and (v) a massive consumer shift to online retail.

We offer consumers and dealers a large selection of pre-owned

vehicles at a value-oriented price that can be purchased in a

seamless transaction in minutes. In addition to a transparent

buying experience, our no haggle pricing, coupled with an

inspected, reconditioned and certified vehicle, backed by a

fender-to-fender warranty and a 3-day money back guarantee,

addresses consumer dissatisfaction with the current buying

processes in the marketplace. As of December 31, 2017, including

vehicles of our dealer partners, we have 751

pre-owned vehicles listed for sale on our website, where

consumers can select and purchase a vehicle, including arranging

financing, directly from their desktop or mobile device. Selling

pre-owned vehicles to consumers and dealers is the key driver of

o

|

|

●

Finance a

purchase.

Customers can pay for their vehicle using

cash or we will provide a range of finance options from unrelated

third parties such as banks or credit unions. Customers fill out a

short online application form, and, if approved, apply the

financing to their purchase.

●

Protect a

purchase.

Customers have the option to protect their

vehicle with unrelated third-party branded Extended Protection

Plans (“EPPs”) and vehicle appearance protection

products as part of our online checkout process. EPPs include

extended service plans which are designed to cover unexpected

expenses associated with mechanical breakdowns and guaranteed asset

protection, which is intended to cover the unpaid balance on a

vehicle loan in the event of a total loss of the vehicle or

unrecovered theft. Vehicle appearance protection includes products

aimed at maintaining vehicle appearance.

To enable a

seamless consumer and dealer experience, we are building a

vertically-integrated pre-owned vehicle supply chain marketplace,

supported by proprietary software systems and data which include

the following attributes:

●

Vehicle sourcing and

acquisition.

We acquire virtually all of our pre-owned

vehicle inventory directly from consumers and dealers. Using

pre-owned retail and wholesale vehicle market data obtained from a

variety of internal and external data sources, we evaluate a

significant number of vehicles daily to determine their fit with

consumer demand, internal profitability targets and our existing

inventory mix. The supply of pre-owned vehicles is influenced by a

variety of factors, including: the total number of vehicles in

operation; the rate of new vehicle sales, which in turn generate

pre-owned vehicles; and the number of pre-owned vehicles sold or

remarketed through our consumer and dealer channels. Based on the

large number of vehicles remarketed each year, consumer acceptance

of our cash offer to buy, and the large size of the United States

market relative to our needs, we believe that sources of pre-owned

vehicles will continue to be sufficient to meet our current and

future needs.

●

Inspection,

reconditioning and logistics.

After acquiring a

vehicle, we transport it to one of our closest regional partners

who are paid to perform an inspection and to recondition the

vehicle to meet “RumbleOn Certified” standards. High

quality photographs are then taken, the vehicle is listed for sale

on Rumbleon.com and the regional partner stores the vehicle pending

delivery to the buyer. This process is supported by a custom

pre-owned vehicle inventory management system, which tracks

vehicles through each stage of the inspection, reconditioning and

logistic process. The ability to leverage and provide a high margin

source of incremental revenue to the existing network of regional

partners in return for providing inspection, reconditioning,

logistics and distribution support reduces our need for any

significant investment in retail or reconditioning

facilities.

Corporate

Information

We were

incorporated as a development stage company in the State of Nevada

as Smart Server, Inc. in October 2013. In February 2017, we changed

our name to RumbleOn, Inc. Our principal executive offices are

located at 4521 Sharon Road, Suite 370, Charlotte, North Carolina

28211 and our telephone number is (704) 448-5240. Our Internet

website is

www.rumbleon.com

.

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q,

Current Reports on Form 8-K, and amendments to reports filed or

furnished pursuant to Sections 13(a) and 15(d) of the Exchange Act

are available, free of charge, under the Investor Relations tab of

our website as soon as reasonably practicable after we

electronically file such material with, or furnish it to, the SEC.

You may also read and copy any materials we file with the SEC at

the SEC’s Public Reference Room at 100 F Street, NE,

Washington, DC 20549. You may obtain information on the operation

of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

The SEC also maintains an Internet website located at

www.sec.gov

that contains the information we file or furnish electronically

with the SEC.

|

THE

OFFERING

|

|

|

|

|

|

|

|

Class B Common

Stock outstanding prior to the offering:

|

|

11,928,541

shares

|

|

|

|

|

Class B Common

Stock to be issued upon exercise of the Representatives’

Warrants:

|

|

218,250

shares

|

|

|

|

|

Class B Common

Stock to be offered by the selling stockholders:

|

|

8,993,541

shares

(1)

|

|

|

|

|

Class B Common

Stock outstanding immediately following the offering:

|

|

12,146,791

shares

(1)

|

|

|

|

|

Use of

proceeds:

|

|

We will not receive

any proceeds from the sale of the shares of common stock by the

selling stockholders but will receive proceeds from the exercise of

the Representatives’ Warrants if the Representatives’

Warrants are exercised, which proceeds will be used for working

capital and other general corporate purposes. See “Use of

Proceeds.”

|

|

|

|

|

Risk

Factors:

|

|

See “Risk

Factors” beginning on page 4 of this prospectus for a

discussion of factors you should carefully consider before deciding

to invest in shares of our Class B Common Stock.

|

|

|

|

|

Stock

Symbol:

|

|

NASDAQ:

RMBL

|

|

(1)

|

The number of

shares of Class B Common Stock to be outstanding after this

offering is based on 11,928,541 shares of Class B Common Stock

outstanding as of March 13, 2018, and assumes the exercise of the

Representatives’ Warrants but excludes:

|

●

741,000

shares of Class B Common Stock underlying awards of restricted

stock units (“RSUs”);

●

690,424

shares of Class B Common Stock reserved for issuance under our 2017

Stock Incentive Plan.

