false

VBI Vaccines Inc/BC

0000764195

0000764195

2024-07-30

2024-07-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported): July 30, 2024

VBI

VACCINES INC.

(Exact

name of registrant as specified in its charter)

| British

Columbia, Canada |

|

001-37769 |

|

N/A |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

160

Second Street, Floor 3

Cambridge,

Massachusetts |

|

02142 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(617)

830-3031

(Registrant’s

telephone number, including area code)

N/A

(Former

Name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Shares, no par value per share |

|

VBIV |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.03 | Bankruptcy

or Receivership |

On

August 2, 2024, the United States Bankruptcy Court for the District of Delaware granted provisional relief under Chapter 15 of the U.S. Bankruptcy Code, and scheduled a further hearing to consider the

recognition of the July 30, 2024, Ontario Superior Court of Justice (Commercial List) order, which granted VBI Vaccines Inc. (the “Company”)

protection under the Companies’ Creditors Arrangement Act, R.S.C. 1985, c. C-36, as amended.

| Item

3.01 | Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing |

On

July 30, 2024, the Company received a letter (the “Delisting Notice”) from the listing qualifications

department staff (the “Staff”) of the Nasdaq Stock Market LLC (“Nasdaq”) notifying

the Company that in accordance with Nasdaq Listing Rules 5101, 5110(b), and IM-5101-1, the Staff has determined that the Company’s

common shares, no par value per share (the “Common Shares”), will be delisted from Nasdaq. The Company does

not intend to appeal the Staff’s delisting determination. As a result of the Delisting Notice, trading of the Common Shares will

be suspended at the opening of business on August 8, 2024, and Nasdaq will file a Form 25-NSE with the Securities and Exchange Commission

(“SEC”), which will remove the Common Shares from listing and registration on Nasdaq. Nasdaq has not specified

a date on which the Form 25-NSE will be filed.

In

the Delisting Notice, the Staff stated that its determination is based on several factors, including (i) the Company’s intention

to commence a case under Chapter 15 of the United States Bankruptcy Code (the “Bankruptcy Code”) to seek recognition

of the initial order granting the company protection under the Companies’ Creditors Arrangement Act, R.S.C. 1985, c. C-36, as amended

(the “CCAA”) and the public concerns raised by such filing, (ii) concerns regarding the residual equity interest

of the existing listed securities holders, and (iii) concerns about the Company’s ability to sustain compliance with all requirements

for continued listing on Nasdaq, including the Company’s ongoing noncompliance with the minimum stockholders’ equity requirement

pursuant to Nasdaq Listing Rule 5550(b)(1) and the minimum bid price requirement pursuant to Nasdaq Listing Rule 5550(a)(2). As previously

disclosed, on May 24, 2024, the Company received a notification from the Staff indicating that the Company no longer satisfies Nasdaq

Listing Rule 5550(b)(1), and on November 1, 2023, the Company received a notification from the Staff indicating that the Company no longer

satisfies Nasdaq Listing Rule 5550(a)(2).

As

previously disclosed, on July 30, 2024, after considering all strategic alternatives following consultation with its legal and

financial advisors, the Company and its subsidiaries commenced voluntary restructuring under the jurisdiction of the Ontario Superior

Court of Justice (Commercial List) pursuant to the CCAA. In connection with these proceedings, the Company and certain of its subsidiaries

commenced a case under Chapter 15 of the Bankruptcy Code under the jurisdiction of the U.S. Bankruptcy Court for the District

of Delaware and intend to do so as well under the relevant provisions of the Israeli Insolvency and Economic Rehabilitation Law,

2018 (“Israeli Insolvency Law”).

The

Company expects to cease reporting as a public reporting company. The Company has not arranged for listing or registration, and does

not currently intend to arrange for listing or registration, of its Common Shares on another national securities exchange or for quotation

in a quotation medium.

On

August 2, 2024, the Company issued a press release announcing the U.S. Order and the receipt of the Delisting Notice. A copy of the press

release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Cautionary

Information Regarding Trading in the Company’s Securities

The

Company cautions that trading in the Company’s securities during the pendency of the restructuring proceedings is highly speculative

and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual value

realized, if any, by holders of the Company’s securities in the restructuring proceedings. Accordingly, the Company urges extreme

caution with respect to existing and future investments in its securities.

Forward-Looking

Statements

This

Current Report on Form 8-K contains “forward-looking statements” within the meaning of the safe harbor provisions of Section

27A of the Securities Act and Section 21E of the Exchange Act and “forward-looking information” within the meaning of applicable

Canadian securities legislation (collectively, “forward-looking statements”). Forward-looking statements are not statements

of historical facts and often contain words such as “may,” “will,” “expect,” “believe,”

“anticipate,” “plan,” “estimate,” “seek,” “could,” “should,”

