Four Corners Pre-Releases Financial Results for Fiscal Year 2010 & Announces Renewal of K&B’s Sales, Inc. Bingo Distributor...

January 26 2011 - 10:37AM

Business Wire

Four Corners, Inc. (FCNE.PK) (the “Company”) today pre-released

unaudited financial results for the 52-week period ended October

31, 2010 and announced the renewal of the bingo distributorship

license for its subsidiary, K&B Sales, Inc. (“K&B”).

Financial Update

The Company reported consolidated net income of approximately

$1.6 million, or $0.16 per basic share including, net income from

discontinued operations of $1.2 million, or $0.13 per basic share,

for the 52-week period ended October 31, 2010. For the 52-week

period ended November 1, 2009, the Company reported a consolidated

net loss of approximately $2.3 million, or $(0.22) per basic and

diluted share, including a net loss from discontinued operations of

approximately $0.8 million, or $(0.08) per basic and diluted share.

Discontinued operations for fiscal years 2010 and 2009 were

comprised principally of the operating results of Eclipse Gaming

Systems, LLC, which the Company sold in May 2010. Discontinued

operations for fiscal year 2010 also includes a gain of $1.5

million resulting from the sale of Eclipse. The Company had net

income from continuing operations of approximately $0.3 million, or

$0.03 per basic and diluted share, for fiscal year 2010 compared to

a net loss from continuing operations of $1.5 million, or $(0.14)

per basic and diluted share, for fiscal year 2009.

The Company had revenue from continuing operations of

approximately $16.4 million in fiscal year 2010, almost all of

which was bingo revenue. Revenue from continuing operations of

$15.7 in fiscal year 2009 was all bingo revenue.

As of October 31, 2010, the Company had approximately $3.0

million of cash and total debt of approximately $6.0 million.

Substantially all of the Company’s indebtedness is to related

parties.

Business Update

On January 20, 2011, the Texas Lottery Commission voted

unanimously to accept a settlement agreement between the Commission

staff and K&B regarding the renewal of K&B’s bingo

distributor license. K&B’s license has been renewed and an

administrative penalty was assessed against K&B in the amount

of $2.3 million. Of that amount $2.1 million is deferred pending

K&B’s compliance with the settlement agreement, and the

deferred penalty will be vacated in five years. During the five

year period, K&B has agreed not operate, promote, service or

install games in Texas that fall within the Commission’s definition

of a gambling device, and it has agreed that it will not allow any

of its officers, directors, employees or agents to do the same.

K&B has agreed to pay the Commission its legal fees and $0.2

million over a 12-month period beginning February 1, 2011.

“We are pleased with our financial results in what was an

important transition year for the Company. We expect to continue to

remain focused on building K&B, while we selectively look at

strategic distribution opportunities in other jurisdictions that

leverage our expertise, reputation and relationships. We remain

excited about the future and believe we are well positioned for

future growth and success,” said John J. Schreiber, the Company’s

chairman, president and chief executive officer.

About Four Corners

Four Corners (FCNE.PK) is a holding company of certain

subsidiaries whose primary focus is the gaming industry. The

Company’s wholly-owned subsidiary, K&B Sales, Inc., distributes

bingo supplies and related equipment to charity bingo licensees in

Texas. FC Distributing LLC, a wholly-owned subsidiary of the

Company, distributes gaming machines and other gaming related

equipment to the Native American casino market in Oklahoma.

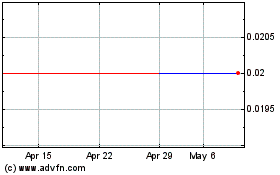

Four Corners (PK) (USOTC:FCNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

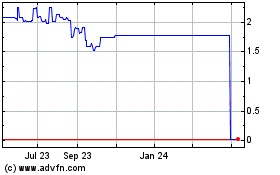

Four Corners (PK) (USOTC:FCNE)

Historical Stock Chart

From Apr 2023 to Apr 2024