0001651721false00016517212023-09-282023-09-280001651721us-gaap:CommonStockMember2023-09-282023-09-280001651721us-gaap:WarrantMember2023-09-282023-09-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 28, 2023

GENERATION INCOME PROPERTIES, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

Maryland |

|

001-40771 |

|

47-4427295 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

401 East Jackson Street, Suite 3300 Tampa, Florida |

|

33602 |

|

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (813)-448-1234

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

GIPR |

|

The Nasdaq Stock Market LLC |

Warrants to purchase Common Stock |

|

GIPRW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

1

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 28, 2023, Allison Davies, Chief Financial Officer and Treasurer of Generation Income Properties, Inc. (the “Company”), delivered a letter of resignation to the Company, pursuant to which Ms. Davies indicated her intent to resign as Chief Financial Officer and Treasurer, effective November 15, 2023 upon the filing of the Company’s Quarterly Report on Form 10-Q for the three months ended September 30, 2023.

On October 3, 2023, the Company and Ms. Davies entered into a Separation and Release Agreement (the “Agreement”) pursuant to which Ms. Davies’ employment with the Company will terminate effective as of the close of business of November 15, 2023, or, if later, the close of business on the day of the Company’s Quarterly Report on Form 10-Q for the three months ended September 30, 2023 is filed with the U.S. Securities and Exchange Commission.

In accordance with the terms of the Agreement, the Company agrees to provide Ms. Davies with a lump-sum payment in the amount of Fifty Seven Thousand Six Hundred and Fifty Nine Dollars ($57,659.00), and the Company has agreed to accelerate the vesting of all 19,366 shares of restricted stock of the Company granted to Ms. Davies on March 1, 2023 under the Company’s 2020 Omnibus Incentive Plan. In consideration for such benefits, Ms. Davies agreed to a general release of claims in favor of the Company and to customary non-disparagement covenants, and the parties have agreed that Ms. Davies’ employment agreement with the Company, dated January 24, 2022, is terminated.

The foregoing description of the Agreement is summary in nature, does not purport to be complete, and is qualified in its entirety by reference to the full text of the Agreement, a copy of which is filed as Exhibit 10.1 hereto and is incorporated by reference herein.

Item 7.01. Regulation FD Disclosure.

On October 4, 2023, the Company issued a press release announcing the departure of Ms. Davies. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 7.01 and the related information in Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act or the Exchange Act except as set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

GENERATION INCOME PROPERTIES, INC. |

|

|

|

Date: October 4, 2023 |

|

By: |

|

/s/ David Sobelman |

|

|

|

|

David Sobelman |

|

|

|

|

Chief Executive Officer |

3

SEPARATION AND RELEASE AGREEMENT

This SEPARATION AND RELEASE AGREEMENT (this “Agreement”) is made as of October

3, 2023 (the “Effective Date”), between Generation Income Properties, Inc. a Maryland corporation (including its successors and assigns, the “Company”), and Allison Davies (“Employee”).

1.Separation of Employment. Employee acknowledges that on September 28, 2023, she presented the Company with a letter of voluntary resignation. Employee agrees that her employment with the Company will terminate effective as of the close of business on November 15, 2023, or, if later, the close of business on the day the Company’s Quarterly Report on Form 10-Q for the three months ended September 30, 2023 (the “10-Q”), is filed with U.S. Securities and Exchange Commission (such later date, the “Separation Date”). Prior to the Separation Date, Employee will continue to perform her duties as Chief Financial Officer and Treasurer of the Company on a full-time basis, with the same responsibilities and duties performed by Employee immediately prior to the date hereof, through and including the Separation Date and will continue during such period to serve as the Company’s principal financial and accounting officer for purposes of all filings with the U.S. Securities and Exchange Commission (and she will accordingly sign the 10-Q and the certifications attached thereto and included therein that are required to be signed by the Company’s principal financial and accounting officer). Also, during the period beginning on the Effecting Date and ending on the Separation Date (the “Transition Period”), Employee agrees to work with and cooperate with the Company to transition her duties and responsibilities to a successor principal financial and accounting officer of the Company. Notwithstanding the foregoing, Employee agrees that the Employment Agreement, dated effective January 24, 2022, between Employee and the Company (“Employment Agreement”) is terminated effective as of the Effective Date and that neither the Employee nor the Company shall have any further rights thereunder as of the Effective Date other than (i) any obligations of Employee in the Employment Agreement that expressly survive the termination of the termination of the Employment Agreement, including without limitation the covenants included in Section 4 of the Employment Agreement (subject to Section 2(c) below), and (ii) any obligations of Employee set forth in this Agreement. During the Transition Period, Employee agrees that she will continue to receive her base salary and benefits as currently in effect, subject to applicable tax withholdings and other required withholdings.

