0001599407

false

0001599407

2023-09-25

2023-09-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 25, 2023

| 1847 Holdings LLC |

| (Exact name

of registrant as specified in its charter) |

| Delaware |

|

001-41368 |

|

38-3922937 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 590 Madison Avenue,

21st Floor, New York, NY |

|

10022 |

| (Address of principal executive offices) |

|

(Zip Code) |

| (212) 417-9800 |

| (Registrant's telephone number, including area code) |

| |

| (Former name or former address,

if changed since last report.) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Shares |

|

EFSH |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On September 25, 2023, Ellery W. Roberts, the

Chairman and Chief Executive Officer of 1847 Holdings LLC (the “Company”), participated in a “Fireside Chat”

for investors, which is available within the News/Events section of the Company’s website at 1847holdings.com/press-releases.

A transcript of the Fireside Chat is attached to this report as Exhibit 99.1. The furnishing of these materials is not intended

to constitute a representation that such furnishing is required by Regulation FD or other securities laws, or that the presentation

materials include material investor information that is not otherwise publicly available. In addition, the Company does not assume any

obligation to update such information in the future.

The information in this report (including Exhibit

99.1) is furnished pursuant to Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this report will not be

deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation

FD.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: September 25, 2023 |

1847 HOLDINGS LLC |

| |

|

| |

/s/ Ellery W. Roberts |

| |

Name: |

Ellery W. Roberts |

| |

Title: |

Chief Executive Officer |

2

Exhibit 99.1

1847 Holdings LLC

Transcript of Fireside Chat

September 2023

Natalya Rudman

Thank you for joining 1847 Holdings fireside chat. My name is Natalya

Rudman, Senior Vice President at Crescendo Communications and I will be joined by Ellery Roberts, CEO of 1847 Holdings.

Before we get started, we would like to remind everyone that this webinar

contains certain "forward-looking statements" within the meaning of the U.S. federal securities laws. Such statements are based

upon various facts and derived utilizing numerous important assumptions and are subject to known and unknown risks, uncertainties and

other factors that may cause actual results, performance or achievements to be materially different from any future results, performance

or achievements expressed or implied by such forward-looking statements. Statements preceded by, followed by or that otherwise include

the words "believes," "expects," "anticipates," "intends," "projects," "estimates,"

"plans" and similar expressions or future or conditional verbs such as "will," "should," "would,"

"may" and "could" are generally forward-looking in nature and not historical facts, although not all forward-looking

statements include the foregoing.

These forward-looking statements involve known and unknown risks as

well as uncertainties. Although the Company believes that its expectations are based on reasonable assumptions, the actual results that

the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the

Company only as of the date hereof. The forward-looking statements made during this call are based upon management’s reasonable

belief as of today’s date, September 22, 2023. 1847 Holdings undertakes no obligation to revise or update publicly any forward-looking

statements for any reason.

With that, we will now turn the call over to CEO Ellery Roberts.

Please go ahead, Ellery.

Ellery Robert

Thank you Natalya, and thanks to everyone for joining us today.

The last couple of months have been transformative for 1847. Our growth

and synergy thesis is playing out as we had planned and this was recently reflected in our quarterly results where we reported a 50% year-over-year

increase in revenue for the second quarter of 2023 and sequential growth of 25.8% from the first quarter of 2023.

We attribute this performance to the strength of our platform and our

ability to support the growth of our portfolio companies, while at the same time improving their profitability. Based on our current trajectory,

we continue to reaffirm our prior guidance of revenue in excess of $90 million in 2023.

We recently restructured promissory notes, held by Mast Hill and Leonite

Capital, totaling approximately $1.75 million outstanding. Based on the agreements with the investors, the promissory notes are no longer

convertible to equity, as long as they are repaid by the Company over a 12-month amortization schedule.

This was an important milestone and is designed to protect the interests

of shareholders by minimizing equity dilution. As I have stated on multiple occasions, we had a short-term cash need driven by the rapid

growth of our portfolio companies. However, with the cash flow now being generated as a result of these investments, we are in a much

stronger financial position. In turn, this has allowed us to negotiate more favorable terms, both with our existing lenders, as well as

potential future lenders, as we seek to appropriately leverage debt to support our accretive M&A strategy.

