BACKGROUND OF THE SOLICITATION

Since October 4, 2021, Mr. Icahn and his representatives have tried to engage in meaningful discussions with the Company’s management to address, among

other things, Mr. Icahn’s concerns that the Company’s incumbent Board and management have failed, and continue to fail, to take actions to maximize value for the Company’s stockholders and that the Company’s stock price continues

to underperform when compared to its peers. Over the past few months, Mr. Icahn and his representatives have made numerous attempts to engage directly with the Company and its management regarding these matters but these attempts have been met with

resistance and the Company has not engaged in discussions with Mr. Icahn regarding his concerns or his financing proposals for the Company.

Mr. Icahn has

reviewed the Company’s description of the past contacts between the Company and Mr. Icahn in the Company’s proxy statement filed with the SEC on March 25, 2022. Mr. Icahn disagrees with the Company’s characterization of the material

events leading up to this proxy solicitation and believes that the Company’s characterization of such events is misleading. The following is a chronology of the material events, including the key interactions and communications between the

Icahn Participants and the Company, leading up to the filing of this Proxy Statement:

Between July 16, 2021 and September 14, 2021, Icahn

Partners and Icahn Master purchased an aggregate of 1,269,350 Shares in open market purchases for an aggregate purchase price of approximately $90.2 million. In addition, between August 10, 2021 and September 7, 2021, Icahn Partners

and Icahn Master entered into forward contracts relating to 1,629,326 Shares, at a forward price of $63.00 per share, for an aggregate forward price of approximately $102.6 million, plus a financing charge. The forward price was subject to

adjustment to account for any dividends or other distributions declared by the Company. Icahn Partners and Icahn Master paid the counterparty to the forward contracts an aggregate amount of approximately $12.7 million upon entering into the

contracts. On November 2, 2021, Icahn Partners and Icahn Master exercised the forward contracts relating to 1,629,326 Shares. As a result of these transactions, the Icahn Participants may be deemed to beneficially own, in the aggregate,

2,898,676 Shares as more fully described on Annex I hereto. The Participants have also entered into, from time to time, one or more cash-settled equity swaps with broker-dealers or other financial institutions and counterparties with respect

to the Shares, with reference prices and maturity dates that vary depending upon the terms of each such cash-settled swap.

On October 4, 2021, after

reading news reports speculating that the Company was negotiating a deal to acquire Questar Pipelines (as defined below) from Dominion Energy, Inc., Mr. Icahn tried to reach Mr. Hester, President and Chief Executive Officer of the Company,

multiple times by telephone during the course of the day but was unsuccessful.

On October 5, 2021, the Company announced that it had entered into a

definitive agreement to acquire Dominion Energy Questar Pipeline, LLC, its subsidiaries and certain associated affiliates, including Overthrust Pipeline, White River Hub and Questar Field Services (“Questar Pipelines”), from

Dominion Energy, Inc. Under the terms of the transaction, the Company agreed to acquire 100% of Questar Pipelines for $1.545 billion in cash and agreed to assume $430 million of Questar Pipelines’ existing debt. The Company further

announced that the transaction was expected to close on or about December 31, 2021, subject to approval under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), and other customary closing

conditions.

On October 5, 2021, Mr. Icahn and affiliated entities released an open letter to the Company’s Board. The letter expressed

disappointment with the performance of the Company’s management over the past few years and specifically with the Company’s decision to enter into the Questar Pipelines transaction.

On October 7, 2021, Mr. Icahn’s office received a call back from Mr. Hester’s office to schedule a time for Messrs. Icahn and Hester

to speak. Later that day, Mr. Icahn and Mr. Hester spoke by telephone and discussed the Questar Pipelines transaction. Mr. Icahn indicated that the proposed greater than 25% equity and equity-linked issuance, without a stockholder

vote, would not only depress the valuation of the Company but would also

4

On October 20, 2021, the Company released a statement that the “Questar acquisition adds scale and

value through a compelling, high-return suite of assets with unique strength and stability” and reiterating the Company’s commitment to long-term value.

On October 22, 2021, affiliates of IEP Utility delivered a demand to inspect the stocklists of the Company pursuant to Section 220 of the Delaware

General Corporation Law (the “DGCL”).

On October 25, 2021, Mr. Icahn issued an open letter to the Board reiterating that a

rights offering to all existing stockholders is the best way to ensure that the Company’s existing stockholders are not massively diluted.

On

October 27, 2021, IEP Utility commenced the tender offer because IEP Utility believes that the tender offer is in the interest of all stakeholders (except for the Company’s senior management and its board of directors). Also, on

October 27, 2021, IEP Utility delivered a request and demand pursuant to Rule 14d-5(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for use of the

stockholder list and security position listings of the Company for the purpose of disseminating the materials relating to the tender offer to the holders of the Shares.

On November 1, 2021, the waiting period under the HSR Act expired with respect to the tender offer.

On November 9, 2021, the Company announced that, on November 5, 2021, the Board increased the size of the Board by two directors, from ten

(10) directors to twelve (12) directors, and appointed E. Renae Conley and Carlos A. Ruisanchez to fill the vacancies created by the increased size of the Board, in each case, effective January 1, 2022. The Company also announced

that, on November 5, 2021, Michael J. Melarkey and Stephen C. Comer each informed the Board of their decisions not to stand for reelection at the Annual Meeting, and that Messrs. Melarkey and Comer would continue as directors until the

time of the Annual Meeting. In connection with the resignations by Messrs. Melarkey and Comer, the Company further announced that the number of directors on the Board would be decreased by two directors, from twelve (12) to ten (10), effective

immediately prior to the Annual Meeting.

On November 9, 2021, the Company also issued a press release announcing that the Board recommended that the

Company’s stockholders reject the tender offer. That same day, Mr. Icahn issued an open letter to the Company’s stockholders responding to the Board’s recommendation.

On November 11, 2021, Mr. Icahn issued an open letter to the Company’s stockholders outlining Mr. Icahn’s position about how the

Board has disregarded its fiduciary duties to the Company’s stockholders with respect to the Quester acquisition.

On November 15, 2021, the

Icahn Participants released a presentation detailing how ratepayers and stockholders are suffering at the hands of the Board and the Company’s management.

Also, on November 15, 2021, Icahn Partners, in its capacity as a record holder of Shares, sent Southwest Gas a formal notice of its intent to nominate

each of Nora Mead Brownell, Marcie L. Edwards, Andrew W. Evans, H. Russell Frisby, Jr., Walter M. Higgins III, Rina Joshi, Henry P. Linginfelter, Jesse A. Lynn, Ruby Sharma, and Andrew J. Teno, who we refer to as

the Icahn Nominees, as director candidates at the Annual Meeting pursuant to the requirements set forth in the Bylaws, and to bring forth the Special Meeting Proposal and the Bylaw Restoration Proposal at the Annual Meeting (the “Nomination

Notice”). Each of the Icahn Nominees also provided a consent to being named as a director nominee in any proxy solicitation materials and to serve on the Board if elected or appointed.

On November 16, 2021, the Company issued a statement responding to the Nomination Notice and stating that the Board will review the Icahn Nominees with

the Nominating and Corporate Governance Committee.