a.Following the execution of this Agreement, the subsequent expiration of the Revocation Period (as defined in Section 6), and the Separation Date, and in exchange for the mutual covenants set forth in this Agreement, the Company agrees to provide Employee a lump-sum payment in the amount of Fifty Seven Thousand Six Hundred and Fifty Nine Dollars ($57,659.00), less all applicable federal, state, local and other employment-related deductions, on the next regular pay date of the Company following the later of the Separation Date or expiration of the Revocation Period (the “Separation Pay”). Employee acknowledges and agrees that payment of the Separation Pay will be conditioned on Employee’s compliance with the terms and provisions of this Agreement (including her continuing obligations in Section 1 above) and the surviving terms and provisions of the Employment Agreement.

b.So long as Employee complies with the terms and provisions of this Agreement (including her continuing obligations in Section 1 above) and the surviving terms and provisions of the Employment Agreement, on the day after the Separation Date, the Company shall accelerate the vesting of all 19,366 shares of restricted stock of the Company granted to Employee on March 1, 2023, under the Generation Income Properties, Inc,. 2020 Omnibus Incentive Plan.

c.The Company agrees that it will not enforce the covenant of non-competition contained in Section 4(b) of the Employment Agreement. Employee understands and acknowledges that

4861-4488-6659.4

all the other covenants and obligations contained in the Employment Agreement which survive the termination of employment shall remain in full force and effect including, but not limited to, the covenant of non-solicitation contained in Sections 4(c) and 4(d) of the Employment Agreement and the covenant of non-disclosure of confidential contained in Section 4(e) of the Employment Agreement.

d.Employee acknowledges and agrees that the Separation Pay and accelerated vesting of restricted stock provided in this Agreement is not otherwise due or owing to Employee under any Company employment agreement (oral or written) or Company policy or practice, and that the Separation Pay to be provided to Employee is not intended to, and shall not constitute, a severance plan, and shall confer no benefit on anyone other than the parties hereto.

e.Employee also represents and affirms that, other than the amounts owed under the terms of this Agreement, Employee has been paid and/or has received all leave (paid or unpaid), compensation, wages, bonuses and/or commissions to which Employee may be entitled and that no other leave (paid or unpaid), compensation, wages, bonuses and/or commissions are due to Employee. Employee represents that while Employee was employed Employee suffered no work-related accident illness of injury. Employee further affirms that Employee is not aware of Company or any of its managers having violated a law, rule or regulation of law.

f.The Company agrees that it will not contest any application for unemployment compensation benefits made by Employee. Employee understands and acknowledges that her entitlement to any such unemployment compensation benefits can only be made by the appropriate governmental agency.

