RNS Number:3493M

Braemar Seascope Group PLC

17 May 2005

For immediate release 17 May 2005

Results - Year ended 28 February 2005

Braemar Seascope Group plc (the "Group"), a leading provider of shipping

services, today announced full year results for the year ended 28 February 2005.

HIGHLIGHTS

* Turnover including joint ventures up to #46.3m (2004: #30.8m)

* Pre-tax profit before goodwill and exceptionals up 73% to #9.0m (2004:

#5.2m)

* Pre-tax profit up 73% to #7.1m (2004: #4.1m)

* Adjusted EPS before goodwill and exceptionals up 60% to 32.31p (2004:

20.16p)

* Basic EPS up 70% to 23.67p (2004: 13.96p)

* Operating cash flow up 88% to #11.0m (2004: #5.9m)

* Final dividend 10.0p per share, full year 16.0p (2004: 13.00p) up 23%

* Seawise Australia acquired and performing well

Commenting on the results and outlook, Sir Graham Hearne, Chairman, said:

"I am delighted to report a year of record profits for the group. The shipping

market was exceptionally strong for much of 2004 and our shipbroking business

has prospered. Activity levels, ship values and freight rates have all been

boosted by the worldwide increase in seaborne trade."

"The shipping market has continued strongly during our first fiscal quarter. It

is undoubtedly the case that the benefit to shipping over the last year or more

has been driven by industrial growth in Asia supported by a healthy trade with

many countries. The outlook for shipbroking remains positive while these

favourable market conditions persist."

For further information, contact:

Braemar Seascope Group plc

Alan Marsh Tel 020 7535 2650

James Kidwell Tel 020 7535 2881

Aquila Financial

Patrick d'Ancona Tel 020 7849 3326

Peter Reilly Tel 020 7849 3319

Charles Stanley & Company Limited

Philip Davies Tel 020 7953 2000

Notes to editors:

Through its subsidiaries Braemar Seascope Group plc's services provided

comprise:

Braemar Seascope Specialised shipbroking and consultancy services to

Limited international ship owners and charterers in the sale &

purchase, tanker, offshore, container and dry bulk markets.

www.braemarseascope.com

Seawise Australia Specialised shipbroking and consultancy services for owners

Pty Limited and charterers particularly in dry bulk markets in

Australia.

www.seawise.com.au

Cory Brothers Liner and port ship agency services within the UK.

Shipping Agency www.cory.co.uk

Limited

Wavespec Marine engineering and naval architecture consultants to the

Limited shipping and offshore markets.

www.wavespec.com

PRELIMINARY ANNOUNCEMENT - YEAR ENDED 28 FEBRUARY 2005

CHAIRMAN'S STATEMENT

I am delighted to report a year of record profits for the group. The shipping

market was exceptionally strong for much of 2004 and our shipbroking business

has prospered. Activity levels, ship values and freight rates have all been

boosted by the worldwide increase in seaborne trade. Continuing demand for the

long-range transportation of raw materials, oil and consumer products has

sustained the major shipping markets (dry bulk, tanker and container) at

historically high levels. Interest in the sector has risen, attracting new

investors and stimulating activity across all types and sizes of ship.

Through the acquisition of Seawise Australia Pty Limited ("Seawise") on 21

February 2005, the group has extended both its presence in the Pacific Basin and

its dry cargo broking business. The Australian economy is enjoying the growth in

Asian industrial production and Seawise is well-placed to benefit from these

circumstances. In the three months since Seawise was acquired we have been

developing our enlarged dry cargo operation, and trading to date has been

pleasing. The acquisition was financed by a mixture of cash and the issue of new

shares to the vendor broking team; we view this as a sensible way to build the

group business where opportunities in shipping services arise.

Since the mergers of Seascope with Braemar Shipbrokers and with Braemar Tankers

in 2001 we have set up wholly or part owned offices in Shanghai, Beijing, Delhi,

Bombay and Singapore and significantly expanded our container, dry cargo and

research teams. We have also acquired Seawise and entered the ship agency market

through the purchase of Cory. Over the last three years the size and scope of

operations have increased, and this is reflected in the results on which we are

now reporting.

