Report of Foreign Issuer (6-k)

July 13 2017 - 4:35PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report Of Foreign Private Issuer

Pursuant To Rule 13a-16 Or 15d-16 Of

The Securities

Exchange Act Of 1934

For the month of July 2017

Commission File Number: 000-54290

Grupo Aval Acciones y Valores S.A.

(Exact name of registrant as specified

in its charter)

Carrera 13 No. 26A - 47

Bogotá D.C., Colombia

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GRUPO AVAL ACCIONES Y VALORES S.A.

TABLE OF CONTENTS

|

ITEM

|

|

|

1.

|

Report of Relevant Information dated July 12, 2017 regarding rating outlook of Banco de Bogotá S.A., Grupo Aval Acciones y Valores S.A. and Grupo Aval Limited

|

Item 1

RELEVANT INFORMATION

Bogota. July 12, 2017.

Grupo Aval

Acciones y Valores S.A. (“Grupo Aval”) informs that Moody’s Investors Service (“Moody´s”) improved

the rating outlooks of Banco de Bogotá S.A., Grupo Aval Acciones y Valores S.A. and Grupo Aval Limited (from “negative”

to “stable”) and affirmed their ratings.

Among other reasons, the improvement in

Banco de Bogota's outlook and affirmation of its ratings consider that the bank has maintained a significantly improved level of

capital since completing its corporate restructuring in June 2016, sustained by sound earnings generation and lower capital consumption.

Additionally, the rating action in Banco

de Bogotá S.A. caused similar rating actions in Grupo Aval and Grupo Aval Limited. Moody’s acknowledged Grupo Aval's

relatively stable leverage ratios, and ample liquidity, with liquid assets sufficient to cover a meaningful portion of debt maturities

in the next three years.

Following please find the mentioned affirmed

ratings with a stable outlook:

Banco de Bogotá S.A.

|

|

·

|

LT Senior Unsecured Deposit Rating , Affirmed

Baa2, Stable

|

|

|

·

|

ST Deposit Rating, Affirmed P-2

|

|

|

·

|

Subordinate Regular Bond/Debenture, Affirmed

Ba2

|

|

|

·

|

Adjusted Baseline Credit Assessment, Affirmed

ba1

|

|

|

·

|

Baseline Credit Assessment, Affirmed ba1

|

|

|

·

|

LT Counterparty Risk Assessment , Affirmed

Baa1(cr)

|

|

|

·

|

ST Counterparty Risk Assessment , Affirmed

P-2(cr)

|

Grupo Aval Acciones y Valores S.A.

|

|

·

|

LT Issuer Rating, Affirmed Ba2, Stable

|

|

|

·

|

ST Issuer Rating, Affirmed NP

|

Grupo Aval Limited

|

|

·

|

Backed Senior Unsecured Regular Bond/Debenture,

Affirmed Ba2, Stable

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: July 13, 2017

|

|

|

GRUPO AVAL ACCIONES Y VALORES S.A.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jorge Adrián Rincón Plata

|

|

|

|

|

|

Name:

|

Jorge Adrián Rincón Plata

|

|

|

|

|

|

Title:

|

Chief Legal Counsel

|

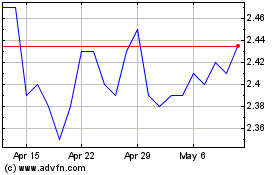

Grupo Aval Acciones y Va... (NYSE:AVAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

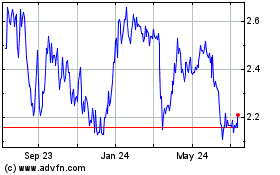

Grupo Aval Acciones y Va... (NYSE:AVAL)

Historical Stock Chart

From Apr 2023 to Apr 2024