Fourth Quarter 2011 Highlights and 2012

Guidance:

- Net earnings of $78.3 million and net earnings per

diluted share of $0.74

- GAAP combined ratio of 86.8%, including 1.9 percentage

points for catastrophes

- Book value per share increased 3.1% to

$31.62

- Annualized return on equity of 9.6% and annualized

operating return on equity(a) of 10.4%

- 2.5 million shares of common stock repurchased for

$65.8 million at an average cost of $26.63 per share

- Net earned premium increased 8% to $550.2

million

- Net earnings guidance of $2.80 to $3.10 per diluted

share for 2012

HCC Insurance Holdings, Inc. (NYSE:HCC) today

released earnings for the fourth quarter and full year of 2011.

Net earnings were $78.3 million for the fourth quarter of 2011,

compared to $97.3 million for the fourth quarter of 2010. Net

earnings per diluted share were $0.74 for the fourth quarter of

2011, versus $0.84 for the same quarter of 2010. Net earnings were

$255.2 million for 2011, or $2.30 per diluted share, compared to

$345.1 million, or $2.99 per diluted share, for 2010.

The 2011 results include previously announced pretax net

catastrophe losses of $10.0 million and $117.9 million for the

fourth quarter and full year of 2011, respectively, which reduced

net earnings by $0.06 and $0.70 per share in the respective

periods. These catastrophe losses added 1.9 and 5.3 percentage

points to the Company's GAAP net loss ratio for the fourth quarter

and full year of 2011, respectively.

The Company's GAAP combined ratio was 86.8% for the fourth

quarter of 2011, compared to 82.3% for the fourth quarter of

2010. The GAAP combined ratio was 90.8% for the full year of

2011, versus 84.6% for 2010. HCC's paid loss ratio for 2011

was 58.9%, compared to 59.7% for 2010.

Book value per share increased 3.1% and 10.3% for the fourth

quarter and full year of 2011, respectively, to $31.62 at December

31, 2011. Book value per share grew at a compounded rate of

11.5% over the last five years. Dividends of $0.60 per share

were declared in 2011. This was the 15th consecutive year in

which HCC raised its dividend.

HCC's annualized return on equity was 9.6% for the fourth

quarter of 2011 and 7.7% for the full year of 2011. The

Company's annualized operating return on equity(a) was 10.4% for

the fourth quarter of 2011 and 8.1% for the full year of 2011.

"HCC had a strong quarter and a solid year despite unprecedented

catastrophe losses. We look forward to 2012 and an improving

pricing environment," HCC Chief Executive Officer John N. Molbeck,

Jr. said.

The Company repurchased 2.5 million shares of its common stock

during the fourth quarter of 2011 for $65.8 million at an average

cost of $26.63 per share. As of February 21, 2012, the Company has

repurchased 14.1 million shares for $412.5 million at an average

cost of $29.30 per share since June 2010.

HCC had net favorable loss development of $11.5 million in the

fourth quarter of 2011, compared to $23.9 million for the same

period of 2010, and net adverse development of $10.1 million for

the full year of 2011, versus $22.7 million of net favorable

development for the full year of 2010. The Company's 2011

accident year net loss ratio was 65.3% and its accident year

combined ratio was 91.0% for the full year of 2011.

Gross written premium increased 1% to $629.0 million for the

fourth quarter of 2011, compared to $624.2 million for the same

quarter of 2010. Net written premium increased 7% to $521.1

million for the fourth quarter of 2011, versus $486.7 million for

the same quarter of 2010. Net earned premium increased 8% to

$550.2 million for the fourth quarter of 2011, compared to $509.8

million for the same quarter of 2010.

Gross written premium increased 3% to $2.6 billion for the full

year of 2011. Net written premium increased 8% to $2.2 billion

for the full year of 2011, compared to $2.0 billion for the same

period of 2010. Net earned premium increased 4% to $2.1

billion for the full year of 2011, versus $2.0 billion for

2010.

Investment income increased to $53.5 million in the fourth

quarter of 2011, compared to $53.2 million in the same quarter of

2010. Investment income increased to $212.3 million in the

full year of 2011, versus $203.8 million in 2010. The

Company's fixed income securities portfolio increased 13% to $5.9

billion at December 31, 2011, from $5.2 billion at December 31,

2010. The Company's total investments increased 6% to $6.0

billion at December 31, 2011, from $5.7 billion at December 31,

2010.

