The Board of Directors of Natuzzi S.p.A. (NYSE:NTZ), Italy’s

largest furniture manufacturer and world’s leading manufacturer of

leather-upholstered furniture, today announced its financial

results for the fourth quarter and full year of 2010.

FULL YEAR 2010

- Total Net Sales were €518.6 million, up

0.6% as compared to FY 2009

- Industrial Margin was €197.1 million as

compared to €185.6 million in FY 2009

- Positive EBIT of €0.4 million vs. a

negative EBIT of €10.6 million in FY 2009

- Net Group Loss of €11.1 million vs. a

Net Group Loss of €17.7 million in FY 2009

FOURTH QUARTER 2010

- Total Net Sales were €132.0 million,

down 13.3% as compared to fourth quarter 2009

- Industrial Margin was €51.3 million as

compared to €59.3 million in fourth quarter 2009

- Positive EBIT of €0.2 million, vs. a

positive EBIT of 2.1million in fourth quarter 2009

- Net Group Loss of €1.4 million vs. a

Net Group Loss of €2.5 million in fourth quarter 2009

- Positive Net Financial Position of

€45.6 million

FULL YEAR 2010 CONSOLIDATED RESULTS

During 2010 Total Net Sales (including raw materials and

semi-finished products sold to third parties) were €518.6 million,

increasing by 0,6% with respect to 2009.

Upholstery net sales were at €460.5, up by 2.2% as compared to

full year 2009.

The break-down of upholstery net sales by geographic area was as

follows: Europe (excluding Italy) 40.5%, the Americas 35.7%, Italy

11.2% and Rest of the World 12.6%.

The best commercial performances were reported in the Rest of

the World area with an increase of 23.8% over 2009 (in particular,

Australia up by 25.1% and China up by 51.9%), and in the Americas

where we recorded a 17.5% increase. In Europe, even if we recorded

an overall negative performance of minus 11.4%, we point out the

positive performance of 13.5% from Great Britain.

Industrial Margin improved in 2010 reaching a 38.0% on

sales versus a 36.0% in full year 2009, thanks to important

industrial rationalization activities started in 2009.

The incidence of Selling Expenses on sales passed from

29.0% in full year 2009 to 29.8% in full year 2010 due to a

remarkable increase of shipping costs and commissions, partially

balanced by a reduction both in advertising costs, commercial

labour costs and other commercial costs.

The incidence of General & Administrative Expenses on

sales, on the contrary, improved in 2010, passing from 9.0%

in 2009 to 8.2% in full year 2010, thanks to the rationalisation

and reorganisation actions carried out by the Group, that allowed a

total saving of €4.1 million.

EBITDA improved from positive €16.2 million in 2009 to

positive €23.8 million for the full year 2010.

The full year 2010 EBIT highlighted a return to a

positive margin of €0.4 million vs. a negative EBIT of €10.6

million for the full year 2009.

The full year 2010 Net Group Result recorded, despite the

greater incidence of extraordinary costs and a lower contribution

from forex, a loss of €11.1 million improving from the €17.7

million loss reported for the full year 2009.

FOURTH QUARTER 2010 CONSOLIDATED RESULTS

Total Net Sales (including raw materials and

semi-finished products sold to third parties) were at €132.0

million.

Upholstery net sales were at €115.8 million, down by 13.5% from

€133.9 million reported in the same period of 2009.

The break-down of upholstery net sales by geographic area was as

follows: Europe (excluding Italy) 43.3%, the Americas 31.8%, Italy

11.3% and Rest of the World 13.6%.

Industrial Margin was at €51,3 million, with an incidence

on sales equal to 38,9% (in line with the 39.0% reported in the

last quarter of 2009).

EBITDA was at €5,4 million as compared to €8,1 million in

the fourth quarter of 2009.

EBIT went from positive €2,1 million in fourth quarter

2009 to positive €0,2 million in the fourth quarter of 2010.

During the fourth quarter of 2010 the Group reported a Net

loss of €1,4 million as compared to a net loss of €2,5 million

in the same period of last year.

CONSOLIDATE BALANCE SHEET

Net Financial Position as of December 31st, 2010 remained

positive at €45.6 million although the reduction of €13.0 million

versus December 31st, 2009, mainly due to industrial investments in

fixed assets of €17.7 million.