6

On January 26, 2022, IEP Utility announced that it was extending the expiration of the tender offer

until Wednesday, February 23, 2022, unless further extended or earlier terminated in the event that a condition to the tender offer becomes incapable of being satisfied. IEP Utility also amended the tender offer to include a condition that a

majority of the Icahn Slate are elected and seated as members of the Board at the Annual Meeting or at any subsequently called special meeting for such purpose.

On February 11, 2022, Defendants moved for summary judgment on Counts IV and V of the Complaint.

On February 15, 2022, the Participants filed this preliminary proxy with the SEC.

Upon the request of Lazard, the Company’s financial advisor, Mr. Icahn participated in a conference call with representatives of Lazard regarding Mr.

Icahn’s financing proposals on February 21, 2022. Following the conversation, Lazard emailed Mr. Icahn a “questionnaire”. On February 28th, the Company filed its preliminary proxy statement, which included a highly inaccurate and

intentionally misleading summary of the conversation on February 21, 2022.

Mr. Icahn then restated his position yet again, which is as follows: Five

months ago, Mr. Icahn offered publicly to purchase $1 billion of common stock from the Company at $75.00 per share in cash to finance the Questar acquisition. Mr. Icahn has confirmed that this offer still remains outstanding today as the

Company will need to refinance the 364-day term loan credit agreement that it used to fund a portion of the purchase price of the Questar acquisition. Mr. Icahn has reiterated this offer multiple times, in both public and private conversations with

the Company and its advisors, including Lazard. Mr. Icahn has also indicated that if the Company receives a bona fide offer from a third party that is superior in price and/or structure to that being offered by Mr. Icahn, then Mr. Icahn would be

willing to beat that third party offer. Mr. Icahn’s offer does not require any particular governance rights or board seats. Mr. Icahn has no preconceived provisions for any such financing and is willing to beat any bona fide competing third

party offer. Mr. Icahn and his representatives have told this to the Company numerous times, yet they have never received anything approaching a counteroffer from the Company. Mr. Icahn has also specifically stated to the Company and its

representatives that Mr. Icahn’s offer to provide financing to the Company so that the Company may refinance its 364-day term loan is not conditioned upon, and does not relate to, the proxy contest or the Icahn tender offer.

As noted above, on February 28, 2022, Southwest Gas filed its preliminary proxy with the SEC.

On March 1, 2022, Southwest Gas announced that its Board of Directors had unanimously determined to separate Centuri Group, Inc., a wholly-owned subsidiary of

Southwest Gas, into a standalone, independent company.

On March 14, 2022, IEP Utility announced that it was increasing the price to be paid in the tender

offer to $82.50 per Share, which is a 10% increase over the initial offer price of $75.00 per Share. All references to the “Offer Price” in this Proxy Statement shall be deemed to refer to the increased Offer Price of $82.50 per Share.

Later that day, Southwest Gas issued a press release that it would provide its position with respect to the increased Offer Price of $82.50 per Share within 10 business days.

On March 15, 2022, a hearing was held before Chancellor Kathaleen S. McCormick of the Delaware Court of Chancery on the Company’s and the director

defendants’ motion for summary judgment relating to the Company’s exclusion of the Special Meeting Proposal. The Court has not yet rendered a decision on the motion.

On March 22, 2022, Southwest Gas announced that its subsidiary, Southwest Gas Corporation, completed a public offering of $600 million aggregate principal

amount of 4.05% Senior Notes due 2032, and that Southwest Gas Corporation received net proceeds of approximately $592.7 million, which Southwest Gas Corporation intends to use to redeem Southwest Gas Corporation’s outstanding 3.875% Senior

Notes due 2022 in full, to repay the outstanding amounts under Southwest Gas Corporation’s credit facility and the remainder for general corporate purposes. Southwest Gas Corporation also announced it had entered into an amendment to extend the

maturity date of its term loan agreement.

9

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

Proposal 1: Election of the Icahn Nominees (Proposal 1 on the GOLD Proxy Card)

The Board of the Company currently consists of 12 directors. Directors hold office until the Company’s next annual meeting following their election or

until their successors are elected and duly qualified. On November 9, 2021, the Company announced that, on November 5, 2021, two of the Company’s current directors, Michael J. Melarkey and Stephen C. Comer, each informed the Board of

their decisions not to stand for reelection at the Annual Meeting, and that Messrs. Melarkey and Comer would continue as directors until the time of the Annual Meeting. In connection with the resignations by Messrs. Melarkey and Comer, the Company

further announced that the number of directors on the Board would be decreased by two directors, from twelve (12) to ten (10), effective immediately prior to the Annual Meeting. Accordingly, on November 15, 2021, we gave notice to the

Company of our intention to nominate the ten (10) Icahn Nominees to serve as directors of the Company.

We have nominated Nora Mead Brownell,

Marcie L. Edwards, Andrew W. Evans, H. Russell Frisby, Jr., Walter M. Higgins III, Rina Joshi, Henry P. Linginfelter, Jesse A. Lynn, Ruby Sharma and Andrew J. Teno. As a result, should a stockholder so authorize us, on the

GOLD proxy card, we would cast votes for all of the Icahn Nominees.

Each of the Icahn Nominees has consented to being named a

nominee in this Proxy Statement and has confirmed his or her willingness to serve on the Board if elected. The Icahn Participants do not expect that any of the Icahn Nominees will be unable to stand for election, but in the event that a vacancy in

the slate of Icahn Nominees should occur unexpectedly because any Icahn Nominee is unable to serve on the Board or for good cause will not serve on the Board, the Shares represented by the GOLD proxy card will be voted for a

substitute candidate selected by the Icahn Participants, to the extent this is not prohibited under the Bylaws and applicable law, in each case in light of the specific facts and circumstances surrounding such substitution. Should the Icahn

Participants determine that it is necessary to add nominees in accordance with the Bylaws and applicable law, whether because the Company expands the size of the Board subsequent to the date of this Proxy Statement or for any other reason, Icahn

Partners will supplement this Proxy Statement.

Directors will be elected by a plurality of the Shares represented in person or by proxy and entitled to

vote on the election of directors, meaning that the ten nominees receiving the most votes for their election will be elected. Abstentions and broker non-votes, if any, will have no effect on the

result of this vote.

Biographical Information Regarding the Icahn Nominees

The following information concerning the age, principal occupation and business experience during the last five years, and current public directorships of each

of the Icahn Nominees has been furnished to the Participants by each of the Icahn Nominees.

Nora Mead Brownell, age 74, is an accomplished

executive and entrepreneur. Since 2009, Ms. Brownell has served as co-founder and principal of Espy Energy Solutions LLC, an energy consulting group that provides strategic planning, marketing,

business planning, and other consulting services to energy utilities, equipment manufacturers, service providers and financial institutions evaluating energy investments. Ms. Brownell is a former Commissioner of the Federal Energy Regulatory

Commission where she served a term from May 2001 to June 2006, and a former member of the Pennsylvania Public Utility Commission where she served from 1997 to 2001. She also served as President of the National Association of Regulatory Utility

Commissioners (NARUC) from 2000 to 2001. Since October 2020, Ms. Brownell has been a director of Sunnova Energy International Inc. (NYSE: NOVA), a residential solar and energy storage service provider, where she serves on the Compensation

Committee, and since December 2020, Ms. Brownell has been a director and member of the Audit Committee of Hennessey Capital Investment Corp. V., a special purpose acquisition vehicle. Ms. Brownell’s prior public company board service

includes: PG&E Corporation (NYSE: PCG), a public utility holding company, from April

13

2019 to June 2020, where she served as Chair of the board of directors; National Grid PLC (NYSE: NGG), one of the world’s largest investor-owned energy utilities, from June 2012 until April

2019, where she served on the Remunerations, Nominations, Safety and Environment and Health committees; Spectra Energy Partners, LP (formerly NYSE: SEP) from May 2007 to November 2018, where she served on the Audit and Conflicts committees; and

Oncor Electric Delivery Co. LLC, a regulated electricity transmission and distribution company, from October 2007 to February 2014, where she served on the Audit Committee. Ms. Brownell has served on the Advisory Board of Fidelis

Infrastructure, LP since January 2020 and the Morgan Stanley Infrastructure Advisory Board since June 2014. Ms. Brownell attended Syracuse University. Ms. Brownell’s principal business address is 105 Pommander Walk Street, Alexandria,

VA 22314. Ms. Brownell is a citizen of the United States of America.

