Eton Pharmaceuticals, Inc (“Eton” or “the Company”) (Nasdaq: ETON),

an innovative pharmaceutical company focused on developing and

commercializing treatments for rare diseases, today reported

financial results for the quarter ended December 31, 2024.

“The fourth quarter of 2024 was the most transformational in

Eton’s history. We closed the pivotal acquisition of Increlex,

acquired another high-value rare disease product in Galzin, and

boosted our product pipeline with the license of Amglidia and

initiation of two exciting new internal development projects,

ET-700 and ET-800. We completed all this while continuing to

execute on our base business, delivering record product sales and

our 16th straight quarter of sequential revenue growth,” said Sean

Brynjelsen, CEO of Eton Pharmaceuticals.

“We are poised for an acceleration of growth in 2025. Increlex

was relaunched in January with our now fully dedicated pediatric

endocrinology sales force and is already adding new patients at a

pace well ahead of our expectations. Galzin was relaunched in March

with our newly deployed metabolic sales force and has been well

received by the Wilson disease community. Launch inventory for

ET-400 has been manufactured and our team stands ready to launch

the product within days of its PDUFA goal date of May 28, if

approved. Finally, ET-600’s successful pivotal study results allow

us to file an additional high-value NDA in the coming weeks.”

concluded Brynjelsen.

Fourth Quarter and Recent Business

Highlights

Delivered 16th

straight quarter of sequential growth in product

sales. Eton reported fourth quarter 2024 net sales of

$11.6 million, an increase of 59% over the prior year period,

driven primarily by strong growth of ALKINDI SPRINKLE® and

Carglumic Acid. The company expects sequential growth in quarterly

product revenue to continue through 2025 and beyond.

Relaunched Increlex, which is tracking

ahead of expectations. Increlex is a highly durable,

complex biologic used for the treatment of an ultra-rare pediatric

endocrinology condition that is estimated to impact approximately

200 children in the U.S. Eton closed the acquisition in late

December and relaunched the product in the United States in

January. The Company intends to leverage its existing sales team

and relationships in the pediatric endocrinology community to

promote the product and increase awareness of this underdiagnosed

and undertreated condition. The launch has seen strong initial

results, with numerous new patients added in January, February, and

the first half of March.

Awarded second patent for ET-400 and preparing for

potential launch. During the fourth quarter, Eton was

granted an additional patent for ET-400 by the United States Patent

& Trademark Office (USPTO). The patent, which expires in 2043,

covers hydrocortisone oral liquid formulations and is expected to

be listed in the FDA’s Orange Book upon approval. The Company has

successfully manufactured launch quantities for the product and its

sales and promotional campaigns are ready to go live. If approved

on its May 28 Prescription Drug User Fee Act (PDUFA) goal date, the

Company anticipates being in position to quickly launch the

product.

Acquired and re-launched Galzin. In January,

Eton added the ultra-rare disease commercial product Galzin to its

metabolic portfolio. Seeing the need for improved patient

experience, increased awareness, and broader access and

affordability, the Company relaunched Galzin on March 3 with its

newly deployed metabolic sales force and robust Eton Cares patient

support service. The Eton Cares patient support program ensures

patients can access Galzin with $0 co-pays, patient assistance,

reimbursement support, and overnight shipments.

Announced positive pivotal study results for ET-600 and

the issuance of a patent. ET-600 passed its pivotal

bioequivalence study, successfully demonstrating pharmacokinetic

equivalence to the reference product. In addition, the Company was

issued a patent covering the product’s proprietary formulation of

desmopressin oral solution. The patent expires in 2044 and is

expected to be listed in the FDA’s Orange Book upon the product’s

approval. Eton is preparing to submit an NDA for ET-600 in April,

which could allow for approval in the first quarter of 2026.

Disclosed two new internal development programs, ET-700

and ET-800. The Company has two new, high-value product

candidates under development internally. More details regarding

these previously undisclosed programs will be shared during Eton’s

Investor Day conference call.