Pasquale Natuzzi, Chairman and CEO of Natuzzi S.p.A., stated:

”Despite steady total sales in 2010, we finally reached a positive

operating result after three years of negative EBIT.

Financial figures are encouraging and confirm the good quality

of the work so far undertaken. We believe these results are below

our growth potential, that we expect to reach in the following

years considering the investments made in factories

requalification, development and awareness of the brands, as well

as in the expansion of foreign commercial branches to improve our

market presence.

Our Group maintains and strengthens its credibility and

leadership within historical markets such as Europe and the United

States, as well as in emerging markets such as India, China and

Brazil.

The re-launch of a company with strong Italian roots like

Natuzzi, goes along with product innovation as well as production

processes improvement.

We have done a good job on brands portfolio and made investments

to give a particular identity to the three brands, “Natuzzi”,

“Italsofa” and “Editons”; each of them addressing different

clients.

We are working to integrate brands , markets, distribution

channels and factories to support the three brands. We have

to further strengthen the Sales organization to increase the

presence in the markets and will continue to leverage on our

high-quality brand by relying on our management skills and

experience”.

The Company will host a conference call on March 30th, 2010 at

10:00 a.m. Eastern Time to discuss fourth quarter and full year

2010 financial results. To participate, dial toll-free

1-877-879-6201 and dial international 1-719-325-4858. A live web

cast of the conference call will be available online at

http://www.natuzzi.com/ under the Investor Relations section.

A replay of the call will be available shortly after the

completion of the conference call through April 30th 2011. To

access the telephone replay, participants should dial

1-877-870-5176 for domestic calls and 1-858-384-5517 for

international calls. The access code for the replay is:

1136006.

Natuzzi S.p.A.

Il Gruppo Natuzzi, fondato nel 1959 da Pasquale Natuzzi,

disegna, produce e vende una vasta collezione di poltrone, divani e

complementi d’arredo. Con un fatturato nel 2010 di 518.6 milioni di

euro, Natuzzi è il più grande produttore italiano nel settore

dell’arredamento ed è leader mondiale nel settore dei divani in

pelle. Il Gruppo esporta divani e poltrone innovativi e di elevata

qualità in 130 mercati nei 5 continenti. Design, superiorità

artigianale italiana, innovazione ed un’avanzata struttura

verticalmente integrata rappresentano le caratteristiche che hanno

fatto del Gruppo Natuzzi il leader di mercato. Natuzzi S.p.A. è

quotata al New York Stock Exchange dal 13 Maggio 1993. Il Gruppo

Natuzzi è certificato ISO 9001 e 14001.

Natuzzi S.p.A. and Subsidiaries

Unaudited Consolidated Profit & Loss for the quarter ended

on December 31, 2010 on the basis of Italian GAAP (expressed in

millions Euro except for share data)

Three months ended on

Change Percent of Sales 31-déc-10

31-déc-09 % 31-déc-10 30-déc-09

Upholstery net sales 115.8 133.9 -13.5% 87.7% 88.0% Other sales

16.2 18.3 -11.5% 12.3% 12.0%

Total Net Sales 132.0

152.2 -13.3% 100.0% 100.0%

Consumption (*) (53.2) (61.4) -13.4% -40.3% -40.3% Labor (18.9)

(20.8) -9.1% -14.3% -13.7% Industrial Costs (**) (8.6) (10.7)

-19.6% -6.5% -7.0% of which Depreciation, Amortization (2.6) (3.4)

Cost of Sales (80.7)

(92.9) -13.1% -61.1% -61.0%

Industrial Margin

51.3 59.3 -13.5% 38.9% 39.0%

Selling Expenses (40.0) (44.7) -10.5% 30.3% 29.4% of which

Transportation (13.3) (13.8) 10.1% 9.1% of which Advertising (9.6)

(12.2) 7.3% 8.0% of which Depreciation, Amortization (1.6) (1.5)

G&A Expenses (11.1) (12.5) -11.2% 8.4% 8.2% of which

Depreciation, Amortization (1.0) (1.1)

EBITDA 5.4 8.1 -33.3%

4.1% 5.3%

EBIT 0.2 2.1 -90.5% 0.2%

1.4% Interest Income/(Costs), Net (0.1) (0.3) Foreign

Exchange, Net 0.6 1.2 Other Income/(Cost), Net (1.3) (2.1)

