Ludlow Research Upgrades Coverage on Integrated Ventures

with $5.00+ Valuation Target Based on Blockchain and Bitcoin Mining

Operations

Philadelphia, PA -- December 29, 2017 -- InvestorsHub NewsWire

-- Integrated Ventures, Inc., (OTCQB:

INTV)(“Company”) today announced that Ludlow Research had

issued upgraded Research Opinion based on the progress of their

Bitcoin Mining operations, newly launched CryptoFunder, and

improving financial outlook, with a new ‘speculative’ short-term

target of $5.00+ per share.

Report Highlights:

Launches Cryptocurrency Mining Operations

Launches CryptoFunder Blockchain

Secures $1 Million Crypto Currency Based Funding Round

Improved Revenue Outlook

Improving Cash Position

Low Convertible Debt Levels

8.3 Million Shares Outstanding

Low Market Cap Valuation

Report Summary:

Based on their launch of Bitcoin Mining operations and

CryptoFunder blockchain, improving revenue outlook, decreasing

convertible debt, low market cap valuation compared to others

within their sector, and most importantly the high retail demand

for crypto currency related stocks Ludlow Research has upgraded its

research coverage on Integrated Ventures, Inc and has raised its

short-term “speculative” valuation target from $2.00 to $3.00 to

$5.00+ per share.

The incredible performance of Bitcoin, Blockchain, and Crypto

Currency related stocks has been nothing less then amazing in

recent weeks. Although this provides bit of difficulty when trying

to establish a general price valuation range due to the high demand

for shares related to this sector.

In the short term, INTV may trade along in market performance to

underlying Bitcoin (BTC/USD) prices with any attempt to retest the

recent highs in BTC/USD of $17,000 to $19,000 as a catalyst to push

INTV back above $5.00 again.

For now, based on the extra ordinary demand taking place with

Bitcoin related stocks, Ludlow Research is not providing a set

valuation projection, but rather keeping a fair ‘speculative’

target of $5.00+ because in case of any extreme event $10.00 could

very well be achievable.

The main drivers have been identified as follow:

1.0 CryptoFunder Blockchain: In Dec. 2017, the

Company announced it has launched "CryptoFunder," a financial

blockchain platform, which acts like a decentralized and encrypted

lending ledger that offers a secure, efficient, verifiable and

permanent way of storing records and other lending information.

These protocols are the backbone of numerous digital currencies

that are being mined by the Company, including Bitcoin, Ethereum

and Litecoin. The CryptoFunder blockchain will be focused on

qualifying, initiating, underwriting and processing funding

transactions, including tracking of digitally mined assets and

using them as main mode of payment for business loans, lending

contracts and convertible debt notes.

The CryptoFunder is the world's first crypto currency secured

lending platform that offers businesses, particularly publicly

traded companies, an access to the potentially non-dilutive funding

structure, accounting and audit system, all powered by a flexible

and transparent ledger that is recorded securely on a

blockchain.

2.0 Bitcoin Mining Operations: As of Dec. 11,

2017, the Company announced the following operational

milestones:

The number of connected and revenue generation mining rigs has

reached 104

Mining revenues up to date stand at $34,000

Sales of mining equipment have reached $21,700.00

Installation of remaining mining units scheduled to be completed

by the end of 2017.

Steve Rubakh, CEO of Integrated Ventures, Inc., comments: "In

less than three weeks, since the launch of our cryptocurrency

operations on 11/22/2017, the Company has generated revenues in

excess of $55,700 which equates to the annual revenues of $668,400.

We have been following and executing our diversified mining

strategy which has been validated by the market activity with BTC,

ETH and LTC reaching all time high prices. We believe the Company

is in a great position and on target to deliver significant returns

to its shareholders and investors."

3.0 Decrease Need for Debt Funding: Upon full

deployment, the total number of mining machines will consist a

minimum of 190 assorted rigs, and generating in excess of $1.2

million in revenues, which should easily exceed ongoing corporate

capital requirements. Along with their decreasing level of

convertible debt financing, this improved revenue outlook now

removes the need for the company to tap into this type of funding

structure, thus reducing chances of dilution to the common

shareholders going forward.

4.0 Growing Liquid Assets: The Company current

holds around 55,555,555 shares of (OTC:OTTV) common shares that

come off restriction on January 3, 2018. Added up with $281,457 of

very liquid mining units that produce revenue INTV assets add up to

roughly $600,000, which can assist in the development and expansion

of their Bitcoin Mining operations.

About Integrated Ventures, Inc: Focused on

acquiring, launching and operating companies, primarily in the

mobile technologies, ride share transportation and cryptocurrency

sector consisting of digital asset mining, hosting, pooling, mining

equipment manufacturing and the development of blockchain based

applications for financial markets.

www.integratedventuresinc.com

About BitcoLab: Focused on pursuing

opportunities in crypto currency sector with focus on bitcoin

mining, hosting, pooling, manufacturing and distributing of own

brand of mining equipment and the development of blockchain based

applications for financial markets. www.bitcolab.io

About CryptoFunder: The world's first financial

blockchain platform which acts like a decentralized and encrypted

lending ledger that offers a secure, efficient, verifiable and

permanent way of storing records and other lending information.

These protocols are the backbone of numerous digital currencies

that are being mined by the Company, including Bitcoin, Ethereum

and Litecoin. The CryptoFunder blockchain consists of qualifying,

initiating, underwriting, processing and managing funding

transactions, including tracking of digitally mined assets and

using them as a main mode of payment for loans, lending contracts

and convertible notes.

About Ludlow Research: New York based equity

research firm that focuses on providing research coverage and

investor awareness services to emerging small-cap companies. For

over 14 years we have worked to provide our readers with a simple

way of evaluating the current and potential value of small-cap

companies, while garnering these clients greater market awareness

to new investors. For more information on us please visit

www.ludlowresearch.com

*** About CryptoCurrency Investments &

Risks: The Company urges all current and potential

investors to visit https://www.sec.gov/news/public-statement/statement-clayton-2017-12-11

to fully understand all risks involved in CryptoCurrency

investing.

Safe Harbor Statement: The information posted

in this release may contain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

You can identify these statements by use of the words "may,"

"will," "should," "plans," "explores," "expects," "anticipates,"

"continue," "estimate," "project," "intend," and similar

expressions. Forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those projected or anticipated. These risks and uncertainties

include, but are not limited to, general economic and business

conditions, effects of continued geopolitical unrest and regional

conflicts, competition, changes in technology and methods of

marketing, and various other factors beyond the Company's

control.

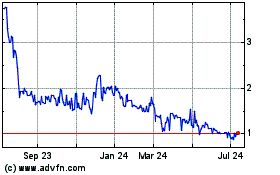

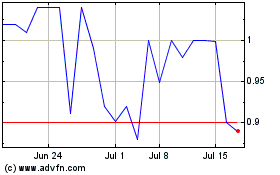

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Apr 2023 to Apr 2024