RISK FACTORS

An investment in our common stock involves a high degree of risk.

Before deciding whether to invest in our common stock, you should

consider carefully the risks described below and discussed under

the section captioned “Risk Factors” in our most recent

Annual Report on Form 10-K, which is incorporated by reference in

this prospectus in its entirety, as well as any amendment or update

to our risk factors reflected in subsequent filings with the SEC,

together with other information in this prospectus and the

information and documents incorporated by reference that we have

authorized for use in connection with this offering. If any of

these risks actually occur, our business, financial condition,

results of operations or cash flows could be seriously harmed. This

could cause the trading price of our common stock to decline,

resulting in a loss of all or part of your investment.

Risks

Related to Ownership of our Common Stock

The trading price for our Class B

Common Stock may be volatile and could be subject to wide

fluctuations in per share price.

Our Class B Common

Stock is listed for trading on

The

NASDAQ Capital Market under

the trading symbol

“RMBL,” however historically there has been a limited

public market for our Class B Common Stock. The liquidity of any

market for the shares of our Class B Common Stock will depend on a

number of factors, including:

●

the number of

stockholders;

●

our operating

performance and financial condition;

●

the market for

similar securities;

●

the extent of

coverage of us by securities or industry analysts; and

●

the interest of

securities dealers in making a market in the shares of our common

stock.

The market price

for

our Class B Common Stock may be

highly volatile and could be subject to wide fluctuations. In

addition, the price of shares of our Class B Common Stock could

decline significantly if our future operating results fail to meet

or exceed the expectations of market analysts and investors and

actual or anticipated variations in our quarterly operating results

could negatively affect our share price.

Other factors may also contribute to volatility of the price of our

Class B Common Stock and could subject our Class B Common Stock to

wide fluctuations. These include, but are not limited

to:

●

developments in the financial markets and worldwide or regional

economies;

●

announcements of innovations or new products or services by us or

our competitors;

●

announcements by the government relating to regulations that govern

our industry;

●

significant sales of our Class B Common Stock or other securities

in the open market;

●

variations in interest rates;

●

changes in the market valuations of other comparable companies;

and

●

changes in accounting principles

Our principal stockholders and management own a significant

percentage of our stock and an even greater percentage of the

Company’s voting power and will be able to exert significant

control over matters subject to stockholder approval.

O

ur executive officers and directors as a group

beneficially own shares of our Class A Common Stock and Class B

Common Stock representing approximately 74.5% in aggregate of our

voting power, including

approximately 62.5

%

in aggregate voting power held by Messrs. Chesrown

and Berrard as the only holders of our 1,000,000 outstanding shares

of our Class A Common Stock, which has ten votes for each one share

outstanding. As a result, these stockholders have the ability to

determine all matters requiring stockholder approval. For example,

these stockholders are able to control elections of directors,

amendments of our organizational documents, approval of any merger,

sale of assets, or other major corporate transaction. This may

prevent or discourage unsolicited acquisition proposals or offers

for our common stock that you may believe are in your best interest

as a stockholder or to take other action that you may believe are

not in your best interest as a stockholder. This may also adversely

affect the market price of our Class B Common

Stock.

If securities or industry analysts do not publish research or

reports about our business, or if they issue an adverse or

misleading opinion regarding our stock, our stock price and trading

volume could decline.

The trading market

for our Class B Common Stock may be influenced by the research and

reports that industry or securities analysts publish about us or

our business. If any of the analysts who cover us issue an adverse

or misleading opinion regarding us, our business model, our

intellectual property or our stock performance, or if our operating

results fail to meet the expectations of analysts, our stock price

would likely decline. If one or more of these analysts cease

coverage of us or fail to publish reports on us regularly, we could

lose visibility in the financial markets, which in turn could cause

our stock price or trading volume to decline.

Because our Class B Common Stock may be deemed a low-priced

“penny” stock, an investment in our Class B Common

Stock should be considered high risk and subject to marketability

restrictions.

When the trading

price of our Class B Common Stock is $5.00 per share or lower, it

is deemed a penny stock, as defined in Rule 3a51-1 under the

Exchange Act, and subject to the penny stock rules of the Exchange

Act specified in rules 15g-1 through 15g-10. Those rules require

broker-dealers, before effecting transactions in any penny stock,

to:

●

deliver to the

customer, and obtain a written receipt for, a disclosure

document;

●

disclose certain

price information about the stock;

●

disclose the amount

of compensation received by the broker-dealer or any associated

person of the broker-dealer;

●

send monthly

statements to customers with market and price information about the

penny stock; and

●

in some

circumstances, approve the purchaser’s account under certain

standards and deliver written statements to the customer with

information specified in the rules.