Revenue for the year was #46.3m (2004: #30.8m) and profit before tax (before

goodwill amortisation and exceptional items) was #9.0m compared with #5.2m in

the prior year. Profit before tax was #7.1m (2004: #4.1m). Adjusted earnings per

share (before exceptionals and goodwill) were 32.31 pence (2004: 20.16 pence)

and basic earnings per share were 23.67 pence (13.96 pence). Net cash inflow

from operations before financing increased to #11.0m (2004: #5.9m) contributing

to the improvement in net funds which ended the year at #6.5m (2004: #2.0m).

The Board is recommending a final dividend of 10.0 pence per ordinary share,

which together with the 6 pence interim dividend takes the total dividend for

the year to 16.0 pence (2004: 13.0 pence), a rise of 23%.

These results would not have been possible without the hard work, dedication and

skill shown by the staff within the group and on behalf of the Board I would

like to express my thanks for their performance during the year. The performance

was also recognised in March 2005 when the company was given the award

"Shipbroker of the Year" as chosen by a Lloyd's List panel.

Outlook

The shipping market has continued strongly during our first fiscal quarter. It

is undoubtedly the case that the benefit to shipping over the last year or more

has been driven by industrial growth in Asia supported by a healthy trade with

many countries. The outlook for shipbroking remains positive while these

favourable market conditions persist, though the weak US dollar will offset some

of the overall benefit. Income in the first half of 2005/6 will include a

significant level of business concluded in the final quarter of 2004/5 for

delivery in the current year - particularly in sale and purchase.

CHIEF EXECUTIVE'S OPERATIONAL AND FINANCIAL REVIEW

The results for both Chartering and Sale and Purchase showed a significant

increase over last year reflecting a rise in average commissions and also the

numbers of transactions in which the company has been involved. The wider

geographic spread of our operations has increased the breadth of our client

service, and it is pleasing that all our overseas operations are making a

positive contribution to the results so soon after being established. We have

also added significantly to our forward order book during the year, particularly

in newbuilding, and won major new supervisory business at Wavespec. During the

year we established a new LNG project team combining our skills in shipbroking,

research and technical support to develop newbuilding and consulting business

much of which will benefit future years.

Shipbroking - Chartering

During the second half of the year, tanker freight rates reached record high

levels, which resulted in earnings for VLCCs ("Very Large Crude Carriers") over

the year as a whole averaging around 75 per cent higher than the previous year.

This improvement in revenue was broadly reflected across the ship size

categories. In spite of high oil prices, consumer demand was undiminished, and

the tanker tonnage supply and demand balance tipped in owners' favour. A greater

diversity of trading routes enabled ship owners to improve the laden/ballast

ratio, which added significantly to net earnings. There have inevitably been

some fluctuations in freight levels, but even the low points have been

comfortably above break even. During this past year, VLCCs have earned on

average around $105,000 per day, compared with close to $60,000 per day the

previous year.

Oil prices look set to remain high for the foreseeable future, and OPEC has

indicated a willingness to supply more oil as the year progresses, implying

continued strong demand for tanker transportation. The phase-out of single hull

tankers is now under way and, with shipyard capacity full for several years to

come, the supply of new tonnage can spring no surprises. We expect firm trading

conditions to persist for the current financial year.

Our Small products, Chemicals and Gas departments have seen an upturn in their

markets over the last year. Most of their business is conducted under long term

contracts on agreed pricing structures, giving them more security of business

and less exposure to the volatility of the market. Their major contracts have

been renewed during the course of the year. Subsequent to the year-end the Group

and its US partner, Quincannon, have increased their respective stakes in SBQ

Pte Ltd from 40 per cent to 50 per cent. SBQ is a Singapore-based gas and

chemicals shipbroker and has now been renamed Braemar Quincannon Pte Ltd.

The dry cargo market surged ahead in the second half of 2004, peaking in the

beginning of December when the BDI ("Baltic Dry Index"), the dry cargo

chartering yardstick, stood at 8,911 with average time-charter rates for modern

Capesize vessels in excess of $100,000 per day (2003/4 average $51,200 per day).