Director Qualifications: Ms. Brownell’s deep

experience in regulatory affairs relating to the Company’s industry gained through her time advising energy utilities and serving as a former Commissioner of the Federal Energy Regulatory Commission and as a former member of a state public

utility commission, as well as her business and finance experience from her service on several public company boards, make Ms. Brownell well qualified to serve on the Board.

Marcie L. Edwards, age 65, has served as the President of MLE Consulting, Inc., a management consulting firm specializing in providing strategic and

operational solutions for companies in the energy and water space, since May 2017. She has served as a director of CIM Commercial Trust Corporation (Nasdaq: CMCT), a real estate investment trust that principally owns and operates Class A and

creative office properties, since her appointment on February 11, 2021. Ms. Edwards previously served as the General Manager of the Los Angeles Department of Water and Power (LADWP) from March 2014 to March 2017. In that capacity, she

managed a city agency with an annual budget of more than $6 billion and approximately 10,000 employees. As part of her role at LADWP, she served as a member of the Board of the Water and Power Employees’ Retirement Plan, overseeing more

than $12 billion in investments. Prior to her tenure at LADWP, Ms. Edwards was the City Manager of the City of Anaheim from 2013 to 2014, overseeing an annual budget of more than $1 billion with approximately 3,000 employees,

including a fire department, a police department, and a public utility company. From 2000 to 2012, Ms. Edwards was the Utility General Manager of Anaheim Public Utilities and, prior to 2000, Ms. Edwards spent almost 25 years with LADWP in

a variety of positions. From 2019 to 2021, she was Chair to the California Wildfire Safety Advisory Board, as a gubernational appointee. Ms. Edwards served on the Board of Directors of the American Public Power Association for Arizona,

California and Nevada from September 2002 to June 2007. Since 2019, Ms. Edwards has been a board member of S&C Electric Company in Chicago (and a member of the Audit Committee since 2021). In 2019, Ms. Edwards was invited to serve on

the Southern California Gas Company’s Advisory Safety Council. Further, since December 2018, Ms. Edwards has served on the Board of the Boys & Girls Club of Santa Clarita Valley, as their secretary. Ms. Edwards has a

Master’s in Public Administration from the University of LaVerne. Ms. Edwards’ principal business address is 27975 Langley Place, Castaic, CA 91384. Ms. Edwards is a citizen of the United States of America.

Director Qualifications: Ms. Edwards’ extensive knowledge of business, finance and administrative matters gained through managing

public entities, including overseeing substantial budgets and investments and a large workforce, as well as her background in the public utilities sector, has provided her with intimate knowledge of the regulatory issues facing utility companies and

makes her well qualified to serve on the Board.

Andrew W. Evans, age 55, has worked in the energy and utility industry for 28 years across a

broad spectrum of capital intensive businesses. He is the retired Chief Financial Officer of Southern Company (NYSE: SO), an electric and natural gas public utility holding company, where he served as Chief Financial Officer from June 2018 to

September 2021 and had responsibility for all investor interaction, public reporting, information technology and cyber security, business development, risk and capital deployment. Prior its acquisition by Southern Company, he served as the Chairman,

President and Chief Executive Officer of AGL Resources, Inc. (AGL), the largest publicly traded gas distribution company in the United States, from April 2017 until June 2018. In this role he was keenly focused on employee and public safety,

customer satisfaction, modernization, and growth. He also served as Chief Operating Officer of AGL from April 2016 until April 2018 and, during his

14

Director Qualifications: Ms. Joshi’s significant experience in business and

finance matters, including her familiarity with capital markets, restructuring and M&A transactions, make her well qualified to serve on the Board.

Henry P. Linginfelter, age 61, has more than 35 years of natural gas utility experience. He retired as Executive Vice President of Southern

Company Gas in 2019. As EVP, he was responsible for all day-to-day operations of the largest gas utility in the United States, serving approximately 4.5 million

customers through seven gas companies across seven states. Responsibilities included safety, construction, customer service, engineering, reliability, marketing, environmental, gas supply and control, budgeting and planning, external affairs, and

financial performance, among other duties. He also served for many years on the board of the company’s captive insurance business which assesses and mitigates risk and liability issues across the corporation. In addition to his broad executive

and operating experience, Mr. Linginfelter has extensive experience in regulatory and legislative affairs, with a track record of achieving constructive and trustworthy engagement and positive outcomes with regulators and elected officials

across several jurisdictions. Mr. Linginfelter is former Chairman of the Southern Gas Association and served on the American Gas Association Leadership Council for several years. He serves on numerous not-for-profit boards and was Chairman of the Georgia Chamber of Commerce in 2016. He holds a Bachelor’s Degree in Industrial Management from Georgia Tech and an MBA from the J. Mack Robinson College of

Business at Georgia State University. Mr. Linginfelter is a Fellow of CEO Perspectives leadership program – University of Chicago’s Booth School and Northwestern University’s Kellogg School. Mr. Linginfelter’s principal

business address is 1724 Dixon Lane, St. Simons Island, GA 31522. Mr. Linginfelter is a citizen of the United States of America.

Director Qualifications: Mr. Linginfelter’s broad and extensive experience in business, finance, operations and administration,

which he gained through serving as the head of all day-to-day operations for the largest gas utility business for more than ten years, his intimate familiarity with the

natural gas utility sector, and his significant experience in regulatory and legislative affairs, make him well qualified to serve on the Board.

Jesse A. Lynn, age 51, has been General Counsel of Icahn Enterprises L.P. (NASDAQ: IEP), a diversified holding company engaged in a variety of

businesses, including investment, energy, automotive, food packaging, real estate, home fashion and pharma, since 2014. Mr. Lynn has also served as Chief Operating Officer of Icahn Capital LP, the entity through which Carl C. Icahn manages

investment funds, since April 2021. From 2004 to 2014, Mr. Lynn was Assistant General Counsel of Icahn Enterprises. Prior to joining Icahn Enterprises, Mr. Lynn worked as an associate in the New York office of Mintz, Levin, Cohn, Ferris,

Glovsky and Popeo, P.C. in its business and finance department from 2000 until 2004. From 1996 to 2000, Mr. Lynn was an associate in the corporate group at Gordon Altman Butowsky Weitzen Shalov & Wein. Mr. Lynn has been a director

of: Xerox Holdings Corporation (NASDAQ: XRX), a provider of print and digital document products and services, since November 2021; FirstEnergy Corp. (NYSE: FE), an electric utility, since March 2021; and Conduent Incorporated (NASDAQ: CNDT), a

provider of business process outsourcing services, since April 2019. Mr. Lynn was previously a director of: Cloudera, Inc. (NASDAQ: CLDR), a provider of enterprise data cloud services, from August 2019 through its sale to CD&R and KKR in

October 2021; Herbalife Nutrition Ltd. (NYSE: HLF), a nutrition company, from April 2014 to January 2021; and The Manitowoc Company, Inc. (NYSE: MTW), a capital goods manufacturer, from April 2015 to February 2018. Carl C. Icahn has or previously

had non-controlling interests in each of Xerox, FirstEnergy, Conduent, Cloudera, Herbalife and Manitowoc through the ownership of securities. Mr. Lynn received a B.A. from the University of Michigan in

1992 and a J.D. from the Boston University School of Law in 1996. Mr. Lynn’s principal business address is 16690 Collins Avenue, Suite PH-1, Sunny Isles Beach, FL 33160. Mr. Lynn is a citizen of

the United States of America.

