Vishay Precision Group, Inc. (NYSE: VPG), a leading producer of

precision sensors and systems, today announced its results for its

fiscal 2017 fourth quarter and twelve fiscal months ended December

31, 2017.

Fourth Quarter Highlights:

- Growth in revenues to $69.4 million, up

24.4% year-over-year

- Earnings increased to $0.33 per diluted

share, compared to $0.22 reported last year

- Adjusted diluted EPS* increased 50% to

$0.39 compared to prior year $0.26

- Operating margin for the quarter is

10.0%, adjusted operating margin* for the quarter is 11.1%

- Cash from operations was $7.9 million

with free cash flow* of $5.4 million

- Book-to-bill remains strong at 1.18,

continues to reflect broadly improving end-markets

- Enactment of the US Tax Cuts and Jobs

Act impact, while provisional, of $1.5 million expense

Ziv Shoshani, Chief Executive Officer of VPG, commented, “Our

operating performance in the fourth quarter of 2017 continues to

demonstrate our ability to capitalize on an improved business

climate across our end markets. We had good operating margins,

solid cash generation and continued to capture opportunity,

reflected in our steady, strong book-to-bill. 2017 was a successful

year for VPG, and as we progress through next year, we believe we

have an opportunity to further leverage our end markets and deliver

value to our shareholders.”

The Company grew fourth fiscal quarter 2017 net earnings

attributable to VPG stockholders to $4.5 million, or $0.33 per

diluted share, compared to $3.0 million, or $0.22 per diluted

share, in the fourth fiscal quarter of 2016. This growth was

achieved despite a foreign currency exchange rates headwind that

reduced net income by $0.7 million, or $0.05 per diluted share

relative to the fourth quarter of last year.

In the twelve fiscal months ended December 31, 2017, net

earnings attributable to VPG stockholders grew to $14.3 million, or

$1.07 per diluted share, compared to $6.4 million, or $0.48 per

diluted share, in the twelve fiscal months ended 2016. This growth

was achieved despite a negative impact from foreign currency

exchange rates of $2.9 million, or $0.21 per diluted share, as

compared to the prior year’s twelve-month period.

Included within Other income (expense) and in cash from

operations, for the twelve fiscal months ended December 31, 2017,

are net proceeds of $1.5 million related to a one time lease

termination payment at the Company’s Tianjin, People's Republic of

China location. The relocation of operations in Tianjin has been

completed.

Fourth fiscal quarter 2017 adjusted net earnings attributable to

VPG stockholders grew 55% to $5.3 million, or $0.39 per diluted

share, compared to adjusted net earnings attributable to VPG

stockholders of $3.4 million, or $0.26 per diluted share, for the

comparable prior year period.

Twelve fiscal months ended December 31, 2017 adjusted net

earnings attributable to VPG stockholders grew by 54% to $15.3

million, or $1.14 per diluted share, compared to adjusted net

earnings attributable to VPG stockholders of $9.9 million, or $0.74

per diluted share, for the comparable prior year period.

The reconciliation table within this release reconciles the

Company's non-GAAP measures, which are provided for comparison with

other results, to the most directly comparable U.S. GAAP

measures.

Segments

Foil Technology Products segment revenues grew 17.6% to $29.9

million in the fourth fiscal quarter of 2017, up from $25.4 million

in the fourth fiscal quarter of 2016; sequential revenue increased

2.0% up from $29.3 million in the third quarter of 2017. The

year-over-year increase in revenues was attributable to precision

resistors growth in all regions for the test and measurement and

AMS markets, in addition to an increase mainly in the advance

sensors products for the force measurement market mainly in Asia.

The sequential increase in revenues was attributable to the

advanced sensors products for the force measurement market in

Asia.

Gross profit margin for the segment was 39.3% for the fourth

fiscal quarter of 2017, a decrease compared to 40.6% in the fourth

fiscal quarter of 2016 and 41.7% in the third fiscal quarter of

2017. The year-over-year decline in gross margin reflects a

negative exchange rate impact and inventory adjustments. The

sequential decline in gross margins primarily reflects inventory

adjustments, an increase in wages and repair and maintenance, and a

negative exchange rate impact.