Since that time the market has cooled considerably and by the end of February

2005 the BDI had fallen to 4,726. The department's performance has increased

significantly over the prior year due to a combination of the improvement in the

market, the addition of new team members and increased market share. The global

demand for raw materials remains strong and dry bulk shipping would normally

follow this demand.

Seawise, purchased in February this year, has offices located in Melbourne,

Perth and Sydney with a total of 38 staff concentrating on the dry cargo market

especially for local mining companies and shipowners. We are actively working on

developing the synergies with these offices.

Shipbroking - Sale and Purchase

The sale and purchase department had another extremely successful year

benefiting from increases in both ship values and transaction volumes. Activity

covered all types and sizes of ship - tankers, bulkers, container and LNG

vessels - reflecting the unrivalled breadth and depth of skills in the

department and the ability to develop business by harnessing the knowledge and

skills in other areas of the group. In particular, both Wavespec and Cory have

contributed to sale and purchase business that has been concluded.

The strength of the shipping market and the investment opportunities it offers

has attracted new types of investor helping to maintain values and deal flow.

The new financial year has begun with a substantial number of ship sales already

contracted at favourable prices.

Newbuilding income, which is recognised in line with the contractual phasing of

payments by the ship owner to the shipyard, and therefore mainly reflects the

activity of previous years, increased substantially over the previous year. The

rise in newbuilding prices has reflected the increased demand for most vessels,

the limitations on yard capacity and the rise in the price of steel. Our forward

order book of contracted income grew strongly in the year with the benefit to

earnings coming mainly over the next four years as the ships are constructed and

delivered. Worldwide shipyard capacity is now almost fully contracted for the

next four years offering opportunities for resale business but could limit

newbuilding business. Recently the major yards have preferred to take orders to

build higher value LNG and container carriers, which has meant that capacity

made available for tankers and dry bulkers has diminished. This trend supports a

view that wet and dry freight rates could remain at higher than average levels

for some time.

Demolition income remained broadly level, with an increase in the price of steel

offsetting fewer ships being scrapped.

Shipbroking - Containers (50 per cent owned)

Over the 2004 calendar year the increase in container charter rates continued

with the market rising by almost 70 per cent. These rates enabled charterers to

commit ships into their liner services at unprecedented levels and for

ever-longer periods, giving owners across the whole spectrum of containership

sizes some extremely healthy returns. A surge in both newbuilding orders and

second-hand prices has mirrored activity in the charter market, and confidence

in the future remains positive. Despite the large order book for new ships

stretching well into 2008, the appetites of many investors remain undiminished.

Lack of development of port infrastructure in Europe and the US threatens to

hamper growth, but throughput at Far Eastern (and particularly Chinese)

terminals is still increasing.

Shipbroking - Offshore

During the early part of the year the Offshore market was weak, but in the final

fiscal quarter term rates in the North Sea improved strongly as exploration

activity increased. Rates continue to be firm and are expected to remain so for

the foreseeable future. The department has already concluded some significant

project business in the first quarter of the current year.

Ship agency - Cory

Cory's results were affected by lower volumes in their ship agency business and

set up costs to support new income streams in forwarding and logistics, a

business which has been developed since Cory was acquired, now trading as Cory

Logistics. Market conditions in UK ship agency remain tough. Whilst Cory is very

well-positioned to take advantage of either a recovery or further consolidation

in the agency sector there are no immediate prospects of a significant

turnaround in this part of the business and therefore a provision has been made

for the impairment of purchased goodwill. However, Cory Logistics has continued

to build its customer base, in particular through the securing of major

telecommunications forwarding contracts. This new business will add

substantially to the level of activity and should result in a significant

improvement in Cory's earnings for the coming year. With their enthusiastic

support of the Group, Cory has also been able to introduce new business leads

for both our chartering and sale and purchase teams.

Technical shipping support - Wavespec

Wavespec's profits were lower than expected due to delays in two major projects

both of which commenced later in the financial year. However it was successful

in winning new business as charterer's representative on the QatarGas II project

for all LNG Carriers to be built for Qatari trade and also as charterer's

representative for the Sakhalin Energy Investment Company for Ice Class LNG

carriers. These projects have established Wavespec as the leading technical

expert on LNG vessel design and will underpin its income stream for at least the

next three years.