To be clear, we do not believe we have any near-term need for equity

funding. Given our growth and improving cash flow, we believe we are in a strong position to maximize returns for shareholders going forward.

Having significantly enhanced our capital structure, we also enacted

a 1-for-25 reverse stock split on September 11. We received a written notification from the NYSE American on August 31, 2023 that stated

that the Company was not in compliance with the continued listing standards. The board took immediate action to implement the reverse

split in order to avoid accelerated delisting action from the NYSE and to protect our shareholders. Since we are a limited liability company,

and under Delaware Law and the Company's operating agreement, the board is authorized to effect a reverse stock split without shareholder

approval or the need to make any filing in the state of Delaware. We didn't undertake this lightly and retaining our listing on a national

exchange was absolutely necessary in order for us to attract institutional, as well as retail investors going forward.

In addition, our cash flow is improving, which we anticipate will allow

us to resume dividends and opportunistically repurchase stock in the future, subject to establishing a stock buyback plan and future market

conditions. Egan-Jones recently affirmed their BB+ rating on our senior credit facility, which further illustrates the strength of our

balance sheet. I have personally purchased shares in the open market, and plan to purchase additional shares subject to limitations within

the Company's insider trading policy. Overall, I am more excited than ever about the outlook for the business, and believe this final

step in our restructuring will allow us to drive significant value for shareholders in the months and years ahead.

We also helped our subsidiary, ICU Eyewear Holdings, replace their

revolving loan with a new lender, increasing the borrowing capacity from $5 million to $15 million and extending the maturity of the revolving

loan to September 11, 2026.

With this new revolving loan facility in place, ICU has strengthened

its liquidity and increased its financial flexibility to enable it to grow its business without any equity dilution. This is another great

example of the significant value we provide to our portfolio companies, through an accretive, private-equity-style holding company business

model.

Most importantly, we are excited about our collaboration with Mountain

Ridge Capital and see an opportunity to potentially expand this relationship across our portfolio companies.

Despite the value we have created and the accomplishments we have achieved,

it hasn’t been recognized in the market. We have received fraudulent attacks on message boards and twitter stating that we have

acted illegally regarding the reverse split, which is false. As a public entity, every action that has been taken by the Company has been

approved by legal and filed appropriately with the Securities and Exchange Commission. We conduct our business ethically, with integrity

and remain committed to conducting our business affairs in compliance with all applicable laws, rules and regulations. We are a fully

audited SEC reporting company and every time we issue a filling, I am legally putting myself on the line.

In contrast, investors have been posting false and misleading information

on the message boards and in other places. I would like to remind everyone on the call that there is no legal accountability for these

posts. Whereas everything we say in our press releases and put in our filings has been reviewed and scrutinized by outside legal counsel

and as it relates to our financials, the auditors as well. So I would simply state that investors should carefully consider the source

of their information when making investment decisions.

We have also received numerous threats and hate speech, including threats

to myself, our board, our employees and our families. We take these threats very seriously. It is a crime to make threats with the intent

to place the recipient, or their family, in fear of their safety. We will not tolerate any threats or harassment and will pursue all available

avenues, including by pressing criminal charges, to protect the safety of our employees.

I would now like to answer questions that have been submitted by our

investors.

Natalya, would you please lead us through the Q&A discussion?

Natalya Rudman

All right, thanks, Ellery. We suggested interested parties submit their

questions in advance. We'd like to address those questions for you now. Some questions were duplicative so we did our best to reconcile

those where possible. If you have any further questions after the call, please feel free to follow up with investor relations and we'll

be sure to respond to you as quickly as possible. Let's start with the first question.

What is the status of Asiens and 1847 cabinets? And why are you considering

spinning out these businesses?

