RNS Number:0636L

Braemar Seascope Group PLC

26 October 2006

BRAEMAR SEASCOPE GROUP plc

PRESS RELEASE

Interim Results - 6 months ended 31 August 2006

Braemar Seascope Group plc (the "Group"), an international provider of shipping

services, today announced half-year results for the six months ended 31 August

2006.

HIGHLIGHTS

* Turnover #50.5m (2005/6: #30.6m)

* Pre-tax profit before impairment charge #5.0m (2005/6: #5.3m)

* Reported pre-tax profit #4.1m (2005/6: #5.3m)

* Basic EPS before impairment charge 16.88p (2005/6: 18.29p)

* Reported EPS 12.03p (2005/6: 18.29p)

* Increased interim dividend declared 6.75p per share (2005/6: 6.50p)

* Net cash #8.1m (31 August 2005: #9.3m, February 2006: #13.6m)

Commenting on the results and outlook, Sir Graham Hearne, Chairman, said:

"The overall performance in shipbroking has been good and our forward order book

is at a record level reflecting a shift towards longer-term business."

"The outlook for the remainder of the year is positive. The diversity of our

shipbroking activities tends to moderate the influence of any one aspect of

shipping on our earnings. Overall conditions are expected to remain favourable

and, taking into account the level of business already concluded this year, we

expect second half earnings to show an improvement over the first half."

For further information, contact:

Braemar Seascope Group plc

Alan Marsh Tel 020 7535 2650

James Kidwell Tel 020 7535 2881

Aquila Financial

Peter Reilly Tel 020 7202 2601

Charles Stanley Securities

Philip Davies Tel 020 7149 6457

Notes to editors:

Through its subsidiaries Braemar Seascope Group plc's services comprise:

Braemar Seascope Limited Specialised shipbroking and consultancy services to international

ship owners and charterers in the tanker, gas, offshore,

container and dry bulk markets.

www.braemarseascope.com

DV Howells Limited Environmental services provided principally to the oil, marine,

rail industries

www.dvhowells.co.uk

Cory Brothers Shipping Agency Limited Freight forwarding and logistics and port agency services within

the UK.

www.cory.co.uk

Wavespec Limited Marine engineering and naval architecture consultants to the

shipping and offshore markets.

www.wavespec.com

INTERIM ANNOUNCEMENT - SIX MONTHS ENDED 31 AUGUST 2006

CHAIRMAN'S STATEMENT

I am pleased to announce another strong set of results for the first half of the

year. The markets in which the Group operates have for the most part remained

buoyant, though perhaps at somewhat lower levels than experienced in 2004 and

2005. The overall performance in shipbroking has been good and our forward

order book is at a record level reflecting a shift towards longer-term business.

In August 2006 we were able to complete the acquisition of the 50 per cent

interest in Braemar Container Shipping and Chartering Limited which the Group

did not already own for #1.3m, thereby consolidating our interest in the

important chartering and sale and purchase broking for container vessels.

Our non-broking businesses - Cory Brothers and Wavespec - also achieved good

results and contributed 20 per cent of our underlying operating profits. This

is a useful start towards our objective of broadening the range of shipping

services we can provide outside of the pure shipbroking field.

A further step in this direction was achieved with the establishment of an

environmental services business through the acquisition of DV Howells in March

2006 and Hi-bar in September for a maximum combined consideration of #1.0m.

Services provided include pollution incident response, training and consultancy

mainly for the oil majors and other transportation companies. We also increased

our presence in the UK agency market, particularly in Liverpool, through the

purchase of Gorman Cory which will take place over two years.

Pre-tax profits in the first half were #4.1m compared to #5.3m in the first half

of last year and earnings per share were 12.03 pence per share compared to 18.29

pence per share in 2005/6. The difference was mainly attributable to an

impairment charge of #0.95m against goodwill on the acquisition of our

Australian dry cargo business due to a lower trading performance and a

restructuring of its business operations. Excluding this impairment charge,

pre-tax profits were #5.0m (2005/6: #5.3m) and earnings per share were 16.88

pence per share (2005/6:18.29 pence per share).