Director Qualifications: Mr. Lynn’s broad business, legal and administration experience, his

experience as a public company director, and his experience in a variety of industries make him well qualified to serve on the Board.

Ruby

Sharma, age 55, is a multi-cultural, global business advisor with comprehensive expertise & skills in Strategy, Operational Risk Transformation, M&A, Governance, Audit & Accounting. She has lived in North

17

America, the United Kingdom, Germany, Asia and is fluent in English, German and Hindi. For more than 25 years as a cross-sector financial & audit committee expert, she has worked with

Fortune 500 multi-national corporations, C-Suite and Board leadership to innovate and change, drive revenue growth, strengthen regulator and investor relationships, incorporating diversity, equity &

inclusion (DEI). Ms. Sharma has served as Managing Partner of RNB Strategic Advisors, a strategic advisory firm, since September 2018. Ms. Sharma served as a Partner at Ernst & Young LLP (EY), a multinational professional services

network, from 2002 until her retirement in December 2017, where she founded and led the Center for Board Matters and developed and built EY’s Global Strategy and Execution infrastructure for Governance Services to Boards and C-suite. She also served as a Partner in Fraud Investigations and Dispute Services at EY from 2004 to 2010. Prior to her time at EY, Ms. Sharma served as Senior Manager of Forensic and Litigation Services at

Arthur Andersen LLP, a holding company that provided auditing, tax and consulting services to large corporations, from 1999 to 2002. Ms. Sharma has led internal investigations, working with the U.S. Securities & Exchange Commission

(SEC) and other regulatory organizations on complex issues involving white-collar crime, Foreign Corrupt Practices Act (FCPA), risk and damage assessments, and accounting and financial issues. Ms. Sharma is a frequent keynote speaker and

panelist on corporate governance topics, contributor to international news media & has authored several audit committee handbooks and guides, white papers on governance, value protection and diversity and inclusion topics.

Effective December 13, 2021, Ms. Sharma was elected to the board of directors of ShotSpotter, Inc. (Nasdaq: SSTI), a developer of precision policing

technology solutions that enable law enforcement to more effectively respond to, investigate and deter crime, and serves as a member of its Audit Committee. In addition to serving as the Chair of the Audit Committee at Penn Medicine Princeton Health

(April 2010 to October 2020), Ms. Sharma is advisory council member for reacHIRE, Princeton Frugal Innovation Accelerator and has served as Board of Trustees, National Ascend Organization; Member, Asia Society Business Council. She was honored

as one of Outstanding 50 Asian Americans in Business in the Americas in 2011 by the Asian American Business Development Center.

Ms. Sharma is a

Fellow Chartered Accountant (Institute of Chartered Accountants in England & Wales) and holds a Bachelor of Arts. in Economics from Delhi University, India. Ms. Sharma has also attended the Executive Education program for EY Partners

at Northwestern University, Kellogg School of Management. Ms. Sharma currently qualifies as an “audit committee financial expert” under the rules of the SEC. Ms. Sharma’s principal business address is 24 Arnold Drive,

Princeton Jct., NJ 08550. Ms. Sharma is a citizen of the United States of America.

Director Qualifications: Ms. Sharma’s

extensive business and finance experience gained from her time advising boards and management teams on mergers and acquisitions, initial public offerings, joint ventures, company restructurings, corporate governance, financial due diligence, and

other compliance matters make her well qualified to serve on the Board.

Andrew Teno, age 37, has been a portfolio manager at Icahn

Capital, the entity through which Carl C. Icahn manages investment funds, since October 2020. Mr. Teno previously worked at Fir Tree Partners, a New York based private investment firm that invests worldwide in public and private companies, real

estate and sovereign debt, from 2011 to April 2020. Prior to that, he worked at Crestview Partners from 2009 to 2011 as an associate in their private equity business, and at Gleacher Partners, a boutique mergers and acquisitions firm, from 2007 to

2009. Mr. Teno has been a director of: FirstEnergy Corp. (NYSE: FE), an electric utility, since March 2021; Herc Holdings Inc. (NYSE: HRI), an equipment rental company, since February 2021; and Cheniere Energy, Inc. (NYSE: LNG), a liquefied

natural gas company, since February 2021. Mr. Teno previously served as a director of Eco-Stim Energy Solutions from March 2017 to December 2018. Carl C. Icahn has or previously had non-controlling interests in each of FirstEnergy, Herc and Cheniere through the ownership of securities. Mr. Teno received an undergraduate business degree from the Wharton School at the University of

Pennsylvania in 2007. Mr. Teno currently qualifies as an “audit committee financial expert” under the rules of the SEC. Mr. Teno’s principal business address is 16690 Collins Avenue, Suite

PH-1, Sunny Isles Beach, FL 33160. Mr. Teno is a citizen of the United States of America.

18

Beneficial Ownership of Shares

The following table shows the number of Shares that are beneficially owned (within the meaning of Rule 13d-3 under the

Exchange Act) by each of the Participants in this solicitation as of the Record Date. Except as described below, each Participant directly owns and has sole voting power and sole dispositive power with regard to the number of Shares beneficially

owned.

|

|

|

|

|

|

|

|

|

|

|

| Title of Class |

|

Name of Beneficial Owner(1) |

|

Amount of Beneficial Ownership |

|

|

Percent of Class (2) |

|

| Shares |

|

Icahn Partners LP |

|

|

2,898,676 |

|

|

|

4.8 |

% |

| Shares |

|

Icahn Partners Master Fund LP |

|

|

2,898,676 |

|

|

|

4.8 |

% |

| Shares |

|

Icahn Onshore LP |

|

|

2,898,676 |

|

|

|

4.8 |

% |

| Shares |

|

Icahn Offshore LP |

|

|

2,898,676 |

|

|

|

4.8 |

% |

| Shares |

|

Icahn Capital LP |

|

|

2,898,676 |

|

|

|

4.8 |

% |

| Shares |

|

IPH GP LLC |

|

|

2,898,676 |

|

|

|

4.8 |

% |

| Shares |

|

Icahn Enterprises Holdings L.P. |

|

|

2,898,676 |

|

|

|

4.8 |

% |

| Shares |

|

Icahn Enterprises G.P. Inc. |

|

|

2,898,676 |

|

|

|

4.8 |

% |

| Shares |

|

Beckton Corp. |

|

|

2,898,676 |

|

|

|

4.8 |

% |

| Shares |

|

Carl C. Icahn |

|

|

2,898,676 |

|

|

|

4.8 |

% |

| (1) |

Each holder listed in this table is, as of the date of this Proxy Statement, the beneficial owner of the Shares

set forth under the heading “Amount of Beneficial Ownership” in this table. |

| (2) |

Percentages of ownership set forth in this column is based upon 60,523,873 Shares stated to be outstanding at