Financial

We consider the most appropriate comparison of the Group's profit performance is

made by adjusting pre-tax profits to exclude goodwill charges and exceptional

items. Adjusted pre-tax profits have increased by 73% to #9.0m and reported

pre-tax profit rose by 73% to #7.1m. Set out in the table below is a

reconciliation of adjusted pre-tax profit to reported pre-tax profit:

#'000 Year to Year to

28 Feb 2005 28 Feb 2004

Adjusted pre-tax profit 8,978 5,187

Less: Goodwill amortisation (1,094) (1,065)

Less: Exceptional goodwill impairment charge (887) -

Add: Exceptional profit on sale of investments 123 -

--------- ----------

Reported pre-tax profit 7,120 4,122

--------- ----------

Operating profits before exceptional items and goodwill rose from #5.5m in 2004

to #8.5m, with an operating margin of 19.5% in 2005 compared with 18.0% in 2004,

reflecting the growth in shipbroking turnover and margins offset by the new, but

less volatile, ship agency business. The majority of the Company's broking and

technical services income is US dollar denominated and the average rate of

exchange for conversion of US dollar income in the year was $1.82/# (2004: $1.64

/#) and at the year ended 28 February 2005 the rate was $1.93/#. The exposure to

the US dollar has been mitigated by the use of forward foreign exchange

contracts partially reducing the effect of the weaker US currency. The

year-on-year impact of the weaker US dollar relative to # sterling is

responsible for a turnover reduction of approximately #3m on a comparable basis.

Cory's income is predominantly in # sterling and therefore serves to reduce the

impact of foreign exchange movements. Seawise has a predominantly US$ income and

Aus$ cost base.

Exceptional items relate to a provision for the impairment of Cory's goodwill

(which is tax deductible) and a profit on disposal of the 16.7% investment in

Lone Star, the US-based tanker chartering broker (which is non-taxable).

The tax rate on profits before exceptional items and goodwill amortisation (most

of which is non-deductible) was 33.7% (2004: 33.2%). The tax rate is higher than

the standard UK tax rate of 30% because of the effect of non-deductible trading

expenses. After exceptional items and goodwill the tax rate was 39% (2004: 42%).

As at 28 February 2005 net cash had improved by #4.5m to #6.5m (2004: #2.0m).

This excludes #4.4m of restricted cash, which the group was holding as escrow

agent for certain clients pending completion of transactions in which the group

acted as broker. Operating cash flow was #11.0m (2004: #5.9m), calculated before

tax and dividend payments.

On 21 February 2005 the group acquired Seawise Australia Pty Limited for a total

consideration of #4.7m, comprising the issue of 833,898 new shares to the

vendors totalling #3.1m and cash of #1.6m including costs. Net assets acquired

were #0.5m with goodwill arising of #4.2m. The impact of Seawise's trading was

not significant during the group's week of ownership in the financial year ended

28 February 2005.

The proposed final dividend of 10.0 pence per ordinary share, at a cost of

#1.9m, will be paid on 28 July 2005 to shareholders on the register at the close

of business on 1 July 2005 (the ex-dividend date will be 29 June 2005). Together

with the 6p interim dividend the Company's dividend for the year is 16.0 pence

(2004: 13.0 pence) at a cost of #3.1m. The dividend is covered 2.0 times by

earnings per share before goodwill and exceptional items.

The Group is adopting International Financial Reporting Standards ("IFRS") with

effect from the 1 March 2005. The 2005/6 interim and annual reports will be

prepared under IFRS and will include restated comparative figures and

reconciliations of changes made. The principal accounting changes following IFRS

adoption relate to accounting for share options, goodwill amortisation,

derivative currency contracts and the proposed final dividend.