Ellery Roberts

Thanks for the question Natalya. The first part of the question is

not a question we can answer at this point because of certain regulatory concerns. But for the second part, why are we considering this

action at this point? It's because for one Asiens is in the midst of an opportunistic situation that may afford it the opportunity to

be spun out. I wish I could provide better clarity but there is sensitive information that can't be disclosed relative to that portfolio

company. With respect to 1847 Cabinets, as we've always said, that has been a driving force behind the growth of 1847 Holdings and its

explosive growth I think would situate it well for going public as a standalone vehicle.

Natalya Rudman

Great so our next question is why weren’t the specifics of the

agreement with Spartan more fully disclosed and why is the Company considering going private?

Ellery Roberts

Well, we arrived at that conclusion as a management team and as a board

as a result of the failure, we believe, by the public market to recognize the value that exists in the holdings we currently own. And

as the stock price does not reflect what we feel, the true value is of the Company. We wanted to let shareholders know that we were not

going to stand pat, and that we would avail ourselves to whatever strategic opportunity might exist to create or unlock fair value for

the Company's stock. All of the terms for the Spartan engagement will be disclosed when needed, and when required by the Securities &

Exchange Commission and the NYSE.

Natalya Rudman

Thank you. Next question. Why did the Company raise capital when it

did and where did the money from the financing that we completed go?

Ellery Roberts

Yes, we raised capital because as we've stated for nearly 12 months,

the growth that we are experiencing is incredibly significant. We are recognizing or realizing nearly 100% growth year over year, and

that growth comes with a cost which is additional capital to fund accrued expenses and to make investments in inventory and equipment

and systems that will further allow us to take advantage of the growth that lies ahead.

Natalya Rudman

Thank you. Next question. Why did the Company default on its debt?

Ellery Roberts

We had payment obligations we failed to satisfy and as a result we

defaulted. The lender had the opportunity to take a much, much more aggressive posture with the Company, but they thought it was more

beneficial for them and the Company to convert to equity. However, as we stated in the past, our cash flow continues to improve as validated

by the lender’s decision to convert to equity given their belief in the underlying business and assets of the Company. Given our

improving cash flow, we also restructured outstanding promissory notes, which are no longer convertible to equity as long as they are

repaid by the Company over a 12-month amortization schedule, which should enable us to avoid further dilution.

Natalya Rudman

That leads us into our next question. How many convertible notes are

left?

Ellery Roberts

There are approximately $4.8 million of convertible notes left. Recently

we raised a round of $3.1 million through Spartan Capital, in addition to the $1.7 million of notes that were outstanding and restructured.

Natalya Rudman

Next question. Why did the Company enact the reverse split? And a related

question. Why act on the reverse split immediately if we had a few months to regain compliance?

Ellery Roberts

The reverse split was enacted as a result of a non-compliance letter

sent from the NYSE American exchange given the fact that the stock price would precipitate an immediate delisting if the price fell below

a certain level. We felt it was prudent to aggressively confront the non-compliance with the reverse split, taking the potential delisting

out of the hands of the market price which could change very quickly without notice.

Natalya Rudman

Thank you. Our next question is why hasn't the Company been communicating

more with investors?

Ellery Roberts

Well, we've been working away trying to improve shareholder value,

and we feel that we would like to communicate within the confines of SEC rules and regulations. We feel that we share information as it

is fully vetted and appropriate, rather than making statements that are not fully vetted. And we will continue to provide information

that has been cleared both by legal and is consistent with the rules and regulations on the exchange and with the SEC.

Natalya Rudman

Thank you. Next question. Are insiders considering purchasing stock?

Ellery Roberts

Insiders are considering purchasing stock but we have to take into

account blackout periods and the limited windows when stock can be purchased. I myself have been purchasing stock when those windows are

open and I believe managers and board members will weigh into the market in the near future.

Natalya Rudman

Thank you. Next question. When will the dividend be back?

Ellery Roberts

As we currently forecast we believe the dividend will be back in the

latter half of 2024 or in the first half of 2025. Right now we're focused on reinvesting our cash in the operating businesses to drive

capital appreciation through the value of the entities. But as soon as we believe that we have excess cash flow beyond our working capital

needs, as we have in the past, we will share that excess cash with our shareholders.