Acquired U.S. rights to Amglidia (glyburide oral

suspension). Amglidia, which has been approved in the E.U.

since 2018, is under development in the U.S. for the treatment of

neonatal diabetes mellitus and has been granted Orphan Drug

Designation by the FDA. Amglidia is a strong strategic fit with

Eton’s existing pediatric endocrinology portfolio, and the Company

is scheduled to meet with the FDA in April 2025 to discuss the

product’s clinical pathway.

Fourth Quarter Financial Results

Net Revenue: Total net revenues for the fourth

quarter of 2024 increased 59% to $11.6 million compared to $7.3

million in the prior year period, driven primarily by growth in

ALKINDI SPRINKLE and Carglumic Acid. The Increlex and Galzin

acquisitions closed in late December and contributed less than $0.2

million of revenue during the fourth quarter.

Gross Profit: Gross profit for the fourth

quarter of 2024 was $6.5 million, compared to gross profit of $3.6

million for the fourth quarter of 2023. The increase was primarily

due to increased product sales. In addition, fourth quarter 2023

gross profit was negatively impacted by $1.0 million as a result of

ALKINDI SPRINKLE net sales triggering a one-time commercial

success-based milestone under the terms of the product’s licensing

agreement.

Research and Development (R&D) Expenses:

R&D expenses for the fourth quarter of 2024 were $(0.9) million

compared to $1.0 million in the prior year period. During the

fourth quarter of 2024, Eton’s ET-400 product was granted Orphan

Drug Designation by the FDA, which resulted in Eton receiving a

refund of the NDA filing fee that was paid and expensed in the

second quarter of 2024.

General and Administrative (G&A) Expenses:

G&A expenses for the fourth quarter of 2024 were $6.7 million

compared to $4.6 million in the prior year period. The increase was

primarily due to personnel additions and increased sales and

marketing investments that were initiated in the fourth quarter of

2024 to support the 2025 launches of Increlex, Galzin, and ET-400,

as well as Increlex related transaction costs.

Net Loss: Net loss for the fourth quarter of

2024 was $0.6 million or $0.02 per basic and diluted share compared

to a net loss of $2.3 million or $0.09 per basic and diluted share

in the prior year period.

Cash Position: As of December 31, 2024, Eton

had cash and cash equivalents of $14.9 million.

Conference Call and Webcast InformationAs

previously announced, Eton Pharmaceuticals will hold a virtual

Investor Day and report fourth quarter 2024 financial results on

Tuesday, March 18, 2025, beginning at 10:00 a.m. ET (9:00 a.m.

CT).To participate, please click here to register. An archived

webcast will be available on the Investors section of Eton’s

website approximately two hours after the completion of the event

and for 30 days thereafter.In addition to taking live questions

from participants on the conference call, management will be

answering emailed questions from investors. Investors can email

questions to: investorrelations@etonpharma.com.

About Eton

PharmaceuticalsEton is an innovative

pharmaceutical company focused on developing and commercializing

treatments for rare diseases. The Company currently has seven

commercial rare disease products: INCRELEX®, ALKINDI SPRINKLE®,

GALZIN®, PKU GOLIKE®, Carglumic Acid, Betaine Anhydrous, and

Nitisinone. The Company has six additional product candidates in

late-stage development: ET-400, ET-600, Amglidia®, ET-700, ET-800

and ZENEO® hydrocortisone autoinjector. For more information,

please visit our website at www.etonpharma.com.