a.In consideration of the Separation Pay, Employee, on behalf of Employee and Employee’s heirs, executors, devisees, successors and assigns, knowingly and voluntarily releases, remises, and forever discharges the Company and its parents, subsidiaries or affiliates, together with each of their current and former principals, officers, members, managers, directors, shareholders, insurers, agents, representatives and employees, and each of their heirs, executors, successors and assigns (collectively, the “Releasees”), from any and all debts, demands, actions, causes of action, accounts, covenants, contracts, agreements, claims, damages, omissions, promises, and any and all claims and liabilities whatsoever, of every name and nature, known or unknown, suspected or unsuspected, both in law and equity (“Claims”), which Employee ever had, now has, or may hereafter claim to have against the Releasees, arising from the beginning of time to the time Employee signs this Agreement, in connection with, related to or arising out of Employee’s employment relationship with the Company or the termination of such employment (the “Release”). This Release of Claims shall apply to any Claim of any type, including, without limitation, any and all Claims of any type that Employee may have arising under the common law, and to the extent any of these laws were ever held to apply to any Releasee under Title VII of the Civil Rights Act of 1964, the Civil Rights Act of 1991, the Age Discrimination in Employment Act, the Older Workers Benefit Protection Act, the Americans With Disabilities Act of 1967, the Family and Medical Leave Act of 1993, the Employee Retirement Income Security Act of 1974, the Florida Whistleblower Protection Act (Fla. Stat. §§ 448.101 to 448.105), and the Florida Workers' Compensation Retaliation Act (Fla. Stat. §440.205), the Florida Minimum Wage Act (Fla. Stat. §448.110), and the Florida Constitution, which requires Florida employers to pay the minimum wage to nonexempt employees and prohibits retaliation for reporting or objecting to a minimum wage violation (Fla. Const. art. X, § 24), each as amended, and any other federal, state or local statutes, regulations, ordinances or common law, or under any policy, agreement, contract, understanding or promise, written or oral, formal or informal, between any of the Releasees and Employee. Notwithstanding the foregoing, nothing in this Release shall be deemed to constitute the waiver of (a) any claim for vested benefits under any employee benefit plan of the Company,

2

4861-4488-6659.4

(b) Employee’s right to indemnification, (c) any claim for compensation for illness or injury or medical expenses under any worker’s compensation statute, (d) benefits under any plan currently maintained by the Company in which Employee is currently a participant and that provides for retirement benefits, (e) rights under any law or any policy or plan currently maintained by the Company that provides health insurance continuation or conversion rights, or (f) any claim that by law cannot be waived or released. In addition, nothing herein shall release the Company of its indemnification obligations to Employee under the Indemnification Agreement, dated January 24, 2022, and under the Company’s charter and bylaws and under the Maryland General Corporation Law.

b.For the purpose of implementing a full and complete release of the Claims described above, Employee understands and agrees that this Agreement is intended to include all Claims, if any, which Employee or Employee’s heirs, executors, devisees, successors and assigns may have and which Employee does not now know or suspect to exist in Employee’s favor against the Releasees, from the beginning of time until the time Employee signs this Agreement, and this Agreement extinguishes those Claims.

c.Except as expressly provided in this Agreement, Employee acknowledges and agrees that the Company has fully satisfied any and all obligations owed to Employee arising out of Employee’s employment with or termination from the Company, and no further sums or benefits are owed to Employee by the Company or by any of the other Releasees at any time.

d.Notwithstanding the foregoing, this Section 3 does not:

(i)prohibit Employee from filing a charge with the Equal Employment Opportunity Commission (“EEOC”), the Florida Commission on Human Relations (“FCHR”) or any comparable state or federal agency; or

(ii)prohibit Employee from participating in an investigation or proceeding by the EEOC, FCHR or any comparable state or local agency; or

4.Non-Disparagement. Employee agrees not to make, publish, or communicate to any person or entity, in any media or public forum, including on any social media sites, any comments or statements (written or oral), that disparage or create a negative impression of the Company, its affiliates or their respective directors, managers, officers, agents, employees, customers, suppliers or investors. Notwithstanding the foregoing, nothing in this Agreement shall prohibit Employee from making any truthful statements or disclosures that are required by applicable law or valid legal process, or that are protected by applicable law, including but not limited to any truthful statements or disclosures to any government or regulatory agency. The Company agrees that it will instruct each of its employees, officers, and directors to not make, publish, or communicate to any person or entity, in any media or public forum, including on any social media sites, any comments or statements (written or oral), that disparage or create a negative impression of Employee.