Force Sensors segment revenues grew 20.0% to $17.7 million in

the fourth fiscal quarter of 2017, up from $14.8 million in the

fourth fiscal quarter of 2016; sequential revenue increased 6.8% up

from $16.6 million in the third quarter of 2017. The year-over-year

increase in revenues was attributable to OEM customers in the force

measurement market, mainly in the Americas and Europe. The increase

in sequential revenue was attributable to OEM customers in the

force measurement market in the Americas.

Gross profit margin for Force Sensors was 29.5% for the fourth

fiscal quarter of 2017, an increase compared to 25.3% in the fourth

fiscal quarter of 2016 and 28.6% in the third fiscal quarter of

2017. Gross margins were up compared to the prior year period and

sequentially directly due to the volume increase experienced in the

fourth fiscal quarter of 2017.

Weighing and Control Systems segment revenues grew by 39.6% to

$21.8 million in the fourth fiscal quarter of 2017, up from $15.6

million in the fourth fiscal quarter of 2016; sequential revenue

increased 29.2% from $16.9 million in the third fiscal quarter of

2017. The increased year-over-year revenues and sequential revenues

are primarily attributable to the steel market in Europe and Asia

in addition to on-board weighing products in Europe and the

Americas. Additionally, the year-over-year revenues were positively

impacted by exchange rates.

Fourth fiscal quarter 2017 gross profit margin for the segment

was 44.8%, a decline from the fourth fiscal quarter of 2016 of

46.5% and up from the third fiscal quarter of 2017 of 43.1%. The

year-over-year decline in gross margin was primarily due to an

increase in fixed manufacturing costs. The sequential gross margin

improvement mainly reflects higher volumes.

Near-Term Outlook

“In light of an improved business environment, excluding the

cyclical nature of the project-driven end user steel market, and at

constant fourth fiscal quarter 2017 exchange rates, we expect net

revenues in the range of $65 million to $70 million for the first

fiscal quarter of 2018,” concluded Mr. Shoshani.

*Use of Non-GAAP Financial Information

We define “adjusted net earnings” as net earnings attributable

to VPG stockholders before acquisition purchase accounting

adjustments, acquisition costs, strategic alternative evaluation

costs, gain on sale of building, restructuring costs, net proceeds

from lease termination, tax rebate and associated tax effects,

including the enactment of the U.S. Tax Cuts and Jobs Act.

“Adjusted gross margin” is defined as gross margin before

acquisition purchase accounting adjustments. “Adjusted operating

margin” is defined as operating margin before acquisition purchase

accounting adjustments, acquisition costs, strategic alternative

evaluation costs, gain on sale of building and restructuring costs.

“Free cash flow” is defined as the amount of cash generated from

operations ($7.9 million for the fourth fiscal quarter of 2017), in

excess of our capital expenditures ($2.6 million for the fourth

fiscal quarter of 2017) net of proceeds, if any, for the sale of

assets ($0.1 million in the fourth fiscal quarter of 2017). For a

reconciliation of GAAP to non-GAAP financial information, refer to

the quarterly financial tables.

Conference Call and Webcast

A conference call will be held today (February 21) at 10:00 a.m.

ET (9:00 a.m. CT). To access the conference call, interested

parties may call 1-888-317-6003 or internationally 1-412-317-6061

and use passcode 7782211, or log on to the investor relations page

of the VPG website at www.vpgsensors.com.

A replay will be available approximately one hour after the

completion of the call by calling toll-free 1-877-344-7529 or

internationally 1-412-317-0088 and by using the passcode 10116650.

The replay will also be available on the investor relations page of

the VPG website at www.vpgsensors.com for a limited time.