As of December 31, 2011, HCC's fixed income securities portfolio

had an average rating of AA, with a duration of 5.0 years and an

average long-term tax equivalent yield of 4.8%. In addition,

HCC's total investments had an average combined duration of 4.9

years.

The Company's liquidity position remains strong with $238.5

million of cash and short-term investments and $407.4 million of

available capacity under its $600.0 million revolving loan facility

at December 31, 2011. In the full year of 2011, the Company

generated $465.0 million of operating cash flow compared to $431.0

million in 2010, before consideration of $43.7 million and $15.8

million in commutations, respectively.

As of December 31, 2011, total assets were $9.6 billion,

shareholders' equity was $3.3 billion and the Company's debt to

total capital ratio was 12.7%.

EARNINGS GUIDANCE: HCC's management estimates the Company will

achieve net earnings of $2.80 to $3.10 per diluted share for

2012. These estimated results assume the following: gross

written premium of $2.7 billion; net written premium of $2.2

billion; a combined ratio of 86%-89%; and average fully diluted

shares outstanding of 100 million shares. These assumptions

include 2.6 loss ratio points for catastrophe losses in the

Company's property treaty and property direct and facultative

businesses. These assumptions do not include any provision for

loss development, foreign currency fluctuation, net realized

investment gains (losses) or other-than-temporary impairment credit

losses.

For further information about HCC's 2011 fourth quarter and

full-year earnings results, see the supplemental financial

schedules that are accessible on HCC's website at

http://www.hcc.com, as well as directly in the Investor Relations

section of HCC's website at http://ir.hcc.com.

(Note: If clicking on the above links does not open in a new web

page, please cut and paste the above URLs into your browser's

address bar.)

HCC will hold an open conference call beginning at 8:00 a.m.

Central Standard Time on Wednesday, February 22. To

participate, the number for domestic calls is (800) 374-0290 and

the number for international calls is (706) 634-0161. There

will also be a live webcast available on a listen-only basis that

can be accessed through the HCC website at http://www.hcc.com. The

webcast replay will be archived in the Investor Relations section

of the HCC website through Friday, May 25, 2012.

Headquartered in Houston, Texas, HCC Insurance Holdings, Inc. is

a leading international specialty insurance group with offices in

the United States, the United Kingdom, Spain and

Ireland. HCC's major domestic and international insurance

companies have financial strength ratings of "AA (Very Strong)"

from Standard & Poor's Corporation, "A+ (Superior)" from A.M.

Best Company, "AA (Very Strong)" from Fitch Ratings, and "A1 (Good

Security)" from Moody's Investors Service, Inc.

For more information about HCC, please visit

http://www.hcc.com.

a) Non-GAAP Financial Measure

Annualized operating return on equity is a non-GAAP financial

measure as defined by Regulation G and is calculated as operating

earnings (or net earnings excluding after-tax net realized

investment gain (loss), other-than-temporary impairment credit

losses and foreign currency benefit (expense)) divided by average

shareholders' equity excluding accumulated other comprehensive

income. To annualize a quarterly rate, we multiply the result

by four. See the supplemental financial schedules for a

reconciliation of this non-GAAP financial measure to corresponding

GAAP amounts. Management believes annualized operating return on

equity is a useful measure for understanding the Company's

profitability relative to shareholders' equity before consideration

of investment-related gains (losses) and foreign currency benefit

(expense) that the Company does not actively manage or consider in

evaluating its operating results internally.

Forward-looking statements contained in this press release are

made under "safe harbor" provisions of the Private Securities

Litigation Reform Act of 1995 and involve a number of risks and

uncertainties. The types of risks and uncertainties which may

affect the Company are set forth in its periodic reports filed with

the Securities and Exchange Commission.

CONTACT: Doug Busker, Director of Investor Relations

HCC Insurance Holdings, Inc.

(713) 996-1192

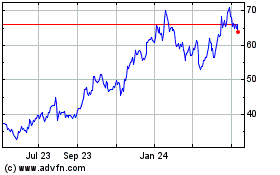

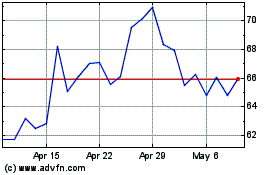

Warrior Met Coal (NYSE:HCC)

Historical Stock Chart

From May 2024 to Jun 2024

Warrior Met Coal (NYSE:HCC)

Historical Stock Chart

From Jun 2023 to Jun 2024