Dow Dips, Nasdaq Gains, Oil Prices Rise

June 26 2024 - 7:00AM

IH Market News

U.S. index futures are mixed pre-market trading on Wednesday,

driven by gains in Nvidia and optimism in the tech sector on Wall

Street. U.S. Treasury yields are rising as investors analyze recent

Fed statements and await important new economic data.

At 6:15 AM, Dow Jones futures (DOWI:DJI) fell 21 points, or

0.06%. S&P 500 futures rose 0.06%, and Nasdaq-100 futures

gained 0.18%. The yield on 10-year U.S. Treasury bonds was

4.281%.

In the commodities market, West Texas Intermediate crude for

August rose 0.85% to $81.52 per barrel. Brent crude for August rose

0.80%, nearing $85.69 per barrel. Iron ore traded on the Dalian

exchange rose 3.38% to $113.67 per metric ton.

The U.S. economic indicator agenda for Wednesday starts at 8:30

AM with the release of the third reading of Q1 GDP by the Commerce

Department. At 10:00 AM, also from the Commerce Department, May new

home sales will be announced. Later, at 10:30 AM, the Department of

Energy (DoE) will release the latest petroleum inventory data up to

last Friday.

Asia-Pacific markets closed with mixed but mostly positive

results. Gains were led by a notable advance in the semiconductor

sector, influenced by Nvidia’s recovery in the U.S. market,

boosting investor confidence in the region. In Australia, May

inflation reached 4%, above expectations, increasing the likelihood

of interest rate hikes by the RBA. In Singapore, industrial

production grew 2.9%, surpassing expectations.

The Shanghai SE index in China closed up 0.76%, while Japan’s

Nikkei saw a more significant increase of 1.26%. The Hang Seng in

Hong Kong had a modest increase of 0.09%, and South Korea’s Kospi

rose 0.64%. Conversely, Australia’s ASX 200 faced a more

challenging day, falling 0.71%.

European markets are up today, recovering from the previous

day’s losses, driven by improvements in global semiconductor

stocks. With no significant new economic data, investors are

focused on upcoming guidance from the European Central Bank (ECB).

There are moderate expectations that the ECB may ease its monetary

policy twice more this year, as suggested by board member Olli

Rehn, who warned against excessively restricting economic activity.

However, investment sentiment in Europe remains cautious due to the

potential for far-right advances in the upcoming legislative

elections in France, which is also negatively impacting the

euro.

U.S. stocks closed mixed on Tuesday after a cautious session.

The Dow Jones lost 299.05 points, or -0.76%, to 39,112.16. The

Nasdaq rose 220.84 points, +1.26%, to 17,717.65, and the S&P

500 gained 21.43 points, or +0.39%, to 5,469.30. The Chicago Fed

National Activity Index rose to +0.18 in May, and the Conference

Board Consumer Confidence Index fell to 100.4 in June.

Among individual stocks, Nvidia (NASDAQ:NVDA),

Meta Platforms (NASDAQ:META),

Alphabet (NASDAQ:GOOGL), Apple

(NASDAQ:AAPL), and others posted strong gains, while

Boeing (NYSE:BA), Nike

(NYSE:NKE), Goldman Sachs (NYSE:GS), and others

fell sharply. Walmart (NYSE:WMT) ended down more

than 2% after the company’s CFO signaled that the second quarter

would be the “most challenging quarter.”

On the quarterly report front, General Mills

(NYSE:GIS), PayChex (NASDAQ:PAYX), and

UniFirst (NYSE:UNF) are reporting before the

market opens.

After the close, numbers are expected from Micron

Technology (NASDAQ:MU), BlackBerry

(NYSE:BB), Levi Strauss (NYSE:LEVI),

Culp (NYSE:CULP), Franklin Covey

(NYSE:FC), Jefferies (NYSE:JEF),

MillerKnoll (NASDAQ:MLKN),

AeroVironment (NASDAQ:AVAV),

Concentrix (NASDAQ:CNXC), H.B.

Fuller (NYSE:FUL).

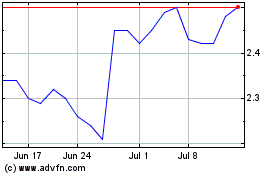

BlackBerry (NYSE:BB)

Historical Stock Chart

From May 2024 to Jun 2024

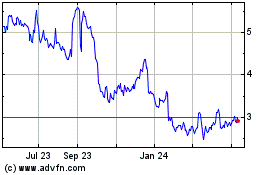

BlackBerry (NYSE:BB)

Historical Stock Chart

From Jun 2023 to Jun 2024