-New Home Orders up 36% Year-Over-Year on

a 9% Increase in Average Selling

Communities--Backlog Dollar Value up 56% on a 32%

increase in Backlog Units--Reports Net Income

Available to Common Stockholders of $72.3 Million, or $0.48 per

Diluted Share--Reports $68.2 Million of Land and

Lot Revenue and $56.2 Million in Land and Lot Gross

Margin-

TRI Pointe Group, Inc. (the "Company") (NYSE:TPH) today announced

results for the third quarter ended September 30, 2017.

Results and Operational Data for Third

Quarter 2017 and Comparisons to Third Quarter 2016

- Net income available to common stockholders was $72.3 million,

or $0.48 per diluted share, compared to $34.8 million, or $0.22 per

diluted share

- New home orders of 1,268 compared to 932, an increase of

36%

- Active selling communities averaged 129.8 compared to 119.0, an

increase of 9%

- New home orders per average selling community were 9.8 orders

(3.3 monthly) compared to 7.8 orders (2.6 monthly)

- Cancellation rate of 15% compared to 17%, a decrease of 200

basis points

- Backlog units at quarter end of 2,265 homes compared to 1,711,

an increase of 32%

- Dollar value of backlog at quarter end of $1.5 billion compared

to $950.2 million, an increase of 56%

- Average sales price in backlog at quarter end of $654,000

compared to $555,000, an increase of 18%

- Home sales revenue of $648.6 million compared to $578.7

million, an increase of 12%

- New home deliveries of 1,111 homes compared to 1,019 homes, an

increase of 9%

- Average sales price of homes delivered of $584,000 compared to

$568,000, an increase of 3%

- Homebuilding gross margin percentage of 19.5% compared to

20.1%, a decrease of 60 basis points

- Excluding interest and impairments and lot option abandonments,

adjusted homebuilding gross margin percentage was 22.0%*

- Land and lot sales revenue of $68.2 million compared to $2.5

million

- Land and lot sales gross margin percentage of 82.4% compared to

31.6%

- Third quarter 2017 results include the sale of a parcel

consisting of 69 homebuilding lots located in the Pacific Highlands

Ranch community in San Diego, California, representing $66.8

million in land and lot sales revenue and $56.1 million in land and

lot gross margin

- SG&A expense as a percentage of homes sales revenue of

10.2% compared to 10.9%, a decrease of 70 basis points

- Ratios of debt-to-capital and net debt-to-net capital of 47.5%

and 45.0%*, respectively, as of September 30, 2017

- Repurchased 975,700 shares of common stock at a weighted

average price per share of $12.83 for an aggregate dollar amount of

$12,519,904 in the three months ended September 30, 2017

- Ended third quarter of 2017 with total liquidity of $554.6

million, including cash of $162.4 million and $392.2 million of

availability under the Company's unsecured revolving credit

facility

* See "Reconciliation of Non-GAAP Financial Measures"

“I am very pleased with our results this quarter,” said TRI

Pointe Group Chief Executive Officer Doug Bauer. “We had a

36% increase in new home orders on a year-over-year basis, driven

primarily by a 9% increase in average selling communities and a 27%

increase in our monthly absorption rate. We believe this

order growth is a strong indicator of the strength in the housing

market and the quality of our home offerings. The positive

trends we saw for the quarter were broad-based, with our operations

in California continuing to produce excellent results and

operations in our other markets making improvements with respect to

order growth and/or profitability. These trends, coupled with

the significant increase to our quarter-ending backlog, put us in a

great position to end the year on a high note and carry that

momentum into 2018.”

Third Quarter 2017 Operating

Results

Net income available to common stockholders was $72.3 million,

or $0.48 per diluted share in the third quarter of 2017, compared

to net income available to common stockholders of $34.8 million, or

$0.22 per diluted share for the third quarter of

2016. The increase in net income available to common

stockholders was primarily due to an increase in land and lot sales

gross margin of $55.4 million due primarily to the sale of a parcel

consisting of 69 homebuilding lots located in the Pacific Highlands

Ranch community in San Diego, California.

Home sales revenue increased $70.0 million, or 12%, to $648.6

million for the third quarter of 2017, as compared to $578.7

million for the third quarter of 2016. The increase was

primarily attributable to a 9% increase in new home deliveries to

1,111, and a 3% increase in the average sales price of homes

delivered to $584,000, compared to $568,000 in the third quarter of

2016.

New home orders increased 36% to 1,268 homes for the third

quarter of 2017, as compared to 932 homes for the same period in

2016. Average selling communities increased 9% to 129.8

for the third quarter of 2017 compared to 119.0 for the third

quarter of 2016. The Company’s overall absorption rate per

average selling community increased 27% for the third quarter of

2017 to 9.8 orders (3.3 monthly) compared to 7.8 orders (2.6

monthly) during the third quarter of 2016.

The Company ended the quarter with 2,265 homes in backlog,

representing approximately $1.5 billion. The average sales price of

homes in backlog as of September 30, 2017 increased $99,000,

or 18%, to $654,000, compared to $555,000 as of September 30,

2016.

Homebuilding gross margin percentage for the third quarter of

2017 decreased to 19.5%, compared to 20.1% for the third quarter of

2016. Excluding interest and impairments and lot option

abandonments in cost of home sales, adjusted homebuilding gross

margin percentage was 22.0%* for the third quarter of 2017,

compared to 22.7%* for the third quarter of 2016. The

decrease in homebuilding gross margin percentage was largely due to

the mix of homes delivered and increased labor and material

cost.

Selling, general and administrative ("SG&A") expense for the

third quarter of 2017 decreased to 10.2% of home sales revenue as

compared to 10.9% for the third quarter of 2016 primarily due to

increased leverage as a result of a 12% increase in home sales

revenue.