5.Consultation with Attorney; Voluntary Agreement. The Company advises Employee to consult with an attorney of Employee’s choosing prior to signing this Agreement. Employee understands and agrees that Employee has the right and has been given the opportunity to review this Agreement and, specifically, the general release in Section 3 above (the “General Release”), with an attorney. Employee also understands and agrees that Employee is under no obligation to consent to the General Release set forth in Section 3 above. Employee acknowledges and agrees that the payments to be made to Employee pursuant to this Agreement are sufficient consideration to require Employee to abide with Employee’s obligations under this Agreement, including but not limited to the General Release set forth in Section 3, and covenants contained in the Employment Agreement. Employee represents that Employee has read this

3

4861-4488-6659.4

Agreement, including the General Release set forth in Section 3, and understands its terms and that Employee enters into this Agreement freely, voluntarily, and without coercion.

6.Effective Date; Revocation. Employee acknowledges and represents that Employee has been given at least twenty-one (21) days during which to review and consider the provisions of this Agreement and, specifically, the General Release set forth in Section 3 above. Employee further acknowledges and represents that Employee has been advised by the Company that Employee has the right to revoke this Agreement for a period of seven (7) days after signing it (the “Revocation Period”). Employee acknowledges and agrees that, if Employee wishes to revoke this Agreement, Employee must deliver a notice of rescission to no later than 5:00 p.m. Eastern Time on the seventh (7th) day of the revocation period. To be effective, such rescission must be in writing and delivered to David Sobelman at mailto:ds@gipreit.com. If no such revocation occurs, the General Release and this Agreement shall become effective on the eighth (8th) day following Employee’s execution of this Agreement.

7.Severability. In the event that any one or more of the provisions of this Agreement are held to be invalid, illegal or unenforceable, the validity, legality and enforceability of the remainder of this Agreement shall not in any way be affected or impaired thereby.

8.Waiver. No waiver by either party of any breach by the other party of any condition or provision of this Agreement to be performed by such other party shall be deemed a waiver of any other provision or condition at the time or at any prior or subsequent time.

9.Entire Agreement. Employee acknowledges and agrees that, with the exception of the Confidentiality and Non-Compete Agreement, which shall remain in full force and effect according to its terms, this Agreement supersedes any and all prior or contemporaneous oral and/or written agreements between Employee and the Company and sets forth the entire agreement between Employee and the Company.

10.Governing Law and Venue; Waiver of Jury Trial. This Agreement shall be governed by and construed and enforced in accordance with the laws of the State of Florida, without reference to the choice of law rules of any jurisdiction. This Agreement shall be deemed executed and performed in the State of Florida, and any suits or actions arising out of or relating to this Agreement shall be brought exclusively in Hillsborough County in the State of Florida or a Federal District Court sitting therein, and the parties expressly consent and submit to the jurisdiction of such courts. THE PARTIES HEREBY WAIVE A JURY TRIAL IN ANY LITIGATION ARISING UNDER OR RELATING TO THIS AGREEMENT.

11.Counterparts. This Agreement may be executed in one or more counterparts, and by the Parties in separate counterparts, each of which when executed shall be deemed to be an original but all of which taken together shall constitute the same agreement. The Parties further agree that facsimile signatures or signatures scanned into .pdf (or similar) format and sent by e-mail shall be deemed original signatures.

[Remainder of Page Blank – Signatures Follow]

4

4861-4488-6659.4

IN WITNESS WHEREOF, the parties hereto, intending to be legally bound, have executed this Agreement as of the date first written above.