The outlook for the remainder of the year is positive. The diversity of our

shipbroking activities tends to moderate the influence of any one aspect of

shipping on our earnings. Overall, conditions are expected to remain favourable

and, taking into account the level of business already concluded this year, we

expect second half earnings to show an improvement over the first half.

In light of the positive outlook the Directors have declared an interim dividend

of 6.75 pence per share. The interim dividend will be paid on 13 December 2006

to shareholders on the register at the close of business on 17 November 2006,

with an ex-dividend date of 15 November 2006.

Sir Graham Hearne

Chairman

25 October 2006

CHIEF EXECUTIVE'S REVIEW OF ACTIVITIES

Shipbroking

The tanker chartering market remained healthy for the first half of our

financial year, after a slow start in the first calendar quarter. Over the

summer, demand for sweet crudes produced in Atlantic regions for Far East

destinations served to increase voyage lengths for many of the larger crude

tankers and by the end of the second quarter freight rates improved to the

levels seen in 2005. However, the recent reduction in oil prices has now had

some effect on the crude tanker chartering, although since refining margins

remain good the volume of product shipments is being sustained. There is concern

that oil production may be constrained and that this could have some effect on

the freight markets, although this may be offset by rising global demand

especially from China and India and seasonal increases in crude shipments.

The chemical sector is currently enjoying sustained growth both on volume and

rates and this should only be strengthened with the change in regulations for

the transport of biofuels which will mean those cargoes falling more under the

'chemical shipping' banner in the future.

During the first half the gas sector remained reasonably strong but started

weakening in the third calendar quarter, associated with a high crude price.

However, as crude prices have fallen certain sectors of the gas market have

shown marked increases in volumes moved.

The average of the Baltic Dry Index for the first half was 2,837 (first half of

2005: 2,959) having declined quite sharply in the early part of the year before

undergoing a steady recovery since August. Our volume of fixtures has increased,

particularly for smaller Handymax vessels, but a larger proportion of business

written so far this year is period charter business where commissions will be

earned evenly over the duration of the charters. Forecasts for the dry cargo

market are positive and the outlook for the remainder of the year is promising.

We opened new offices in Singapore in March and in Brazil in September, to

service the growing importance of both places for ship owners and charterers.

There are significant fiscal incentives for ship operators who base their

operations in Singapore and our new office has been staffed from our Australian

company, in recognition of the attraction to clients.

Sale and purchase activity has seen a shift in the activity mix from second hand

to newbuilding. There have been fewer high value second hand transactions this

half, especially when compared with the first half of 2005/6 which benefited

from a number of deals financed by new capital raised in the public markets.

Offsetting this is a substantial increase in newbuilding orders placed at

shipyards in China, Japan, Korea, Vietnam and Poland. This is despite the

extensiveness of shipyards' order books, which is an indication of the

confidence in the long-term returns that can be made from shipping assets. The

newbuilding forward order book is now at its highest level (both in terms of the

number of ships and commission value) with ship deliveries stretching out to

2010/11. There is a steady rise in demolition business, which we expect will

increase as the phase-out of single hull tankers accelerates.

Our Offshore team had their most successful ever six months in a market that has

seen greater exploration activity in the North Sea and around the World. The

stimulus for this activity has been provided by a higher oil price. Day rates

and spot activity have both been high and the addition of good period charter

and project business has increased an already extensive forward book.

The Container chartering market was relatively stable during the first half and

our business has grown through involvement in both chartering and sale and

purchase transactions. The first half results are reflected as a 50 per cent

joint venture and, following our buyout of the other shareholders, the second

half will include 100 per cent of the results. The market is expected to soften

in the coming months providing new opportunities for our young team, which will

be well placed to take advantage of greater liquidity in the charter market as

more tonnage becomes available for employment.