“Our homebuilding teams did an excellent job of executing this

quarter, as we once again met or exceeded our quarterly guidance

for deliveries, average sales prices and homebuilding gross

margin,” said TRI Pointe Group President and Chief Operating

Officer Tom Mitchell. “In addition, we continue to be

encouraged by the quality of our land pipeline and the improvement

in both our operations and product. I would especially like

to thank and applaud our team in Houston for displaying such

dedication, perseverance and compassion for the community in the

wake of Hurricane Harvey and its aftermath. Our team members

really came together to help one another and to make sure our

communities were safe and back open for business.”

* See “Reconciliation of Non-GAAP Financial Measures”

Outlook

For the fourth quarter of 2017, the Company expects to open 14

new communities, and close out of 10, resulting in 131 active

selling communities as of December 31, 2017. In

addition, the Company anticipates delivering approximately 75% to

80% of its 2,265 units in backlog as of September 30, 2017 at an

average sales price of $630,000 to $640,000. The Company

anticipates its homebuilding gross margin percentage to be in a

range of 21.0% to 22.0% for the fourth quarter resulting in a range

of 20.0% to 21.0% for the full year. Finally, the Company

expects its SG&A expense as a percentage of home sales revenue

to be in the range of 7.6% to 7.8% for the fourth quarter and 10.2%

to 10.4% for the full year.

Earnings Conference Call

The Company will host a conference call via live webcast for

investors and other interested parties beginning at 10:00 a.m.

Eastern Time on Wednesday, October 25, 2017. The

call will be hosted by Doug Bauer, Chief Executive Officer, Tom

Mitchell, President and Chief Operating Officer and Mike Grubbs,

Chief Financial Officer.

Interested parties can listen to the call live and view the

related presentation slides on the internet through the Investor

Relations section of the Company’s website at

www.TRIPointeGroup.com. Listeners should go to the website at least

fifteen minutes prior to the call to download and install any

necessary audio software. The call can also be accessed

by dialing 1-877-407-3982 for domestic participants or

1-201-493-6780 for international participants. Participants

should ask for the TRI Pointe Group Third Quarter 2017 Earnings

Conference Call. Those dialing in should do so at least ten

minutes prior to the start. The replay of the call will be

available for two weeks following the call. To access

the replay, the domestic dial-in number is 1-844-512-2921, the

international dial-in number is 1-412-317-6671, and the reference

code is #13671772. An archive of the webcast will be

available on the Company’s website for a limited time.

About TRI Pointe Group, Inc.

Headquartered in Irvine, California, TRI Pointe Group, Inc.

(NYSE: TPH) is one of the top ten largest public homebuilders by

equity market capitalization in the United States. The company

designs, constructs and sells premium single-family homes through

its portfolio of six quality brands across eight states, including

Maracay Homes® in Arizona; Pardee Homes® in California and Nevada;

Quadrant Homes® in Washington; Trendmaker® Homes in Texas; TRI

Pointe Homes® in California and Colorado; and Winchester® Homes in

Maryland and Virginia. Additional information is available at

www.TRIPointeGroup.com. Winchester is a registered trademark and is

used with permission.

Forward-Looking Statements

Various statements contained in this press release, including

those that express a belief, expectation or intention, as well as

those that are not statements of historical fact, are

forward-looking statements. These forward-looking

statements may include projections and estimates concerning the

timing and success of specific projects and our future production,

land and lot sales, operational and financial results, financial

condition, prospects, and capital spending. Our

forward-looking statements are generally accompanied by words such

as “anticipate,” “believe,” “estimate,” “goal,” “guidance,”

“expect,” “intend,” “outlook,” “project,” “potential,” “plan,”

“predict,” “target,” “will,” or other words that convey

future events or outcomes. The forward-looking

statements in this press release speak only as of the date of this

press release, and we disclaim any obligation to update these

statements unless required by law, and we caution you not to rely

on them unduly. These forward-looking statements are

inherently subject to significant business, economic, competitive,

regulatory and other risks, contingencies and uncertainties, most

of which are difficult to predict and many of which are beyond our

control. The following factors, among others, may cause

our actual results, performance or achievements to differ

materially from any future results, performance or achievements

expressed or implied by these forward-looking statements: the

effect of general economic conditions, including employment rates,

housing starts, interest rate levels, availability of financing for

home mortgages and strength of the U.S. dollar; market demand for

our products, which is related to the strength of the various U.S.

business segments and U.S. and international economic conditions;

levels of competition; the successful execution of our internal

performance plans, including restructuring and cost reduction

initiatives; global economic conditions; raw material prices; oil

and other energy prices; the effect of weather, including the

re-occurrence of drought conditions in California; the risk of loss

from earthquakes, volcanoes, fires, floods, droughts, windstorms,

hurricanes, pest infestations and other natural disasters, and the

risk of delays, reduced consumer demand, and shortages and price

increases in labor or materials associated with such natural

disasters; transportation costs; federal and state tax policies;

the effect of land use, environment and other governmental

regulations; legal proceedings or disputes and the adequacy of

reserves; risks relating to any unforeseen changes to or effects on

liabilities, future capital expenditures, revenues, expenses,

earnings, synergies, indebtedness, financial condition, losses and

future prospects; changes in accounting principles; risks related

to unauthorized access to our computer systems, theft of our

customers’ confidential information or other forms of cyber-attack;

and additional factors discussed under the sections captioned “Risk

Factors” included in our annual and quarterly reports filed with

the Securities and Exchange Commission. The foregoing

list is not exhaustive. New risk factors may emerge from

time to time and it is not possible for management to predict all

such risk factors or to assess the impact of such risk factors on

our business.