THE COMPANY

By: /s/ David Sobelman

David Sobelman

Chief Executive Officer

EMPLOYEE

By: /s/ Allison Davies

Allison Davies

4861-4488-6659.4

4861-4488-6659.4

FOR IMMEDIATE RELEASE

Contact: ir@gipreit.com

Generation Income Properties

Announces Planned Departure of Company’s

Chief Financial Officer, Allison Davies

Tampa, FL, October 4, 2023 – Generation Income Properties, Inc. (NASDAQ: GIPR) (the “Company”) announced today that its Chief Financial Officer and Treasurer, Allison Davies will be departing the Company on November 15, 2023, or, if later, after the filing of the Company’s Form 10-Q for Q3 2023, in order to work closer to where she resides in the Jacksonville, FL area.

Ms. Davies will remain in her roles until her final departure date, and the Company has begun a search to identify Ms. Davies’ successor. David Sobelman, GIPR’s President and CEO stated, “Allison has contributed so much to GIPR, but the Board and I understand that working from a distance is not an ideal scenario for either of us at this stage of the Company’s growth. Allison's efforts were instrumental in having GIPR qualify for REIT status and in building out the accounting and finance function at GIPR, including a new ERP system, as well as providing guidance for us in our Investment Committee. We think the world of Allison and know that we'll both be cheering for each other in the future.” Ms. Davies commented, “I will always be thankful for the opportunity GIPR has provided me and look forward to watching one of the most resilient and driven teams I have ever worked with continue to grow. Thank you to the GIPR team and Board for their support and understanding as I move into the next phase of my career.”

About Generation Income Properties

Generation Income Properties, Inc., located in Tampa, Florida, is an internally managed real estate investment trust formed to acquire and own, directly and jointly, real estate investments focused on retail, office and industrial net lease properties located primarily in densely populated submarkets throughout the United States. Additional information about Generation Income Properties, Inc. can be found on the Company’s corporate website: www.gipreit.com.

Forward-Looking Statements:

This press release, whether or not expressly stated, may contain "forward-looking" statements as defined in the Private Securities Litigation Reform Act of 1995. The words "believe," "intend," "expect," "plan," "should," "will," "would," and similar expressions and all statements, which are not historical facts, are intended to identify forward-looking statements. These statements reflect the Company's expectations regarding future events and economic performance and are forward-looking in nature and, accordingly, are subject to risks and uncertainties. Such forward-looking statements include risks and uncertainties that could cause actual results to differ materially from those expressed or implied

1 | GENERATION INCOME PROPERTIES | 401 E Jackson St, Suite 3300, Tampa, FL 33602 | (813) 448-1234

by such forward-looking statements which are, in some cases, beyond the Company’s control which could have a material adverse effect on the Company's business, financial condition, and results of operations. These risks and uncertainties include those identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed on March 28, 2023, as well as our other filings with the SEC, which are available at www.sec.gov. The occurrence of any of these risks and uncertainties could have a material adverse effect on the Company's business, financial condition, and results of operations. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Any forward-looking statement made by us herein speaks only as of the date on which it is made. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof, except as may be required by law.

2 | GENERATION INCOME PROPERTIES

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> * MERGEFORMAT 4862-4533-0819.3

v3.23.3

Document and Entity Information

|

Sep. 28, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 28, 2023

|

| Entity Registrant Name |

GENERATION INCOME PROPERTIES, INC.

|

| Entity Central Index Key |

0001651721

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity File Number |

001-40771

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Tax Identification Number |

47-4427295

|

| Entity Address, Address Line One |

401 East Jackson Street

|

| Entity Address, Address Line Two |

Suite 3300

|

| Entity Address, City or Town |

Tampa

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33602

|

| City Area Code |

(813)

|

| Local Phone Number |

448-1234

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

GIPR

|

| Security Exchange Name |

NASDAQ

|

| Warrants |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase Common Stock

|

| Trading Symbol |

GIPRW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

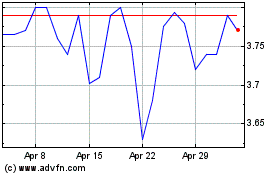

Generation Income Proper... (NASDAQ:GIPR)

Historical Stock Chart

From Apr 2024 to May 2024

Generation Income Proper... (NASDAQ:GIPR)

Historical Stock Chart

From May 2023 to May 2024