March 21, 2022, by the Company in its definitive proxy statement filed with the SEC on March 24, 2022. |

A-4

Two Year Summary Table

The table below indicates the date of each purchase and sale of Shares (including Shares underlying forward contracts) by the Icahn Participants within the

past two years and the number of Shares in each such purchase and sale or exercise of forward contracts. The Icahn Participants have entered into, and may enter into from time to time, one or more cash-settled equity swaps with broker-dealers or

other financial institutions and counterparties with respect to the Shares, with reference prices and maturity dates that vary depending upon the terms of each such cash-settled swap. Unless otherwise indicated, all transactions were effected on the

open market. None of the Icahn Nominees have purchased any Shares during the past two years.

|

|

|

|

|

|

|

|

|

| Name |

|

Date |

|

Shares

Purchased/Shares

Underlying Forward Contracts |

|

Price Per

Share |

|

| Icahn Partners LP |

|

7/16/2021 |

|

122,172 |

|

|

$71.39 |

|

| Icahn Partners LP |

|

7/19/2021 |

|

137,346 |

|

|

$69.71 |

|

| Icahn Partners LP |

|

7/20/2021 |

|

75,984 |

|

|

$70.97 |

|

| Icahn Partners LP |

|

7/21/2021 |

|

58,450 |

|

|

$70.70 |

|

| Icahn Partners LP |

|

7/22/2021 |

|

20,011 |

|

|

$70.13 |

|

| Icahn Partners LP |

|

8/2/2021 |

|

35,091 |

|

|

$70.84 |

|

| Icahn Partners LP |

|

8/3/2021 |

|

29,558 |

|

|

$72.52 |

|

| Icahn Partners LP |

|

8/4/2021 |

|

101,422 |

|

|

$71.80 |

|

| Icahn Partners LP |

|

8/5/2021 |

|

46,766 |

|

|

$71.95 |

|

| Icahn Partners LP |

|

8/6/2021 |

|

40,781 |

|

|

$72.33 |

|

| Icahn Partners LP |

|

8/9/2021 |

|

52,599 |

|

|

$71.24 |

|

| Icahn Partners LP |

|

8/10/2021 |

|

19,872 |

|

|

$70.53 |

|

| Icahn Partners LP |

|

8/10/2021 |

|

14,611(1) |

|

|

$7.68(2) |

|

| Icahn Partners LP |

|

8/11/2021 |

|

43,833(1) |

|

|

$8.44(2) |

|

| Icahn Partners LP |

|

8/12/2021 |

|

23,378(1) |

|

|

$8.71(2) |

|

| Icahn Partners LP |

|

8/13/2021 |

|

29,900(1) |

|

|

$8.44(2) |

|

| Icahn Partners LP |

|

8/16/2021 |

|

52,600(1) |

|

|

$9.01(2) |

|

| Icahn Partners LP |

|

8/17/2021 |

|

43,833(1) |

|

|

$9.34(2) |

|

| Icahn Partners LP |

|

8/18/2021 |

|

43,833(1) |

|

|

$9.00(2) |

|

| Icahn Partners LP |

|

8/19/2021 |

|

43,834(1) |

|

|

$8.91(2) |

|

| Icahn Partners LP |

|

8/20/2021 |

|

49,677(1) |

|

|

$9.07(2) |

|

| Icahn Partners LP |

|

8/23/2021 |

|

64,289(1) |

|

|

$8.24(2) |

|

| Icahn Partners LP |

|

8/24/2021 |

|

81,530(1) |

|

|

$6.38(2) |

|

| Icahn Partners LP |

|

8/25/2021 |

|

58,444(1) |

|

|

$6.25(2) |

|

| Icahn Partners LP |

|

8/26/2021 |

|

58,445(1) |

|

|

$5.33(2) |

|

| Icahn Partners LP |

|

8/27/2021 |

|

52,600(1) |

|

|

$6.02(2) |

|

| Icahn Partners LP |

|

8/30/2021 |

|

49,678(1) |

|

|

$6.77(2) |

|

| Icahn Partners LP |

|

8/31/2021 |

|

61,366(1) |

|

|

$7.16(2) |

|

| Icahn Partners LP |

|

9/1/2021 |

|

49,743(1) |

|

|

$8.43(2) |

|

| Icahn Partners LP |

|

9/2/2021 |

|

55,525(1) |

|

|

$8.80(2) |

|

| Icahn Partners LP |

|

9/3/2021 |

|

43,835(1) |

|

|

$8.47(2) |

|

| Icahn Partners LP |

|

9/7/2021 |

|

31,366(1) |

|

|

$7.98(2) |

|

| Icahn Partners LP |

|

9/7/2021 |

|

23,379(4) |

|

|

$70.66 |

|

| Icahn Partners LP |

|

9/8/2021 |

|

55,525(4) |

|

|

$71.66 |

|

| Icahn Partners LP |

|

9/9/2021 |

|

61,369(4) |

|

|

$70.77 |

|

| Icahn Partners LP |

|

9/10/2021 |

|

64,291(4) |

|

|

$69.10 |

|

| Icahn Partners LP |

|

9/13/2021 |

|

70,136(4) |

|

|

$69.27 |

|

| Icahn Partners LP |

|

9/14/2021 |

|

1,812 |

|

|

$69.16 |

|

| Icahn Partners LP |

|

9/14/2021 |

|

64,291(4) |

|

|

$69.25 |

|

| Icahn Partners LP |

|

9/15/2021 |

|

40,913(4) |

|

|

$69.21 |

|

A-5

|

|

|

|

|

|

|

|

|

| Name |

|

Date |

|

Shares

Purchased/Shares

Underlying Forward Contracts |

|

Price Per

Share |

|

| Icahn Partners LP |

|

9/16/2021 |

|

40,913(4) |

|

|

$68.78 |

|

| Icahn Partners LP |

|

9/17/2021 |

|

87,670(4) |

|

|

$68.21 |

|

| Icahn Partners LP |

|

9/20/2021 |

|

93,515(4) |

|

|

$66.82 |

|

| Icahn Partners LP |

|

9/21/2021 |

|

55,525(4) |

|

|

$66.84 |

|

| Icahn Partners LP |

|

9/22/2021 |

|

52,602(4) |

|

|

$67.43 |

|

| Icahn Partners LP |

|

9/23/2021 |

|

52,602(4) |

|

|

$67.69 |

|

| Icahn Partners LP |

|

9/24/2021 |

|

52,602(4) |

|

|

$67.45 |

|

| Icahn Partners LP |

|

9/27/2021 |

|

49,680(4) |

|

|

$67.87 |

|

| Icahn Partners LP |

|

9/28/2021 |

|

49,680(4) |

|

|

$66.75 |

|

| Icahn Partners LP |

|

9/29/2021 |

|

49,680(4) |

|

|

$67.76 |

|

| Icahn Partners LP |

|

9/30/2021 |

|

58,446(4) |

|

|

$67.19 |

|

| Icahn Partners LP |