Investor Relations Contact:

Chris Martin, TRI Pointe GroupDrew Mackintosh,

Mackintosh Investor RelationsInvestorRelations@TRIPointeGroup.com,

949-478-8696

Media Contact:Carol Ruiz,

cruiz@newgroundco.com, 310-437-0045

| KEY OPERATIONS AND FINANCIAL

DATA(dollars in thousands)(unaudited) |

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

Change |

|

2017 |

|

2016 |

|

Change |

| Operating Data: |

|

|

|

|

|

|

|

|

|

|

|

| Home

sales revenue |

$ |

648,638 |

|

|

$ |

578,653 |

|

|

$ |

69,985 |

|

|

$ |

1,609,458 |

|

|

$ |

1,558,633 |

|

|

$ |

50,825 |

|

|

Homebuilding gross margin |

$ |

126,720 |

|

|

$ |

116,330 |

|

|

$ |

10,390 |

|

|

$ |

314,895 |

|

|

$ |

339,073 |

|

|

$ |

(24,178 |

) |

|

Homebuilding gross margin % |

19.5 |

% |

|

20.1 |

% |

|

(0.6 |

)% |

|

19.6 |

% |

|

21.8 |

% |

|

(2.2 |

)% |

| Adjusted

homebuilding gross margin %* |

22.0 |

% |

|

22.7 |

% |

|

(0.7 |

)% |

|

22.0 |

% |

|

24.0 |

% |

|

(2.0 |

)% |

| Land and

lot sales revenue |

$ |

68,218 |

|

|

$ |

2,535 |

|

|

$ |

65,683 |

|

|

$ |

69,661 |

|

|

$ |

70,204 |

|

|

$ |

(543 |

) |

| Land and

lot gross margin |

$ |

56,217 |

|

|

$ |

801 |

|

|

$ |

55,416 |

|

|

$ |

56,362 |

|

|

$ |

53,231 |

|

|

$ |

3,131 |

|

| Land and

lot gross margin % |

82.4 |

% |

|

31.6 |

% |

|

50.8 |

% |

|

80.9 |

% |

|

75.8 |

% |

|

5.1 |

% |

| SG&A

expense |

$ |

66,135 |

|

|

$ |

63,130 |

|

|

$ |

3,005 |

|

|

$ |

193,502 |

|

|

$ |

180,914 |

|

|

$ |

12,588 |

|

|

SG&A expense as a % of home sales revenue |

10.2 |

% |

|

10.9 |

% |

|

(0.7 |

)% |

|

12.0 |

% |

|

11.6 |

% |

|

0.4 |

% |

| Net

income available to common stockholders |

$ |

72,264 |

|

|

$ |

34,834 |

|

|

$ |

37,430 |

|

|

$ |

113,171 |

|

|

$ |

137,310 |

|

|

$ |

(24,139 |

) |

| Adjusted

EBITDA* |

$ |

139,550 |

|

|

$ |

74,215 |

|

|

$ |

65,335 |

|

|

$ |

237,755 |

|

|

$ |

262,945 |

|

|

$ |

(25,190 |

) |

| Interest

incurred |

$ |

22,865 |

|

|

$ |

18,601 |

|

|

$ |

4,264 |

|

|

$ |

61,669 |

|

|

$ |

50,030 |

|

|

$ |

11,639 |

|

| Interest

in cost of home sales |

$ |

15,623 |

|

|

$ |

14,385 |

|

|

$ |

1,238 |

|

|

$ |

38,448 |

|

|

$ |

34,653 |

|

|

$ |

3,795 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Other Data: |

|

|

|

|

|

|

|

|

|

|

|

| Net new

home orders |

1,268 |

|

|

932 |

|

|

336 |

|

|

4,012 |

|

|

3,339 |

|

|

673 |

|

| New homes

delivered |

1,111 |

|

|

1,019 |

|

|

92 |

|

|

2,940 |

|

|

2,784 |

|

|

156 |

|

| Average

selling price of homes delivered |

$ |

584 |

|

|

$ |

568 |

|

|

$ |

16 |

|

|

$ |

547 |

|

|

$ |

560 |

|

|

$ |

(13 |

) |

| Average

selling communities |

129.8 |

|

|

119.0 |

|

|

10.8 |

|

|

127.4 |

|

|

117.0 |

|

|

10.4 |

|

| Selling

communities at end of period |

127 |

|

|

123 |

|

|

4 |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

Cancellation rate |

15 |

% |

|

17 |

% |

|

(2 |

)% |

|

15 |

% |

|

14 |

% |