BRAEMAR SEASCOPE GROUP plc

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 28 FEBRUARY 2005

Year ended Year ended

28-02-2005 28-02-2004

#000 #000

Turnover including share of joint ventures 46,263 30,794

Less: share of joint ventures (1,206) (452)

----------- -----------

Group turnover (note 2) 45,057 30,342

Administrative expenses before exceptional

items and goodwill amortisation (36,526) (24,812)

Goodwill amortisation (1,078) (1,065)

Exceptional goodwill impairment (note 3) (887) -

Total administrative expenses (38,491) (25,877)

----------- -----------

Group operating profit 6,566 4,465

Share of joint ventures' and associated

undertaking's operating profit 456 13

----------- -----------

Operating profit including joint ventures

and associated undertakings (note 2) 7,022 4,478

Exceptional profit on sale of investment (note 3) 123 -

Net interest payable and similar charges (25) (356)

----------- -----------

Profit on ordinary activities before taxation 7,120 4,122

Taxation on profit on ordinary activities (note 4) (2,762) (1,723)

----------- -----------

Profit on ordinary activities after taxation 4,358 2,399

Dividends (note 5) (3,057) (2,347)

----------- -----------

Retained profit for the period 1,301 52

=========== ===========

Earnings per ordinary share - pence (note 6)

-Basic 23.67p 13.96p

-Adjusted EPS excl. amortisation and exceptionals 32.31p 20.16p

-Diluted 22.94p 13.63p

BRAEMAR SEASCOPE GROUP plc

CONSOLIDATED BALANCE SHEET AS AT 28 FEBRUARY 2005

28 Feb 28 Feb

2005 2004

#000 #000

Restated

Fixed assets

Intangible fixed assets: goodwill 20,768 18,534

Tangible assets 4,960 4,963

Investments:

Investment in joint ventures:

Share of gross assets 868 209

Share of gross liabilities (485) (180)

----------- -----------

383 29

Investment in associated undertaking 373 373

Other investments 783 1,028

----------- -----------

Investments 1,539 1,430

----------- -----------

27,267 24,927

----------- -----------

Current assets

Debtors 12,045 9,775

Restricted cash 4,434 -

Cash at bank and in hand 9,606 4,071

----------- -----------

26,085 13,846

Creditors: amounts falling due within one year (note 7) (28,181) (17,279)

----------- -----------

Net current liabilities (2,096) (3,433)

----------- -----------

Total assets less current liabilities 25,171 21,494

Creditors: amounts falling due after

more than one year (8) -

Provisions for liabilities and charges (151) (330)

----------- -----------

Net assets 25,012 21,164

=========== ===========

Capital and reserves

Called up share capital 1,945 1,862

Capital redemption reserve 396 396

Share premium 7,505 7,505

Shares to be issued (637) (65)

Merger reserve 21,346 18,302

Profit and loss account (note 13) (5,543) (6,836)

----------- -----------

Total equity shareholders' funds (note 8) 25,012 21,164

=========== ===========

BRAEMAR SEASCOPE GROUP plc

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEAR ENDED 28 FEBRUARY 2005

Year ended Year ended

28 Feb 2005 to 28 Feb 2004

#000 #000

Net cash inflow from operating activities (note 10) 11,052 5,872

Returns on investments and servicing of finance

Interest received 26 21

Interest paid (52) (464)

Interest element of finance lease rental payments - (3)

----------- -----------

Net cash outflow from returns on

investments and servicing of finance (26) (446)

Taxation

UK Corporation tax paid (2,448) (1,511)

Capital expenditure and financial investment

Payments to acquire tangible fixed assets (175) (230)

Disposal of tangible fixed assets 11 -

Purchase of investments (21) (110)

Sale of investments 386 -

----------- -----------

Net cash outflow from investing activities 201 (340)

Acquisitions and disposals

Purchase of subsidiaries including expenses (1,613) (1,658)

Cash acquired with subsidiaries 587 1,597

Deferred consideration paid - (225)

----------- -----------

Net cash outflow for acquisitions (1,026) (286)

Equity dividends paid (2,597) (2,062)

----------- -----------

Net cash inflow before financing 5,156 1,227

Financing

Restricted cash received as escrow agent 4,434 -

Increase in escrow client monies (4,434) -

Share issues 1 -

Purchase of own shares (572) -

Loan repayment - (2,500)

Payment of principal under finance leases (2) (24)

----------- -----------

Net cash outflow from financing (573) (2,524)

Increase/(decrease) in cash (note 11) 4,583 (1,297)

=========== ===========

Note 1 - Accounting policies

The accounting policies applied in the preparation of these financial statements

are consistent with those used and set out in the 2004 Annual Report and

Accounts, with the exception of the adoption of UITF Abstract 38 "Accounting for

ESOP Trusts" and FRS 20 "Share Based Payments". The Abstract is effective for

accounting periods ending on or after 22 June 2004 and it has therefore been

applied in the accounts for the year ended 28 February 2005. The Abstract

requires own shares held through an ESOP trust to be deducted in arriving at

shareholders' funds and recommends the creation of a separate negative reserve.