|

10/1/2021 |

|

52,355(4) |

|

|

$67.78 |

|

| Icahn Partners LP |

|

11/2/2021 |

|

952,320(3) |

|

|

$63.00 |

|

| Icahn Partners Master Fund LP |

|

7/16/2021 |

|

86,849 |

|

|

$71.39 |

|

| Icahn Partners Master Fund LP |

|

7/19/2021 |

|

97,639 |

|

|

$69.71 |

|

| Icahn Partners Master Fund LP |

|

7/20/2021 |

|

54,016 |

|

|

$70.97 |

|

| Icahn Partners Master Fund LP |

|

7/21/2021 |

|

41,550 |

|

|

$70.70 |

|

| Icahn Partners Master Fund LP |

|

7/22/2021 |

|

14,227 |

|

|

$70.13 |

|

| Icahn Partners Master Fund LP |

|

8/2/2021 |

|

24,849 |

|

|

$70.84 |

|

| Icahn Partners Master Fund LP |

|

8/3/2021 |

|

21,008 |

|

|

$72.52 |

|

| Icahn Partners Master Fund LP |

|

8/4/2021 |

|

72,078 |

|

|

$71.80 |

|

| Icahn Partners Master Fund LP |

|

8/5/2021 |

|

33,234 |

|

|

$71.95 |

|

| Icahn Partners Master Fund LP |

|

8/6/2021 |

|

29,219 |

|

|

$72.33 |

|

| Icahn Partners Master Fund LP |

|

8/9/2021 |

|

37,401 |

|

|

$71.24 |

|

| Icahn Partners Master Fund LP |

|

8/10/2021 |

|

14,128 |

|

|

$70.53 |

|

| Icahn Partners Master Fund LP |

|

8/10/2021 |

|

10,389(1) |

|

|

$7.68(2) |

|

| Icahn Partners Master Fund LP |

|

8/11/2021 |

|

31,167(1) |

|

|

$8.44(2) |

|

| Icahn Partners Master Fund LP |

|

8/12/2021 |

|

16,622(1) |

|

|

$8.71(2) |

|

| Icahn Partners Master Fund LP |

|

8/13/2021 |

|

21,260(1) |

|

|

$8.44(2) |

|

| Icahn Partners Master Fund LP |

|

8/16/2021 |

|

37,400(1) |

|

|

$9.01(2) |

|

| Icahn Partners Master Fund LP |

|

8/17/2021 |

|

31,167(1) |

|

|

$9.34(2) |

|

| Icahn Partners Master Fund LP |

|

8/18/2021 |

|

31,167(1) |

|

|

$9.00(2) |

|

| Icahn Partners Master Fund LP |

|

8/19/2021 |

|

31,166(1) |

|

|

$8.91(2) |

|

| Icahn Partners Master Fund LP |

|

8/20/2021 |

|

35,323(1) |

|

|

$9.07(2) |

|

| Icahn Partners Master Fund LP |

|

8/23/2021 |

|

45,711(1) |

|

|

$8.24(2) |

|

| Icahn Partners Master Fund LP |

|

8/24/2021 |

|

57,970(1) |

|

|

$6.38(2) |

|

| Icahn Partners Master Fund LP |

|

8/25/2021 |

|

41,556(1) |

|

|

$6.25(2) |

|

| Icahn Partners Master Fund LP |

|

8/26/2021 |

|

41,555(1) |

|

|

$5.33(2) |

|

| Icahn Partners Master Fund LP |

|

8/27/2021 |

|

37,400(1) |

|

|

$6.02(2) |

|

| Icahn Partners Master Fund LP |

|

8/30/2021 |

|

35,322(1) |

|

|

$6.77(2) |

|

| Icahn Partners Master Fund LP |

|

8/31/2021 |

|

43,634(1) |

|

|

$7.16(2) |

|

| Icahn Partners Master Fund LP |

|

9/1/2021 |

|

35,257(1) |

|

|

$8.43(2) |

|

| Icahn Partners Master Fund LP |

|

9/2/2021 |

|

39,475(1) |

|

|

$8.80(2) |

|

| Icahn Partners Master Fund LP |

|

9/3/2021 |

|

31,165(1) |

|

|

$8.47(2) |

|

| Icahn Partners Master Fund LP |

|

9/7/2021 |

|

22,300(1) |

|

|

$7.98(2) |

|

| Icahn Partners Master Fund LP |

|

9/7/2021 |

|

16,621(4) |

|

|

$70.66 |

|

| Icahn Partners Master Fund LP |

|

9/8/2021 |

|

39,475(4) |

|

|

$71.66 |

|

| Icahn Partners Master Fund LP |

|

9/9/2021 |

|

43,631(4) |

|

|

$70.77 |

|

| Icahn Partners Master Fund LP |

|

9/10/2021 |

|

45,709(4) |

|

|

$69.10 |

|

| Icahn Partners Master Fund LP |

|

9/13/2021 |

|

49,864(4) |

|

|

$69.27 |

|

A-6

|

|

|

|

|

|

|

|

|

| Name |

|

Date |

|

Shares

Purchased/Shares

Underlying Forward Contracts |

|

Price Per

Share |

|

| Icahn Partners Master Fund LP |

|

9/14/2021 |

|

1,288 |

|

|

$69.16 |

|

| Icahn Partners Master Fund LP |

|

9/14/2021 |

|

45,709(4) |

|

|

$69.25 |

|

| Icahn Partners Master Fund LP |

|

9/15/2021 |

|

29,087(4) |

|

|

$69.21 |

|

| Icahn Partners Master Fund LP |

|

9/16/2021 |

|

29,087(4) |

|

|

$68.78 |

|

| Icahn Partners Master Fund LP |

|

9/17/2021 |

|

62,330(4) |

|

|

$68.21 |

|

| Icahn Partners Master Fund LP |

|

9/20/2021 |

|

66,485(4) |

|

|

$66.82 |

|

| Icahn Partners Master Fund LP |

|

9/21/2021 |

|

39,475(4) |

|

|

$66.84 |

|

| Icahn Partners Master Fund LP |

|

9/22/2021 |

|

37,398(4) |

|

|

$67.43 |

|

| Icahn Partners Master Fund LP |

|

9/23/2021 |

|

37,398(4) |

|

|

$67.69 |

|

| Icahn Partners Master Fund LP |

|

9/24/2021 |

|

37,398(4) |

|

|

$67.45 |

|

| Icahn Partners Master Fund LP |

|

9/27/2021 |

|

35,320(4) |

|

|

$67.87 |

|

| Icahn Partners Master Fund LP |

|

9/28/2021 |

|

35,320(4) |

|

|

$66.75 |

|

| Icahn Partners Master Fund LP |

|

9/29/2021 |

|

35,320(4) |

|

|

$67.76 |

|

| Icahn Partners Master Fund LP |

|

9/30/2021 |

|

41,554(4) |

|

|

$67.19 |

|

| Icahn Partners Master Fund LP |

|

10/1/2021 |

|

37,645(4) |

|

|

$67.78 |

|

| Icahn Partners Master Fund LP |

|

11/2/2021 |

|

677,066(3) |

|

|

$63.00 |

|

| (1) |

Represents Shares underlying forward contracts. The forward contracts were exercised on November 2, 2021.

