- Report of Foreign Issuer (6-K)

September 28 2010 - 1:54PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities

Exchange Act of 1934

For the month

of September, 2010

Commission File Number

1-14493

VIVO PARTICIPAÇÕES S.A.

(Exact

name of registrant as specified in its charter)

VIVO Holding Company

(Translation

of Registrant's name into English)

Av. Roque Petroni Jr., no.1464, 6

th

floor – part, "B"building

04707-000 - São Paulo, SP

Federative Republic of Brazil

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under

cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check

mark whether the registrant by furnishing the information contained in this

Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

|

VIVO PARTICIPAÇÕES S.A.

Publicly-held Company

CNPJ 02.558.074/0001-73 NIRE 35.3.001.587.9-2

|

RELEVANT FACT

VIVO PARTICIPAÇÕES S.A. (“VIVO PART.”) hereby communicates to the market that TELEFÓNICA S.A. (Telefónica) disclosed the following Relevant Fact on September 27, 2010:

“Further to the Significant Event filed on July 28, TELEFÓNICA has acquired the fifty percent (50%) of the shares of Brasilcel, N. V., (Dutch company that owns shares representing, approximately, 60% of the capital stock of the Brazilian company Vivo Participações, S.A.), owned by Portugal Telecom SG SGPS, S.A., today, having made a first payment, as agreed, of four thousand five hundred (4,500) million Euros. The rest of the price, up to seven thousand five hundred (7,500) million euros, will be satisfied under the following schedule of payments: one thousand (1,000) million Euros on 30 December 2010, and two thousand (2,000) million Euros, on 31 October 2011, although Portugal Telecom SG SGPS, S.A. will be able to request for this last payment to be executed on July 29, 2011, and therefore the price of the acquisition and the closing payment will be reduced in approximately twenty-five (25) million Euros. As a result of this acquisition, TELEFÓNICA has achieved the control of Vivo Participações, S.A.

Coinciding with the closing of the transaction, the agreements signed in year 2002 between TELEFÓNICA and Portugal Telecom SGPS SG, S. A., in relation to its joint venture in Brazil, (Suscription Agreement and Shareholders Agreement), have been terminated.

TELEFONICA confirms that it will launch a Tender Offer over the voting shares of Vivo Participações, S.A., (ONs), for a price equal to eighty percent (80%) of the price paid by TELEFONICA to Portugal Telecom SGPS SG, S.A., for each voting share of Vivo Participações, S.A. (ON) owned by Brasilcel, N.V.”

São Paulo, September 27, 2010.

Roberto Oliveira de Lima

Chief Executive Officer

Vivo Participações S.A.

Cristiane Barretto Sales

Investor Relations Officer

Vivo Participações S.A.

VIVO – Investor Relations

Tel: +55 11 7420-1172

Email: ri@vivo.com.br

Information available from: www.vivo.com.br/ri

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 27, 2010

|

VIVO PARTICIPAÇÕES S.A.

|

|

|

|

By:

|

/

S

/ Cristiane Barretto Sales

|

|

|

Cristiane Barretto Sales

Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

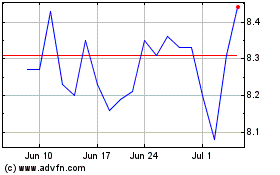

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Apr 2024 to May 2024

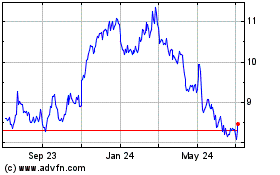

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From May 2023 to May 2024