“intend,” “potential,” or words of similar meaning. Forward-looking statements are based on management’s

current expectations, beliefs, assumptions and estimates regarding the company, industry, economic conditions, government regulations

and other factors. Forward-looking statements may include, for example, statements regarding the timing, manner, outcome and impact of

the restructuring proceedings, and other statements regarding the Company’s plans, strategies, prospects and expectations concerning

the Company’s business, operating results, financial condition, liquidity and other matters that do not relate strictly to historical

facts. These statements are subject to significant risks, uncertainties, and assumptions that are difficult to predict and could cause

actual results to differ materially and adversely from those expressed or implied in the forward-looking statements, including risks

and uncertainties regarding the Company’s ability to successfully complete a sale process under Chapter 15 and/or the CCAA and/or

Israeli Insolvency Law; potential adverse effects of the restructuring proceedings on the Company’s liquidity and results of operations;

the Company’s ability to obtain timely approval by the applicable courts with respect to the motions filed in the restructuring

proceedings; objections to the Company’s sale process, the Debtor-In-Possession facility (“DIP Facility”)

Facility, or other pleadings filed that could protract the restructuring proceedings; employee attrition and the Company’s ability

to retain senior management and other key personnel due to the distractions and uncertainties, including the Company’s ability

to provide adequate compensation and benefits during restructuring proceedings; the Company’s ability to comply with the restrictions

imposed by the DIP Facility and other financing arrangements; the Company’s ability to maintain relationships with suppliers, customers,

employees and other third parties and regulatory authorities as a result of the Chapter 15, CCAA filings, and proceedings under the Israeli

Insolvency Law; the applicable rulings in the restructuring proceedings, including the approval of the DIP Facility, and the outcome

of the restructuring proceedings generally; the length of time that the Company will operate under Chapter 15, CCAA protection, and protection

under Israeli Insolvency Law and the continued availability of operating capital during the pendency of the proceedings; risks associated

with third party motions in the restructuring proceedings, which may interfere with the Company’s ability to consummate a sale;

and increased administrative and legal costs related to the Chapter 15, the CCAA proceedings, proceedings under Israeli Insolvency Law,

and other litigation and inherent risks involved in a bankruptcy process. Forward-looking statements are also subject to the risk factors

and cautionary language described from time to time in the reports the Company files with the SEC, including those in “Item 1A

- Risk Factors” in the Company’s most recent Annual Report on Form 10-K and any updates thereto in the Company’s Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K. Additional factors, events, or uncertainties that may emerge from time to time,

or those that the Company currently deems to be immaterial, could cause the Company’s actual results to differ, and it is not possible

for the Company to predict all of them. The Company makes forward-looking statements based on currently available information, and the

Company assumes no obligation to, and expressly disclaim any obligation to, update or revise publicly any forward-looking statements

made in this Current Report on Form 8-K, whether as a result of new information, future events or otherwise, except as required by law.

| Item

9.01 | Financial

Statements and Exhibits. |

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VBI

Vaccines Inc. |

| |

|

|

| Date:

August 2, 2024 |

By: |

/s/

Jeffrey R. Baxter |

| |

|

Jeffrey

R. Baxter |

| |

|

President

and Chief Executive Officer |

Exhibit 99.1

VBI

Vaccines Provides an Update on its Restructuring Proceedings

CAMBRIDGE,

Mass. (August 2, 2024) – VBI Vaccines Inc. (Nasdaq: VBIV) (VBI), a biopharmaceutical company driven by immunology in

the pursuit of powerful prevention and treatment of disease, today provided an update on the restructuring proceedings announced on July

30, 2024.

U.S.

Chapter 15 Filing

On

August 2, 2024, the United States Bankruptcy Court for the District of Delaware granted provisional relief under Chapter 15 of the U.S.

Bankruptcy Code, and scheduled a further hearing to consider the recognition of the July 30, 2024, Ontario Superior Court of Justice

(Commercial List) order (“Initial Order”), which granted the company protection under the Companies’ Creditors Arrangement

Act, R.S.C. 1985, c. C-36, as amended (“CCAA”).

NASDAQ

Listing

On

July 30, 2024, the Company received a letter from the listing qualifications department staff of the Nasdaq Stock Market LLC (“Nasdaq”)

notifying the Company that its common shares will be delisted from Nasdaq effective as of opening of business on August 8, 2024. The

Company does not intend to appeal the delisting determination.

Stikeman

Elliott LLP, Haynes and Boone, LLP, Morris, Nicols, Arsht & Tunnell LLP, and Pearl Cohen Zedek Latzer Baratz are acting as legal

advisors to VBI. As previously announced, Ernst & Young Inc. (“EY”) has been appointed as Monitor in the CCAA proceedings

and the proposed sale and investment solicitation process (“SISP”).

Additional

information regarding the CCAA proceeding can be found on the Monitor’s website here, or by contacting the Monitor at vbi.monitor@ca.ey.com

or 1-888-338-1764. Additional information regarding the Chapter 15 Case can be found here.

About

VBI Vaccines Inc.