|

1 |

% |

| Backlog

(estimated dollar value) |

$ |

1,482,265 |

|

|

$ |

950,171 |

|

|

$ |

532,094 |

|

|

|

|

|

|

|

| Backlog

(homes) |

2,265 |

|

|

1,711 |

|

|

554 |

|

|

|

|

|

|

|

| Average

selling price in backlog |

$ |

654 |

|

|

$ |

555 |

|

|

$ |

99 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

| |

|

|

|

|

|

|

2017 |

|

2016 |

|

Change |

| Balance Sheet

Data: |

|

|

|

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

|

|

|

|

|

$ |

162,396 |

|

|

$ |

208,657 |

|

|

$ |

(46,261 |

) |

| Real

estate inventories |

|

|

|

|

|

|

$ |

3,303,421 |

|

|

$ |

2,910,627 |

|

|

$ |

392,794 |

|

| Lots

owned or controlled |

|

|

|

|

|

|

27,892 |

|

|

28,309 |

|

|

(417 |

) |

| Homes

under construction (1) |

|

|

|

|

|

|

2,599 |

|

|

1,605 |

|

|

994 |

|

| Homes

completed, unsold |

|

|

|

|

|

|

243 |

|

|

405 |

|

|

(162 |

) |

| Debt |

|

|

|

|

|

|

$ |

1,669,558 |

|

|

$ |

1,382,033 |

|

|

$ |

287,525 |

|

|

Stockholders' equity |

|

|

|

|

|

|

$ |

1,842,429 |

|

|

$ |

1,829,447 |

|

|

$ |

12,982 |

|

| Book

capitalization |

|

|

|

|

|

|

$ |

3,511,987 |

|

|

$ |

3,211,480 |

|

|

$ |

300,507 |

|

| Ratio of

debt-to-capital |

|

|

|

|

|

|

47.5 |

% |

|

43.0 |

% |

|

4.5 |

% |

| Ratio of

net debt-to-net capital* |

|

|

|

|

|

|

45.0 |

% |

|

39.1 |

% |

|

5.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________(1) Homes under construction included 64 and 65 models

at September 30, 2017 and December 31, 2016,

respectively.* See “Reconciliation of Non-GAAP Financial

Measures”

| CONSOLIDATED BALANCE SHEETS(in

thousands, except share amounts) |

| |

| |

September 30, |

|

December 31, |

| |

2017 |

|

2016 |

|

Assets |

(unaudited) |

|

|

| Cash and

cash equivalents |

$ |

162,396 |

|

|

$ |

208,657 |

|

|

Receivables |

84,583 |

|

|

82,500 |

|

| Real

estate inventories |

3,303,421 |

|

|

2,910,627 |

|

|

Investments in unconsolidated entities |

17,616 |

|

|

17,546 |

|

| Goodwill

and other intangible assets, net |

161,094 |

|

|

161,495 |

|

| Deferred

tax assets, net |

108,664 |

|

|

123,223 |

|

| Other

assets |

58,292 |

|

|

60,592 |

|

| Total

assets |

$ |

3,896,066 |

|

|

$ |

3,564,640 |

|

| |

|

|

|

|

Liabilities |

|

|

|

| Accounts

payable |

$ |

64,038 |

|

|

$ |

70,252 |

|

| Accrued

expenses and other liabilities |

316,487 |

|

|

263,845 |

|

| Unsecured

revolving credit facility |

200,000 |

|

|

200,000 |

|

| Seller

financed loans |

— |

|

|

13,726 |

|

| Senior

notes |

1,469,558 |

|

|

1,168,307 |

|

| Total

liabilities |

2,050,083 |

|

|

1,716,130 |

|

| |

|

|

|

|

Commitments and contingencies |

|

|

|

| |

|

|

|

|

Equity |

|

|

|

|

Stockholders' Equity: |

|

|

|

| Preferred

stock, $0.01 par value, 50,000,000 shares authorized; no

shares issued and outstanding as of September 30, 2017 and

December 31, 2016, respectively |

— |

|

|

— |

|

| Common

stock, $0.01 par value, 500,000,000 shares authorized;