Technical shipping support - Wavespec

Both revenue and profits have increased significantly as the company is now

benefiting from the plan approval and supervisory work at three shipyards for

the construction of up to 48 new LNG vessels in connection with the Qatargas II

project. This project is expected to generate income for the company for

several years. Wavespec and Braemar Seascope together are playing a leading role

in the development of the seaborne transportation of Compressed Natural Gas,

both in a technical and commercial capacity.

Ship agency, forwarding and logistics - Cory Brothers

Cory Brothers has shown an improved performance across all activities. Agency

volumes at all offices have continued strongly following the increases seen in

the latter part of 2005. The acquisition of the business and assets of Gorman

Shipping, which handles over 750 vessels per annum concentrated on the Mersey

and the Manchester Ship Canal, has strengthened our UK agency activities. The

business has been combined with the existing Cory Liverpool office making it one

of the foremost ships' agents in the area. The Liner, Logistics and Forwarding

businesses continue to grow their income from most key logistics contracts and

supplemented these with a number of one-off projects. The acquisitions made in

2005 have both performed in line with expectations. Morrison Tours has added to

its customer base and improved the take-up of the shore excursions on offer,

whilst in forwarding, Planetwide has seen significant growth of existing

services and added new consolidation routes to the Middle East. Recently Cory

has been successful in winning several new pieces of business such that activity

levels should be at least maintained in the second half of the year.

Environmental services - DV Howells

DV Howells has had a promising first six months in the Group, maintaining

activity with its core customers while focusing on growing its customer base.

The success in winning the prestigious MOD contract is an indication of the

potential the company has to build its business within the UK and beyond. The

purchase of Hi-bar's business in September 2006 has completed the incident

response coverage within the UK and enhanced the company's training and

consultancy capability.

Bunker trading

Bunker sales have been lower than expected due to the high oil price which has

to some extent limited demand in the Australasian region. The second half is

expected to benefit from an upturn associated with the cruise season in the

Pacific and also the recent drop in the crude oil price which has resulted in

lower bunker prices.

Financial

The Group's profits and earnings are seen most clearly in the analysis below

which shows the figures before the Braemar Seascope Pty goodwill impairment

charge, which is not a cash cost. The impairment has arisen because the earnings

derived from the Australian business have been less than expected at acquisition

mainly as a result of a weaker handymax chartering market in the Pacific region.

First half 2006/7 First half 2005/6

#000 #000

Profit before impairment charge and tax 5,023 5,297

Impairment of Braemar Seascope Pty goodwill (950) -

Reported profit before tax 4,073 5,297

pence Pence

EPS (pre impairment charge) 16.88 18.29

Impairment of goodwill (4.85) -

Basic EPS 12.03 18.29

The majority of the Group's income is US$ denominated and the average rate of

exchange for conversion of US$ income in the six months to August 2006 was

$1.81/# (Interim 2005/6: $1.80/#, Full Year 2005/6: $1.80/#). The rate of

translation at 31 August 2006 was $1.90/#.

The estimated full year tax rate on profits has been applied at the half year.

This rate was 33.0% excluding the impact of the impairment charge which is

non-deductible for tax (Interim 2005/6: 33.3%, Full year 2005/6: 30.3%).

Net cash was #8.1m at 31 August 2006 compared with net cash of #13.6m as at 28

February 2006. This excludes #4.9m of restricted cash, which the company was

holding as escrow agent for certain clients pending completion of transactions

in which the company acted as broker. The Group normally generates most of its

annual cash flow in the second half of the year and the reduction in cash

principally reflects the payment of the annual broking bonus and full year

dividend relating to the prior year.

Net cash expended on acquiring businesses was #1.1m in respect of DV Howells, 50

per cent of Braemar Container Shipping and Chartering and 41 per cent of Gorman

Cory. This is net of #0.7m of cash in the acquired balance sheets but does not

include further potential cash consideration of, in aggregate, #0.9m dependent

on profitability.