VBI

Vaccines Inc. (“VBI”) is a biopharmaceutical company driven by immunology in the pursuit of powerful prevention and treatment

of disease. Through its innovative approach to virus-like particles (“VLPs”), including a proprietary enveloped VLP (“eVLP”)

platform technology and a proprietary mRNA-launched eVLP (“MLE”) platform technology, VBI develops vaccine candidates that

mimic the natural presentation of viruses, designed to elicit the innate power of the human immune system. VBI is committed to targeting

and overcoming significant infectious diseases, including hepatitis B, coronaviruses, and cytomegalovirus (CMV), as well as aggressive

cancers including glioblastoma (GBM). VBI is headquartered in Cambridge, Massachusetts, with research operations in Ottawa, Canada, and

a research and manufacturing site in Rehovot, Israel.

Website

Home: http://www.vbivaccines.com/

News

and Resources: http://www.vbivaccines.com/news-and-resources/

Investors:

http://www.vbivaccines.com/investors/

Cautionary

Statement on Forward-looking Information

Certain

statements in this press release that are forward-looking and not statements of historical fact are forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are forward-looking information

within the meaning of Canadian securities laws (collectively, “forward-looking statements”). The Company cautions that such

forward-looking statements involve risks and uncertainties that may materially affect the Company’s results of operations. Such

forward-looking statements are based on the beliefs of management as well as assumptions made by and information currently available

to management. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain

factors, including but not limited to, risks and uncertainties regarding the Company’s ability to successfully complete a sale

process under Chapter 15 and/or the CCAA and/or Israeli Insolvency Law; potential adverse effects of the Restructuring Proceedings on

the Company’s liquidity and results of operations; the Company’s ability to obtain timely approval by the applicable courts

in Canada, US, and Israel, with respect to the motions filed in or in connection with the Restructuring Proceedings; objections to the

Company’s sale process, the DIP Loan, or other pleadings filed that could protract the restructuring proceedings; employee attrition

and the Company’s ability to retain senior management and other key personnel due to the distractions and uncertainties, including

the Company’s ability to provide adequate compensation and benefits during the Restructuring Proceedings; the Company’s ability

to comply with the restrictions imposed by the DIP Loan and other financing arrangements; the Company’s ability to maintain relationships

with suppliers, customers, employees and other third parties and regulatory authorities as a result of the Chapter 15, CCAA filings,

and proceedings under the Israeli Insolvency Law; the applicable rulings in the Restructuring Proceedings, including the approval of

the DIP Loan, and the outcome of the Restructuring Proceedings generally; the length of time that the Company will operate under Chapter

15, CCAA protection, and protection under the Israeli Insolvency Law, and the continued availability of operating capital during the

pendency of the proceedings; risks associated with third party motions in the Restructuring Proceedings and/or under Israeli Insolvency

Law, which may interfere with the Company’s ability to consummate a sale; and increased administrative and legal costs related

to the Chapter 15, the CCAA proceedings, and proceedings under Israeli Insolvency Law, and other litigation and inherent risks involved

in a bankruptcy process, the Company’s ability to regain and maintain compliance with the listing standards of the Nasdaq Capital

Market, the Company’s ability to satisfy all of the conditions to the consummation of the transactions with Brii Biosciences, the

Company’s ability to comply with its obligations under its loan agreement with K2 HealthVentures, the impact of general economic,

industry or political conditions in the United States or internationally; the impact and continuing effects of the COVID-19 epidemic

on our clinical studies, manufacturing, business plan, and the global economy; the ability to successfully manufacture and commercialize

PreHevbrio/PreHevbri; the ability to establish that potential products are efficacious or safe in preclinical or clinical trials; the

ability to establish or maintain collaborations on the development of pipeline candidates and the commercialization of PreHevbrio/PreHevbri;

the ability to obtain appropriate or necessary regulatory approvals to market potential products; the ability to obtain future funding

for developmental products and working capital and to obtain such funding on commercially reasonable terms; the Company’s ability

to manufacture product candidates on a commercial scale or in collaborations with third parties; changes in the size and nature of competitors;

the ability to retain key executives and scientists; and the ability to secure and enforce legal rights related to the Company’s

products. A discussion of these and other factors, including risks and uncertainties with respect to the Company, is set forth in the

Company’s filings with the SEC and the Canadian securities authorities, including its Annual Report on Form 10-K filed with the

SEC on March 13, 2023, and filed with the Canadian security authorities at sedarplus.ca on March 13, 2023, as may be supplemented or

amended by the Company’s Quarterly Reports on Form 10-Q. Given these risks, uncertainties and factors, you are cautioned not to

place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. All such

forward-looking statements made herein are based on our current expectations and we undertake no duty or obligation to update or revise

any forward-looking statements for any reason, except as required by law.

VBI

Contact

Email:

IR@vbivaccines.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

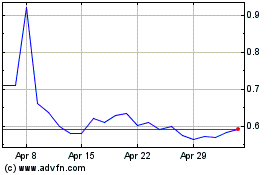

VBI Vaccines (NASDAQ:VBIV)

Historical Stock Chart

From Jul 2024 to Aug 2024

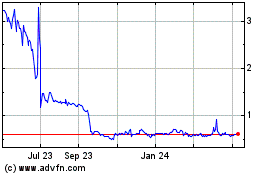

VBI Vaccines (NASDAQ:VBIV)

Historical Stock Chart

From Aug 2023 to Aug 2024