SalMar - Results for the third quarter 2017

November 15 2017 - 12:30AM

STRONG OPERATIONS AND IMPROVING BIOLOGY

An improved biological situation and strong operations in all the

Group's segments contributed to lower costs and a strong result for

the SalMar Group in the third quarter 2017. The Group's Operational

EBIT for the period came to NOK 801.3 million, up from NOK 576.3

million in the third quarter last year.

"Strong operations in all segments and an improving biological

situation have enabled SalMar to once again deliver strong

financial results, despite a fall in salmon prices through the

quarter," says SalMar's CEO Trond Williksen. "It is particularly

pleasing that the steady reduction in costs we have achieved in

recent periods continued in the third quarter, and that the

extensive efforts and substantial investments we have made over

time to deal with salmon lice are now starting to pay

off."

SalMar generated gross operating revenues of NOK 2.7 billion in the

third quarter, up from NOK 2.3 billion in the corresponding period

last year. The Group harvested 34,000 tonnes, compared with 29,600

tonnes in the third quarter 2016. This gave an EBIT per kg of NOK

23.60 in the third quarter, while EBIT per kg in the second quarter

came to NOK 28.12.

Fish Farming Central Norway's cost per kg biomass harvested fell

for the third successive quarter. The strong performance is the

result of good underlying operations and the company's systematic

efforts to strengthen its preparedness, capacity and expertise with

regard to managing biological challenges. The segment's biological

situation has improved through the quarter, and costs are expected

to hold steady in the fourth quarter.

The biological situation for Fish Farming Northern Norway is good.

Combined with strong operations, this has resulted in a high level

of output from the generations that have been harvested during the

quarter. Furthermore, it has led to a fall in costs from the

previous quarter. As in previous years, SalMar experienced a slight

increase in lice numbers in the third quarter. However, SalMar is

well equipped to meet any biological challenges, and costs are

expected to hold steady in the coming quarter.

The Sales and Processing segment posted an operating profit of NOK

46.2 million in the quarter. High capacity utilisation in the

secondary processing business, positive contributions from

contracts and good dispositions in the spot market all resulted in

a substantial improvement in the segment's financial results.

Contract sales accounted for 45 per cent of the volume in the

quarter. The contract rate in the fourth quarter 2017 will be

around 40 per cent, with price levels similar to the first half of

2017.

SalMar expects to harvest around 134,000 tonnes in Norway in 2017

as a whole (Fish Farming Central Norway, 86,000 tonnes; Fish

Farming Northern Norway, 48,000 tonnes). Norskott Havbruk (Scottish

Seafarms) and Arnarlax are expected to harvest 32,000 tonnes and 9

500 tonnes respectively.

SalMar expects to harvest around 143,000 tonnes in Norway in 2018

as a whole. Norskott Havbruk (Scottish Seafarms) and Arnarlax

expect to harvest 27,000 tonnes and 11,000 tonnes respectively in

2018.

For further information, please contact:

CEO Trond Williksen

Tel: + 47 916 30 173

Email: trond.williksen@salmar.no

CFO Trond Tuvstein

Tel: + 47 918 53 139

Email: trond.tuvstein@salmar.no

See www.salmar.no for more information about the company.

This information is subject to the disclosure requirements

stipulated in section 5-12 of the Norwegian Securities Trading

Act.

SalMar Q3 2017 report

SalMar Q3 2017 presentation

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: SalMar ASA via Globenewswire

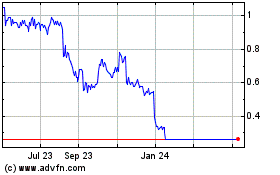

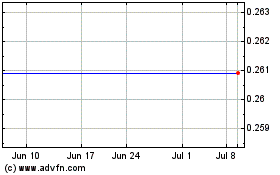

Salem Media (NASDAQ:SALM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Salem Media (NASDAQ:SALM)

Historical Stock Chart

From Apr 2023 to Apr 2024