150,429,021 and 158,626,229 shares issued and outstanding at

September 30, 2017 and December 31, 2016, respectively |

1,504 |

|

|

1,586 |

|

|

Additional paid-in capital |

780,715 |

|

|

880,822 |

|

| Retained

earnings |

1,060,210 |

|

|

947,039 |

|

| Total

stockholders' equity |

1,842,429 |

|

|

1,829,447 |

|

|

Noncontrolling interests |

3,554 |

|

|

19,063 |

|

| Total

equity |

1,845,983 |

|

|

1,848,510 |

|

| Total

liabilities and equity |

$ |

3,896,066 |

|

|

$ |

3,564,640 |

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED STATEMENT OF

OPERATIONS(in thousands, except share and per share

amounts)(unaudited) |

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

Homebuilding: |

|

|

|

|

|

|

|

| Home

sales revenue |

$ |

648,638 |

|

|

$ |

578,653 |

|

|

$ |

1,609,458 |

|

|

$ |

1,558,633 |

|

| Land and

lot sales revenue |

68,218 |

|

|

2,535 |

|

|

69,661 |

|

|

70,204 |

|

| Other

operations revenue |

584 |

|

|

606 |

|

|

1,752 |

|

|

1,790 |

|

| Total

revenues |

717,440 |

|

|

581,794 |

|

|

1,680,871 |

|

|

1,630,627 |

|

| Cost of

home sales |

521,918 |

|

|

462,323 |

|

|

1,294,563 |

|

|

1,219,560 |

|

| Cost of

land and lot sales |

12,001 |

|

|

1,734 |

|

|

13,299 |

|

|

16,973 |

|

| Other

operations expense |

575 |

|

|

575 |

|

|

1,726 |

|

|

1,724 |

|

| Sales and

marketing |

33,179 |

|

|

31,852 |

|

|

92,209 |

|

|

90,621 |

|

| General

and administrative |

32,956 |

|

|

31,278 |

|

|

101,293 |

|

|

90,293 |

|

|

Homebuilding income from operations |

116,811 |

|

|

54,032 |

|

|

177,781 |

|

|

211,456 |

|

| Equity in

(loss) income of unconsolidated entities |

— |

|

|

(20 |

) |

|

1,646 |

|

|

181 |

|

| Other

income, net |

26 |

|

|

21 |

|

|

147 |

|

|

287 |

|

|

Homebuilding income before income taxes |

116,837 |

|

|

54,033 |

|

|

179,574 |

|

|

211,924 |

|

| Financial

Services: |

|

|

|

|

|

|

|

|

Revenues |

295 |

|

|

235 |

|

|

881 |

|

|

762 |

|

|

Expenses |

82 |

|

|

72 |

|

|

233 |

|

|

183 |

|

| Equity in

income of unconsolidated entities |

1,351 |

|

|

1,247 |

|

|

2,911 |

|

|

3,246 |

|

| Financial

services income before income taxes |

1,564 |

|

|

1,410 |

|

|

3,559 |

|

|

3,825 |

|

| Income before

income taxes |

118,401 |

|

|

55,443 |

|

|

183,133 |

|

|

215,749 |

|

| Provision for income

taxes |

(46,112 |

) |

|

(20,298 |

) |

|

(69,824 |

) |

|

(77,701 |

) |

| Net income |

72,289 |

|

|

35,145 |

|

|

113,309 |

|

|

138,048 |

|

| Net income attributable

to noncontrolling interests |

(25 |

) |

|

(311 |

) |

|

(138 |

) |

|

(738 |

) |

| Net income available to

common stockholders |

$ |

72,264 |

|

|

$ |

34,834 |

|

|

$ |

113,171 |

|

|

$ |

137,310 |

|

| Earnings per share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.48 |

|

|

$ |

0.22 |

|

|

$ |

0.73 |

|

|

$ |

0.85 |

|

|

Diluted |

$ |

0.48 |

|

|

$ |

0.22 |

|

|

$ |

0.73 |

|

|

$ |

0.85 |

|

| Weighted average shares

outstanding |

|

|

|

|

|

|

|

|

Basic |

151,214,744 |

|

|

160,614,055 |

|

|

155,238,206 |

|

|

161,456,520 |

|

|

Diluted |

152,129,825 |

|

|

161,267,509 |

|

|

155,936,076 |

|

|

161,916,352 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MARKET DATA BY REPORTING SEGMENT &

STATE(dollars in thousands)(unaudited) |

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

NewHomesDelivered |

|

AverageSalesPrice |

|

NewHomesDelivered |

|

AverageSalesPrice |

|

NewHomesDelivered |

|

AverageSalesPrice |

|

NewHomesDelivered |

|

AverageSalesPrice |

| New Homes

Delivered: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Maracay

Homes |

164 |

|

|

$ |

477 |

|

|

165 |

|

|

$ |

412 |

|

|

447 |

|

|

$ |

459 |

|

|

400 |

|

|

$ |

403 |

|

| Pardee

Homes |

328 |

|

|

502 |

|

|

302 |

|

|

623 |

|

|

896 |

|

|

478 |

|

|

828 |

|

|

587 |

|

|

Quadrant Homes |

79 |

|

|

686 |

|

|

90 |

|

|

531 |

|

|

206 |

|

|

649 |

|

|

287 |

|

|

515 |

|

|

Trendmaker Homes |

104 |

|

|

504 |

|

|

121 |

|

|

516 |

|

|

343 |

|

|

493 |

|

|

335 |

|

|

506 |

|

|

TRI Pointe Homes |

332 |

|

|

720 |

|

|

260 |

|

|

645 |

|

|

783 |

|

|

669 |

|

|

678 |

|

|

667 |

|

|

Winchester Homes |

104 |

|

|

579 |

|

|

81 |

|

|

550 |

|

|

265 |

|

|

561 |

|

|

256 |

|

|

554 |

|

| Total |

1,111 |

|

|

$ |

584 |

|

|

1,019 |

|

|

$ |

568 |

|

|

2,940 |

|

|

$ |

547 |

|

|

2,784 |

|

|

$ |

560 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

NewHomesDelivered |

|

AverageSalesPrice |

|

NewHomesDelivered |

|

AverageSalesPrice |

|

NewHomesDelivered |

|

AverageSalesPrice |

|

NewHomesDelivered |

|

AverageSalesPrice |

| New Homes

Delivered: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California |

535 |

|

|

$ |

640 |

|

|

412 |

|

|

$ |

716 |

|

|

1,272 |

|

|

$ |

603 |

|

|

1,093 |

|

|

$ |

707 |

|

|

Colorado |

30 |

|

|

591 |

|

|

30 |

|

|

526 |

|

|

97 |

|

|

593 |

|

|

118 |

|

|

505 |

|

|

Maryland |

77 |

|

|

562 |

|

|

55 |

|

|

510 |

|

|

192 |

|

|

534 |

|

|

169 |

|

|

504 |

|

|

Virginia |

27 |

|

|

625 |

|

|

26 |

|

|

634 |

|

|

73 |

|

|

633 |

|

|

87 |

|

|

650 |

|

|

Arizona |

164 |

|

|

477 |

|

|

165 |

|

|

412 |

|

|

447 |

|

|

459 |

|

|

400 |

|

|

403 |

|

|

Nevada |

95 |

|

|

458 |

|

|

120 |

|

|

377 |

|

|

310 |

|

|

414 |

|

|

295 |

|

|

360 |

|

|

Texas |

104 |

|

|

504 |

|

|

121 |

|

|

516 |

|

|

343 |

|

|

493 |

|

|

335 |

|

|

506 |

|

|

Washington |

79 |

|

|

686 |

|

|

90 |

|

|

531 |

|

|

206 |

|

|

649 |

|

|

287 |

|

|

515 |

|

| Total |

1,111 |

|

|

$ |

584 |

|

|

1,019 |

|

|

$ |

568 |

|

|

2,940 |

|

|

$ |

547 |

|

|

2,784 |

|

|

$ |

560 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MARKET DATA BY REPORTING SEGMENT & STATE,