|

| (2) |

Represents a forward price of $63.00 per Share, plus the amount per Share that Icahn Partners or Icahn Master

paid the counterparty to the forward contracts upon entering into the contracts. The forward price was subject to adjustment to account for any dividends or other distributions declared by the Company. In addition, Icahn Partners and Icahn Master

paid a financing charge to the counterparty to the forward contracts. The forward contracts provided for physical settlement, with Icahn Partners and Icahn Master retaining the right to elect cash settlement. The forward contracts did not give Icahn

Partners or Icahn Master direct or indirect voting, investment or dispositive control over the Shares to which the contracts related. The forward contracts were exercised on November 2, 2021. |

| (3) |

On November 2, 2021, Icahn Partners and Icahn Master exercised the forward contracts relating to 1,629,326

Shares. The aggregate number of Shares beneficially owned by Icahn Partners and Icahn Master did not change as a result of the exercise of these forward contracts as the Shares underlying these forward contracts were previously reported as

beneficially owned by Icahn Partners and Icahn Master. After the exercise of the forward contracts on November 2, 2021, Icahn Partners and Icahn Master no longer hold any forward contracts relating to the Shares. |

| (4) |

Represents cash-settled equity swaps entered into by Icahn Partners or Icahn Master with broker-dealers or

other financial institutions and counterparties with respect to the Shares, with reference prices and maturity dates that vary depending upon the terms of each such cash-settled swap. |

A-7

IMPORTANT

Please review this Proxy Statement and the enclosed materials carefully. YOUR VOTE IS VERY IMPORTANT, no matter how many or how few Shares you own.

| |

1. |

If your Shares are registered in your own name, please sign, date and mail the

enclosed GOLD proxy card to Harkins Kovler in the postage-paid envelope provided today. |

| |

2. |

If you have previously signed and returned a proxy card to the Company, you have every right to change your

vote. Only your latest dated proxy card will count. You may revoke any proxy card already sent to the Company by signing, dating and mailing the enclosed GOLD proxy card in the postage-paid envelope provided. Any proxy may be

revoked at any time prior to the Annual Meeting (i) by delivering a written notice of revocation or a later-dated proxy for the Annual Meeting to Harkins Kovler, (ii) by delivering a written notice of revocation or a later-dated proxy for

the Annual Meeting to the Company or its proxy solicitor, or (iii) by voting at the Annual Meeting. Attendance at the Annual Meeting will not by itself constitute a revocation. |

| |

3. |

If your Shares are held in the name of a bank, brokerage firm, dealer, trust company or other custodian, only

such firm, custodian or other institution can vote your Shares and only after receiving your specific instructions by mail, telephone or Internet. Accordingly, please sign, date and mail the enclosed GOLD voting instruction

form in the postage-paid envelope provided or vote by telephone or Internet by following the instructions provided by your custodian broker or bank, and to ensure that your Shares are voted, you should also contact the person responsible for your

account and give instructions for a GOLD proxy card to be issued representing your Shares. |

| |

4. |

After signing and returning the enclosed GOLD proxy card or, if applicable, the

GOLD voting instruction form, do not sign or return the Company’s proxy card or, if applicable, voting instruction form unless you intend to change your vote, because only your latest dated proxy card will be counted.

|

WE URGE YOU NOT TO RETURN ANY PROXY CARD PROVIDED BY SOUTHWEST GAS. YOU DO NOT NEED TO (AND SHOULD NOT) VOTE “WITHHOLD” ON

SOUTHWEST GAS’ PROXY CARD TO VOTE FOR OUR DIRECTOR CANDIDATES. IF YOU WISH TO VOTE FOR THE ICAHN NOMINEES, YOU SHOULD NOT VOTE FOR ANY OF SOUTHWEST GAS’ DIRECTOR NOMINEES OR ANY OTHER MATTER ON SOUTHWEST GAS’ PROXY CARD. IF YOU

VOTE AND RETURN BOTH OUR GOLD PROXY CARD AND SOUTHWEST GAS’ PROXY CARD, ONLY THE LAST-DATED PROXY CARD WILL BE COUNTED.

If you have any questions concerning this Proxy Statement, would like to request additional copies of this Proxy Statement, or need help

voting your Shares, please contact our proxy solicitor:

Harkins Kovler, LLC

3 Columbus Circle, 15th Floor

New York, NY 10019

Banks

and Brokerage Firms Please Call Collect: +1 (212) 468-5380

All Others Call Toll Free: +1

(800) 326-5997

Email: swx@harkinskovler.com

A-8

[FORM OF GOLD PROXY CARD]

SOUTHWEST GAS HOLDINGS, INC.

2022 ANNUAL MEETING OF STOCKHOLDERS

THIS PROXY (THIS “PROXY”) IS SOLICITED ON BEHALF OF CARL C. ICAHN, ICAHN PARTNERS LP, ICAHN PARTNERS MASTER FUND LP, ICAHN

ONSHORE LP, ICAHN OFFSHORE LP, ICAHN CAPITAL LP, IPH GP LLC, ICAHN ENTERPRISES HOLDINGS L.P., ICAHN ENTERPRISES G.P. INC., BECKTON CORP., DAVID ADAME, NORA MEAD BROWNELL, MARCIE L. EDWARDS, ANDREW W. EVANS, H. RUSSELL FRISBY, JR., WALTER M. HIGGINS

III, RINA JOSHI, HENRY P. LINGINFELTER, JESSE A. LYNN, RUBY SHARMA AND ANDREW J. TENO (COLLECTIVELY, THE “PARTICIPANTS”)

THIS PROXY SOLICITATION IS NOT BEING MADE BY OR ON BEHALF OF

SOUTHWEST GAS HOLDINGS, INC.

The

undersigned appoint(s) Peter C. Harkins and Jordan M. Kovler and each of them, as proxies (each and any substitute, a “Proxyholder”) with full power of substitution and with discretionary authority to vote all shares of common

stock, par value $1.00 per share (the “Shares”), of Southwest Gas Holdings, Inc. (the “Company”), which the undersigned would be entitled to vote if present at the 2022 Annual Meeting of Stockholders of the Company

scheduled to be held virtually on May 12, 2022, at 9:00 AM (EDT), including any adjournments, continuations or postponements thereof and at any meeting called in lieu thereof (the “Annual Meeting”) on all matters coming before the

Annual Meeting.

The undersigned hereby revokes any other proxy or proxies heretofore given to vote or act with respect to the Shares of the Company held

by the undersigned, and hereby ratifies and confirms all actions the herein named Proxyholders, their substitutes, or any of them may lawfully take by virtue hereof. Other than the five proposals set forth on the reverse side of this card, the

Participants are not aware of any other matters to be considered at the Annual Meeting. However, should other matters, unknown a reasonable time before the Annual Meeting, be brought before the Annual Meeting, each Proxyholder will vote on such

matters in their discretion. If properly executed, this Proxy will be voted as directed on the reverse side and each Proxyholder will vote in his or her discretion with respect to any other matters, unknown a reasonable time before the Annual

Meeting, as may properly come before the Annual Meeting.