About VPG

Vishay Precision Group, Inc. (VPG) is an internationally

recognized designer, manufacturer and marketer of: components based

on its resistive foil technology; sensors; and sensor-based

measurement systems specializing in the growing markets of stress,

force, weight, pressure, and current measurements. VPG is a market

leader of foil technology products, providing ongoing technology

innovations in precision foil resistors and foil strain gages,

which are the foundation of the company's force sensors products

and its weighing and control systems. The product portfolio

consists of a variety of well-established brand names recognized

for precision and quality in the marketplace. To learn more, visit

VPG at www.vpgsensors.com.

Forward-Looking Statements

From time to time, information provided by us, including but not

limited to statements in this report, or other statements made by

or on our behalf, may contain "forward-looking" information within

the meaning of the Private Securities Litigation Reform Act of

1995. Such statements involve a number of risks, uncertainties, and

contingencies, many of which are beyond our control, which may

cause actual results, performance, or achievements to differ

materially from those anticipated.

Such statements are based on current expectations only, and are

subject to certain risks, uncertainties, and assumptions. Should

one or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those anticipated, expected, estimated, or

projected. Among the factors that could cause actual results to

materially differ include: general business and economic

conditions; difficulties or delays in completing acquisitions and

integrating acquired companies (including the acquisitions of

Stress-Tek and Pacific Instruments); the inability to realize

anticipated synergies and expansion possibilities; difficulties in

new product development; changes in competition and technology in

the markets that we serve and the mix of our products required to

address these changes; changes in foreign currency exchange rates;

difficulties in implementing our cost reduction strategies, such as

underutilization of production facilities, labor unrest or legal

challenges to our lay-off or termination plans, operation of

redundant facilities due to difficulties in transferring production

to achieve efficiencies; and other factors affecting our

operations, markets, products, services, and prices that are set

forth in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2016. We undertake no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise.

VISHAY PRECISION GROUP,

INC. Consolidated Statements of Operations (Unaudited - In

thousands, except per share amounts)

Fiscal quarter

ended December 31, 2017 December 31, 2016 Net

revenues

$ 69,439 $ 55,814 Costs of products sold

42,699 34,540 Gross profit

26,740 21,274 Gross profit margin

38.5 % 38.1

% Selling, general, and administrative expenses

19,063 15,529 Acquisition costs

— 80 Restructuring

costs

752 271 Operating income

6,925 5,394 Operating margin

10.0 % 9.7 %

Other income (expense): Interest expense

(450

) (410 ) Other

(254 ) 31

Other (expense) income - net

(704 )

(379 ) Income before taxes

6,221 5,015 Income

tax expense

1,771 2,035

Net earnings

4,450 2,980 Less: net earnings attributable to

noncontrolling interests

(26 ) (25 )

Net earnings attributable to VPG stockholders

$ 4,476

$ 3,005 Basic earnings per share attributable

to VPG stockholders

$ 0.34 $ 0.23 Diluted earnings

per share attributable to VPG stockholders

$ 0.33 $

0.22 Weighted average shares outstanding - basic

13,292 13,192 Weighted average shares outstanding - diluted

13,529 13,450

VISHAY PRECISION GROUP, INC. Consolidated Statements of

Operations (Unaudited - In thousands, except per share amounts)

Years ended December 31, 2017 December 31,

2016 Net revenues

$ 254,350 $ 224,929 Costs of

products sold

156,067 142,120

Gross profit

98,283 82,809 Gross profit margin

38.6

% 36.8 % Selling, general, and administrative

expenses

74,614 68,938 Acquisition costs

— 494

Restructuring costs

2,044 2,666

Operating income

21,625 10,711 Operating margin

8.5

% 4.8 % Other income (expense): Interest expense

(1,842 ) (1,486 ) Other

780

382 Other (expense) income - net

(1,062

) (1,104 ) Income before taxes

20,563

9,607 Income tax expense

6,169

3,199 Net earnings

14,394 6,408 Less: net

earnings attributable to noncontrolling interests

49

4 Net earnings attributable to VPG

stockholders

$ 14,345 $ 6,404

Basic earnings per share attributable to VPG stockholders

$

1.08 $ 0.49 Diluted earnings per share attributable to VPG

stockholders

$ 1.07 $ 0.48 Weighted average

shares outstanding - basic

13,262 13,187 Weighted average

shares outstanding - diluted

13,471 13,419

VISHAY PRECISION GROUP, INC.