Alan Marsh

Chief Executive

25 October 2006

Income statement for the six months ended 31 August 2006

Unaudited Unaudited Unaudited

Six months to Six months to Year ended

31 Aug 2006 31 Aug 2005 28 Feb 2006

Continuing operations Notes #'000 #'000 #'000

Revenue 2 50,512 30,592 68,497

Operating costs (46,725) (25,381) (58,607)

Amortisation of other intangibles (62) (172) (287)

Impairment of goodwill (950) - -

Operating costs excluding amortisation of

other intangibles and impairment of goodwill (45,713) (25,209) (58,320)

Operating profit 2 3,787 5,211 9,890

Finance income 148 47 162

Finance costs (4) (15) (2)

Share of post-tax profit from joint ventures 142 54 243

Profit before taxation 4,073 5,297 10,293

Taxation 3 (1,657) (1,769) (3,115)

Profit for the period 2,416 3,528 7,178

Attributable to:

Ordinary shareholders 2,357 3,528 7,178

Minority interest 59 - -

Profit for the period 2,416 3,528 7,178

Earnings per ordinary share 5

Basic - pence 12.03 p 18.29 p 37.03 p

Diluted - pence 11.84 p 17.79 p 36.18 p

Consolidated Balance Sheet as at 31 August 2006

Unaudited Unaudited Unaudited

As at As at As at

31 Aug 06 31 Aug 05 28 Feb 06

Assets Notes #'000 #'000 #'000

Non current assets

Goodwill 21,909 21,953 22,480

Other intangible assets 1,812 245 462

Property, plant and equipment 5,349 4,954 5,034

Investments 1,481 1,410 1,611

Deferred tax assets 566 269 510

Other receivables 76 71 58

31,193 28,902 30,155

Current assets

Trade and other receivables 18,732 15,591 17,717

Financial assets

- Derivative financial

instruments 473 194 12

Restricted cash 4,946 1,090 -

Cash and cash equivalents 8,134 11,464 13,567

32,285 28,339 31,296

Total assets 63,478 57,241 61,451

Liabilities

Current liabilities

Financial liabilities

- Short term borrowings - 2,198 -

- Derivative financial

instruments - - 99

Trade and other payables 21,831 18,929 25,490

Current tax payable 2,362 4,148 2,224

Finance leases - 31 11

Provisions 210 - 288

Client monies held as escrow agent 4,946 1,090 -

29,349 26,396 28,112

Non-current liabilities

Deferred tax liabilities 239 58 139

Provisions 433 341 343

672 399 482

Total liabilities 30,021 26,795 28,594

Total assets less total

liabilities 33,457 30,446 32,857

Equity

Share capital 2,014 1,975 1,988

Capital redemption reserve 396 396 396

Share premium 8,434 7,880 8,046

Merger reserve 21,346 21,346 21,346

Shares to be issued (997) (637) (997)

Other reserves 393 426 639

Retained earnings 1,541 (940) 1,439

33,127 30,446 32,857

Minority interest 330 - -

Total equity 33,457 30,446 32,857

Consolidated Cash Flow Statement

Unaudited Unaudited Unaudited

Six months Six months Year ended

31 Aug 06 31 Aug 05 28 Feb 06

Notes #'000 #'000 #'000

Cash flows from operating activities

Cash generated from operations 6 (771) 5,732 13,769

Interest received 148 43 156

Interest paid (4) (16) (1)

Tax paid (1,670) (1,389) (3,210)

Net cash generated from operating activities (2,297) 4,370 10,714

Cash flows from investing activities

Dividends received from joint ventures 145 228 239

Acquisition of subsidiaries, net of cash

acquired (1,132) (274) (521)

Purchase of property, plant and equipment (246) (115) (387)

Proceeds from sale of property, plant and

equipment - - 29

Purchase of investments - (29) (36)

Other long term receivables (18) 24 37

Net cash used in investing activities (1,251) (166) (639)

Cash flows from financing activities

Proceeds from issue of ordinary shares 414 405 535

Dividends paid (2,255) (1,923) (3,194)

Purchase of own shares - - (360)

Payment of principal under finance leases (11) (11) (28)

Net cash used in financing activities (1,852) (1,529) (3,047)

