false

0001043186

0001043186

2024-05-07

2024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2024

Stabilis Solutions, Inc.

(Exact name of registrant as specified in its charter)

|

Florida

|

001-40364

|

59-3410234

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

11750 Katy Freeway Suite 900

Houston, Texas

|

77079

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: 832-456-6500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, $.001 par value

|

SLNG

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 7, 2024, Stabilis Solutions, Inc. (the “Company”) issued a press release announcing information regarding its results of operations and financial condition for the three months ended March 31, 2024. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Form 8-K.

The Company’s press release contains non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with United States generally accepted accounting principles, or ("GAAP"). Pursuant to the requirements of Regulation G, the Company has provided within the press release quantitative reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures.

The information in this Current Report, including the exhibit, is being furnished pursuant to Item 7.01 of Form 8-K and General Instruction B.2 thereunder. The information in this Current Report shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be deemed incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 7.01 Regulation FD Disclosure.

The information set forth under Item 2.02 is incorporated by reference as if fully set forth herein.

Item 9.01 Financial Statements and Exhibits.

Exhibits:

|

Exhibit No.

|

Description

|

| |

|

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

STABILIS SOLUTIONS, INC.

|

| |

By: /s/Andrew L. Puhala

|

| |

Andrew L. Puhala

|

| |

Chief Financial Officer

|

Date: May 7, 2024

Exhibit 99.1

STABILIS SOLUTIONS ANNOUNCES STRONG FIRST QUARTER 2024 RESULTS

Houston, May 7, 2024 — Stabilis Solutions, Inc., (“Stabilis” or the “Company”) (Nasdaq: SLNG), a leading provider of clean fueling, production, storage, and last mile delivery solutions for many of the world’s most recognized, high-performance brands, today announced financial results for the first quarter ended March 31, 2024.

FIRST QUARTER PERFORMANCE HIGHLIGHTS

| |

●

|

Strong demand led to an 8% increase in LNG volumes delivered and $1.5 million of net income, an increase of 36% on a year-over-year basis

|

| |

●

|

$3.9 million of cash flow from operations, an increase of $3.8 million on a year-over-year basis

|

| |

●

|

$12.6 million of cash and availability under our credit agreements and trailing twelve-month net leverage ratio of 0.1x as of March 31, 2024

|

MANAGEMENT COMMENTARY

“We delivered a strong first quarter performance, highlighted by new commercial wins and strong operational execution,” stated Westy Ballard, President and Chief Executive Officer. "Our first quarter results benefited from customary seasonality in the northeast, and high utilization of our liquefaction capacity, resulting in improved fixed cost absorption and margin realization.”

“In recent months, we’ve announced a transformational marine bunkering supply contract, extended an agreement with a major power generation customer, and continued to expand our presence as a leading fuel supplier to the commercial space launch industry,” stated Ballard. “We continue to prioritize long-term contractual relationships that provide the opportunity for higher-value, recurring revenue streams, consistent with our focus on profitable growth and we anticipate our owned production capacity to be fully utilized through 2025.”

STRATEGIC AND OPERATIONAL UPDATE

| |

●

|

Strong balance sheet and solid liquidity profile. Over the past 24 months, the Company has successfully transitioned its business model toward firm, longer-term customer relationships to drive higher utilization from its asset base and more predictable cash flows. These efforts have resulted in $12.6 million of cash and available liquidity under credit agreements and trailing twelve-month net leverage ratio of 0.1x as of March 31, 2024, while making significant discretionary capital investments for strategic growth.