Consequently, if

our Class B Common Stock is $5.00 per share price or lower, the

penny stock rules may restrict the ability or willingness of

broker-dealers to sell the Class B Common Stock and may affect the

ability of holders to sell their Class B Common Stock in the

secondary market and the price at which such holders can sell any

such securities. These additional procedures could also limit our

ability to raise additional capital in the future.

A significant portion of our total outstanding shares of Class B

Common Stock is restricted from immediate resale but may be sold

into the market in the near future. This could cause the market

price of our Class B Common Stock to drop significantly, even if

our business is doing well.

Sales of a

substantial number of shares of our Class B Common Stock in the

public market or the perception that these sales might occur, could

depress the market price of our Class B Common Stock and could

impair our ability to raise capital through the sale of additional

equity securities. We are unable to predict the effect that sales

may have on the prevailing market price of our Class B Common

Stock.

On February 8,

2017, our executive officers, directors, and certain stockholders

entered into an Amended and Restated Stockholders Agreement (the

“Stockholders Agreement”), restricting the

stockholders’ ability to transfer shares of our common stock

through the earlier of (i) October 19, 2017, or (ii) the

date on which we receive at least $3,500,000 in proceeds of any

equity financing, subject to certain exceptions. Approximately 7.3

million shares of our Class B Common Stock were subject to these

restrictions. In addition to the Stockholders Agreement, our

executive officers, directors and certain stockholders entered into

lock-up agreements, which restricted the sale of our common stock

by such parties through December 31, 2017. Approximately 7.1

million shares of our Class B Common Stock were subject to

these lock-up agreements. In addition, approximately 6.3 million

shares of our Class B Common Stock are currently subject to a

contractual lock-up through April 21, 2018 with the underwriters of

the 2017 Public Offering. Subject to certain limitations, including

sales volume limitations with respect to shares held by our

affiliates, following April 21, 2018, substantially all of our

outstanding shares of common stock will become eligible

for sale. Sales of stock by the stockholders currently subject

to these lock-ups could have a material adverse effect on the

trading price of our common stock.

We do not currently or for the foreseeable future intend to pay

dividends on our common stock.

We have never

declared or paid any cash dividends on our common stock. We

currently do not intend to pay cash dividends in the foreseeable

future on the shares of common stock. We intend to reinvest any

earning in development and expansion of our business. As a result,

any return on your investment in our common stock will be limited

to the appreciation in the price of our common stock, if

any.

We are an “emerging growth company” under the JOBS Act

of 2012, and we cannot be certain if the reduced disclosure

requirements applicable to emerging growth companies will make our

common stock less attractive to investors.

We are an

“emerging growth company,” as defined in the Jumpstart

Our Business Startups Act of 2012 (“JOBS Act”), and we

may take advantage of certain exemptions from various reporting

requirements that are applicable to other public companies that are

not “emerging growth companies” including, but not

limited to, not being required to comply with the auditor

attestation requirements of Section 404 of the Sarbanes-Oxley Act,

reduced disclosure obligations regarding executive compensation in

our periodic reports and proxy statements, and exemptions from the

requirements of holding a nonbinding advisory vote on executive

compensation and shareholder approval of any golden parachute

payments not previously approved. We cannot predict if investors

will find our common stock less attractive because we may rely on

these exemptions. If some investors find our common stock less

attractive as a result, there may be a less active trading market

for our common stock and our stock price may be more

volatile.

We will remain an

“emerging growth company” for up to five years,

although we will lose that status sooner if our revenue exceeds $1

billion, if we issue more than $1 billion in non-convertible debt

in a three-year period, or if the market value of our common stock

that is held by non-affiliates exceeds $700 million.

Even if we no longer qualify as an “emerging growth

company”, we may still be subject to reduced reporting

requirements so long as we are considered a “smaller

reporting company.”

Many of the

exemptions available for emerging growth companies are also

available to smaller reporting companies like us that have less

than $75 million of worldwide common equity held by non-affiliates.

So, although we may no longer qualify as an emerging growth

company, we may still be subject to reduced reporting

requirements.

If we fail to maintain an effective system of internal control over

financial reporting, we may not be able to accurately report our

financial results or prevent fraud. As a result, stockholders could

lose confidence in our financial and other public reporting, which

would harm our business and the trading price of our common

stock.

Effective internal

controls over financial reporting are necessary for us to provide

reliable financial reports and, together with adequate disclosure

controls and procedures, are designed to prevent fraud. Any failure

to implement required new or improved controls, or difficulties

encountered in their implementation could cause us to fail to meet

our reporting obligations. In addition, any testing by us conducted

in connection with Section 404 of the Sarbanes-Oxley Act, or

any subsequent testing by our independent registered public

accounting firm, may reveal deficiencies in our internal controls

over financial reporting that are deemed to be material weaknesses

or that may require prospective or retroactive changes to our

financial statements or identify other areas for further attention

or improvement. Inferior internal controls could also cause

investors to lose confidence in our reported financial information,

which could have a negative effect on the trading price of our

common stock.