Forward-Looking StatementsStatements contained

in this press release regarding matters that are not historical

facts are “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, including

statements associated with the expected ability of Eton to

undertake certain activities and accomplish certain goals and

objectives. These statements include but are not limited to

statements regarding Eton’s business strategy, Eton’s plans to

develop and commercialize its product candidates, the safety and

efficacy of Eton’s product candidates, Eton’s plans and expected

timing with respect to regulatory filings and approvals, and the

size and growth potential of the markets for Eton’s product

candidates. Because such statements are subject to risks and

uncertainties, actual results may differ materially from those

expressed or implied by such forward-looking statements. Words such

as “believes,” “anticipates,” “plans,” “expects,” “intends,”

“will,” “goal,” “potential” and similar expressions are intended to

identify forward-looking statements. These forward-looking

statements are based upon Eton’s current expectations and involve

assumptions that may never materialize or may prove to be

incorrect. Actual results and the timing of events could differ

materially from those anticipated in such forward-looking

statements as a result of various risks and uncertainties, which

include, without limitation, risks associated with the process of

discovering, developing and commercializing drugs that are safe and

effective for use as human therapeutics, and in the endeavor of

building a business around such drugs. These and other risks

concerning Eton’s development programs and financial position are

described in additional detail in Eton’s filings with the

Securities and Exchange Commission. All forward-looking statements

contained in this press release speak only as of the date on which

they were made. Eton undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist

after the date on which they were made.

Investor Relations:Lisa M. Wilson, In-Site

Communications, Inc.T: 212-452-2793E: lwilson@insitecony.com

| |

|

|

|

|

|

|

|

|

Eton Pharmaceuticals, Inc.STATEMENTS OF

OPERATIONS(In thousands, except per share

amounts) |

| |

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

|

|

For the years ended |

|

| |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

|

December 31, |

|

|

|

December 31, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Licensing revenue |

|

$ |

— |

|

|

$ |

— |

|

|

|

$ |

500 |

|

|

$ |

5,500 |

|

| Product sales and royalties,

net |

|

|

11,647 |

|

|

|

7,313 |

|

|

|

|

38,511 |

|

|

|

26,142 |

|

| Total net

revenues |

|

|

11,647 |

|

|

|

7,313 |

|

|

|

|

39,011 |

|

|

|

31,642 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Licensing revenue |

|

|

— |

|

|

|

1,000 |

|

|

|

|

270 |

|

|

|

1,000 |

|

| Product sales and

royalties |

|

|

5,171 |

|

|

|

2,683 |

|

|

|

|

15,330 |

|

|

|

9,581 |

|

| Total cost of

sales |

|

|

5,171 |

|

|

|

3,683 |

|

|

|

|

15,600 |

|

|

|

10,581 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

6,476 |

|

|

|

3,630 |

|

|

|

|

23,411 |

|

|

|

21,061 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

(871 |

) |

|

|

1,047 |

|

|

|

|

3,255 |

|

|

|

3,322 |

|

| General and

administrative |

|

|

6,718 |

|

|

|

4,575 |

|

|

|

|

22,753 |

|

|

|

18,931 |

|

| Total operating

expenses |

|

|

5,847 |

|

|

|

5,622 |

|

|

|

|

26,008 |

|

|

|

22,253 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from

operations |

|

|

629 |

|

|

|

(1,992 |

) |

|

|

|

(2,597 |

) |

|

|

(1,192 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (expense)

income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and other (expense)

income, net |

|

|

(1,140 |

) |

|

|

(17 |

) |

|

|

|

(1,211 |

) |

|

|

503 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income tax

expense |

|

|

(511 |

) |

|

|

(2,009 |

) |

|

|

|

(3,808 |

) |

|

|

(689 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense |

|

|

87 |

|

|

|

247 |

|

|

|

|

15 |

|

|

|

247 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(598 |

) |

|

$ |

(2,256 |

) |

|

|

$ |

(3,823 |

) |

|

$ |

(936 |

) |

| Net loss per share,

basic and diluted |

|

$ |

(0.02 |

) |

|

$ |

(0.09 |

) |

|

|

$ |

(0.15 |

) |

|

$ |

(0.04 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of common shares outstanding, basic and

diluted |

|

|

26,136 |

|

|

|

25,741 |

|

|

|

|

25,895 |

|

|

|

25,645 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Eton Pharmaceuticals, Inc.BALANCE

