Amended Report of Foreign Issuer (6-k/a)

November 13 2017 - 6:22AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of November 2017

KOREA

ELECTRIC POWER CORPORATION

(Translation of registrant’s name into English)

55 Jeollyeok-ro, Naju-si, Jeollanam-do, 58217, Korea

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by

furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82-

.

This Form 6-K/A is an amendment to the Form 6-K of Korea Electric Power Corporation (“KEPCO”), dated

November 7, 2017 (“Original 6-K”). The information in the Original 6-K relating to the condensed consolidated statements of comprehensive income for the third three-month and the first nine months ended September 30, 2016 and

2017 is amended and replaced as follows. No other changes have been made to the Original 6-K.

Disclaimer:

The financial information relating to the unaudited consolidated results of operations of KEPCO for the third three-month and first nine months ended

September 30, 2017 as presented below (the “Information”) has been prepared by KEPCO based on preliminary estimates and in accordance with K-IFRS. The Information has been neither audited nor reviewed by KEPCO’s independent

accountants, KPMG Samjong Accounting Corp., or any other independent public accountants. The Information may differ significantly from the actual results of operations of KEPCO, and accordingly should not be relied upon for investment, including but

not limited to purchase of any securities, or for other purposes.

CONDENSED

CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME

For the third three-month and the first nine months ended September 30, 2016 and 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unit : in billions of Korean Won)

|

|

2016

Jul.-Sep.

|

|

|

2017

Jul.-Sep.

|

|

|

Change

|

|

|

2016

Jan.-Sep.

|

|

|

2017

Jan.-Sep.

|

|

|

Change

|

|

|

Operating revenues

|

|

|

15,944

|

|

|

|

16,188

|

|

|

|

1.5

|

%

|

|

|

44,904

|

|

|

|

44,260

|

|

|

|

-1.4

|

%

|

|

Operating income (loss)

|

|

|

4,424

|

|

|

|

2,773

|

|

|

|

-37.3

|

%

|

|

|

10,734

|

|

|

|

5,083

|

|

|

|

-52.6

|

%

|

|

Income (Loss) before income tax

|

|

|

4,120

|

|

|

|

2,187

|

|

|

|

-46.9

|

%

|

|

|

10,033

|

|

|

|

4,160

|

|

|

|

-58.5

|

%

|

|

Net income (loss)

|

|

|

2,938

|

|

|

|

1,529

|

|

|

|

-48.0

|

%

|

|

|

6,869

|

|

|

|

2,788

|

|

|

|

-59.4

|

%

|

|

Net income (loss) attributable to owners of the company

|

|

|

2,913

|

|

|

|

1,493

|

|

|

|

-48.8

|

%

|

|

|

6,775

|

|

|

|

2,687

|

|

|

|

-60.3

|

%

|

|

*

|

The figures may not add up to the relevant total numbers due to rounding.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

By:

|

|

/s/ Kim, Jeong-soo

|

|

Name:

|

|

Kim, Jeong-soo

|

|

Title:

|

|

Head of Finance & IR Team

|

Date: November 13, 2017

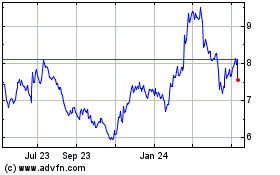

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

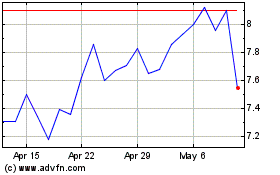

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Apr 2023 to Apr 2024