Earning before Income

Taxes (0.6) 0.9 -0.4% 0.6%

Current taxes (0.8) (3.3) -0.6% -2.2%

Net result (1.4) (2.4)

-42.5% -1.0% -1.6% Minority interest

(0.0) (0.1)

Net Group

Result (1.4) (2.5) 43.5% -1.1%

-1.6% Net Group

Result per Share (0.03) (0.05)

Key

Figures in U.S. dollars Three months ended on

Change Percent of Sales (millions)

31-déc-10

31-déc-09 % 31-déc-10 30-déc-09

Total Net Sales 179.2 206.7

-13.3%

100.0% 100.0% Gross Profit 69.7 80.5

-13.5% 38.9% 39.0% Operating Income

(Loss) 0.3 2.9

-90.5% 0.2% 1.4%

Net Group Result (1.9) (3.4)

43.5%

-1.1% -1.6% Net Group Result per Share

(0.0) (0.1)

Average exchange rate (U.S.$ per

€) 1.3579

(*) Purchases plus beginning stock minus final stock (**)

Including Third-party manufacturers

UPHOLSTERY NET SALES BREAKDOWN

Geographic

breakdown Net sales million euro Net sales seats

three months ended

on three months ended on

31 December 2010 31 December

2009 Change % 31 December 2010 31 December

2009 Change % Americas 36.8

31.8% 43.8 32.7% -16.0% 207,270

41.6% 245,578 43.3% -15.6% Natuzzi 3.5

2.5% 3.6 2.7% -2.8% 9,378 1.9% 6,951 1.2% 34.9% All brands (*) 33.3

28.8% 40.2 30.0% -17.2% 197,892 39.7% 238,627 42.1% -17.1%

Europe 50.1 43.3% 61.0 45.6%

-17.9% 186,996 37.5% 216,769

38.2% -13.7% Natuzzi 24.7 21.3% 29.9 22.3% -17.4%

57,785 11.6% 62,210 11.0% -7.1% All brands (*) 25.4 21.9% 31.1

23.2% -18.3% 129,211 154,559 27.3% -16.4%

Italy

(Natuzzi) 13.2 11.3% 15.3 11.4%

-13.7% 44,441 8.9% 47,421 8.4%

-6.3% Rest of the world 15.7

13.6% 13.8 10.3% 13.8% 59,972

12.0% 57,090 10.1% 5.0% Natuzzi 8.3

7.2% 8.1 6.0% 2.5% 19,359 3.9% 20,132 8.4%

-3.8% All brands

(*) 7.4 6.4% 5.7 4.3% 29.8% 40,613 8.1% 36,959 6.5% 9.9%

Total 115.8

100.0% 133.9 100.0% -13.5%

498,679 100.0% 566,858 100.0%

-12.0%

Brands breakdown Net sales million euro Net sales

seats

three months

ended on three months ended on

31 December 2010 31 December

2009 Change % 31 December 2010 31 December

2009 Change % Natuzzi 49.7

42.9% 56.9 42.5% -12.7% 130,963

26.3% 136,713 24.1% -4.2% All

brands (*) 66.1 57.1% 77.0 57.5%

-14.2% 367,716 73.7% 430,144

75.9% -14.5%

Total 115.8 100.0% 133.9

100.0% -13.5% 498,679 100.0%

566,858 100.0% -12.0%

(*) Italsofa, Natuzzi Editions,

Editions and unbranded

Natuzzi S.p.A. and

Subsidiaries Unaudited Consolidated Profit

& Loss for the quarter ended on December 31, 2010 on the basis

of Italian GAAP (expressed in millions Euro except for share

data)

Twelve months ended on Change Percent of Sales

31-déc-10 31-déc-09 % 31-déc-10

31-déc-09 Upholstery net sales 460.5 450.6 2.2% 88.8%

87.4% Other sales 58.1 64.8 -10.3% 11.2% 12.6%

Total Net

Sales 518.6 515.4 0.6% 100.0%

100.0% Consumption (*) (213.6) (212.5) 0.5% -41.2%

-41.2% Labor (75.8) (78.5) -3.4% -14.6% -15.2% Industrial Costs

(**) (32.1) (38.8) 17.3% -6.2% -7.5% of which Depreciation,

Amortization (11.5) (14.5)

