Current Report Filing (8-k)

November 20 2017 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 20, 2017

H&E Equipment Services, Inc.

(Exact name of registrant as specified in its charter)

Commission

File Number: 000-51759

|

|

|

|

|

Delaware

|

|

81-0553291

|

|

(State or other jurisdiction

of incorporation)

|

|

(IRS Employer

Identification No.)

|

7500 Pecue Lane

Baton Rouge, LA 70809

(Address of principal executive offices, including zip code)

(225) 298-5200

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box

below if the

Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17

CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange

Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange

Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of

the Securities Exchange Act of

1934 (§240.12b-2 of

this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On November 20, 2017, H&E Equipment Services, Inc.

(the “Company”) entered into a Purchase Agreement (the “Purchase Agreement”), by and among the Company, certain subsidiaries of the Company (the “Guarantors”), Merrill Lynch, Pierce, Fenner & Smith Incorporated

and Wells Fargo Securities, LLC (the “Initial Purchasers”) pursuant to which the Company agreed to issue and sell to the Initial Purchasers $200 million in aggregate principal amount of the Company’s 5.625% senior notes due 2025

(the “New Notes”). The sale of the New Notes is expected to close on November 22, 2017, subject to the satisfaction of customary closing conditions.

On November 20, 2017, the Company issued a press release announcing the pricing of

$200 million in aggregate principal amount of its 5.625% senior notes due 2025, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Additional Information

This press

release is neither an offer to sell, nor a solicitation of an offer to buy, any securities and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale is unlawful. The securities described

herein have not been and will not be registered under the Securities Act, or any state securities laws, and unless so registered, may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of

the Securities Act, and applicable state securities laws.

Forward-Looking Statements

Except for historical information, all other information in this Form

8-K

consists of forward-looking statements.

Statements that are not historical facts, including statements about our beliefs and expectations are forward-looking statements. Statements containing the words “may”, “could”, “would”, “should”,

“believe”, “expect”, “anticipate”, “plan”, “estimate”, “target”, “project”, “intend” and similar expressions constitute forward-looking statements. These forward-looking

statements involve a number of risks, uncertainties and other factors, including the possible completion of the offering, the prospective impact of a note offering, plans to repay certain indebtedness (including the terms and success of such

repayment), the use of proceeds of the offering, including our ability to enter into acquisition agreements, to consummate such acquisitions and the success of such acquisitions the Company’s ability to satisfy the conditions contained in the

Purchase Agreement with the Initial Purchasers and other factors discussed in our public filings, including the risk factors included in the Company’s most recent Annual Report on Form

10-K,

which may

cause the actual results to be materially different from those expressed or implied in the forward-looking statements. Other important factors that could cause the statements made in this Form

8-K

or the

actual results of operations or financial condition of the Company to differ include, without limitation, that the offering is subject to market conditions, other conditions and approvals. There can be no assurance that the offering will be

completed as described herein or at all. Other important factors are discussed under the caption “Forward-Looking Statements” in the most recent Annual Report on Form

10-K

and in subsequent filings

made prior to or after the date hereof. The Company does not intend to review or revise any particular forward-looking statement in light of future events.

|

Item 9.01.

|

Financial Statements and Exhibits

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H&E Equipment Services, Inc.

|

|

|

|

|

|

|

Date: November 20, 2017

|

|

|

|

By:

|

|

/s/ Leslie S. Magee

|

|

|

|

|

|

|

|

Leslie S. Magee

|

|

|

|

|

|

|

|

Chief Financial Officer

|

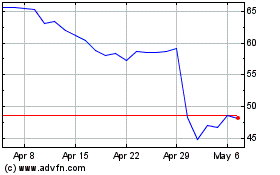

H and E Equipment Services (NASDAQ:HEES)

Historical Stock Chart

From Mar 2024 to Apr 2024

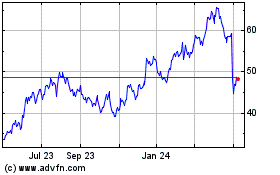

H and E Equipment Services (NASDAQ:HEES)

Historical Stock Chart

From Apr 2023 to Apr 2024