Foreign exchange differences (33) 52 -

(Decrease)/increase in cash and cash

equivalents (5,433) 2,727 7,028

Cash and cash equivalents at beginning of the

period 13,567 6,539 6,539

Cash and cash equivalents at end of the

period 8,134 9,266 13,567

Consolidated Statement of changes in shareholders' equity

Unaudited 2006 2005

Share Share Other Retained Total Total equity

capital premium reserves earnings equity

#'000 #'000 #'000 #'000 #'000 #'000

At 28 February 1,988 8,046 21,384 1,439 32,857 29,062

Profit for the period - - - 2,357 2,357 3,528

Cash flow hedges - - 364 - 364 (740)

Exchange differences - - (17) - (17) 45

Dividends paid - - - (2,255) (2,255) (1,902)

Issue of shares 26 388 - - 414 405

Consideration to be paid - - (738) - (738) -

Credit in respect of

share option schemes - - 145 - 145 48

At 31 August 2,014 8,434 21,138 1,541 33,127 30,446

BRAEMAR SEASCOPE GROUP PLC

NOTES TO THE FINANCIAL INFORMATION

FOR THE SIX MONTHS ENDED 31 AUGUST 2006

1. Basis of preparation

This financial information comprises the consolidated interim balance sheets as

of 31 August 2006 and 31 August 2005 and related consolidated interim statements

of income and cash flows and statement of changes in equity for the six months

then ended of Braemar Seascope Group PLC (herein after referred to as "financial

information"). In preparing this financial information management has used the

principal accounting policies as set out in the Group's financial statements for

the year ended 28 February 2006 on pages 22 to 25.

The comparative figures for the financial year ended 28 February 2006 are not

the company's statutory accounts for that financial year, but have been

extracted from those accounts. Those accounts have been reported on by the

company's auditors and delivered to the registrar of companies. The report of

the auditors was (i) unqualified, (ii) did not include a reference to any

matters to which the auditors drew attention by way of emphasis without

qualifying their report, and (iii) did not contain a statement under Section 237

(2) or (3) of the Companies Act 1985.

2. Segmental information

Revenue Six months to Six months to Year ended

31 Aug 2006 31 Aug 2005 28 Feb 2006

#'000 #'000 #'000

Shipbroking 17,348 21,838 39,745

Ship agency, forwarding & logistics 10,904 6,433 15,851

Technical shipping support 3,191 2,321 5,202

Environmental services 1,121 - -

Bunker trading 17,948 - 7,699

50,512 30,592 68,497

Operating profit

Shipbroking 3,828 4,929 9,003

Goodwill impairment charge - shipbroking (950) - -

2,878 4,929 9,003

Ship agency, forwarding & logistics 588 180 568

Technical shipping support 245 102 289

Environmental services 68 - -

Bunker trading 8 - 30

3,787 5,211 9,890

Net Assets As at As at As at

31 Aug 2006 31 Aug 2005 28 Feb 2006

#'000 #'000 #'000

Shipbroking 26,261 23,885 19,355

Ship agency, forwarding & logistics (1,888) (1,363) (755)

Technical shipping support 1,377 1,185 1,599

Environmental services 622 - -

Bunker trading (495) - (667)

Operating group 25,877 23,707 19,532

Cash and cash equivalents 8,134 11,464 13,567

Short term borrowings - (2,198) -

Current and deferred taxation (2,035) (3,937) (1,853)

Share of joint ventures 698 627 828

Other investments 783 783 783

Group 33,457 30,446 32,857

3. Taxation

The taxation charge for the half-year is calculated using the estimated

effective tax rate for the full year applied to the pre-tax profits at the half

year.

4. Dividends

The following dividends were paid by the Group:

Six months to Six months to Year ended

31-Aug-06 31-Aug-05 28-Feb-06

#000 #000 #000

Interim dividend 6.5 pence per share - - 1,271

Final dividend 11.5 pence (2005: 10 pence) per share 2,255 1,902 1,902

2,255 1,902 3,173

The Directors have declared a dividend of 6.75 pence per ordinary share, payable

on 13 December 2006 to shareholders on the register on 17 November 2006.