IF THIS PROXY IS SIGNED AND RETURNED, IT WILL BE VOTED IN ACCORDANCE WITH YOUR

SPECIFICATIONS. IF NO DIRECTION IS INDICATED WITH RESPECT TO THE PROPOSALS ON THE REVERSE SIDE, THIS PROXY WILL BE VOTED (1) “FOR” ALL NOMINEES SET FORTH IN PROPOSAL 1, (2) “AGAINST” THE APPROVAL, ON AN

ADVISORY BASIS, OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS, (3) “FOR” THE RATIFICATION THE SELECTION OF PRICEWATERHOUSECOOPERS LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE COMPANY FOR

FISCAL YEAR 2022, (4) “FOR” THE BYLAW RESTORATION PROPOSAL, (5) “FOR” THE SPECIAL MEETING PROPOSAL, AND (6) IN THE PROXY HOLDERS’ DISCRETION AS TO OTHER MATTERS THAT MAY COME BEFORE THE ANNUAL MEETING.

IMPORTANT: PLEASE COMPLETE, SIGN, DATE AND MAIL THIS PROXY CARD TODAY!

PROPOSAL 1: To elect ten directors of Southwest Gas to serve until the 2023 Annual Meeting of

Stockholders or until their respective successors are appointed, elected and qualified. Icahn Partners’ proposal is to elect Nora Mead Brownell, Marcie L. Edwards, Andrew W. Evans, H. Russell Frisby, Jr., Walter M. Higgins III, Rina

Joshi, Henry P. Linginfelter, Jesse A. Lynn, Ruby Sharma and Andrew J. Teno as directors of the Company. Icahn Partners is NOT seeking authority to vote for and WILL NOT exercise any authority to vote for any of Southwest Gas’ director

nominees. You should refer to the proxy statement and form of proxy distributed by Southwest Gas for the names, background, qualifications and other information concerning the Southwest Gas nominees.

If you do not wish your Shares voted “FOR” a particular nominee, mark the “FOR ALL EXCEPT” box and write the name(s) of the nominee(s) you

do not support on the line below. WE RECOMMEND A VOTE “FOR” THE ELECTION OF ALL NOMINEES LISTED IN PROPOSAL 1 BELOW.

INSTRUCTIONS: FILL IN VOTING BOXES “∎” IN BLACK OR BLUE INK)

|

|

|

|

|

| FOR ALL NOMINEES |

|

WITHHOLD AUTHORITY TO VOTE FOR ALL

NOMINEES |

|

FOR ALL EXCEPT NOMINEE(S) WRITTEN BELOW |

| (A) Nora Mead Brownell |

|

|

|

|

| (B) Marcie L. Edwards |

|

|

|

|

| (C) Andrew W. Evans |

|

|

|

|

| (D) H. Russell Frisby, Jr. |

|

|

|

|

| (E) Walter M. Higgins III |

|

|

|

☐ |

| (F) Rina Joshi |

|

|

|

|

| (G) Henry P. Linginfelter |

|

|

|

|

| (H) Jesse A. Lynn |

|

|

|

|

| (I) Ruby Sharma |

|

|

|

|

| (J) Andrew J. Teno |

|

|

|

|

| ☐ |

|

☐ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Icahn Partners does not expect that any of the nominees will be unable to stand for election, but, in the event any

nominee is unable to serve or for good cause will not serve, the Shares represented by this Proxy will be voted for substitute nominee(s), to the extent this is not prohibited under the Company’s organizational documents and applicable law. In

addition, Icahn Partners has reserved the right to nominate substitute person(s) if the Company makes or announces any changes to its organizational documents or takes or announces any other action that has, or if consummated would have, the effect

of disqualifying any nominee, to the extent this is not prohibited under the Company’s organizational documents and applicable law. In any such case, Shares represented by this Proxy will be voted for such substitute nominee(s). To the extent

one or more directors are elected but unable to be seated as a result of any regulatory limitation on the number of Icahn Nominees that may be seated at one time, then such number of elected directors will be seated as feasible, and any remaining

elected but unseated directors shall be seated at such time as may be permitted.

PROPOSAL 2: To approve, on a non-binding, advisory basis, the

Company’s executive compensation.

WE RECOMMEND A VOTE “AGAINST” THE APPROVAL, ON A NON-BINDING, ADVISORY BASIS, OF THE

COMPANY’S EXECUTIVE COMPENSATION.

|

|

|

|

|

| FOR |

|

AGAINST |

|

ABSTAIN |

|

|

|

| ☐ |

|

☐ |

|

☐ |

PROPOSAL 3: Ratification of the selection of PricewaterhouseCoopers LLP as the independent registered public

accounting firm for the Company for fiscal year 2022.

WE RECOMMEND A VOTE “FOR” THE RATIFICATION OF THE SELECTION OF

PRICEWATERHOUSECOOPERS LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE COMPANY FOR FISCAL YEAR 2022.

|

|

|

|

|

| FOR |

|

AGAINST |

|

ABSTAIN |

|

|

|

| ☐ |

|

☐ |

|

☐ |

PROPOSAL 4: To repeal any attempt by the Southwest Gas Board of Directors to change, amend, modify, or alter

the Bylaws, as such Bylaws existed on October 19, 2021, that could interfere with the seating of the Icahn Nominees on the Southwest Gas Board of Directors.

WE RECOMMEND A VOTE “FOR” THE REPEAL OF ANY CHANGE, AMENDMENT, MODIFICATION OR ALTERATION OF THE BYLAWS, AS SUCH BYLAWS EXISTED ON OCTOBER

19, 2021, THAT COULD INTERFERE WITH THE SEATING OF THE ICAHN NOMINEES ON THE SOUTHWEST GAS BOARD OF DIRECTORS.

|

|

|

|

|

| FOR |

|

AGAINST |

|

ABSTAIN |

|

|

|

| ☐ |

|

☐ |

|

☐ |

PROPOSAL 5: To approve the calling of a special meeting to permit the matters necessary for the nomination of

the Icahn Nominees to the Southwest Gas Board of Directors and to deliver notice thereof as well as any other documents as may be required to call a special meeting to the Secretary of the Corporation.

WE RECOMMEND A VOTE “FOR” THE CALLING OF A SPECIAL MEETING TO PERMIT THE MATTERS NECESSARY FOR THE NOMINATION OF THE ICAHN NOMINEES TO THE

SOUTHWEST GAS BOARD OF DIRECTORS

|

|

|

|

|

| FOR |

|

AGAINST |

|

ABSTAIN |

|

|

|

| ☐ |

|

☐ |

|

☐ |

IN ORDER FOR YOUR PROXY TO BE VALID, IT MUST BE SIGNED. PLEASE ALSO DATE THE PROXY WHERE INDICATED BELOW.

|

|

|

|

Signature (Capacity/Title) |

|

Date |

|

|

|

|

Signature (Joint Owner) (Capacity/Title) |

|

Date |

NOTE: Please sign exactly as your name(s) appear(s) on stock certificates or on the label affixed hereto. When signing

as attorney, executor, administrator or other fiduciary, please give full title as such. Joint owners must each sign personally. ALL HOLDERS MUST SIGN. If a corporation or partnership, please sign in full corporate or partnership name by an

authorized officer and give full title as such.

PLEASE SIGN, DATE AND PROMPTLY RETURN THIS PROXY USING THE

ENCLOSED RETURN ENVELOPE.

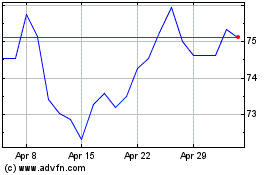

Southwest Gas (NYSE:SWX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Southwest Gas (NYSE:SWX)

Historical Stock Chart

From Jul 2023 to Jul 2024