Consolidated Balance Sheets (In thousands, except per share

amounts)

December 31, 2017 December 31, 2016

(Unaudited) Assets Current assets: Cash and cash

equivalents

$ 74,292 $ 58,452 Accounts receivable,

net of allowances for doubtful accounts

46,789 34,270

Inventories: Raw materials

16,601 15,647 Work in process

23,160 21,115 Finished goods

20,174

19,559 Inventories, net

59,935 56,321 Prepaid

expenses and other current assets

10,299

6,831 Total current assets

191,315 155,874

Property and equipment, at cost: Land

3,434 3,344

Buildings and improvements

50,276 48,454 Machinery and

equipment

95,158 89,080 Software

7,955 7,441

Construction in progress

2,252 4,340 Accumulated

depreciation

(103,401 ) (97,374 )

Property and equipment, net

55,674 55,285 Goodwill

19,181 18,717 Intangible assets, net

20,475

21,585 Other assets

19,906

19,049 Total assets

$ 306,551 $ 270,510

Liabilities and equity Current

liabilities: Trade accounts payable

$ 13,678 $ 8,264

Payroll and related expenses

15,892 11,978 Other accrued

expenses

15,952 13,285 Income taxes

2,515 772 Current

portion of long-term debt

3,878 2,623

Total current liabilities

51,915 36,922

Long-term debt, less current portion

28,477 33,529 Deferred

income taxes

2,300 735 Other liabilities

14,131

13,054 Accrued pension and other postretirement costs

16,424 14,713 Total liabilities

113,247 98,953 Commitments and

contingencies Equity: Common stock

1,288 1,278 Class

B convertible common stock

103 103 Treasury stock

(8,765 ) (8,765 ) Capital in excess of par value

192,904 190,373 Retained earnings

43,076 28,731

Accumulated other comprehensive loss

(35,450 )

(40,337 ) Total Vishay Precision Group, Inc. stockholders'

equity

193,156 171,383 Noncontrolling interests

148 174 Total equity

193,304 171,557 Total liabilities and

equity

$ 306,551 $ 270,510

VISHAY PRECISION GROUP,

INC. Consolidated Statements of Cash Flows (Unaudited - In

thousands)

Years ended December 31, 2017

December 31, 2016 Operating activities Net earnings

$ 14,394 $ 6,408 Adjustments to reconcile net

earnings to net cash provided by operating activities: Depreciation

and amortization

10,626 11,149 (Gain) loss on disposal of

property and equipment

(195 ) (823 ) Share-based

compensation expense

1,499 37 Inventory write-offs for

obsolescence

2,065 1,755 Deferred income taxes

1,890

301 Other

893 (2,044 ) Net changes in operating assets and

liabilities, net of acquisition: Accounts receivable

(10,537

) 1,322 Inventories

(4,307 ) (1,968 ) Prepaid

expenses and other current assets

(3,260 ) 955 Trade

accounts payable

2,009 237 Other current liabilities

7,652 (5,824 ) Net cash provided by operating

activities

22,729 11,505

Investing activities Capital expenditures

(6,960

) (10,425 ) Proceeds from sale of property and equipment

541 4,203 Purchase of business

—

(10,626 ) Net cash used in investing activities

(6,419 ) (16,848 )

Financing

activities Principal payments on long-term debt

(2,628

) (2,133 ) Proceeds from revolving facility

41,000

25,000 Payments on revolving facility

(41,000 )

(20,000 ) Distributions to noncontrolling interests

(75

) (15 ) Payments of employee taxes on certain share-based

arrangements

(303 ) (85 ) Net cash

(used in) provided by financing activities

(3,006 )