We are required to

disclose changes made in our internal controls and procedures on a

quarterly basis and our management will be required to assess the

effectiveness of these controls annually. However, for as long as

we are an “emerging growth company” under the JOBS Act,

our independent registered public accounting firm will not be

required to attest to the effectiveness of our internal controls

over financial reporting pursuant to Section 404. We could be

an “emerging growth company” for up to five years. An

independent assessment of the effectiveness of our internal

controls could detect problems that our management’s

assessment might not. Undetected material weaknesses in our

internal controls could lead to financial statement restatements

and require us to incur the expense of remediation.

Anti-takeover provisions may limit the ability of another party to

acquire us, which could cause our stock price to

decline.

Nevada law and our charter, bylaws, and other governing documents

contain provisions that could discourage, delay or prevent a third

party from acquiring us, even if doing so may be beneficial to our

stockholders, which could cause our stock price to decline. In

addition, these provisions could limit the price investors would be

willing to pay in the future for shares of our common

stock.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Our business,

financial condition, results of operations, cash flows and

prospects, and the prevailing market price and performance of our

securities, may be adversely affected by a number of factors,

including the matters discussed below. Certain statements and

information set forth in this prospectus, as well as other written

or oral statements made from time to time by us or by our

authorized executive officers on our behalf, constitute

“forward-looking statements” within the meaning of the

Federal Private Securities Litigation Reform Act of 1995. We intend

for our forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and we set forth this

statement and these risk factors in order to comply with such safe

harbor provisions. You should note that our forward-looking

statements speak only as of the date of this prospectus or when

made and we undertake no duty or obligation to update or revise our

forward-looking statements, whether as a result of new information,

future events or otherwise. Although we believe that the

expectations, plans, intentions and projections reflected in our

forward-looking statements are reasonable, such statements are

subject to risks, uncertainties and other factors that may cause

our actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. The risks,

uncertainties and other factors that our stockholders and

prospective investors should consider include the

following:

●

We have a limited

operating history and we cannot assure you we will achieve or

maintain profitability;

●

Our annual and

quarterly operating results may fluctuate significantly or may fall

below the expectations of investors or securities analysts, each of

which may cause our stock price to fluctuate or

decline;

●

The initial

development and progress of our business to date may not be

indicative of our future growth prospects and, if we continue to

grow rapidly, we may not be able to manage our growth

effectively;

●

We may require

additional capital to pursue our business objectives and respond to

business opportunities, challenges or unforeseen circumstances. If

capital is not available on terms acceptable to us or at all, we

may not be able to develop and grow our business as anticipated and

our business, operating results and financial condition may be

harmed;

●

The success of our

business relies heavily on our marketing and branding efforts,

especially with respect to the RumbleOn website and our branded

mobile applications, and these efforts may not be

successful;

●

The failure to

develop and maintain our brand could harm our ability to grow

unique visitor traffic and to expand our dealer

network;

●

We rely on Internet

search engines and social media to drive traffic to our website,

and if we fail to appear prominently in the search results, our

traffic would decline, and our business would be adversely

affected;

●

A significant

disruption in service on our website or of our mobile applications

could damage our reputation and result in a loss of consumers,

which could harm our business, brand, operating results, and

financial condition;

●

We may be unable to

maintain or grow relationships with information data providers or

may experience interruptions in the data feeds they provide, which

may limit the information that we are able to provide to our users

and dealers as well as adversely affect the timeliness of such

information and may impair our ability to attract or retain

consumers and our dealers and to timely invoice all

parties;

●

If key industry

participants, including powersports and recreation vehicle dealers

and regional auctions, perceive us in a negative light or our

relationships with them suffer harm, our ability to operate and

grow our business and our financial performance may be

damaged;

●

If we are unable to

provide a compelling recreation vehicle buying experience to our

users, the number of transactions between our users, RumbleOn and

dealers will decline, and our revenue and results of operations

will suffer harm;

●

The growth of our

business relies significantly on our ability to increase the number

of dealers and regional auctions in our network such that we are

able to increase the number of transactions between our users,

dealers and auctions. Failure to do so would limit our

growth;

●

Our ability to grow

our complementary product offerings may be limited, which could

negatively impact our development, growth, revenue and financial

performance;

●

We rely on

third-party financing providers to finance a portion of our

customers’ vehicle purchases;

●

Our sales of

powersports/recreational vehicles may be adversely impacted by

increased supply of and/or declining prices for pre-owned

powersports and recreational vehicles and excess supply of new

powersports and recreational vehicles;

●

We rely on a number

of third parties to perform certain operating and administrative

functions for the Company;

●

We participate in a

highly competitive market, and pressure from existing and new

companies may adversely affect our business and operating

results;

●

Seasonality or

weather trends may cause fluctuations in our unique visitors,

revenue and operating results;

●

We collect,

process, store, share, disclose and use personal information and

other data, and our actual or perceived failure to protect such

information and data could damage our reputation and brand and harm

our business and operating results;

●

Failure to

adequately protect our intellectual property could harm our

business and operating results;

●

We may in the

future be subject to intellectual property disputes, which are

costly to defend and could harm our business and operating

results;

●

Results of

operations from quarter to quarter may be volatile as a result of

the impact of fluctuations in the fair value of our outstanding

warrants;

●

We depend on key

personnel to operate our business, and if we are unable to retain,

attract and integrate qualified personnel, our ability to develop

and successfully grow our business could be harmed;

●

We may acquire

other companies or technologies, which could divert our

management’s attention, result in additional dilution to our

stockholders and otherwise disrupt our operations and harm our

operating results;