|

| |

●

|

Leverage proven operations capabilities and contract awards to capitalize on significant demand growth for LNG as marine bunker fuel. The first quarter 2024 was Stabilis’ first full quarter of LNG fueling operations and related services for Carnival Corporation and marks the first ever LNG bunkering operation in Galveston, Texas. Looking ahead, Stabilis continues to focus on rapidly expanding its bunkering operations directly to the waterfront of strategic ports across the continental U.S. These efforts will be supported by Stabilis’ unique and robust inland LNG supply chain and the Company’s extensive experience in developing, constructing, and commissioning new liquefaction plants, which significantly de-risk greenfield expansion activities. Additionally, Stabilis’ inland LNG supply chain allows for the execution of new bunkering contracts, and the supplementation of LNG deliveries should there be a surge in demand. The Company remains in advanced discussions with several potential marine customers currently seeking LNG as a lower cost, cleaner burning bunker fuel alternative.

|

| |

●

|

Capitalize on multi-year investment cycle in infrastructure and electrification, supported by rising demand for data centers, cloud computing, and emerging technologies, giving rise to increased demand for behind-the-meter power generation solutions. Stabilis’ recently announced 14-month contract extension solidifies its position as a leading clean fuel solutions provider for behind-the-meter energy installations. This sector generated 25% of Stabilis 2023 revenues and the Company expects this opportunity to accelerate as domestic energy demand continues to grow over the next decade.

|

FIRST QUARTER CONFERENCE CALL AND WEBCAST

Stabilis will host a conference call on Wednesday May 8, 2024, at 9:00 am ET to review the Company’s financial results, discuss recent events and conduct a question-and-answer session.

A webcast of the conference call will be available in the Investor Relations section of the Company’s corporate website at https://investors.stabilis-solutions.com/events. To listen to a live broadcast, go to the site at least 15 minutes prior to the scheduled start time in order to register, download, and install any necessary audio software.

To participate in the live teleconference:

| Domestic Live: |

800-245-3047 |

| International Live: |

203-518-9783 |

| Conference ID: |

SLNGQ124 |

To listen to a replay of the teleconference, which will be available through May 15, 2024:

| Domestic Live: |

800-839-2459 |

| International Live: |

402-220-7218 |

ABOUT STABILIS SOLUTIONS

Stabilis Solutions, Inc. is a leading provider of clean fueling, production, storage, and last mile delivery solutions to many of the world’s most recognized, high-performance brands. To learn more, visit www.stabilis-solutions.com.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This press release includes “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995 and within the meaning of Section 27a of the Securities Act of 1933, as amended, and Section 21e of the Securities Exchange Act of 1934, as amended. Any actual results may differ from expectations, estimates and projections presented or implied and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “can,” “believes,” “feels,” “anticipates,” “expects,” “could,” “will,” “plan,” “may,” “should,” “predicts,” “potential” and similar expressions are intended to identify such forward-looking statements.

Such forward-looking statements relate to future events or future performance, but reflect our current beliefs, based on information currently available. Most of these factors are outside our control and are difficult to predict. A number of factors could cause actual events, performance or results to differ materially from the events, performance and results discussed in the forward-looking statements. Factors that may cause such differences include, among other things: the future performance of Stabilis, future demand for and price of LNG, availability and price of natural gas, unexpected costs, and general economic conditions.

The foregoing list of factors is not exclusive. Additional information concerning these and other risk factors is contained in the Risk Factors in Item 1A of our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 7, 2024 which is available on the SEC’s website at www.sec.gov or on the Investors section of our website at www.stabilis-solutions.com. All subsequent written and oral forward-looking statements concerning Stabilis, or other matters attributable to Stabilis, or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made.

Stabilis does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in their expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

# # # # #

Investor Contact:

Andrew Puhala

Chief Financial Officer

832-456-6502

ir@stabilis-solutions.com

Stabilis Solutions, Inc. and Subsidiaries

Selected Consolidated Operating Results

(Unaudited, in thousands, except share and per share data)