The Abstract requires this change to be retrospective and therefore comparatives

have been restated. The effect has been to reduce net assets as at 28 February

2004 by #65,000. FRS 20 is applicable for accounting periods beginning on or

after 1 January 2005 and the Group has adopted the standard early. The effect of

adopting FRS 20 is to increase profits and net assets by #171,000 in the year to

28 February 2005 (28 February 2004 - Nil).

Note 2 - Segmental results

Year to Year to

28 Feb 2005 28 Feb 2004

Turnover #'000 #'000

Shipbroking 32,274 22,523

Technical shipping support 4,322 5,127

Ship agency, forwarding and logistics 8,461 2,692

----------- -----------

45,057 30,342

Share of joint ventures - Shipbroking 1,206 452

----------- -----------

46,263 30,794

=========== ===========

Operating profit #'000 #'000

Shipbroking 8,673 5,210

Technical shipping support 140 294

Ship agency, forwarding and logistics (282) 26

----------- -----------

8,531 5,530

Share of joint ventures & associates -

shipbroking 456 13

----------- -----------

8,987 5,543

Goodwill amortisation (1,078) (1,065)

Exceptional goodwill impairment charge

- Ship agency, forwarding and logistics (887) -

----------- -----------

7,022 4,478

=========== ===========

Note 3 - Exceptional items

Year to Year to

28 Feb 2005 28 Feb 2004

#'000 #'000

Impairment of Cory goodwill (887) -

Profit on disposal of Lone Star 123 -

----------- -----------

Net loss before tax (764) -

=========== ===========

Tax relief at 30% is applicable to the goodwill impairment charge. There is no

tax due on the sale of the 18% trade investment in Lone Star.

Note 4 - Taxation

The rate of taxation applicable to the company's profits before goodwill

amortisation and exceptional items is 33.7% (2004: 33.2%).

Note 5 - Dividend

The proposed final dividend of the year is 10.0 pence per share (2004: final 8.0

pence) taking the total dividend charged for the year to 16.0 pence (2004: 13.0

pence). The cost is based on 19,230,816 shares being the total in issue less

222,500 shares held in the ESOP for which the dividend has been waived.

Note 6 - Earnings per share

Reconciliation of basic earnings per share to adjusted earnings per share:

2005 2004

Earnings Year to Year to

28 Feb 28 Feb

#'000 #'000

Profit after taxation 4,358 2,399

Goodwill amortisation (incl. associated company

-#16,000) 1,094 1,065

Exceptional items before tax (note 2) 764 -

Related tax credit (266) -

----------- -----------

Adjusted profit after tax 5,950 3,464

----------- -----------

Weighted average number of shares 18,412,881 17,181,600

Basic EPS (pence) 23.67 13.96

Adjusted EPS (pence) 32.31 20.16

Note 6 - Earnings per share (continued)

Diluted EPS 2005 2004

#'000 #'000

Profit after taxation 4,358 2,399

Interest on convertible #3m loan notes - 124

----------- -----------

Diluted earnings 4,358 2,523

----------- -----------

Weighted average number of shares 18,412,881 17,181,600

Conversion of #3m loan notes - 1,236,301

Share options 585,077 97,653

----------- -----------

Diluted average number of shares 18,997,958 18,515,554

----------- -----------

Diluted EPS (pence) 22.94 13.63

Note 7 - Creditors falling due within one year

2005 2004

#'000 #'000

Bank overdrafts 3,067 2,113

Trade creditors 7,673 8,530

Corporation tax 1,556 954

Dividends payable 1,944 1,484

Accruals and deferred income 7,767 3,277

Obligations under finance lease 31 -

Other taxation and social security 1,611 721

Other creditors 98 200

Client monies held as escrow agent 4,434 -

----------- -----------

28,181 17,279

----------- -----------

At 28 February 2005 the Group was holding cash balances totaling #4.4 million as

escrow agent for certain clients, pending completion of transactions in which

the Group acted as the broker. The amounts are held in designated accounts and

any interest earned is due to the clients.