●

The trading price

for our Class B Common Stock may be volatile and could be subject

to wide fluctuations in per share price;

●

Our principal

stockholders and management own a significant percentage of our

stock and an even greater percentage of the Company’s voting

power and will be able to exert significant control over matters

subject to stockholder approval;

●

If securities or

industry analysts do not publish research or reports about our

business, or if they issue an adverse or misleading opinion

regarding our stock, our stock price and trading volume could

decline;

●

Because our Class B

Common Stock may be deemed a low-priced “penny” stock,

an investment in our Class B Common Stock should be considered high

risk and subject to marketability restrictions;

●

A significant

portion of our total outstanding shares of Class B Common Stock is

restricted from immediate resale but may be sold into the market in

the near future. This could cause the market price of our Class B

Common Stock to drop significantly, even if our business is doing

well;

●

We do not currently

or for the foreseeable future intend to pay dividends on our common

stock;

●

We are an

“emerging growth company” under the JOBS Act of 2012,

and we cannot be certain if the reduced disclosure requirements

applicable to emerging growth companies will make our common stock

less attractive to investors;

●

Even if we no

longer qualify as an “emerging growth company”, we may

still be subject to reduced reporting requirements so long as we

are considered a “smaller reporting

company”;

●

If we fail to

maintain an effective system of internal control over financial

reporting, we may not be able to accurately report our financial

results or prevent fraud. As a result, stockholders could lose

confidence in our financial and other public reporting, which would

harm our business and the trading price of our common

stock;

●

Anti-takeover

provisions may limit the ability of another party to acquire us,

which could cause our stock price to decline;

and

●

as well as other

statements regarding our future operations, financial condition and

prospects, and business strategies.

Forward-looking

statements may appear throughout this prospectus, including without

limitation, the following sections: “Risk Factors” and

“Overview”. Forward-looking statements generally can be

identified by words such as “anticipates,”

“believes,” “estimates,”

“expects,” “intends,” “plans,”

“predicts,” “projects,” “will

be,” “will continue,” “will likely

result,” and similar expressions. These forward-looking

statements are based on current expectations and assumptions that

are subject to risks and uncertainties, which could cause our

actual results to differ materially from those reflected in the

forward-looking statements. Factors that could cause or contribute

to such differences include, those discussed in this prospectus,

and in particular, the risks discussed under the caption

“Risk Factors” and those discussed in other documents

we file with the Securities and Exchange Commission (SEC). We

undertake no obligation to revise or publicly release the results

of any revision to these forward-looking statements, except as

required by law. Given these risks and uncertainties, readers are

cautioned not to place undue reliance on such forward-looking

statements.

USE OF PROCEEDS

We will not receive

any proceeds from the sale of the shares of common stock by the

selling stockholders but will receive proceeds from the exercise of

the Representatives’ Warrants if the Representatives’

Warrants are exercised, which proceeds will be used for working

capital and other general corporate purposes.

SELLING STOCKHOLDERS

The selling

stockholders may offer from time to time up to an aggregate of

8,993,541 shares of

RumbleOn, Inc. Class B Common Stock

. On February 8, 2017,

our executive officers, directors, and certain stockholders entered

into the Stockholders Agreement, restricting the

stockholders’ ability to transfer shares of our common stock

through the earlier of (i) October 19, 2017, or (ii) the

date on which we receive at least $3,500,000 in proceeds of any

equity financing, subject to certain exceptions. Approximately 7.3

million shares of our Class B Common Stock were subject to these

restrictions. In addition to the Stockholders Agreement, our

executive officers, directors and certain stockholders entered into

lock-up agreements, which restricted the sale of our common stock

by such parties through December 31, 2017. Approximately 7.1

million shares of our Class B Common Stock were subject to

these lock-up agreements. In addition, approximately 6.3 million

shares of our Class B Common Stock are currently subject to a

contractual lock-up through April 21, 2018 with the underwriters of

the 2017 Public Offering. Subject to certain limitations, including

sales volume limitations with respect to shares held by our

affiliates, following April 21, 2018, substantially all of our

outstanding shares of common stock will become eligible

for sale.

Except as otherwise

provided, the following table sets forth certain information with

respect to the beneficial ownership of our Class B Common Stock

including the names of the selling stockholders, the number of

shares of our Class B Common Stock owned beneficially by the

selling stockholders as of March 13, 2018 the number of shares of

Class B Common Stock being offered by each selling stockholder

hereby, and the number and percentage of shares of Class B Common

Stock that will be owned by each selling stockholder following the

completion of this offering. The table has been prepared based upon

a review of information furnished to us by or on behalf of the

selling stockholders.

|

Name of Selling

Stockholder

|

Shares of Class

B Common Stock Owned Before the Offering

|

Shares of Class

B Common Stock to be Offered for the Selling Stockholder’s

Account

|

Shares of Class

B Common Stock Owned by the Selling Stockholder after the

Offering

|

Percent of

Class B Common Stock to be Owned by the Selling Stockholder after

the Offering

|

|

Beverly

Rath

|

50,000

|

50,000

|

--

|

--

|

|

Denmar Dixon

(1)

|

1,002,179

*

|

962,179

*

|

40,000

*

|

--

|

|

Cameron M.