Cost of

Sales (321.5) (329.8) -2.5% -62.0%

-64.0%

Industrial Margin 197.1 185.6 6.2%

38.0% 36.0% Selling Expenses (154.3) (149.6)

3.1% 29.8% 29.0% of which Transportation (50.7) (42.5) 9.8% 8.2% of

which Advertising (28.1) (31.9) 5.4% 6.2% of which Depreciation,

Amortization (7.6) (7.9) G&A Expenses (42.4) (46.6) -9.0% 8.2%

9.0% of which Depreciation, Amortization (4.3) (4.4)

EBITDA 23.8 16.2

46.9% 4.6% 3.1%

Operating Income/(Loss) (EBIT) 0.4

(10.6) 103.8% 0.1% -2.1%

Interest Income/(Costs), Net (1.0) (1.1) Foreign Exchange, Net 1.1

6.9 Other Income/(Cost), Net (4.5) (2.6)

Earning before Income Taxes

(4.0) (7.4) 45.9% -0.8% -1.4%

Current taxes (7.0) (9.9) -1.3% -1.9%

Net result (11.0) (17.3)

36.4% -2.1% -3.4% Minority interest 0.1

0.4

Net Group

Result (11.1) (17.7) 37.3% -2.1%

-3.4% Net Group

Result per Share (0.20) (0.32)

Key

Figures in U.S. dollars Twelve months ended on

Change Percent of Sales (millions)

31-déc-10

31-déc-09 % 31-déc-10 31-déc-09

Total Net Sales 688.1 683.8

0.6% 100.0%

100.0% Gross Profit 261.5 246.3

6.2%

38.0% 36.0% Operating Income (Loss) 0.5

(14.1)

103.8% 0.1% -2.1% Net Group

Result (14.7) (23.5)

37.3% -2.1%

-3.4% Net Group Result per Share (0.3) (0.4)

Average exchange rate (U.S.$ per €) 1.3268

(*) Purchases plus

beginning stock minus final stock (**) Including Third-party

manufacturers

UPHOLSTERY NET SALES

BREAKDOWN

Geographic breakdown Net

sales million euro Net sales seats

Twelve months ended on Twelve

months ended on

31 December 2010 31 December 2009

Change % 31 December 2010 31 December 2009

Change % Americas 164.2 35.7%

139.8 31.0% 17.5% 886,471 45.4%

785,156 40.8% 12.9% Natuzzi 15.5 3.4% 15.3

3.4% 1.3% 40,112 2.1% 43,520 2.3% -7.8% All brands (*) 148.7 32.3%

124.5 27.6% 19.4% 846,359 43.3% 741,636 38.6% 14.1%

Europe 186.4 40.5% 210.3 47.2%

-11.4% 685,124 35.1% 776,057

40.4% -11.7% Natuzzi 93.3 20.3% 106.5 23.6% -12.4%

208,298 10.7% 247,831 12.9% -16.0% All brands (*) 93.1 20.2% 103.8

23.0% -10.3% 476,826 24.4% 528,227 27.5% -9.7%

Italy

(Natuzzi) 51.7 11.2% 53.5 11.9%

-3.4% 162,328 8.3% 167,046 8.7%

-2.8% Rest of the world 58.2

12.6% 47.0 10.4% 23.8% 220,670

11.3% 194,961 10.1% 13.2% Natuzzi 31.6

6.9% 27.8 6.2% 13.7% 73,050 3.7% 70,855 3.7% 3.1% All brands (*)

26.6 5.8% 19.2 4.3% 38.5% 147,620 7.6% 124,106 6.5% 18.9%

Total 460.5

100.0% 450.6 100.5% 2.2%

1,954,592 100.0% 1,923,220 100.0%

1.6%

Brands breakdown Net sales million euro Net sales

seats

Nine

months ended on Nine months ended on

31 December 2010

31 December 2009 Change % 31 December 2010

31 December 2009 Change % Natuzzi

192.1 41.7% 203.1 45.1% -5.4%

483,788 24.8% 529,251 27.5%

-8.6% All brands (*) 268.4 58.3%

247.5 54.9% 8.4% 1,470,805 75.2%

1,393,969 72.5% 5.5%

Total 460.5 100.0%

450.6 100.0% 2.2% 1,954,592

100.0% 1,923,220 100.0% 1.6%

(*) Italsofa,

Natuzzi Editions, Editions and unbranded Natuzzi S.p.A. and

Subsidiaries

Unaudited Consolidated Balance Sheets

as at December 31, 2010 on the basis of Italian GAAP (Expressed

in millions of euro)