Note 8 - Reconciliation of movement in shareholders' funds

2005 2004

#'000 #'000

Opening shareholders' funds as previously reported 21,164 17,800

Prior year adjustment - shares to be issued - 65

----------- -----------

Opening shareholders' funds as restated 21,164 17,735

Profit on ordinary activities after tax 4,358 2,399

Dividends (3,057) (2,347)

Issue of shares 3,127 3,377

Purchase of shares to be issued (572) -

Exchange differences (8) -

----------- -----------

Net increase in shareholders' funds 3,848 3,429

----------- -----------

Closing shareholders' funds 25,012 21,164

=========== ===========

Note 9 - Consolidated statement of total recognised gains and losses

2005 2004

#000 #000

Profit on ordinary activities after taxation 4,358 2,399

Foreign exchange differences (8) -

----------- -----------

Total recognised gains relating to the year 4,350 2,399

=========== ===========

Note 10 - Reconciliation of operating profit to net cash flow from operating

activities

2005 2004

#000 #000

Operating profit 6,566 4,465

Depreciation charge 297 282

Goodwill amortisation 1,078 1,065

Impairment of goodwill 887 -

Loss on disposal of fixed assets - 28

Write down on investments - 77

(Increase) in debtors (1,262) (3,836)

Increase in creditors 3,715 4,287

Decrease in provisions (229) (496)

----------- -----------

Net cash flow from operating activities 11,052 5,872

=========== ===========

Note 11 - Reconciliation of net cash flow to movement in net funds

2005 2004

#000 #000

Increase/(decrease) in cash 4,583 (1,297)

Finance leases acquired (41) -

Decrease in finance leases - 24

Decrease in bank loan - 2,500

----------- -----------

Movement in net funds 4,542 1,227

Net debt at beginning of period 1,958 (2,456)

Repayment of loan notes - 187

Conversion of loan stock to ordinary shares - 3,000

----------- -----------

Net funds at end of period 6,500 1,958

=========== ===========

Note 12 - Acquisition of Seawise Australia Pty Ltd.

On 21 February 2005 the Group acquired Seawise Australia Pty Ltd for a

consideration totalling #4.7m. The provisional fair value of the net assets

acquired and goodwill arising on the transaction are set out below:

#'000 #'000

Cash consideration 1,448

Transaction costs 165

-----------

1,613

New share capital issued to vendors 3,127

-----------

Total consideration 4,740

Fixed assets acquired 129

Debtors 797

Creditors (972)

Cash 587

-----------

Net tangible assets acquired 541

-----------

Goodwill 4,199

===========

Fair value adjustments totaling #43k in respect of employee entitlements have

been made within the book values above.

Note 13 - Profit and loss account

The negative cumulative profit and loss account balance is the result of a

goodwill write-off, in the amount of #5,599,794, which took place in the

financial year to 31 December 1998 upon the Company's adoption of FRS10.

The financial information set out above does not constitute the Company's

statutory accounts for the year ended 28 February 2005 and the year ended

February 2004. The financial information in respect of the year ended 28

February 2005 has been extracted from the audited accounts. The audited accounts

will be posted to shareholders shortly. Statutory accounts for the year ended 28

February 2004 on which the auditors have given an unqualified report pursuant to

section 235 of the Companies Act 1985, have been filed with the Registrar of

Companies.

--------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EADSKFSLSEFE

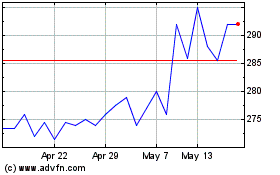

Braemar (LSE:BMS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Braemar (LSE:BMS)

Historical Stock Chart

From Jul 2023 to Jul 2024