Harris

|

25,000

|

25,000

|

--

|

--

|

|

Chris and Samantha

Carabell JTWROS

|

6,250

|

6,250

|

--

|

--

|

|

Dale

Owens

|

6,250

|

6,250

|

--

|

--

|

|

David Alan

Duncan

|

25,000

|

25,000

|

--

|

--

|

|

David

Aucamp

|

12,500

|

12,500

|

--

|

--

|

|

George

Kovacs

|

50,000

|

50,000

|

--

|

--

|

|

Heather J. Larsen

(2)

|

12,500

|

12,500

|

--

|

--

|

|

Jack

Lynn

|

15,000

|

15,000

|

--

|

--

|

|

James

Bird

|

10,000

|

10,000

|

--

|

--

|

|

James

Dillon

|

25,000

|

25,000

|

--

|

--

|

|

Jason and Anissa

Larsen JTWROS

|

6,250

|

6,250

|

--

|

--

|

|

Jay

Goodart

|

268,750

|

268,750

|

--

|

--

|

|

Jeff Cheek

(3)

|

262,500

|

262,500

|

--

|

--

|

|

Jeffrey Larson

(4)

|

21,250

|

21,250

|

--

|

--

|

|

Jon T.

Goodart

|

5,000

|

5,000

|

--

|

--

|

|

Kartik Kakarala

(5)

|

1,523,809

*

|

1,523,809

*

|

--

|

--

|

|

Kevin

Westfall

|

12,500

*

|

12,500

*

|

--

|

--

|

|

Klaire Odumody

Taylor

|

3,750

|

3,750

|

--

|

--

|

|

Lori Sue

Chesrown

|

458,204

|

458,204

|

--

|

--

|

|

Mango Mist,

Inc.

|

8,750

|

8,750

|

--

|

--

|

|

Marshall

Chesrown

|

1,742,156

*

|

1,737,656

*

|

4,500

*

|

--

|

|

Marvin

Neuman

|

25,000

|

25,000

|

--

|

--

|

|

Michael

Cook

|

8,750

|

8,750

|

--

|

--

|

|

Matthew Galliano

(6)

|

12,500

|

12,500

|

--

|

--

|

|

Pierce Family

Trust

|

37,500

*

|

37,500

*

|

--

|

--

|

|

Ralph

Wegis

|

891,537

|

891,537

|

--

|

--

|

|

Richard A. Gray

Jr.

|

25,000

*

|

25,000

*

|

--

|

--

|

|

Robert Thigpen,

Jr.

|

25,000

|

25,000

|

--

|

--

|

|

Shawn B.

Welch

|

25,000

|

25,000

|

--

|

--

|

|

Special Trust FBO

Daniel L. Grubb

|

12,500

|

12,500

|

--

|

--

|

|

Steven

Hatleman

|

3,750

|

3,750

|

--

|

--

|

|

Steven R. Berrard

(7)

|

1,970,000

*

|

1,970,000

*

|

--

|

--

|

|

The Just B

Irrevocable Trust

|

37,500

|

37,500

|

--

|

--

|

|

Tim

Duplantis

|

12,500

|

12,500

|

--

|

--

|

|

Tim J.

Setnicka

|

37,500

|

37,500

|

--

|

--

|

|

Tin Roof,

Inc.

|

8,750

|

8,750

|

--

|

--

|

|

Tom

Aucamp

|

287,656

|

287,656

|

--

|

--

|

|

Tom

Byrne

|

65,000

|

65,000

|

--

|

--

|

*

Represents shares

that are subject to a contractual lock-up restricting their resale

through April 21, 2018.

(1)

Shares are held by

Blue Flame Capital, LLC, an entity controlled by Mr. Dixon.

Excludes 28,000 shares held directly by Mr. Dixon, 250 shares held

by Mr. Dixon’s son and 7,750 shares held by Mr. Dixon's

spouse.

(2)

Shares are held by

Mainstar Trust, Custodian (“Mainstar”), for the benefit

of Ms. Larsen.

(3)

12,500 shares are

held by Mainstar for the benefit of Mr. Cheek.

(4)

Shares are held by

Fidelity Management Trust Company, for the benefit of Mr.

Larson.

(5)

Shares are held by

Halcyon Consulting, LLC, an entity controlled by Mr. Kakarala ad

his brother.

(6)

Shares are held by

Mainstar for the benefit of Mr. Galliano.

(7)

Shares are held by

Berrard Holdings Limited Partnership, an entity controlled by Mr.

Berrard.

None of the selling

stockholders has, or within the past three years has had, any

position, office or material relationship with us or any of our

predecessors or affiliates, except as follows:

●

Marshall Chesrown

serves as Chair of the Company’s Board of Directors and as

Chief Executive Officer of the Company.

●

Steven R. Berrard

serves as a Director and as Chief Financial Officer and Secretary

of the Company.

●

Kartik Kakarala

serves as a Director of the Company.

●

Kevin Westfall

serves as a Director of the Company.

●

Mitch Pierce,

trustee of Pierce Family Trust, serves as a Director of the

Company.

●

Denmar Dixon, who

serves as a Director of the Company, is the founder of Blue Flame

Capital, LLC.

●

Richard Gray serves

as a Director of the Company.