continued(unaudited) |

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

Net New Home Orders |

|

Average Selling Communities |

|

Net New Home Orders |

|

Average Selling Communities |

|

Net NewHomeOrders |

|

AverageSellingCommunities |

|

Net NewHomeOrders |

|

AverageSellingCommunities |

| Net New Home

Orders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Maracay

Homes |

158 |

|

|

13.5 |

|

|

134 |

|

|

17.8 |

|

|

504 |

|

|

15.3 |

|

|

526 |

|

|

18.1 |

|

| Pardee

Homes |

421 |

|

|

30.8 |

|

|

283 |

|

|

22.5 |

|

|

1,282 |

|

|

29.3 |

|

|

936 |

|

|

22.8 |

|

|

Quadrant Homes |

84 |

|

|

8.3 |

|

|

49 |

|

|

7.3 |

|

|

311 |

|

|

7.6 |

|

|

274 |

|

|

8.5 |

|

|

Trendmaker Homes |

113 |

|

|

29.3 |

|

|

130 |

|

|

29.0 |

|

|

393 |

|

|

30.9 |

|

|

385 |

|

|

26.8 |

|

|

TRI Pointe Homes |

378 |

|

|

34.7 |

|

|

239 |

|

|

28.7 |

|

|

1,144 |

|

|

31.9 |

|

|

883 |

|

|

27.3 |

|

|

Winchester Homes |

114 |

|

|

13.2 |

|

|

97 |

|

|

13.7 |

|

|

378 |

|

|

12.4 |

|

|

335 |

|

|

13.5 |

|

| Total |

1,268 |

|

|

129.8 |

|

|

932 |

|

|

119.0 |

|

|

4,012 |

|

|

127.4 |

|

|

3,339 |

|

|

117.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

Net New Home Orders |

|

Average Selling Communities |

|

Net New Home Orders |

|

Average Selling Communities |

|

Net New Home Orders |

|

Average Selling Communities |

|

Net New Home Orders |

|

Average Selling Communities |

| Net New Home

Orders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California |

632 |

|

|

45.2 |

|

|

380 |

|

|

35.0 |

|

|

1,885 |

|

|

43.1 |

|

|

1,333 |

|

|

34.3 |

|

|

Colorado |

40 |

|

|

8.0 |

|

|

31 |

|

|

5.0 |

|

|

144 |

|

|

6.5 |

|

|

107 |

|

|

4.8 |

|

|

Maryland |

81 |

|

|

10.0 |

|

|

72 |

|

|

7.2 |

|

|

265 |

|

|

9.0 |

|

|

214 |

|

|

6.7 |

|

|

Virginia |

33 |

|

|

3.2 |

|

|

25 |

|

|

6.5 |

|

|

113 |

|

|

3.4 |

|

|

121 |

|

|

6.8 |

|

|

Arizona |

158 |

|

|

13.5 |

|

|

134 |

|

|

17.8 |

|

|

504 |

|

|

15.3 |

|

|

526 |

|

|

18.1 |

|

|

Nevada |

127 |

|

|

12.3 |

|

|

111 |

|

|

11.2 |

|

|

397 |

|

|

11.6 |

|

|

379 |

|

|

11.0 |

|

|

Texas |

113 |

|

|

29.3 |

|

|

130 |

|

|

29.0 |

|

|

393 |

|

|

30.9 |

|

|

385 |

|

|

26.8 |

|

|

Washington |

84 |

|

|

8.3 |

|

|

49 |

|

|

7.3 |

|

|

311 |

|

|

7.6 |

|

|

274 |

|

|

8.5 |

|

| Total |

1,268 |

|

|

129.8 |

|

|

932 |

|

|

119.0 |

|

|

4,012 |

|

|

127.4 |

|

|

3,339 |

|

|

117.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MARKET DATA BY REPORTING SEGMENT & STATE,