Natalya Rudman

Thank you. Next question. What happened to the warrant dividend that

was issued?

Ellery Roberts

The warrant dividends still exists. But given the strike price, it's

unlikely that that warrant dividend would materialize as cash available to the Company because that would that would require shareholders

effectively exercising those warrants and the warrants strike price is well above the current stock price of the Company.

Natalya Rudman

Thank you, our next question. Are you thinking about doing a share

buyback to regain investors' confidence?

Ellery Roberts

We are considering a share buyback to gain investor competence, but

as with the dividend, we are first and foremost focused on accumulating cash, reinvesting that cash to address our working capital needs

to ensure that we are self sufficient prior to distributing excess cash or buying back our stock. So to the extent that we decided to

buy back stock, that would also be something potentially that occurred in the latter half of 2024 or in the first half of 2025.

Natalya Rudman

Have you found out anything about the naked short sellers as a result

of your investigations?

Ellery Roberts

We have. That is information that has been accumulated for us by a

firm called ShareIntel and we are sharing that information with the appropriate authorities.

Natalya Rudman

Next question. Are you planning on acquiring any more subsidiaries?

Ellery Roberts

We are. We currently have under contract a consumer product company

that we hope to close within the near future.

Natalya Rudman

Thank you. Our next question. Why is management compensated with bonuses

if the stock has decreased.

Ellery Roberts

Our management team is compensated consistent with management executives

at other operating entities. As a result of that, to attract top talent we have to provide for bonus incentives that are sometimes disconnected

from the stock price as they might be functional accomplishments that can be used as a means of measuring the contributions of management

to the operations excuse me of the entity. Case in point. The filings that are done on a consistent basis by our CFO and finance team

are very important. And based on meeting certain filing deadlines and dates, and keeping us in a position where we are in compliance with

a number of different regulatory bodies, the managers, we feel, should be justly rewarded for their hard work.

Natalya Rudman

We have two more questions left. Next question is, the subsidiaries

are supposedly generating positive operating income. So why did the Company show a net loss for the last quarter?

Ellery Roberts

The Company has shown a net loss for the last quarter despite positive

operating income being generated by our operating subsidiaries because of the cost that is attached to what we've created, which we believe

is scalable and provides an umbrella under which we can continue to add other operating entities. We feel that we are near the inflection

point where operating income will surpass public company costs associated with operating in the public. As a result of that, we're very

excited about the near future.

Natalya Rudman

Very exciting. Last question is looking at the recent steps to help

stop the decline of the stock and the good position the Company has with improving cash flows and positive performing assets and restructuring

of debt, what plans does the Company have to bolster the stock value?

Ellery Roberts

Well, we are going to continue to keep our nose to the grindstone,

continue to focus on improving the operations of the business, and reporting, I think, continued operating improvements and updates on

strategic initiatives at the Company, is how we feel that we can further educate the public on the value that we hold. And that should

drive greater recognition of the value and therefore, potentially, appreciation in the price of the stock. There are from our perspective,

things that we would do that are disconnected from what I just mentioned, that would draw that would drive the value of the stock. Our

job is to acquire good assets, put in place the right capital structure, and work to improve those assets over time.

Natalya Rudman

Thank you. That is all for questions. Ellery, I'll turn it over to

you for closing remarks.

Ellery Roberts

Thank you Natalya. We believe we built a scalable business targeting

accretive cashflow companies and we remain committed to delivering maximum value for our shareholders. As always, we appreciate the support

of all our shareholders and look forward to providing updates as developments unfold.

7

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

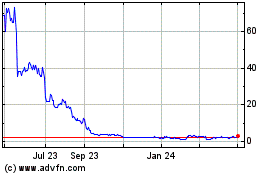

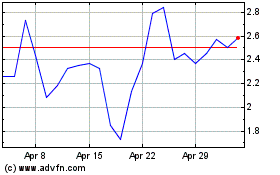

1847 (AMEX:EFSH)

Historical Stock Chart

From Apr 2024 to May 2024

1847 (AMEX:EFSH)

Historical Stock Chart

From May 2023 to May 2024