Report of Foreign Issuer (6-k)

September 18 2017 - 4:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of

September 2017

Commission File Number

000-20181

SAPIENS INTERNATIONAL CORPORATION N.V.

(Translation of registrant’s name

into English)

Azrieli Center

26 Harokmim St.

Holon, 5885800 Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form

40-F

¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

¨

CONTENTS

Israeli Private Placement of Additional Non-Convertible

Debentures

On September 18, 2017, Sapiens International

Corporation N.V. (“

Sapiens

” or the “

Company

”) reported to the Tel Aviv Stock Exchange (the

“

TASE

”) and Israeli Securities Authority that on September 14, 2017, Sapiens entered into agreements with Israeli

accredited investors for the private placement to those investors, in Israel, of 45.86 million New Israeli Shekels (“

NIS

”)

(approximately US $12.96 million) principal amount of the Company’s Series B, unsecured, non-convertible debentures (the

“

Series B Debentures

”). The Series B Debentures were sold in the private placement at a price of NIS 995.5 for

each NIS 1,000 principal amount, thereby generating approximately NIS 45.65 million (US $12.90 million) of proceeds for Sapiens.

Upon the completion of the private placement

and the recently completed Israeli public offering of Series B Debentures that was consummated on September 12, 2017, Sapiens will

have issued and sold the full NIS 280 million (approximately US $79.14 million) principal amount of Series B Debentures that it

had offered in that Israeli public offering.

The Series B Debentures have been offered

as, and will trade on the TASE as, 280,000 units of NIS 1,000 principal amount each. In the case of the privately placed Series

B Debentures, resale by the purchasers will be restricted for an initial period, in accordance with the Israeli Securities Law,

5728-1968, and the regulations thereunder.

The terms of the privately placed Series

B Debentures are identical to those of the publicly offered Series B Debentures. Consequently, upon registration of the privately

placed Series B Debentures for trading on the TASE, they will be considered, for all purposes, part of the same series together

with the publicly offered Series B Debentures. The terms of the Series B Debentures were described in the Company’s Report

of Foreign Private Issuer on Form 6-K (a “

Form 6-K

”) furnished to the Securities and Exchange Commission on

September 14, 2017, which description is incorporated by reference herein.

The issuance of the privately placed Series

B Debentures is subject to receipt of the approval of the TASE for the registration of those debentures for trading on the TASE.

On September 18, 2017, the Company issued

a press release to announce the entry into agreements for the private placement, a copy of which is appended to this Form 6-K as

Exhibit 99.1.

Important Note

re: Debenture Private Placement and Related Disclosures

The private placement of the Series B

Debentures was made only in Israel and not to U.S. persons (as defined in Rule 902(k) under the Securities Act of 1933, as amended

(the “

Securities Act

”)), in an overseas directed offering (as defined in Rule 903(b)(i)(ii) under the Securities

Act), and was exempt from registration under the Securities Act pursuant to the exemption provided by Regulation S thereunder.

The sale of the Series B Debentures will not be registered under the Securities Act, and the Series B Debentures may not be offered

or sold in the United States and/or to U.S. persons without registration under the Securities Act or an applicable exemption from

the registration requirements of the Securities Act.

This Form 6-K shall not be deemed to be

an offer to sell or a solicitation of an offer to buy any of the Series B Debentures.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

SAPIENS INTERNATIONAL CORPORATION N.V.

|

|

|

|

|

|

|

|

|

|

|

|

Date: September 18, 2017

|

By:

|

/s/ Roni Giladi

|

|

|

|

|

Name: Roni Giladi

|

|

|

|

|

Title: Chief Financial Officer

|

|

EXHIBIT INDEX

The following exhibit

is furnished as part of this Form 6-K:

|

Exhibit

|

|

Description

|

|

99.1

|

|

Press release, dated September 18, 2017, announcing entry into agreements for an Israeli private placement of additional non-convertible, unsecured Series B Debentures by Sapiens International Corporation N.V.

|

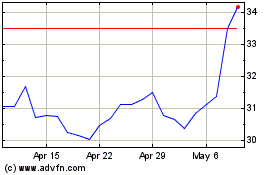

Sapiens International Co... (NASDAQ:SPNS)

Historical Stock Chart

From Apr 2024 to May 2024

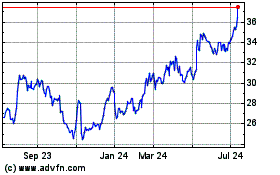

Sapiens International Co... (NASDAQ:SPNS)

Historical Stock Chart

From May 2023 to May 2024