continued(dollars in thousands)(unaudited) |

|

|

| |

As of September 30, 2017 |

|

As of September 30, 2016 |

| |

Backlog Units |

|

Backlog Dollar Value |

|

Average Sales Price |

|

Backlog Units |

|

Backlog Dollar Value |

|

Average Sales Price |

|

Backlog: |

|

|

|

|

|

|

|

|

|

|

|

| Maracay

Homes |

305 |

|

|

$ |

154,324 |

|

|

$ |

506 |

|

|

329 |

|

|

$ |

144,127 |

|

|

$ |

438 |

|

| Pardee

Homes |

646 |

|

|

436,376 |

|

|

676 |

|

|

382 |

|

|

182,263 |

|

|

477 |

|

| Quadrant

Homes |

206 |

|

|

160,202 |

|

|

778 |

|

|

130 |

|

|

83,467 |

|

|

642 |

|

|

Trendmaker Homes |

213 |

|

|

107,968 |

|

|

507 |

|

|

186 |

|

|

98,874 |

|

|

532 |

|

| TRI

Pointe Homes |

659 |

|

|

481,537 |

|

|

731 |

|

|

495 |

|

|

319,823 |

|

|

646 |

|

|

Winchester Homes |

236 |

|

|

141,858 |

|

|

601 |

|

|

189 |

|

|

121,617 |

|

|

643 |

|

|

Total |

2,265 |

|

|

$ |

1,482,265 |

|

|

$ |

654 |

|

|

1,711 |

|

|

$ |

950,171 |

|

|

$ |

555 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

As of September 30, 2017 |

|

As of September 30, 2016 |

| |

Backlog Units |

|

Backlog Dollar Value |

|

Average Sales Price |

|

Backlog Units |

|

Backlog Dollar Value |

|

Average Sales Price |

|

Backlog: |

|

|

|

|

|

|

|

|

|

|

|

|

California |

1,015 |

|

|

$ |

750,947 |

|

|

$ |

740 |

|

|

641 |

|

|

$ |

387,125 |

|

|

$ |

604 |

|

|

Colorado |

106 |

|

|

65,563 |

|

|

619 |

|

|

73 |

|

|

42,809 |

|

|

586 |

|

|

Maryland |

175 |

|

|

98,920 |

|

|

565 |

|

|

122 |

|

|

75,444 |

|

|

618 |

|

|

Virginia |

61 |

|

|

42,937 |

|

|

704 |

|

|

67 |

|

|

46,172 |

|

|

689 |

|

|

Arizona |

305 |

|

|

154,324 |

|

|

506 |

|

|

329 |

|

|

144,127 |

|

|

438 |

|

|

Nevada |

184 |

|

|

101,404 |

|

|

551 |

|

|

163 |

|

|

72,153 |

|

|

443 |

|

|

Texas |

213 |

|

|

107,968 |

|

|

507 |

|

|

186 |

|

|

98,874 |

|

|

532 |

|

|

Washington |

206 |

|

|

160,202 |

|

|

778 |

|

|

130 |

|

|

83,467 |

|

|

642 |

|

| Total |

2,265 |

|

|

$ |

1,482,265 |

|

|

$ |

654 |

|

|

1,711 |

|

|

$ |

950,171 |

|

|

$ |

555 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MARKET DATA BY REPORTING SEGMENT & STATE,

continued(unaudited) |

| |

| |

September 30, |

|

December 31, |

| |

2017 |

|

2016 |

| Lots Owned or

Controlled: |

|

|

|

| Maracay

Homes |

2,606 |

|

|

2,053 |

|

| Pardee

Homes |

15,655 |

|

|

16,912 |

|

| Quadrant

Homes |

1,685 |

|

|

1,582 |

|

|

Trendmaker Homes |

1,856 |

|

|

1,999 |

|

| TRI

Pointe Homes |

3,784 |

|

|

3,479 |

|

|

Winchester Homes |

2,306 |

|

|

2,284 |

|

| Total |

27,892 |

|

|

28,309 |

|

| |

|

|

|

| |

|

|

|

| |

September 30, |

|

December 31, |

| |

2017 |

|

2016 |

| Lots Owned or

Controlled: |

|

|

|

|

California |

16,403 |

|

|

17,245 |

|

|

Colorado |

817 |

|

|

918 |

|

|

Maryland |

1,661 |

|

|

1,779 |

|

|

Virginia |

645 |

|

|

505 |

|

|

Arizona |

2,606 |

|

|

2,053 |

|

|

Nevada |

2,219 |

|

|

2,228 |

|

|

Texas |

1,856 |

|

|

1,999 |

|

|

Washington |

1,685 |

|

|

1,582 |

|

| Total |

27,892 |

|

|

28,309 |

|

| |

|

|

|

| |

|

|

|

| |

September 30, |

|

December 31, |

| |

2017 |

|

2016 |

| Lots by

Ownership Type: |

|

|

|

| Lots

owned |

24,803 |

|

|

25,283 |

|

| Lots

controlled (1) |

3,089 |

|

|

3,026 |

|

| Total |

27,892 |

|

|

28,309 |

|

| |

|

|

|

|

|

__________(1) As of September 30, 2017 and

December 31, 2016, lots controlled included lots that were

under land option contracts or purchase contracts.

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES(unaudited)

In this press release, we utilize certain financial measures

that are non-GAAP financial measures as defined by the Securities

and Exchange Commission. We present these measures because we

believe they and similar measures are useful to management and

investors in evaluating the Company’s operating performance and

financing structure. We also believe these measures facilitate the

comparison of our operating performance and financing structure

with other companies in our industry. Because these measures are

not calculated in accordance with Generally Accepted Accounting

Principles (“GAAP”), they may not be comparable to other similarly

titled measures of other companies and should not be considered in

isolation or as a substitute for, or superior to, financial

measures prepared in accordance with GAAP.

The following tables reconcile homebuilding gross margin

percentage, as reported and prepared in accordance with GAAP, to

the non-GAAP measure adjusted homebuilding gross margin percentage.

We believe this information is meaningful as it isolates the impact

that leverage has on homebuilding gross margin and permits

investors to make better comparisons with our competitors, who

adjust gross margins in a similar fashion.

| |

Three Months Ended September 30, |

| |

2017 |

|

% |

|

2016 |

|

% |

| |

(dollars in thousands) |

| Home sales revenue |

$ |

648,638 |

|

|

100.0 |

% |

|

$ |

578,653 |

|

|

100.0 |

% |

| Cost of home sales |

521,918 |

|

|

80.5 |

% |

|

462,323 |

|

|

79.9 |

% |

| Homebuilding gross

margin |

126,720 |

|

|

19.5 |

% |

|

116,330 |

|

|

20.1 |

% |

|

Add: interest in cost of home sales |

15,623 |

|

|

2.4 |

% |

|

14,385 |

|

|

2.5 |

% |

|

Add: impairments and lot option abandonments |

374 |

|

|

0.1 |

% |

|

389 |

|

|

0.1 |

% |

| Adjusted homebuilding

gross margin |

$ |

142,717 |

|

|

22.0 |

% |

|

$ |

131,104 |

|

|

22.7 |

% |

| Homebuilding gross

margin percentage |

19.5 |

% |

|

|

|

20.1 |

% |

|

|

| Adjusted homebuilding

gross margin percentage |

22.0 |

% |

|

|

|

22.7 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Nine Months Ended September 30, |