2,767 Effect of exchange rate changes on cash and cash equivalents

2,536 (1,613 ) Increase (decrease) in

cash and cash equivalents

15,840 (4,189 ) Cash and

cash equivalents at beginning of year

58,452

62,641 Cash and cash equivalents at end of year

$ 74,292 $ 58,452

Supplemental disclosure of investing transactions: Capital

expenditures purchased

(10,092 ) (10,425 )

Supplemental disclosure of non-cash financing transactions:

Conversion of exchangeable notes to common stock

$

(1,303 ) $

—

VISHAY PRECISION GROUP, INC. Reconciliation of

Consolidated Adjusted Gross Profit Margin (Unaudited - In

thousands)

Fiscal quarter ended Years ended

December 31, 2017 December 31, 2016 December 31,

2017 December 31, 2016 Gross profit

$

26,740 $ 21,274

$ 98,283 $ 82,809 Gross profit

margin

38.5 % 38.1 %

38.6 % 36.8 %

Reconciling items

affecting gross profit margin

Acquisition purchase accounting adjustments

49 49

91

586

Adjusted gross profit

$ 26,789

$ 21,323

$ 98,374 $ 83,395

Adjusted gross profit margin

38.6 % 38.2 %

38.7 % 37.1 %

VISHAY

PRECISION GROUP, INC. Reconciliation of Consolidated Adjusted

Operating Margin (Unaudited - In thousands)

Fiscal

quarter ended Years ended December 31, 2017

December 31, 2016 December 31, 2017 December 31,

2016 Operating income

$ 6,925 $ 5,394

$

21,625 $ 10,711 Operating margin

10.0 % 9.7 %

8.5 % 4.8 %

Reconciling items

affecting operating margin

Acquisition purchase accounting adjustments

49 49

91

586 Acquisition costs

— 80

— 494 Strategic

alternative evaluation costs

— 265

— 1,344 Gain on

sale of building

— (837 )

— (837 ) Restructuring

costs

752 271

2,044 2,666

Adjusted

operating income

$ 7,726 $ 5,222

$ 23,760 $ 14,964 Adjusted operating

margin

11.1 % 9.4 %

9.3 % 6.7 %

VISHAY PRECISION GROUP, INC. Reconciliation of

Adjusted Earnings Per Share (Unaudited - In thousands, except per

share data)

Fiscal quarter ended Years ended

December 31, 2017 December 31, 2016 December 31,

2017 December 31, 2016 Net earnings attributable to VPG

stockholders

$ 4,476 $ 3,005

$ 14,345 $

6,404

Reconciling items affecting operating margin

Acquisition purchase accounting adjustments

49 49

91

586 Acquisition costs

— 80

— 494 Strategic

alternative evaluation costs

— 265

— 1,344 Gain on

sale of building

— (837 )

— (837 ) Restructuring

costs

752 271

2,044 2,666

Reconciling items

affecting other income/expense Net proceeds from lease

termination

— —

(1,544 ) — Tax rebate

189 —

189 —

Less reconciling items

affecting income tax expense Tax effect of reconciling items

and discrete tax items

165 (597 )

(174 ) 719 Adjusted net earnings

attributable to VPG stockholders

$ 5,301 $

3,430

$ 15,299 $ 9,938

Weighted average shares outstanding - diluted

13,529 13,450

13,471 13,419 Adjusted net earnings per diluted share

$ 0.39 $ 0.26

$ 1.14 $ 0.74

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180221005389/en/

VPGFor InvestorsICR, Inc.James Palczynski,

203-682-8229jp@icrinc.comorFor MediaICR, Inc.Phil Denning,

646-277-1258phil.denning@icrinc.com

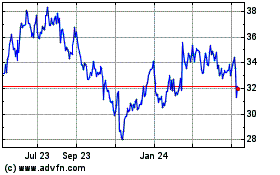

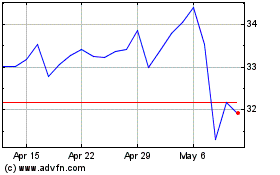

Vishay Precision (NYSE:VPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vishay Precision (NYSE:VPG)

Historical Stock Chart

From Apr 2023 to Apr 2024