ASSETS 31-déc-10

31 Dec 09 Current assets: Cash and cash

equivalents 61.1 66.3 Marketable debt securities 0.0 0.0 Trade

receivables, net 95.8 97.1 Other receivables 51.7 54.5 Inventories

87.4 81.6 Unrealized foreign exchange gains 0.2 0.3 Prepaid

expenses and accrued income 1.3 1.4 Deferred income taxes 1.1 0.7

Total current assets

298.6 301.9 Non current assets:

Net property, plant and equipment 196 193.9 Other assets 9.3 12.8

Total non current assets

205.3 206.7 TOTAL ASSETS

503.9 508.6 LIABILITIES AND

SHAREHOLDERS' EQUITY Current

liabilities: Short-term borrowings 0.1 0.8 Current portion of

long-term debt 2.6 1.1 Accounts payable-trade 64.3 66.5 Accounts

payable-other 27.9 29.3 Unrealized foreign exchange losses 1.1 0.4

Accounts payable-shareholders for dividends 0.0 0.0 Income taxes

2.9 3.7 Salaries, wages and related liabilities 9.9 15.0

Total current liabilities 108.8

116.8 Long-term liabilities: Employees'

leaving entitlement 28.4 29.6 Long-term debt 12.8 5.9 Deferred

income for capital grants 10.4 11.2 Other liabilities 18.2 18.2

Total long-term liabilities

69.8 64.9

Minority interest 2.1 1.9

Shareholders' equity: Share capital 54.9 54.9 Reserves 12.0

12.0 Additional paid-in capital 9.3 9.3 Retained earnings 247.0

248.8

Total shareholders' equity

323.2 325.0 TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY 503.9 508.6 Natuzzi

S.p.A. and Subsidiaries

Consolidated Statements of

Cash Flows (Expressed in million of euro)

31 Dec

10 31 Dec 09 Cash flows from operating

activities: Net earnings (loss) (11.1)

(17.7) Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 23.4 26.8 Employees' leaving entitlement (1.2) (2.1)

Deferred income taxes (0.4) 3.7 Minority interest 0.1 0.4 (Gain)

loss on disposal of assets 0.6 (0.1) Unrealized foreign exchange

losses and gains 0.8 (4.4) Impairment of long lived assets (0.7) -

Deferred income for capital grants (1.0)

Non monetary operating

costs 22.6 23.3 Change in assets and

liabilities: Receivables, net 1.2 25.7 Inventories (5.8) 10.5

Prepaid expenses and accrued income 0.1 (0.2) Other assets 2.8

(8.3) Accounts payable (2.2) (2.1) Income taxes (0.7) 1.9 Salaries,

wages and related liabilities (5.1) (1.8) Other liabilities (0.2)

2.6

Net working capital (9.9) 28.3

Net cash provided by operating activities 1.6

33.9 Cash flows from investing

activities: Property, plant and equipment: Additions (17.9)

(9.2) Disposals 0.2 0.2 Marketable debt securities: - -

Net cash used in investing activities (17.7)

(9.0) Cash flows from financing activities:

Long-term debt: Proceeds 9.8 3.9 Repayments (1.3) (0.7)

Short-term borrowings (0.7) (8.9) Capital injection - - Dividends

paid to minority interests - -

Net cash used in financing

activities 7.8 (5.7) Effect of translation

adjustments on cash 3.1 (0.2)

Increase (decrease) in cash

and cash equivalents (5.2) 19.0 Cash

and cash equivalents, beginning of the year 66.3

47.3 Cash and cash equivalents, end of the

year 61.1 66.3

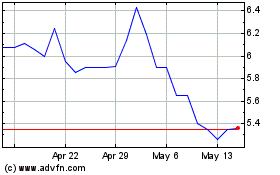

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

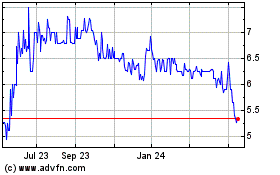

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Jul 2023 to Jul 2024