| |

2017 |

|

% |

|

2016 |

|

% |

| |

(dollars in thousands) |

| Home sales revenue |

$ |

1,609,458 |

|

|

100.0 |

% |

|

$ |

1,558,633 |

|

|

100.0 |

% |

| Cost of home sales |

1,294,563 |

|

|

80.4 |

% |

|

1,219,560 |

|

|

78.2 |

% |

| Homebuilding gross

margin |

314,895 |

|

|

19.6 |

% |

|

339,073 |

|

|

21.8 |

% |

|

Add: interest in cost of home sales |

38,448 |

|

|

2.4 |

% |

|

34,653 |

|

|

2.2 |

% |

|

Add: impairments and lot option abandonments |

1,169 |

|

|

0.1 |

% |

|

678 |

|

|

0.0 |

% |

| Adjusted homebuilding

gross margin |

$ |

354,512 |

|

|

22.0 |

% |

|

$ |

374,404 |

|

|

24.0 |

% |

| Homebuilding gross

margin percentage |

19.6 |

% |

|

|

|

21.8 |

% |

|

|

| Adjusted homebuilding

gross margin percentage |

22.0 |

% |

|

|

|

24.0 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (continued)(unaudited)

The following table reconciles the Company’s ratio of

debt-to-capital to the non-GAAP ratio of net debt-to-net capital.

We believe that the ratio of net debt-to-net capital is a relevant

financial measure for management and investors to understand the

leverage employed in our operations and as an indicator of the

Company’s ability to obtain financing.

| |

September 30, 2017 |

|

December 31, 2016 |

| Unsecured revolving

credit facility |

$ |

200,000 |

|

|

$ |

200,000 |

|

| Seller financed

loans |

— |

|

|

13,726 |

|

| Senior notes |

1,469,558 |

|

|

1,168,307 |

|

| Total

debt |

1,669,558 |

|

|

1,382,033 |

|

| Stockholders’

equity |

1,842,429 |

|

|

1,829,447 |

|

| Total

capital |

$ |

3,511,987 |

|

|

$ |

3,211,480 |

|

| Ratio of

debt-to-capital(1) |

47.5 |

% |

|

43.0 |

% |

| |

|

|

|

| Total debt |

$ |

1,669,558 |

|

|

$ |

1,382,033 |

|

| Less: Cash and cash

equivalents |

(162,396 |

) |

|

(208,657 |

) |

| Net

debt |

1,507,162 |

|

|

1,173,376 |

|

| Stockholders’

equity |

1,842,429 |

|

|

1,829,447 |

|

| Net

capital |

$ |

3,349,591 |

|

|

$ |

3,002,823 |

|

| Ratio of net

debt-to-net capital(2) |

45.0 |

% |

|

39.1 |

% |

| |

|

|

|

|

|

__________(1) The ratio of debt-to-capital is computed as the

quotient obtained by dividing debt by the sum of debt plus

equity.(2) The ratio of net debt-to-net capital is computed as the

quotient obtained by dividing net debt (which is debt less cash and

cash equivalents) by the sum of net debt plus equity.

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (continued)(unaudited)

The following table calculates the non-GAAP measures of EBITDA

and Adjusted EBITDA and reconciles those amounts to net income, as

reported and prepared in accordance with GAAP. EBITDA

means net income before (a) interest expense, (b) income

taxes, (c) depreciation and amortization, (d) expensing

of previously capitalized interest included in costs of home sales

and (e) amortization of stock-based compensation. Adjusted

EBITDA means EBITDA before (f) impairment and lot option

abandonments and (g) restructuring charges. Other companies may

calculate EBITDA and Adjusted EBITDA (or similarly titled measures)

differently. We believe EBITDA and Adjusted EBITDA are useful

measures of the Company’s ability to service debt and obtain

financing.

| |

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

(in thousands) |

| Net income available to

common stockholders |

$ |

72,264 |

|

|

$ |

34,834 |

|

|

$ |

113,171 |

|

|

$ |

137,310 |

|

| Interest

expense: |

|

|

|

|

|

|

|

| Interest

incurred |

22,865 |

|

|

18,601 |

|

|

61,669 |

|

|

50,030 |

|

| Interest

capitalized |

(22,865 |

) |

|

(18,601 |

) |

|

(61,669 |

) |

|

(50,030 |

) |

|

Amortization of interest in cost of sales |

15,899 |

|

|

14,415 |

|

|

38,771 |

|

|

34,808 |

|

| Provision

for income taxes |

46,112 |

|

|

20,298 |

|

|

69,824 |

|

|

77,701 |

|

|

Depreciation and amortization |

867 |

|

|

866 |

|

|

2,567 |

|

|

2,322 |

|

|

Amortization of stock-based compensation

|

3,887 |

|

|

3,285 |

|

|

11,631 |

|

|

9,648 |

|

| EBITDA |

139,029 |

|

|

73,698 |

|

|

235,964 |

|

|

261,789 |

|

|

Impairments and lot abandonments |

374 |

|

|

389 |

|

|

1,203 |

|

|

678 |

|

|

Restructuring charges |

147 |

|

|

128 |

|

|

588 |

|

|

478 |

|

| Adjusted EBITDA |

$ |

139,550 |

|

|

$ |

74,215 |

|

|

$ |

237,755 |

|

|

$ |

262,945 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

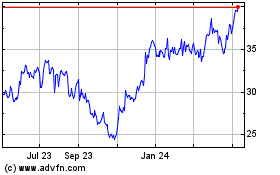

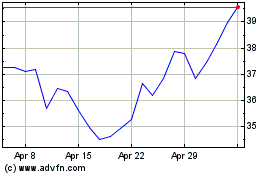

TRI Pointe Homes (NYSE:TPH)

Historical Stock Chart

From Aug 2024 to Sep 2024

TRI Pointe Homes (NYSE:TPH)

Historical Stock Chart

From Sep 2023 to Sep 2024