SHEETS(in thousands, except share and per share

amounts) |

| |

|

|

|

|

|

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

Assets |

|

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

14,936 |

|

|

$ |

21,388 |

|

| Accounts receivable, net |

|

|

5,361 |

|

|

|

3,411 |

|

| Inventories, net |

|

|

15,232 |

|

|

|

911 |

|

| Prepaid expenses and other

current assets |

|

|

5,492 |

|

|

|

1,129 |

|

| Total current

assets |

|

|

41,021 |

|

|

|

26,839 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

34 |

|

|

|

58 |

|

| Intangible assets, net |

|

|

34,881 |

|

|

|

4,739 |

|

| Operating lease right-of-use

assets, net |

|

|

175 |

|

|

|

92 |

|

| Other long-term assets,

net |

|

|

12 |

|

|

|

12 |

|

| Total

assets |

|

$ |

76,123 |

|

|

$ |

31,740 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

4,167 |

|

|

$ |

1,848 |

|

| Current portion of long-term

debt, net of discount |

|

|

— |

|

|

|

5,380 |

|

| Accrued Medicaid rebates |

|

|

6,866 |

|

|

|

3,627 |

|

| Accrued liabilities |

|

|

8,914 |

|

|

|

5,386 |

|

| Total current

liabilities |

|

|

19,947 |

|

|

|

16,241 |

|

| |

|

|

|

|

|

|

|

|

| Long-term debt, net of

discount and including accrued fees |

|

|

29,811 |

|

|

|

— |

|

| Operating lease liabilities,

net of current portion |

|

|

107 |

|

|

|

22 |

|

| Other long-term

liabilities |

|

|

1,830 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| Total

liabilities |

|

|

51,695 |

|

|

|

16,263 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

| Common stock, $0.001 par

value; 50,000,000 shares authorized; 26,709,084 and 25,688,062

shares issued and outstanding at December 31, 2024 and 2023,

respectively |

|

|

27 |

|

|

|

26 |

|

| Additional paid-in

capital |

|

|

132,294 |

|

|

|

119,521 |

|

| Accumulated deficit |

|

|

(107,893 |

) |

|

|

(104,070 |

) |

| Total stockholders’

equity |

|

|

24,428 |

|

|

|

15,477 |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities and

stockholders’ equity |

|

$ |

76,123 |

|

|

$ |

31,740 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Eton Pharmaceuticals, Inc.STATEMENTS OF

CASH FLOWS(In thousands) |

| |

|

|

|

|

|

|

| |

|

For the three months ended |

|

|

For the years ended |

|

| |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(598 |

) |

|

$ |

(2,256 |

) |

|

$ |

(3,823 |

) |

|

$ |

(936 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustments to reconcile net

loss to net cash from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

782 |

|

|

|

750 |

|

|

|

3,165 |

|

|

|

3,137 |

|

| Depreciation and

amortization |

|

|

355 |

|

|

|

325 |

|

|

|

1,146 |

|

|

|

901 |

|

| Non-cash lease expense |

|

|

17 |

|

|

|

17 |

|

|

|

70 |

|

|

|

67 |

|

| Debt discount

amortization |

|

|

1,039 |

|

|

|

27 |

|

|

|

1,109 |

|

|

|

117 |

|

| Changes in operating assets

and liabilities, net of impact of product acquisitions: |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