| |

|

Three Months Ended

|

|

| |

|

March 31,

|

|

|

December 31,

|

|

|

March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$ |

19,770 |

|

|

$ |

18,049 |

|

|

$ |

26,842 |

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

|

13,514 |

|

|

|

12,008 |

|

|

|

20,270 |

|

|

Change in unrealized (gain) loss on natural gas derivatives

|

|

|

(252 |

) |

|

|

(219 |

) |

|

|

169 |

|

|

Selling, general and administrative expenses

|

|

|

3,456 |

|

|

|

3,469 |

|

|

|

3,379 |

|

|

Gain from disposal of fixed assets

|

|

|

(127 |

) |

|

|

(221 |

) |

|

|

— |

|

|

Depreciation expense

|

|

|

1,800 |

|

|

|

1,872 |

|

|

|

2,011 |

|

|

Total operating expenses

|

|

|

18,391 |

|

|

|

16,909 |

|

|

|

25,829 |

|

|

Income from operations before equity income

|

|

|

1,379 |

|

|

|

1,140 |

|

|

|

1,013 |

|

|

Net equity income from foreign joint venture operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from equity investment in foreign joint venture

|

|

|

247 |

|

|

|

431 |

|

|

|

393 |

|

|

Foreign joint venture operating related expenses

|

|

|

(50 |

) |

|

|

(54 |

) |

|

|

(48 |

) |

|

Net equity income from foreign joint venture operations

|

|

|

197 |

|

|

|

377 |

|

|

|

345 |

|

|

Income from operations

|

|

|

1,576 |

|

|

|

1,517 |

|

|

|

1,358 |

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net

|

|

|

(4 |

) |

|

|

(19 |

) |

|

|

(150 |

) |

|

Interest (expense), net - related parties

|

|

|

— |

|

|

|

(7 |

) |

|

|

(32 |

) |

|

Other (expense), net

|

|

|

(21 |

) |

|

|

(49 |

) |

|

|

(84 |

) |

|

Total other income (expense)

|

|

|

(25 |

) |

|

|

(75 |

) |

|

|

(266 |

) |

|

Net income before income tax expense

|

|

|

1,551 |

|

|

|

1,442 |

|

|

|

1,092 |

|

|

Income tax expense

|

|

|

82 |

|

|

|

20 |

|

|

|

8 |

|

|

Net income

|

|

$ |

1,469 |

|

|

$ |

1,422 |

|

|

$ |

1,084 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per common share

|

|

$ |

0.08 |

|

|

$ |

0.08 |

|

|

$ |

0.06 |

|

|

Diluted net income per common share

|

|

$ |

0.08 |

|

|

$ |

0.08 |

|

|

$ |

0.06 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

$ |

3,355 |

|

|

$ |

3,340 |

|

|

$ |

3,285 |

|

|

Adjusted EBITDA

|

|

$ |

3,103 |

|

|

$ |

2,900 |

|

|

$ |

3,454 |

|

Stabilis Solutions, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited, in thousands, except share and per share data)

| |

|

March 31,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Assets

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

8,286 |

|

|

$ |

5,374 |

|

|

Accounts receivable, net

|

|

|

5,620 |

|

|

|

7,752 |

|

|

Inventories, net

|

|

|

137 |

|

|

|

169 |

|

|

Prepaid expenses and other current assets

|

|

|

1,442 |

|

|

|

1,677 |

|

|

Total current assets

|

|

|

15,485 |

|

|

|

14,972 |

|

|

Property, plant and equipment:

|

|

|

|

|

|

|

|

|

|

Cost

|

|

|

111,435 |

|

|

|

110,646 |

|

|

Less accumulated depreciation

|

|

|

(62,819 |

) |

|

|

(61,167 |

) |

|

Property, plant and equipment, net

|

|

|

48,616 |

|

|

|

49,479 |

|

|

Goodwill

|

|

|

4,314 |

|

|

|

4,314 |

|

|

Investments in foreign joint ventures

|

|

|

11,780 |

|

|

|

12,009 |

|

|

Right-of-use assets and other noncurrent assets

|

|

|

452 |

|

|

|

525 |

|

|

Total assets

|

|

$ |

80,647 |

|

|

$ |

81,299 |

|

|

Liabilities and Stockholders’ Equity

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

5,811 |

|

|

$ |

5,707 |

|

|

Accrued liabilities

|

|

|

2,432 |

|

|

|

4,166 |

|

|

Current portion of long-term notes payable

|

|

|

1,657 |

|

|

|

1,682 |

|

|

Current portion of finance and operating lease obligations

|

|

|

112 |

|

|

|

164 |

|

|

Total current liabilities

|

|

|

10,012 |

|

|

|

11,719 |

|

|

Long-term notes payable, net of current portion and debt issuance costs

|

|

|

7,446 |

|

|

|

7,747 |

|

|

Long-term portion of finance and operating lease obligations

|

|

|

— |

|

|

|

21 |

|

|

Total liabilities

|

|

|

17,458 |

|

|

|

19,487 |

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity:

|

|

|

|

|

|

|

|

|

|

Common stock; $0.001 par value, 37,500,000 shares authorized, 18,585,014 and 18,573,391 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively

|

|

|

19 |

|

|

|

19 |

|

|

Additional paid-in capital

|

|

|

102,431 |

|

|

|

102,057 |

|

|

Accumulated other comprehensive loss

|

|

|

(484 |

) |

|

|

(18 |

) |

|

Accumulated deficit

|

|

|

(38,777 |

) |

|

|

(40,246 |

) |

|

Total stockholders’ equity

|

|

|

63,189 |

|

|

|

61,812 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

80,647 |

|

|

$ |

81,299 |

|

Stabilis Solutions, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited, in thousands)

| |

|

Three Months Ended

|

|

| |

|

March 31,

|

|

|

December 31,

|

|

|

March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income from operations

|

|

$ |

1,469 |

|

|

$ |

1,422 |

|

|

$ |

1,084 |

|

|

Adjustments to reconcile net income from operations to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

1,800 |

|

|

|

1,872 |

|

|

|

2,011 |

|

|

Stock-based compensation expense

|

|

|

383 |

|

|

|

387 |

|

|

|

589 |

|

|

Bad debt expense

|

|

|

168 |

|

|

|

- |

|

|

|

- |

|

|

Gain from disposal of assets

|

|

|

(127 |

) |

|

|

(221 |

) |

|

|

- |

|

|

Income from equity investment in joint venture

|

|

|

(247 |

) |

|

|

(431 |

) |

|

|

(393 |

) |

|

Realized and unrealized losses on natural gas derivatives, net

|

|

|

- |

|

|

|

32 |

|

|

|

421 |

|

|

Distributions from equity investment in joint venture

|

|

|

- |

|

|

|

412 |

|

|

|

- |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

1,964 |

|

|

|

(1,617 |

) |

|

|

2,044 |

|

|

Prepaid expenses and other current assets

|

|

|

235 |

|

|

|

554 |

|

|

|

507 |

|

|

Accounts payable and accrued liabilities

|

|

|

(1,812 |

) |

|

|

(1,084 |

) |

|

|

(6,361 |

) |

|

Other

|

|

|

96 |

|

|

|

6 |

|

|

|

191 |

|

|

Net cash provided by operating activities

|

|

|

3,929 |

|

|

|

1,332 |

|

|

|

93 |

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition of fixed assets

|

|

|

(873 |

) |

|

|

(1,270 |

) |

|

|

(3,727 |

) |

|

Proceeds from sale of assets

|

|

|

207 |

|

|

|

1,255 |

|

|

|

— |

|

|

Proceeds from sale of Brazil operations

|

|

|

— |

|

|

|

87 |

|

|

|

— |

|

|

Net cash provided by (used in) investing activities

|

|

|

(666 |

) |

|

|

72 |

|

|

|

(3,727 |

) |

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments on short- and long-term notes payable