PLAN OF DISTRIBUTION

Selling

Stockholders

We are registering

the shares of Class B Common Stock to permit the resale of these

shares of Class B Common Stock by the holders of the Class B Common

Stock from time to time after the date of this prospectus. We will

not receive any of the proceeds from the sale by the selling

stockholders of the shares of Class B Common Stock. We will bear

all fees and expenses incident to our obligation to register the

shares of Class B Common Stock.

The selling

stockholders, or their pledgees, donees, transferees, or any of

their successors in interest selling shares received from a named

selling stockholder as a gift, partnership distribution or other

non-sale-related transfer after the date of this prospectus (all of

whom may be selling stockholders), may sell the securities from

time to time on any stock exchange or automated interdealer

quotation system on which the securities are listed, in the

over-the-counter market, in privately negotiated transactions or

otherwise, at fixed prices that may be changed, at market prices

prevailing at the time of sale, at prices related to prevailing

market prices or at prices otherwise negotiated. The selling

stockholders may sell the securities by one or more of the

following methods, without limitation:

(a)

block trades in

which the broker or dealer so engaged will attempt to sell the

securities as agent but may position and resell a portion of the

block as principal to facilitate the transaction;

(b)

purchases by a

broker or dealer as principal and resale by the broker or dealer

for its own account pursuant to this prospectus;

(c)

an exchange

distribution in accordance with the rules of any stock exchange on

which the securities are listed;

(d)

ordinary brokerage

transactions and transactions in which the broker solicits

purchases;

(e)

privately

negotiated transactions;

(g)

through the writing

of options on the securities, whether or not the options are listed

on an option exchange;

(h)

through the

distribution of the securities by any selling stockholder to its

partners, members or stockholders;

(i)

one or more

underwritten offerings on a firm commitment or best efforts basis;

or

(j)

any combination of

any of these methods of sale.

The selling

stockholders may also transfer the securities by gift. We do not

know of any arrangements by the selling stockholders for the sale

of any of the securities. The selling stockholders may engage

brokers and dealers, and any brokers or dealers may arrange for

other brokers or dealers to participate in effecting sales of the

securities. These brokers, dealers or underwriters may act as

principals, or as an agent of a selling stockholder. Broker-dealers

may agree with a selling stockholder to sell a specified number of

the securities at a stipulated price per security. If the

broker-dealer is unable to sell securities acting as agent for a

selling stockholder, it may purchase as principal any unsold

securities at the stipulated price. Broker-dealers who acquire

securities as principals may thereafter resell the securities from

time to time in transactions in any stock exchange or automated

interdealer quotation system on which the securities are then

listed, at prices and on terms then prevailing at the time of sale,

at prices related to the then-current market price or in negotiated

transactions. Broker-dealers may use block transactions and sales

to and through broker-dealers, including transactions of the nature

described above. The selling stockholders may also sell the

securities in accordance with Rule 144 under the Securities Act of

1933, as amended, rather than pursuant to this prospectus,

regardless of whether the securities are covered by this

prospectus.

From time to time,

one or more of the selling stockholders may pledge, hypothecate or

grant a security interest in some or all of the securities owned by

them. The pledgees, secured parties or persons to whom the

securities have been hypothecated will, upon foreclosure in the

event of default, be deemed to be selling stockholders. The number

of a selling stockholder’s securities offered under this

prospectus will decrease as and when it takes such actions. The

plan of distribution for that selling stockholder’s

securities will otherwise remain unchanged. In addition, a selling

stockholder may, from time to time, sell the securities short, and,

in those instances, this prospectus may be delivered in connection

with the short sales and the securities offered under this

prospectus may be used to cover short sales.

To the extent

required under the Securities Act of 1933, the aggregate amount of

selling stockholders’ securities being offered and the terms

of the offering, the names of any agents, brokers, dealers or

underwriters and any applicable commission with respect to a

particular offer will be set forth in an accompanying prospectus

supplement. Any underwriters, dealers, brokers or agents

participating in the distribution of the securities may receive

compensation in the form of underwriting discounts, concessions,

commissions or fees from a selling stockholder and/or purchasers of

selling stockholders’ securities of securities, for whom they

may act (which compensation as to a particular broker-dealer might

be in excess of customary commissions).

The selling

stockholders and any underwriters, brokers, dealers or agents that

participate in the distribution of the securities may be deemed to

be “underwriters” within the meaning of the Securities

Act of 1933, and any discounts, concessions, commissions or fees

received by them and any profit on the resale of the securities

sold by them may be deemed to be underwriting discounts and

commissions.

Representatives'

Warrants and Advisory Fees

Upon closing of the

2017 Public Offering on October 19, 2017, we issued the

Representatives’ Warrants to the representatives of the

underwriters, and their affiliates, as compensation warrants to

purchase a number of shares of Class B Common Stock equal to 7.5%

of the aggregate number of shares of Class B Common Stock sold in

the 2017 Public Offering, representing an aggregate of 218,250

shares of Class B Common Stock. The Representatives' Warrants are

exercisable at a per share exercise price equal to 115% of the

public offering price per share of the shares of Class B Common

Stock sold in the 2017 Public Offering, resulting in an exercise

price of $6.325 per share. The Representatives' Warrants are

exercisable at any time and from time to time, in whole or in part,

during the four-year period commencing one year from the effective

date of the registration statement related to the Public Offering,

which was October 18, 2017.