| Accounts receivable |

|

|

(939 |

) |

|

|

84 |

|

|

|

(3,118 |

) |

|

|

(1,559 |

) |

| Inventories |

|

|

(34 |

) |

|

|

140 |

|

|

|

(1,061 |

) |

|

|

(354 |

) |

| Prepaid expenses and other

assets |

|

|

(3,520 |

) |

|

|

(655 |

) |

|

|

(3,349 |

) |

|

|

94 |

|

| Accounts payable |

|

|

1,482 |

|

|

|

105 |

|

|

|

2,318 |

|

|

|

53 |

|

| Accrued Medicaid rebates |

|

|

(1,181 |

) |

|

|

476 |

|

|

|

3,239 |

|

|

|

2,818 |

|

| Accrued liabilities |

|

|

2,043 |

|

|

|

1,374 |

|

|

|

1,484 |

|

|

|

2,477 |

|

| Other non-current assets and

liabilities |

|

|

38 |

|

|

|

— |

|

|

|

38 |

|

|

|

— |

|

| Net cash from

operating activities |

|

|

(516 |

) |

|

|

387 |

|

|

|

1,218 |

|

|

|

6,815 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash from investing

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchases of property and

equipment |

|

|

(12 |

) |

|

|

— |

|

|

|

(26 |

) |

|

|

— |

|

| Acquisition of business |

|

|

(30,000 |

) |

|

|

— |

|

|

|

(30,000 |

) |

|

|

— |

|

| Purchase of product licensing

rights |

|

|

(8,369 |

) |

|

|

(775 |

) |

|

|

(10,237 |

) |

|

|

(775 |

) |

| Net cash from

investing activities |

|

|

(38,381 |

) |

|

|

(775 |

) |

|

|

(40,263 |

) |

|

|

(775 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net proceeds from the issuance

of long-term debt |

|

|

25,309 |

|

|

|

— |

|

|

|

25,309 |

|

|

|

— |

|

| Repayment of long-term

debt |

|

|

— |

|

|

|

(385 |

) |

|

|

(1,155 |

) |

|

|

(1,155 |

) |

| Common stock issued in private

placement offering |

|

|

7,000 |

|

|

|

— |

|

|

|

7,000 |

|

|

|

— |

|

| Proceeds from stock option

exercises |

|

|

1,015 |

|

|

|

— |

|

|

|

1,191 |

|

|

|

148 |

|

| Payment of tax withholding

related to net share settlement of stock option exercises |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(180 |

) |

| Employee stock purchase

plan |

|

|

108 |

|

|

|

91 |

|

|

|

248 |

|

|

|

229 |

|

| Stock warrant exercises |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net cash from

financing activities |

|

|

33,432 |

|

|

|

(294 |

) |

|

|

32,593 |

|

|

|

(958 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in cash and

cash equivalents |

|

|

(5,465 |

) |

|

|

(682 |

) |

|

|

(6,452 |

) |

|

|

5,082 |

|

| Cash and cash equivalents at

beginning of period |

|

|

20,401 |

|

|

|

22,070 |

|

|

|

21,388 |

|

|

|

16,305 |

|

| Cash and cash equivalents at

end of period |

|

$ |

14,936 |

|

|

$ |

21,388 |

|

|

$ |

14,936 |

|

|

$ |

21,388 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

140 |

|

|

$ |

204 |

|

|

$ |

665 |

|

|

$ |

842 |

|

| Cash paid for income

taxes |

|

$ |

(99 |

) |

|

$ |

247 |

|

|

$ |

82 |

|

|

$ |

247 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental

disclosures of non-cash investing and financing

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Debt issuance costs |

|

$ |

386 |

|

|

$ |

— |

|

|

$ |

386 |

|

|

$ |

— |

|

| Fair value of warrants issued

in connection with debt agreement |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1,171 |

|

|

$ |

— |

|

| Right-of-use assets obtained

in exchange for lease liabilities |

|

$ |

66 |

|

|

$ |

— |

|

|

$ |

219 |

|

|

$ |

29 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

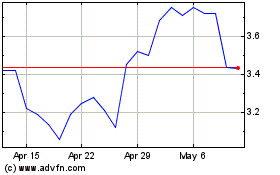

Eton Pharmaceuticals (NASDAQ:ETON)

Historical Stock Chart

From Mar 2025 to Mar 2025

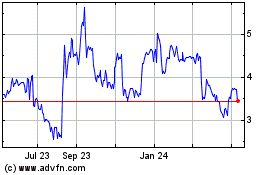

Eton Pharmaceuticals (NASDAQ:ETON)

Historical Stock Chart

From Mar 2024 to Mar 2025