|

|

|

(346 |

) |

|

|

(319 |

) |

|

|

(365 |

) |

|

Payments on notes payable from related parties

|

|

|

— |

|

|

|

(622 |

) |

|

|

(596 |

) |

|

Employee tax payments from restricted stock withholdings

|

|

|

(9 |

) |

|

|

— |

|

|

|

— |

|

|

Net cash used in financing activities

|

|

|

(355 |

) |

|

|

(941 |

) |

|

|

(961 |

) |

|

Effect of exchange rate changes on cash

|

|

|

4 |

|

|

|

(3 |

) |

|

|

5 |

|

|

Net increase (decrease) in cash and cash equivalents

|

|

|

2,912 |

|

|

|

460 |

|

|

|

(4,590 |

) |

|

Cash and cash equivalents, beginning of period

|

|

|

5,374 |

|

|

|

4,914 |

|

|

|

11,451 |

|

|

Cash and cash equivalents, end of period

|

|

$ |

8,286 |

|

|

$ |

5,374 |

|

|

$ |

6,861 |

|

Non-GAAP Measures

Our management uses EBITDA and Adjusted EBITDA to assess the performance and operating results of our business. EBITDA is defined as Earnings before Interest (includes interest income and interest expense), Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for certain special items that occur during the reporting period, as noted below. We include EBITDA and Adjusted EBITDA to provide investors with a supplemental measure of our operating performance. Neither EBITDA nor Adjusted EBITDA is a recognized term under generally accepted accounting principles in the U.S. (“GAAP”). Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for management’s discretionary use, as they do not consider certain cash requirements, such as debt service requirements. Because the definition of EBITDA and Adjusted EBITDA may vary among companies and industries, it may not be comparable to other similarly titled measures used by other companies. The following table provides a reconciliation of net income (loss), the most directly comparable GAAP measure, to EBITDA and Adjusted EBITDA (in thousands).

| |

|

Three Months Ended

|

|

| |

|

March 31,

|

|

|

December 31,

|

|

|

March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

Net income

|

|

$ |

1,469 |

|

|

$ |

1,422 |

|

|

$ |

1,084 |

|

|

Depreciation

|

|

|

1,800 |

|

|

|

1,872 |

|

|

|

2,011 |

|

|

Interest expense, net

|

|

|

4 |

|

|

|

26 |

|

|

|

182 |

|

|

Income tax expense

|

|

|

82 |

|

|

|

20 |

|

|

|

8 |

|

|

EBITDA

|

|

|

3,355 |

|

|

|

3,340 |

|

|

|

3,285 |

|

|

Special items*

|

|

|

(252 |

) |

|

|

(440 |

) |

|

|

169 |

|

|

Adjusted EBITDA

|

|

$ |

3,103 |

|

|

$ |

2,900 |

|

|

$ |

3,454 |

|

|

*

|

Special items for the three months ended March 31, 2024 consist of the subtraction of an unrealized (gain) related to natural gas derivatives of $0.3 million. Special items for the three months ended March 31, 2023 consist of an addback for an unrealized loss on natural gas derivatives of $0.2 million. Special items for the three months ended December 31, 2023 consist of the subtraction of an unrealized (gain) on natural gas derivatives of $0.2 and a $0.2 million gain on disposition of assets.

|

# # # # #

v3.24.1.u1

Document And Entity Information

|

May 07, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Stabilis Solutions, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 07, 2024

|

| Entity, Incorporation, State or Country Code |

FL

|

| Entity, File Number |

001-40364

|

| Entity, Tax Identification Number |

59-3410234

|

| Entity, Address, Address Line One |

11750 Katy Freeway Suite 900

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77079

|

| City Area Code |

832

|

| Local Phone Number |

456-6500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SLNG

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001043186

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

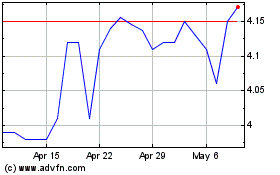

Stabilis Solutions (NASDAQ:SLNG)

Historical Stock Chart

From Apr 2024 to May 2024

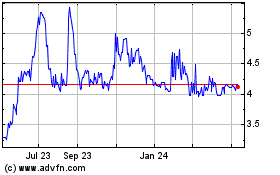

Stabilis Solutions (NASDAQ:SLNG)

Historical Stock Chart

From May 2023 to May 2024