The

Representatives' Warrants and the shares of Class B Common Stock

underlying the Representatives' Warrants have been deemed

compensation by FINRA and are, therefore, subject to a 180-day

lock-up pursuant to FINRA Rule 5110(g)(1). The representative, or

permitted assignees under such rule, may not sell, transfer,

assign, pledge, or hypothecate the Representatives' Warrants or the

securities underlying the Representatives' Warrants, nor will the

representative engage in any hedging, short sale, derivative, put,

or call transaction that would result in the effective economic

disposition of the Representatives' Warrants or the underlying

shares of Class B Common Stock for a period of 180 days from the

effective date of the registration statement. Additionally, the

Representatives' Warrants may not be sold transferred, assigned,

pledged or hypothecated for a 180-day period following the

effective date of the registration statement except to any

underwriter and selected dealer participating in the offering and

their bona fide officers or partners. The Representatives' Warrants

provide for adjustment in the number and price of the

Representatives' Warrants and the shares of Class B Common Stock

underlying such Representatives' Warrants in the event of

recapitalization, merger, stock split or other structural

transaction, or a future financing undertaken by us.

Upon the closing of

the 2017 Public Offering, we have also agreed to pay Roth Capital

Partners, LLC as compensation a one-time advisory fee in the amount

of $150,000

.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference”

information into this prospectus, which means that we can disclose

important information about us by referring to another document

filed separately with the SEC. The information incorporated by

reference is considered to be a part of this prospectus. This

prospectus incorporates by reference the documents and reports

listed below other than portions of these documents that are

furnished under Item 2.02 or Item 7.01 of a Current Report on Form

8–K:

●

The Annual Report on Form 10–K for the fiscal year ended

December 31, 2017, filed on February 27, 2018;

●

The Current Report on Form 8–K filed on February 23, 2018;

and

●

The description of the Company’s common stock contained in

the Company’s Registration Statement on Form 8-A, filed with

the SEC on October 18, 2017.

In addition, all documents subsequently filed by us pursuant to

Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, shall be

deemed to be incorporated by reference in this prospectus and to be

a part hereof from the date of filing of such documents. Any

statement contained in a document incorporated or deemed to be

incorporated by reference herein shall be deemed to be modified or

superseded for purposes of this prospectus to the extent that a

statement contained herein or in any subsequently filed document

that also is or is deemed to be incorporated by reference herein,

as the case may be, modifies or supersedes such statement. Any such

statement so modified or superseded shall not be deemed, except as

so modified or superseded, to constitute a part of this

prospectus.

We will provide, without charge, to any person, including any

beneficial owner, to whom a copy of this prospectus is delivered,

upon oral or written request of such person, a copy of any or all

of the documents that have been incorporated by reference in this

prospectus but not delivered with the prospectus, including any

exhibits to such documents that are specifically incorporated by

reference in those documents.

Please make your request by writing or telephoning us at the

following address or telephone number:

RumbleOn, Inc.

4521 Sharon Road, Suite 370

Charlotte, North Carolina 28211

Attention: Investor Relations

Tel: (704) 448-5240

WHERE YOU CAN FIND MORE INFORMATION

We are currently

subject to the information requirements of the Exchange Act and in

accordance therewith file periodic reports, proxy statements and

other information with the Securities and Exchange Commission. You

may read and copy (at prescribed rates) any such reports, proxy

statements and other information at the SEC’s Public

Reference Room at 100 F Street, N.E., Washington, D.C. 20549.

Please call the SEC at 1-800-SEC-0330 for further information on

the operation of the public reference room. Our SEC filings will

also be available to you on the SEC’s website at

http://www.sec.gov

.

We have filed with the SEC a registration statement on Form

S–3 under the Securities Act for the shares of Class B Common

Stock being offered by the selling stockholders. This prospectus

does not contain all of the information in the registration

statement and the exhibits and schedules that were filed with the

registration statement. For further information with respect to us

and our common stock, we refer you to the registration statement

and the exhibits that were filed with the registration statement.

Anyone may obtain the registration statement and its exhibits and

schedules from the SEC as described above.

LEGAL MATTERS

The validity of the shares of Class B Common Stock offered through

this prospectus has been passed on by Akerman LLP.

EXPERTS

The consolidated financial statements and schedule of RumbleOn,

Inc. (formerly Smart Server, Inc.) as of December 31, 2017 and

December 31, 2016 and for the years then ended incorporated by

reference in this prospectus have been so incorporated in reliance

on the report of Scharf Pera & Co., PLLC, an independent

registered public accounting firm, incorporated herein by

reference, given on the authority of said firm as experts in

auditing and accounting.

8,993,541 Shares of Class B Common

Stock

218,250 Shares of Class B Common Stock

underlying Representatives' Warrants

PROSPECTUS

March 14, 2018

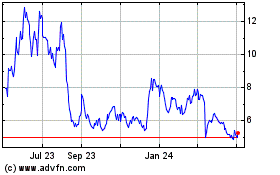

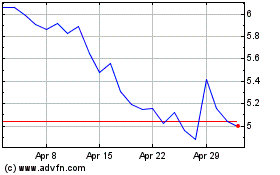

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024