5. Earnings per share

Six months to Six months to Year ended

31 Aug 2006 31 Aug 2005 28 Feb 2006

#'000 #'000 #'000

Earnings - continuing operations 2,357 3,528 7,178

Goodwill impairment charge 950 - -

Earnings before impairment charge 3,307 3,528 7,178

Pence Pence Pence

Earnings per share - pence 12.03 18.29 37.03

Goodwill impairment - pence 4.85 - -

Earnings before impairment charge - pence 16.88 18.29 37.03

Shares Shares Shares

Weighted average number of ordinary shares 19,586,694 19,293,750 19,385,615

Share options 326,503 536,150 452,339

Diluted weighted average number of ordinary shares 19,913,197 19,829,900 19,837,954

BRAEMAR SEASCOPE GROUP PLC

NOTES TO THE FINANCIAL INFORMATION

FOR THE SIX MONTHS ENDED 31 AUGUST 2006

6. Cash generated from operations

#'000 #'000 #'000

Profit for the period 2,416 3,528 7,178

Adjustments for:

-Tax 1,657 1,769 3,115

-Depreciation 232 143 339

-Amortisation 62 172 287

-Goodwill impairment charge 950 - -

-Derivative financial instruments - 201 -

-Profit on sale of property plant and - - (17)

equipment

-Interest income (148) (47) (162)

-Interest expense 4 15 2

-Share of post-tax profits of joint ventures (142) (54) (243)

-Stock option expense 145 48 244

Changes in working capital

-Trade and other receivables (625) (1,335) (129)

-Trade and other payables (5,336) 1,106 2,913

-Provisions 14 186 242

Cash generated from operations (771) 5,732 13,769

Independent review report to Braemar Seascope Group plc

Introduction

We have been instructed by the company to review the financial information for

the six months ended 31 August 2006 which comprises the consolidated interim

balance sheet as at 31 August 2006 and the related consolidated interim

statements of income, cash flows and changes in shareholders' equity and related

notes for the six months then ended. We have read the other information

contained in the interim report and considered whether it contains any apparent

misstatements or material inconsistencies with the financial information.

Directors' responsibilities

The interim report, including the financial information contained therein, is

the responsibility of, and has been approved by the directors. The Listing Rules

of the Financial Services Authority require that the accounting policies and

presentation applied to the interim figures should be consistent with those

applied in preparing the preceding annual accounts except where any changes, and

the reasons for them, are disclosed.

This interim report has been prepared in accordance with the basis set out in

Note 1.

Review work performed

We conducted our review in accordance with guidance contained in Bulletin 1999/4

issued by the Auditing Practices Board for use in the United Kingdom. A review

consists principally of making enquiries of group management and applying

analytical procedures to the financial information and underlying financial data

and, based thereon, assessing whether the disclosed accounting policies have

been applied. A review excludes audit procedures such as tests of controls and

verification of assets, liabilities and transactions. It is substantially less

in scope than an audit and therefore provides a lower level of assurance.

Accordingly we do not express an audit opinion on the financial information.

This report, including the conclusion, has been prepared for and only for the

company for the purpose of the Listing Rules of the Financial Services Authority

and for no other purpose. We do not, in producing this report, accept or assume

responsibility for any other purpose or to any other person to whom this report

is shown or into whose hands it may come save where expressly agreed by our

prior consent in writing.

Review conclusion

On the basis of our review we are not aware of any material modifications that

should be made to the financial information as presented for the six months

ended 31 August 2006.

PricewaterhouseCoopers LLP

Chartered Accountants

West London

25 October 2006

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UVUKRNSRRUAA

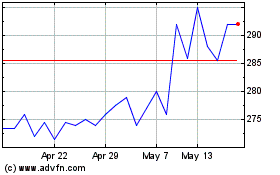

Braemar (LSE:BMS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Braemar (LSE:BMS)

Historical Stock Chart

From Jul 2023 to Jul 2024